UPSC Prelims Previous Year Questions 2023: Indian Economy | Indian Economy for UPSC CSE PDF Download

Q1: Consider the following statements:

Statement-I: Interest income from the deposits in Infrastructure Investment Trusts (InvITs) distributed to their investors is exempted from tax, but the dividend is taxable.

Statement-II: InviTs are recognized as borrowers under the 'Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002'.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-1

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-1

(c) Statement-1 is correct but Statement-II is incorrect

(d) Statement-I is incorrect Statement-II is correct

View Answer

View Answer

Ans: (d)

- Interest income that InvIT gets from its underlying SPVs and passes on to unitholders is taxed. The dividends that InvIT pays also get taxed. Both interest and dividend are taxed per the income tax slab. This is applicable where the InvIT has opted for taxation under section 115BAA of the Act. Hence, statement 1 is not correct.

- InvITs are recognized as borrowers under the SARFAESI Act 2002. The SARFAESI Act and the Recovery of Debts Act have been amended. Now, a pooled investment vehicle can be considered a borrower under these laws. This means that a debenture trustee for listed secured debt securities issued by an InvIT or REIT can use the protections and enforcement mechanisms under the SARFAESI Act. Hence, statement 2 is correct.

Q2: Consider the following statements:

Statement-I: In the post-pandemic recent past, many Central Banks worldwide had carried out interest rate hikes.

Statement-II: Central Banks generally assume that they have the ability to counteract the rising consumer prices via monetary policy means.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-1

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-1

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

View Answer

View Answer

Ans: (a)

- In the post-pandemic recent past, many Central Banks worldwide had carried out interest rate hikes to contain the post pandemic inflation. For Example, since May 2022, the Monetary Policy Committee (RBI) has gone for rate hikes many times. Hence, statement 1 is correct.

- The central banks generally are mandated with the task of containing the rising prices of the commodities. Central banks use monetary policy to manage economic fluctuations and achieve price stability. Hence, Statement 2 is correct.

Q3: Consider the following statements:

Statement-I: Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement-II: Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

View Answer

View Answer

Ans: (c)

- Carbon markets, for years short of puff, have at last become one of the most widespread tools in the fight against climate change. By the end of 2021 more than 21% of the world’s emissions were covered by some form of carbon pricing, up from 15% in 2020. Hence, Statement 1 is correct.

- Carbon markets are designed to create a financial mechanism that encourages the reduction of greenhouse gas emissions. In carbon markets, companies and organisations can buy and sell emissions allowances or credits, which represent the right to emit a certain amount of greenhouse gases. While carbon markets can generate revenue for the government through the sale of emissions allowances, it is not accurate to say that they transfer resources solely from the private sector to the government. Hence, statement 2 is NOT correct.

Q4: Which one of the following activities of the Reserve Bank of India is considered to be part of 'sterilization'?

(a) Conducting 'Open Market Operations'

(b) Oversight of settlement and payment systems

(c) Debt and cash management for the Central and State Governments

(d) Regulating the functions of Non-banking Financial Institutions

View Answer

View Answer

Ans: (a)

- Sterilisation refers to the process by which the RBI takes away money from the banking system to neutralise the fresh money that enters the system. Classical sterilisation involves central banks conducting buy and sell operations in open markets. Hence, option a is the correct answer.

- For sterilisation, the RBI usually adopts the Market Stabilisation Scheme (MSS).

- Market Stabilisation Scheme (MSS): Surplus liquidity arising from large capital inflows is absorbed through the sale of short-dated government securities and treasury bills.

Q5: Consider the following markets:

- Government Bond Market

- Call Money Market

- Treasury Bill Market

- Stock Market

How many of the above are included in capital markets?

(a) Only one

(b) Only two

(c) Only three

(d) All four

View Answer

View Answer

Ans: (b)

- Government bond market is a part of the Capital Market. Hence, option 1 is correct. Call money rate is the rate at which short term funds are borrowed and lent in the money market. Hence, option 2 is not correct.

- Treasury bills are short-term debt securities issued by thgovernment. They have a maturity of up to one year and are considered to be the safest type of money market instrument. Hence, option 3 is not correct.

- The Stock Market is a part of the Capital Market. Hence, option 4 is correct.

Q6: Which one of the following best describes the concept of 'Small Farmer Large Field'?

(a) Resettlement of a large number of people, uprooted from their countries due to war, by giving them a large cultivable land which they cultivate collectively and share the produce

(b) Many marginal farmers in an area organize themselves into groups and synchronize and harmonize selected agricultural operations

(c) Many marginal farmers in an area together make a contract with a corporate body and surrender their land to the corporate body for a fixed term for which the corporate body makes a payment of agreed amount to the farmers

(d) A company extends loans, technical knowledge and material inputs to a number of small farmers in an area so that they produce the agricultural commodity required by the company for its manufacturing process and commercial production

View Answer

View Answer

Ans: (b)

“Small Farmers Large Field (SFLF)” is an agri model to overcome the disadvantages faced by millions of small and marginal farmers due to diseconomies of scale and lack of bargaining power in the supply chain. This model is participatory and flexible and allows small farmers to benefit from achieving economies of scale by organising themselves into groups and synchronising and harmonising selected operations.

Q7: Consider the following statements:

- The Government of India provides Minimum Support Price for niger (Guizotia abyssinica) seeds.

- Niger is cultivated as a Kharif crop.

- Some tribal people in India use niger seed oil for cooking.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

View Answer

View Answer

Ans: (c)

- The government provides MSP for Niger Seeds. Hence, statement 1 is correct.

- Niger Seed is cultivated as Kharif crop. Hence, statement 2 is correct.

- The tribal population uses niger seed oil for cooking, the press cake post oil-extraction as livestock feed, and also consume the seeds as a condiment. Hence, statement 3 is correct.

Q8: Consider the investments in the following assets:

- Brand recognition

- Inventory

- Intellectual property

- Mailing list of clients

How many of the above are considered intangible investments?

(a) Only one

(b) Only two

(c) Only three

(d) All four

View Answer

View Answer

Ans: (c)

- The assets that cannot be touched are known as intangible assets. They are non- physical in nature and can be used for a year or more and the list includes brand value, goodwill, and intellectual property like trademarks, patents, and copyrights etc.

- A tangible asset is an asset that has physical substance. Examples include inventory, a building, rolling stock, manufacturing equipment or machinery, and office furniture.

Hence, (c) is the correct answer.

Q9: Consider the following heavy industries:

- Fertilizer plants

- Oil refineries

- Steel plants

Green hydrogen is expected to play a significant role in decarbonizing how many of the above industries?

(a) Only one

(b) Only two

(c) All three

(d) None

View Answer

View Answer

Ans: (c)

Green Hydrogen:

- Hydrogen is a key industrial fuel that has a variety of applications including the production of ammonia (a key fertiliser), steel, refineries and electricity.

- However, all of the hydrogen manufactured now is the so-called ‘black or brown’ hydrogen because they are produced from coal.

- But when electric current is passed through water, it splits it into elemental oxygen and

- hydrogen through electrolysis. And if the electricity used for this process comes from a renewable source like wind or solar then the hydrogen thus produced is referred to as green hydrogen.

Need for Producing Green Hydrogen:

- Green hydrogen in particular is one of the cleanest sources of energy with close to zero emission. It can be used in fuel cells for cars or in energy-guzzling industries like fertilizers and steel manufacturing.

- Green Hydrogen can aid the desulfurisation of crude oil, without the output of CO2 into the atmosphere hence it can provide a clean, on-site green hydrogen supply which will decarbonise the refining process and reduce emissions.

Hence option (c) is correct.

Q10: Consider, the following statements:

Statement-I: India accounts for 3.2% of global export of goods.

Statement-II: Many local companies and some foreign companies operating in India have taken advantage of India's ‘Production-linked Incentive’ scheme.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

View Answer

View Answer

Ans: (d)

- According to the recent WTO’S Global Trade Outlook and Statistics report, India accounts for 1.8 % of global exports of goods. Hence, statement 1 is not correct.

- The ‘Production Linked Initiative’ (PLI) scheme offers companies incentives on incremental sales from products manufactured in India. It aims to attract foreign companies to set up units in India while encouraging local companies to expand their manufacturing units, generate more employment, and reduce the country's reliance on imports. Hence, Statement 2 is correct.

Q11: Consider the following statements with reference to India :

- According to the ‘Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the ‘medium enterprises’ are those with investments in plant and machinery between ₹ 15 crore and ₹ 25 crore.

- All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (b)

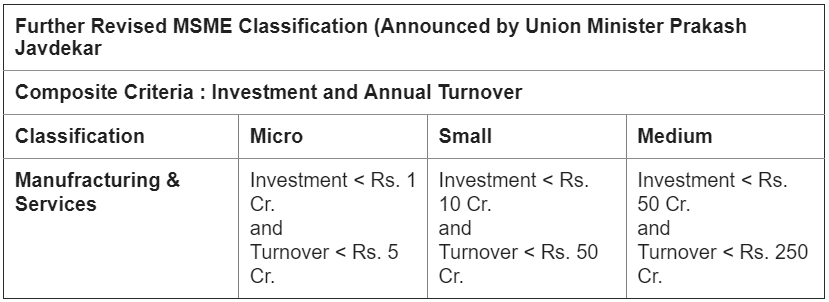

- The new definition and criterion of MSMEs will come into effect from 1st July, 2020. The definition of Micro manufacturing and services units was increased to Rs. 1 Crore of investment and Rs. 5 Crore of turnover.

- The limit of small unit was increased to Rs. 10 Crore of investment and Rs 50 Crore of turnover.

- For medium Enterprises, now it will be Rs. 50 Crore of investment and Rs. 250 Crore of turnover. Hence, Statement 1 is not correct.

- Priority Sector Lending Guidelines: In terms of Master Direction on ‘Priority Sector Lending (PSL) – Targets and Classification’ dated September 4, 2020, all bank loans to MSMEs conforming to the conditions prescribed therein qualify for classification under priority sector lending.

- Bank loans to Micro, Small and Medium Enterprises (for both manufacturing and service sectors) engaged in providing or rendering of services and defined in terms of investment in equipment under MSMED Act, 2006, irrespective of loan limits, are eligible for classification under priority sector, w.e.f. March 1, 2018. Hence, Statement 2 is correct.

Q12: With reference to Central Bank digital currencies, consider the following statements :

- It is possible to make payments in a digital currency without using US dollar or SWIFT system.

- A digital currency can be distributed with condition programmed into it such as a time- frame for spending it.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(b) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (c)

- Central Bank Digital Currency (CBDC) is a digital form of currency notes issued by a central bank. Here payments in a digital currency are without using the US dollar or SWIFT system. Hence, statement 1 is correct.

- CBDC can be classified into two broad types viz. general purpose or retail (CBDC-R) and wholesale (CBDC-W).

- Retail CBDC would be potentially available for use by all viz. private sector, non- financial consumers and businesses while wholesale CBDC is designed for restricted access to select financial institutions.

- While Wholesale CBDC is intended for the settlement of interbank transfers and related wholesale transactions, Retail CBDC is an electronic version of cash primarily meant for retail transactions.

- Programmability: One interesting application of CBDC is the technical possibility of programmability. CBDCs have the possibility of programming the money by tying the end use. For example, agriculture credit by banks can be programmed to ensure that it is used only at input store outlets.

- However, the programmability feature of CBDC needs to be carefully examined in order to retain the essential features of a currency. It can also have other implications for monetary policy transmission as tokens may have an expiry date, by which they would need to be spent, thus ensuring consumption. Hence, statement 2 is correct.

- The programmability of tokens can be achieved using the following:

- Smart contracts: Business rules are stored as code that is executed during transactions to verify that the token is being used correctly.

- Token version: The version of the token can be tightly linked to the technical code class. The alternative is that the version is stored as a token data field.

Q13: In the context of finance, the term ‘beta’ refers to

(a) the process of simultaneous buying and selling of an asset from different platforms

(b) an investment strategy of a portfolio manager to balance risk versus reward

(c) a type of systemic risk that arises where perfect hedging is not possible

(d) a numeric value that measures the fluctuations of a stock to changes in the overall stock market.

View Answer

View Answer

Ans: (d)

- In the context of finance, the term ‘beta’ refers to a measure of how an individual asset moves (on average) when the overall stock market increases or decreases. It is used as a measure of risk and is an integral part of the Capital Asset Pricing Model (CAPM). A company with a higher beta has greater risk and also greater expected returns.

The beta coefficient can be interpreted as follows:- β =1 exactly as volatile as the market β >1 more volatile than the market

- β <1>0 less volatile than the market β =0 uncorrelated to the market

- β <0 negatively correlated to the market2

- The beta coefficient can be calculated by dividing the product of the covariance of the security’s returns and the market’s returns by the variance of the market’s returns over a specified period

- A type of systemic risk that arises where perfect hedging is not possible is called basis risk.

- An investment strategy of a portfolio manager to balance risk versus reward is called asset allocation.

- The process of simultaneous buying and selling of an asset from different platforms, exchanges or locations to cash in on the price difference is called arbitrage.

- A numeric value that measures the fluctuations of a stock to changes in the overall stock market is called beta. Hence, option (d) is correct.

Q14: Consider the following statements:

- The Self-Help Group (SHG) programme was originally initiated by the State Bank of India by providing microcredit to the financially deprived.

- In an SHG, all members of a group take responsibility for a loan that an individual member takes.

- The Regional Rural Banks and Scheduled Commercial Banks support SHGs.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

View Answer

View Answer

Ans: (b)

- Self-Help Group or in-short SHG is now a well-known concept. It is now almost two decade old. It is reported that the SHGs have a role in hastening country’s economic development. SHGs have now evolved as a movement. We can trace the origin of the concept of SHGs in Bangladesh (Dr. Mehmud Yunus). India has adopted the Bangladesh’s model in a modified form.

- In 1970, Ilaben Bhat, founder member of ‘SEWA’(Self Employed Women’s Association) in Ahmadabad, had developed a concept of ‘women and micro-finance’. The Annapurna Mahila Mandal’ in Maharashtra and ‘Working Women’s Forum’ in Tamilnadu and many National Bank for Agriculture and Rural Development (NABARD)- sponsored groups have followed the path laid down by ‘SEWA’.

- In 1991-92 NABARD started promoting self-help groups on a large scale. And it was the real take-off point for the ‘SHG movement’. In 1993, the Reserve Bank of India also allowed SHGs to open saving accounts in banks. Hence, statement 1 is not correct.

- Such groups work as a collective guarantee system formembers who propose to borrow from organised sources. The poor collect their savings and save it in banks. In return they receive easy access to loans with a small rate of interest to start their micro unit enterprise. Hence, statement 2 is correct.

|

108 videos|430 docs|128 tests

|

FAQs on UPSC Prelims Previous Year Questions 2023: Indian Economy - Indian Economy for UPSC CSE

| 1. What is the significance of the UPSC Prelims exam in the selection process for government jobs in India? |  |

| 2. How can one prepare for the Indian Economy section of the UPSC Prelims exam? |  |

| 3. What are the key areas to focus on while studying the Indian Economy for the UPSC Prelims exam? |  |

| 4. What are some important government schemes and policies related to the Indian Economy that candidates should be familiar with for the UPSC Prelims exam? |  |

| 5. How can candidates stay updated with the latest developments in the Indian Economy for the UPSC Prelims exam? |  |