Market Structure: Oligopoly | Economics Optional for UPSC PDF Download

| Table of contents |

|

| Oligopoly |

|

| Collusive and Non-Collusive Oligopoly |

|

| The Emergence of Oligopoly/Monopoly or Why Does Oligopoly/Monopoly Exist |

|

| Chamberlain’s Oligopoly Model |

|

Oligopoly

An oligopoly is a market situation with only a few large sellers. The oligopoly is derived from the Greek words “oligo,” which means few, and poly means “control” or “seller.” Thus, it is a market situation where a few large firms sell either homogenous or differentiated products with a high degree of interdependence among the sellers regarding their price and output policy.

A special case of oligopoly: Duopoly is a special case of oligopoly in which there are exactly two sellers selling almost the same (homogenous product).

Example: Pepsi and Coca-Cola in the soft drink market

Features

1. Few sellers and many buyers:

- Oligopoly is a market structure in which few firms dominate the industry: for example, in India, Maruti, Hyundai, and Tata produce a majority of small cars.

- Implication: Each firm commands a significant share of the market and thus can impact the market price of the product. Also, there exists severe competition among different firms, and every firm keeps a close watch on the activities of rival firms.

2. Homogenous or differentiated products:

- Firms in oligopolistic industries may produce either homogenous or differentiated products. If the firms produce a homogenous product like cement or steel or LPG or aluminum, the industry is called a pure or perfect oligopoly.

- If the firms produce differentiated products like automobiles, the industry is called a differentiated or imperfect oligopoly.

3. Mutual interdependence:

- A very important feature of oligopoly is the mutual interdependence of the firms. Mutual interdependence means that firms are significantly affected by each other’s price and output decisions.

- Since, in an oligopoly, a limited number of firms compete with each other, the sales of one firm depend upon that firm's price and the price charged by other firms.

Implication: It leads to a price war if one firm lowers the price, its own sales will increase, but the sales of other firms in the industry decrease. In such a situation, the other firms will, most likely, lower their prices, too. There are a large number of difficulties faced in price determination. The indeterminate demand curve is the major difficulty faced by each firm.

4. Advertisement:

- An oligopoly firm has to incur a lot of expenditure on advertisement.

- Given the high cross-elasticity of demand for production and price rigidity, the only way open to the oligopolist firm is to promote its sales by advertising its product. The expenditure on advertisement is aimed primarily at shifting the demand in favor of the advertised product.

5. Existence of price rigidity:

- The term price rigidity means that firms would not like to change their prices. It will stick to its price.

- If a firm tries to reduce the price, the rivals will also reduce their prices so that it will not be of any advantage to it.

- Likewise, if a firm tries to raise its price, other firms will not do so. As a result, the firm will lose its customers and incur losses. So there is price rigidity in an oligopolistic market.

6. Some barriers to entry:

- Usually, an oligopolistic firm is also characterized by barriers to entry in the industry.

- Some common barriers to entry are the economics of scale, the absolute cost advantage of old firms, patent rights, control over important inputs, preventive price, and prevailing excess capacity, etc.

- Such barriers prevent the entry of new firms.

7. Non-price competition:

- Oligopolistic firms generally don’t disturb the price of products, and they attract customers by giving free gifts, services, coupons, and other attractive schemes.

- Thus non-price competition refers to competing with other firms by offering free gifts, making favorable credit terms, etc without changing the prices of their own products.

Example: In India, both Coca-Cola and Pepsi sell at the same price. However, in order to increase sales and market share, each firm tries to resort to non-price competition:

(a) sponsoring different games and shows

(b) offering many schemes

(c) sponsoring school and college canteen

8. Indeterminate the firm’s demand curve:

- As there is high degree of interdependence between the firms, the firms demand curve is indeterminate under oligopoly.

- Price and output policy of one firm has significant impact on the rival firm’s price and output policy in the market. It is hard to estimate change in firm’s sales caused by a change in price.

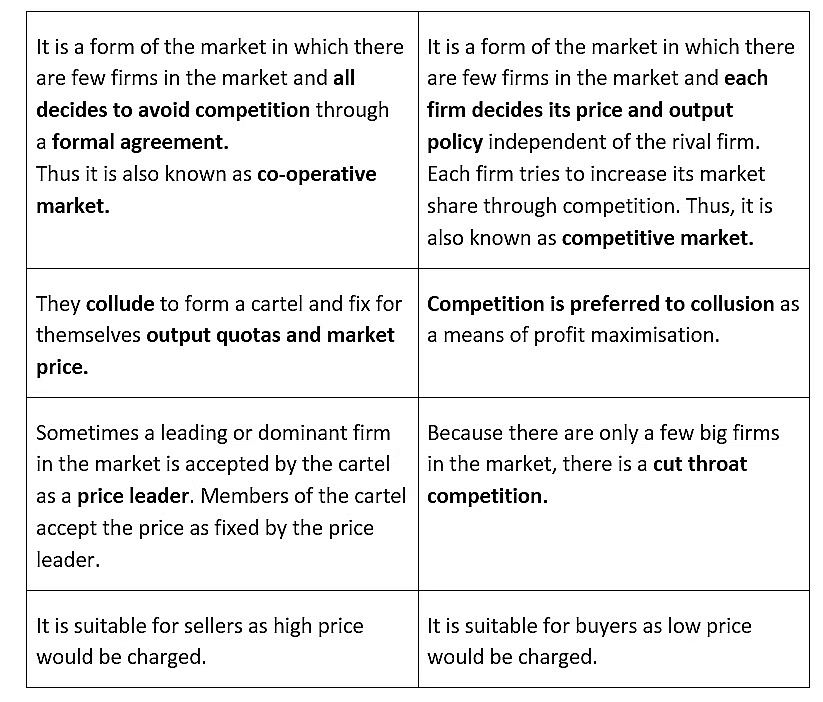

Collusive and Non-Collusive Oligopoly

The Emergence of Oligopoly/Monopoly or Why Does Oligopoly/Monopoly Exist

1. Innovations:

- Difficulty due to innovations limits the entry of a number of firms in an oligopoly. Oligopoly is often found in industries started by a major invention or innovation. The innovation may have enabled the innovating firms to establish and then maintain their dominance of the industry.

- Example: Companies making operating systems for computers and mobiles

2. Control of an essential resource:

- An oligopoly may result because a few firms have control of essential resources.

- Example: DeBeers company of South Africa controls about 80% of the world’s production of diamonds.

3. Successful differentiation:

- Some firms are able to establish their brands of differentiated products successfully. The successful differentiation can actually make entry more difficult.

- The new firms who want entry should have to spend a huge amount on the advertisement to compete with the established brands. Thus successful differentiation also leads to oligopoly.

4. Large fixed costs:

- If huge capital investment is necessary to operate a business, new firms will be discouraged from entering the industry. A new firm cannot enter or quit an industry because of the large fixed costs.

- Example: Operating railways involves huge expenditure on infrastructure.

5. Mergers:

- Many oligopolies were created by combining two or more previously independent firms. The combination of two or more firms into one firm is called a merger.

- The motives of mergers include

(a) increasing market power

(b) economics of scale

(c) market extension, and economies of wide scope.

6. Patents:

- A patent is an exclusive right granted by the government to use some productive technique or to produce a certain product.

- These are granted to the inventor of a technique or product as a reward for risk-taking and investment in r and d. It is a sort of legal right to a monopoly.

7. Government policy:

- The government may grant a license to a firm to have the exclusive privilege to produce a given good or service in a particular area. No firm can enter that area without a license provided by the government.

- These licenses are awarded in the case of public utilities like electricity, gas, telephones, and a variety of other situations.

8. Cartel:

- It is a business combination under which firms coordinate their output and price to reap the benefits of a monopoly. Thus a cartel is a group of firms that jointly sets the “ output and prices” of its product to exercise monopoly power.

- Example: In 1960, some oil-producing companies formed a cartel by the name of OPEC, which sets production quotas for member states and thereby tries to manipulate the prices of petroleum to derive the highest possible profit.

9. Anti-trust legislation:

- These refer to the laws that prevent big firms from forming trusts or cartels with a view to preventing them from acquiring monopoly control over the market.

- Example: MRTP 1969 Act of India. Now it is replaced by the Competition Act 2002.

Chamberlain’s Oligopoly Model

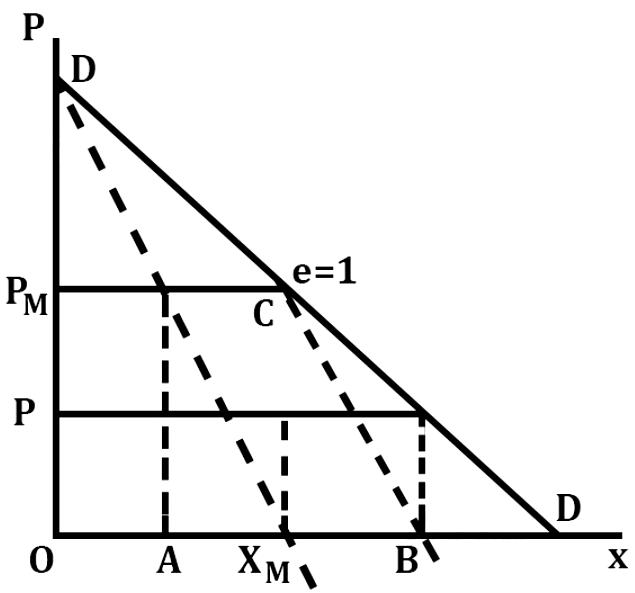

- Chamberlin said that if the firms do not recognize their interdependence, the industry will reach either of the Cournot’s equilibrium. He says that each form acts independently on the assumption that the rivals will either keep their output constant.

- The industry will reach the Bertrand equilibrium, trying to maximize its profit on the assumption that the other rivals will not change their price.

- However, he rejected the assumption of the independent actions by the competitors. He believes that firms are not as naive as assumed by Cournot and Bertrand.

- His model can be best understood in a duopoly market.

- It is vital to know that Chamberlin’s model of Oligopoly observed a kinked demand curve.

- Chamberlin’s model is a bit more advanced over the previous models. As it assumes that the firms are sophisticated enough to realize their interdependence. Also, further, it leads to a stable equilibrium, which is the monopoly solution. He model is also known as a ‘closed’ model.

- If the entry does occur it is uncertain that a stable monopoly solution will ever be reached. This will be unless there are special assumptions regarding the behavior of the old firms and the new entrants.

|

66 videos|222 docs|73 tests

|

FAQs on Market Structure: Oligopoly - Economics Optional for UPSC

| 1. What is an oligopoly? |  |

| 2. What is the difference between collusive and non-collusive oligopoly? |  |

| 3. Why does oligopoly or monopoly exist in markets? |  |

| 4. What is the duopoly model? |  |

| 5. How does oligopoly impact market competition? |  |