Commercial Banks | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Classification of Commercial Banks |

|

| Resources of Commercial Banks |

|

| Employment of Resources |

|

| Reserve Bank's Directives and Norms |

|

| Problem of Non-Performing Assets |

|

Introduction

- Commercial banks hold a venerable status as the oldest and most extensive banking entities in India, with some having a century-long legacy. Their branches span across the nation, reaching even rural areas.

- The evolution of commercial banking in India can be delineated into three distinct phases since Independence. The period from 1955 to 1970 marked the genesis of the public sector's dominance in Indian banking, beginning with the establishment of the State Bank of India in 1955 and culminating in the nationalization of 14 major banks in 1969.

- The subsequent two decades post-nationalization, spanning the 1970s and 1980s, witnessed a shift towards mass banking from class banking. This era was characterized by extensive branch expansion and a surge in bank workforce recruitment, alongside an emphasis on prioritizing sectoral advances, particularly targeting the underprivileged and marginalized segments. Loan melas (fairs) emerged as a prominent feature during this period, while regulatory oversight by the Reserve Bank of India intensified across various banking operations.

- However, the post-nationalization period was not devoid of challenges. Issues such as inadequate training, diminished employee efficiency, loan recovery difficulties, and increased fund preemption to meet statutory requirements led to diminished bank profitability.

- The year 1991 marked a turning point with the introduction of new economic policies by the government. A Committee on the financial sector, chaired by Shri M. Narashimham, proposed significant measures aimed at enhancing the efficiency, productivity, and profitability of banks. These measures have largely been implemented, leading to a transformation in the landscape of commercial banks in India. In this unit, we will explore the current state of commercial banks in India following the implementation of these reform measures.

Classification of Commercial Banks

Commercial banks in India are categorized into two main groups based on ownership and management control:

- Public Sector Banks

- Private Sector Banks

Public Sector Banks:

Public sector banks constitute the majority share of the banking industry in India and are further divided into two categories:

- State Bank of India Group

- Nationalized Banks

State Bank of India Group:

- This group comprises the State Bank of India and its seven subsidiaries, representing the largest commercial bank network in India. The State Bank of India was established in 1955 through the conversion of the Imperial Bank of India into a state-owned entity under the State Bank of India Act, 1955. Initially, the Reserve Bank of India held about 93% of its shares.

- The State Bank of India acts as the agent of the Reserve Bank of India in locations where the latter has no office. In 1959, eight state-associated banks were converted into subsidiaries of the State Bank of India under the State Bank of India (Subsidiary Banks) Act, 1959, subsequently merging one of them. Thus, the State Bank Group comprises eight banks, aimed at expanding banking services in rural areas.

Nationalized Banks:

- In July 1969, the Indian government nationalized 14 major commercial banks through the Banking Companies (Acquisition and Transfer of Undertakings) Act 1970. Another six commercial banks with deposits exceeding Rs. 200 crore each were nationalized in 1980, bringing the total number of nationalized banks to 19.

- The nationalization aimed to establish numerous branches nationwide, particularly in rural regions, and mobilize deposits on a large scale to fund productive sectors, including agriculture, small industries, and weaker sections of society. Initially, these banks were fully owned by the Government of India, but subsequent amendments allowed private shareholding, ensuring the government's ownership remains above 51%.

Private Sector Banks:

Private sector banks fall into two categories:

- Old Private Sector Banks

- New Private Sector Banks

Old Private Sector Banks:

- Existing private sector banks at the time of nationalization numbered 23 and are referred to as old private sector banks. No new banks were allowed to be established in India until 1993.

New Private Sector Banks:

- In 1993, the Reserve Bank of India introduced guidelines for establishing new private sector banks in India. Nine new banks were established under these guidelines, with a minimum capital requirement of Rs. 100 crore and compliance with capital adequacy norms from the outset. Subsequently, the guidelines were revised in 2001, increasing the minimum capital requirement to Rs. 200 crore (further raised to Rs. 300 crore) and raising the capital adequacy norm to 9%.

Foreign Banks:

- Currently, 41 foreign banks from 21 countries operate in India as branches of banking companies incorporated outside the country. As of June 30, 2001, there were 194 branches of foreign banks operating in India.

Scheduled Banks

As per Section 42.01 of the Reserve Bank of India Act, 1934, both public sector and private sector banks are designated as Scheduled Banks if their names are listed in the Second Schedule to the Reserve Bank of India Act. To qualify for this status, a bank must fulfill the following criteria:

- It must possess a paid-up capital and reserves totaling at least Rs. 5 lakhs.

- It must demonstrate to the Reserve Bank of India that its operations are not being conducted in a manner that harms the interests of its depositors.

- It must be either a State Co-operative Bank, a company, an institution notified by the Central Government, a corporation, or a company incorporated under any applicable law.

Therefore, in addition to Commercial Banks, Regional Rural Banks, State Co-operative Banks, and Urban Co-operative Banks are also eligible to be designated as Scheduled Banks.

Resources of Commercial Banks

The primary function of commercial banks lies in receiving deposits for the purpose of lending and investment. Deposits, therefore, constitute the principal source of funds for them, with their own funds representing a relatively small portion of their total resources. Efforts have been underway in recent years to increase the banks' owned funds as well.

Paid-Up Capital and Reserves

- The authorized capital of nationalized banks stands at Rs. 1500 crore each. The Central Government holds 100% of the paid-up capital in some banks, while its percentage holding has decreased in others due to share issuances to the public.

- Banks allocate 20% (now 25%) of their net profits to a Statutory Reserve Fund annually. Additionally, they maintain various other Reserve Funds, including Capital Reserves, Share Premium, Revenue Reserves, and Investment Fluctuation Reserve.

Deposits

Deposits from the public, institutions, and organizations form the bulk of commercial banks' resources. They accept deposits under three main types of accounts:

- Fixed Deposits: These deposits have a minimum period of 15 days.

- Savings Deposits

- Current Deposits

Interest is not payable on current deposits, while the interest on savings bank accounts is determined by the Reserve Bank of India, currently set at 4% per annum. Interest on fixed deposits used to be regulated by the Reserve Bank of India, but now banks are free to set their own rates for different maturities. At the discretion of the Reserve Bank of India, banks offer slightly higher rates on bulk deposits exceeding Rs. 15 lakhs and on deposits held by senior citizens (aged 60 years and above).

- Deposits with commercial banks, as well as with Regional Rural Banks and Co-operative banks, are insured by the Deposit Insurance and Credit Guarantee Corporation of India, up to Rs. 1 lakh in each account. These banks pay an insurance premium of 5 paise per cent to the corporation for this coverage.

- Scheduled Commercial Banks also attract significant deposits through certificates of deposits. The amount of CDs issued by them was Rs. 1695 crore as of October 20, 2000, but decreased to Rs. 823 crore as of October 5, 2001.

In addition to deposits, banks enhance their resources through borrowings from various sources:

- Reserve Bank of India

- Other Banks

- Other Institutions and Agencies

The Reserve Bank of India provides refinance for export credit and short-term funds under its Liquidity Adjustment Facility. Banks also obtain refinance from other Apex Banks such as Exim Bank and IDBI.

Employment of Resources

As observed, the majority of funds for banks are acquired through deposits, which are repayable either on demand or after a specified period. Therefore, banks utilize these funds partly in liquid assets such as cash balances with themselves and other banks, and the remaining amount is either invested in securities or extended in the form of loans and advances.

Cash and Balances with Other Banks

- These are highly liquid assets held by banks, often referred to as the first line of defense since they can promptly fulfill depositors' claims.

- Banks typically maintain a reasonable proportion of cash, approximately 10% of deposits, in such balances.

Money at Call and Short Notice

- Surplus funds held by banks are lent to other banks in need of short-term financing, usually for a day or a few days.

- Banks earn interest on these short-term loans, with interest rates fluctuating based on the demand and supply of funds.

Cash Reserves with Reserve Bank of India

- As per Section 42 of the Reserve Bank of India Act, 1934, scheduled commercial banks are mandated to maintain a minimum of 3% of their net demand and time liabilities with the Reserve Bank of India, with the authority to raise it up to 20%.

- Effective from June 1, 2002, the Cash Reserve Ratio (CRR) requirement is set at 5%, reduced from 5.5%.

Investments

- Banks allocate a significant portion of their deposit liabilities towards investments, primarily in government and other approved securities to meet statutory liquidity requirements. Additionally, banks are permitted to invest in corporate securities within certain limits.

- These investments are categorized in their balance sheets under various headings such as government securities, shares, debentures, etc.

Loans and Advances

- Granting loans and advances constitutes the core business of commercial banks. Loans are provided in various forms including bills purchased and discounted, cash credits, overdrafts, and term loans.

- These loans can be secured by tangible assets, covered by bank or government guarantees, or unsecured.

Interest Rate Policy

- The Reserve Bank of India has implemented financial sector reforms to grant operational flexibility to banks. Banks now have autonomy to determine their Prime Lending Rate (PLR) and are permitted to offer tenor-linked PLRs.

- They can also lend below the PLR to specific borrowers such as exporters and creditworthy entities.

Sectoral Deployment of Bank Credit

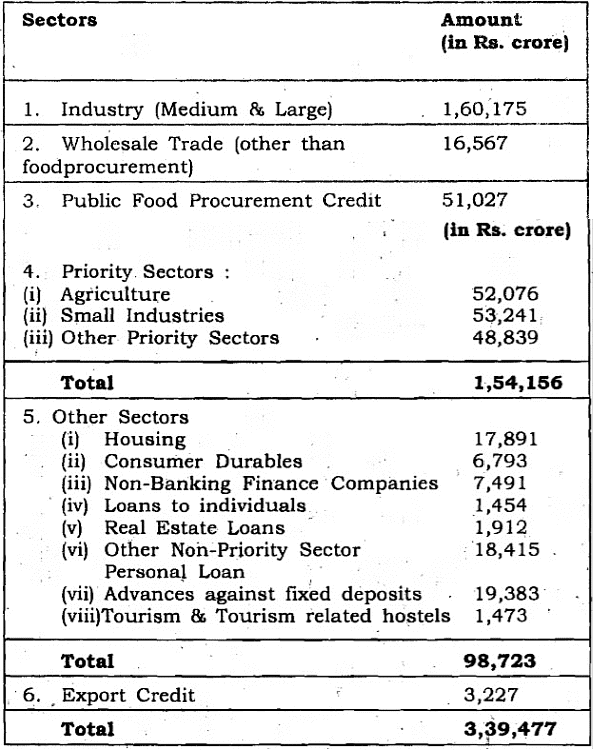

- Commercial banks cater to the diverse needs of different sectors of the economy, including industry, trade, consumer credit, retail credit, and housing loans.

- Priority sector advances constitute over 40% of bank credit, emphasizing the broad spectrum of sectors served by commercial banks.

Sectoral Deployment of Bank Credit as on July 27,2001

Reserve Bank's Directives and Norms

Priority Sector Advances

- Indian commercial banks, both in the public and private sectors, are obligated to extend loans to priority sectors as per the targets set by the Reserve Bank of India (RBI).

- These targets include allocating 40% of the net bank credit to total priority sector advances, with specific allocations for agricultural advances and loans to weaker sections. Foreign banks operating in India have different targets, including 32% for total priority sector advances.

Prudential Norms

- To reform the operations of commercial banks, the RBI has established prudential norms. These norms cover various aspects such as non-performing assets (NPAs), income recognition, asset classification, provisioning, and exposure limits.

Non-Performing Assets:

- Assets are classified as NPAs if interest or principal remains overdue for a specified period, typically 180 days.

- The classification period will be reduced to 90 days from March 31, 2004.

Income Recognition:

- Banks are prohibited from recognizing interest income on NPAs. However, interest on certain assets like advances against term deposits may be recognized if adequate margin is available.

Asset Classification and Provisioning:

- NPAs are categorized into sub-standard, doubtful, and loss assets based on their overdue period. Banks are required to make provisions for these assets in their books according to specified percentages.

Exposure Norms:

- The RBI has set exposure limits for commercial banks, restricting the maximum amount that can be lent to individual borrowers or groups of borrowers.

- Additionally, exposure to the capital market is capped at 5% of total outstanding advances.

Capital Adequacy Norms:

- Since 1992, the RBI has mandated capital adequacy norms for commercial banks. Banks are required to maintain a Capital to Risk-Weighted Assets Ratio (CRAR) of at least 9%. This ratio ensures that banks have sufficient capital to cover the risks associated with their assets.

- Capital funds include Tier I and Tier II capital components, with specific criteria for inclusion and deduction.

As of March 2001, most banks met or exceeded the required CRAR, indicating their compliance with capital adequacy norms.

Problem of Non-Performing Assets

One of the most pressing issues facing Commercial Banks currently is the significant volume of non-performing assets (NPAs). Between the fiscal years ending in March 2000 and March 2001, the gross NPAs of Scheduled Commercial Banks rose from Rs. 60,408 crore to Rs. 63,883 crore. The net NPAs during the same period increased from Rs. 30,073 crore to Rs. 32,468 crore. This problem affects all categories of banks in India, including public sector, private sector, and foreign banks. To address this issue, both the Government of India and the Reserve Bank of India have implemented various measures.

These initiatives include:

Establishment of Debt Recovery Tribunals

- Following the enactment of the Recovery of Debts due to Banks and Financial Institutions Act 1993, twenty-three Debt Recovery Tribunals have been set up across India.

- These tribunals aim to facilitate swift adjudication and recovery of debts owed to banks and financial institutions. Recently, these tribunals have been granted expanded powers to enhance their effectiveness. They handle claims exceeding Rs. 10 lakhs each.

Proposed Establishment of Asset Reconstruction Companies

The government issued an ordinance in June 2002 allowing for the establishment of Asset Reconstruction Companies. These entities will take over non-performing assets from banks and financial institutions, working to realize them promptly.

- The majority of commercial banking in India is conducted in the public sector, with the State Bank of India and its subsidiaries forming the State Bank Group based on their ownership structure. New private sector banks, including ICICI Bank Ltd., rank among the largest banks after the State Bank of India. Banks obtain scheduled bank status upon meeting prescribed criteria.

- The banking system relies heavily on deposits as its primary source of funds. Interest rates on deposits are now fully deregulated, except for savings accounts. Banks also supplement their funds through borrowings from the Reserve Bank and other institutions.

- Commercial banks deploy their funds across liquid assets, semi-liquid assets, and income-generating assets like loans and advances. They must maintain a specified percentage of deposits with the Reserve Bank of India as the Cash Reserve Ratio (CRR) and also meet the Statutory Liquidity Ratio (SLR) requirement of 25%.

- Funds are lent for a variety of purposes, with priority sector advances accounting for over 40% of total advances. Banks also extend loans for housing, consumer durables, real estate financing, and other personal needs.

- The Reserve Bank of India has established prudential norms for commercial banks to follow, including the Capital Adequacy Norm of 9%.

- The substantial challenge facing Commercial Banks currently is the large volume of non-performing assets. Efforts are underway to address this issue through Debt Recovery Tribunals and other means. While Banking Sector Reforms have been initiated since 1991, further reforms are necessary to enhance the functioning of commercial banks.

|

196 videos|219 docs

|