Tertiary Sector in the Indian Economy - Solved Questions (2010-2024) | UPSC Topic Wise Previous Year Questions PDF Download

Question 1: With reference to Central Bank digital currencies, consider the following statements :(2023)

- It is possible to make payments in a digital currency without using US dollar or SWIFT system.

- A digital currency can be distributed with condition programmed into it such as a time- frame for spending it.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(b) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (c)

- Central Bank Digital Currency (CBDC) is a digital form of currency notes issued by a central bank. Here payments in a digital currency are without using the US dollar or SWIFT system. Hence, statement 1 is correct.

- CBDC can be classified into two broad types viz. general purpose or retail (CBDC-R) and wholesale (CBDC-W).

- Retail CBDC would be potentially available for use by all viz. private sector, non- financial consumers and businesses while wholesale CBDC is designed for restricted access to select financial institutions.

- While Wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions, Retail CBDC is an electronic version of cash primarily meant for retail transactions.

- Programmability: One interesting application of CBDC is the technical possibility of programmability. CBDCs have the possibility of programming the money by tying the end use. For example, agriculture credit by banks can be programmed to ensure that it is used only at input store outlets.

- However, the programmability feature of CBDC needs to be carefully examined in order to retain the essential features of a currency. It can also have other implications for monetary policy transmission as tokens may have an expiry date, by which they would need to be spent, thus ensuring consumption. Hence, statement 2 is correct.

- The programmability of tokens can be achieved using the following:

- Smart contracts: Business rules are stored as code that is executed during transactions to verify that the token is being used correctly.

- Token version: The version of the token can be tightly linked to the technical code class. The alternative is that the version is stored as a token data field.

Question 2: With reference to Non-Fungible Token (NFTs), consider the following statements:(2022)

- They enable the digital representation of physical assets.

- They are unique cryptographic tokens that exist on a blockchain.

- They can be traded or exchanged at equivalency and therefore can be used as a medium of commercial transactions.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Ans: (a)

- Anything that can be converted into a digital form can be an NFT.

- Everything from drawings, photos, videos, GIFs, music, in-game items, selfies, and even a tweet can be turned into an NFT, which can then be traded online using cryptocurrency.

- If anyone converts its digital asset to an NFT, he/she will get proof of ownership, powered by Blockchain.

Hence, statement 1 and 2 are correct.

- NFTs are non-fungible, which means the value of one NFT is not equal to another.

- Nonfungible means NFTs aren't mutually interchangeable. Every art is different from others, making it non-fungible, and unique.

Hence, statement 3 is not correct.

Question 3: With reference to foreign-owned e-commerce firms operating in India, which of the following statements is/are correct?(2022)

- They can sell their own goods in addition to offering their platforms as market-places.

- The degree to which they can own big sellers on their platforms is limited.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (d)

Based on the rules of e-commerce:

- E-commerce entities providing a market place shall not exercise ownership over the inventory. Such ownership of inventory would render the business in an inventory based model. Hence statement 1 is not correct.

- An entity having equity participation by e-commerce marketplace entity or its group companies, or having control on its inventory by e-commerce marketplace entity or its group companies, will not be permitted (if not permitted, the question of limit does not arise) to sell its products on the platform run by such marketplace entity.

Question 4: Consider the following statements:

Other things remaining unchanged, market demand for a good might increase if:

1. Price of its substitute increases

2. Price of its complement increases

3. The good is an inferior good and income of the consumers increases

4. Its price falls

Which of the above statements are correct?

(a) 1 and 4 only

(b) 2, 3 and 4

(c) 1, 3 and 4

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (a)

The main influences on buying plans that change demand are:

- Prices of related goods

- Income

- Expectations

- Number of buyers

- Preferences

The Demand increases when

- The demand for good increases, if the price of one of its substitutes rises.

- The demand for good increases, if the price of one of its substitutes rises.

- An inferior good is an economic term that describes a good whose demand drops when people’s incomes rise.

- If the price of a good falls, the quantity demanded of that good increases

Question 5: The Service Area Approach was implemented under the purview of [2019-I]

(a) Integrated Rural Development Programme

(b) Lead Bank Scheme

(c) Mahatma Gandhi National Rural Employment Guarantee Scheme

(d) National Skill Development Mission

View Answer

View Answer

Correct Answer is Option (b)

Basic function of Lead Ban k: Preparation of service area credit plan. Coordination with the efforts of Government, banks and credit agencies. Service Area approach is a modification of Lead Bank scheme.

Question 6: Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering

themselves directly? [2019-I]

(a) Certificate of Deposit

(b) Commercial Paper

(c) Promissory Note

(d) Participatory Note

View Answer

View Answer

Correct Answer is Option (d)

Participatory Note (P-Notes): A foreigner wishes to invest in India but does not want to go through the hassles of registering with SEBI, getting PAN card number, opening a DEMAT account etc. So, he will approach a SEBI registered foreign institutional investor (FII) / foreign portfolio investor (FPI) and invest via Participatory Notes.

Question 7: In the context of any country which one of the following would be considered as part of its social capital? [2019-I]

(a) The proportion of literates in the population.

(b) The stock of its buildings, other infrastructure and machines.

(c) The size of the population in the working age group.

(d) The level of mutual trust and harmony in the society

View Answer

View Answer

Correct Answer is Option (d)

- A: Human Capital would be a suitable word.

- B: Economic capital or tangible capital would be a suitable word.

- C: Demographic dividend would be a suitable word.

- By elimination we are left with Ans (d).

Question 8: With reference to the governance of public sector banking in India, consider the following statements [2018-I]

1. Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

2. To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct ?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (b)

From government reports, If we look at the data graph of capital infusion in last one decade, there have been ups and downs to #1 is wrong. And as per Economic Survey, #2 is correct.

Question 9: Which one of the following statements correctly describes the meaning of legal tender money? [2018-I]

(a) The money which is tendered in courts of law to defray the fee of legal cases

(b) The money which a creditor is under compulsion to accept in settlement of his claims

(c) The bank money in the form of cheques, drafts, bills of exchange, etc.

(d) The metallic money in circulation in a country

View Answer

View Answer

Correct Answer is Option (b)

NCERT Class 12 Macroeconomics Chapter 3: Legal tender- is a fiat money which cannot be refused by any citizen of the country for settlement of any kind of transaction. So, B is the appropriate description.

Question 10: What is/are the purpose/purposes of the ‘Marginal Cost of Funds based Lending Rate (MCLR)’ announced by RBI? [2016-I]

1. These guidelines help improve the transparency in the methodology followed by banks for determining the interest rates on advances.

2. These guidelines help ensure availability of bank credit at interest rates which are fair to the borrowers as well as the banks.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (c)

(i) With effect from 1st April, 2016, all loans in India shall be priced with reference to Marginal Cost of Funds based Lending Rates (MCLR) which will comprise of :- 1. Marginal Cost of Funds 2. Negative carry on account of CRR 3. Operating Costs 4. Tenor of premium. Banks shall review and publish their MCLR every month on a preannounced date. Marginal Cost of Funds which will comprise of marginal cost of borrowings and return on networth.

(ii) Both right. Verbatim lifted from RBI's press statement first paragraph.

Question 11: The establishment of ‘Payment Banks’ is being allowed in India to promote financial inclusion. Which of the following statements is/are correct in this context? [2016-I]

1. Mobile telephone companies and supermarket chains that are owned and controlled by residents are eligible to be promoters of Payment Banks.

2. Payment Banks can issue both credit cards and debit cards.

3. Payment Banks cannot undertake lending activities.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (b)

(i) They can enable transfers and remittance through mobile phones. The RBI guidelines say that the payments bank cannot undertake lending activities.

(ii) Mobile phone companies and supermarket eligible. But, Payment banks can’t issue credit card or give loans. Go by eliminating all options with “2”, and you’re left with (b) 1 and 3 only.

Question 12: The term ‘Core Banking Solutions’ is sometimes seen in the news. Which of the following statements best describes/describe this term? [2016-I]

1. It is a networking of a bank’s branches which enables customers to operate their accounts from any branch of the bank on its network regardless of where they open their accounts.

2. It is an effort to increase RBI’s control over commercial banks through computerization.

3. It is a detailed procedure by which a bank with huge non-performing assets is taken over by another bank.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (a)

(i) Core Banking Solution (CBS) is networking of branches, which enables Customers to operate their accounts, and avail banking services from any branch of the Bank on CBS network, regardless of where he maintains his account. The customer is no more the customer of a Branch. He becomes the Bank’s Customer. Thus CBS is a step towards enhancing customer convenience through Anywhere and Anytime Banking.

(ii) 3 is definitely not the purpose, so by elimination the answer is (a).

Question 13: With reference to ‘Bitcoins’, sometimes seen in the news, which of the following statements is/are correct? [2016-I]

1. Bitcoins are tracked by the Central Banks of the countries.

2. Anyone with a Bitcoin address can send and receive Bitcoins from anyone else with a Bitcoin address.

3. Online payments can be sent without either side knowing the identity of the other.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (b)

(i) Bitcoin are not maintained by the Central Bank. Bitcoins are created as a reward for payment processing work in which users offer their computing power to verify and record payments into a public ledger.

(ii) They’re not tracked by any central bank or authority. Both 2 and 3 are right.

Question 14: The term ‘Base Erosion and Profit Shifting’ is sometimes seen in the news in the context of [2016-I]

(a) mining operation by multinational companies in resource-rich but backward areas

(b) curbing of the tax evasion by multinational companies

(c) exploitation of genetic resources of a country by multinational companies

(d) lack of consideration of environmental costs in the planning and implementation of developmental projects

View Answer

View Answer

Correct Answer is Option (b)

(i) Base Erosion and Profit Shifting (BEPS) is a tax avoidance strategy used by multinational companies, wherein profits are shifted from jurisdictions that have high taxes (such as the United States and many Western European countries) to jurisdictions that have low (or no) taxes (so-called tax havens). The BEPS project is said to be an “attempt by the world’s major economies to try to rewrite the rules on corporate taxation to address the widespread perception that the [corporations] don’t pay their fair share of taxes”.

(ii) BEPS aims to curb the tax evasion by MNCs, hence B is the answer.

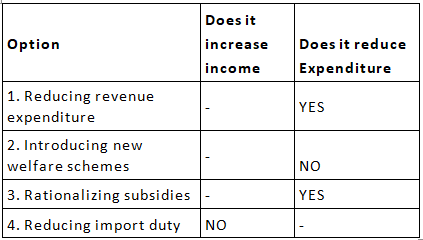

Question 15: There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit? [2016-I]

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (c)

(i) In order to reduce the fiscal deficit, the government needs to increase its earnings and reduce its expenditure. This is done by following methods: Cut down the subsidies; reforms in tax structures; improve profit generated by Public Sector Enterprises and austerity measures.

(ii) Just by applying logic i.e. to reduce deficit, we’ve to increase income and reduce Expenditure.

So, answer is only 1 and 3.

Question 16: Which of the following is/are included in the capital budget of the Government of India? [2016-I]

1. Expenditure on acquisition of assets like roads, buildings, machinery, etc.

2. Loans received from foreign governments

3. Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (d)

The main items of capital budget are receipts and expenditure for capital (Financial) gains. It also includes loans raised by Government from public, Reserve Bank and other parties, and from foreign Governments and bodies. It also includes capital expenditure on acquisition of assets like land, buildings, machinery, equipment, etc and loans and advances granted by Central Government to State and Union Territory Governments, Government companies, Corporations and other parties.

Question 17: ‘Global Financial Stability Report’ is prepared by the [2016-I]

(a) European Central Bank

(b) International Monetary Fund

(c) International Bank for Reconstruction and Development

(d) Organization for Economic Cooperation and Development

View Answer

View Answer

Correct Answer is Option (b)

(i) The Global Financial Stability Report (GFSR) is a survey by the IMF staff published twice a year, in the spring and fall. The report draws out the financial ramifications of economic issues highlighted in the IMF’s World Economic Outlook (WEO).

(ii) IMF prepares this report.

Question 18: 'Basel III Accord' or simply 'Basel III', often seen in the news, seeks to [2015-I]

(a) develop national strategies for the conservation and sustainable use of biological diversity

(b) improve banking sector's ability to deal with financial and economic stress and improve risk management

(c) reduce the greenhouse gas emissions but places a heavier burden on developed countries

(d) transfer technology from developed Countries to poor countries to enable them to replace the use of chlorofluorocarbons in refrigeration with harmless chemicals

View Answer

View Answer

Correct Answer is Option (b)

Basel III is a comprehensive set of reform measures which was developed by the Basel Committee on Banking Supervision and to strengthen the regulation, supervision and risk management of the banking sector. These measures aim to:

Improve the banking sector's ability to absorb shocks arising from financial and economic stress, whatever the source; improve risk management and governance; strengthen banks' transparency and disclosures.

Question 19: With reference to Indian economy, consider the following [2015-I]

1. Bank rate

2. Open market operations

3. Public debt

4. Public revenue

Which of the above is/are component/ components of Monetary Policy?

(a) 1 only

(b) 2, 3 and 4

(c) 1 and 2

(d) 1, 3 and 4

View Answer

View Answer

Correct Answer is Option (c)

The RBI implements the monetary policy through open market operations, bank rate policy, reserve system, credit control policy, moral persuasion and through many other instruments.

Question 20: When the Reserve Bank of India reduces the Statutory Liquidity Ratio by 50 basis points, which of the following is likely to happen? [2015-I]

(a) India's GDP growth rate increases drastically

(b) Foreign Institutional Investors may bring more capital into our country

(c) Scheduled Commercial Banks may cut their lending rates

(d) It may drastically reduce the liquidity to the banking system

View Answer

View Answer

Correct Answer is Option (c)

When the Reserve Bank of India reduces the Statutory Liquidity Ratio by 50 basis points; the Scheduled Commercial Banks may cut their lending rates.

Question 21: What is/are the facility/facilities the beneficiaries can get from the services of Business Correspondent (Bank Saathi) in branchless areas? [2014 - I]

1. It enables the beneficiaries to draw their subsidies and social security benefits in their villages.

2. It enables the beneficiaries in the rural areas to make deposits and withdrawals.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (c)

Besides giving access to banking, it also enables government subsidies and social security benefits to be directly credited to the accounts of the beneficiaries, enabling them to draw the money from the bank saathi or business correspondents in their village itself.

Question 22: In the context of Indian economy, which of the following is/ are the purpose/purposes of ‘Statutory Reserve Requirements’? [2014 - I]

1. To enable the Central Bank to control the amount of advances the banks can create

2. To make the people’s deposits with banks safe and liquid

3. To prevent the commercial banks from making excessive profits

4. To force the banks to have sufficient vault cash to meet their day-to-day requirements

Select the correct answer using the code given below.

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (a)

1 is definitely correct as CRR. SLR is used to control money supply and credit off take. 2 may or may not be correct, to make people's deposit safe, capital adequacy ratio is the norm. 3 is definitely wrong as to control excess profit, margins would have to be reduced, not CRR, SLR.

Question 23: The Reserve Bank of India regulates the commercial banks in matters of [2013 - I]

1. liquidity of assets

2. branch expansion

3. merger of banks

4. winding-up of banks

Select the correct answer using the codes given below.

(a) 1 and 4 only

(b) 2, 3 and 4 only

(c) 1, 2 and 3 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (d)

The Reserve Bank of India is the main monetary authority of the country and beside that, in its capacity as the central bank, acts as the bank of the national and state governments.

Question 24: An increase in the Bank Rate generally indicates that the [2013 - I]

(a) market rate of interest is likely to fall

(b) Central Bank is no longer making loans to commercial banks

(c) Central Bank is following an easy money policy

(d) Central Bank is following a tight money policy

View Answer

View Answer

Correct Answer is Option (d)

A tight monetary policy is a course of action undertaken by Central bank to constrict spending in an economy, or to curb inflation when it is rising too fast. The increased bank rate increases the cost of borrowing and effectively reduces its attractiveness.

Question 25: Which of the following grants / grant direct credit assistance to rural households? [2013 - I]

1. Regional Rural Banks

2. National Bank for Agriculture and Rural Development

3. Land Development Banks

Select the correct answer using the codes given below.

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (c)

Land development bank started financing long term loan for more significant rural development activities like rural and cottage industries, rural artisans etc. The main purpose of RRB’s is to mobilize financial resources from rural / semi-urban areas and grant loans and advances mostly to small and marginal farmers, agricultural labourers and rural artisans. NABARD does not give “direct” credit assistance. It provides credit Via intermediaries such as Microfinance companies, Cooperative society, RRB.

Question 26: Consider the following statements: [2013 - I]

1. Inflation benefits the debtors.

2. Inflation benefits the bondholders.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (a)

Those who benefit from higher inflation are debtors and those who suffer from it are creditors. If one has substantial debt, each rupee one has to repay would be worth less than when it was borrowed. In this way, one pays back less in real terms.

Question 27: Consider the following liquid assets: [2013 - I]

1. Demand deposits with the banks

2. Time deposits with the banks

3. Saving deposits with the banks

4. Currency

The correct sequence of these assets in the decreasing order of liquidity is

(a) 1-4-3-2

(b) 4-3-2-1

(c) 2-3-1-4

(d) 4-1-3-2

View Answer

View Answer

Correct Answer is Option (d)

Currency/cash is the most liquid, then the demand deposits (current accounts), then the saving deposits with bank and finally the least liquid is the time deposits with the bank (fixed deposits).

Question 28: The basic aim of Lead Bank Scheme is that [2012 - I]

(a) big banks should try to open offices in each district

(b) there should be stiff competition among the various nationalized banks

(c) individual banks should adopt particular districts for intensive development

(d) all the banks should make intensive efforts to mobilize deposits

View Answer

View Answer

Correct Answer is Option (c)

The basic aim of Lead Bank scheme is that the bank should adopt particular districts for intensive development by offering loans and banking services.

Question 29: Which of the following terms indicates a mechanism used by commercial banks for providing credit to the government? [2010]

(a) Cash Credit Ratio

(b) Debt Service Obligation

(c) Liquidity Adjustment Facility

(d) Statutory Liquidity Ratio

View Answer

View Answer

Correct Answer is Option (d)

Commercial banks provide long-term credit to government by investing their funds in government securities and short-term finance by purchasing Treasury Bills. This comes under Statutory Liquidity Ratio (SLR).

Question 30: With reference to the Non-banking Financial Companies (NBFCs) in India, consider the following statements: [2010]

1. They cannot engage in the acquisition of securities issued by the government.

2. They cannot accept demand deposits like Savings Account

Which of the statement given above is/ are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (b)

A non-banking financial company (NBFC) is a company registered under the Companies Act, 1956 and is engaged in the business of loans and advances, acquisition of shares/stock/bonds/debentures/securities issued by government or local authority or other securities of like marketable nature, leasing, hire-purchase, insurance business, chit business, but does not include any institution whose principal business is that of agriculture activity, industrial activity, sale/purchase/construction of immovable property. They cannot accept demand deposits like commercial banks as they are not a part of clearance and settlement system.

Question 31: In the parlance of financial investments, the term ‘bear’ denotes [2010]

(a) An investor who feels that the price of a particular security is going to fall

(b) An investor who expects the price of particular shares to rise

(c) A shareholder or a bondholder who, has an interest in a company, financial or otherwise

(d) Any lender whether by making a loan or buying a bond

View Answer

View Answer

Correct Answer is Option (a)

Bear is a speculator who sells shares in anticipation of fall operator prices to buy them back and thus make a profit.

Question 32: In India, the interest rate on savings accounts in all the nationalized commercial banks is fixed by [2010]

(a) Union Ministry of Finance

(b) Union Finance Commission

(c) Indian Banks’ Association

(d) None of the above.

View Answer

View Answer

Correct Answer is Option (d)

It is fixed by Reserve Bank of India. In 2011, RBI permitted the commercial banks to fix interest rate on saving account independently.

Question 33: With reference to the institution of Banking Ombudsman in, India, which one of the statements is not correct? [2010]

(a) The Banking Ombudsman is appointed by the Reserve Bank of India.

(b) The Banking Ombudsman can, consider complaints from Non Resident Indians having accounts in India.

(c) The orders passed by the Banking Ombudsman are final and binding on the parties concerned.

(d) The service provided by the Banking Ombudsman is free of any fee.

View Answer

View Answer

Correct Answer is Option (c)

The Banking ombudsman Scheme is an expeditious and inexpensive forum for bank customers for resolution of complaints relating to certain services rendered by banks. Any person aggrieved by the decision of the Banking Ombudsman can approach the Appellate Authority. The Appellate Authority is vested with a Deputy Governor of the RBI.

Question 34: With reference to India, consider the following: [2010]

1. Nationalization of Banks

2. Formation of Regional Rural Banks

3. Adoption of villages by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (d)

“Financial inclusion” is the delivery of financial services at affordable costs to vast sections of disadvantaged and low income groups. Banking services are in the nature of public good. It is essential that availability of banking and payment services be available to the entire population without discrimination.

Question 35: Consider the following statements: [2010]

The functions of commercial banks in India include

1. Purchase and sale of shares and securities on behalf of customers

2. Acting as executors and trustees of wills

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (c)

Miscellaneous functions of commercial banks in India include: Transfer and collection of funds, purchase and sale of shares on behalf of customers, acting as executors and transfers of wills, purchase and sale of foreign exchange etc.

Question 36: The International Development Association, a lending agency, is administered by the [2010]

(a) International Bank for Reconstruction and Development

(b) International Fund for Agricultural Development

(c) United Nations Development Programme.

(d) United Nations Industrial Development Organization

View Answer

View Answer

Correct Answer is Option (a)

International Development Association (IDA) , is that part of the World Bank that helps the world’s poorest countries. It complements the World Bank’s other lending arm— the International Bank for Reconstruction and Development (IBRD) which serves middle-income countries with capital investment and advisory services. IDA was created in 1960.

|

72 docs|31 tests

|

FAQs on Tertiary Sector in the Indian Economy - Solved Questions (2010-2024) - UPSC Topic Wise Previous Year Questions

| 1. What is the significance of the tertiary sector in the Indian economy? |  |

| 2. How has the tertiary sector evolved in India over the past decade? |  |

| 3. What are the challenges faced by the tertiary sector in India? |  |

| 4. How does the tertiary sector contribute to employment generation in India? |  |

| 5. What policies has the Indian government implemented to boost the tertiary sector? |  |