Worksheet Solutions: Accounting for Partnerships : Basic Concepts | Accountancy Class 12 - Commerce PDF Download

Very Short Answer Type

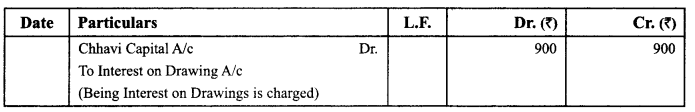

Q1. Chhavi and Neha were partners in a firm sharing profits and losses equally. Chhavi withdrew a fixed amount at the beginning of each quarter. Interest on drawings is charged @ 6% p.a. At the end of the year, interest ‘ on Chhavi’s drawings amounted to ₹ 900. Pass necessary journal entry for charging interest on drawings.

Ans: The interest on Chhavi's drawings is charged at a rate of 6% per annum. At the end of the year, the total interest on her drawings amounted to ₹ 900. To record this, the necessary journal entry is as follows:

- Debit Interest on Drawings Account ₹ 900

- Credit Chhavi's Capital Account ₹ 900

This entry reflects the charge for interest on the amount Chhavi withdrew during the year.

Q2. Dev withdrew ₹ 10,000 on 15th day of every month. Interest on drawings was to be charged @ 12% per annum. Calculate interest on Dev’s drawings.

Ans: Interest on Drawings Calculation

- Dev withdrew ₹ 10,000 on the 15th day of each month.

- Interest on drawings is charged at 12% per annum.

- To calculate the total interest:

Interest on Drawings = ₹ 1,20,000 × 12/100 × 6 × 12 = ₹ 7,200

Q3. Amit, a partner in a partnership firm, withdrew ₹ 7,000 at the beginning of each quarter. For how many months would interest on drawings be charged₹

Ans: Interest on drawings for Amit will be charged for a total of 7.5 months.

- Amit withdrew ₹ 7,000 at the beginning of each quarter.

- Since the withdrawals occur at the start of each quarter, interest is calculated for 7.5 months.

- This includes the full duration of the first three withdrawals and a portion of the last.

Q4. Raj and Seema started a partnership firm on 1st July 2018. They agreed that Seema was entitled to a commission of 10% of the net profit after charging Raj’s salary of ₹ 2,500 per quarter and Seema’s commission. The net profit before charging Raj’s salary and Seema’s commission for the year that ended on 31st March 2019 was ₹ 2,27,500. Calculate Seema’s commission.

Ans: Net profit before salary and commission: ₹ 2,27,500

- Raj's salary: ₹ 2,500 x 3 = ₹ 7,500

- Net profit after Raj's salary: ₹ 2,27,500 - ₹ 7,500 = ₹ 2,20,000

- Seema's commission: 10% of ₹ 2,20,000 = ₹ 20,000

Thus, Seema's commission is ₹ 20,000.

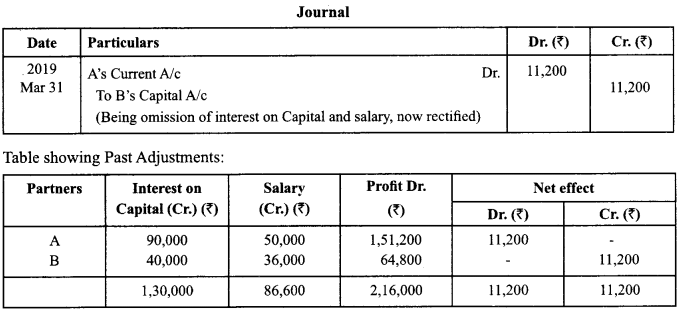

Q5. A and B are partners in a firm sharing profits and losses in the ratio of 7 : 3. Their fixed capitals were: A ₹ 9,00,000 and B ₹ 4,00,000. The partnership deed provided the following:(i) Interest on capital @ 10% p.a.(ii) A’s salary of ₹50,000 per year and B’s salary of ₹3,000 per month.Profit for the year ended 31st March 2019: ₹2,78,000 was distributed without providing for interest on capital and partner’s salary.Showing your working clearly, pass the necessary adjustment entry for the above omissions.

Ans:

Q6. Partners of ABC Corporation have agreed that D, a minor, should be admitted as a partner in the firm. What will be liability of D?

Ans: The liability of D, a minor admitted as a partner in ABC Corporation, is limited.

Q7. X, Y and Z are partners in a firm. The firm had adopted fixed capital method. Mention the account in which the interest on capital will be recorded:

Ans: The interest on capital will be recorded in the Capital Account.

Q8. A partnership deed provides for the payment of interest on capital but there was a loss instead of profits during the year 2010-11. Will interest on capital be allowed?

Ans: No, interest on capital will not be allowed.

- The partnership deed specifies payment of interest on capital.

- However, since the firm incurred a loss during the year 2010-11, no interest can be paid.

- Partners will share the loss according to their profit-sharing ratio.

Q9. Where is interest on a partner’s loan debited to Profit and Loss Account or Profit and Loss Appropriation Account?

Ans: Interest on a partner's loan is debited to the Profit and Loss Account.

Q10. Is interest on a partner’s loan is payable even in case of loss to the firm?

Ans: Yes. Interest on a partner's loan is still payable even if the firm incurs a loss. Here are the key points:

- The partnership agreement typically stipulates the terms regarding interest on loans.

- Partners are entitled to receive interest on loans provided to the firm, regardless of the firm's profitability.

- This interest is usually calculated at an agreed rate, often around 6% per annum.

Q11. The net profit of a firm is ₹ 30,000, the partners’ salary is ₹ 12,000, and the interest on capital is ₹ 20,000. Mention the amount of partners’ salary and interest on capital, which should be debited to Profit and Loss Appropriation Account if both items are treated as appropriation.

Ans: The amounts to be debited to the Profit and Loss Appropriation Account for the partners' salary and interest on capital are as follows:

- Partners' salary: ₹11,250

- Interest on capital: ₹18,750

This distribution is based on the ratio of the salary and interest on capital, which is 3:5 (₹12,000 : ₹20,000).

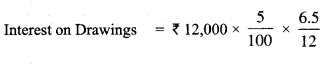

Q12. Ram and Shyam are partners who share profits/losses equally. Ram withdrew ₹ 1,000 p.m. regularly on the first day of every month during the year 2013-14 for personal expenses. If interest on drawings is charged @ 5% p.a. Calculate interest on the drawings of Ram.

Ans:

= ₹325

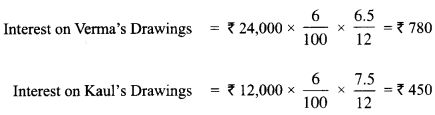

Q13. Verma and Kaul are partners in a firm. The partnership agreement provides that interest on drawings should be charged @ 6% p.a. Verma withdraws X 2,000 per month starting from April 01, 2013 to March 31, 2014. Kaul withdraw ₹ 3,000 per quarter, starting from April 01, 2013. Calculate interest on partner’s drawings.

Ans:

Q14. Himanshu withdraws ₹ 2,500 at the end of each month. The partnership deed provides for charging the interest on drawings @ 12% p.a. Calculate interest on Himanshu’s drawings for the year ending 31st December 2013.

Ans:

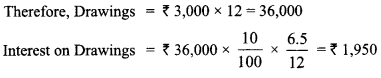

Q15. Bharam is a partner in a firm. He withdraws ₹ 3,000 at the starting of each month for 12 months. The books of the firm close on March 31 every year. Calculate interest on drawings if the rate of interest is 10% p.a.

Ans: Bharam withdraws ₹ 3,000 at the start of each month.

Q16. Amit and Bhola are partners in a firm. They share profits in the ratio of 3 : 2. As per their partnership agreement, interest on drawings is to be charged @ 10% p.a. Their drawings during 2013 were ₹ 24,000 and ₹ 16,000, respectively. Calculate interest on drawings based on the assumption that the amounts were withdrawn evenly, throughout the year.

Note: In the absence of date of drawings, it is assumed drawings have been made in the middle of each month/period.

Q17. A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. B was guaranteed a profit of X 2,00,000. During the year the firm earned a profit of ₹ 84,000. Calculate the net amount of Profit/Loss transferred to the capital accounts of A and C.

Ans: Net Amount of Loss transferred to:

- A’s Capital Account: ₹ 87,000

- C’s Capital Account: ₹ 29,000

Short Answer Type

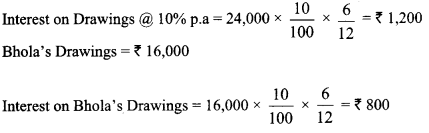

Q1: A and B were partners in a firm sharing profits in the ratio of 5 : 3. Their fixed capitals on 31st March, 2017 were: A ₹ 60,000 and B ₹ 80,000. They agreed to allow interest on capital @ 12% p.a. The profit of the firm for the year ended 31st March, 2018 before allowing interest on capitals, was ₹ 12,600.

Pass necessary journal entries for the above transactions in the books of A and B. Also show your working notes clearly.

Ans:

Working Notes:

Interest on Capital:

A= 12% of 60,000 = 7,200

B = 12% of 80,000 = 9,600

Total interest = 16,800

Since profits are insufficient interest on capital will be distributed in the ratio of 7,200:9,600 i.e. 3:4

A = 3/7 of 12,600 = 5,400

B = 4/7 of 12,600 = 7,200

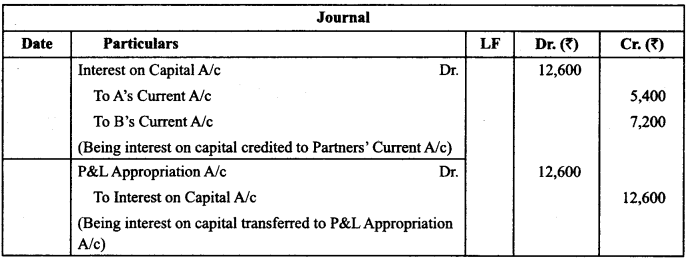

Q2: Maanika, Bhavi and Komal are partners sharing profits in the ratio of 6:4:1. Komal is guaranteed a minimum profit of ₹ 2,00,000. The firm incurred a loss of ₹22,00,000 for the year ended 31st March 2018. Pass the necessary journal entry regarding the deficiency borne by Maanika and Bhavi and prepare Profit and Loss Appropriation Account.

Ans:

Working Note:

Loss of the firm = 22,00,000

Komal’s share of loss = 22,00,000 x 1/11 = 2,00,000

Guaranteed minimum profit = 2,00,000

Q3: A, B and C were partner in a firm. On 1st April, 2018, their capitals stood at ₹ 4,00,000, ₹ 3,00,000 and ₹2,00,000 respectively. As per the provisions of the partnership deed.

(i) A was entitled to a salary of ₹ 5,000 per month.

(ii) Partner were entitled to interest on capital @ 10% p.a.

The net profit for the year ended 31st March 2019, ₹ 3,00,000 was divided among the partners without providing for the above items.

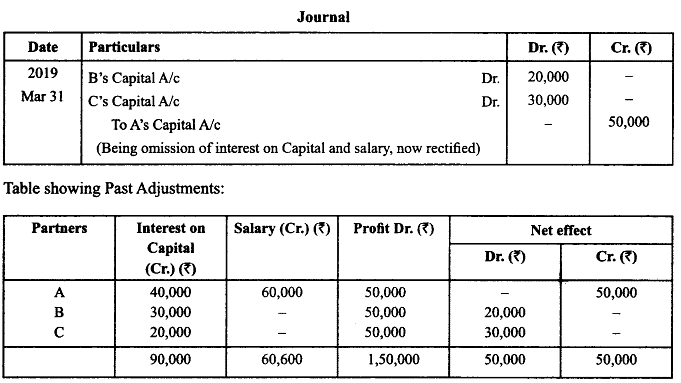

Showing your working clearly, pass an adjustment entry to rectify the above error.

Ans:

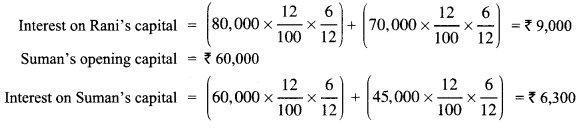

Q4: Rani and Suman are in partnership with capitals of ₹ 80,000 and ₹ 60,000, respectively. During the year 2013 – 2014, Rani withdrew ₹ 10,000, and Suman withdrew ₹ 15,000 from their capital profits before charging interest on capital was ₹ 50,000. Ravi and Suman shared profits in the ratio of 3: 2. Calculate the amounts of interest on their capitals @ 12% p.a. for the year ended March 31,2014.

Ans: Interest on capital is always calculated on opening balance of capital.

Rate of interest = 12% p.a.

Rani’s opening capital = ₹ 80,000

Note: Date of capital withdrawn is not given in the question, it has been assumed that the same have been done in the mid of the accounting year.

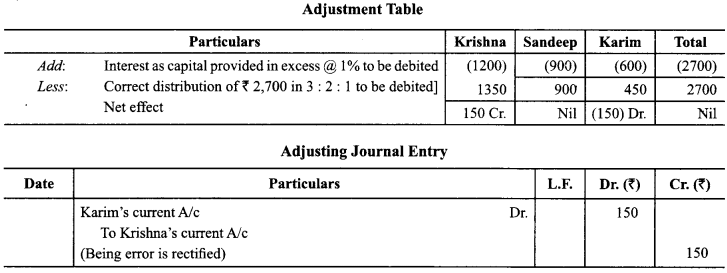

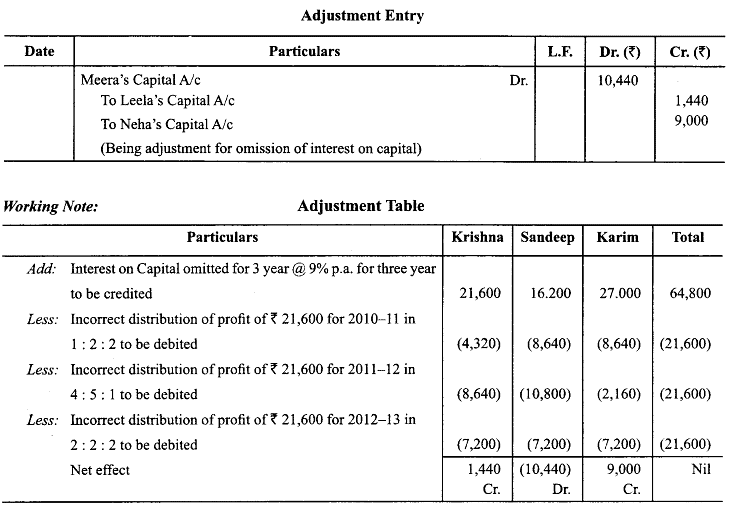

Q5: Krishna, Sandeep and Karim are partners sharing profits in the ratio of 3 : 2 : 1. Their fixed capitals are: Krishan ₹ 1,20,000, Sandeep ₹ 90,000 and Karim ₹ 60,000. For the year 2013-14, interest was credited to them @ 6% p.a. instead of 5% p.a. Record adjustment entry.

Ans:

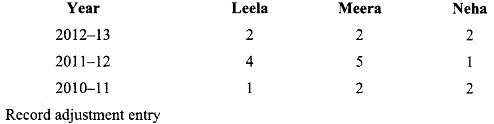

Q6: Leela, Meera and Neha are partners and have omitted interest on capital @ 9% p.a. for three years ended March 31, 2013. Their fixed capitals on which interest was to be allowed throughout were: Leela ₹ 80,000, Meera ₹ 60,000 and Neha ₹ 1,00,000. Their profit sharing ratio during the last three years were:

Ans:

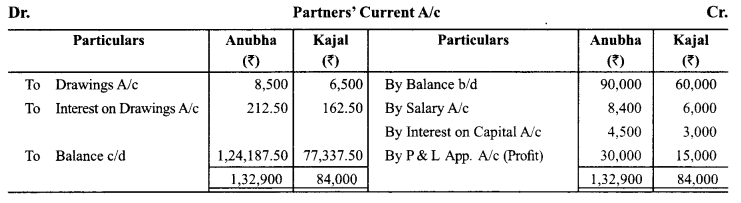

Q7: Anubha and Kajal are partners of a firm sharing profits and losses in the ratio of 2 : 1. Their capital were ₹ 90,000 and ₹ 60,000. The divisible profit during the year were ₹ 45,000. According to partnership deed, both partners are allowed salary @ ₹ 700 per month to Anubha and ₹ 500 per month to Kajal. Interest allowed on capital @ 5% p.a. The drawings at the end of the period were ₹ 8,500 for Anubha and ₹ 6,500 for Kajal. Interest is to be charged @ 5% p.a. on drawings. Prepare partners capital accounts, assuming that the . capital accounts are fluctuating.

Ans:

Note:

(1) It has been assumed that profit given is divisible profit.

(2) It has been assumed drawings have been made in the middle of the year. Normally, in the absence of date, drawings are assumed to have been made in the middle of the year.

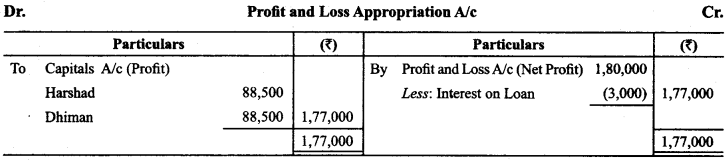

Q8: Harshad and Dhiman are in partnership since April 01, 2013. No Partnership agreement was made. They contributed ₹ 4,00,000 and 1,00.000 respectively as capital. In addition, Harshad advanced an amount of ₹ 1,00,000 to the firm, on October 01, 2013. Due to long illness, Harshad could not participate in business activities from August 1, to September 30. 2013. The profits for the year ended March 31, 2014 amounted to ₹ 1,80,000.

Dispute has arisen between Harshad and Dhiman.

Harshad Claims:

- He should be given interest @ 10% per annum on capital and loan

- Profit should be distributed in proportion of capital

Dhiman Claims:

- Profits should be distributed equally

- He should be allowed ₹ 2,000 p.m. as remuneration for the period he managed the business, in the absence of Harshad

- Interest on capital and loan should be allowed @ 6% p.a.

You are required to settle the dispute between Harshad and Dhiman. Also prepare P&L Appropriation Account.

Ans: Harshad’s Claims

(i) Harshad’s claim that he should be given interest @ 10% p.a. on capital is not justified. According to the provisions of Partnership Act, 1932, he is not entitled to receive interest on loan @ 10% but only entitled to receive @ 6% p.a.

(ii) His second claim that profits should be distributed in proportion of capital does not fall within the provisions of Partnership Act, 1932. Act provides for equal distribution of profits among partners.

Dhiman’s Claims

(i) His claim to distribute the profits equally is right as per the provisions of Partnership Act, 1932.

(ii) His claim for remuneration for managing the business is not justified because Partnership Act, 1932 does not allow any such remuneration.

(iii) His claim that interest on capital should be allowed @ 6% p.a. is wrong but his claim to provide interest on loan @ 6% p.a. is a right claim as per the provisions of Partnership Act., 1932.

Note: Since interest on loan is charged against the profit, it can be shown on the debit side of profit and loss account or as a deduction from the pro fit on the credit side of Profit and Loss Appropriation Account.

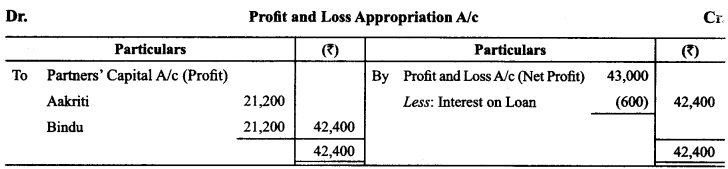

Q9: Aakriti and Bindu entered into partnership for making garment on April 01, 2013 without any partnership agreement. They introduced capitals of₹ 5,00,000 and ₹ 3,00,000 respectively on October 01,2013. Aakriti Advanced. ₹ 20,000 by way of loan to the firm without any agreement as to interest. Profit and Loss account for the year ended March 2014 showed profit of ₹ 43,000. Partners could not agree upon the question of interest and the basis of division of profit. You are required to divide the profits between them giving reason for your solution.

Ans:

Reason:

(1) In the absence of any partnership deed, the provisions of Partnership Act, 1932 is applied. According to the provisions, no interest on capital, no salary, no commission will be allowed to the partners They will also share the profits equally. The interest on loan also will be provided at 6% p.a.

(2) Since interest on loan is charged against the profit, it can be shown on the debit side of profit and loss account or as a deduction from the profit on the credit side of Profit and Loss Appropriation Account.

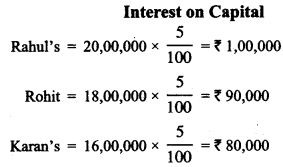

Q10: Rahul, Rohit and Karan started partnership business on April 1, 2013 with capitals of ₹ 20,00,000, ₹ 18,00,000 and ₹ 16,00,000, respectively. The profit for the year ended March 2014 amounted to 7 1,35,000 and the partner’s drawings had been Rahul 7 50,000, Rohit 7 50,000 and Karan 7 40,000. The profits are distributed among partner’s in the ratio of 3 : 2 : 1. Calculate the interest on capital @ 5% p.a.

Ans:

Note: As interest on capital is calculated on the opening capitals, rest of the information apart from opening capitals is irrelavant.

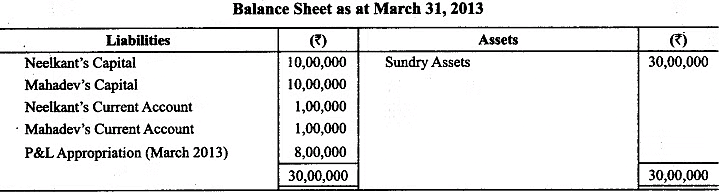

Q11: Following is the extract of the Balance Sheet of Neelkant and Mahadev as on March 31,2013:

During the year Mahadev’s drawings were 7 30,000. Profits dining 2013 is 7 10,00,000. Calculate interest on capital @ 5% p.a. for the year ending March 31,2013.

Ans:

Note: Since the capitals are fixed, profit and drawings must have been transferred to Current Accounts. Therefore, capitals must be fixed in beginning as well as at the end.

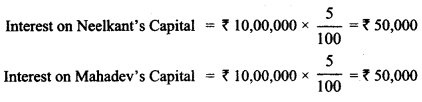

Q12: Raj and Neeraj are partners in a firm. Their capitals as on April 01, 2013 were 72,50,000 and 71,50,000, respectively. They share profits equally. On July 01, 2013, they decided that their capitals should be 71,00,000 each. The necessary adjustment in the capitals were made by introducing or withdrawing cash by the partners Interest on capital is allowed @ 8% p.a. Compute interest on capital for both the partners for the year ending on March 31,2014.

Ans: Interest on Ram’s Capital @ 8% p.a.

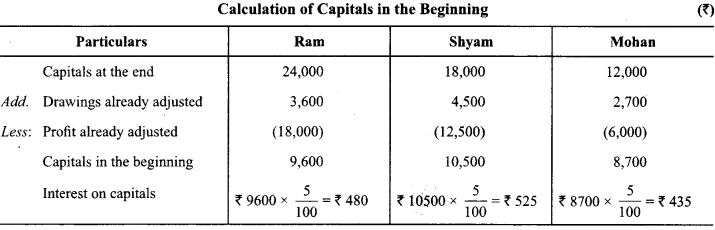

Q13: On March 31, 2013, after the close of books of accounts, the capital accounts of Ram, Shyam and Mohan showed a balance of₹ 24,000 ₹ 18,000 and ₹ 12,000, respectively. It was later discovered that interest on capital @ 5% had been omitted. The profit for the year ended March 31,2013, amounted to ₹ 36,000 and the partner’s drawings had been Ram, ₹ 3,600; Shyam, ₹ 4,500 and Mohan, ₹ 2,700. The profit sharing ratio of Ram, Shyam and Mohan was 3:2:1. Calculate interest on capitals.

Ans: Note. Interest on Capital is always calculated on Opening Capital.

Opening Capital = Closing Capital + Drawings – Share of Profit

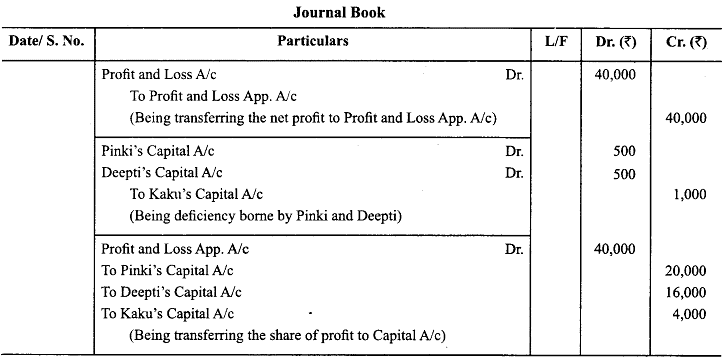

Q14: Pinki, Deepti and Kaku are partner’s sharing profits in the ratio of 5 : 4 : 1. Kaku is given a guarantee that his share of profits in any given year would not be less than ₹ 5,000. Deficiency, if any, would be borne by Pinki and Deepti equally. Profits for the year amounted to ₹ 40,000. Record necessary journal entries in the books of the firm showing the distribution of profit.

Ans:

There is deficiency in Kaku’s Share of₹ 1,000 (5,000 – 4,000). It will be borne by Pinki and Deepti equally.

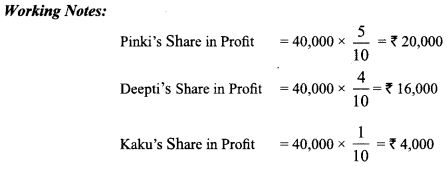

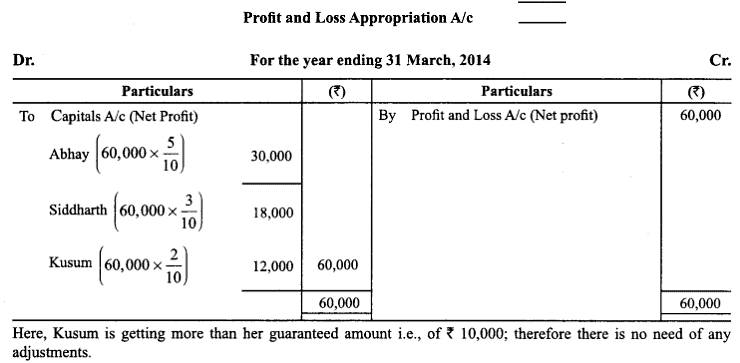

Q15: Abhay, Siddharth and Kusum are partners in a firm, sharing profits in the ratio of 5 : 3 : 2. Kusum is guaranteed a minimum amount of₹ 10,000 as per share in the profits. Any deficiency arising on that account shall be met by Siddharth. Profits for the years ending March 31, 2013 and 2014 are ₹ 40,000 and 60,000 respectively. Prepare Profit and Loss Appropriation Account.

Ans: Profit and Loss Appropriation A/c

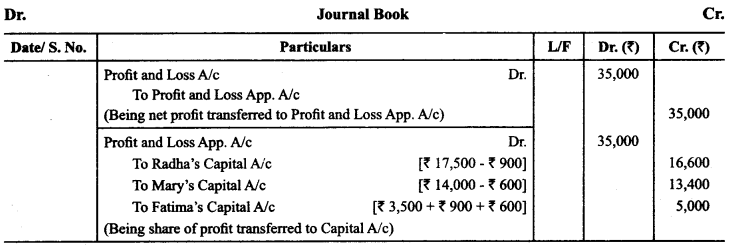

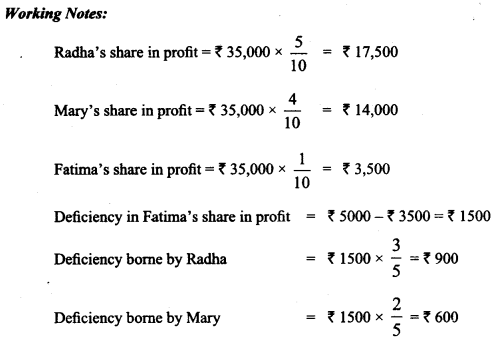

Q16: Radha, Mary and Fatima are partners sharing profits in the ratio of 5 :4 : 1 Fatima is given a guarantee that her share of profit, in any year will not be less than ₹ 5,000. The profits for the year ending March 31,2013 amounts to ₹ 35,000. Shortfall if any, in the profits guaranteed to Fatima is to be borne by Radha and Mary in the ratio of 3 : 2. Record necessary journal entry to show distribution of profit among partner.

Ans:

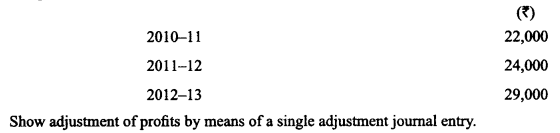

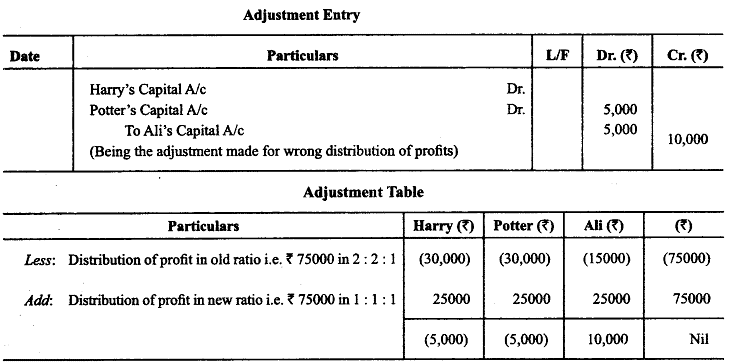

Q17: The firm of Harry, Potter and Ali who have been sharing profits in the ratio of 2 :2 :1, have existed for some years Ali wants that he should get equal share in the profits with Harry and Potter and he further wishes that the change in the profit sharing ratio should come into effect retrospectively for the last three years Harry and Potter have agreement on this account.

The profits for the last three years were:

Ans:

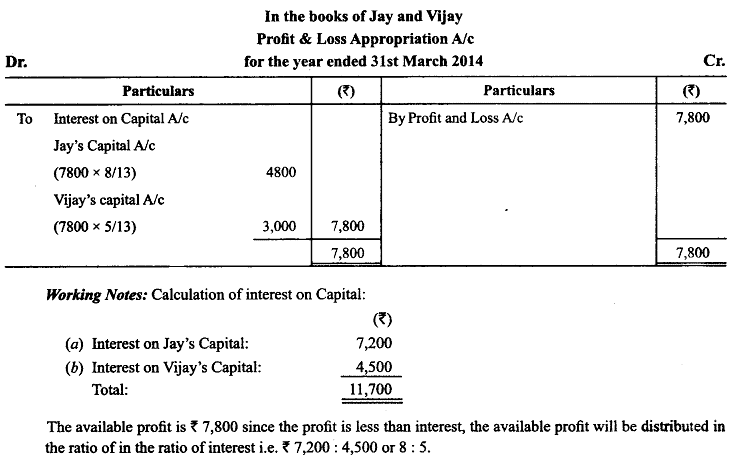

Q18: On 1.4.2013 Jay and Vijay, entered into partnership for supplying laboratory equipments to government . schools situated in remote and backward areas. They contributed capitals of ₹ 80,000 and ₹ 50,000 respectively and agreed to share the profits in the ratio of 3 : 2 The partnership deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of ₹ 7,800. Showing your calculations clearly, prepare ‘Profit and Loss Appropriation Account’ of Jay and Vijay for the year ened 31-3-2014.

Ans:

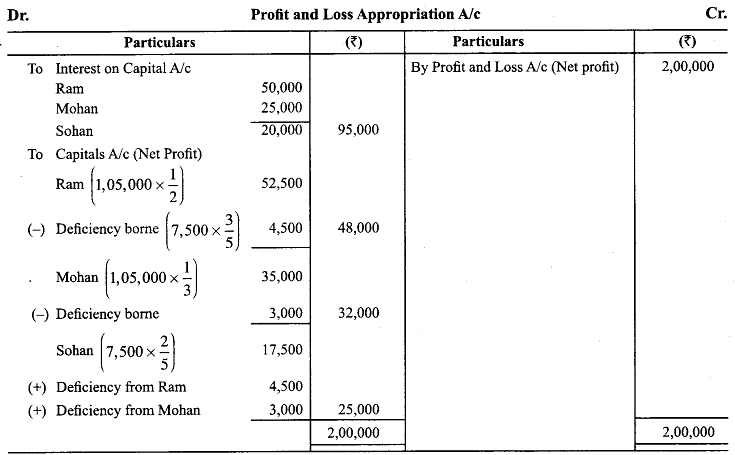

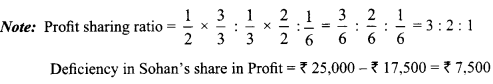

Q19: Ram, Mohan and Sohan are partners with capitals of ₹ 5,00,000, ₹ 2,50,000 and 2,00,000 respectively. After providing interest on capital @ 10% p.a. the profits are divisible as follows:

Ram 1/2, Mohan 1/3 and Sohan 1/6. But Ram and Mohan have guaranteed that Sohan’s share in the profit shall not be less than ₹ 25,000, in any year. The net profit for the year ended March 31, 2013 is ₹ 2,00,000, before charging interest on capital.

You are required to show distribution of profit.

Ans:

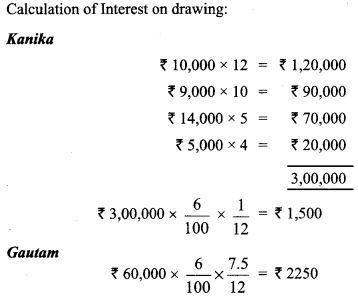

Q20: Kanika and Gautam are partners doing a dry cleaning business in Lucknow, sharing profits in the ratio 2 : 1 with capitals ₹ 5,00,000 and ₹4,00,000 respectively, Kanika withdrew the following amounts during the year to pay the hostel expenses of her son.

Gautam withdrew ₹ 15,000 on the first day of April, July, October and January to pay rent for the accommodation of his family. He also paid ₹ 20,000 per month as rent for the office of partnership which was in a nearby shopping complex. Calculate interest on Drawings @ 6% p.a.

Ans:

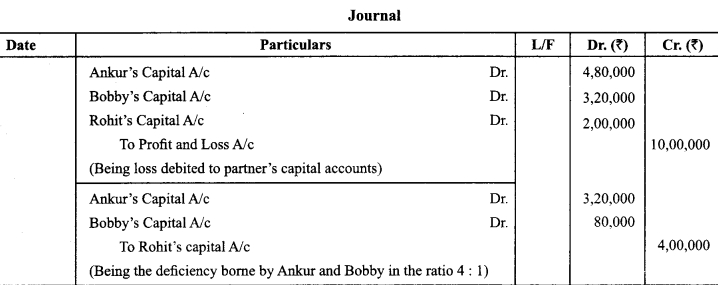

Q21: Ankur and Bobby were into the business of providing software solutions in India. They were sharing profits and losses in the ratio 3 : 2. They admitted Rohit for a 1/5 share in the firm. Rohit, an alumni of IIT, Chennai would help them to expand their business to various South African countries where he had been working earlier. Rohit is guaranteed a minimum profit of₹ 2,00,000 for the year. Any deficiency in Rohit’s share is to . be borne by Ankur and Bobby in the ratio 4:1. Losses for the year ₹ 10,00,000. Pass the necessary journal entries.

Ans:

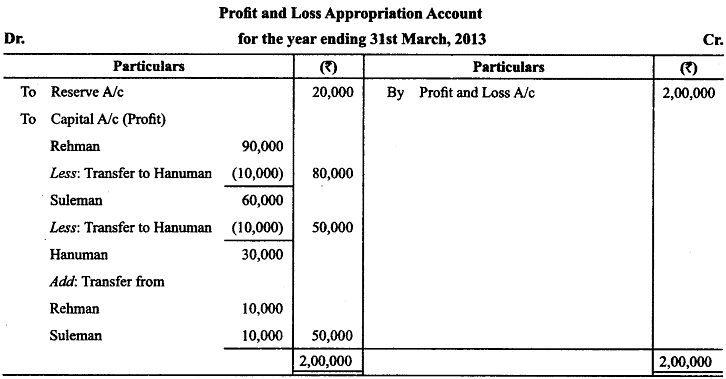

Q22: Rehman, Suleman and Hanuman were partners in a firm sharing profits in the ratio of 3 : 2 : 1 respectively. Their fixed capitals were as follows: Rehman ₹ 3,00,000, Suleman ₹ 2,00,000 and Hanuman ₹ 1,00,000. The partnership deed provided for the following for the division of profit:

(i) 10% of trading profit will be transferred to Reserve Account.

(ii) Hanuman was guaranteed a profit of ₹ 50,000. Any loss because of guarantee to Hanuman will be shared by Rehman and Suleman equally.

The trading profit of the firm for the year ended 31. 12. 2012 was ₹ 2,00,000.

Prepare the Profit and Loss Appropriation Account of Rehman, Suleman and Hanuman for the year ended 31. 12. 2012.

Ans:

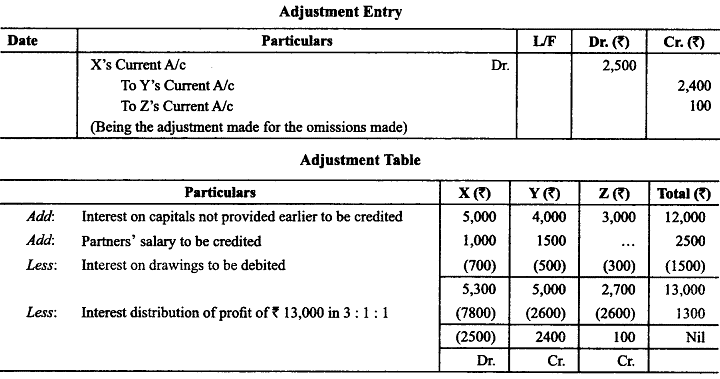

Q23: The net profit of X, Y and Z for the year ended March 31,2014 was ₹ 60,000 and the same was distributed among them in their agreed ratio of 3 : 1 : 1. It was subsequently discovered that the under mentioned transactions were not recorded in the books:

- Interest on capital @ 5% p.a.

- Interest on drawings amounting to X ₹ 700, Y ₹ 500 and Z ₹ 300.

- Partner’s salary: X ₹ 1,000 p.a., Y ₹ 1,500 p.a.

The capital accounts of partners were fixed as: X ₹ 1,00,000, Y ₹ 80,000 and Z ₹ 60,000. Record the adjustment entry.

Ans:

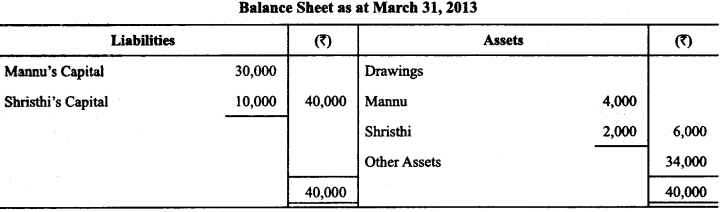

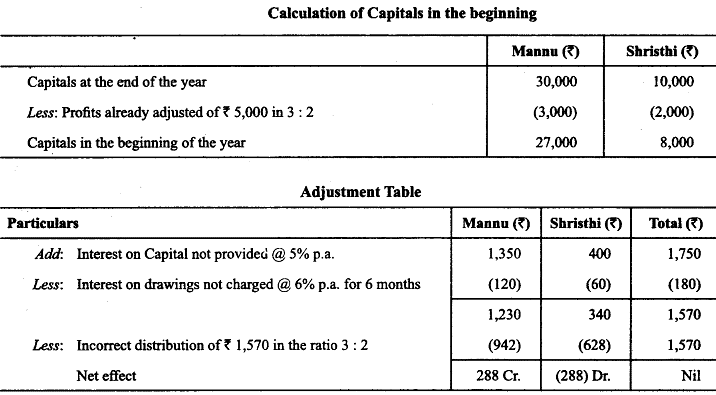

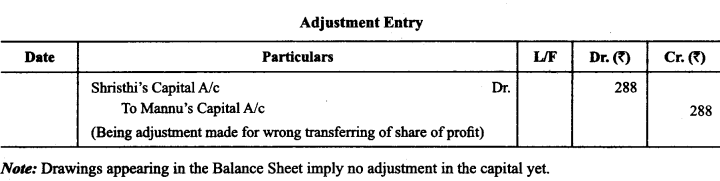

Q24: Mannu and Shristhi are partners in a firm sharing profit in the ratio of 3 :2. Following is the balance sheet of firm as on March 31,2013.

Profit for the year ended March 31, 2013 was ₹ 5,000 which was divided in the agreed ratio, but interest @ 5% p.a. on capital and @ 6% p.a. on drawings was inadvertently ignored. Adjust interest on drawings on an average basis for 6 months. Give the adjustment entry.

Ans:

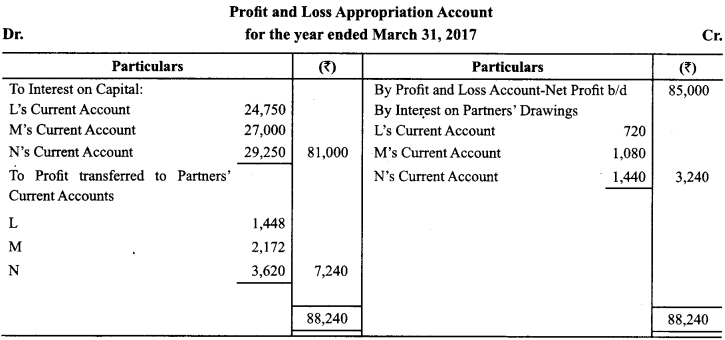

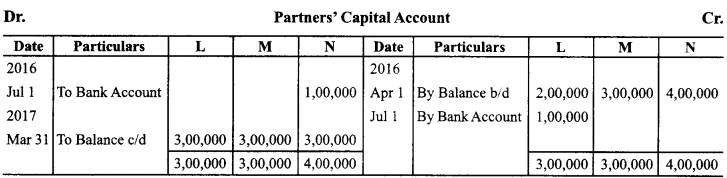

Q25: L, M and N are partners in a firm sharing profits & losses in the ratio of 2 : 3 : 5.

On April 1, 2016 their fixed capitals were ₹ 2,00,000, ₹ 3,00,000 and ₹ 4,00,000 respectively. Their partnership deed provided for the following:

- Interest on capital @ 9% per annum.

- Interest on Drawings @ 12% per annum.

- Interest on partners’ loan @ 12% per annum.

On July 1, 2016, L brought ₹ 1,00,000 as additional capital and N withdrew ₹ 1,00,000 from his capital. During the year L, M and N withdrew ₹ 12,000, ₹ 18,000 and ₹ 24,000 respectively for their personal use. On January 1, 2017 the firm obtained a Loan of ₹ 1,50,000 from M. The Net profit of the firm for the year ended March 31, 2017 after charging interest on M’s Loan was ₹ 85,000.

Prepare Profit & Loss Appropriation Account and Partners Capital Account.

Ans:

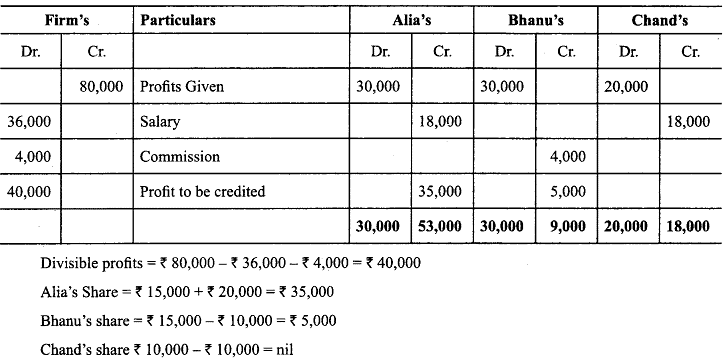

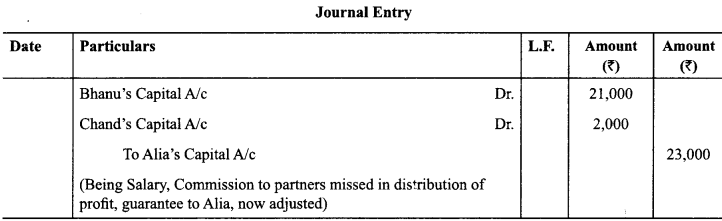

Q26: The partners of a firm, Alia, Bhanu and Chand distributed the profits for the year ended 31st March, 2017, ₹ 80,000 in the ratio of 3:3:2 without providing for the following adjustments:

- Alia and Chand were entitled to a salary of₹ 1,500 each p.a.

- Bhanu was entitled for a commission of ₹ 4,000

- Bhanu and Chand had guaranteed a minimum profit of ₹ 35,000 p.a. to Alia any deficiency to borne equally by Bhanu and Chand.

Pass the necessary Journal entry for the above adjustments in the books of the firm. Show workings clearly.

Ans:

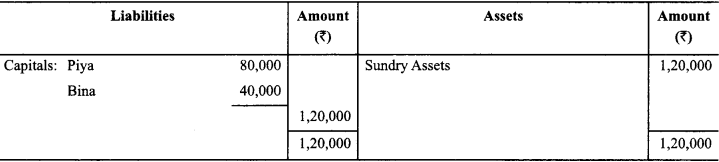

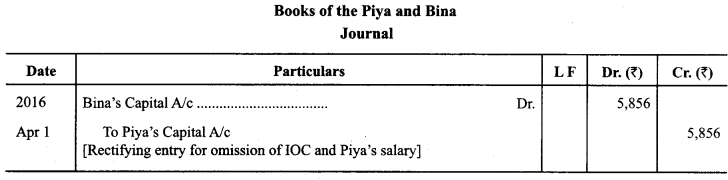

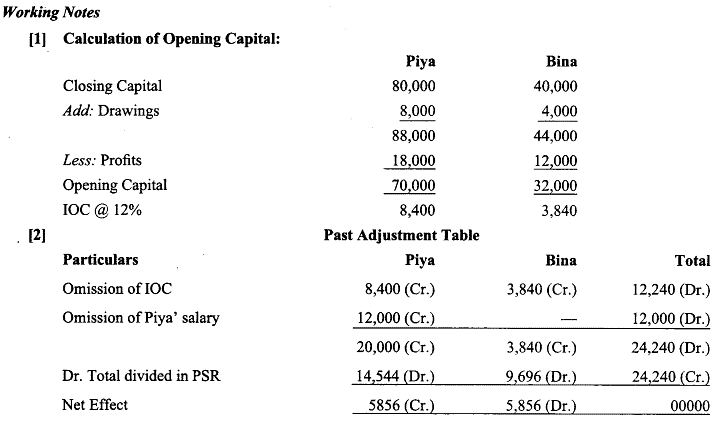

Q27: Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3 : 2. Following was the Balance Sheet of the firm as on 31-3-2016.

The profits ₹ 30,000 for the year ended 31-3-2016 were divided between the partners without allowing interest on capital @ 12% p.a. and salary to Piya @ ₹ 1,000 per month. During the year Piya withdrew ₹8,000 and Bina withdrew ₹4,000.

Showing your working notes clearly, pass the necessary rectifying entry.

Ans:

Long Answer Type Questions

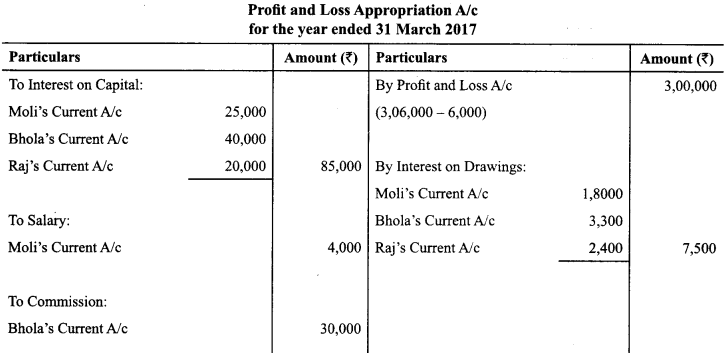

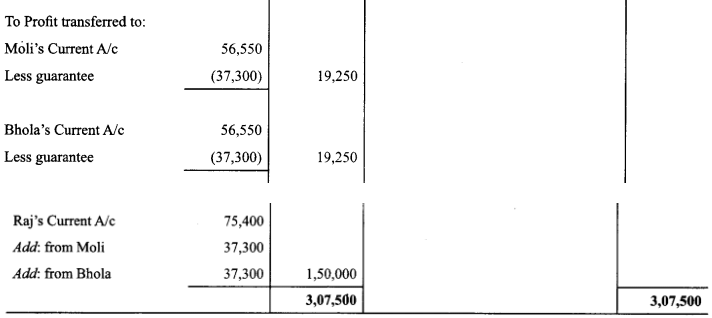

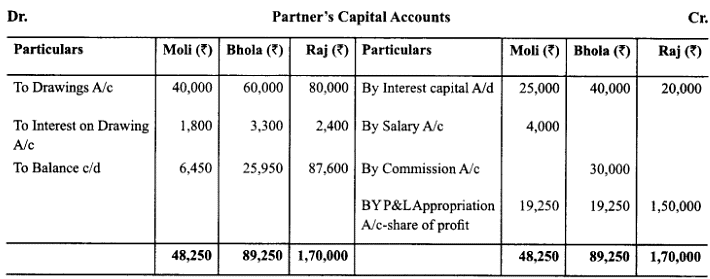

Q1: Moli, Bhola and Raj were partners in a firm sharing profit and losses in the ratio of 3 : 3 : 4. Their partnership deed provides for the following:

- Interest on Capital @ 5% p.a.

- Interest on Drawing @ 12% p.a.

- Interest on Partner’s Loan @ 6% p.a.

- Moli was allowed an annual salary of ₹4,000.

Bhola was allowed a commission of 10% of net profit as shown by Profit and Loss Account and Raj was guaranteed a profit ₹ 1,50,000 after making all the adjustments as provided in the partnership agreement. Their fixed capital were Moli ₹5,00,000, Bhola ₹8,00,000 and Raj ₹4,00,000. On 1st April 2016 Bhola extended a loan of ₹ 1,00,000 to the firm. The net profit for the year en ded 31st March 2017 before interest on Bhola’s Loan was ₹3,06,000. Prepare Profit and Loss Appropriation Account of Moli, Bhola and Raj for the year ended 31 st March 2017 and their Current Account assuming that Bhola withdrew ₹ 5,000 at the end of each month. Moli withdrew ₹ 10,000 at the end of each quarter and Raj withdrew ₹40,000 at the end of each half year.

Ans:

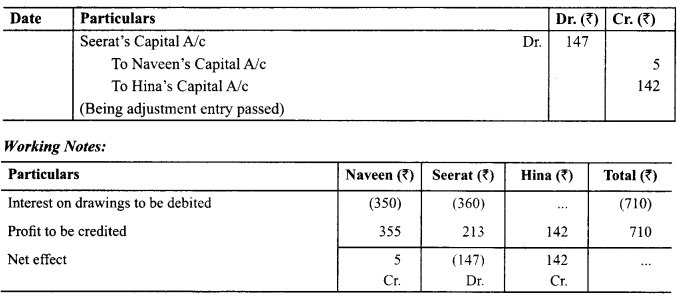

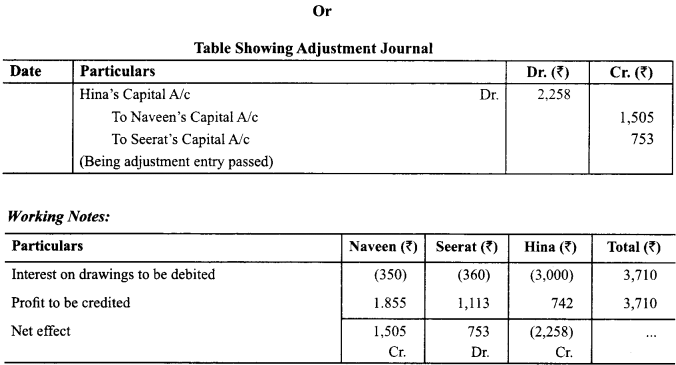

Q2: Naveen, Seerat andHina were partners in a firm manufatcturing blankets. They were sharing profits in the ratio of 5:3:2. Their capitals on 1st April, 2012 were ₹ 2,00,000; ₹ 3,00,000 and ₹ 6,00,000 respectively. After the floods in Uttaranchal, all partners decided to help the flood victims personally.

For this Naveen withdrew ₹ 10,000 from the firm on 1st September, 2012. Seerat, instead of withdrawing cash from the firm, took blankets amounting to ₹ 12,000 on 1st October, 2012 from the firm and distributed to the flood victims. On the other hand, Hina withdrew ₹ 2,00,000 from her capital on 1st January, 2013 and set up a centre to provide medical facilities in the flood affected area.

The partnership deed provides for charging interest on drawings @ 6% p.a. After the Final Accounts were prepared, it was discovered that interest on drawings had not been charged. Give the necessary adjusting journal entry and show the working notes clearly.

Ans:

|

42 videos|199 docs|43 tests

|

FAQs on Worksheet Solutions: Accounting for Partnerships : Basic Concepts - Accountancy Class 12 - Commerce

| 1. What are the basic concepts of accounting for partnerships? |  |

| 2. How is a partnership different from other forms of business organizations? |  |

| 3. What is a partnership agreement and why is it important? |  |

| 4. How are capital accounts maintained in a partnership? |  |

| 5. How is goodwill treated in partnership accounting? |  |