Farm Budgeting - 1 | Agriculture Optional for UPSC PDF Download

Introduction

Farm budgeting can be described as a comprehensive representation of a farming plan or any modifications to it, typically spanning a specific timeframe. It serves as a technique for evaluating how agricultural resources will be utilized by the individual making decisions. To put it simply, farm budgeting involves converting a farming plan into financial terms by estimating income, expenditures, and profits.

Types of Farm Budgeting

The following are the different types of farm budgeting techniques:

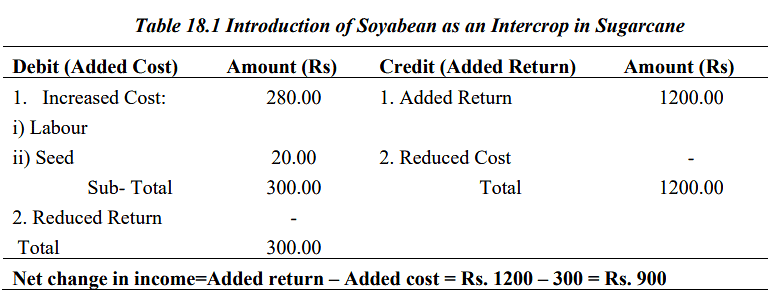

Partial Budgeting

This concept involves estimating the anticipated outcomes or returns for a specific portion of the agricultural business, such as one or a few activities. Partial budgeting is a tool used to assess the expected profit changes resulting from proposed alterations in the farm operation. It focuses solely on those income and expenditure items that would be affected by the proposed changes in the farming plan, excluding the overall values. The end result is an estimation of the potential increase or decrease in profit. To make this estimation, a partial budget methodically addresses the following four questions concerning the proposed changes: 1) What new or additional costs will be incurred? 2) What current income will be forfeited or reduced? 3) What new or additional income will be gained? and 4) What current costs will be lowered or eliminated? The first two questions identify factors that could diminish profit by increasing costs or reducing income. Similarly, the last two questions identify factors that could enhance profit by generating additional income or reducing costs. The net change in profit can be calculated by determining the total increase in profit minus the total reduction in profit. A positive value indicates that the proposed changes in the farming plan would be profitable.

All the potential changes in the farm plan that can be effectively evaluated using a partial budget can be categorized into three types, as outlined below:

- Enterprise substitution: This refers to either a complete or partial replacement of one farming activity with another, for example, substituting one acre of paddy for one acre of sugarcane.

- Input substitution: Changes involving the substitution of one input for another or adjustments in the total amount of input to be used can be easily analyzed with a partial budget, such as replacing machinery for labor.

- Size or scale of operation: This category encompasses changes in the overall size of the farm business or in the size of a specific farming activity, for instance, acquiring or leasing additional land or machinery.

Drawbacks of the partial budgeting method

- Partial changes may not always offer comprehensive solutions.

- The outcomes of partial budgets are influenced by fluctuations in prices of inputs and outputs, the availability of resources, and variations stemming from factors such as soil type and soil fertility.

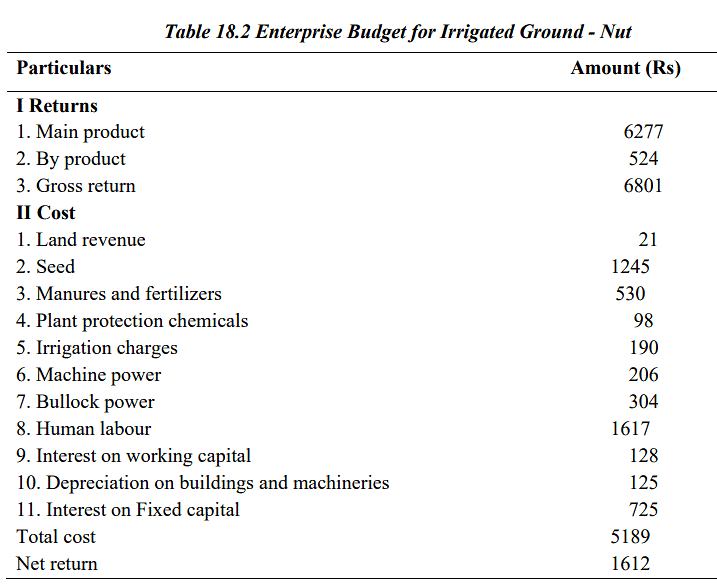

Enterprise Budgeting

An enterprise refers to a specific agricultural product, be it a crop or a livestock commodity. Most farms involve a mix of various enterprises. An enterprise budget is an assessment of all the income and expenses related to a particular enterprise, along with an estimation of its profitability. It serves as a fundamental step in creating a comprehensive farm budget or applying farm planning methods like linear programming. The enterprise budget provides a detailed breakdown of expected output in both physical and monetary terms for a unit of a specific activity, such as per hectare, per animal, or per 100 birds, within the farm. The enterprise budget holds significance because it illustrates the relative profitability of different enterprises or activities, aiding in the assessment of which ones are more financially advantageous. It encompasses variable costs, total operating expenses, and fixed costs, which include depreciation and interest on fixed assets. Additionally, any enterprise budget can be analyzed in terms of cash versus non-cash expenditures and total costs versus actual cash outlays.

Cash Flow Budgeting

Understanding the cash flow statement is a prerequisite for applying cash flow budgeting.

Cash Flow Statement

It provides an overview of the amount of cash coming in and going out during a specific timeframe.

Significance of Cash Flow Statement

It aids in evaluating:

- whether there will be an adequate cash supply at the right time;

- whether surpluses can be effectively redirected; and

- the timing and extent of necessary borrowings. Depending on the nature of the business, cash flow statements can be prepared annually, quarterly, monthly, or weekly.

Cash Inflows encompass the cash received during the specified period and include:

- the starting cash balance,

- revenue from sales of farm and non-farm assets, and

- proceeds from short-term (operational), intermediate, and long-term loans.

Cash Outflows represent the expenditures incurred within the defined timeframe and include:

- cash expenses (comprising variable cash expenses, fixed cash expenses, non-farm investments, and personal expenses),

- repayment of operational (crop) loans, and

- repayment of intermediate and long-term loans.

Cash flow analysis quantifies the cash movement in and out of the farm business during a specific period. While both cash flow statements and income statements show the flow of money, they differ in how they handle certain critical accounting entries. A cash flow statement includes non-farm elements like income taxes, non-farm income, and living expenses, providing a comprehensive account of debt transactions by showing principal repayments and proceeds from new loans. In contrast, the income statement only reveals interest payments.

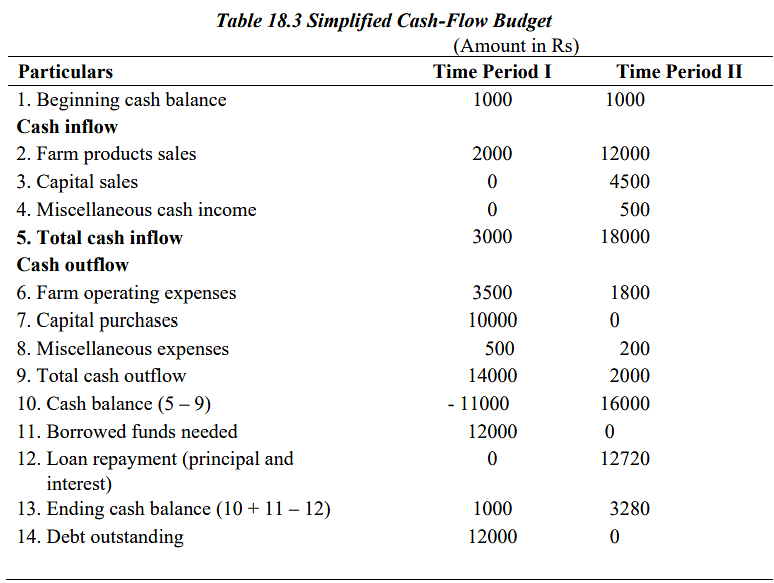

Cash Flow Budgeting

A cash flow budget summarizes the cash inflows and outflows for a business over a specified time frame. Its primary purpose as a forward planning tool is to estimate future borrowing requirements and the business's capacity to repay loans. Cash flow budgeting is employed to assess the entire farm plan.

In this scenario, we are looking at two time periods. During the first period, there is a cash inflow of Rs. 3,000 and cash outflows of Rs. 14,000, resulting in a projected cash balance of - Rs. 11,000. This necessitates borrowing Rs. 12,000 to maintain a minimum ending cash balance of Rs. 1,000. In the second period, the total cash outflow is Rs. 18,000, leaving a projected cash balance of Rs. 16,000, which allows for the repayment of the debt incurred in the first period, estimated at Rs. 12,720 when interest is factored in. The final result is an estimated cash balance of Rs. 3,280 at the end of the second period. The primary purpose of a cash flow budget is to predict when and how much new borrowing the business will require throughout the year and the timing and amount of loan repayments.

|

52 videos|224 docs

|