Worksheet Solutions: Recording of Transactions - I | Accountancy Class 11 - Commerce PDF Download

Q1: If total assets of a business are Rs 2,60,000 and capital is Rs 1,60,000 calculate the outside liabilities.

Ans: Total Assets = Capital + Outside Liabilities

2,60,000 = 1,60,000 + Outside Liabilities

2,60,000 – 1,60,000 = Outside Liabilities

Outside Liabilities = 1,00,000

Q2: If total assets of a business are Rs 2,60,000 and net worth is Rs 1,60,000. Calculate the creditors.

Ans: Total Assets = Net worth – Creditors

Creditors = Total Assets – Net worth

Creditors = 2,60,000 – 1,60,000

Creditors = Rs. 1,00,000

Q3: Do you think that a transaction can break the accounting equation?

Ans: No, any transaction can only change the equation but can’t break it. The Accounting equation remains equal.

Q4: State when is a capital account debited.

Ans: A capital account is debited when there is a loss and when the owner makes drawings.

Q5: When proprietor withdraws cash for his/her personal use what will be the effect on capital?

Ans: Decrease in capital. A drawing account is an accounting record maintained to track money withdrawn from a business by its owners.

Q6: When an account is said to have a debit balance and credit balance?

Ans: The difference between the sum of the two sides of an account is called the balance. This is the most important part of an account as it shows value or position of asset, liability, capital, income or expenses of which the account is a record. If the total of the debit side exceeds the total of credit side then this would be represented by a debit balance and opposite is true for a credit balance.

Q7: Why is the evidence provided by source documents important to accounting?

Ans: A source document is the original document that contains the details of a business transaction. A source document captures the key information about a transaction, such as the names of the parties involved, amounts paid (if any), the date, and the substance of the transaction. Source documents are frequently identified with a unique number, so that they can be differentiated in the accounting system. The pre-numbering of documents is particularly useful, since it allows a company to investigate whether any documents are missing. Source documents are critical to auditors, who use them as evidence that recorded transactions actually occurred. A source document is also used by companies as proof when dealing with their business partners, usually in regard to a payments.

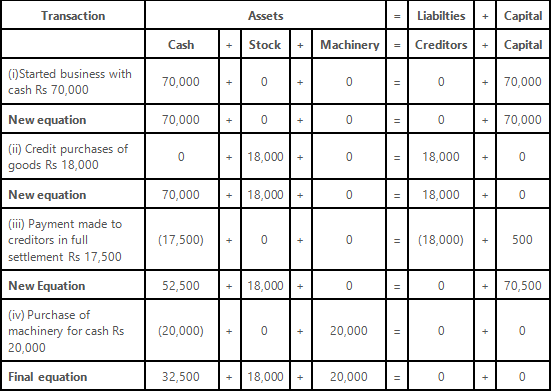

Q8: Prepare the accounting equation on the basis of the following

(i) Started business with cash Rs 70,000.

(ii) Credit purchases of goods Rs 18,000.

(iii) Payment made to creditors in full settlement Rs 17,500.

(iv) Purchase of machinery for cash Rs 20,000.

Ans: The fundamental accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner’s equity of a person or business. It is the foundation for the double-entry book keeping system. For each transaction, the total debits equal the total credits.

Accounting equation

Q9: What entry (debit or credit) would you make to

(i) increase revenue,

(ii) decrease in expense

(iii) record drawings,

(iv) record the fresh capital introduced by the owner.

Ans: The following entry will be made in the above case

- Increase Revenue-Revenue account have always credit balance so credit entry will be made to record increase in revenue.

- Decrease in Expense- Expense account always have a debit balance so credit entry will be made to record decrease in expenses.

- Record Drawings- Drawings is a reduction of capital balance so debit entry will be made in capital account to record drawings.

- Record the fresh Capital Introduced by the Owner- Capital account always have a credit balance so credit entry will be made to record increase in capital.

Q10: Analyse the effect of each transaction and prove that the accounting equation(A = L + C) always remains balanced.

(i) Introduced Rs 4,00,000 as cash and Rs 25,000 by stock.

(ii) Purchased plant for Rs 1,50,000 by paying Rs 7,500 in cash and balance at a later date.

(iii) Deposited Rs 3,00,000 into the bank.

(iv) Purchased office furniture for Rs 50,000 and made payment by cheque.

(v) Purchased goods worth Rs 40,000 for cash and for Rs 17,500 on credit.

(vi) Goods amounting to Rs 22,500 was sold for Rs 30,000 on cash basis.

(vii) Goods costing to 1 40,000 was sold for 1 62,500 on credit basis.

(viii) Cheque issued to the supplier of goods worth Rs 17,500.

(ix) Cheque received from customer amounting to Rs 37,500.

(x) Withdrawn by owner for personal use Rs 12,500.

Ans: The accounting formula serves as the foundation of double-entry book keeping. Also called the accounting equation or balance sheet equation, this formula represents the relationship between the assets, liabilities, and owners’ equity of a business. The equation shows that the value of a company’s assets always equals the sum of its liabilities and owners’ equity. The accounting formula essentially shows what the firm owns (its assets) as purchased with either the money it owes to creditors (its liabilities) or by money its owners invest in the business (its owner’s equity or capital). This relationship can be expressed in the form of a simple equation:

Assets = Liabilities + Owners’ Equity

| Assets | = | Liabilities | + | Capital | ||||||

S.No. | Particulars | Cash | +Stock | +Plant | +Bank | +Furniture | +Debtors | = | Creditors | + | Capital |

1 | Started business with Rs 4,00,000 as cash and Rs 25,000 by stock | 4,00,000 | +25,000 | +0 | +0 | +0 | +0 | = | 0 | + | 4,25,000 |

2 | Purchased plant for Rs 1,50,000 by paying Rs 7,500 in cash and balance at a later date. | (7,500) | +0 | +1,50,000 | +0 | +0 | +0 | = | 1,42,500 | + | 0 |

New Equation | 3,92,500 | +25,000 | +1,50,000 | +0 | +0 | +0 | = | 1,42,500 | + | 4,25,000 | |

3 | Deposited cash into the bank. | (3,00,000) | +0 | +0 | +3,00,000 | +0 | +0 | = | 0 | + | 0 |

New Equation | 92,500 | +25,000 | +1,50,000 | +3,00,000 | +0 | +0 | = | 1,42,500 | + | 4,25,000 | |

4 | Purchased office furniture for Rs 50,000 and made payment by cheque. | 0 | +0 | +0 | (50,000) | +50,000 | +0 | = | 0 | + | 0 |

New Equation | 92,500 | +25,000 | +1,50,000 | +2,50,000 | +50,000 | +0 | = | 1,42,500 | + | 4,25,000 | |

5 | Purchased goods worth Rs 40,000 for cash and for Rs 17,500 on credit. | (40,000) | +57,500 | +0 | +0 | +0 | +0 | = | 17,500 | + | 0 |

New Equation | 52,500 | +82,500 | +1,50,000 | +2,50,000 | +50,000 | +0 | = | 1,60,000 | + | 4,25,000 | |

6 | Goods amounting to Rs 22,500 was sold for Rs 30,000 on cash basis. | 30,000 | (22,500) | +0 | +0 | +0 | +0 | = | 0 | + | 7,500 |

New Equation | 82,500 | +60,000 | +1,50,000 | +2,50,000 | +50,000 | +0 | = | 1,60,000 | + | 4,32,500 | |

7 | Goods costing Rs 40,000 was sold for Rs 62,500 on credit basis. | 0 | (40,000) | +0 | +0 | +0 | +62,500 | = | 0 | + | 22,500 |

New Equation | 82,500 | +20,000 | +1,50,000 | +2,50,000 | +50,000 | +62,500 | = | 1,60,000 | + | 4,55,000 | |

8 | Cheque issued to the supplier of goods worth Rs 17,500. | 0 | +0 | +0 | (17,500) | +0 | +0 | = | (17,500) | + | 0 |

New Equation | 82,500 | +20,000 | +1,50,000 | +2,32,500 | +50,000 | +62,500 | = | 1,42,500 | + | 4,55,500 | |

9 | Cheque received from customer amounting to Rs 37,500. | 0 | +0 | +0 | +37,500 | +0 | (37,500) | = | 0 | + | 0 |

New Equation | 82,500 | +20,000 | +1,50,000 | +2,69,500 | +50,000 | +15,000 | = | 1,42,500 | + | 4,55,500 | |

10 | Withdrawn by owner for personal use Rs 12,500. | (12,500) | +0 | +0 | +0 | +0 | +0 | = | 0 | + | (17,500) |

New Equation | 70,000 | +20,000 | +1,50,000 | +2,69,500 | +50,000 | +15,000 | = | 1,42,500 | + | 4,38,000 | |

|

61 videos|220 docs|39 tests

|