Class 10 Exam > Class 10 Notes > Economics for GCSE/IGCSE > Definitions & Measurement

Definitions & Measurement | Economics for GCSE/IGCSE - Class 10 PDF Download

Inflation & Deflation

- Inflation signifies a sustained rise in the overall price level of goods and services within an economy.

- The general price level is gauged by monitoring prices of a 'basket' of goods and services typically purchased by an average household each month.

- This assortment is converted into an index known as the Consumer Price Index (CPI).

- The UK maintains an inflation target of 2% annually.

- Low inflation is preferable to no inflation, as it serves as an indicator of economic growth.

- Deflation arises when there is a decline in the overall price level of goods and services within an economy.

- Deflation occurs only when the percentage change in prices drops below zero percent.

Using the Consumer Price Index (CPI) to Measure Inflation & Deflation

- Inflation is the continuous rise in the overall price level of goods and services within an economy.

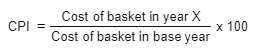

- The inflation rate signifies the fluctuations in general price levels over a specific period. It is typically calculated using an index with 100 designated as the base year.

- For example, if the index is 100 in year 1 and 107 in year 2, the inflation rate is 7% (107 - 100 = 7%).

- The Consumer Price Index (CPI) acts as a tool to gauge inflation trends and variations in price levels over time.

- A 'household basket' comprises 700 goods and services that an average family typically buys annually.

- Every year, a household expenditure survey is conducted to ascertain the basket's contents, with items being added or removed as spending patterns change.

- The goods and services in the basket are assigned weights based on how much households typically spend on them. For instance, food, being a higher expenditure, has a greater weight than shoes.

- On a monthly basis, prices of these items are collected from various locations nationwide, and their averages are calculated.

- The price of each item is multiplied by its weight to determine its contribution to the overall basket price.

- By summing up these values, the total cost of the 'basket' is computed.

- The inflation rate between two periods is derived from the percentage difference in CPI values for those periods.

Question for Definitions & MeasurementTry yourself: What is inflation?View Solution

The document Definitions & Measurement | Economics for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Economics for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

57 videos|110 docs|40 tests

|

FAQs on Definitions & Measurement - Economics for GCSE/IGCSE - Class 10

| 1. How is inflation measured using the Consumer Price Index (CPI)? |  |

Ans. The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It is calculated by comparing the current prices of the items in the basket to their prices in a base period.

| 2. What is the difference between inflation and deflation? |  |

Ans. Inflation refers to a general increase in prices, leading to a decrease in the purchasing power of money. Deflation, on the other hand, is the opposite - a general decrease in prices, which can potentially lead to economic stagnation.

| 3. How does inflation impact the economy? |  |

Ans. Inflation can have both positive and negative impacts on the economy. Mild inflation can encourage spending and investment, while hyperinflation can erode savings and disrupt economic stability.

| 4. How does the government use the CPI to make policy decisions? |  |

Ans. The government uses the CPI to adjust various benefits, such as Social Security payments, tax brackets, and cost-of-living adjustments. It also helps policymakers gauge the overall health of the economy and make decisions accordingly.

| 5. What are some ways individuals can protect themselves from the effects of inflation? |  |

Ans. Some strategies to protect against inflation include investing in assets that tend to increase in value over time, such as real estate or stocks, and diversifying your investment portfolio to reduce risk. Additionally, investing in inflation-protected securities can help safeguard against the erosion of purchasing power.

Related Searches