UPSC Exam > UPSC Notes > Current Affairs & Hindu Analysis: Daily, Weekly & Monthly > The Hindu Editorial Analysis- 23rd May 2023

The Hindu Editorial Analysis- 23rd May 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Slow withdrawal

Why in news?

- The Reserve Bank of India has decided to withdraw Rs 2,000 denomination banknotes from circulation.

- Banknotes of ₹2,000 denomination were introduced after₹1000 and ₹500 banknotes were demonetised on November 8, 2016.

Demonetisation

- It is the process through which a nation's economic unit of exchange loses its legally enforceable validity.

- It is a drastic intervention into the economy that involves removing the legal tender status of a currency.

Why countries opt for demonetisation?

- To address issues like hyperinflation and to stabilize the currency

- To eliminate negative situations or actions like counterfeit currency, terror, and tax fraud

- To introduce a new monetary system in some circumstances

- To facilitate trade and access to markets,

- To push informal economic activity into more transparency

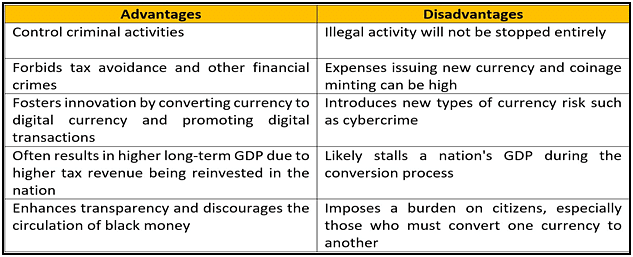

What are the advantages and disadvantages of Demonetization?

Demonetisation in India

- Previous demonetisation - Demonetisation has been implemented twice:

- In 1946, RBI demonetized 1000- and 10000-rupee notes.

- In 1978, the government demonetized 1000-, 5000-, and 10000-rupee notes in order to curb the menace of black money.

- 2016 demonetisation

- On November 8, 2016, PM Modi announced the decision of the government to demonetise currency notes of Rs 500 and Rs 1,000 in a bid to tackle corruption.

News Summary: RBI to withdraw Rs 2,000 notes from circulation

- The Reserve Bank of India announced that it has decided to withdraw the Rs 2,000 currency notes from circulation.

- It asked all to exchange these notes by September 30, 2023.

Key highlights:

- The Rs 2,000 notes, however, will continue to be legal tender.

- Legal tender refers to the recognized currency or monetary instrument that is considered valid for transactions within a specific jurisdiction.

- Deposit into bank accounts can be made in the usual manner, without any restriction.

- The exchange facility for Rs 2,000 currency notes will start from May 23, 2023.

Why are Rs 2000 denomination banknotes being withdrawn?

- Rationale behind introduction of ₹2000 denomination banknote

- The ₹2000 denomination banknote was introduced in November 2016 under Section 24(1) of RBI Act, 1934.

- It was introduced primarily with the objective to meet the currency requirement of the economy in an expeditious manner after withdrawal of the legal tender status of all ₹500 and ₹1000 banknotes in circulation at that time.

- Objective fulfilled and printing of ₹2000 banknotes was stopped

- With fulfilment of that objective, printing of ₹2000 banknotes was stopped in 2018-19.

- A majority of the ₹2000 denomination notes were issued prior to March 2017 and are at the end of their estimated life-span of 4-5 years.

- ₹2000 banknotes lost its sheen

- It has also been observed that this denomination is not commonly used for transactions.

- The total value of these banknotes in circulation has declined from ₹6.73 lakh crore at its peak of March 31, 2018 (37.3 per cent of Notes in Circulation) to ₹3.62 lakh crore, constituting only 10.8 per cent of Notes in Circulation on March 31, 2023.

- Availability of banknotes in other denominations in adequate quantities

- The stock of banknotes in other denominations continue to be adequate to meet the currency requirement of the public.

- Clean Note Policy of RBI

- In view of the above factors, and in pursuance of the Clean Note Policy of the Reserve Bank of India, it has been decided to withdraw the ₹2000 denomination banknotes from circulation.

- Clean Note Policy is a policy adopted by RBI to ensure availability of good quality banknotes to the members of public.

Analysis

- Segments most affected

- The three segments which will be affected by this move will be gold & jewellery, real estate and political parties.

- In the run up to elections, there is always a tendency to stack up cash.

- Deposit accretion of banks

- Experts believe that, due to recent decision, deposit accretion of banks could improve marginally in the near term.

- Deposit accretion refers to the increase in deposits held by a bank over a certain period of time.

- It represents the growth or accumulation of funds in a bank's deposit accounts, which can come from various source.

- This will ease the pressure on deposit rate hikes and could also moderate short-term interest rates.

- Crowd management at branches

- At a time only 10 notes of ₹2,000 can be exchanged. Anyone can come back again as the restriction is at a time.

- Hence, crowd management at branches may become difficult.

- Demonetisation with a human face

- Many analysts feel this is demonetisation with a human face.

- The latest RBI decision impacts just about 11% of currency in circulation and therefore will probably trigger little chaos.

- People have time until September-end 2023, to deposit and/or exchange ₹2000 banknotes.

Has such withdrawal of notes happened before?

- In 2014, the RBI completely withdrew from circulation all banknotes issued prior to 2005.

- The January 22, 2014 notification urged public to approach banks for exchanging these notes after April 1.

The document The Hindu Editorial Analysis- 23rd May 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC is a part of the UPSC Course Current Affairs & Hindu Analysis: Daily, Weekly & Monthly.

All you need of UPSC at this link: UPSC

|

44 videos|5283 docs|1115 tests

|

Related Searches