Automobile, Fertiliser & Paper Industry | Geography Optional for UPSC PDF Download

Automobile Industry in India

- The term "automobile" comes from two words: "auto," meaning self, and "mobile," meaning movable. It refers to vehicles that can move by themselves without the need for human or animal force. Automobiles are used for the transportation of goods and passengers through various means, such as roads, tracks, water, or airways.

- Before India gained its independence, the automobile industry did not truly exist in the country. Only assembly work was done using imported parts. General Motors (India) Ltd. began assembling trucks and cars in their Mumbai factory in 1928. Ford Motor Co. (India) Ltd. started assembling cars and trucks in Chennai in 1930 and Mumbai in 1931.

- The real growth of the automobile industry in India began with the establishment of Premier Automobiles Ltd. in Kurla (Mumbai) in 1947 and Hindustan Motors Ltd. in Uttarpara (Kolkata) in 1948. Since then, the industry has made significant progress over the past three decades and is now one of the most dynamic sectors of the Indian economy.

- The Indian automobile industry has continued to expand since the liberalization policies of 1991. Today, there are 15 manufacturers of passenger cars and multi-utility vehicles, nine commercial vehicle manufacturers, 14 two/three-wheeler manufacturers, and 14 tractor manufacturers, as well as five engine manufacturers. The industry has attracted investments of over Rs. 50,000 crore.

- In 2003-04, the turnover of the Indian automobile sector exceeded Rs. 1,00,000 crore. The industry also offers significant employment opportunities, currently providing 4.5 lakh direct jobs and about one crore indirect jobs. The contribution of the automobile industry to India's GDP has increased from 2.77 percent in 1992-93 to 4.7 percent in 2002-03.

Production and Distribution

- The commercial vehicle industry is divided into two main segments: passenger and goods vehicles. The passenger segment is predominantly managed by state-owned transport undertakings (STUs), while goods vehicles are generally produced by private sector companies. The production of commercial vehicles began in the 1950s, and the industry experienced significant growth during the post-liberalization era due to government incentives.

- Commercial vehicle production, which includes buses, trucks, tempos, and 3- and 4-wheelers, increased from a mere 8.6 thousand units in 1950-51 to 145.5 thousand in 1990-91 and 327.3 thousand in 1996-97. However, production trends have fluctuated since then, and in 2003-04, India produced 275.1 thousand commercial vehicles.

- Currently, there are seven major companies involved in the manufacturing of buses and trucks. Tata Engineering and Locomotive Co. Ltd. (TELCO) is the top producer of medium and heavy commercial vehicles, accounting for over 70% of such vehicles produced in India. Light commercial vehicles are manufactured at four plants located in Hyderabad, Pithampur (M.P.), Arson near Rupnagar (Punjab), and Surajpur in U.P.

- Other notable manufacturers include Premier Automobiles and Mahindra & Mahindra in Mumbai, Ashok Leyland Ltd. and Standard Motor Products of India Ltd. in Chennai, Hindustan Motors Ltd. in Kolkata, and Bajaj Tempo Ltd. in Pune. Additionally, Shaktiman trucks are produced under the Ministry of Defence, and Nissan Jeeps are manufactured in Jabalpur in collaboration with Nissan of Japan.

Passenger Cars

- A number of companies are engaged in manufacturing passenger cars. Of these, Maruti Udyog Ltd. (MUL) is at the top. It is located at Gurgaon in Haryana. It started production in 1983 with the collaboration of Suzuki Motor Corporation of Japan. Currently, this company produces about four-fifths of the total cars produced in India.

- It produces a variety of models of which Maruti 80, Zen, Wagon R, Esteem, and Gypsy are very popular.

- Hindustan Motors (Kolkata and Chennai), Premier Automobiles (Mumbai), Standard Motor Products (Chennai), and Sunrise Industries (Bangalore) are other important producers.

- Several new companies have entered the car manufacturing industry of India after liberalization in 1991. These include Hyundai Motors India at Irrungattukottai in Kanchiura district (Tamil Nadu), Daewoo of Korea in 1995 at Surajpur (Uttar Pradesh), Telco at Pimpri (near Pune). Honda of Japan has set up a plant in Uttar Pradesh to manufacture ‘City’. General Motors has launched Opel Astra. It has a tie-up with Hindustan Motors.

- Ford in collaboration with Mahindra has introduced Ford.

- Hindustan Motors in collaboration with Mitsubishi of Japan has launched ‘Lancer’.

- Mercedes Benz of Germany in collaboration with Telco is manufacturing E220 and 250D for the upper strata of society.

- Premier Automobiles in collaboration with Fiat-India Auto Limited is manufacturing the Fiat Uno model.

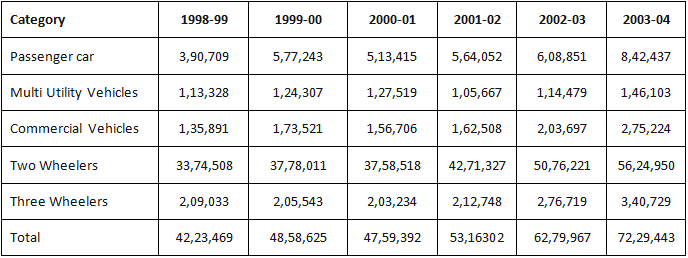

- Table 27.19 shows that the car manufacturing industry made rapid progress particularly after Maruti Udyog Limited (MUL) started production in the mid-1980s. The production of passenger cars increased from 390.7 thousand in 1998-99 to 842.4 thousand in 2003-04.

Production of Vehicles in India

- The production of cars (including jeeps and land rovers) recorded more than a hundred percent increase in a short span of six years from 220.8 thousand in 1999-91 to 483.0 thousand in 1996-97. After a brief slack period of 1997-98 and 1998-99, the production again picked up in 1999-2000 and stood at 1,008.1 thousand in 2003-04.

- Several factors have made it a buoyant industry in the recent past and the industry has a bright future. Reduction in excise duty on passenger cars from 32 to 24 percent in 2004 has led to reduced car prices and created the potential for an increase in demand.

- This has helped in the growth of the industry to a great extent. The government’s Auto Policy also has the stated aim of making India an ‘Asian hub’ for the manufacture of small cars. The small car segment, which refers to the A and В segments, accounts for over 65 percent of the market. Giving a further push to this segment, therefore, adds impetus to a movement that is already underway. For India to become a large manufacturer of small cars, quality and price are the two basic deciding factors.

- The potential for growth is good considering that passenger car penetration in India is a mere 20 cars per 1,000 population whereas it is much higher in other developing countries. The market is projected to grow at a rate of around 7 percent annually.

- Over the years car sales in the A and В segments category as a whole have registered a steady growth because these cars are available in a wide range of models and at affordable prices. The mid-size category normally pertains to С segment cars. This segment accounts for 15-16 percent.

- In addition to varied models and affordable prices, various finance options have also grown with the automobile industry.

- There were times when a car loan meant tedious trips to the bank, reams of paperwork, and long waiting periods for requisite approvals from the sanctioning authority. Today the scenario is quite different, with customers having fast access to very flexible financing options that suit their different needs. Attractive automobile financing schemes have definitely boosted sales of passenger cars. Today, almost 70 percent of new cars are financed through auto loans.

Jeeps

- Almost the entire production of jeeps comes from Mahindra, Mumbai. It has a capacity to produce about 13,000 jeeps per annum.

Two Wheelers

- Two-wheeler industries mainly comprise motorcycles, scooters, mopeds, and scooterettes. The Indian two-wheeler industry made a humble beginning in the early 1950s when Automobile Products of India (API) started manufacturing scooters in the country. Until 1958, API and Enfield were the sole producers. In 1960, Bajaj Auto set up a plant in collaboration with Pioggio of Italy.

- Two-wheeler industries have also made rapid strides. It came a long way from an insignificant production of 0.9 thousand units in 1960-61 to 5,624.9 thousand units in 2003-04. The two-wheeler market was opened to foreign competition in the mid-1980s. Practically, all the global giants have been present in India for quite some time.

- The first to come was Suzuki Motor Corporation with TVS in 1984. Honda followed within a year, in a joint venture with Hero Group. Then Kawasaki and Yamaha entered into a license agreement with Bajaj Auto and Escorts respectively.

- Piaggio has joined up with LML which is planning to expand its capacity to six lakh vehicles per annum. Bajaj Auto is expanding its capacity to two million vehicles per annum. Hero Honda is expanding its Dharuhera plant capacity to over 2, 52,000 vehicles a year and has set up a plant at Gurgaon with an investment of Rs.160 crore.

- TVS Suzuki plans to invest Rs. 200 crores to expand its production capacity to one million vehicles per annum. Yamaha-Escorts, a joint venture has also announced plans to introduce a new range of products and expansion facilities in its Surajpur plant. Mumbai, Pune, New Delhi, and Kanpur are the main centers of scooter manufacturing. Public sector units are located at Hyderabad, Bangalore, Satara, Lucknow, and Alwar. Motorcycle-producing units are located in New Delhi, Chennai, Mysore, and Gurgaon.

- The dynamics of the two-wheeler industry in India makes fascinating reading. From a semi-luxury product for the urban middle class in the 1980s and earlier, the two-wheeler has now become not only the favorite form of personal transport but also the most coveted personal possession among various consumer classes except perhaps the most affluent.

- Leading this emergent boom has been the stylish fuel-efficient and sturdy four-stroke motorcycle that seems to be equally at home on highways and rural byways. In addition, economically active and ambitious consumer class, the relative youth of the population, the substantially lower cost of two-wheelers (as compared to cars) as well as its inherent attractiveness, especially to the young male population have played a crucial role.

- Today with annual sales of over 5 million units, the Indian two-wheeler market is the second-largest market in the world after that of China (annual sales of 12.5 million units).

- Technically, the two-wheeler industry is divided into five major classifications: mopeds, motorcycles, scooters, step thrust, and ungeared scooters. Of all the two-wheelers, motorcycles have registered the maximum growth.

- In fact, motorcycles are the fastest-growing segment, with scooter and moped volumes seeing a steady decline. The sale of motorcycles registered a more than fourfold increase in a short span of six years. It increased from 802 thousand units in 1996-97 to 3,757 thousand units in 2002-03.

- In contrast, the sale of scooters declined from 1,137 thousand units in 1964-97 to only 338 thousand units in 2002- 03 Similarly the sale of mopeds was reduced to about half from 655 thousand units in 1996-97 to 362 thousand units in 2002-03 (see Fig. 27.9).

- While sales of all other product categories declined motorcycles grow at a robust 31 percent in 2002-03 and represented 74 percent of all two-wheeler rates as against just 27 percent in 1996-97 (see Figure 27.10). While scooter sales have predominantly been in urban areas, motorcycle sales are split 50: 50 among urban and semi-urban/rural areas.

- Like the passenger car industry, the two-wheeler industry has also gained a lot from the availability of easy finance. Financing was a rare phenomenon till the early 1990s but increased fourfold between 1996-97 and 2003-04. Though only 35-45 percent of two-wheeler sales are financed now, this proportion has moved up from 15 percent in 1999-2000.

- Two-wheelers are the most effective safety valve which relieves pressure on urban personal transportation. More than 65 percent of the two-wheeler population is concentrated in urban and semi-urban areas. With public transport being scarce in most cities of India, the two-wheelers offer a convenient alternative.

- The demography of the Indian population is skewed in favor of the younger generation, which prefers two-wheelers. Therefore, the scope of further growth of the industry is great. The younger generation in the age group of 15-34 years comprised 35.1 percent of the population as per 2001 census figures, and this is expected to increase in the near future.

- The office-going middle class (typically in the age group of 25 and 59 years) which prefers motorcycles on account of fuel economy, formed 23.5 percent of the population in 2001, and this is expected to increase further in the near future. Consequently, this segment in expected to progress rapidly in the next ten years.

- Although India is the second-largest two-wheeler market in the world after China, the penetration levels are low at 38 per thousand people, compared to Indonesia (75), Thailand (150), and Malaysia (220). Thus there is ample scope for this industry to grow fast.

Fertilizer Industry

Fertilizers are substances added to soil or plants to supply essential nutrients necessary for healthy growth and development. Key nutrients such as nitrogen, phosphorus, and potassium are crucial for plants as they support various processes including:

- Photosynthesis: the process by which plants make food using sunlight.

- Protein synthesis: the creation of proteins needed for various plant functions.

- Cell division: the mechanism through which plants grow by producing new cells.

Although fertilizers are commonly used in agriculture, their effectiveness can depend on factors such as:

- Soil health: the quality of the soil and its nutrient content.

- Environmental conditions: factors like weather and climate.

When used appropriately, fertilizers can significantly improve crop yields and promote robust plant health.

Key Facts About the Fertilizer Industry in India

Fertilizer Industry Facts

Fertilizer Industry Facts

- Urea Consumption: India is the second largest consumer of urea in the world, following China.

- Production of Nitrogenous Fertilisers: India ranks second in the production of nitrogenous fertilisers.

- Core Industry: The fertiliser industry is considered one of the eight core industries in India.

- Subsidy: Fertiliser accounts for the second largest subsidy in India, after food.

- Potash Demand: India meets its potash demand primarily through imports.

Usage of Fertilizers in India

Fertilizer Usage India

Fertilizer Usage India

- Deficiencies in India: Indian soils generally have low organic carbon content and face a widespread nitrogen deficiency.

- Phosphorus and potassium levels are usually low to medium, while sulfur deficiencies have gradually emerged.

- Rapid Growth:Fertilizer use has surged from less than 1 million tonnes of total nutrients in the mid-1960s to nearly 17 million tonnes today.

- The introduction of high-yielding varieties in the 1960s significantly increased fertilizer consumption.

- Import Dependency for Fertilizers: India relies on imports for 25% of its Urea needs, 90% for Phosphates, and 100% for Potash.

- Disparities in Fertilizer Consumption:Fertilizer usage varies greatly across regions.

- Example: 40.5 kg/ha of total nutrients in Rajasthan compared to 184 kg/ha in Punjab.

- Urea makes up 82 percent of total nitrogen consumption.

- Di-ammonium phosphate accounts for 63 percent of phosphate consumption.

- Sales / consumption of different Fertilizerssaw a substantial increase during 2019-20 compared to 2018-19.

- Urea increased by 5.29%

- DAP increased by 15.67%

- MOP increased by 3.45%

- NPKS increased by 9.95%

- Organic Manures Use: Organic manures play a vital role in supplying plant nutrients and improving soil fertility.

- Dominant Crops: Rice, wheat, cotton, sugar cane, rapeseed, and mustard use about two-thirds of the fertilizers applied.

Fertilizer Subsidy Mechanism in India

- The fertilizer subsidy mechanism in India is administered as per government schemes.

- Urea Fertilizers:

- The MRP (Maximum Retail Price) of neem-coated urea is set by government policy.

- The average cost for manufacturers and importers of neem-coated urea is about four to five times the MRP.

- The government provides a subsidy to cover the difference between the MRP and production costs, which varies based on the production location.

- Non-Urea Fertilizers:

- The MRPs of non-urea fertilizers are either decontrolled or set by the companies.

- The Centre pays a flat per-tonne subsidy on these nutrients to keep prices reasonable.

- Farmers purchase fertilizers at MRPs that are lower than the usual market rates or production/import costs.

- Raw Materials:

- Ammonia: Used to make urea and produced from natural gas.

- Sulphur:. raw material for phosphoric acid fertilizer, is a by-product of oil refineries.

How is the subsidy paid?

- Beneficiaries: The subsidy is intended for fertiliser companies, but the real beneficiaries are the farmers. Farmers pay Maximum Retail Prices (MRPs) that are lower than the market rates due to this subsidy.

- Companies used to be compensated only after their bagged products were delivered and received at a district’s railhead or an approved godown.

- Direct Benefit Transfer (DBT): Introduced in 2018, this system ensures that subsidy payments to companies occur only after actual sales to farmers by retailers.

- DBT in Fertiliser:

- Retailers are equipped with point-of-sale (PoS) machines linked to the Department of Fertilisers’ e-Urvarak DBT portal.

- To purchase subsidised fertilisers, buyers must provide their Aadhaar unique identity or Kisan Credit Card number.

- The PoS device must record the quantity of fertilisers bought, along with the buyer’s name and biometric verification.

- Companies can claim the subsidy only after the sale is logged on the e-Urvarak platform.

Fertilizer Related Schemes

- Pradhan Mantri Kisan Samrudhi Kendra (PMKSK)

- Aims to meet farmers' needs by providing essential agri-inputs such as fertilizers, seeds, and implements.

- Offers testing facilities for soil, seeds, and fertilizers.

- Raises awareness among farmers about best practices and available resources.

- Pradhan Mantri Bhartiya Jan Urvarak Pariyojana(One Nation, One Fertiliser)

- Introduced by the Ministry of Chemicals & Fertilisers to streamline fertiliser branding.

- Establishes a single brand name for UREA, DAP, MOP, and NPK fertilisers to reduce confusion.

- Example: All urea sold will carry the same name, brand, and quality. Bharat.

- Bharat Brand

- Highlights the fertiliser subsidy scheme under Pradhan Mantri Bhartiya Jan Urvarak Pariyojana.

- New bags reflecting the One Nation One Fertiliser concept were introduced on 02 August 2022.

- Nutrient Based Subsidy (NBS)

- Initiated in 2010 by the Department of Fertilisers.

- Applies to 22 fertilisers (excluding urea) based on nutrient content (N, P, K, & S).

- Additional subsidies for fertilisers fortified with micronutrients like molybdenum and zinc.

- Aims to achieve an optimal N:P:K fertilization balance of 4:2:1.

- Market Development Assistance Policy

- Promotes the use of alternative fertilisers such as green manure, organic compost, and slurry from rural areas.

- Soil Health Card

- Issued to farmers every 2 years by the Ministry of Agriculture and Farmers Welfare.

- Covers the cost of sampling, testing, and reporting.

- Village-level soil testing labs to be established by youth with agricultural education, SHGs, and FPOs.

- Provides fertiliser recommendations for six crops and organic manures based on 12 soil parameters including macronutrients, secondary nutrients, micronutrients, and physical parameters.

Urea

- Urea is not part of the Nutrient Based Subsidy.

- The Urea Subsidy is a Central Sector Scheme that offers a freight subsidy for the transportation of urea across the country.

- The Department of Fertilisers (DoF) mandates that all domestic producers must produce 100% of urea as Neem Coated Urea (NCU). This is a legal requirement.

- The benefits of Neem Coated Urea include:

- Gradual release of nitrogen into the soil.

- Improved nitrogen absorption by plants.

- Reduced need for pesticides.

- Increased crop yield.

Fertigation

- Combines water-soluble fertilizers in a drip system to deliver nutrients directly to the roots, minimizing waste.

Conclusion

- The use of chemical fertilizers in India has been on the rise, driven by the need to enhance agricultural productivity.

- However, challenges persist, including regional disparities in usage, dependence on imports for certain nutrients, and concerns about the decline in soil fertility.

- To promote sustainable agricultural development in India, it is crucial to encourage balanced nutrient application, increase local production, and ensure effective distribution of subsidies.

Paper Industry

- The pulp and paper industry comprises companies that use wood as raw material and produce pulp, paper, paperboard, and other cellulose-based products.

- The pulp and paper industry is one of the largest industries in the world. It is dominated by North American, Northern European, and East Asian countries. Latin America and Australasia also have significant pulp and paper industries.

- Over the next few years, it is expected that both India and China will become the key countries in the industry’s growth. World production of paper and paperboard is around 390 million tonnes and is expected to reach 490 million tonnes by 2020. In 2009, the total global consumption of paper was 371 million tonnes.

- The Paper industry is a vital and core industry for any country and the per capita paper consumption can be taken as a measure of growth and progress in areas related to industrial culture and education activities. Per capita consumption is tending to be stagnant in India at approximately 2 kg as against more than 200 kg in highly developed countries.

Growth and development

- Though the art of papermaking was introduced in India by Muslim rulers during the 10th century, it was flourishing as a cottage industry only.

- The first modern paper mill of course was established in 1832 at Serampore (West Bengal) which could not survive and the industry made a beginning again in 1870 at Ballygaunj ( Royal Bengal paper mills) near Calcutta.

- Many mills thereafter were started at Serampur (W.B), Lucknow (U.P), Titagarh (W.B), Deccan paper mills (Pune), Bengal paper mills (Raniganj), and Indian paper pulp (Shyam Nagar). But progress was sluggish till independence.

- During the period of planned development since independence, the paper industry has made rapid progress.

- In 1950-51 there were 17 units which produced 0.16 million tonnes of paper and 0.9 million tonnes of paper was imported.

- At present, there are more than 30 small and medium paper mills with a capacity of 18.38 lakh tonnes. At present, there are 43 large integrated pulp & paper mills. Besides these, more than 300 small & medium paper mills with a capacity of around 20 lakh tones are also working.

- The small sector accounts for 50% of the installed capacity and of production of paper in the country. In the early 1970s when the country was faced with paper famine, the government came to appreciate the role of the small paper units cause of the short gestation period, the use of cheap second-hand machinery readily available in foreign countries, the use of non-conventional raw materials such as rice and wheat straw, bagasse, jute stalks paper. The small units could be set up in any part of the country.

- The government gave necessary fillip and encouragement to the paper sector and liberal incentives were provided to paper units. The small paper units went into production and adverted the paper crisis.

- Production of paper falls short of our demand and hence large quantities of paper board, better quality paper (insulation paper, parchment paper, tissue paper, etc) have to be imported from Sweden, Canada, Japan, France, Belgium, U.S.A. Paper pulp and west paper are also imported for use as raw materials.

- Some quantities of printing and writing paper, craft and paper board, packing and wrapping paper is also exported to countries of the Middle East, East Africa, and South East Asia.

Paper industry: Growth Pattern

Since paper can be manufactured using a variety of raw materials, the growth pattern of the industry is sporadic, which is mainly due to:

- Large integrated paper mills.

- Small paper mills based on non-conventional raw materials like bagasse, or in combination with pulp.

- Small units based on waste paper.

- Units as part of large integrated sugar complexes.

- Large integrated newsprint manufacturing units.

- Handmade paper units under KVIC.

Location factors

The main factors that determine the location of the paper industry are:

- Nearness to the source of raw material: The location of the paper industry is dependent on the availability of bamboo, softwood. E.g. South Gujarat, Odisha, Madhya Pradesh

- Supply of abundant coal: Energy requirement and total transport cost of coal offset the disadvantage of the dearth of raw materials. Paper manufacturing started in Bengal due to the availability of coal.

- Nearness to the market: Some of the paper mills are located near the market where cheap labour is also available. For example, in Kolkata where raw material is brought from the North Eastern States. Here cheap labour, coal, water is readily available.

- Water Supply: The paper/pulp mills require clean water free from chemicals/pollutants. This is one of the reason why they are set up near forest locations away from polluted rivers.

Manufacturing

- Paper is manufactured in 2 stages in India:

- First Stage:Pulp is extracted from cellulose raw material: In 1st stage gross raw materials is required due to which pulp manufacturing units are located in the midst of cellulose producing areas.

- Second Stage: Pulp is pressed to from paper: In 2nd stage pulp is the raw material and therefore, paper units can be located near urban markets.

- Pulp is drawn from variety of sources like wood, bamboo, sabai/salai grass, bagasse, and crop straw. Hence paper industry is widely distributed across different regions in India.

Raw materials for manufacturing paper

- Bamboo

- Generally speaking 2.3 to 2.4 tonnes of bamboo is required for producing one tonne of paper. The paper industry uses bamboo to the extent of 60-70 percent of the totalrequirements of cellulosic raw materials. Bamboo has the advantage of possessing long fiber, dense stands, and quick regeneration.

- It reaches maturity in 2-3 years and provides a continuous flow of renewable sources of raw material.

- However, there is a danger of this source of important raw material being depleted if the rate of exploitation exceeds the rate of regeneration. The total supply of bamboo at the current rate is estimated at 20-30 lakh tonnes per annum.

- Assam, Orissa, Andhra Pradesh, Madhya Pradesh, Tamil Nadu, Karnataka, and Maharashtra are important producers of bamboo.

- Sabai grass

- This is another important raw material for manufacturing paper. It was the sole raw material before the introduction of bamboo as a significant raw material, but its use has decreased considerably since then. It now constitutes 7 to 9 percent of the total cellulosic raw material in the country.

- Although Sabai grass has long fiber and requires low chemical consumption, it grows in tufts intermixed with other vegetation and it is often difficult to separate impurities from it.

- Moreover, its supplies are much less than those of bamboo. The annual supply of Sabai grass along with other allied grasses is about one million tonnes. It mainly grows in the sub-Himalayan tracts of the Shiwaliks and the Tarai area.

- Bagasse

- It is a fibrous residue of the sugarcane stalk, mainly from the sugar mills, obtained after sucrose is extracted by crushing the sugarcane.

- On an average 50-60 lakh tonne of bagasse is produced in the country, half of which is used for manufacturing paper.

- Salia wood: It is widely used in the manufacture of newsprint paper.

- Others

- Paper is also manufactured by using materials other than those mentioned above. These include waste paper, rags, straw from rice and wheat, jute sticks, and soft wood obtained from eucalyptus, pine-wood, wattle, and mulberry trees.

Paper industry: Some other facts

- For producing one tonne of paper nearly 2.5 ton of bamboo and about 4 ton of coal are required. Both these materials are heavy as well as weight loosing. The location of industry should be advantageous to both.

- In the beginning when sabai and other grasses were largely used for making paper, it had to be carried to long distance to Bengal units from UP, Punjab, Bihar and Nepal. As coal mines were in Bengal, the mills were located here despite of its unfavourable position.

- In regard to source of raw materials, the Hoogly revering regime was preferred for location of earlier mills for two significant reasons viz.

- The availability of coal in large quantity

- The proximity of large market for the finished product.

- But now with the introduction of bamboo for making paper, Bengal does posses a favourable position for paper industry, from now not only large supplies of bamboo are available in the neighbourhood of the Hoogly riverine tract, but also coal mines and large consuming market exists.

- Some of the south Indian mill in Karnataka and Kerala also use bamboo which grows abundantly there.

- Most of the mills of UP and Haryana depends of sabai grass and murj grass. In UP the paper mills at Lucknow and Saharanpur (using sabai grass) command excellent transport relation in regard to raw materials and markets though in.

Location of Industry

- It is a raw material intensive industry. According to Weber concept, the ratio of raw material and finished product for the paper industry is 4:1 as it is a weight losing industry.

- The material index for it is greater than 1. Hence, in the initial phase, it is advantageous for the industry to be located near the raw material sources.

- Presently more and more plants are using bamboo as raw material. In comparison to sabai grass bamboo possesses certain advantages. Sabai grass is found intermixed with other vegetation and is often difficult to separate impurities from it.

- Further its supplies are so limited and it requires 60 years for regeneration of the forest whereas bamboo is exhausted because of its quick and dense growth and it generates in a year or two.

- Though the quality of paper produced from bamboo lacks in strength, yet bamboo has an advantage over the sabai grass in that, paper can be made entirely from bamboo without any admixture of wood pulp, the paper made from bamboo cannot be used for painting and for writing.

- Recent discovery of method for manufacturing paper from hard wood has made a revolution. Now mills have therefore been set up in M.P to utilize the hard wood.

- The newsprint mill in M.P at Nepanagar uses sabai wood for making paper pulp and also uses imported pulp from Canada and Scandavian countries. Hardwood (as in M.P), West Bengal, West Coast of India and temperate wood in the Himalaya region, J & K also provide potentialities for paper facture.

- Thus as the raw materials and chemicals are available in most of the areas around the country, all the paper mills are dispersed in locations.

Distribution

- Among the paper-producing states of India, West Bengal, Orissa Madhya Pradesh, Andhra Pradesh, Maharashtra and Karnataka constitute nearly 65% of the total production capacity. Other important producers are Tamil Nadu, Kerala, Assam, Haryana, Bihar and Gujarat. According to the estimates available, Assam possesses greatest potential to develop paper industry because of the presence of large forests as raw material.

- State-wise distribution of paper mills are:

- West Bengal: Since early eighteenth century, West Bengal contributed substantially to the national paper output. Major Mills in the state are situated along Hooghly River. The important mills of the state are Calcutta, Tribeni, Titagarh, Alambazar, Kakinara, Bansberia, Baranagar and Ranigunj. Some of these mills use waste paper and agro-residues as raw material; others use sabai grass and eucalyptus tree as raw material.

- Orissa: As a producer of paper, Orissa is gradually improving her position. Right now, three mills are producing paper at Brajarajnagar, Rayagada and Chowdwar. This state possesses wonderful assemblage of vast forest resources and cheap hydel power.

- Madhya Pradesh: A good number of new paper mills were set up within Madhya Pradesh in recent years. Major Mills are located at Nepanagar, Vidisha, Rewa, Ratlam, Shahdol etc. Nepa Nagar is the only newsprint manufacturing unit in the country.

- Andhra Pradesh: Abundance of bamboo and incentives declared by the state government attracted number of paper manufacturing units in Andhra Pradesh. All the mills are new, with sophisticated machines. Major Mills are situated at Rajamundry, Kagaznagar, Bodhan and Bhadrachalam.

- Maharashtra: At least 15 mills are located within the state. Mills are located at Kalyan, Khopli, Ballarpur, Pune, Nagpur, Bhiwandi, Bombay and Kamptee etc. Most of these mills are old and worn out.

- Karnataka: Leading paper manufacturing units in the state are Bhadravati, Belagola, Dandeli, Ramanagram, Bangalore, Krishnaraj Sagar.

- Tamil Nadu: Tamil Nadu has 24 small sized mills accounting for 5.74 per cent of the total installed capacity of the country. These mills use locally grown bamboo. Cheranmahadevi, Pallipalayam, Udmalpet, Chennai, Salem, Amravathinagar, Pahanasam, Madurai, etc. are the major producers.

- Uttar Pradesh: This state has the largest number of 68 mills, but the size of the mills being small, the installed capacity does not exceed 9 per cent. Saharanpur and Lalkuan have mills of large size. The other centres are at Meerut, Modinagar, Ghaziabad, Lucknow, Gorakhpur, Pipraich, Muzaffamagar, Allahabad (Naini), Varanasi, Kalpi, Budaun and Mainpuri.

Problems of the industry

- Shortage of raw material

- Sabai grass and Bamboo supply is often interrupted by various reasons. No industry has created its own plantation through which it could own raw material demand.

- With the dwindling forest wealth in India, there is a serious shortage of raw materials to meet the needs of paper industry. Use of unconventional raw materials (like eucalyptus, wheat bran, rice straw) also demands new process developments, installation of new processing & control equipment.

- High cost of production

- The international price of capital equipments needed for paper industry is very high. In the last decade, the cost of power and coal has increased by 400 units, royalties on bamboo and hardwood has been increased by 70% and faces heavy transport cost due to bulkiness of the raw material.

- Problems of Royalties and lease

- Many governments started raising their royalties from forest land leased to paper mills to meet their current expenditure. Some state governments have raised the royalty rates to 5-6 times in a short period of 5 to 6 years. Such policies towards royalties and the terms of lease are extremely unsatisfactory. The policy should be stable and based on long term basis.

- Over capacity and under utilization

- Active encouragement by government has resulted in over capacity in the industry.

- Between 1974 and 1984, 180 mills are set UP in the country thus creating excess capacity. Even when capacity utilization is high 72% in recent years, 7 large units & 13 small paper units have been idle for year.

- Sickness in small paper units

- High cost of investment & low rate of realization is one of the major reasons for sickness of small units. Further, heavy burden towards investment, financial institutions and markets have aggravate the problem.

- Non–availability of coal and raw materials, rise in electricity & water charges are the other major hurdles in the growth of this industry. Owing to these reasons, they could not compete with large paper units.

- Disposal of Effluents

- Disposal of effluents is a great problem. Suitable processing technique is not available for small units. So they were forced to close.

- Lack of research

- There is a need to develop new processes for the utilization of raw materials, developing the different grades of suitable pulp, designing and engineering of suitable equipment.

- In order to meet the demand, the industry need to look for unconventional raw material but this need new advanced technology which a developed country like India cannot afford.

- Eco–conservation: The growing consciousness for preservation of forests and maintenance of ecological balance and biodiversity has further reduced the availability of raw material. Moreover the environmentalists are up in arms against this industry due to effluents thrown by the paper mills into open drains, rivers and rivulets there by polluting the environment.

- Increasing demand: At the present low rate of consumption i.e. about 17% of world population constituted by India consumes only 2.5% of the world paper and paper board. India is facing wide gap between supply and demand of paper. Now with spread of education and literacy demand for paper is bound to increase and is expected to double in next 10 years.

- Average size of paper mills is abnormally own at less than 10000 tones as against 50,000 tonnes in south East Asia & 85,000 tonnes in Asia-pacific.

- Only 15% of total output of paper & paper board is based on recycled material against the world average of 30-85%. Thus there is a vast scope for using recycled material in paper industry, currently India has over 16% of world’s population but consumes a meagre 1% of worlds paper & paper board. With the spread of education & literacy the demand of the paper is bound to increase.

Future prospects and suggestions

- To overcome the problem of raw materials, various methods have been adopted such as:

(i)Shift in raw materials from bamboo to eucalyptus, wattle, mulberry wood

(ii) To recycle the fiber and making paper production environment friendly. - Move overthrust on social & farm forestry has started to ease the raw material availability.

- As bamboo cultivation has become uneconomical, reliance has been placed on unconventional raw materials. Paper mills have to undertake plantation forestry in their surrounding areas.

- Indian paper industry is placed in and better position compared to industry leaders in the west in two ways:

(i) Growth cycle of tropical plantations takes 6-7 years whereas conifers (in the west) take nearly 50 years to grow.

(ii)Low wage structure in India. - The Indian paper industry has trained manpower at all levels & hence it can produce good quality paper with appropriate technology at relatively low manpower cost.

- But for the improvement of the paper industry, technology modernization is a must. However, it requires a huge capital investment on part of private players which is not always easy to avail.

- Bagasse: Judicious use of bagasse should be encouraged as the large quantity of bagasse is used as fuel in the sugar industry and is not made available to the paper industry. Sugar mills need to be encouraged to use coal-fired boilers instead of those based on bagasse. India being the largest producer of sugarcane holds huge potential in this regard.

Advantages of the Indian paper industry

- As compared to the western countries growth cycle of Indian tropical forests is 6 to 7 years whereas the growth of conifers of the west requires 50 years.

- Labour is cheap in India as compared to the Western world. Besides that Indian manpower of this industry is well trained and produces good quality paper with relatively low manpower cost.

Conclusion

In conclusion, the Indian fertilizer industry faces challenges such as raw material availability, fluctuating prices, government policies, and outdated technology. However, the industry also has promising prospects due to the increasing population, changing food consumption patterns, and growing awareness among farmers about the benefits of fertilizers. The introduction of neem-coated urea has also led to reduced consumption and increased efficiency, improving the overall potential for the industry's growth.Frequently Asked Questions (FAQs) of Automobile, Fertiliser & Paper Industry

What are the primary challenges faced by the Indian fertilizer industry?

The Indian fertilizer industry faces challenges such as availability and fluctuating prices of raw materials, lack of natural resources required to produce fertilizers, obsolete technology, and government policies that affect subsidies and growth.

How do government policies affect the growth of the Indian fertilizer industry?

Government policies, such as subsidies, were initially introduced to make fertilizers available to farmers at a low cost and prevent an increase in the cost of food crop production. However, under the WTO agreement, there must be a reduction in subsidies, which goes against the growth of the industry.

What factors contribute to the prospects of the fertilizer industry?

Factors such as increasing population, rising demand for food security, changing patterns of food consumption, and increased awareness among farmers about the use of fertilizers contribute to the prospects of higher growth in the fertilizer industry.

What is Neem Coated Urea and how does it benefit the fertilizer industry?

Neem Coated Urea is a type of urea coated with neem, which has proven nitrification inhibition properties. It slows down the process of nitrogen release from urea and reduces the consumption of the fertilizer. The government has made it mandatory for all domestic producers of urea to produce 100% as Neem Coated Urea, which has increased its demand and benefits the industry.

How has the expansion of irrigation facilities affected the growth of the fertilizer industry?

Lesser expansion of irrigation facilities has led to low fertilizer consumption and demand, restricting the growth of the industry. However, increased awareness among farmers and improved irrigation facilities can contribute to higher growth in the fertilizer industry.

|

303 videos|636 docs|252 tests

|

FAQs on Automobile, Fertiliser & Paper Industry - Geography Optional for UPSC

| 1. What are the primary types of fertilizers used in agriculture? |  |

| 2. How does the fertilizer industry impact the environment? |  |

| 3. What are the key factors influencing fertilizer demand in agriculture? |  |

| 4. What are the major challenges faced by the fertilizer industry? |  |

| 5. How do government policies affect the fertilizer industry? |  |