Profit and Loss: Shortcuts & Tricks | Quantitative Techniques for CLAT PDF Download

Concepts of Profit and loss

Here are some important statements and definitions related to profit and loss concepts. Understanding these is important before you get started with solving profit and loss examples.

- Cost Price (CP): The price at which goods are bought is called the cost price.

- Selling Price (SP): The price at which goods are sold is called the selling price.

- Profit: When the selling price is more than the cost price, then the trader makes a profit which is equal to SP - CP.

- Loss: When the selling price is less than the cost price, then the trader makes a loss which is equal to CP - SP.

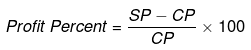

- Profit Percentage: The value of profit, when expressed as a percent of the cost price (CP), is called profit percent.

- Loss Percentage: Loss, when expressed as a percentage of cost price, is called loss percentage.

Note: Profit or loss percentage is always calculated as a percentage of cost price unless mentioned in the question. - Marked Price or List Price (MP or LP) and discount: Marked price is the price that is marked on the product or that is quoted in the price list. It is the price at which the product is quoted or intended to be sold. However, the seller can decide to give discounts to the buyer and the actual selling price might be different from the marked price. Given that there is no discount, the marked price is the same as the selling price.

- The amount of discount given will always be calculated on the marked price. This can be expressed as

Formulas of Profit and Loss

Here are some of the most Important Formulas of Profit and Loss used in solving any question on profit and loss.

- Gain = (S.P) – (C.P)

- Loss = (C.P) – (S.P)

- Loss or gain is always reckoned on C.P

- Gain percentage = (gain*100)/C.P

- Loss percentage = (Loss*100)/C.P

- Selling Price = ((100+Gain%)/100)*C.P

- Selling Price = ((100-Loss%)/100)*C.P

- Cost Price = (100/(100+Gain%))*S.P

- Cost Price = (100/(100-Loss%))*S.P

- If an article is sold at a gain of say 35%, then the selling price = 135% of C.P. Similarly, if an article is sold at a loss of say 35%, then selling price = 65% of C.P. For example, have a look at the below diagram.

- Here SP = CP can also be written as SP = 1 CP.

- If SP = 1.3 CP then 0.3 is more than 1. It is definitely profit and the profit is 0.3 and in percentage, it is 30% i.e (0.3 x 100).

- If SP = 0.8 CP then 0.2 is less than 1. It is definitely a loss and the loss is 0.2 and in percentage, it is 20% i.e (0.2 x 100).

- When a person sells two similar items, one at a gain of x% and the other at a loss of x% then the seller always incurs a loss given which is equal to

Loss % =(x/10) to the power of 2. - If a trader professes to sell his goods at cost price but uses false weights, then

Gain % = [Error/(True value -Error)]*100 - If a trader professes to sell his goods at a profit of x% but uses a false weight which is y% less than the actual weight, then

Gain%= { [ x+y/100-y]*100}% - If a trader professes to sell his goods at a loss of x% but uses a false weight which is y% less than the actual weight, then

Gain or loss%= { [ y-x/100-y]*100}% according as the sign + ve or – ve.

Profit and Loss Shortcuts

Here is an important shortcut to solve profit and loss problems when it is based on Successive discounts.

If the first discount is a% and the second discount is b% then,

Total discount = (a + b - ab / 100) %

Examples

Q.1 The marked price of a shirt is Rs.1000. A shopkeeper offers 30% discount on this shirt and then again offers a 20% discount on the new price. How much will you have to pay, finally?

Sol: As the successive discount is 30% and 20%

x = 30% and y = 20%

Total discount = [ x + y - (xy)/100]%

Total discount = [ 30 + 20 - (30 x 20 )/100]% = (50 - 600/100)% = 44%

Discount = 44% of 1000 = [44/100] x 1000 = Rs.440

Selling price (SP) = marked (MP) - discount = 1000 - 440 = Rs.560

Q2. If selling price is doubled, the profit triples. Find the profit percent.

Sol: Let C.P. be Rs. x and S.P. be Rs. y.

Then, 3(y - x) = (2y - x) y = 2x.

Profit = Rs. (y - x) = Rs. (2x - x) = Rs. x.

Profit % =x/x 100% = 100%x

Q3: In a certain store, the profit is 320% of the cost. If the cost increases by 25% but the selling price remains constant, approximately what percentage of the selling price is the profit?

Sol:

Let C.P.= Rs. 100. Then, Profit = Rs. 320, S.P. = Rs. 420.

New C.P. = 125% of Rs. 100 = Rs. 125

New S.P. = Rs. 420.

Profit = Rs. (420 - 125) = Rs. 295.

Required percentage =295/420 x 100%=(1475/21)% = 70% (approximately).

Q4: A man buys a fan for Rs. 1000 and sells it at a loss of 15%. What is the selling price of the fan?

Sol:

Cost Price of the fan is Rs.1000

Loss percentage is 15%

As we know, Loss percentage = (Loss/Cost Price) x 100

15 = (Loss/1000) x 100

Therefore, Loss = 150 rs.

As we know,

Loss = Cost Price – Selling Price

So, Selling Price = Cost Price – Loss

= 1000 – 150

Selling Price = R.850/-

Q5: If a pen cost Rs.50 after 10% discount, then what is the actual price or marked price of the pen?

Sol:

MP x (100 – 10) /100 = 50

MP x (90/100) = 50

MP = (50 x 100)/90

MP = Rs. 55.55/-

|

57 videos|108 docs|73 tests

|

FAQs on Profit and Loss: Shortcuts & Tricks - Quantitative Techniques for CLAT

| 1. What are some common shortcuts and tricks for solving profit and loss problems? |  |

| 2. How can I calculate the profit or loss percentage? |  |

| 3. Is there a shortcut for finding the selling price when the cost price and profit percentage are known? |  |

| 4. How can I calculate the cost price when the selling price and profit percentage are known? |  |

| 5. Can you explain the alligation method in profit and loss problems? |  |

|

Explore Courses for CLAT exam

|

|