UPSC Exam > UPSC Notes > Economics Optional for UPSC > Capital Formation in Agriculture & Impact of Public Expenditure on Agriculture

Capital Formation in Agriculture & Impact of Public Expenditure on Agriculture | Economics Optional for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Give Broad Trends of Capital Formation? |

|

| How public expenditure impacts the agriculture? |

|

| What are the public expenditure instruments? |

|

| Policy suggestions |

|

Introduction

- Net addition to assets

- Examples of public sector capital formation would be investments in major and medium irrigation, power, roads, markets etc., whereas private capital formation would include minor irrigation, agricultural implements, machinery, tools, transportation etc.

- It helps in improving stock of tools, productivity of resources which leads to better utilisation of existing resources such as Land and Labour.

- That is why there is a direct correlation between Capital Formation, Agricultural Growth and Decline in Poverty

- Gulati and Bhalla – 10% decrease in public investment leads to 2.5% reduction in agriculture growth

Give Broad Trends of Capital Formation?

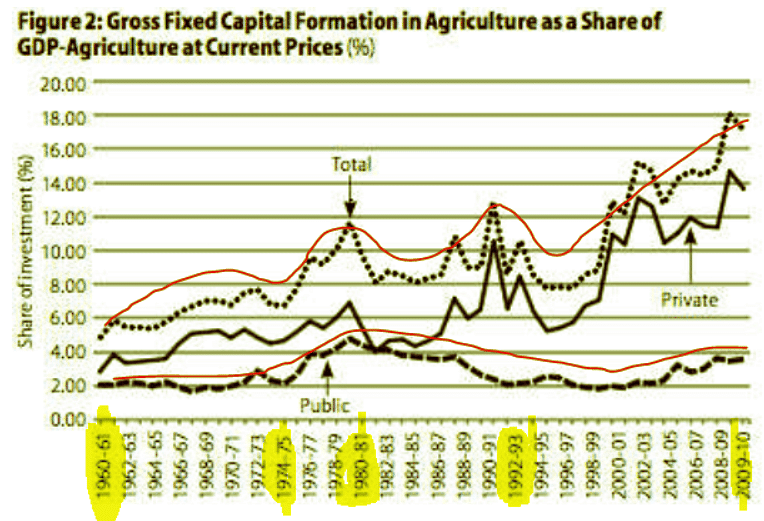

1960-1970

- In this period public investment in the agriculture was constant. Reasons was in first three plans more importance was given to capital goods industries. However after introduction of green revolution private capital formation started increasing. Overall capital formation was constant at 6-8%.

1970-1980

- In this period public capital formation increased from 2% to 4%. It also helped to crowd in private investment. In 1978 overall capital expenditure increased to 12%.

1980-1990

- In this period public investment saw a dip. By 1990 it again fall to 2%. As with public investment, private investment also experienced a dip in the early 1990s. In early 80s public private investment was almost equal.

- Both declined not only in terms of share in GDP but also in absolute terms during this period. Subsidy rise from 4% to 7%. It diverted funds. This led to a perceptible slowdown in agricultural growth in the 1996- 2006.

GCFA declined in 80s ( Public ). Should have led to lower growth in the early 90s. But it did not happen because

- Private Investment increased, increasing the total GCFA

- Food grain did decline, but Horticulture Production increased

- Higher per capita growth (4.5%) . Favourable export shock, etc

1990-2000

- In this period Public GCFA was stagnant. It was might be due to high expenditure on subsidies. During this period difference between private and public expenditure increased drastically. Now public investment forms only 16% share.

Reasons for higher Private Investment from the 80s

- ToT better due to higher MSP and Higher International Commodity Prices

- Growth of Institutional Credit – Savings > 20%

2000 onwards

- Projects like Bharat Nirman increased public capital expenditure. However due to slow agriculture growth private investment decreased.

How public expenditure impacts the agriculture?

- Operates after a time lag (Especially public investment like DAM, Road)

- Thus High GCFA in 70s led to a higher growth in the 80s

- Similarly, declining GCFA in 90s led to a lower growth in the 96-2006 period

- Some economists suggest that Private Investment and Public Investment are supplementary to each other and Private Investment can fill in the gap, as seen by the 80s Divergence. However, there does exist a strong degree of Complementarity

- Gulati – Public Investment has a strong Inducement on Private investment, but operates after a time lag due to the high Gestation Period of Public Investment

- Gulati and Bhalla – 10% decrease in public investment leads to 2.5% reduction in agriculture growth

- As Sawant (pneumonic – doosra Abhijeet) et al ( 2002) show that Private Investment can never fill the gap of Large scale public investment like in Dams , Rural Infrastructure due to capital constraints, etc

- Public Investment have large Externalities

- Complementarity may have disappeared in some states where Private Capacities have rise, but especially in rain fed areas

- Since, Private Investment is mostly on groundwater irrigation. It is necessary to undertake massive investment projects To reduce over exploitation of groundwater.

What are the public expenditure instruments?

- RIDF – Rural Infra Development Fund (1995)

- Issues (Rao & Jeorom)

- Is not a additional resource (unused PSL resources). Banks less interested in expansion of PSL (RIDF is safe place to park fund)

- NABARD

- Bharat Nirman – Rural Roads

- To connect al habitations with > 1000 population (500 in hills / tribal areas) with all weather roads.

- To create 10 mha additional irrigation potential.

- To construct 6 mm rural houses.

- To provide potable water to all habitations.

- To provide electricity to all villages.

- To connect all villages with telephone.

- PMGSY

- Irrigation

- According to RBI, the Positive monsoon shock less intense than negative monsoon shock

- 90% of GCFA in Irrigation. As a result the cropping intensity has gone up from 120 in 1971 to 140

- Thus Gross cropped area irrigated has increased from 15 % in 1950-51 to 45% – TRIPLED

- India’s existing storage capacity is 13% of the annual availability. Large number of projects are pending.

- Further groundwater is a major source of irrigation which has been over-exploited. Thus there is a need for institutional reforms, developing smaller irrigation projects and right incentive structures – Eg Feeder separation

- Swaminathan Committee – Launch Million Wells Recharge Program

- Research

- Agri R&D @ 0.3% of agri GDP against 2-3% in developed

- Advanced Marketing Commitment (AMC) (Like the Old Guarantee system )

- Suggested by Harvard economist Michael Kremer for health funding

- Since, private companies are unlikely to fund for health benefits with low returns especially in LDCs

- Install a mechanism where the 1st to develop a vaccine is awarded a large bounty

- Winner is rewarded with a very high return

- Yet, IP lies with the govt

- Extension services to take the research to the farmer

- ATMA: Agriculture Technology Management Agency, Responsible for technology dissemination at district leve

- Krishi Vigyan kendra

- M- Kisan

- Kisan Call Centre

- Credit

- Share of credit to agri GDP risen to 40% from 10% in 2000

- But, share of long term credit has fallen from 55% to 40% in the period

- South India makes up 18% of GCA but takes 40% of credit

- NSS 70th round, 40% farmers still depend on informal sources for lending

Question for Capital Formation in Agriculture & Impact of Public Expenditure on AgricultureTry yourself: How does public expenditure impact agriculture?View Solution

Policy suggestions

- Evidence shows that long-term public investment in capital projects will give rise to more than double the rate of return from subsidies.

- Gradual withdrawal of state subsidies for irrigation, water, electricity, fertilizers, pesticides etc. would provide a large pool of resources for public investments

- There are wide regional disparities in agricultural development; investments in backward states will have greater productivity enhancement effect

- To stimulate private GCF, alongside public GCF, there is an urgent need to prioritize institutional credit, favourable terms of trade, flow of technology, farmer education, and appropriately targeted subsidies, as these have a strong positive effect on household-level investments.

The document Capital Formation in Agriculture & Impact of Public Expenditure on Agriculture | Economics Optional for UPSC is a part of the UPSC Course Economics Optional for UPSC.

All you need of UPSC at this link: UPSC

|

66 videos|223 docs|73 tests

|

FAQs on Capital Formation in Agriculture & Impact of Public Expenditure on Agriculture - Economics Optional for UPSC

| 1. What are the broad trends of capital formation in agriculture? |  |

Ans. Capital formation in agriculture refers to the accumulation of physical and financial assets that contribute to increasing agricultural productivity and overall development in the sector. Some broad trends of capital formation in agriculture include:

- Increased investment in farm machinery and equipment: Farmers are investing in modern machinery and equipment such as tractors, harvesters, and irrigation systems to enhance their productivity and efficiency.

- Infrastructure development: Investments in agricultural infrastructure, such as irrigation facilities, roads, storage facilities, and market linkages, are crucial for improving the overall agricultural value chain and facilitating market access for farmers.

- Research and development: Capital formation in agriculture also involves investments in research and development activities aimed at improving crop varieties, soil health, and agricultural practices, leading to higher yields and better quality produce.

- Technological advancements: With the advent of digital technologies and precision agriculture, there is an increasing trend of capital formation in agriculture through investments in smart farming techniques, remote sensing, and data-driven decision-making tools.

- Access to credit: Availability of credit plays a vital role in capital formation in agriculture. Farmers need access to affordable credit to invest in capital assets such as land, machinery, and inputs, which can significantly enhance their productivity and income.

| 2. How does public expenditure impact agriculture? |  |

Ans. Public expenditure in agriculture refers to the government's spending on various programs, policies, and initiatives aimed at promoting agricultural development and supporting farmers. It has a significant impact on the agriculture sector in the following ways:

- Infrastructure development: Public expenditure in agriculture can be directed towards building and improving infrastructure such as irrigation systems, rural roads, storage facilities, and market linkages. This helps in reducing post-harvest losses, improving market access, and enhancing overall agricultural productivity.

- Research and development: Governments invest in agricultural research and development activities to develop improved crop varieties, promote sustainable farming practices, and enhance agricultural productivity. Public expenditure in this area leads to technological advancements and innovation in the sector.

- Subsidies and financial support: Public expenditure often includes providing subsidies and financial support to farmers, such as input subsidies, credit facilities, and insurance schemes. These measures help in reducing the financial burden on farmers and encourage them to adopt modern techniques and technologies.

- Skill development and capacity building: Governments can allocate public funds towards skill development and capacity-building programs for farmers. This helps in improving their knowledge and skills in agricultural practices, leading to increased productivity and income.

- Market interventions: Public expenditure can be used for implementing market interventions such as price stabilization mechanisms, procurement and distribution of agricultural produce, and market infrastructure development. These interventions ensure fair prices for farmers and stabilize market conditions.

| 3. What are the public expenditure instruments in agriculture? |  |

Ans. Public expenditure in agriculture can take various forms and utilize different instruments. Some common public expenditure instruments in agriculture include:

- Direct subsidies: Governments provide direct subsidies to farmers for agricultural inputs such as seeds, fertilizers, and irrigation equipment. These subsidies aim to reduce the cost of production and encourage farmers to adopt modern technologies and practices.

- Agricultural research and development: Governments allocate funds for research and development activities in agriculture, including the development of improved crop varieties, pest and disease management, and sustainable farming practices.

- Rural infrastructure development: Public funds are used for building and improving rural infrastructure, such as irrigation systems, rural roads, storage facilities, and market linkages. These investments help in enhancing agricultural productivity and market access.

- Credit facilities: Governments may provide subsidized credit facilities or loan guarantees to farmers to enable them to invest in agricultural inputs, machinery, and land. This helps in improving farmers' access to finance and promotes capital formation in agriculture.

- Insurance schemes: Public expenditure can be utilized for implementing crop insurance schemes, which provide financial protection to farmers against yield losses due to natural disasters, pests, or diseases. These schemes help in reducing farmers' risks and promoting investment in agriculture.

| 4. How does capital formation in agriculture impact rural development? |  |

Ans. Capital formation in agriculture has a significant impact on rural development in the following ways:

- Increased agricultural productivity: Capital formation in agriculture, such as investments in machinery, infrastructure, and research, leads to increased agricultural productivity. Higher productivity results in higher agricultural output, which can contribute to rural economic growth and development.

- Income generation: Capital formation in agriculture can lead to increased income generation for farmers. Investments in modern machinery, improved irrigation facilities, and high-yielding crop varieties can enhance farmers' productivity and profitability, ultimately improving their income levels.

- Employment generation: Capital formation in agriculture often requires the use of labor-intensive machinery and infrastructure development, leading to increased employment opportunities in rural areas. This can help in reducing rural unemployment and poverty levels.

- Market linkages: Investments in agricultural infrastructure, such as rural roads and storage facilities, improve market linkages for farmers. This enables them to access wider markets and obtain better prices for their produce, contributing to rural development.

- Technology transfer and knowledge dissemination: Capital formation in agriculture often involves the adoption of new technologies and practices. This leads to the transfer of knowledge and technical know-how to farmers, empowering them with improved farming techniques and enhancing their capacity for sustainable agricultural practices.

| 5. How can public expenditure in agriculture be optimized for maximum impact? |  |

Ans. To optimize the impact of public expenditure in agriculture, the following policy suggestions can be considered:

- Prioritize investments in rural infrastructure: Governments should prioritize investments in rural infrastructure, such as irrigation systems, rural roads, and storage facilities. This will help in reducing post-harvest losses, improving market access, and enhancing overall agricultural productivity.

- Increase investment in agricultural research and development: Governments should allocate sufficient funds for agricultural research and development activities. This will promote technological advancements, innovation, and the development of improved crop varieties and sustainable farming practices.

- Targeted subsidies and financial support: Public expenditure should be targeted towards providing subsidies and financial support to small and marginalized farmers who are most vulnerable to economic shocks. This will help in reducing income disparities and ensuring equitable distribution of benefits.

- Strengthen extension services: Governments should invest in strengthening agricultural extension services to facilitate the dissemination of knowledge, information, and best practices to farmers. This will enhance their capacity for adopting new technologies and practices.

- Promote public-private partnerships: Governments can encourage public-private partnerships in agriculture to leverage private sector expertise, investment, and resources. This can help in improving efficiency, promoting innovation, and attracting private investment in the sector.

These policy suggestions aim to optimize the utilization of public expenditure in agriculture and maximize its impact on agricultural development, rural livelihoods, and overall economic growth.

Related Searches