Deductions from Gross Total Income - 2 | Commerce & Accountancy Optional Notes for UPSC PDF Download

Deductions For Economic Growth

Deduction in Respect of Profits from Undertakings of Enterprise Engaged in Infrastructure Development (Section 80 IA)

- Eligibility: This deduction is available to assessees whose income consists of the profits from enterprises involved in Telecommunication Services, Infrastructure Facilities, Industrial Parks, and Generation and Distribution of Power.

Conditions for Deduction

This deduction is applicable to profits and gains derived from businesses involved in:

Infrastructure Facility: This includes projects like roads, bridges, rail systems, highways (including housing), water supply projects, irrigation projects, sanitation and sewerage systems, waste management systems, ports, airports, inland waterways, or inland ports. The following conditions must be met:

- The infrastructure facility must commence operations and maintenance between April 1, 1995, and March 31, 2017.

- There must be an agreement with the Central or State Government for the development, maintenance, and operation of the new infrastructure facility.

- The enterprise must be owned by a company registered in India or by an authority, board, corporation, or any other body established or constituted under any central/state act.

Telecommunication Services: This includes basic and cellular services, radio, paging, domestic satellite services, networks of trucking, broadband networks, internet services, and electronic data interchange services. The following condition applies:

- The telecommunication services must commence after March 31, 1995, but before April 1, 2005.

Industrial Park: This involves the development, maintenance, and operation of an industrial park or Special Economic Zone (SEZ) as notified by the Central Government. The following condition applies:

- The industrial park must commence operations between April 1, 2006, and March 31, 2011.

Generation and Distribution of Power: This involves the setting up of enterprises for power generation and distribution. The following conditions apply:

- Power generation and distribution must commence between March 31, 1993, and March 31, 2017.

- Transmission or distribution must commence by laying a new network of transmission or distribution lines between March 31, 1999, and April 1, 2017.

Businesses Involved in the Distribution of Natural Gas: This includes the establishment of a cross-country natural gas distribution network, including laying pipelines and storage facilities, subject to certain conditions.

Quantum and Period of Deduction

Telecommunication Services:

- The deduction is 100% of profits for the first ten assessment years.

- For the next five assessment years, the deduction is 30% of such profits, for a total of 15 years from the year of commencement.

Others:

- The deduction is 100% of profits for ten consecutive assessment years (out of 15 years) beginning with the year in which the enterprise becomes operational. However, for inland waterways, inland ports, or navigational channels in the sea, the period is 20 years instead of 15 years.

Deduction In Respect Of Profits From Industrial Undertaking, Other Than Infrastructure Development Undertakings (section 80 Ib)

- Eligibility: This deduction is applicable to assessees whose total income comprises profits from various types of enterprises, including those involved in scientific and industrial research, the construction and development of housing projects, the maintenance, storage, and transportation of food grains, the refining of mineral oil, the operation and maintenance of hospitals in rural areas, and industrial undertakings such as institutions engaged in cold chain facilities, multiplex theaters, hotels, and convention centers.

- Conditions for Deduction: This Section applies to enterprises established in India that are not engaged in the production of articles or commodities listed in the eleventh schedule of the Income Tax Act. These enterprises should not be formed by old businesses, and the old machinery should not exceed 20% of the total cost.

If the industrial undertakings are established in backward states and commence production during the period from April 1, 1993, to March 31, 2004 (March 31, 2012, in the case of Jammu & Kashmir), deductions shall be allowed as follows:

- For companies - 100% for the first 5 years, 30% for the next 5 years.

- For cooperative societies - 100% for the first 5 years, 25% for the next 7 years.

- For others - 100% for the first 5 years, 25% for the next 5 years.

In the case of Scientific Industrial Research and Development (Section 80 IB (8)):

- This deduction is allowed to a company registered in India and approved by the prescribed authority before April 1, 1997. The deduction shall be allowed from the assessment year 1997-98. 100% deduction from profits shall be allowed for 5 consecutive years, and if the enterprise is approved by the prescribed authority after March 31, 2000, but before April 1, 2007, then this deduction shall be allowed for 10 years starting from the initial year.

In the case of refining of mineral oil (Section 80 IB (9)):

- If the enterprises are established in the northeast region, and production on mineral oil starts before April 1, 1997, or if the enterprises are established in other states and production starts on or after April 1, 1997, but before April 1, 2017, 100% deduction from profits shall be allowed for 7 years from the year in which the business of refining oil starts, provided the undertaking is engaged in the business of refining mineral oil on or after October 1, 1998, but not after March 31, 2012. It begins commercial production of natural gas on or after April 1, 2009.

In the case of housing projects (Section 80 IB (10)):

- This deduction is allowed for projects approved by a local authority before March 31, 2008. This deduction is allowed for plots of land with a minimum area of one acre. If the residential unit is established within a 25-kilometer limit of the Municipal Corporation of Delhi or Mumbai or within the cities of Delhi & Mumbai, its built area should not exceed 1,000 square feet. If the residential unit is established in places other than Delhi and Mumbai, its built area should not exceed 1,500 square feet.

- 100% deduction from profits shall be allowed for enterprises where construction and development work starts on or after October 1, 1998, and construction completes on or before March 31, 2008 (if the housing project is approved by a local authority before April 1, 2004) or if the housing project is approved during 2004-05, it should be completed within 4 years of the end approval year by the end of the financial year of the local authority, or if the housing project has been approved on or after April 1, 2005, the project should be completed within 5 years from the end of the financial year in which the housing project is approved by the local authority. For commercial establishments, the ceiling is 3% of the aggregate built area or 5000 square feet, whichever is less.

In the case of hospitals in rural areas:

100% deduction from profits shall be allowed for 5 assessment years starting from the initial year in which the undertaking begins to provide medical services subject to the fulfillment of the following conditions:

- The hospital has a capacity of 100 beds for patients.

- The hospital is constructed between October 1, 2004, and March 31, 2008, in accordance with the rules applicable and enforced by the local authority.

- The hospital starts functioning between April 1, 2008, and March 31, 2013.

In the case of storing and transportation of food grains:

- This deduction shall be allowed to undertakings engaged in storing and transportation of food grains in the form of an integrated business on or after April 1, 2001. 100% deduction to company assesses will be allowed for the first 5 years and 30% for the next 5 years.

- Other assesses shall be allowed 100% deduction for the first 5 years and 25% for the next 5 years. The business of processing, preservation, and packaging of meat and meat products or poultry or marine or dairy products should commence on or after March 31, 2009.

Deduction for Profits from Housing Projects (Section 80- IBA)(Effective from AY 2018-2019)

Eligibility: This deduction is available to any assessee, including individuals, HUFs, AOPs, BOIs, companies, firms, or other entities.

Conditions for Deduction:

- The housing project must predominantly consist of residential units with amenities as specified by the competent authority.

- The competent authority must have approved the project between June 1, 2016, and March 31, 2019.

- The project must be completed within 5 years from the date of initial approval by the competent authority.

- The project is considered complete when a written completion certificate for the entire project is obtained from the competent authority.

- The housing project's commercial area (shops and other establishments) cannot exceed 3% of the total built-up area.

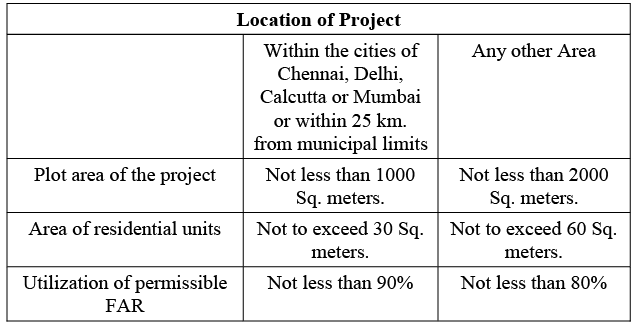

- The plot size, residential unit area, and minimum utilization of Floor Area Ratio (FAR) must meet specified criteria.

- Only one residential unit can be allotted to an individual in the housing project. No other residential unit can be allotted to that individual or his spouse or his minor children, to whom such one residential unit is allotted.

- The assessee should keep and maintain separate books of accounts in respect of the housing project.

Quantum of Deduction

- Subject to the fulfillment of the above conditions, 100% deduction of profits and gains derived from the business of developing and building a housing project.

Deduction in Respect of Profits and Gains from Undertaking in Special Category States (Section 80 IC)

Eligibility: This deduction is allowed to all those assesses who are engaged in manufacturing any articles under the scheme of Central board of Direct Taxation (CBDT) in Export Processing Zone or Industrial park, Software Technology park, or Industrial area as notified by CBDT. Commodities specified in XIII Schedule shall not be included but articles specified in XIV Schedule shall be eligible for deduction.

Conditions for Deduction

- Undertaking should not be formed by transferring old used plant and machine.

- Undertaking should not be formed by splitting up or reconstruction of any old undertaking.

Quantum of Deduction

- 100% deduction from profits shall be allowed for first 10 years if industrial undertaking is set up in Sikkim and production or expansion takes place between December 23, 2002 to March 31, 2007.

- Similarly, if the industrial undertaking is set up in Himachal Pradesh and Uttarakhand and product expansion takes place between Jan 07, 2003 to March 31, 2012, 100% deduction from profit should be allowed for first 5 year and 25% of profit (In case of a company 30%) for the industrial undertaking is set up in North Eastern states and starts production expansion between December 24, 1997 and March 31, 2007 the deduction shall be allowed as 100% of profit for first 10 years.

Deduction in Respect of Eligible Start up (Section 80 IAC)

Eligibility: This deduction is allowed to start-up assessee who derives profits from Eligible Business.

Conditions for Deduction

- Eligible Start-Up Company or Limited Liability Partnership (LLP) engaged in eligible business subject to fulfilling following conditions can claim this deduction:

- It is incorporated on or after 01.04.2016 but before 01.04.2024.

- Annual turnover of such company or LLP does not exceed Rs. 25 crores (Rs. 100 crore from the assessment year 2021-22) in the previous year relevant to the assessment year for which deduction is claimed u/s 80-IAC (1).

- Such eligible start-up (company and LLP) holds a certificate of eligibility from the authority (Inter-Ministerial Board of Certification) as notified by Central Government.

Quantum of Deduction

- The assessee shall be allowed 100% deduction of profits and gains of such business for 3 consecutive years out of five years, (7 years for the assessment years 2018-19 to 2020-21),(10 years from the assessment year 2021-22) beginning from the year in which the eligible start-up is incorporated.

- Eligible Business means a business carried out by an eligible start-up engaged in innovation, development or improvement of products or processes or services or a scalable business model with high potential of employment generation or wealth creation.

Deduction in Respect of Profits and Gains from Business of Hotels and Convention Centers in Specified Area (Section 80 ID)

Eligibility: This deduction is allowed to an assessee whose gross total income includes the profit and gain derived from business of a hotel located in National Capital Territory of Delhi.

Conditions for deduction

- Deduction under this Section is subject to the fulfillment of the following conditions:

- An existing business should not be spitted or reconstructed to avail this deduction.

- No existing building previously used as hotel or convention Centre (as the case may be) should be transferred to form such new eligible business.

- Machinery or plant previously used for any purpose should not be transferred to form such new eligible business.

- Return of Income is submitted before the due date u/s 139 (i).

- Audit report should be submitted along-with the return of income.

- The benefit of deduction under this Section is allowed to the business of hotel (2, 3, 4 stars) in the specified area provided that it is constructed and has started working during the period between April 1, 2007 to July 31, 2010.

- This deduction is also applicable to the business of hotels (2, 3, 4 star) situated in the specified districts having a world heritage site provided that it has started working during the period between April 1, 2008 to March 31, 2013.

- If the business of building, owning and operating a convention Centre in specified area is carried out and such convention Centre is constructed during the period between April 1, 2007 to July 31, 2010.

Quantum of Deduction

The assessee shall be allowed 100% deduction of profits earned from above mentioned businesses for 5 consecutive assessment years beginning from the initial assessment year.

Deduction in Respect of Certain Undertakings Carrying Business in North-Eastern States (Section 80-IE)

Eligibility: This deduction is available to an assessee whose gross total income includes any profits and gains derived from certain undertakings established in North-Eastern States. It covers eligible services like hotels, business training institutes, nursing homes, hardware units, and training centers relating to IT.

Conditions for deduction

- The undertaking should be formed without splitting up or reconstruction of any existing business and without using more than 20% old plant and machinery (or total value of machinery in new business) in any of the North-Eastern States.

- The assessee should commence its operation of manufacturing or producing or substantial expansion to manufacture or produce or carry on any eligible business between the period 1st April, 2007 and March 31, 2017.

- This deduction is allowed subject to the condition of furnishing Income-Tax Return u/s 139 (1) along-with an audit report.

Quantum of Deduction

- The assessee shall be eligible for 100% deductions of profits and gains of such eligible business for 10 consecutive assessment years commencing from the previous year of manufacture or production or substantial expansion.

Deduction in Respect of Profits and gains from Business for Collecting and Processing of Bio-Degradable Waste (Section 80 JJA)

Eligibility: This deduction is allowed for the above type of business only and is not allowed if such activity is carried out by job work customers.

Conditions for deduction

- This deduction is disallowed if not claimed in the return of income.

Quantum of Deduction

- An assessee is allowed a 100% of deduction (for a period of 5 consecutive assessment years commencing from the previous year of commencement of business) from such gross total income that includes any profit and gains of the business of collecting and processing or treating of bio-degradable waste for generating power or producing biofertilizers, bio-pesticides, or other biological agents or for producing biogas, making pallets or briquettes for fuel or organic manure.

Deduction in Respect of Employment of New Regular Workmen (Section 80 JJ-AA)

Eligibility: An assessee whose books of accounts are subject to audit u/s 44 AB of the income tax act and whose gross total income includes profits and gains derived from that business is eligible.

Conditions for deduction

Such deduction is available to assessee on the fulfillment of the following conditions:

- Business is not formed through splitting up or by way of reconstruction of an existing business.

- Business has not come into existence by way of acquisition or transfer or as a result of any business reorganization.

- Return of income should accompany an audit report of a chartered accountant.

Quantum of Deduction

- The deduction of 30% of new (additional) employee cost for 3 assessment years commencing from the assessment year relevant to the previous year in which such new employment is given.

Note: For a detailed study of this deduction (Section 80 JJAA), refer to the Income Tax Act.

Deduction in Respect of Certain Income of Offshore Banking Units and International Financial Service Center (Section 80 LA)

Eligibility

- If an assessee is a Scheduled Bank or a Foreign Bank, having a unit of offshore banking in a Special Economic Zone (SEZ) or a unit of International Financial Services and the Gross Total Income of such assessee includes: (i) Any income from the offshore banking unit in SEZ (ii) Any income from a business with an undertaking located in SEZ or any other undertaking which develops, operates and maintains a SEZ. (iii) Any income from any unit of the international financial services center from its business for which it has been approved for setting up such a center in a SEZ.

Conditions for deduction

- Deduction under this Section is available only when it is claimed in the return of income. ii) The above income should be earned in Convertible Foreign Currency. iii) The assesse shall have to submit a certificate of a chartered accountant in a prescribed form with the return of income certifying that the deduction has been claimed correctly.

Quantum of Deduction

- A 100% deduction of the aforesaid income is allowed for 5 consecutive assessment years beginning with the assessment year relevant to the previous year in which permission for the aforesaid business was obtained and thereafter 50% (100% from the assessment year 2024-25) of such income for 5 consecutive assessment years.

- From the assessment year 2020-21, deduction (in the case of a unit of the international financial services center) shall be 100% for any 10 consecutive years (out of 15 years beginning with the year in which the necessary permission is obtained).

Note: 1) Offshore banking means a branch of a bank located in a Special Economic Zone and which has obtained the permission under clause (a) of sub-Section (1) of Section 23 of Banking Regulation Act, 1949. 2) An international financial service means International Financial Service Center which has been approved by the Central Government under sub-Section (1) of Section 18 of Special Economic Zone, 2005.

Deduction in Respect of Co-operative Societies (Section 80-P)

- Under this Section, 100% deduction shall be allowed for certain specified income of a co-operative society, engaged in specified activities subject to the condition that such income of the Society is included in the Gross Total Income of the Society.

- 100% deduction is available from the profits and gains of Co-operative Societies carrying business of banking, cottage industry, marketing of agricultural produce (grown by members), purchase of articles (seeds, livestock etc.) for members, processing of members agriculture produce providing collective disposal of the labour of its member, fishing and allied activities, and primary societies business of supply of milk, fruits/vegetable and oilseeds.

- In case of Consumer Co-operative Society, a deduction of up to Rs. 1,00,000 is allowed, while in any other case it is Rs. 50,000.

Deductions in Respect of Royalty Income

Deduction in Respect of Royalty Income of Authors of Certain Books other than Textbooks (Section 80 QQB)

Eligibility: This deduction is available to resident authors and co-authors who have been paid royalty in respect of the copyright of books.

Conditions for deduction

- The manuscript of the book should be of a literary, artistic, or scientific nature.

- The term 'Book' shall not include guides, magazines, newspapers, journals, or textbooks for schools.

- If the royalty is not paid in a lump sum and is based on a percentage, and the rate of royalty is more than 15% of the value of books during the year, a deduction from Gross Total Income shall be allowed at 15%.

- The deduction is not available unless it is claimed in the return of income.

- No such deduction is allowed unless the assessee furnishes a certificate in the prescribed form (Form No. 10CCD) from the prescribed authority along with the return of income.

- When any royalty income is earned from outside India, then only the amount brought into India by or on behalf of the assessee in convertible foreign exchange within a period of six months from the end of the previous year in which such income is earned or within such further period as the competent authority may allow will be considered for this section. No deduction is allowed unless the assessee furnishes a certificate in the prescribed form (Form No. 10H) along with the return of income.

Quantum of Deduction

- A deduction of 100% of such royalty income or Rs. 3,00,000, whichever is less, shall be allowed under this Section.

Deduction in Respect of Royalty on Patents (Section 80 RRB)

Eligibility: This deduction is allowed to that individual who is a resident in India and is a patentee.

Conditions for deduction

- The patent should be registered on or after 1st April 2003 under the Patents Act, 1970.

- The assessee must have brought such income (Convertible foreign exchange) into India within six months from the expiry of the previous year.

- When any royalty income is earned from outside India, then only the amount brought into India by or on behalf of the assessee in convertible foreign exchange within a period of six months from the end of the previous year in which such income is earned or within such further period as the competent authority may allow will be considered for this section.

Quantum of deduction

- A deduction of 100% of such income or Rs. 3,00,000, whichever is less, is allowed under this Section.

Deduction In Respect Of Saving Bank A/c Interest (sections 80 Tta And Ttb)

The provisions relating to Section 80 TTA are as follows:

- If an assessee (Individual or HUF) earns interest income up to Rs. 10,000/- on a saving bank deposit account in a Bank, cooperative society (carrying on the business of banking), or post office, the whole of such income or Rs. 10,000/- in aggregate, whichever is less, shall be allowed as a deduction. The deduction regarding this interest income of up to Rs. 10,000/- shall not be allowed to senior citizens or very senior citizens.

- If the assessee has a post office saving bank account (single operation), a deduction of Rs. 3,500/- shall be admissible, and if such a post office saving bank account is in (Joint operation), the deduction amount shall be Rs. 7,000/-. These deductions will have no relation to the admissible deduction of Rs. 10,000/-. This means the aforesaid deductions shall be in addition to Rs. 10,000/-.

Deduction In Respect Of Interest On Deposits Of Senior Citizens (section 80 Ttb)

An assessee who is a Resident Senior Citizen (60 years & above at any time during the year) can claim a deduction of the whole of the interest income from (Bank, cooperative society engaged in banking business, or post office) or Rs. 50,000/- in aggregate (whichever is less) from his gross total income from FY (2018-2019) AY (2019-2020). With the introduction of Section 80 TTB exclusively for senior citizens, no deduction shall be allowed to them (Senior Citizens) under Section 80 TTA.

Eligibility: A resident assessee with a disability (Not less than 40%) duly certified by a medical authority by issuing a certificate of disability is entitled to this deduction, disability may be at any time during the previous year.

Conditions for deduction: The assessee shall have to submit a certificate in a prescribed form along with his return of income duly certified by a medical authority.

Quantum of Deduction

- A deduction of Rs. 75,000, in case of a person with a disability and Rs. 1,25,000, in case of a person with a severe disability. Disability is considered severe if it is 80 % or above.

Note: Where the condition of disability requires reassessment of its extent after a period stipulated in the aforesaid certificate, no deduction under this Section shall be allowed for any assessment year relating to any previous year beginning after the expiry of the previous year during which the aforesaid certificate of disability had expired, unless a new certificate is obtained from the medical authority in the prescribed manner, along with the copy of return of income u/s 139.

|

196 videos|219 docs

|

FAQs on Deductions from Gross Total Income - 2 - Commerce & Accountancy Optional Notes for UPSC

| 1. What are the deductions available for economic growth in income tax? |  |

| 2. How can individuals claim deductions for royalty income in income tax? |  |

| 3. What is the maximum deduction allowed for interest on deposits of senior citizens under section 80TTB? |  |

| 4. Are there any specific conditions to be met in order to claim a deduction for savings bank account interest under section 80TTA? |  |

| 5. Can individuals claim deductions for both savings bank account interest and interest on deposits of senior citizens in the same financial year? |  |