Weekly Current Affairs (15th to 21st February 2023) Part - 2 | General Test Preparation for CUET UG - CUET Commerce PDF Download

National Organ Transplantation Guidelines

Context: Recently, the Ministry of Health and Family Welfare has modified National Organ Transplantation Guidelines, allowing those above 65 years of age to receive an organ for transplantation from deceased donors.

- In India, Transplantation of Human Organs Act, 1994 provides various regulations for the removal of human organs and its storage. It also regulates the transplantation of human organs for therapeutic purposes and for the prevention of commercial dealings in human organs.

What are the Highlights of the New Guidelines?

Removed Age Cap:

- The upper age limit has been removed as people are now living longer.

- Earlier, according to the NOTTO (National Organ and Tissue Transplant Organization) guidelines, an end-stage organ failure patient above 65 years of age was prohibited from registering to receive the organ.

No Domicile Requirement:

- The ministry has removed the domicile requirement to register as an organ recipient in a particular state under a ‘One Nation, One Policy’ move.

- Now a needy patient can register to receive an organ in any state of his or her choice and will also be able to get the surgery done there.

No Fees for Registration:

- There will be no registration fee that states used to charge for this purpose, the Centre has asked states that used to charge for such registration to not do so.

- Among the states that sought money for registration were Gujarat, Telangana, Maharashtra, and Kerala.

- Certain states asked for anything between Rs 5,000 and Rs 10,000 to register a patient on the organ recipient waitlist.

Note

- NOTTO is set up under Directorate General of Health Services, Ministry of Health and Family Welfare, located in New Delhi.

- National Network division of NOTTO functions as apex centre for all India activities for procurement, distribution and registry of organs and tissues donation and transplantation in the country.

What is the Purpose of New Guidelines?

- The Centre is planning to make changes in the rules of Transplantation of Human Organs (Amendment) Act 2011 towards creating a national policy for transplantation.

- Currently, different states have different rules; the Union government is considering changes to the rules so that there is a standard criterion followed in all states across the country.

- However, Health being a state subject, the rules formed by the central government will not be binding on the states.

- The steps are aimed at better and more equitable access to organs and also to promote cadaver donations, which currently form a minuscule fraction of all organ transplants carried out in India.

What is the Scenario of Organ Transplantation in India?

- India conducts the third highest number of transplants in the world.

- Organs from deceased donors accounted for nearly 17.8% of all transplants in 2022.

- The total number of deceased organ transplants climbed from 837 in 2013 to 2,765 in 2022.

- The total number of organ transplants – with organs from both deceased and living donors – increased from 4,990 in 2013 to 15,561 in 2022.

- Every year, an estimated 1.5-2 lakh people need a kidney transplant.

- Only around 10,000 got one in 2022. Of the 80,000 people who required a liver transplant, less than 3,000 got one in 2022.

- And, of the 10,000 who needed a heart transplant, only 250 got it in 2022.

Way Forward

- Promoting Organ donations is an important initiative that can save lives and benefit society as a whole.

- By increasing awareness, educating the public, and improving the donation process, we can make organ and tissue donation more accessible and increase the number of potential donors.

- For increasing accessibility of donated organs to weaker sections, the public hospitals need to increase the infrastructural capacity to carry out transplantation and provide affordable proper treatment to the poor.

- It is suggested that cross-subsidization will increase accessibility to the weaker section. For every 3 or 4 transplants, the private hospitals should carry out free of cost transplantation to the section of the population that donates a majority of organs.

Vibrant Villages Programme

Context: Recently, the Union Cabinet has approved raising of seven new ITBP (Indo-Tibetan Border Police) battalions and allocated Rs 4,800 crore under the Vibrant Villages Programme (VVP) to bolster the social and security framework along the China border.

- The Cabinet has also cleared a 4.1-km Shinku-La tunnel on the Manali-Darcha-Padum-Nimmu axis to allow all-weather connectivity to Ladakh.

What is the Significance?

- It is aimed at strengthening the security grid on the Line of Actual Control (LAC). It will also provide a window for the ITBP to rest, recuperate and train its personnel.

- The decision to raise additional battalions was taken keeping an eye on the need for effective monitoring in the border areas and the battalion.

- The government's decision to approve a financial package for border villages and upgrade security comes at a time when issues with China are still to be resolved along the LAC in Ladakh. PLA troops are still squatting in the Depsang Plains and Demchok. China is also upgrading its infrastructure along the LAC.

What is the Vibrant Villages Programme?

- About:

- It is a Centrally sponsored scheme, announced in the Union Budget 2022-23 (to 2025-26) for development of villages on the northern border, thus improving the quality of life of people living in identified border villages.

- It will cover the border areas of Himachal Pradesh, Uttarakhand, Arunachal Pradesh, Sikkim and Ladakh.

- It will cover 2,963 villages with 663 of them to be covered in the first phase.

- Vibrant Village Action Plans will be created by the district adminstration with the help of Gram Panchayats.

- There will not be overlap with Border Area Development Programme.

- Objective:

- The scheme aids to identify and develop the economic drivers based on local, natural, human and other resources of the border villages on the northern border;

- Development of growth centres on ‘hub and spoke model’ through promotion of social entrepreneurship, empowerment of youth and women through skill development and entrepreneurship;

- Leveraging the tourism potential through promotion of local, cultural, traditional knowledge and heritage;

- Development of sustainable eco-agri businesses on the concept of ‘one village-one product’ through community-based organisations, cooperatives, NGOs.

What are the Key Points of the Shinku-La tunnel?

- It is a 4.1-km tunnel on the Nimu-Padam-Darcha Road link to provide all-weather connectivity to the border areas of Ladakh.

- The tunnel will be completed by December 2025.

- It is very important as far as the security and safety of the country is concerned.

- It will also help in the movement of security forces in that region.

Demographic Transition and Opportunity for India

Context: The world is going through a phase of demographic transition towards aged populations. Adaptation strategies will require governments, businesses and common people to make key adjustments.

- This may usher in a great opportunity for India that is experiencing a demographic dividend.

What is the Demographic Transition and Demographic Dividend?

- A demographic shift refers to a change in the composition of a population over time.

- This change can occur due to various factors such as changes in birth and death rates, migration patterns, and changes in social and economic conditions.

- A demographic dividend is a phenomenon that occurs when a country's population structure shifts from having a high proportion of dependents (children and elderly) to having a higher proportion of working-age adults.

- This change in population structure can result in economic growth and development if the country invests in its human capital and creates conditions for productive employment.

What is the Significance of India’s Demographic Dividend?

About:

- India entered the demographic dividend opportunity window in 2005-06 and will remain there till 2055-56.

- India’s median age is markedly lower than that of the US or China.

- While the median ages of the US and China are already 38 and 39 respectively, India’s median age is not expected to reach 38 until 2050.

Challenges Associated with India’s Demographic Dividend:

- Low Female Labour Force Participation: India’s labour force is constrained by the absence of women from the workforce.

- As per Periodic Labour Force Survey 2020- 2021, female labour workforce participation stands at 25.1%.

- Environmental Degradation: India's rapid economic growth and urbanisation have led to significant environmental degradation, including air pollution, water pollution, and deforestation.

- Addressing these issues is essential to ensuring sustainable economic growth.

- High Dropout Rate: While over 95% of India’s children attend primary school, the National Family Health Surveys confirm that poor infrastructure in government schools, malnutrition, and scarcity of trained teachers have resulted in poor learning outcomes and high dropout ratios.

- Lack of Employment Opportunities: With a large and growing working-age population, Indian job market is not able to generate enough jobs to meet the demands of this expanding workforce.

- This has resulted in high rates of underemployment and unemployment.

- Lack of Adequate Infrastructure: Poor infrastructure, including inadequate education and health facilities, transportation, power, and communication network, makes it challenging for people to access basic services and employment opportunities, particularly in rural areas.

- Brain Drain: India has a large pool of highly skilled and talented professionals, but many of them choose to leave the country in search of better job opportunities and living conditions abroad.

- This brain drain is a significant loss for India, as it results in a shortage of skilled workers and limits the country's ability to fully leverage its demographic dividend.

How India can Utilise its Demographic Dividend?

- Gender Equality: India needs to address gender inequality in education and employment, including improving access to education and employment opportunities for women.

- Women's participation in the workforce can increase economic growth and lead to a more inclusive society.

- Raising Education Standards: In both rural and urban settings, the public school system must ensure that every child completes high school and goes on to skilling, training, and vocational education.

- The modernization of school curricula along with the implementation of Massive Open Online Courses (MOOCS) and the establishment of open digital universities will further contribute to India’s qualified workforce.

- Encouraging Entrepreneurship: India needs to encourage entrepreneurship and innovation, particularly among the youth, to create job opportunities and contribute to economic growth.

Payment Aggregators

Context: Recently, the Reserve Bank of India (RBI) has given in-principle approval to 32 firms to operate as Online Payment Aggregators (PA), under the Payment and Settlement Systems Act, 2007 (PSS Act).

- The PSS Act, 2007 provides for the regulation and supervision of payment systems in India and designates the RBI as the authority for that purpose and all related matters.

Note

- In principle approval means that an approval has been granted based on certain conditions or assumptions, but that additional information or steps may be required before final approval is given.

What is a Payment Aggregator?

About:

- Online payment aggregators are companies that facilitate online payments by acting as intermediaries between the customer and the merchant.

- The RBI introduced Guidelines for Regulating PAs and Payment Gateway in March 2020.

Functions:

- They typically provide a range of payment options to customers, including credit and debit cards, bank transfers, and e-wallets.

- Payment aggregators collect and process payment information, ensuring that transactions are secure and reliable.

- By using a payment aggregator, businesses can avoid the need to set up and manage their own payment processing systems, which can be complex and expensive.

- Some examples of payment aggregators include PayPal, Stripe, Square, and Amazon Pay.

Key Features:

- Multiple Payment Options: Payment aggregators offer a range of payment options to customers, making it easier for them to pay for goods and services.

- Secure Payment Processing: Payment aggregators use advanced security measures to ensure that transactions are safe and secure.

- Fraud Detection and Prevention: Payment aggregators use algorithms and machine learning to detect and prevent fraud, reducing the risk of chargebacks and other payment disputes.

- Payment Tracking and Reporting: Payment aggregators provide detailed reports on payment transactions, making it easier for businesses to manage their finances and reconcile their accounts.

- Integration with Other Systems: Payment aggregators can integrate with a range of other systems, such as accounting software and inventory management systems, to streamline the payment process and make it easier to manage business operations.

Types:

- Bank Payment Aggregators:

- They involve high setup costs and are difficult to integrate.

- They lack many of the popular payment options along with detailed reporting features. Because of the high cost, bank payment aggregators are not suitable for small businesses and startups.

- e.g.; Razorpay and CCAvenue.

- Third-Party Payment Aggregators:

- Third-party PAs offer innovative payment solutions to businesses and have become more popular these days.

- Their user-friendly features include a comprehensive dashboard, easy merchant onboarding, and quick customer support.

- e.g.; PayPal, Stripe and Google Pay.

- RBI's Criteria for Approving an Entity as Payment Aggregator:

- Under the payment aggregator framework, only firms approved by the RBI can acquire and offer payment services to merchants.

- A company applying for aggregator authorisation must have a minimum net worth of Rs 15 crore in the first year of application, and at least Rs 25 crore by the second year.

- It must also be compliant with global payment security standards.

How is the Payment Aggregator different from Payment Gateway?

- A payment gateway is a software application that connects an online store or merchant to a payment processor, allowing the merchant to accept payment from a customer.

- Payment aggregators, on the other hand, are intermediaries that provide a single platform to connect multiple merchants to different payment processors.

- The main difference between a payment aggregator and payment gateway is that the former handles funds while the latter provides technology.

- Payment aggregators can offer a payment gateway, but vice versa is not true.

What are RBI’s Other Initiatives to Regulate Fintech Firms?

- RBI’s Fintech Regulatory Sandbox: Established in 2018 with the primary objective of being a controlled regulatory environment for testing fintech products.

- Payment System Operators license: This initiative was brought in in order to scrutinize the ever-expanding payments landscape in India.

- Digital Lending Norms: All digital loans must be disbursed and repaid through bank accounts of regulated entities only, without the pass-through of lending service providers (LSPs)

- RBI's Payment Vision 2025: It aims to elevate the payment systems towards a realm of empowering users with affordable payment options accessible anytime and anywhere with convenience. It builds on the initiatives of Payments Vision 2019-21.

- RBI’s upcoming White-List: The RBI has prepared a “white-list” of digital lending apps (List of Approved Lenders) in order to curb rising malpractices in the digital lending ecosystem.

Draft Norms Lending and Borrowing of G-secs

Context: Recently, the Reserve Bank of India released Draft Reserve Bank of India (Government Securities Lending) Directions, 2023.

- The RBI proposed introduction of securities lending and borrowing in Government Securities (G-sec) with an aim to facilitate wider participation in the securities lending market by providing investors an avenue to deploy idle securities and enhance portfolio returns.

What are the Draft Norms?

- Government Securities Lending (GSL) transactions shall be undertaken for a minimum period of one day and a maximum of 90 days.

- Government Securities issued by the central government excluding Treasury Bills would be eligible for lending/borrowing under a GSL transaction.

- Government securities issued by the Central government (including Treasury Bills) and the state governments would be eligible for placing as collateral under a GSL transaction.

- An entity eligible to undertake repo transactions in government securities, and any other entity approved by the Reserve Bank would be eligible to participate in GSL transactions as lender of securities.

What are Government Securities?

About:

- A G-Sec is a tradable instrument issued by the Central Government or the State Governments.

- A G-Sec is a type of debt instrument issued by the government to borrow money from the public to finance its Fiscal Deficit.

- A debt instrument is a financial instrument that represents a contractual obligation by the issuer to pay the holder a fixed amount of money, known as principal or face value, on a specified date.

- It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year- presently issued in three tenors, namely, 91-day, 182 day and 364 day) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

- In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

- G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

- Gilt-edged securities are high-grade investment bonds offered by governments and large corporations as a means of borrowing funds.

What are the Types of G-Sec?

- Treasury Bills (T-bills): Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity.

- Cash Management Bills (CMBs): In 2010, Government of India, in consultation with RBI introduced a new short-term instrument, known as CMBs, to meet the temporary mismatches in the cash flow of the Government of India. The CMBs have the generic character of T-bills but are issued for maturities less than 91 days.

- Dated G-Secs: Dated G-Secs are securities which carry a fixed or floating coupon (interest rate) which is paid on the face value, on half-yearly basis. Generally, the tenor of dated securities ranges from 5 years to 40 years.

- State Development Loans (SDLs): State Governments also raise loans from the market which are called SDLs. SDLs are dated securities issued through normal auction similar to the auctions conducted for dated securities issued by the Central Government.

- Issue Mechanism: The RBI conducts (Open Market Operations) OMOs for sale or purchase of G-secs to adjust money supply conditions.

- The RBI sells g-secs to remove liquidity from the system and buys back g-secs to infuse liquidity into the system.

- These operations are often conducted on a day-to-day basis in a manner that balances inflation while helping banks continue to lend.

- RBI carries out the OMO through commercial banks and does not directly deal with the public.

- The RBI uses OMO along with other monetary policy tools such as repo rate, cash reserve ratio and statutory liquidity ratio to adjust the quantum and price of money in the system.

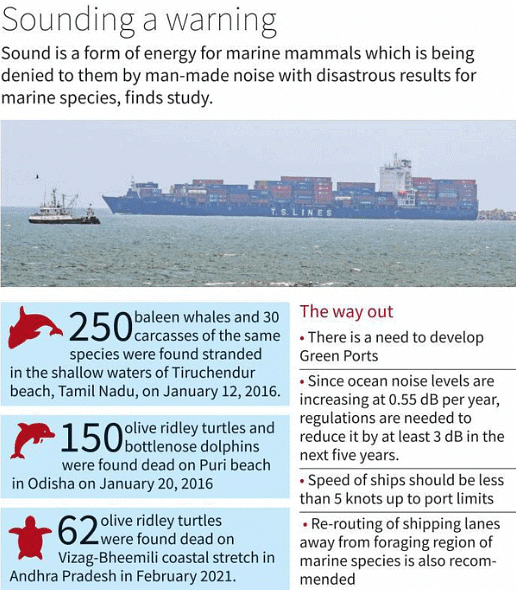

Underwater Noise Emissions

Context: According to a News Study, “Measuring Underwater Noise Levels Radiated by Ships in Indian Waters”, the rising Underwater Noise Emissions (UNE) from ships in the Indian waters are posing a threat to the Marine Ecosystem.

- The measurement of the ambient noise levels was carried out by deploying a hydrophone autonomous system around 30 nautical miles from the Goa coastline.

What are the Highlights of the Study?

Increased UNE Levels:

- The sound pressure levels of UNE in the Indian waters are 102-115 decibels, relative to one microPascal (dB re 1µ Pa).

- Scientists have agreed to use 1µPa as the reference pressure for underwater sound.

- The East Coast level is slightly higher than that of the West. There is an increase by a significant value of about 20 dB re 1µPa.

Factors:

- Continuous shipping movement is identified to be a major contributor to the increase in the global ocean noise level.

- UNE is posing a threat to the life of mammals like Bottlenose Dolphin, Manatees, Pilot Whale, Seal, and Sperm Whale.

- The main form of energy for multiple behavioural activities of marine mammals, which include mating, communal interaction, feeding, cluster cohesion and foraging, is based on sound.

Impact:

- The frequencies of ships’ underwater self-noise and machinery vibration levels are overlapping the marine species’ communication frequencies in the low-frequency range of less than 500 Hz.

- This is called masking, which may lead to a change in the migration route of the marine species to the shallow regions and also making it difficult for them to go back to the deeper water.

- However, the sound that radiates from ships on a long-term basis affects them and results in internal injuries, loss of hearing ability, change in behavioural responses, masking, and stress.

What is Marine Sound Pollution?

- Marine sound pollution is the excessive or harmful sound into the ocean environment. It is caused by a variety of human activities, such as shipping, military sonar, oil and gas exploration, and recreational activities like boating and jet skiing.

- It can have a range of negative impacts on marine life, such as its interference with the communication, navigation, and hunting behaviors of marine mammals, such as whales, dolphins, and porpoises. It can also damage the hearing and other physiological functions of these animals, leading to injury or death.

Is there any Initiative to Safeguard Marine Ecosystems?

Global:

- Global Programme of Action (GPA) for the Protection of the Marine Environment from Land-based Activities:

- The GPA is the only global intergovernmental mechanism directly addressing the connectivity between terrestrial, freshwater, coastal and marine ecosystems.

- MARPOL Convention (1973): It covers pollution of the marine environment by ships from operational or accidental causes.

- It lists various forms of marine pollution caused by oil, noxious liquid substances, harmful substances in packaged form, sewage and garbage from ships, etc.

- The London Convention (1972):

- Its objective is to promote the effective control of all sources of marine pollution and to take all practicable steps to prevent pollution of the sea by dumping of wastes and other matter.

Indian:

- Wild Life Protection Act of India (1972): It provides legal protection to many marine animals. There are a total of 31 major Marine Protected Areas in India covering coastal areas that have been notified under Wildlife Protection Act, 1972.

- Coastal Regulation Zone (CRZ): The CRZ notification (1991 and later versions) prohibits developmental activities and disposal of wastes in fragile coastal ecosystems.

- Centre for Marine Living Resources and Ecology (CMLRE): The CMLRE, an attached office of Ministry of Earth Sciences (MoES) is mandated with the management strategies development for marine living resources through ecosystem monitoring and modelling activities.

|

164 videos|626 docs|1128 tests

|

FAQs on Weekly Current Affairs (15th to 21st February 2023) Part - 2 - General Test Preparation for CUET UG - CUET Commerce

| 1. What are the National Organ Transplantation Guidelines? |  |

| 2. What is the Vibrant Villages Programme? |  |

| 3. What is demographic transition and its opportunity for India? |  |

| 4. What are payment aggregators? |  |

| 5. What are draft norms on lending and borrowing of G-secs? |  |