Risk and Return - 1 | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Evolution of Risk Connotations |

|

| Sources of Risk |

|

| Types of Risk |

|

Introduction

- The term 'risk' is commonly used in the investment sector. In everyday life, the word risk frequently connotes an unexpected negative outcome. When you say it is risk to drive on a certain route, you are implying that driving on that route could result in an accident. The term risk in the context of investments, on the other hand, has a different meaning. It not only denotes the possibility of a negative outcome but also the likelihood of a less positive outcome.

- As you are aware risk and return are interrelated. A person purchases a financial asset with the intent of receiving a profit. The investment decision would be based on an 'anticipated return,' which may be realized or not. The risk associated with an investment decision is the possibility of an "unexpected" negative or "adverse" return. Almost every decision involves some level of risk. When a manufacturing manager chooses equipment, a marketing manager creates an ad campaign, or a finance manager manages a portfolio of assets, they are all dealing with uncertain cash flows.

- Nearly every decision entails some degree of risk. Whether it's a manufacturing manager selecting equipment, a marketing manager devising an advertising campaign, or a finance manager overseeing an asset portfolio, uncertainty regarding cash flows is omnipresent. Financial analysis involves evaluating risks and factoring their potential impact into decision-making. In theory, the variability in returns from a security is defined as risk. Conversely, a security that provides steady returns over time, backed by some form of guarantee—typically a sovereign guarantee—is labeled as a "risk-less security" or "risk-free security." In contrast, a security that yields inconsistent returns over time is termed a "risky asset." For instance, consider the following options:

- Consider the Rs.1000, 12% 2020 Government of India Loan versus the Rs.100, 14.5% 2005 TISCO Non-Convertible Debentures. The Government Loan carries negligible risk due to the stability of the government system and the assurance of interest and principal repayments. On the other hand, TISCO debentures offer protective measures such as corporate assets and consistent financial performance, but there remains a risk of underperformance and default.

- For numerous investors, the fear of investment risk is a significant concern. When a secondary market fails to align with rational expectations, the risk factor in such markets becomes substantial, often leaving investors unaware of the true risks involved. Risk aversion is prevalent among many small investors in the secondary market. They seek a predictable return from the market, and unmet expectations can detrimentally affect their morale. Consequently, these investors tend to favor assets offering modest but consistent returns over securities with potentially high but volatile returns.

- However, the financial system also accommodates risk-taking investors. Speculators, for instance, are willing to invest in securities offering significant returns despite the lower certainty associated with such investments. They are recognized as risk-takers within the market. A functioning secondary market necessitates the presence of both risk-takers and risk-averse investors.

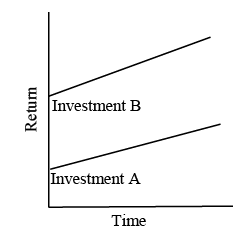

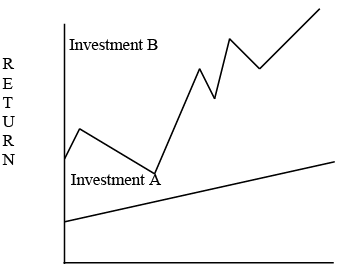

- In Figure (i), presented with investment options, an investor would likely choose investment 'B' over 'A'. Conversely, in Figure (ii), investment 'A' provides a steady income stream. Comparing Figures (i) and (ii), it's evident that investment 'B' offers predictability in Figure (i) but variability in Figure (ii). Despite the inherent danger in the latter case, investors still prefer investment 'B' as it consistently yields better returns. This suggests that investors are rewarded with higher returns for assuming greater risk.

Evolution of Risk Connotations

The connotations of risk have evolved significantly in the twenty-first century. Analysts now rely on financial statement data to evaluate the risk associated with a company's securities, often using the amount of debt held by the company as a key indicator. This approach stems from the belief that higher debt levels correlate with increased risk. In their influential 1962 work, "Security Analysis," Graham Dodd and Cottle, regarded as pioneers in the field of security analysis, emphasized the concept of "margin of safety" as a crucial measure of risk.

- They argued that security analysis should focus on determining a security's "intrinsic worth," which is independent of its market price. This intrinsic value is based on factors such as earning power and financial attributes. The margin of safety, defined as the difference between intrinsic value and market price, became a key criterion for assessing risk, with the principle being that a larger margin of safety indicates lower risk.

- Various methods have been employed to measure risk beyond the standard deviation, including range, semivariance, and mean absolute deviation. However, the standard deviation remains widely accepted due to its ability to provide probability statements for a wide range of distributions.

- Investment risk can be decomposed into multiple components through two main approaches. One approach is to divide total risk into systematic and unsystematic risk, while the other is to identify specific sources of risk within total risk. Pervasive risks such as inflation, interest rates, and market sentiment can affect all securities to varying degrees, categorizing them as systematic risks. Conversely, risks specific to individual securities, such as financial risk and business risk, fall under the category of unsystematic risk.

- Systematic risk, also known as market risk, arises when return variability is correlated with overall market movements. This type of risk is inherent and unavoidable, causing considerable concern for investors. For example, fluctuations in prices impact all enterprises' expenses and revenues, contributing to return variability. Investors seek compensation for this risk factor when calculating their expected rate of return.

- In contrast, non-systematic risk, or firm-specific risk, occurs due to factors unique to a particular company, such as failure to secure a significant contract or heightened exposure to default risks. This type of risk can be mitigated through diversification and is not factored into calculations of expected or required rates of return.

Sources of Risk

The risk associated with an investment is always a concern for an investor. He is confronted with several inquiries. To comprehend risk, S/he needs to be aware of the following:

- What makes investment risky?

- What are the various elements or sources of risk that the investments are exposed to?

Variations in investment return can be attributed to a variety of factors. Each of these sources carries a certain amount of danger. We have mentioned above that there are various causes for future returns differing from predicted returns. Now, let us focus on understanding distinct risk sources. The following are the several sources of risk in investments:

Market Risk

- Market Risk Even though the company's earnings do not change, market prices of investments, particularly equity shares, may fluctuate in a short period.

- Several factors could be responsible for this change in pricing. Changes in investor sentiment towards equities due to various factors can lead to fluctuations in market prices. This fluctuation in return, dependent on market price changes, is termed market risk. Market risk encompasses the variation in returns caused by fluctuations in the market price of an investment, stemming from investors' reactions to various significant events. Social, political, economic, and company-specific events all impact the market prices of equity shares. Additionally, market psychology plays a role, with bull markets driving prices upward and bear markets leading to declines.

- Business cycles are identified as a primary driver influencing the timing and magnitude of bull and bear market phases. These cycles correspond to the expansion and contraction of the economy, with bear markets triggering pessimism and widespread price declines. While there may be exceptions, historical evidence suggests that avoiding losses in bear markets is challenging for investors.

- Market risk can be categorized as systematic or non-systematic. Systematic market risk occurs when various systematic factors drive most stock prices to rise during bull markets and fall during bear markets. Conversely, a small portion of securities may exhibit a negative correlation with the prevailing market trend, such as companies securing valuable patents during market downturns. These unsystematic price movements are diversifiable, and exposure to them can be managed through portfolio diversification.

Interest-Rate Risk

- Interest rate risk is another significant factor influencing security returns. Changes in interest rates impact the expected or required rate of return on investments, as investors compare risk-free returns with expected returns. Rising interest rates increase the expected or required rate of return on other assets, affecting both government securities and the general interest rate environment.

- This risk refers to the variation in returns caused by changes in market prices of fixed income products like bonds and debentures, with prices of these securities moving inversely to interest rates. Consequently, changes in interest rates directly affect bond and debenture prices and indirectly impact equity share values.

Inflation Risk

- Inflation risk pertains to the uncertainty surrounding the purchasing power of an asset, stemming from the overall rise in prices. It reflects the unpredictability of the future buying power of expected cash flows from an investment, illustrating how inflation or deflation impacts an investment. Bonds, debentures, and dividend rates on stocks and preference shares are expressed in monetary terms. However, if the general price level increases, the purchasing power of cash interest/dividend income will inevitably decrease. If the rate of return on money equals the rate of inflation, the investor effectively achieves a zero rate of return.

- Despite inflation, some investors believe they will benefit if the market prices of their financial assets rise. However, this perception is often a monetary illusion. For instance, if the market price of a security doubles while the overall price level quadruples, one may feel wealthier due to the increased money control. However, considering the substantial rise in general pricing, the control over goods and services— the ultimate goal of investment decisions—has diminished. Hence, inflation risk stems from the uncertainty regarding the future purchasing power of money gained from investments.

Business Risk

- Business enterprises operate in dynamic environments, leading to fluctuations in expected income. Changes in government policies, such as alterations in fertilizer subsidies, can adversely affect specific industries. Similarly, the actions of competitors, whether domestic or foreign, can impact other businesses. While some environmental changes are attributable to specific entities, numerous factors alter the operational landscape without clear sources. For instance, businesses across various sectors are affected by the business cycle, resulting in significant earnings fluctuations from year to year.

- Industries like steel, automotive, and transportation are particularly susceptible to such cycles. Determining whether a company's risk is systematic or specific can be challenging. Diversifying portfolios across multiple industries can mitigate company-specific risks to a considerable extent. Conversely, portfolios concentrated in few firms or industries may face heightened vulnerability to business risks if all sectors are impacted by environmental changes.

Financial Risk

- Financial risk arises when a company's capital structure includes debt. Debt introduces fixed liabilities, increasing income variability for equity stockholders. However, financial risk is not inherently negative; it can be managed effectively.

- Boosting profitability occurs when a company performs well, providing stock investors with higher returns than would otherwise be available. However, debt, due to its fixed liability, poses challenges during tough times. Failure to meet debt obligations requires managers to spend considerable time persuading lenders to accept delayed payments, diverting valuable managerial resources. Defaults easily disseminate negative information about the organization, leading to multiple problems.

- The company may struggle to secure financing from suppliers, lose key employees, and face customer preference for financially robust organizations to minimize supply disruptions. Additionally, excessive debt poses challenges for current debt security holders until the loan is fully secured, as the lengthy legal process of seizing and selling assets to meet liabilities is cumbersome.

Management Risk

- Management risk accounts for the portion of total return variability attributed to managerial actions in companies where owners are not the managers. Regardless of management's experience, the risk of errors or poor decisions is ever-present. Owners and investors are rightfully displeased when executives receive hefty salaries, bonuses, and non-essential expenses such as luxury cars and lavish offices, only to make detrimental decisions. Management errors primarily contribute to this risk component.

- While numerous potential managerial blunders exist, some can be identified, such as neglecting product obsolescence. Adequate investment in research and development and promotion of alternative products before the end of a product's life cycle are essential. Companies with a single product line are particularly vulnerable to this risk compared to those with diverse product ranges. Dependence on a single large customer can also heighten management risk, prompting companies, such as software firms, to diversify their customer base and geographic exposure.

- Furthermore, mishandling correct decisions, especially when faced with unfair criticism or litigation, can exacerbate management risk. For instance, discontinuing a fuel-efficient vehicle due to unwarranted safety concerns following a lawsuit can lead to significant capital and revenue losses for investors. These examples highlight potential managerial pitfalls, though the list of such risks is extensive and indefinite.

Agency Theory and Management Risk

- Recent research focuses on understanding the fundamental motivations of owners and managers, shedding light on management risks. It's suggested that owners exert greater effort compared to managers who lack ownership stakes in the company. Additionally, non-owner managers, being hired employees, often have strong incentives for non-monetary perks.

- A prevailing view suggests that owner-non-manager relationships transform into principal-agent dynamics, where non-owner managers wield full authority on behalf of owners. This arrangement leads to a conflict of interest between owners and managers, potentially resulting in managerial abuse of authority to the detriment of owners. Consequently, rational investors may value shares of owner-managed companies higher than those of employee-managed ones, leading to differences in share prices known as "agency costs." While this hypothesis has faced criticism, it is increasingly gaining acceptance.

Liquidity Risk

- Liquidity risk refers to the difficulty of selling assets without resorting to price discounts and commissions. Asset liquidity can be easily assessed, with a country's currency unit being the most immediately saleable asset. Government securities and blue-chip stocks follow in terms of liquidity.

- Conversely, debt securities and equity shares of smaller, lesser-known corporations may exhibit lower liquidity, if not outright illiquidity. Lack of liquidity may force investors to sell securities at prices below their current value, particularly when selling large quantities. Hence, investors must consider liquidity risk when selecting securities.

Social or Regulatory Risk

- Social or regulatory risk arises when otherwise successful ventures are hindered by unfavorable legislation, stringent regulatory environments, or, in extreme cases, nationalization by socialist governments. For instance, price controls can diminish industrial enterprise revenues, while rent controls can significantly devalue rental properties.

- This risk is inherently political and unpredictable, as increasing government intervention in corporate affairs becomes more prevalent under representative democracies.

Other Risks

- Additional categories of risk include monetary value risk and political environment risk, especially pertinent when investing in foreign assets. Investors venturing into foreign government bonds or securities of foreign firms face risks such as government repudiation of outstanding debt, nationalization of businesses, or the inability of foreign governments or corporations to manage their debt obligations.

- When considering international investments, investors should carefully weigh the higher associated risks against projected returns, whether in the form of interest, dividends, or capital gains.

Risk Preferences

- Managers exhibit varying risk perspectives, influencing their firms' risk profiles. Establishing a universally accepted risk threshold is crucial. Basic risk preference behaviors include risk aversion, risk indifference, and risk-seeking.

- Most managers tend to be risk-averse, requiring increased rewards for higher risks. They typically adopt a conservative approach when taking risks for their company. Therefore, a risk-averse financial manager is anticipated, demanding greater returns in exchange for assuming higher risks.

|

Download the notes

Risk and Return - 1

|

Download as PDF |

Types of Risk

The first trio of risks in investments—market risk, interest rate risk, and inflation risk—are external to firms and thus beyond management control. These risks are pervasive, impacting all businesses universally. In contrast, business and financial risks are internal to specific corporations and can be managed. This analysis leads to the classification of risk into systematic and unsystematic categories.

Systematic Risk

Systematic risk refers to the portion of return variability caused by factors affecting all enterprises. Diversification cannot effectively mitigate this risk. Examples of systemic risk include:

- Changes in government interest rate policies.

- Increases in corporate tax rates.

- Government reliance on substantial deficit financing.

- Escalation in inflation rates.

- Implementation of restrictive credit policies by the country's Central Bank.

- Government failure to attract Foreign Institutional Investors (FIIs).

Unsystematic Risk

Unsystematic risk encompasses variations in investment returns attributable to firm-specific factors rather than market-wide conditions. Also known as unique risk, this type of risk can be entirely offset through diversification. Examples of unsystematic risk include:

- Worker strikes within a company.

- Departure of key Research and Development personnel.

- Entry of a formidable competitor into the market.

- Loss of a significant contract during bidding.

- Company breakthrough in innovation processes.

- Government imposition of increased customs duty on materials used by the company.

- Inadequate procurement of essential raw materials.

Total risk equals the sum of systematic and unsystematic risk, as these components are additive. In most cases, systemic risk is gauged by comparing a stock's performance against market performance across various scenarios. For instance, if a stock appreciates more than others during favorable market conditions but depreciates more during downturns, it indicates a higher level of systematic risk. The market's systematic risk is standardized to one, with the systematic risk of all stocks expressed in terms of the market index's systematic risk. This is typically accomplished by measuring a value known as beta, where a stock's beta reflects its sensitivity to market movements. For instance, a stock with a beta of 1.50 is expected to experience a price increase 1.5 times greater than the market return, and a fall 1.5 times greater during market declines.

Risk Versus Uncertainty

- While the terms risk and uncertainty are sometimes used interchangeably, they carry distinct connotations. Risk implies that a decision-maker possesses knowledge of the potential outcomes of a decision and their associated probabilities. Uncertainty, on the other hand, describes a situation where the likelihood of a specific event is unknown.

- Investors aim to maximize expected returns while adhering to their risk tolerance levels. The level of risk is influenced by various factors including the characteristics of assets, investment instruments, and the chosen mode of investment.

Causes of Risk: Several factors contribute to the emergence of risk in the investment landscape, including:

- Selection of an inappropriate investment method

- Timing of investment that does not align with market conditions

- Allocation of an incorrect quantity of investment capital

- Exposure to interest rate fluctuations

- Characteristics of investment instruments

- Characteristics of the industry in which the investment is made

- Economic conditions at the national and international levels

- Incidence of natural disasters, among others.

FAQs on Risk and Return - 1 - Management Optional Notes for UPSC

| 1. What is the concept of risk connotations? |  |

| 2. What are the sources of risk? |  |

| 3. What are the different types of risk? |  |

| 4. How does risk relate to return? |  |

| 5. How has the concept of risk evolved over time? |  |