Salaries - 3 | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Provident Fund Schemes |

|

| Tax Treatment of Provident Funds |

|

| Certain Other Aspects of Taxable Salary |

|

| Deduction under Section 80C |

|

Provident Fund Schemes

A provident fund is a financial mechanism designed to provide for an individual's future needs, particularly after retirement or in the event of death. It involves regular contributions from both the employee and the employer, with the funds typically invested in government securities to earn interest. The accumulated amount is then given to the employee upon retirement or voluntary retirement and to their legal heirs in the event of their death.

There are various types of provident funds:

- Statutory Provident Fund: Established under the Provident Fund Act, 1925, this fund is maintained by government and semi-government departments, financial institutions like the Reserve Bank of India and the State Bank of India, railways, statutory corporations, universities, colleges, and local bodies.

- Recognized Provident Fund: This fund is recognized by the Commissioner of Income Tax in accordance with the rules outlined in the Fourth Schedule of the Income Tax Act, 1961. It includes provident funds established under the Employees Provident Fund Act, 1952, and is crucial for tax purposes. If a provident fund is recognized by the Provident Fund Commissioner but not by the Commissioner of Income Tax, tax concessions cannot be extended to the contributions to such a fund.

- Unrecognized Provident Fund: This fund is not recognized by the Commissioner of Income Tax and therefore does not receive tax relief. It is typically maintained by private employers.

- Public Provident Fund (PPF): This scheme, introduced by the central government, is aimed at encouraging savings, particularly for self-employed individuals such as doctors, lawyers, accountants, actors, and traders. It allows individuals and associations of persons to deposit funds, with accounts being opened at specified branches of nationalized banks and the State Bank of India. The minimum subscription amount is Rs. 500, and the maximum is Rs. 1,50,000 per year. Interest is credited annually but is payable only at maturity, which occurs after 15 years. The entire amount, along with interest, is tax-exempt upon maturity, and the account can be extended for another 5 years. Non-resident Indians and Hindu Undivided Families (HUFs) are not eligible for this account.

- Approved Superannuation Fund: This fund is approved by the Commissioner of Income Tax and is intended solely for providing annuities to employees upon retirement after a specified age or upon incapacitation prior to retirement, or for the widows or dependents of such employees in the event of their death.

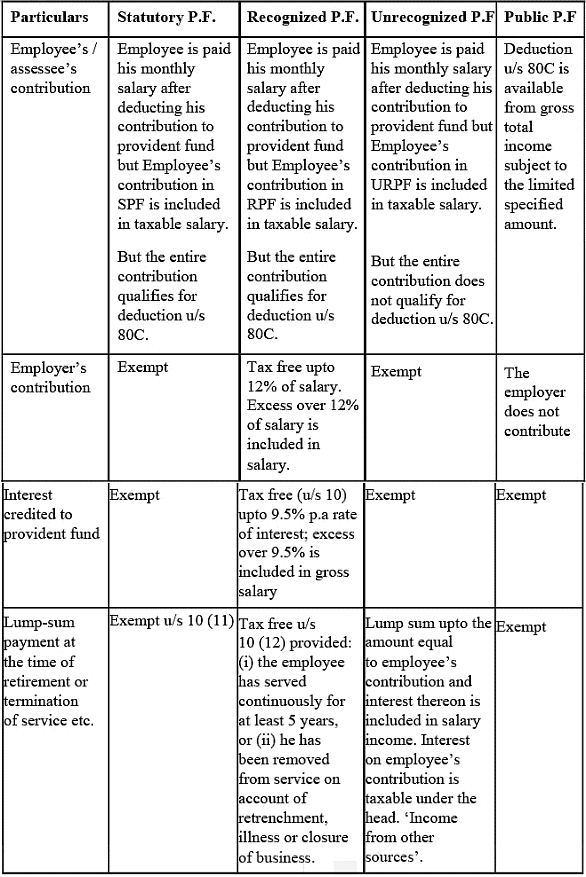

Tax Treatment of Provident Funds

The tax exemptions related to these funds are as follows:

- Employer's contribution is tax-exempt.

- Employee's contribution is eligible for deduction under section 80C.

- Interest on the accumulated balance is tax-exempt.

Provisions of Provident Funds

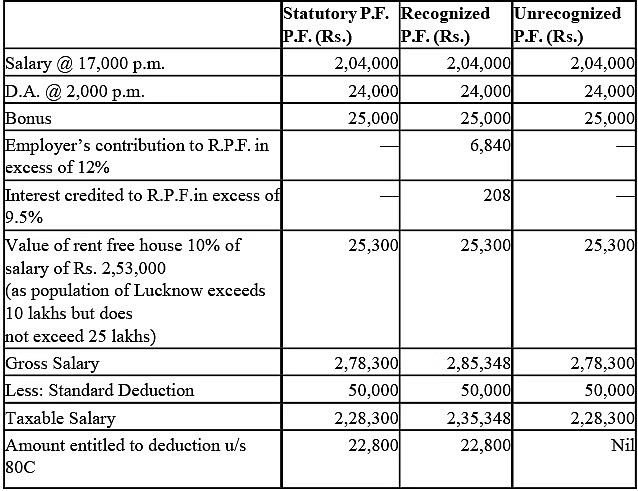

Illustration 1: Mr. Gaurav Modi is employed in Khadi Samiti in Lucknow. He is in receipt of a salary of Rs. 17,000 p.m. and a dearness allowance of Rs. 2,000 p.m. He contributes 10% of his salary and dearness allowance to a provident fund to which Khadi Samiti contributes 15%. He is provided with a rent free unfurnished house by his employer. He received Rs. 25,000 as bonus during previous year. The interest credited to his provident fund @ 12% amounted to Rs. 1,000. Compute taxable income of Mr. Gaurav Modi for the assessment year 2023-24, if the P.F. in question is (i) Statutory (ii) Recognized or (iii) Unrecognized. On what amount the assessee is entitled to deduction u/s 80C.

Computation of Taxable Income of Mr. Gaurav Modi for AY 2023-24

Note: Calculation of Recognized P.F.

Employer’s contribution RPF = 2, 28,000 (Salary + D.A.)

Assessee is entitled to deduction u/s 80C, upto a maximum amount of Rs. 1,50,000 in respect of his contribution to statutory or recognized provident fund, i.e. 10% of his salary and D.A., say Rs. 22,800. He is not entitled to deduction u/s 80C in respect of his contribution to unrecognized provident fund.

Salary = Basic Pay + D.A+ Bonus = 2,04,000+ 24,000+25,000 = Rs. 2,53,000

Certain Other Aspects of Taxable Salary

When calculating taxable income from salary, we must consider the following aspects of salary:

- Waivers of Salary: Once salary accrues to an employee, it becomes taxable under Section 15. Even if the employee waives their right to receive payment, it will be considered as a mere application of their income, and their tax liability will remain unaffected.

- Surrender of Salary: If an employee surrenders their salary to the central government under Section 2 of the Voluntary Surrender of Salaries, the surrendered salary will be excluded when computing their salary income.

- Tax-Free Salaries: An employer can choose to pay the tax on behalf of the employee and not deduct the same from the employee's salary. However, while computing the employee's income, the tax paid by the employer will be added to the salary income of the employee.

|

Download the notes

Salaries - 3

|

Download as PDF |

Deduction under Section 80C

Section 80C allows certain investments and expenditures to be tax-exempt. This deduction is available to individual or Hindu Undivided Family (HUF) taxpayers (assessees) for specified qualifying amounts paid or deposited during the previous year.

Gross Qualifying Amount: The deductions available under section 80C include:

- Life Insurance Premium

- Deferred Annuity

Contributions to Provident Fund, Public Provident Fund, and certain shares and debentures

- Eligibility of Assessee: This deduction is allowed only to individuals or Hindu Undivided Families (HUFs) from their gross total income computed as per the provisions of the Act.

- Deduction Limit: The deduction for the following savings/investments cannot exceed Rs. 1,50,000:

- Life Insurance Premium: The premium paid by an assessee on their life, their spouse's life, and their children's lives, as well as contributions to employee insurance plans, joint life premiums, and group insurance.

- Deferred Annuity: Payments for a deferred annuity on the life of the assessee, their spouse, or their children.

Contributions to Statutory Provident Fund, Recognized Provident Fund, and Public Provident Fund.

- Payment under Unit Linked Insurance Plans (ULIPs).

- Amounts deducted from a government employee's salary for deferred annuities or provisions for their wife and children (restricted to 1/5th of salary).

- Contributions to Approved Superannuation Funds.

- Contributions to Notified Central Government Securities or Deposit Schemes.

- Reinvestment of accrued interest on National Saving Certificates (NSCs).

- Deposits in National Housing Schemes or contributions to pension funds.

- Contributions to Mutual Funds established under section 10(23D) or Equity Linked Saving Schemes of Unit Trust of India.

- Tuition fees for children's education.

- Sukanya Samridhi accounts for girl children.

- Payments made for annuity plans of the Life Insurance Corporation or any other insurer.

For Hindu Undivided Families (HUFs), the following payments in the previous year qualify for deduction under section 80C:

- Premiums paid on life insurance for any family member.

- Contributions to Public Provident Fund.

- Contributions to Notified Central Government Securities or Deposit Schemes.

- Contributions to Mutual Funds established under section 10(23D).

- National Saving Certificates.

- Accrued interest on NSCs.

- Deferred Annuity payments.

- Contributions to deposit schemes provided by public sector companies or authorities established for solving residential problems or development.

- Payments for the purchase or construction of a new residential house.

- Stamp duty, registration fees, and other transfer expenses for house property.

- Contributions to National Housing Bank Deposit Schemes or pension funds.

- Contributions to Mutual Funds established under section 10(23D) or Equity Linked Saving Schemes of Unit Trust of India.

- Investments in term deposits.

- Payments for Sukanya Samridhi accounts.

- Payments for annuity plans of the Life Insurance Corporation or any other insurer.

Note:

- Investments/deposits are qualified on a payment basis under section 80C, meaning that the amount paid is eligible for deduction, whether the payment is related to the last year or the next year.

- If joint life premiums are paid on the life of the assessee, their spouse, or their children, the deduction is admissible. However, if the joint life policy involves outsiders, no such deduction is allowed.

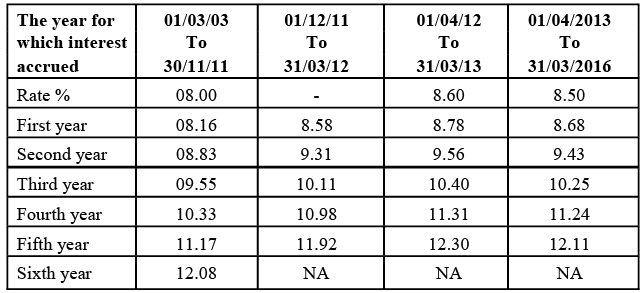

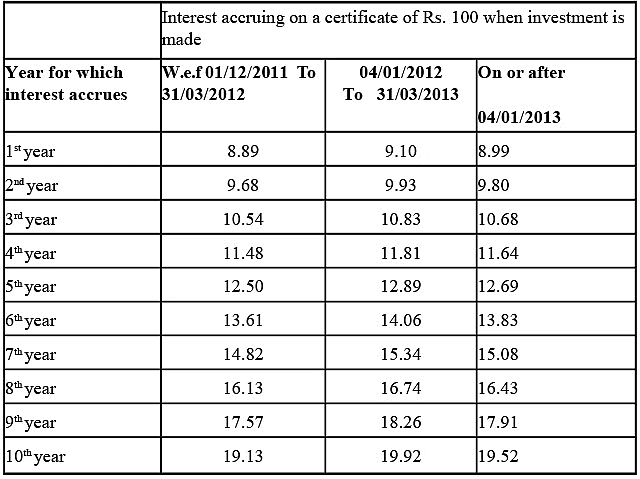

Interest Table accrued on N.S.C. (VIII Issue) Interest accruing on a certificate of Rs. 100

Interest accruing on a certificate of Rs. 100

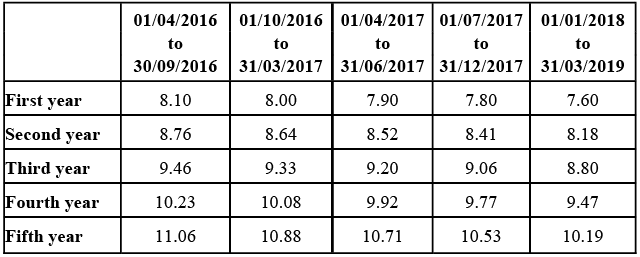

NSC IX ISSUE

The table shows the amount of interest accrued at the end of each year:

Important Note: National Saving Certificates VIII issue mature after 5 years. The accrued interest of the 5th year is not treated as reinvested. Hence, no deduction under Section 80C is allowed on this interest from the 5th year.

Cancellation of Deduction under Section 80C: Under the following circumstances, the deduction shall be cancelled:

- If the life policy is terminated on notice or due to non-payment of premium after two years of paying premiums, the premium of that year will not be eligible for deduction under Section 80C. The amount previously deducted under this section shall be added to the income of the assessee.

- If contributions to a policy or fund are stopped before 5 years, the deduction will not be allowed in the year of closing. The deduction previously allowed on such contributions shall be included in the income in the year of its closing.

- If an assessee has received a deduction under Section 80C for a loan taken for the purchase or construction of a residential house and sells that house within 5 years, the previously availed deduction shall be cancelled. This cancelled deduction shall be included in the taxable income of the year in which it is cancelled.

- If an assessee has received a deduction under Section 80C by purchasing shares or debentures of an infrastructure company and sells them within 3 years of the purchase date, the previously availed deduction will be cancelled. Such a deduction shall be included in the income of the year in which it is cancelled.

|

180 videos|153 docs

|

FAQs on Salaries - 3 - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the tax treatment of Provident Fund schemes? |  |

| 2. Can employers contribute to employees' Provident Fund accounts? |  |

| 3. Are withdrawals from Provident Fund accounts taxable? |  |

| 4. How can employees claim deductions under Section 80C for Provident Fund contributions? |  |

| 5. Are there any other aspects of taxable salary related to Provident Fund schemes that employees should be aware of? |  |