The Hindu Editorial Analysis- 18th October 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

A modified UBI policy may be more feasible

Why in News?

The idea of a Universal Basic Income (UBI) keeps surfacing from time to time. A recent report by the International Labour Organization talks about how jobs growth has been lagging globally due to automation and Artificial Intelligence, and notes the massive problem of youth unemployment in India. The phenomenon of jobless growth, where productivity rises but job creation lags and contributes to the alarming trend in inequality, has rekindled interest in a UBI as a component of a social safety net across the world.

About Universal Basic Income (UBI)

Universal Basic Income (UBI)

Universal Basic Income is a social and economic policy where every citizen gets a regular payment from the government. This payment is given to everyone, no matter their job situation or how much money they have.

Aim

The main goal of UBI is to offer financial security and help reduce poverty. By ensuring that everyone receives a basic amount of money, it aims to create a safety net for all individuals.

Key Features

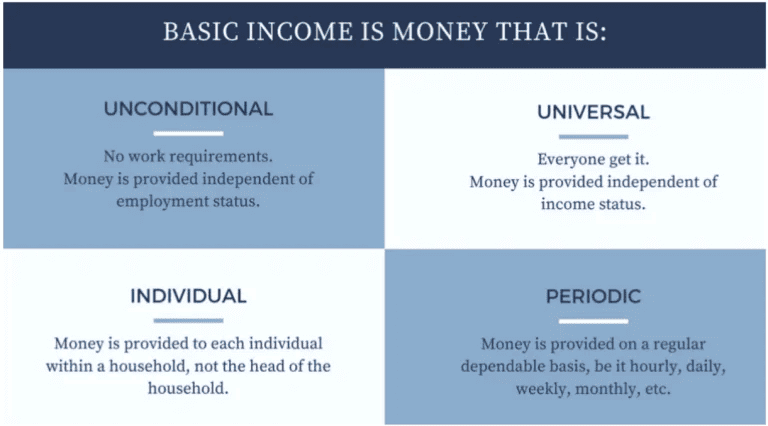

- Unconditional: UBI is provided to everyone without any requirements, such as needing to have a job or a certain level of wealth.

- Universal: All citizens can receive UBI, regardless of their financial situation.

- Regular and Recurring: Payments are usually made on a consistent schedule, like every month or once a year.

- Cash Payments: UBI is given in cash, not as goods or services (like food or housing help), allowing people to choose how to spend the money according to their own needs.

Need for Introducing Universal Basic Income in India

- Reducing Inequality: Universal Basic Income (UBI) can help lessen the financial gap between rich and poor by providing money to everyone, no matter their economic background.

- Employment Challenges for Young Women: According to the ILO's study, in 2024, nearly a third of young women (28.2%) worldwide will not be in jobs, school, or training, which is twice the rate for young men (13.1%).

- Safety Net for Workers: About 80% of India’s workforce is in the informal sector, which lacks job security and benefits. UBI can offer these workers financial support.

- Inefficient Welfare Programs: India has a complicated welfare system that often suffers from inefficiency, corruption, and poor targeting. UBI could simplify this by giving direct cash payments to everyone, reducing the need for middlemen and cutting down on lost funds.

- Entrepreneurship and Innovation: By offering a basic income, UBI could encourage people to take risks, like starting a business or going back to school, without the worry of falling into poverty.

- Agrarian Distress: UBI could help farmers who are facing financial troubles from low income, debts, and failed crops, providing a safety net during tough times.

- Supporting Women and Vulnerable Groups: UBI could give women, especially those in rural and low-income families, direct cash payments, enhancing their financial independence and ability to make decisions.

- Migration and Rural Poverty: UBI could help reduce poverty in rural areas and decrease the movement of people from villages to cities, ensuring they have some economic stability where they live.

Implementing a Universal Basic Income (UBI) in India poses several challenges

- High Cost: India has a big population, and giving every citizen a basic income would need a lot of money.

- For Example: According to the Economic Survey of 2016-17, a Universal Basic Income (UBI) of Rs. 7,620 per year for each person in India would cost about 4.9% of the country's GDP.

- Universal vs. Targeted: A universal system might waste money on people who don’t need it, while a targeted system could lead to problems like missing out on the people who truly need help, similar to issues seen in current welfare programs.

- Price Rise: Putting a lot of cash into the economy could cause inflation, especially for food and essential items.

- This inflation could reduce the positive impacts of UBI for poor people, who would be most affected by rising prices.

- Unequal Access: If UBI is not designed carefully, it might not solve gender inequality issues.

- In patriarchal families, men could have more control over the money, leaving women out.

- Dependency Risk: Some worry that UBI could create a dependence on the basic income, leading people to rely on it instead of working or improving their situation through education or jobs.

- Labour Market Distortion: Critics believe that a guaranteed income might lower the motivation to work, which could harm labor-intensive sectors like agriculture and informal jobs, which are crucial in India’s economy.

Global Precedents

- Finland: Finland completed a study on the effects of Universal Basic Income (UBI) for unemployed people. This experiment started in January 2017.

- Canada: Previously, Canada announced a plan to try out a type of unconditional income guarantee. They included participants from three areas in the province, providing them with a guaranteed income for up to three years.

- Netherlands: Several cities in the Netherlands have begun their own local trials for Universal Basic Income.

Way Forward for Implementing Universal Basic Income in India

A careful, step-by-step, and well-thought-out plan is essential for a successful rollout.

- Localized Experiments: Initiating pilot programs in different areas of India, similar to successful examples from other countries like Finland and Canada, can help determine how UBI might work here.

- The government should prioritize gathering detailed information to evaluate how UBI impacts poverty reduction, spending habits, inflation, and workforce participation.

- Targeted Implementation Initially: Instead of applying UBI to everyone right away, the government could first target those who need it most, such as small farmers, informal workers, women, and marginalized groups.

- This approach would lessen the financial strain while providing immediate aid to those in greatest need.

- Rationalize Existing Subsidies: Streamlining welfare programs that overlap could help free up funds for UBI.

- Tax Reforms: The government might consider new revenue sources, like wealth taxes or carbon taxes, to sustainably support UBI without increasing the budget deficit.

- Monetary Policy Coordination: The Reserve Bank of India (RBI) needs to work with the government to control inflation that could result from cash transfers.

- Distributing UBI payments gradually instead of in large amounts could help minimize the risk of inflation, especially for essential goods and services.

- Aadhaar and Direct Benefit Transfers (DBT): Strengthening India’s existing systems like Aadhaar and DBT can ensure that cash transfers to beneficiaries are efficient, transparent, and reduce corruption and waste.

- Linking UBI with Economic Empowerment: Past efforts in the mid-2000s showed that giving money without any work can create divisions in society and undermine dignity.

- It’s important to provide job opportunities to avoid feelings of isolation and negative labels for those unemployed.

- This will motivate people to use the financial stability from UBI to pursue education, start businesses, and engage in productive activities.

Conclusion

- By learning from experiences around the world,

- using technology effectively,

- and addressing the specific challenges of India’s varied economic and social landscape,

- Universal Basic Income (UBI)can be introduced in a way that:

- strengthens the welfare system of the country,

- while also minimizing risks.

|

38 videos|5288 docs|1117 tests

|

FAQs on The Hindu Editorial Analysis- 18th October 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is Universal Basic Income (UBI) and how does it work? |  |

| 2. What are the potential benefits of a modified UBI policy? |  |

| 3. What challenges might arise in implementing a modified UBI policy? |  |

| 4. How could a modified UBI policy be funded? |  |

| 5. What lessons can be learned from UBI trials conducted in different countries? |  |