UPSC Exam > UPSC Notes > Geography Optional for UPSC > Export Processing Zones

Export Processing Zones | Geography Optional for UPSC PDF Download

Special Economic Zone

- The concept of SEZ is expected to bring large dividends to the state in terms of economic and industrial development and the generation of new employment opportunities.

- The SEZs are expected to be engines for economic growth.

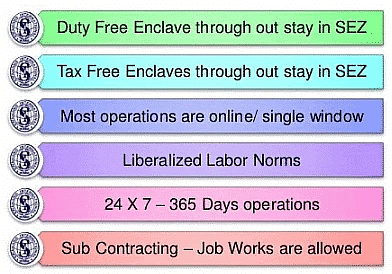

- Special Economic Zone (SEZ) is defined as “a specifically delineated duty-free enclave and shall be deemed to be foreign territory for the purposes of trade operations and duties and tariffs”.

- SEZ covers a broad range of more specific zones, some of them are:

- Free Trade Zones (FTZ): A foreign-trade zone (FTZ) is a class of special economic zone. It is a geographic area where goods may be landed, stored, handled, manufactured, or reconfigured and re-exported under specific customs regulation and generally not subject to customs duty. Free trade zones are generally organized around major seaports, international airports, and national frontiers—areas with many geographic advantages for trade.

- Export Processing Zone (EPZ): An export processing zone, or EPZ, is an area set up to enhance commercial and industrial exports by encouraging economic growth through investment from foreign entities. Incentives such as tax exemptions and a barrier-free environment are the main attractions of an EPZ.

- Free Zones (FZ): Free economic zones (FEZ), free economic territories (FETs), or free zones (FZ) are a class of special economic zone (SEZ) designated by the trade and commerce administrations of various countries. The term is used to designate areas in which companies are taxed very lightly or not at all to encourage economic activity.

- Industrial Estates (IE): An industrial estate is a place where necessary infrastructural facilities are made available to entrepreneurs. Industrial parks, industrial zone, industrial areas, Industrial Township are some of the other terms used to denote industrial estates.

- Free Ports (FP): Freeports or zones are designated by the government as areas with little to no tax in order to encourage economic activity. While located geographically within a country, they essentially exist outside its borders for tax purposes.

- Urban Enterprise Zones: An urban enterprise zone is an area in which policies to encourage economic growth and development are implemented. Urban enterprise zone policies generally offer tax concessions, infrastructure incentives, and reduced regulations to attract investments and private companies into the zones. They are a type of special economic zone where companies can locate free of certain local, state, and federal taxes and restrictions.

History of Free Trade Zones

- First Free Trade Zone in the world had started on 1st January 1965 at Kandla port, Kutch, India.

- By 1978 India had another four free trade zones at Mumbai, Chennai, Noida, and Falta.

- In 1978 China had gone through a major economic makeover and they had realized the power in the concept of Free Trade Zones.

- First Chinese Free Trade Zone became operational in 1984 in Shenzhen.

- In the year 2000 one zone of Shenzhen was Exporting thrice than that of India.

- As on today, there are about 2000 operation-free zones spread over 150 countries in the world.

Kinds of SEZ

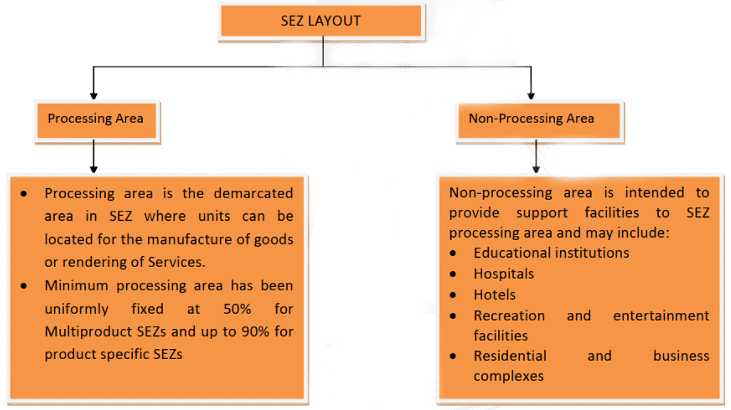

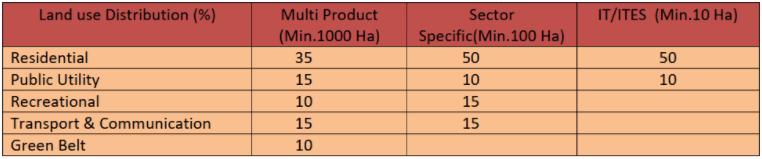

- SEZs can be categorized on basis of sector, function or location and required to have processing as well as non-processing area.

Fundamentals of SEZs

- SEZs (Special Economic Zones) are fundamentally different from the traditional free zones.

- They are much larger in size and offer a broader range of activities such as:

- A single-window management,

- Streamlined procedures,

- Duty-free privileges,

- Access to the domestic market on a duty-paid basis.

- Cardinal factors that decides whether the enclave is termed an EPZ, FTZ, or SEZ are:

- Appropriate infrastructure and transport facilities

- Low factor cost

- Flexible labour laws

- Convertibility of currency

- Stable legal and administrative regime

- A commitment to the canons of an open economy.

Role of SEZ in Indian economy

- To provide an internationally competitive environment

- To encourage FDI and enhance GDP

- To increase share in global exports

- SEZ exports accounting for 26% of India’s total export.

Salient features of SEZ

- Self certification for export and import

- Import and export movement of goods are based on self-declaration in SEZ

- No routine examination is made unless specific order from Development Commissioner or authority is made.

- Sub contracting

- A SEZ unit may sub-contract a part of its product or production process to different units, even in abroad.

- Fiscal incentives-Tax

- There is an exemption from excise and customs duty on procurement of capital assets, consumable stores, and raw-materials from the domestic market.

- There is an exemption from sales tax, import duty, income tax, minimum alternative tax, and dividend distribution tax.

- Single Window Clearance

- There is a facility of the submission of documents at single locations on regular basis.

- The proceedings are less and time-saving.

SEZ in India

- Asia’s first EPZ (Export Processing Zones) was established in 1965 at Kandla, Gujarat.

- While these EPZs had a similar structure to SEZs, the government began to establish SEZs in 2000 under the Foreign Trade Policy to redress the infrastructural and bureaucratic challenges that were seen to have limited the success of EPZs.

- The Special Economic Zones Act was passed in 2005. The Act came into force along with the SEZ Rules in 2006.

- However, SEZs were operational in India from 2000 to 2006 (under the Foreign Trade Policy).

- India’s SEZs were structured closely with China’s successful model.

- Presently, 379 SEZs are notified, out of which 265 are operational. About 64% of the SEZs are located in five states – Tamil Nadu, Telangana, Karnataka, Andhra Pradesh and Maharashtra.

- The Board of Approval is the apex body and is headed by the Secretary, Department of Commerce (Ministry of Commerce and Industry).

- The Baba Kalyani led committee was constituted by the Ministry of Commerce and Industry to study the existing SEZ policy of India and had submitted its recommendations in November 2018.

- It was set up with a broad objective to evaluate the SEZ policy towards making it WTO (World Trade Organisation) -compatible and to bring in global best practices to maximise capacity utilisation and to maximise potential output of the SEZs.

Baba Kalyani committee recommendations

- Framework shift from export growth to broad-based Employment and Economic Growth (Employment and Economic Enclaves-3Es).

- Formulation of separate rules and procedures for manufacturing and service SEZs.

- Shift from supply-driven to demand-driven approach for 3Es development to improve the efficiency of investment-based on certain industries, the current levels of existing inventory in the region.

- Enabling framework for Ease of Doing Business (EoDB) in 3Es in sync with State EoDB initiatives. One integrated online portal for new investments, operational requirements, and exits related matters.

- Enhance competitiveness by enabling ecosystem development by funding high-speed multi-modal connectivity, business services, and utility infrastructure.

- Promote integrated industrial and urban development– walk to work zones, States and centers to coordinate on the framework development to bring linkages between all initiatives.

- Procedural relaxations for developers and tenants to improve operational and exit issues.

- Extension of Sunset Clause and retaining tax or duty benefits.

- Broad-banding definition of services/allowing multiple services to come together.

- Additional enablers and procedural relaxations.

- Unified regulator for IFSC.

- Utilizing Multi Services SEZ IFSC for all inbound and outbound investment of the country.

- Incentives for availing services from IFSC SEZ by domestic institutions.

- Extension of benefit under services Export incentives scheme.

- Allowing alternate sectors to invest in sector-specific SEZs/ 3Es.

- The flexibility of long term lease for developers and tenants.

- The facility of sub-contracting for customers outside 3Es/SEZs without any restriction or cap at any level.

- Specified domestic supplies supporting ‘Make in India’ to be considered in NFE computation.

- Export duty should not be levied on goods supplied to developers and used in the manufacture of goods exported.

- Flexibility in the usage of NPA by developers and sale space to investors/ units.

- Infrastructure status to improve access to finance and enable long term borrowing.

- Promote MSME participation in 3Es and enable manufacturing enabling service players to locate in 3E.

- Dispute resolution through arbitration and commercial courts.

Some of important SEZ in India

- Karnataka Biotechnology and Information Technology Services: SEZ on biotechnology sector in Bangalore’s Electronics City, over an area of 43 acres.

- Shree Renuka Sugars Limited – SEZ on sugarcane processing complex covering 100 hectares, comprising a sugar plant, power station, and distillery, at Burlatti in Belgaum district.

- Wipro Infotech: SEZ on IT/ITES at Electronics City, Sarajpur Bangalore.

- Hewlett Packard India Software Operation Pvt. Ltd. – SEZ on IT.

- Food processing and related SEZ services in Hassan spread over an area of 157.91 hectares

- SEZs on pharmaceuticals, biotechnology, and chemical sector in Hassan, covering of 281.21 hectares.

- Some other SEZs worth noting are:

- SEEPZ – Andheri (East), Mumbai

- Navi Mumbai – Multi-product, Mumbai

- Salt Lake Electronic City, West Bengal

- Manikanchan – Jems and jewellery, West Bengal

- Calcutta Leather Complex, West Bengal

- Falta Food Processing Unit, West Bengal.

Advantages of SEZ

- Growth and development: SEZs acts as the hub for the growth and development of a country as the motive pertains to the boosting of trade by simplified mechanisms.

- Attract Foreign Direct Investment: Relaxed trade rule make the foreign investor to invest in SEZ with lucrative deals

- Exposure to technology and global market: It is done when foreign investor comes with their technology and best business practices in Indian markets.

- Increasing GDP and Economic Model: SEZs act as the growth engines with the economic model that helps in increasing the economic activities in the area.

- Employment opportunities are created: With increased economic activities the employment opportunities also increases.

benefits and incentives of SEZ

benefits and incentives of SEZ

benefits and incentives of SEZ

benefits and incentives of SEZ

Disadvantages of SEZ

- Land acquisition at very low prices done which leads to the loss of farming land and revenue of the farmers leading to violent protests.

- Tax holidays affect GDP: Revenue losses occur because of the various tax exemptions and incentives.

- Many traders are interested in SEZ so that they can acquire at cheap rates and create a land bank for themselves.

- The number of units applying for setting up EOU’s is not commensurate to the number of applications for setting up SEZ’s leading to a belief that this project may not match up to expectations.

SEZ Act of 2005

- The basic idea of SEZs emerges from the fact that, while it might be very difficult to dramatically improve infrastructure and business environment of the overall economy ‘overnight’, SEZs can be built in a much shorter time, and they can work as efficient enclaves to solve these problems.

- The SEZ Act, 2005, provides the legal framework for establishment of SEZs and also for units operating in such zones.

- The main objectives of the SEZ Act are:

- Generation of additional economic activity

- Promotion of exports of goods and services

- Promotion of investment from domestic and foreign sources

- Creation of employment opportunities

- Development of infrastructure facilities

- Salient Features

- A SEZ is a designated duty free enclave to be treated as foreign territory for the purpose of trade operations and duties and tariffs.

- An SEZ does not require a license for imports.

- Other notable features are as follows:

- The units must become net foreign exchange-earners within 3 years

- SEZ are allowed manufacturing, trading and service activities.

- Full freedom for subcontracting.

- The domestic sales from the SEZ are subject to full custom duties and import policy is in force, when they sell their produce to domestic markets.

- There was no routine examination by the customs authorities.

- The corporation in SEZs will not have to pay any income tax on their profits for the first five years and only 50% of the tax for 2 more years thereafter.

- If half of the profit is reinvested in the corporation, the concession of 50% tax is extendable for the next 3 years.

- For SEZ developers, the raw material from cement to steel to electrical parts is subject to zero tax and duty.

- For the SEZ, the Government acquires vast land tracts and gives to the developers. The basic condition involves that 25% of the area of the SEZ must be used only for export-related activities. Rest 75% area can be used for economical and social infrastructure. However, all SEZ benefits are applicable over the entire SEZ area.

- There were provisions for sector-specific SEZs and Multiproduct SEZs.

- The Sector-specific SEZ may have 7500 houses, hotels with 100 rooms, 25 bed hospital, schools, and other institutions, a multiplex in 50000 sq. meters.

- Multiproduct SEZ are allowed to build 25000 houses. 250 room hotel and 100 bed hospitals along with a multiplex with 2 lakh sq. meters.

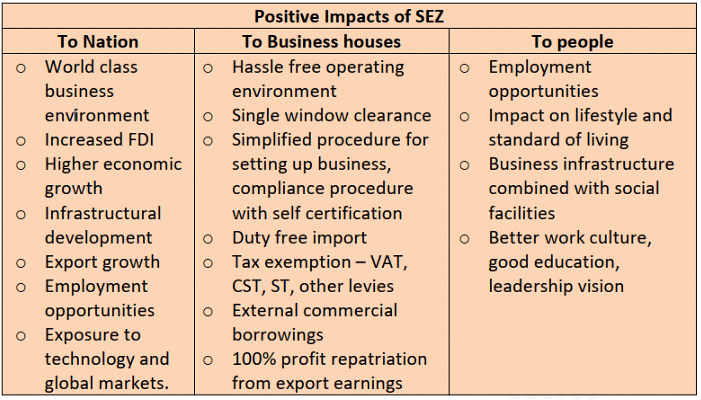

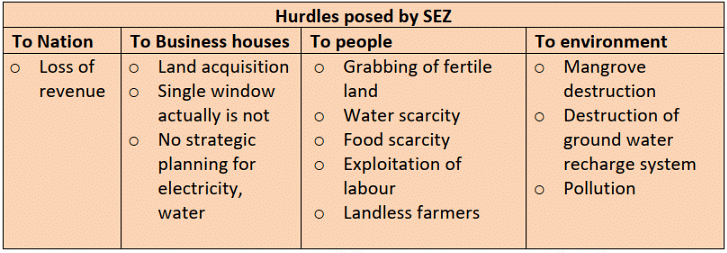

Impacts of SEZs

Impacts of SEZs are enumerated in the tables below:

Swot (Strength, Weakness, Opportunities, Threats) analysis of Indian SEZ

- Strength

- Based on western model or SEZ in China

- An established legal redress system

- Relatively low labour costs

- Employment opportunities

- India’s large English speaking and skilled workforce

- Exposure to technology and global market

- Worldwide acceptance of capabilities in fields like

- Pharmaceutical manufacturing & research

- Clinical trials

- Manufacturing designing & consultancy, IT & ITES

- Malls and hotels

- Hospital

- Financial & other institutional networks.

- Weakness

- Poor infrastructure and transport facilities

- The high cost of capital

- Inadequate institutional support

- Political changes

- Inappropriate locations

- Opportunities

- An alternative manufacturing base, particularly compared to Chinese SEZs

- Investments in core strength areas like IT and software products and services.

- New Delhi ports & airports are also being developed keeping SEZ concept in mind

- A large NRI base who have traditionally invested less in Greenfield development in India.

- Threats

- The pattern of buying & selling may not continue. With relocations of industries in other third world countries, new competitors will emerge

- Opposing interests

- Prospect of even more restrictive labour laws being introduced.

- Increasing rejection rate for proposals to establish SEZs.

The document Export Processing Zones | Geography Optional for UPSC is a part of the UPSC Course Geography Optional for UPSC.

All you need of UPSC at this link: UPSC

|

303 videos|636 docs|252 tests

|

FAQs on Export Processing Zones - Geography Optional for UPSC

| 1. What is a Special Economic Zone (SEZ)? |  |

Ans. A Special Economic Zone (SEZ) is a designated area within a country that is established to promote economic growth by offering special incentives and benefits to businesses operating within the zone. These incentives may include tax exemptions, relaxed regulations, and streamlined procedures for trade and investment.

| 2. What are the objectives of Export Processing Zones (EPZs)? |  |

Ans. The primary objectives of Export Processing Zones (EPZs) are to attract foreign direct investment, boost exports, create employment opportunities, and enhance technological and skill development. EPZs aim to create a favorable environment for export-oriented industries by providing infrastructure facilities, fiscal incentives, and simplified administrative procedures.

| 3. How do Special Economic Zones contribute to economic development? |  |

Ans. Special Economic Zones contribute to economic development by attracting foreign direct investment, promoting exports, generating employment, and facilitating technology transfer. These zones create a conducive business environment with infrastructure facilities, tax incentives, and streamlined procedures, which attract both domestic and international businesses, leading to economic growth and industrial development.

| 4. What are the key features of Special Economic Zones? |  |

Ans. The key features of Special Economic Zones (SEZs) include a well-defined geographical area, streamlined procedures for setting up businesses, tax incentives and exemptions, world-class infrastructure facilities, simplified regulations, and a favorable business environment. SEZs aim to create a self-sustained ecosystem for businesses to thrive and contribute to the overall economic development of the country.

| 5. What are the challenges faced by Special Economic Zones? |  |

Ans. Some of the challenges faced by Special Economic Zones (SEZs) include land acquisition issues, infrastructure development costs, regulatory compliance, competition with neighboring countries, and the need for skilled labor. Additionally, SEZs need to ensure sustainable development, environmental protection, and social inclusiveness while attracting investments and promoting economic growth.

Related Searches