Worksheet: Recording of Transactions - II | Accountancy Class 11 - Commerce PDF Download

Q1: Which balance of the bank column in the cash book signifies bank overdraft?

Q2: Mention two transactions which are recorded in journal proper.

Q3: Is it correct to say, sales book is a record prepared from invoices issued to customers?

Q4: In which book of original entry, a discount of Rs. 50 offered for an early payment of cash of Rs. 1,050 be recorded?

Q5: Described the advantages of sub-dividing the journal?

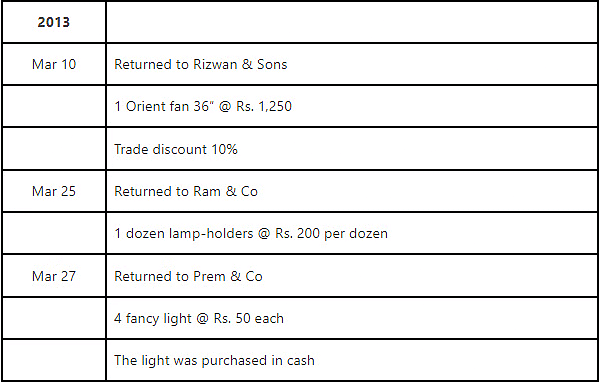

Q6: Prepare the purchases return book in the book of Abdulla Stores from the following transactions:

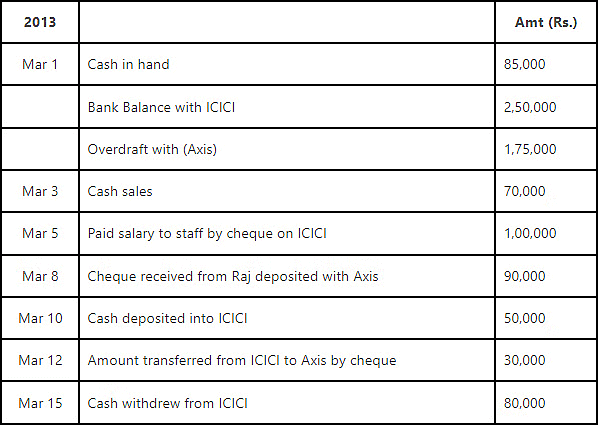

Q7: From the following particulars provided by Rishi, prepare a cash book with suitable column.

Q8: Prepare two column cash book from the following transactions for the month of April, 2013

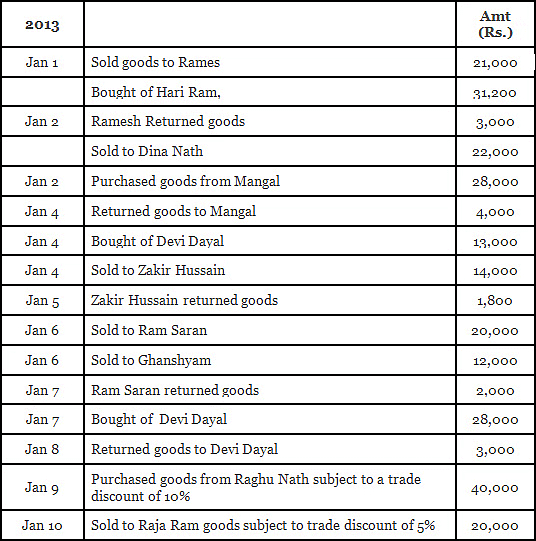

Q9: Enter the following transactions in proper subsidiary books of Balram

You can access the solutions to this worksheet here.

|

61 videos|154 docs|35 tests

|

FAQs on Worksheet: Recording of Transactions - II - Accountancy Class 11 - Commerce

| 1. What are the key components of recording transactions in commerce? |  |

| 2. Why is it important to maintain accurate transaction records in business? |  |

| 3. What is double-entry bookkeeping and how does it relate to recording transactions? |  |

| 4. How can businesses ensure their transaction records are accurate and reliable? |  |

| 5. What common mistakes should businesses avoid when recording transactions? |  |