Preparation and Presentation of Company Final Accounts | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| What is a Profit and Loss Statement (P&L)? |

|

| Definition of Balance Sheet |

|

| Examples |

|

Introduction

Final accounts provide insights into the profitability and financial standing of a business for its management, owners, and other concerned parties. Initially, all business transactions are recorded in a journal, followed by their transfer to a ledger and subsequent balancing. These conclusive summaries are created for specific periods, representing the concluding step in the accounting cycle. The preparation of final accounts is crucial for determining the financial status of the business, necessitating the creation of a trading account, a profit and loss account, and a balance sheet. The term "final accounts" encompasses the trading account, profit and loss account, and balance sheet.

Legal Provisions

Sections 209 to 220 of the Indian Companies Act 2013 deal with legal provisions relating to preparation and presentation of final accounts by companies. Section 210 deals with preparation of final accounts by companies, while section 211 deals with the form and contents of the balance sheet and the profit and loss account.

Trading Account

A trading account shows the results of the buying and selling of goods. This sheet is prepared to demonstrate the difference between selling price and cost price. The trading account is prepared to show the trading results of the business, e.g. gross profit earned or gross loss sustained by the business. It records the direct expenses of a business firm. According to J.R.Batlibboi- "The Trading Account shows the result of buying and selling goods. In preparing this account, the general establishment charges are ignored and only the transactions in goods are included."

What is a Profit and Loss Statement (P&L)?

- The Profit and Loss (P&L) statement is a financial document that summarizes the revenues, costs, and expenses incurred during a specific period, typically a fiscal quarter or year.

- Synonymous with the income statement, the P&L statement offers insights into a company's ability to generate profit through revenue growth, cost reduction, or a combination of both.

- Also known as the statement of profit and loss, income statement, statement of operations, statement of financial results, income statement, earnings statement, or expense statement.

- P&L management involves how a company navigates its P&L statement by effectively managing revenue and costs.

- Issued quarterly and annually, the P&L statement is one of the three key financial statements, alongside the balance sheet and cash flow statement.

- It is crucial to analyze P&L statements across different accounting periods, as changes in revenues, operating costs, research and development (R&D) spending, and net earnings over time offer more meaningful insights than the absolute numbers themselves.

- When combined with the balance sheet and cash flow statement, the P&L statement provides a comprehensive understanding of a company's financial performance.

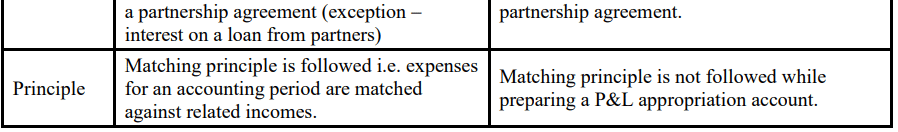

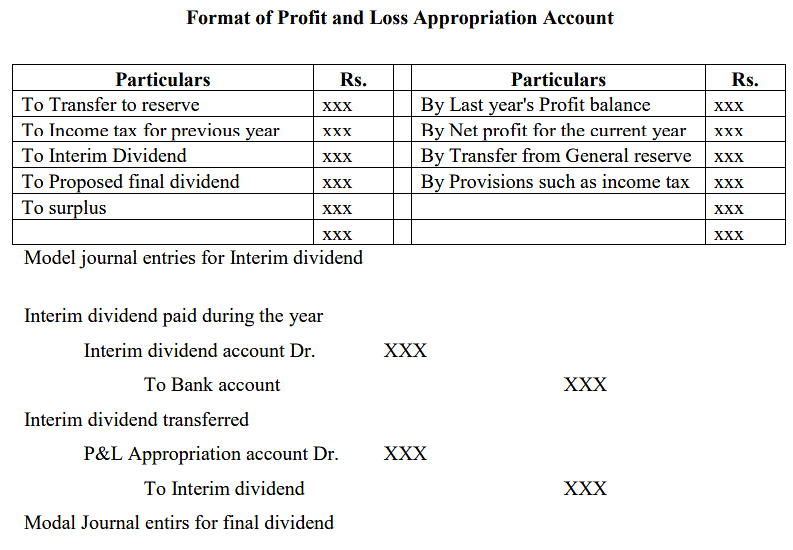

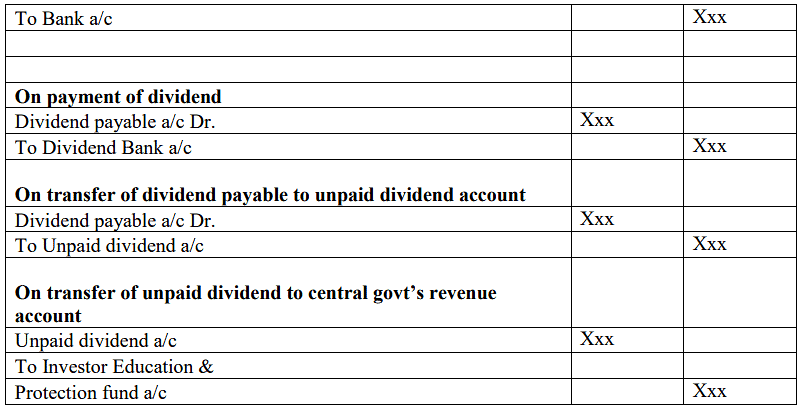

On recommending payment of dividend to shareholders:

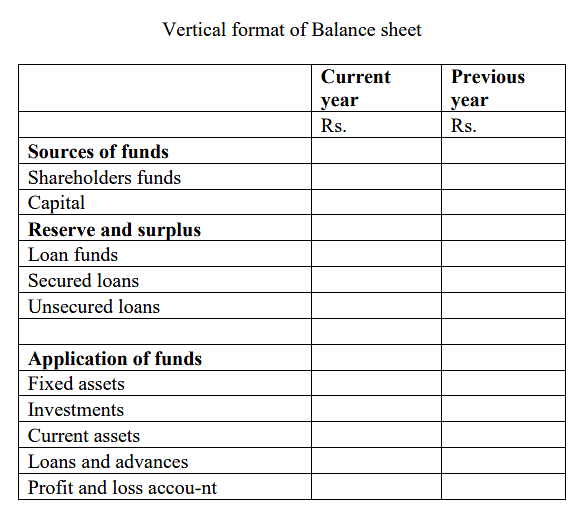

Definition of Balance Sheet

- The balance sheet serves the purpose of presenting an organization's financial position at the conclusion of an accounting period, typically as of midnight on March 31.

- It provides a comprehensive overview of a corporation's financial status, encompassing:

- Assets: Resources obtained in previous transactions.

- Liabilities: Obligations and customer deposits.

- Stockholders' equity: The difference between assets and liabilities.

- The balance sheet can be interpreted as a report detailing both the assets and the claims against those assets, represented by liabilities and stockholders' equity.

- Another perspective is viewing it as a report on a corporation's assets and the funding sources, distinguishing between amounts provided by creditors (liabilities) and owners (stockholders' equity).

- A classified balance sheet segregates current assets from long-term assets and current liabilities from long-term liabilities, facilitating the calculation of working capital and the current ratio.

- Despite its utility, the balance sheet has limitations, such as reporting property, plant, and equipment at cost minus accumulated depreciation, excluding any increase in fair value. Additionally, intangible assets like brand names and trademarks may hold substantial value but are not reported unless acquired in a transaction.

- To gain a comprehensive understanding, the balance sheet should be analyzed in conjunction with other financial statements (income statement, statement of comprehensive income, statement of cash flows, and statement of changes in stockholders' equity), along with the accompanying notes to the financial statements.

Points to remembered while preparing Balance sheet

- Calls in Arrears:

- Definition: It denotes the outstanding amount unpaid by shareholders on the calls made by the company.

- Treatment: Typically found in the trial balance, it is subtracted from the called-up capital on the liabilities side of the balance sheet to determine paid-up capital. If only paid-up capital is in the trial balance and calls in arrears are provided separately, the amount is first added to show called-up capital and then deducted to display paid-up capital in the outer column.

- Unclaimed Dividend:

- Definition: Refers to dividends not collected by shareholders from the company.

- Presentation: Appears on the credit side of the trial balance and is reflected on the liabilities side of the balance sheet under "Current Liabilities."

- Forfeited Shares Account:

- Description: Appears as a credit item in the trial balance and is displayed on the liabilities side of the balance sheet by incorporating it into the paid-up capital.

- Securities Premium Account:

- Placement: Shown on the liabilities side of the balance sheet categorized under "Reserves and Surplus."

- Profit & Loss Account:

- Purpose: Provides insights into an enterprise's income and expenses, leading to net profit or loss.

- Evaluation: Assists in evaluating enterprise performance, forming a basis for future forecasts, and furnishing essential information for loan sanctioning by banks.

- Description: Describes various business activities such as revenues and expenses, offering valuable insights for assessing the risk of not achieving specific income levels in the future.

Assets

- Cash and Cash Equivalents:

- Definition: The most liquid assets, including Treasury bills, short-term certificates of deposit, and hard currency.

- Liquidity Order: Listed at the top of current assets.

- Marketable Securities:

- Description: Equity and debt securities with a liquid market.

- Liquidity Order: Follows cash and cash equivalents.

- Accounts Receivable:

- Meaning: Money owed by customers to the company, possibly accounting for doubtful accounts.

- Liquidity Order: Listed after marketable securities.

- Inventory:

- Definition: Goods available for sale, valued at the lower of cost or market price.

- Liquidity Order: Positioned after accounts receivable.

- Prepaid Expenses:

- Explanation: Represents already paid-for values like insurance, advertising contracts, or rent.

- Liquidity Order: Appears in current assets.

Long-Term Assets

- Long-Term Investments:

- Description: Securities not liquidated within the next year.

- Examples: Fixed assets, land, machinery, equipment, and capital-intensive assets.

- Fixed Assets:

- Meaning: Includes land, machinery, equipment, buildings, and durable, capital-intensive assets.

- Intangible Assets:

- Definition: Non-physical but valuable assets like intellectual property and goodwill.

- Note: Only listed if acquired, not developed in-house.

Liabilities

- Current Liabilities:

- Explanation: Money owed within one year, ordered by due date.

- Examples: Current portion of long-term debt, bank indebtedness, interest payable, rent, tax, utilities, wages payable, customer prepayments, dividends payable, earned and unearned premiums.

- Long-Term Liabilities:

- Description: Debts due after one year.

- Examples: Long-term debt (interest and principal on bonds issued), pension fund liability, deferred tax liability.

- Off-Balance Sheet Liabilities:

- Explanation: Liabilities not appearing on the balance sheet.

Shareholders' Equity

- Definition:

- Represents the money belonging to a business' owners, i.e., shareholders.

- Also referred to as "net assets," calculated as total assets minus liabilities.

- Retained Earnings:

- Explanation: Net earnings reinvested in the business or used to pay off debt.

- Distribution: The remaining amount is given to shareholders as dividends.

- Treasury Stock:

- Description: Stock repurchased or never issued, held for potential future sale or to prevent a hostile takeover.

- Preferred Stock:

- Meaning: Separate from common stock, with an assigned par value.

- Calculation: "Common stock" and "preferred stock" accounts determined by multiplying par value by the number of shares issued.

- Additional Paid-In Capital (APIC) or Capital Surplus:

- Definition: Amount invested by shareholders beyond the par value of common or preferred stock.

- Relationship to Market Capitalization: Not directly linked; market capitalization relies on stock's current price, while paid-in capital is the sum of equity bought at any price.

Limitations of Balance Sheets

- Snapshot Nature:

- Issue: Represents a single moment, limiting its ability to show changes over periods.

- Implication: Financial ratios often combine balance sheet data with dynamic statements for a comprehensive view.

- Static View:

- Concern: Lack of dynamism in a static balance sheet.

- Mitigation: Analytical tools draw from income statements and cash flow statements for a more dynamic understanding.

- Variability in Accounting Practices:

- Challenge: Different accounting systems and treatments of depreciation and inventories.

- Impact: Can be manipulated by managers, requiring scrutiny of footnotes for insights and identification of potential red flags.

Examples

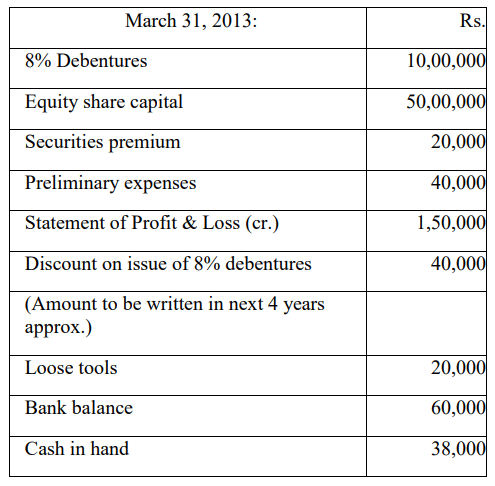

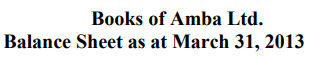

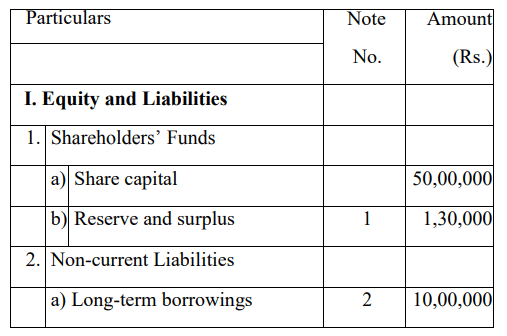

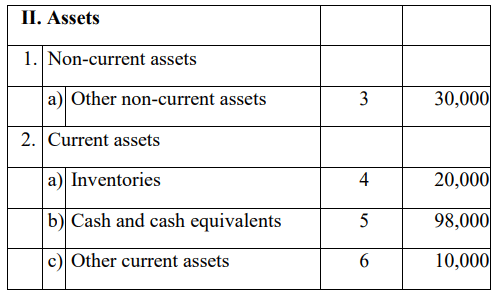

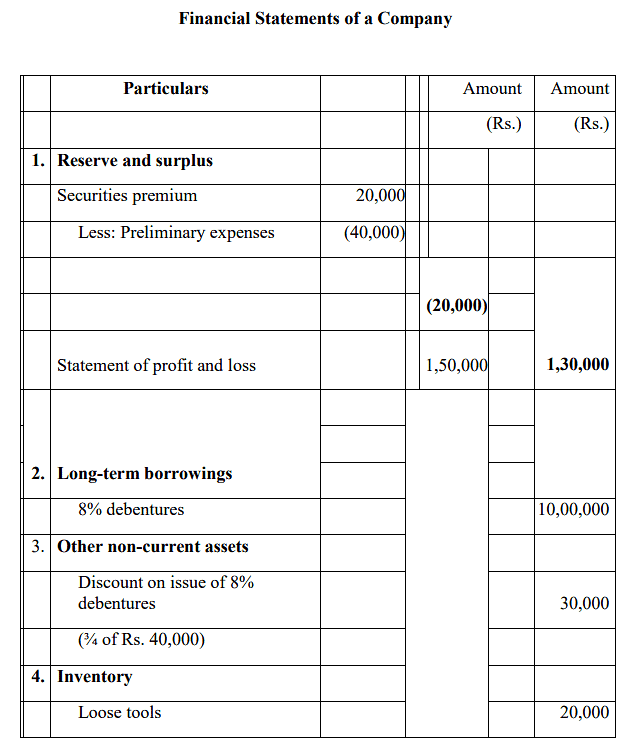

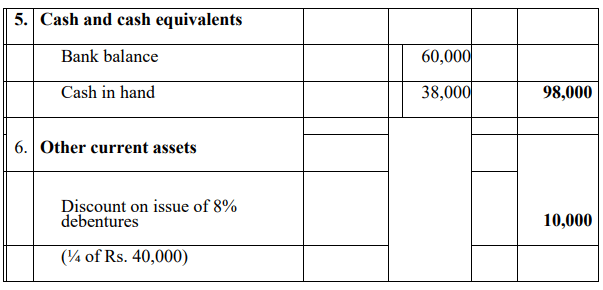

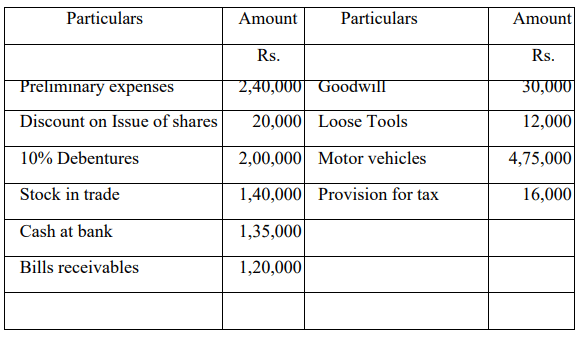

Example 1: Show the following items in the balance sheet of Amba Ltd. as per revised schedule Ans:

Ans:

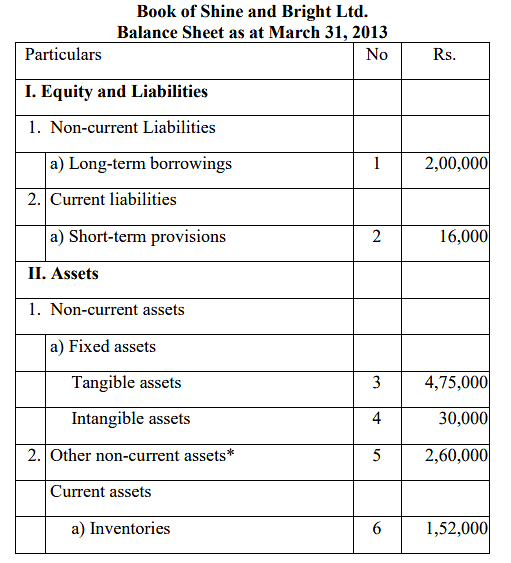

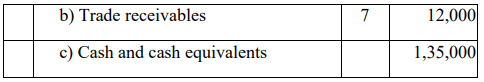

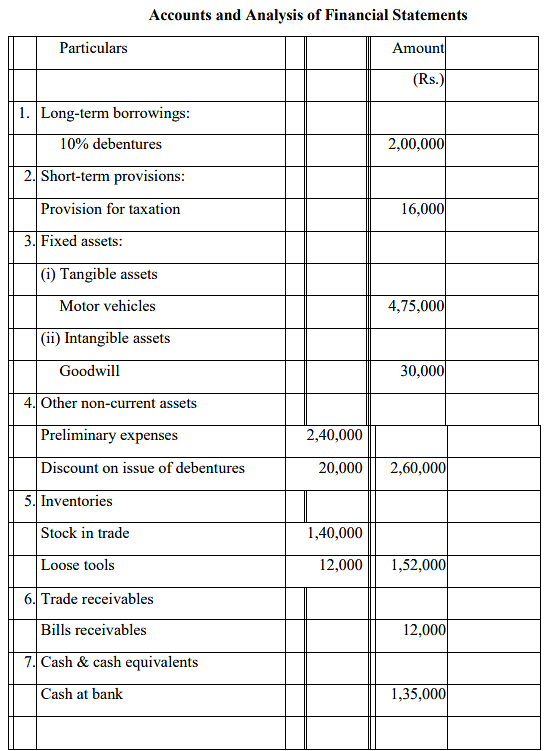

Example 2: From the given particulars of Shine and Bright Co. Ltd. as at March 31, 2013, prepare balance sheet in accordance to the (revised) Schedule VI:

Ans:

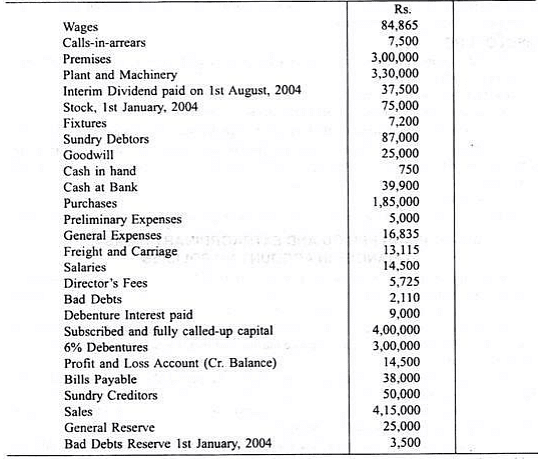

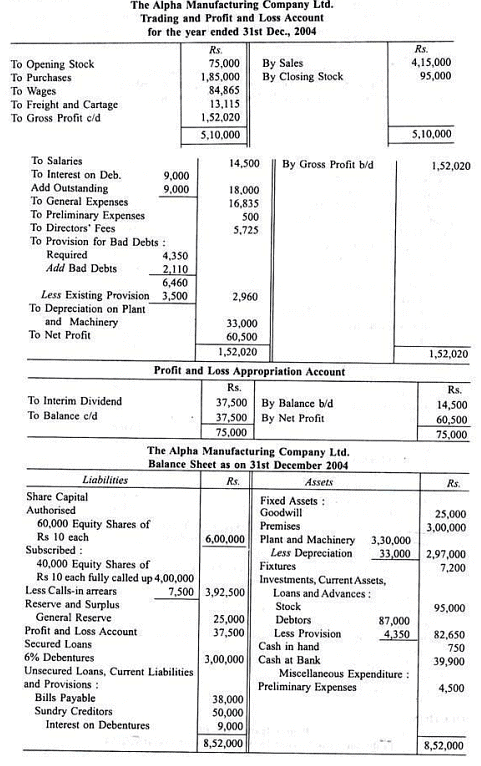

Example 3: The following is the list of balances extracted from its books on 31st December, 2004: Prepare Trading and Profit and Loss Account and Balance Sheet in proper form after making the following adjustments: Depreciate Plant and Machinery by 10%. Write off Rs 500 from Preliminary Expenses. Provide half year‟s Debenture interest due. Leave Bad and Doubtful Debts Reserve at 5% on Sundry Debtors. Stock on 31st December, 2004, was Rs. 95,000.

Prepare Trading and Profit and Loss Account and Balance Sheet in proper form after making the following adjustments: Depreciate Plant and Machinery by 10%. Write off Rs 500 from Preliminary Expenses. Provide half year‟s Debenture interest due. Leave Bad and Doubtful Debts Reserve at 5% on Sundry Debtors. Stock on 31st December, 2004, was Rs. 95,000.

Ans:

|

196 videos|219 docs

|

FAQs on Preparation and Presentation of Company Final Accounts - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the purpose of a Profit and Loss Statement (P&L)? |  |

| 2. How is a Balance Sheet defined? |  |

| 3. What are some examples of items included in a company's final accounts? |  |

| 4. How are company final accounts prepared and presented? |  |

| 5. What are some frequently asked questions (FAQs) related to the preparation and presentation of company final accounts? |  |