Ramesh Singh Summary: Inflation & Business Cycle- 1 | Indian Economy for UPSC CSE PDF Download

Definition

- A rise in the general level of prices, a sustained rise in the general level of prices, persistent increases in the general level of prices.

- An increase in the general level of prices in an economy that is sustained over time, rising prices across the board — is inflation.

- These are some of the most common academic definitions of inflation. If the price of one good has gone up, it is not inflation, it is inflation only if the prices of most goods have gone up.

- Two terms are used to show a fall in general level of prices— disinflation and deflation.

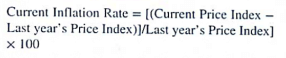

Rate of inflation (year x) = Price level (year x) - Price level (year x-1) / Price level (year x - 1) x 100

Why does inflation occur?

1. Pre-1970s

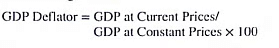

➢ Demand-Pull Inflation

- A mismatch between demand and supply pulls up prices.

- Either the demand increases over the same level of supply, or the supply decreases with the same level of demand and thus the situation of demand-pull inflation arise.

- This was a Keynesian idea.

➢ Cost-Push Inflation

- An increase in factor input costs (i.e., wages and raw materials) pushes up prices. The price rise which is the result of increase in the production cost is cost-push inflation.

2. Post-1970s

➢ Demand-Pull Inflation - For the monetarists, a demand-pull inflation is creation of extra purchasing power to the consumer over the same level of production.➢ Cost-Push Inflation - Similarly, for the monetarists, 'cost-push' is not a truly independent theory of inflation, it has to be financed by some extra money.

Measures to Check Inflation

➢ Demand side measure

- In this category mainly, two types of steps are taken. Firstly, the consumers are appealed to cut back the consumption of the items which show higher inflation (called austerity).

- This step has generally failed across the world because it does not work in case of essential items (such as wheat, rice, milk, tea, etc.) and as people who have money, they don't wish to cut down consumption.

➢ Supply-side measure

- Aimed at increasing the supply of the items showing inflation, the government may go in for upscaling the production or import of the items.

➢ Cost side measure

- Two variety of steps may be taken under it, in short-run cutting taxes can bring in comfort but in the long-run cutting cost of production is the only way out.

Types of Inflation

1. Low Inflation

- Such inflation is slow and on predictable lines, which might be called small or gradual.

- This is a comparative term which puts it opposite to the faster, bigger and unpredictable inflations.

- Low inflation takes place in a longer period and the range of increase is usually in 'single-digit'. Such inflation has also been called as 'creeping inflation'.

2. Galloping Inflation

- This is a 'very high inflation' running in the range of double-digit or triple digit.

- Contemporary journalism has given some other names to this inflation— hopping inflation, jumping inflation and running or runaway inflation.

3. Hyperinflation

This form of inflation is 'large and accelerating' which might have the annual rates in million or even trillion. In such inflation not only the range of increase is very large, but the increase takes place in a very short span of time, prices shoot up overnight.

Other Variants of Inflation

1. Bottleneck Inflation

- This inflation takes place when the supply falls drastically and the demand remains at the same level.

- Such situations arise due to supply-side hurdles, hazards or mismanagement which is also known as 'structural inflation'.

- This could be put in the 'demand-pull inflation' category.

2. Core Inflation

- This nomenclature is based on the inclusion or exclusion of the goods and services while calculating inflation.

- Popular in western economies, core inflation shows price rise in all goods and services excluding energy and food articles.

Other Important Terms

➢

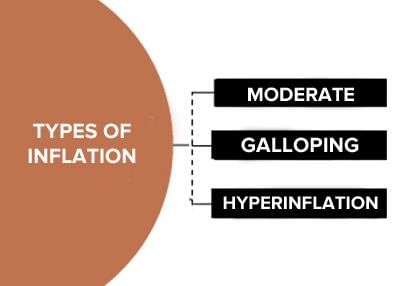

Phillips Curve- It is a graphic curve which advocates a relationship between inflation and unemployment in an economy.

- As per the curve, there is a 'trade-off' between inflation and unemployment, i.e., an inverse relationship between them.

- The curve suggests that lower the inflation, higher the unemployment and higher the inflation, lower the unemployment. During the 1960s, this idea was among the most important theories of modern economists.

➢

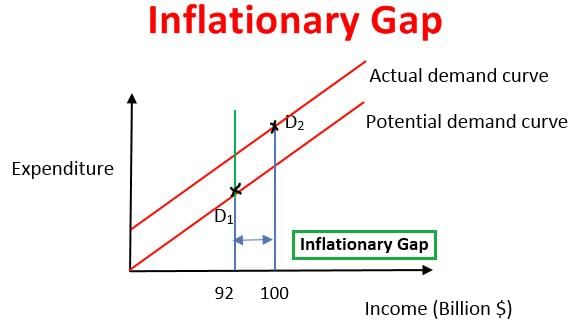

Inflationary Gap- The excess of total government spending above the national income (i.e., fiscal deficit) is known as the inflationary gap.

➢

Deflationary Gap- The shortfall in total spending of the government (i.e., fiscal surplus) over the national income creates deflationary gaps in the economy.

➢

Inflation Tax- Inflation erodes the value of money and the people who hold currency suffer in this process. As the governments have authority of printing currency and circulating it into the economy, this act functions as an income to the governments.

➢

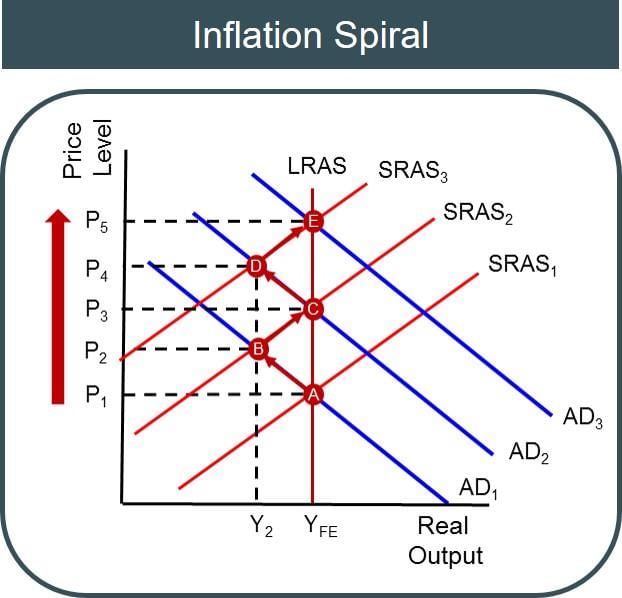

Inflation Spiral- An inflationary situation in an economy which results out of a process of wage and price interaction 'when wages press prices up and prices pull wages up' is known as the inflationary spiral.

➢

Inflation Accounting- A term popular in the area of corporate profit accounting. Basically, due to inflation the profit of firms/companies gets overstated.

➢

Inflation Premium- The bonus brought by inflation to the borrowers is known as the inflation premium. The interest banks charge on their lending is known as the nominal interest rate.

➢

Reflation- Reflation is a situation often deliberately brought by the government to reduce unemployment and increase demand by going for higher levels of economic growth.

➢

Stagflation- Stagflation is a situation in an economy when inflation and unemployment both are at higher levels, contrary to conventional belief. Such a situation first arose in the 1970s in the US economy and in many Euro-American economies.

Inflation Targeting

- The announcement of an official target range for inflation is known as inflation targeting.

- It is done by the Central Bank in an economy as a part of their monetary policy to realise the objective of a stable rate of inflation (the Government of India asked the RBI to perform this function in the early 1970s).

- India commenced inflation targeting 'formally' in February 2015 when an agreement between the Gol and the RBI was signed related to it—the Agreement on Monetary Policy Framework.

- The agreement provides the aim of inflation targeting in this way—'it is essential to have a modern monetary framework to meet the challenge of an increasingly complex economy.

- Whereas the objective of monetary policy is to primarily maintain price stability, while keeping in mind the objective of growth.'

➢

Skewflation

- Economists usually distinguish between inflation and a relative price increase. 'Inflation' refers to a sustained, across-the-board price increase, whereas 'a relative price increase' is a reference to an episodic price rise pertaining to one or a small group of commodities.

- This leaves a third phenomenon, namely one in which there is a price rise of one or a small group of commodities over a sustained period of time, without a traditional designation. 'Skewflation' is a relatively new term to describe this third category of price rise.

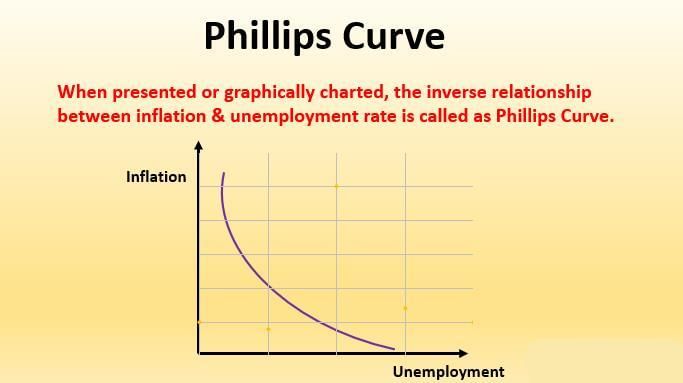

GDP Deflator

This metric reveals the increase in GDP value resulting from inflation between the base year (i.e., the year of constant prices) and the current year. It serves as a measure of inflation, also known as the 'implicit price deflator.'

- Countries commonly use inflation indices to gauge inflation, but these indices may not encompass all goods and services produced.

- In India, the Wholesale Price Index (WPI) excludes services, and the Consumer Price Index (CPI) includes only goods and services purchased by households for consumption (e.g., food, clothing, health, education).

- Several other goods and services, such as intermediate goods and those required by firms, are not covered by the CPI.

Given that the GDP deflator encompasses the entire range of goods and services produced in the economy, it is considered a more comprehensive measure of inflation.

Base Effect

The base effect in inflation calculation refers to the influence of the previous year's increase in the price level (i.e., last year's inflation) on the corresponding increase in price levels in the current year (i.e., current inflation). The concept operates as follows:

- If the price index experienced a high rate of increase in the corresponding period of the previous year, resulting in high inflation, some of the potential increase is already factored in. Consequently, a similar absolute increase in the price index in the current year will lead to a relatively lower inflation rate.

- Conversely, if the inflation rate was relatively low in the corresponding period of the previous year, even a relatively smaller rise in the price index will arithmetically yield a high rate of current inflation.

The index increased by 20 points in all three years (2018, 2019, and 2020). However, the 'year-on-year' inflation rate, calculated on a yearly basis, tends to decline over the three years:

- In 2018, the inflation rate was 20%.

- In 2019, the inflation rate decreased to an intermediate value.

- In 2020, the inflation rate further declined to 14.29%.

This pattern occurs because the absolute increase of 20 points in the price index each year raises the base year price index by an equivalent amount. Simultaneously, the absolute increase in the price index remains constant. The 'year-on-year' inflation is calculated using the formula:

Effects of Inflation

- On Creditors and Debtors Inflation redistributes wealth from creditors to debtors, i.e., lenders suffer and borrowers benefit out of inflation. The opposite effect takes place when inflation falls (i.e., deflation).

- On Lending- With the rise in inflation, lending institutions feel the pressure of higher lending. Institutions don't revise the nominal rate of interest as the 'real cost of borrowing' (i.e., nominal rate of interest minus inflation) falls by the same percentage with which inflation rises.

- On Aggregate- Demand rising inflation indicates rising aggregate demand and indicates comparatively lower supply and higher purchasing capacity among the consumers. Usually, higher inflation suggests the producers to increase their production level as it is generally considered as an indication of higher demand in the economy.

- On Investment - Investment in the economy is boosted by inflation because of two reasons :

(a) Higher inflation indicates higher demand and suggests entrepreneurs to expand their production level.

(b) Higher the inflation, lower the cost of loan. - On Income- Inflation affects the income of individual and firms alike. An increase in inflation, increases the 'nominal' value of income, while the 'real' value of income remains the same.

- On Exchange Rate - With every inflation the currency of the economy depreciates provided it follows the flexible currency regime. Though it is a comparative matter, there might be inflationary pressure on the foreign currency against which the exchange rate is compared.

- On Export- With inflation, exportable items of an economy gain competitive prices in the world market. Due to this, the volume of export increases and thus export income increases in the economy. It means export segment of the economy benefits due to inflation. Importing partners of the economy exert pressure for a stable exchange rate as their imports start increasing and exports start decreasing.

- On Import- Inflation gives an economy the advantage of lower imports and import-substitution as foreign goods become costlier.

Wholesale Price Index

- The first index number of wholesale prices commenced in India for the week January 10, 1942.

- It was having the base week ending August 19, 1939 = 100, which was published by the office of the Economic Adviser to the Government of India (Ministry of Industry).

- Independent India followed the same series with more number of commodities included in the index.

- Several changes regarding the inclusion of commodities, assigning them the logical weights took place in the coming times including revisions in the base years for the WPI.

Consumer Price Index

India has been measuring inflation at the consumer prices also besides at the wholesale prices. But in place of a single consumer price index (CPI).

1. CPI-IW

- The Consumer Price Index for the industrial workers (CPI-IW) has 260 items (plus the services) in its basket with 2001 as the base year (the first base year was 1958-59). The data is collected at 76 centres with one month's frequency and the index has a time lag of one month.

2. CPI-UNME

- The Consumer Price Index for the Urban Non-Manual Employees (CPI-UNME) has 1984-85 (first base year was 1958-59 ) as the base year and 146-365 commodities in the basket for which data is collected at 59 centres in the country— data collection frequency is monthly with two weeks time lag.

3. CPI-AL

- The Consumer Price Index for Agricultural Labourers (CPI-AL) has 1986-87 as its base year with 260 commodities in its basket. The data is collected in 600 villages with a monthly frequency and has three weeks time lag.

4. CPI-RL

- There is yet another Consumer Price Index for the Rural Labourers (CPI-RL) with 1983 as the base year, data is collected at 600 villages on monthly frequency with three weeks time lag, its basket contains 260 commodities.

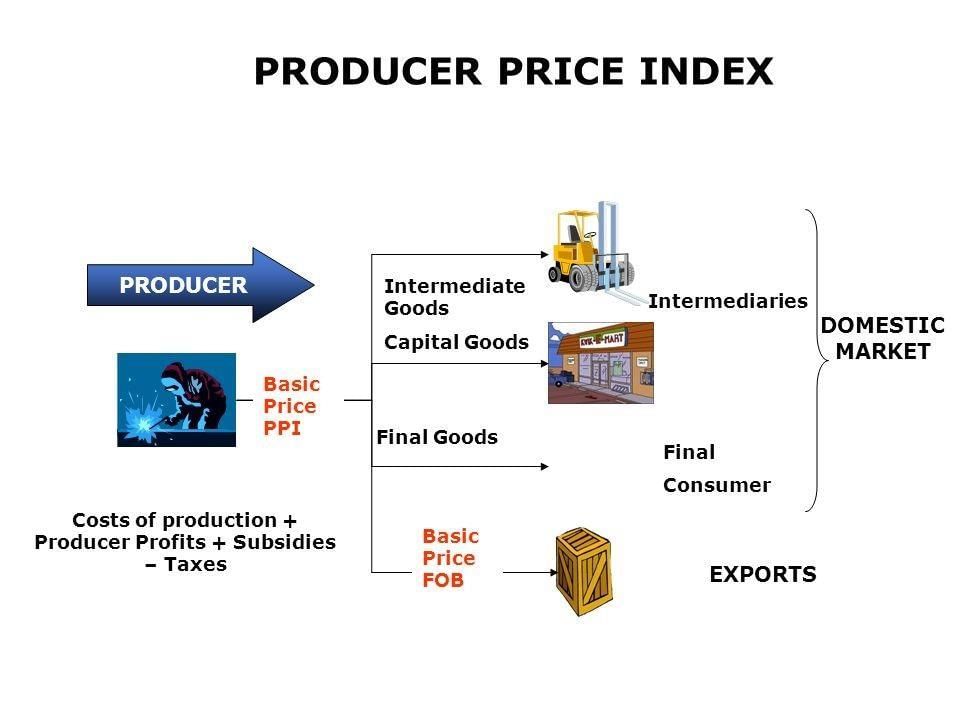

Producer Price Index

- Producer price index (PPI) is a better measure of inflation in comparison to both WPI and CPI.

- The ongoing process of economic reforms has increasingly connected India to the world which makes it necessary to evolve right comparative indicators.

- Inflation being among the most vital economic indicator in comparative economics the government proposed to switch over from the WPI to PPI in 2003-04.

Housing Price Index

India's official Housing Price Index (HPI] was launched in July 2007 in Mumbai. Basically developed by the Indian home loans regulator, the National Housing Bank (NHB) the index is named NHB Residex.

- Currently, it is published for 50 cities (being expanded to cover 100 cities] on quarterly basis with 2012-13 as base year. Among 50 cities covered are 18 State/UT capitals and 37 Smart Cities.

Service Price Index

The contribution of the tertiary sector in India's GDP has been strengthening for the past 10 years and today it stands above 60 per cent. The need for a service price index (SPI) in India is warranted by the growing dominance of the sector in the economy.- There is no index, so far, to measure the price changes in the services sector.

- The present inflation (at the WPI) only shows the price movements of the commodity-producing sector, i.e., it includes only the primary and the secondary sectors—the tertiary sector is not represented by it.

Recent Developments

1. Inflation Trends (2021–2025)

- India’s Consumer Price Index (CPI) inflation averaged around 5.5% from 2021 to 2023, peaking at 7.8% in April 2022 due to supply chain disruptions and high food prices, before moderating to 4.8% by mid-2024 (Economic Survey 2024–2025).

- Wholesale Price Index (WPI) inflation saw volatility, with a high of 15.9% in May 2022, driven by fuel and manufacturing costs, but turned negative (-0.5%) in mid-2023 due to a high base effect, stabilizing at 2.3% by early 2025.

- Food inflation remained a concern, with vegetable prices spiking (e.g., tomatoes at ₹200/kg in July 2023) due to weather shocks, contributing to skewflation in rural areas.

2. RBI’s Monetary Policy

- The Reserve Bank of India (RBI) maintained its inflation target of 4% (±2%) under the 2015 Monetary Policy Framework, with the Monetary Policy Committee (MPC) hiking the repo rate from 4% in April 2022 to 6.5% by February 2023 to curb inflation (RBI Annual Report 2024).

- By late 2024, with inflation stabilizing, the MPC adopted a neutral stance, holding the repo rate at 6.5% in December 2024 to balance growth and price stability.

- The RBI introduced the Central Bank Digital Currency (CBDC), or digital rupee, in a pilot phase in 2023, aiming to enhance monetary policy transmission and reduce inflation tax effects.

3. Global Influences

- The Russia-Ukraine conflict (2022–ongoing) disrupted global energy and food supply chains, pushing crude oil prices to $120/barrel in June 2022, impacting India’s import bill and fuel inflation.

- US Federal Reserve rate hikes (2022–2023) strengthened the dollar, leading to rupee depreciation (₹82/USD in March 2023), increasing imported inflation for India.

- Global supply chain bottlenecks, particularly in semiconductors, raised input costs for India’s manufacturing sector, contributing to WPI inflation.

4. Government Measures

- To tackle food inflation, the government imposed export bans on wheat and non-basmati rice in 2022–2023 and increased buffer stocks via the Food Corporation of India (FCI).

- Fiscal policy focused on supply-side measures, with increased capital expenditure (₹10 lakh crore in Budget 2024–25) to boost infrastructure and reduce production bottlenecks.

- Subsidies on fertilizers and fuel were extended to mitigate cost-push inflation, while GST exemptions on essential food items were introduced in 2024.

5. Economic Indicators and UPSC Relevance

- The GDP deflator, a broader measure of inflation, rose to 5.1% in 2023–24, reflecting underlying price pressures despite moderate CPI inflation (Economic Survey 2024–2025).

- The Phillips Curve’s relevance has weakened, as India experienced stagflation-like conditions in 2022–2023 with high inflation (7%) and unemployment (7.5% urban, CMIE data), challenging the traditional trade-off.

|

108 videos|425 docs|128 tests

|

FAQs on Ramesh Singh Summary: Inflation & Business Cycle- 1 - Indian Economy for UPSC CSE

| 1. What is the main cause of inflation? |  |

| 2. What are the different types of inflation? |  |

| 3. What are some other variants of inflation? |  |

| 4. What is inflation targeting? |  |

| 5. How does inflation impact businesses and the economy? |  |