Ramesh Singh Summary: Burning Socioeconomic Issues | Indian Economy for UPSC CSE PDF Download

Introduction

In the tapestry of a nation's development, socioeconomic issues form critical threads that demand thoughtful consideration and effective solutions. This introduction delves into the burning socioeconomic issues that currently grip societies, addressing their multifaceted nature and far-reaching implications. From inequality and poverty to healthcare and education challenges, these issues resonate globally. The discourse aims to unravel the complexities surrounding these concerns and foster a deeper understanding of the efforts required for meaningful change.

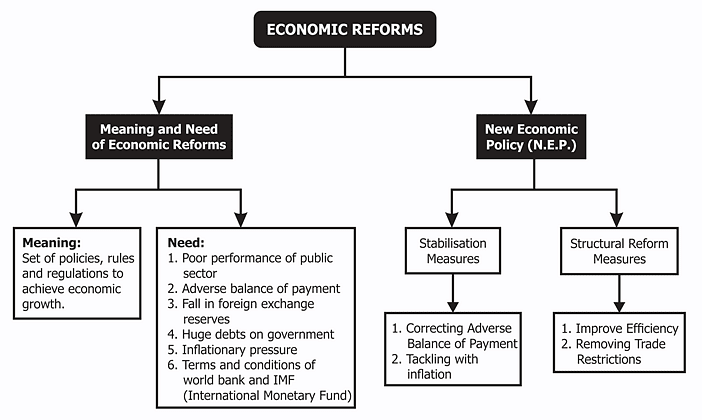

Process Reforms in India

Introduction

Regulation is a crucial governmental function, but the challenge lies in creating effective regulations in a world full of uncertainties. Over-regulation, as highlighted in the Economic Survey 2020-21, can render regulations ineffective. To enhance the ease of living, India urgently requires reforms in its regulatory framework.

Regulatory Framework of India

Contrary to popular belief, India's regulatory issues stem from the "effectiveness" of regulations rather than a lack of standards and poor compliance. Unnecessary regulations, characterized by undue delays, rent-seeking, and complex rules, lead to poor outcomes. International comparisons reveal that India fares well on regulatory standards and compliance but faces challenges in the quality and timeliness of regulation.

Causes and Remedies

Over-regulation arises from attempts to account for every possible outcome, resulting in complex and opaque laws. The solution lies in balancing discretionary powers with improved transparency and accountability. Recent initiatives, such as the e-Marketplace portal, exemplify the government's commitment to transparent decision-making.

Recent Initiatives

- Labour Law: The government has consolidated 29 central labor laws into 4 comprehensive codes: the Code on Wages, the Code on Social Security, the Occupational Safety, Health and Working Conditions Code, and the Industrial Relations Code. These codes have been passed by Parliament and notified, with implementation dates pending.

- Other Service Providers (OSPs): Regulations for OSPs, particularly in the Business Process Outsourcing (BPO) sector, have been liberalized to align with global practices. This includes the removal of several cumbersome requirements to enhance ease of doing business.

- Income Tax Law Reform: In February 2025, the government introduced a new bill in Parliament to replace the decades-old income tax law. This initiative aims to simplify tax regulations, reduce litigation, and make the law more accessible.

- High-Level Committee for Regulatory Reforms: The government has proposed the establishment of a High-Level Committee to review non-financial sector regulations, licenses, and permissions. This move is intended to streamline approvals, reduce compliance burdens, and expedite project execution.

- Securities and Exchange Board of India (SEBI) Measures: SEBI has implemented regulatory interventions to curb high-risk derivatives trading among retail investors. Actions include increasing the minimum contract size for derivatives and restricting weekly options contracts to enhance market stability and protect investors.

- Insurance Regulatory and Development Authority of India (IRDAI) Reforms: IRDAI has removed the requirement for prior approval of general insurance products and de-notified tariff wordings for various insurance categories. This allows insurers greater flexibility in product development and fosters innovation in the insurance sector.

Institutional Architecture

Steps have been taken to prune autonomous bodies for transparency and efficiency. The closure and merger of various organizations demonstrate a commitment to rationalizing institutional architecture.

Transparency of Rules

Enacting a law for the "transparency of rules" is proposed to eliminate information asymmetry and simplify citizens' understanding of regulations. This move aligns with the goal of achieving "minimum government and maximum governance."

Conclusion

Simplifying India's regulatory framework, coupled with effective implementation of process reforms, is essential. This approach not only ensures better outcomes for citizens but also promotes transparency, accountability, and the overarching principle of efficient governance.

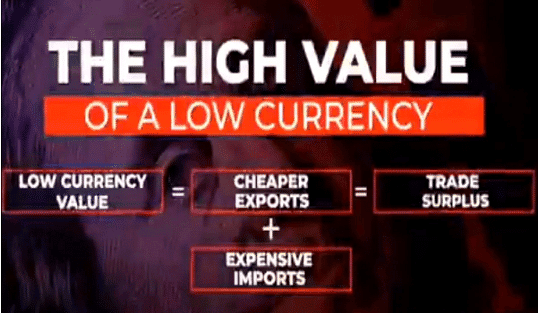

India as Currency Manipulator

Introduction

The sensitivity of world currency exchange rates has become more pronounced with the advent of globalization. Currency manipulation, particularly highlighted in the case of the United States, has been a significant issue, involving several countries, including India, over the past four years.

Currency Manipulation

Under currency manipulation, a country intentionally influences its currency for various advantages, including trade benefits, interest benefits, and enhanced forex flow. Although deemed unfair by UN economic institutions, economies engage in manipulation to gain competitive edges in global markets.

On Manipulators’ List

In December 2020, the United States included India in its list of countries with potentially "questionable foreign exchange policies" and currency manipulation. Criteria for inclusion involve a significant trade surplus, a material current account surplus, and persistent one-sided intervention. However, India's charge of currency manipulation is contested based on its increased payment costs for external debts.

India's Exchange Management

India transitioned from a fixed to a floating exchange rate system in 1993-94. The dual exchange system involves one rate announced by the RBI and another determined by market forces. Despite focusing on initiatives like Make in India and Atmanirbhar Bharat Abhiyan to boost exports and attract foreign investments, there is no indication of manipulation in India's exchange regime, as confirmed by international financial institutions.

Conclusion

The United States, in its recent trade stance, has shown protectionist tendencies and declared trade and currency wars. However, it has not substantiated claims of currency manipulation against China or India. Experts believe that the current US administration, under Joe Biden, is expected to take a more constructive role, potentially keeping India away from the currency manipulator watchlist.

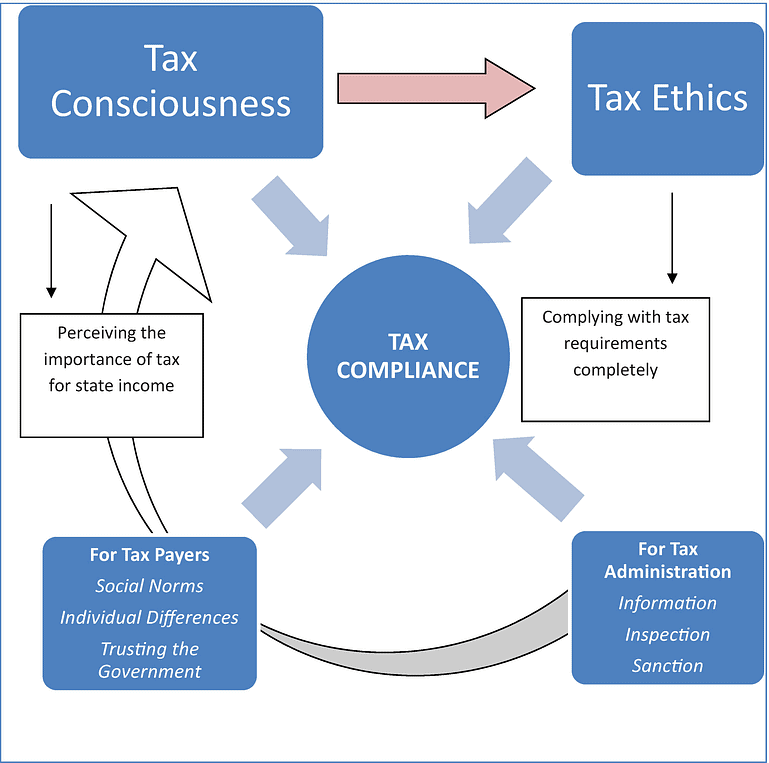

Taxpayers Services Enhance Trust in Tax System

Introduction

Modern economics defines tax as a means of income redistribution for the larger welfare goal. However, the traditional approach of giving "limited attention to tax services" as regulators and enforcers of tax laws persisted for decades. It wasn't until the late 1980s that a shift occurred towards recognizing the importance of providing better tax services to taxpayers, with the Washington Consensus and discussions for the World Trade Organization playing facilitative roles.

The Need for Better Tax Services

The worldwide recognition of taxpayers' rights gained momentum, starting with the United Kingdom in 1986, followed by initiatives in countries like the United States (1988), New Zealand (2002), and Canada (2007). Establishing an "independent institution" like the Ombudsman has proven beneficial in several countries, focusing on tax issues from the taxpayers' perspective and ensuring fair treatment by tax departments.

Case with India

In India, a formal "taxpayers' charter" was introduced in 2020-21, emphasizing the expected behavior from tax officials in the mission statement of the tax department. The taxpayers' charter comprises 14 commitments of the income tax department and six obligations of taxpayers. However, the experience with a tax Ombudsman in India was not successful. Despite instituting Ombudsmen for income tax (in 2003) and indirect taxes (in 2011), they were abolished in February 2019 due to their ineffectiveness. The Ombudsman lacked legal empowerment and operated merely in an advisory capacity.

Conclusion

Experts emphasize the need to revitalize the grievance redress system, taking a more holistic approach to enhance customer experience and protect taxpayers' rights. Establishing an independent institution, akin to the Ombudsman, with sufficient authority and independence is crucial for improving tax compliance and building trust in the tax system.

India's Self-Reliance VS. Multilateralism

Introduction

The COVID-19 pandemic exposed global supply chain vulnerabilities, leading India to reevaluate its reliance on it. The Atmanirbhar Bharat Abhiyan campaign aimed at self-reliance was perceived by some as a shift towards protectionism, challenging India's historical support for globalization and multilateralism.

Self-Reliance vs. Multilateralism

While India's recent emphasis on self-reliance appears contradictory to its stance on multilateralism, self-reliance has been a consistent objective in India's planning since independence. Global perceptions, fueled by recent trade disputes, suggest India may be turning protectionist. However, it's essential to interpret India's evolving stance in the context of changing global perspectives.

The Changing Global Economic Order

Post-Cold War, geopolitical and trade-related instabilities, including the 2008 recession and China's economic rise, have reshaped the global economic landscape. India, as an emerging economic power, must adapt its approach to multilateralism and position itself favorably in this evolving order.

India's Strategic Moves

India's self-reliance campaign aims to address trade deficits with China and attract multinational companies relocating from China. It complements initiatives like 'Make in India,' 'Assemble in India,' and remains open to foreign investment while protecting domestic interests. India is strategically navigating unemployment, demographic challenges, and surplus agricultural production.

Commitment to Multilateralism

India remains committed to multilateralism despite recent emphasis on self-reliance. Actively engaged in free trade negotiations, India supports global cooperation and continues its involvement in the WTO, advocating for global economic collaboration.

Conclusion

India's pursuit of self-reliance aligns with protecting its socio-economic interests in the evolving global economic order. It smartly integrates domestic interests with global funds, emphasizing a nuanced approach rather than being antagonistic to globalization or multilateralism.

Resolving the Menace of Bad Loans

Introduction

The surge in bad loans, particularly in public sector banks (PSBs), has significantly impacted investment prospects in India. PSBs, being major lenders to the infrastructure sector, have seen a decline in the pace of infrastructure expansion. Recent estimates from RBI (as of March 2024) indicate that 94% of loans from PSBs are non-performing, with stressed assets at 9.96%. In addressing this crisis, the RBI introduced various schemes, but their effectiveness was limited. The government then implemented the Insolvency and Bankruptcy Code (IBC) in 2016 and proposed the establishment of a bad bank for bad loan resolution.

The Concept

Bad banks function on a straightforward concept—banks categorize their loans into good and bad. The bad bank takes over or purchases the bad loans, while the good loans remain with the original bank. This separation prevents bad loans from affecting the bank's healthy assets. The implementation, however, involves organizational and financial complexities. The RBI supports the idea of a bad bank but emphasizes the importance of designing it properly. Different models exist for creating a bad bank, and India needs to choose a model that suits its needs. The Economic Survey 2016-17 recommended the creation of a public sector rehabilitation agency (PARA), falling under this category.

Government Initiatives

In the Union Budget 2021-22, the government announced the establishment of NARCL (National Asset Reconstruction Company Ltd.) in September 2021, with 51% ownership by the Government of India. NARCL aims to take over the bad assets of banks. Additionally, IDRCL (Infrastructure Debt Resolution Company Limited) has been set up, with 51% ownership by the private sector, to manage the assets it undertakes. IDRCL will function as a service and operational body, engaging market professionals and turnaround experts.

Conclusion

While experts anticipate potential success in addressing NPAs through NARCL and IDRCL, concerns exist about the high costs, as Asset Reconstruction Companies (ARCs) may demand significant discounts for bad assets. Similar to the insolvency and bankruptcy law, where high haircuts were observed, the success of these initiatives in resolving bad loans remains to be seen.

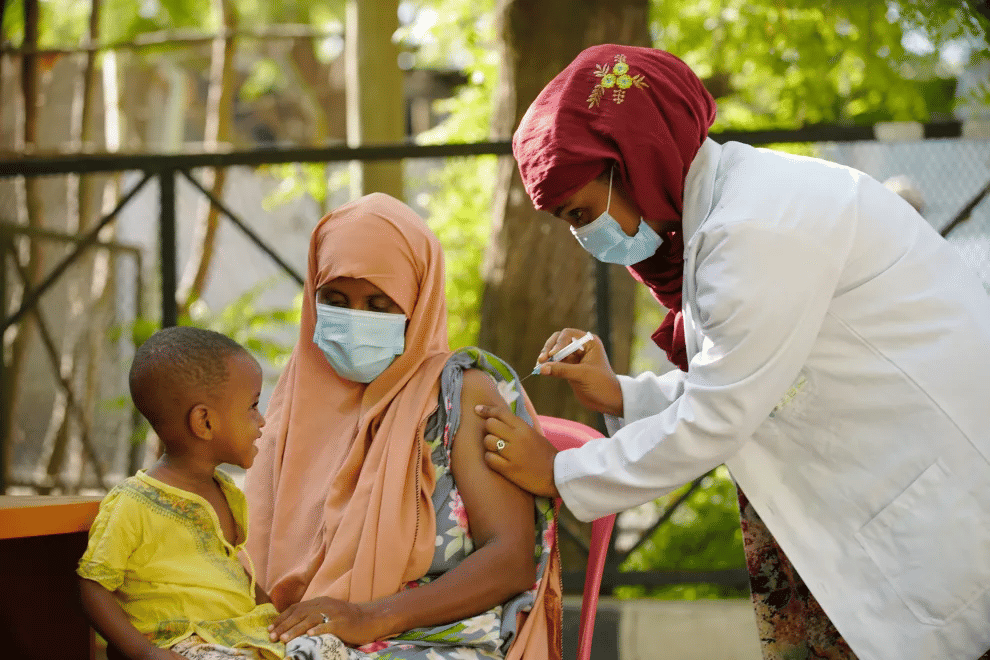

Preparing Health Care for the Future

Introduction

The ongoing COVID-19 pandemic has underscored the significance of the healthcare sector and its connections with other critical segments of the economy. It highlights how a healthcare crisis can transform into an economic and social crisis. Mahatma Gandhi's quote, "It is health that is real wealth and not pieces of gold and silver," holds wisdom applicable to the world's current situation.

Lessons from the Hard Times

The pandemic has left countries like India in a state of complete uncertainty. Despite facing challenges due to one of the highest investments in healthcare, the available health infrastructure provided some hope. India, too, grappled with this dilemma, showcasing resilience in its healthcare system during these difficult times. However, it is crucial not to overlook these lessons once the pandemic subsides.

The pandemic highlighted the role of technology-enabled platforms as an alternative channel for remote healthcare services. These platforms offer a promising avenue to address India’s last-mile healthcare access challenges. With digitization and the potential of artificial intelligence, there has been a significant increase in the utilization of telemedicine for primary care and mental health.

Telemedicine relies heavily on internet connectivity and health infrastructure. Therefore, both central and state governments should invest in telemedicine on a mission mode to complement the digital health mission, ensuring broader access to the masses. The National Health Mission (NHM) has played a critical role in reducing healthcare inequity, and its emphasis should continue in conjunction with Ayushman Bharat.

Outline for the Future

A country like India must carefully prioritize its policy focus and resource deployment not only to combat the current pandemic but also to prepare for future health crises. The following areas require attention:

- Financial Impact: India has one of the highest levels of out-of-pocket expenditures (OOPEs) globally (65%). Increasing public expenditure on health, even marginally, can significantly reduce catastrophic expenditures and poverty.

- Information Asymmetry: As a significant portion of healthcare is provided by the private sector, policymakers need to address information asymmetry, which affects market dynamics. The National Digital Health Mission, supported by artificial intelligence and machine learning, can help mitigate this asymmetry.

- Insurance Infrastructure: Limited visibility into patients’ medical records and the absence of standardized treatment protocols pose risks for insurance companies. Mitigating information asymmetry can lead to lower premiums, better product offerings, and increased insurance penetration.

- Regulator: Establishing a sectoral regulator for the healthcare sector is crucial for effective regulation and supervision, impacting the quantity, quality, safety, and distribution of services.

Conclusion: Recognizing the vital role of the healthcare system in achieving sustainable development goals, India must take steps to enhance both accessibility and affordability of healthcare.

Reforming India's Public Debt Management

Introduction

Modern economies heavily rely on loans to meet various needs, leading to increased government dependence on loans post-war. One such category is public debt, encompassing all debts created by the Government of India, leaving a profound impact on the economy. Scrutinizing aspects like interest rates and the independence of the managing body becomes crucial for experts and policymakers.

The Case with India

The debate on public debt management began when the Union Budget 2015-16 proposed establishing a public debt management agency, suggesting a shift from the RBI's responsibility. The key points of contention include the degree of independence such an agency would have and the related arrangements. In 2019-20, the NITI Aayog emphasized the idea of an independent debt management agency outside the RBI's purview.

Experts find strong logic in this proposal, considering the conflicting roles played by the RBI, such as managing public debt, overseeing government market borrowings, announcing monetary policy, and participating in open market operations. These roles create a clear conflict of interest, impacting India's financial market and overall economic development. Practical problems include a lack of alignment between India's domestic and external bond markets due to conflicting interest rates set by the RBI.

Conclusion

Most experts believe that separating the debt management office from the RBI will allow the government to focus more on debt aspects, adapting to changing fund needs over time and reducing the cost of funds. Despite potential reluctance from the RBI, such a step is expected, given the emphasis on self-reliance and aspirations to position India favorably in the global economic scenario.

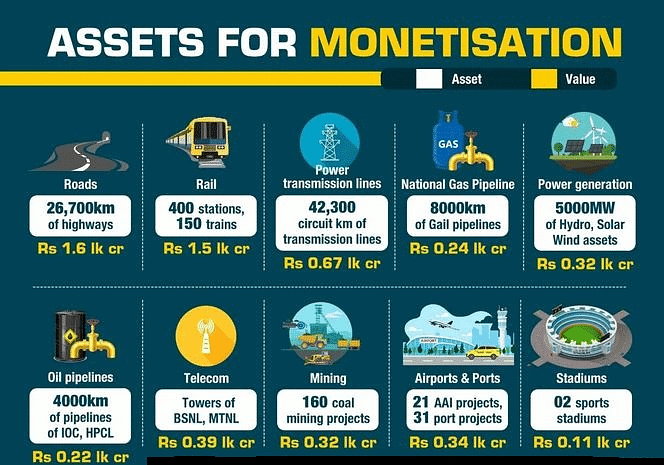

Monetisation of Public Assets - The Significance

Introduction

Public assets, referring to assets owned by governments (central, states, and local bodies) resulting from their capital expenditures, include central public sector enterprises (CPSEs) and public sector undertakings (PSUs) owned by the Central Government of India. With economic reforms initiated in the early 1990s, the government has taken steps to enhance their efficiency and profitability, with one recent significant step being the monetisation of these assets.

Comprehensive Management

The government's approach towards public assets shifted in 2016 when the mandate of the Department of Disinvestment (DoD) changed to the 'comprehensive management of the Government's investment in public assets' (CMPA). This involved achieving optimum return and accelerating growth, leveraging assets through capital and financial restructuring, improving investor confidence through capital market exposure, and rationalising decision-making processes for efficient management. The department was renamed the Department of Investment and Public Asset Management (DIPAM).

Asset Monetisation

One action under CMPA is the monetisation of assets, where the government hands over existing national highways to private bidders on a toll-operate-transfer (TOT) basis. This model, designed to create opportunities for private sector investment in low-risk assets, allows private players to operate, maintain, and collect tolls on road stretches during the concession period.

The Significance

The policy of monetising public assets is significant, impacting economic reforms and development by providing a level playing field, boosting economic viability of roads, attracting foreign investment, and attempting to operate public assets on a business line. This move is seen as a rebalancing act to optimize economic and social outcomes for the country.

Conclusion

The monetisation of public assets may appear as the government engaging in business activities. However, this is not entirely accurate because not all public assets can be operated for profit, and the government cannot afford to abandon its role in promoting welfare. Instead, this should be viewed as a strategic rebalancing by the government to optimize economic and social outcomes for the country.

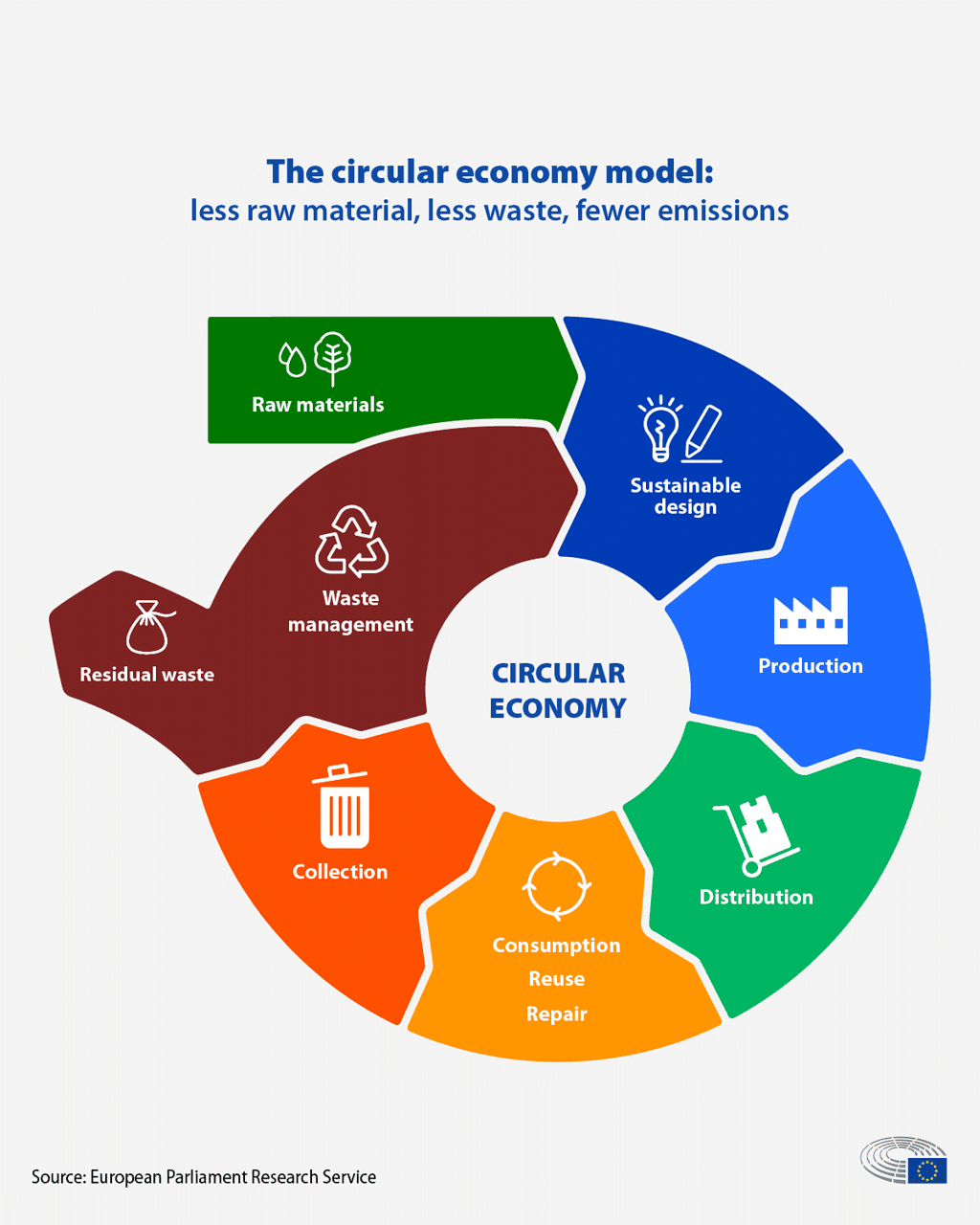

The Circularity of Economy

Introduction

Recently, India's policy think tank, Niti Aayog, in its 2019-20 proposal, advocated for the adoption of the circular economy concept. This approach underscores the importance of sustainable development and resource circularity, aiming to reuse waste within the production cycle rather than allowing materials with embedded resources to go to waste.

Niti Aayog projects that by 2050, the global population will reach 9.7 billion, with 3 billion people attaining middle-class consumption levels. This scenario is expected to demand 71% more resources per capita, leading to a surge in total material demand from 50 billion to 130 billion tons by 2030.

The Hypothesis

The concept of the circular economy originates from the idea of a "steady-state economy," rooted in ecological economics. This approach advocates for using materials and energy in a way that maintains a constant state. While the circular economy has multiple definitions emphasizing different aspects, it generally focuses on resource use and system change. The 3-R approach is commonly employed: Reduce (minimize raw material use), Reuse (maximize product and component reuse), and Recycle (high-quality reuse of raw materials).

In a circular economy, the goal is to emulate an ecosystem, where nothing is considered waste. Every residual item can be repurposed into a new product, ensuring that toxic substances are eliminated. This approach goes beyond mere recycling, also prioritizing quality assurance and product longevity, such as producers reclaiming and repairing their products for extended use.

Vis-a-Vis the Traditional Approach

The circular economy concept stands in contrast to the 'linear' or growth economy. While its roots trace back to 1960s environmentalism, it evolved under the influence of ecology and cybernetics. The concept challenges the post-war policies that promoted reconstruction and widespread social and economic democratization in the West, marked by the expansion of mass consumption. Circular economy thinking highlights the role of the counterculture of the 1960s in shaping a popular reaction against the growth-based agenda, influencing subsequent environmentalism and contributing to the understanding of the environmental crisis.

Conclusion

To meet the material needs of humanity sustainably, the circular economy concept promotes the responsible use of resources and a shift away from the traditional linear economic model. Embracing circularity aims to address the challenges posed by increasing global population and resource demands.

Fulfillng the Minimum Needs of Citizens

Introduction

In light of widespread poverty, governments have consistently prioritized meeting the 'minimum needs' (essential goods and services) of citizens. Accessibility to these needs, such as housing, water, sanitation, electricity, and clean cooking fuel, is considered crucial for measuring economic development in academic and policymaking circles.

Basic Needs Approach to Development

Renowned economists globally have framed development in terms of 'basic needs,' focusing on minimum quantities of necessities like food, clothing, shelter, water, and sanitation. Poverty, in this context, is defined as a failure to attain certain minimum basic needs or capacities. Drawing inspiration from this approach, the Government introduced a Bare Necessities Index (BNI) in 2020-21 to gauge achievements in this area.

Progress in Provision of Minimum Needs

The BNI utilizes data from two National Statistical Office (NSO) rounds to analyze drinking water, sanitation, hygiene, and housing conditions in India. The index, comparing 2012 and 2018, indicates improved access across all states in 2018, with disparities decreasing. Notably, improvements were more significant for the poorest households, contributing to enhanced equity.

Access to these necessities, jointly consumed by all household members, has shown improvements, positively impacting health and education. Ongoing government schemes, including Swachh Bharat Mission, National Rural Drinking Water Programme, Pradhan Mantri Awaas Yojana, Saubhagya, and Ujjwala Yojana, equipped with modern features, have demonstrated enhanced efficiency and governance.

Deepening of the Idea

The government should prioritize and target populations in need of minimum necessities, ensuring convergence in scheme implementation at various levels. For urban areas, where local self-governments provide civic amenities, there is a call for coordinated efforts. Developing a dedicated district-level index with suitable indicators and methodology can assess progress in enabling access to these necessities at the local level.

Conclusion

Emphasizing the accessibility of minimum needs not only enhances the well-being of the masses but also aligns with the broader goal of inclusive growth. Experts believe that a focused approach and leveraging existing schemes will help India achieve Sustainable Development Goals (SDGs) related to poverty reduction and improved access to water, sanitation, and housing by 2030.

Regulating Crypto Ecosystem

Introduction

In recent years, cryptocurrencies have gained global prominence, attracting investors and media attention. Despite reservations from financial regulators worldwide, the collapse of FTX crypto exchange in November 2022 and subsequent market sell-offs highlighted vulnerabilities in the crypto ecosystem, underscoring the urgent need for global regulation of crypto assets.

Crypto assets, primarily cryptocurrencies, represent new digital forms based on cryptographic techniques like blockchain. These assets, lacking intrinsic cashflows, exhibit high volatility, with total valuations swinging drastically. The Economic Survey 2022-23 reports a shift from almost US$ 3 trillion in November 2021 to less than US$ 1 trillion in January 2023.

Need of Regulation

The volatile crypto asset ecosystem raises concerns about fragile backing, governance, and non-transparency, prompting the need for regulation. The international community, recognizing the geographically pervasive nature of crypto assets, is discussing a globally coordinated approach for regulation through forums like OECD and G20.

Regulatory Challenges

Regulating cryptocurrencies poses challenges, with difficulties in monitoring and addressing emerging issues. The promise of decentralization in crypto assets has given rise to unregulated intermediaries, such as exchanges and wallet providers, requiring a shift in regulatory focus. Regulatory gaps persist in addressing risks associated with crypto assets, demanding a coordinated international effort.

Global Efforts of Regulation

Countries worldwide are actively working on regulatory frameworks for crypto assets:

- In the USA, regulators have disqualified Bitcoin, Ether, and other crypto assets as securities.

- The European Union proposes onshoring, notification, and licensing regimes for crypto assets in its digital finance strategy.

- Japan's financial services agency (JFSA) introduced legislation in April 2017, focusing on client asset segregation and operational risk management.

- Switzerland's Financial Market Supervisory Authority (FINMA) issued guidelines categorizing tokens and clarifying their status as securities.

- The UK Treasury outlined a roadmap for crypto asset regulation, emphasizing stablecoins and proposing a sandbox regime for blockchain-based Financial Market Infrastructures (FMIs).

- The Monetary Authority of Singapore published guidelines on crypto asset marketing, limiting promotions to official social media accounts and mobile applications.

Conclusion

Despite global efforts, creating foolproof policy provisions for crypto asset regulation remains challenging. The diverse challenges and concerns associated with crypto assets make devising a uniform regulatory framework difficult. Additionally, global cooperation and coordination are essential due to the cross-border nature of these assets.

Recent Developments

1. Process Reforms: The High-Level Committee for regulatory reforms, proposed in 2024, has initiated reviews of non-financial sector regulations, with recommendations expected by mid-2025. The Government e-Marketplace (GeM) portal recorded transactions worth over ₹4 lakh crore in FY 2024-25, boosting procurement transparency.

2. Currency Manipulation: In late 2023, India was removed from the U.S. currency manipulator watchlist, reflecting improved trade relations. The Reserve Bank of India (RBI) continues to manage a floating exchange rate, ensuring stability without manipulation.

3. Taxpayers Services: The taxpayers’ charter has been embedded in the new income tax bill introduced in February 2025. Digital grievance redressal platforms have improved, and discussions for a legally empowered Ombudsman-like body are underway.

4. Self-Reliance vs. Multilateralism: India signed free trade agreements with the UK and Oman in 2024, reinforcing multilateralism. The Atmanirbhar Bharat campaign now focuses on export-led growth, with PLI schemes attracting ₹1.5 lakh crore in investments.

5. Bad Loans: NARCL acquired ₹2 lakh crore in bad assets by March 2025, though resolution remains slow due to high haircuts. Amendments to the Insolvency and Bankruptcy Code (IBC) in 2024 aim to expedite corporate insolvency.

6. Healthcare Preparedness: The National Digital Health Mission (NDHM) has issued 50 crore unique health IDs by April 2025. Telemedicine accounts for 30% of urban primary care consultations, supported by expanded internet infrastructure.

7. Public Debt Management: The Public Debt Management Agency (PDMA) proposal is progressing, with a draft framework expected by late 2025. This aims to separate debt management from the RBI’s monetary policy roles.

8. Public Asset Monetization: The National Monetisation Pipeline (NMP) achieved ₹2.5 lakh crore in monetization by March 2025, primarily in roads and railways. New toll-operate-transfer (TOT) bids were launched in April 2025.

9. Circular Economy: Niti Aayog initiated pilot projects in 2024 for circular economy practices in electronics and textiles, targeting a 20% waste reduction by 2030, aligning with sustainable development goals.

10. Minimum Needs: The Bare Necessities Index (BNI) 2024 reports 90% household access to drinking water and 85% to sanitation, driven by Swachh Bharat and Jal Jeevan Mission. Urban schemes are being scaled up.

11. Crypto Regulation: India implemented a 1% TDS on crypto transactions in 2024. A comprehensive crypto law is under discussion, aligned with G20 recommendations for global coordination.

|

108 videos|425 docs|128 tests

|

FAQs on Ramesh Singh Summary: Burning Socioeconomic Issues - Indian Economy for UPSC CSE

| 1. What are the key process reforms in India aimed at improving governance and economic efficiency? |  |

| 2. How does India’s classification as a currency manipulator affect its trade relations? |  |

| 3. Why is enhancing taxpayer services important for building trust in the tax system? |  |

| 4. What are the implications of India's emphasis on self-reliance compared to multilateralism? |  |

| 5. What measures are being taken to resolve the issue of bad loans in India? |  |