UPSC Mains Answer PYQ 2021: Economics Optional Paper 1 (Part - 1) | Economics Optional Notes for UPSC PDF Download

Q1(a): Compare and contrast Marshallian and Walrasian approaches of the stability in equilibrium.

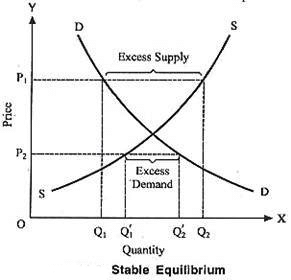

Ans: Walrasian Approach is price adjustment approach while Marshallian Approach is quantity adjustment approach.

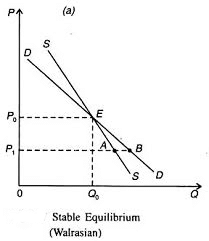

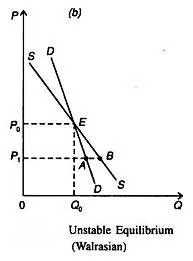

Walrasian Stability Condition:

Let us assume, at given price if Quantity demanded (Qd) < Quantity Supplied (Qs) supplier reduces price and if Qd> Qs supplier increases prices. Under this condition Walrasian equilibrium is stable if above equilibrium price Qd < Qs and below equilibrium price Qd > Qs. Marshallian Stability Condition:

Marshallian Stability Condition:

Let us assume, at given quantity if demand price (Pd) > supply price (Ps) supplier increases output and if Pd < Ps supplier reduces output. Under this condition Marshallian equilibrium is stable if on left of equilibrium output Pd > Ps and on right of equilibrium output Pd < Ps. Stable Walrasian and Unstable Marshallian

Stable Walrasian and Unstable Marshallian

Stable Marshallian and Unstable Walrasian

NOTE :There could be multiple cases of stability and instability but in exam neither you have space not time so restict yourself.

Q1(b): Using generalised Lorenz dominance show that lower inequality represents a higher social welfare state.

Ans: If one generalized lorenz curve (GL1) lies above another (GL2) in at least some portion and no where it lies below the other then GL1 dominates GL2 and this is called generalized lorenz dominance.

Sen’s welfare function is given as follow:

W1 = µ1 * (1 – G1) and W2 = µ2 * (1 – G2) where u1 & u2 is per capita income and G1 & G2 is Gini coefficient. If W1 > W2 then W1 represents a higher social welfare state.

We know G (gini coefficient) is the ratio of area between the diagonal and the lorenz curve to the area below the diagonal. So 1 – G = ratio of the area below the lorenz curve to the are below the diagonal.

Consider a generalized lorenz curve. Area below the diagonal in such a curve = 0.5 * base * height = 0.5 * µ (since base = 1 and height = µ). So µ * (1 – G) = 2 * area below a generalized lorenz curve.

This means that every W = µ * (1 – G) can be represented as a generalized lorenz curve. So if W1 > W2 it means that area below the generalized lorenz curve of W1 (GL1) > area below the generalized lorenz curve of W2 (GL2). Now it will always be possible to construct at least one set of generalized lorenz curve in a way that GL1 will dominate GL2 .

According to Shorrock’s theorem, for the same preferences and strict concavity of individual utility functions, if a generalized lorenz curve GL1 dominates another generalized lorenz curve GL2 then GL1 represents a higher social welfare state. Now invoking Shorrock’s result we can see that GL1 represents a higher state of welfare than GL2 and thus W1 represents higher welfare than W2.

Q1(c): Examine the relationship between business cycle and changes in autonomous expenditure.

Ans: Autnomous expenditure is level of expenditure which is not determined by the level of income. It depends on interest rate, economic situation, expected income, etc.

Real Business Cycle and Autnomous Expenditure:

Lets say goal of economic agent is to maximize his utility in each period of his life. He gets utility from two sources: consumption (C) and leisure (L).

Thus,

U = F(C, L)

Output in the model is generated by the production function

Y = z*F(K, N)

Where z represents shock to the economy. With positive shock income will increase and with negative shock income will decrease. Lets say there is positive economic shock.

Temporary Shock:

In case of temporary shock economic agents knows that this will not change future income. Thus, to allow higher consumption in future he will save.

Permanent Shock:

In case of permanent shock agent know that rise in income will last long. So his incentive to save would be reduced and his incentive to consume increased. Hence autnomous expenditure will also increase due to change in expected future income.

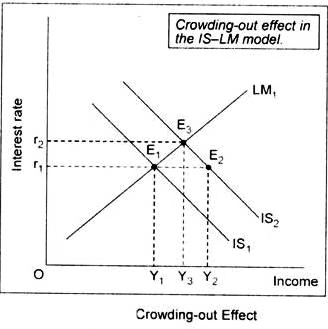

Q1(d): Does government borrowing always crowd out the private investment ? Illustrate.

Ans:In crowding out increase in public spending increases interest rate and thus drive outs private investment.

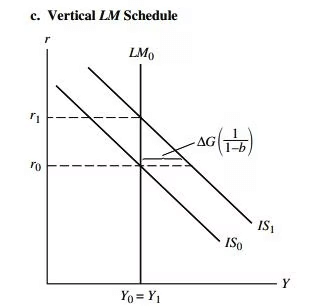

Complete crowding out:

Lets say money demand is completely interest inelastic. With rise in fiscal expenditure transaction demand for money increases there will be only one income at transaction demand is equal to money supply. Thus interest rate increases such that increases in government spending compensated by fall in private investment and consumption. No crowding out:

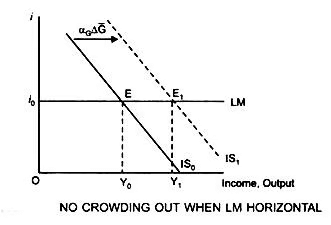

No crowding out:

When interest elasticity of money demand is infinitely elastic then rise in fiscal spending will have no effect on interest rate and thus no crowding out. Partial Crowding out:

Partial Crowding out:

When interest elasticity of money demand is in between completely inelastic and infinitely elastic then rise in fiscal spending will increase interest rate such that private investment is partially crowd out and there is rise in equilibrium income Thus, government borrowing not always crowd outs private investment.

Thus, government borrowing not always crowd outs private investment.

Q1(e): The slope of the IS schedule will become steeper if the government reduces the rate of proportional tax but will not change at all if the government reduces the level of a lump sum tax. True or false ? Explain.

Ans:IS curve gives relationship between income and interest rate at which goods market is in the equilibrium. For simplicity lets assume closed economy.

IS : Y = C + I + G

Lump Sum Tax Case:

C = a + bYd and

I = v – qr (Depends on interest rate)

Now Yd = Y – T (Lump Sum Tax)

Thus

(1-b)Y = a – bT + v – qr + G

Hence d(r)/d(Y) = -(1-b)/q

Thus change in lumpsum tax will not change slope of IS curve

Proportional Tax Case:

C = a + b*(1-t)*Y

Where t is proportional tax

(1- b + b*t)Y = a – b + v – qr + G

d(r)/d(Y) = -(1- b + b*t)/q

Hence reduction in t will flatten the curve.

Thus given statement is partially true and partially false.

Q2(a): Explain the differences between Cournot model of duopoly with similar product and differentiated product.

Ans:Cournot’s model is duopoly model. In Cournot each firm acts on the assumption that its competitor will not change its output irrespective of its decisions.

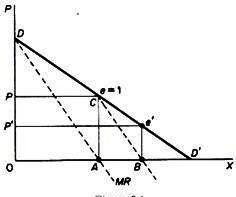

Cournot Model With Similar Produces:

Lets say firm A enter into market first. Then he will behave as monopoly and start selling quantity OA. Now firm B enters into market it will assume that A will keep producing OA. Hence it considers its own demand curve as CD’

With CD’ curve it maximizes output by producing AB. Now A will realize that price has fall. He will assume that firm B will keep producing same output. And adjust output accordingly. He will produce (Total output – Output of B)/2. Similarly By seeing rise in prices B will react assuming constant output of A. This pattern of action reaction continue till each firm produces equal output that is 1/3 rd of total output.

With CD’ curve it maximizes output by producing AB. Now A will realize that price has fall. He will assume that firm B will keep producing same output. And adjust output accordingly. He will produce (Total output – Output of B)/2. Similarly By seeing rise in prices B will react assuming constant output of A. This pattern of action reaction continue till each firm produces equal output that is 1/3 rd of total output.

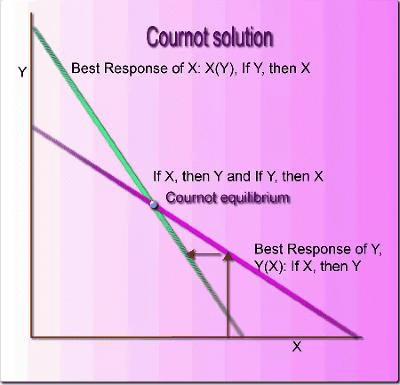

Cournot Model With Differentiated Product:

In case of differentiated product demand for the each firms will be different. Thus because of this case output for each firm will be different which was same in the case of similar Cournot model.

In case of similar product Cournot model they assumed same cost (due to similarity of product). However, in case of differentiated product cost may also vary due to differentiation.

Due to different demand function and possibility of cost differentiation reaction curve will be required to find out equilibrium. The reaction curve of a firm is the locus of points of highest profits that fir can attain, given the level of output of rival firm.

Interaction of reaction curve of both the firms will be equlibirum in the differentiated product Cournot Model.

Interaction of reaction curve of both the firms will be equlibirum in the differentiated product Cournot Model.

Q2(b): What type of conjecture is involved in the existence of kinked demand curve ? Do you think that kinked demand curve model is a price determination model in an oligopoly market ? Justify your answer.

Ans: In oligopoly theory, conjectural variation is the belief that one firm has an idea about the way its competitors may react if it varies its output or price.

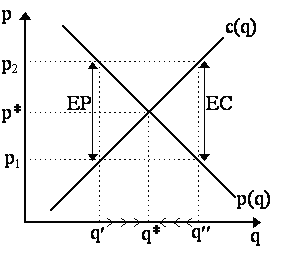

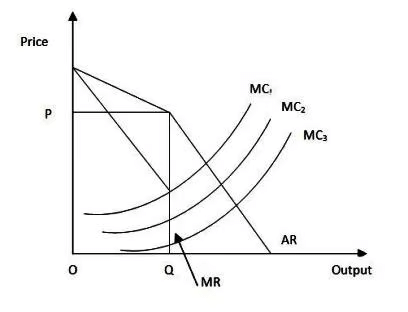

Conjectural Variation in Kinked Demand Curve

Lets say market is at equilibrium at price p* and quantity q*. Now if single firm decided to increase prices other firms may not follow it (This is conjecture). Thus firm increasing prices will loose its market share to the other firms. Hence demand curve is more elastic above price p*.If single firm decreases price, other firms will also follow it to prevent the loss of market share (This is conjecture). Hence demand curve is inelastic below price p*.

Lets say market is at equilibrium at price p* and quantity q*. Now if single firm decided to increase prices other firms may not follow it (This is conjecture). Thus firm increasing prices will loose its market share to the other firms. Hence demand curve is more elastic above price p*.If single firm decreases price, other firms will also follow it to prevent the loss of market share (This is conjecture). Hence demand curve is inelastic below price p*.

Kinked Demand Curve & Price Determination:

Kinked demand curve is not model of price determination. Kinked demand curve just explains price stickiness. However, it fails to explain to determine exact price and quantiy.

Also in the real world, prices are not static as suggested by Sweezy. Also firms may not try to maximize profit but to increase market share by price and non price competition. Due to advertisement a strong customer loyalty can be seen in that case firms can raise prices without loosing much market. Thus Sweezy’s demand curve is not providing satisfactory solution to price output decision under oligopoly.

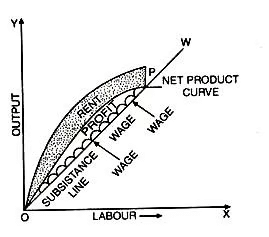

Q2(c): Examine how profit, wage and rent in Ricardian system move differently with the movements in level of income.

Ans: Ricardian system is classical theory of distribution.

Assumptions:

- Fixed supply of land.

- Law of diminishing returns applies on land.

- All workers are paid constant subsistence wages. (Malthusian theory)

- There is perfect competition.

- Profit is incentive for capital accumulation and capital accumulation for growth.

- There are two sectors of economy, i.e. agriculture and industry. In agriculture wages and output is same ie corn. In industry output is money good while wages are corn.

Model

Rent is surplus over the transfer earning of the land. Thus the difference between average product and marginal product is paid as rent to the landowners. Now remaining surplus has to be divided between labors and capitalist. There is constant subsistence wage rate thus labors are paid w*number of labors. Remaining is profit of capitalist.

Industry agriculture linkages:

Industry agriculture linkages:

At full mobility condition equilibrium is achieved when monetary rate of profit in industry is equal to the corn rate of profit in agriculture.

Capital Accumulation and stationary state:

With the profit and capital accumulation employment increases. Increased employment declines MP of labor and widens gap between MP and AP of labor. This increases share of rent. At constant wage level wage fund increases and profit decreases and thus capital accumulation. This continues till the zero level of profit is reached. Thus with the rise in income level profit share will decrease and that of rent will increase.

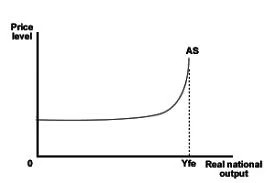

Q3(a): Show that differences in underlying expectation lead to differences in Keynesian and classical aggregate supply curve.

Ans: Supply curve explains relation between price and output in the economy.

Early Kenesian & Classical:

Early Keynesican proposed that supply curve is completely horizontal while classicals proposed that supply curve is completely vertical.

Classical Model: Classical assumed that

- Flexible money wages

- Flexible price level

- Labor market clears

With rise in demand and thus prices increases. At higher price level with constant money wages labor demand curve will shift rightward. However labor will immediately understand fall in real wages and thus labor supply curve will shift leftward (Change in money wages). Thus output will remain same and just prices will increase.

With rise in demand and thus prices increases. At higher price level with constant money wages labor demand curve will shift rightward. However labor will immediately understand fall in real wages and thus labor supply curve will shift leftward (Change in money wages). Thus output will remain same and just prices will increase.

Keynesian Model: On contarary to classical model Keynesian assumed

- Rigid money wages

- Constant price level

Due to constant price and wages supply curve will be horizontal till full employment level. After that it will become vertical (Prices will rise for same output).

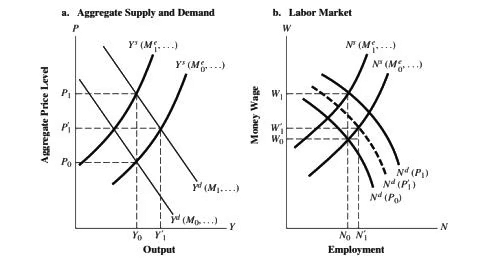

Later Kenesian & Classical

Adaptive Expectation Model: Later Keynesian assumed adaptive expectations which forms expectations from past experiences. According to the Keynesians fiscal policy affects short run national output and employment. However in long run labor perceives changed prices and initial levels of employment and output are restored at new price levels. Thus supply curve for them is upward rising in short run.

Rational Expectation Model:

Rational Expectation Model:

Later Classical (New Classical) assumed rational expectations. According to them labor and economic agents can predict the changes in the economy. They forms expectations based on all available information. Because of this even in short run labor changes its labor supply as response to change in the economy. Hence even in short run supply curve is vertical.

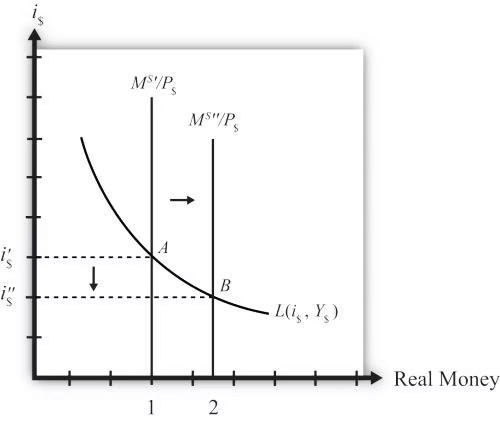

Q3(b): Apply the theory of liquidity preference to explain why an increase in money supply lowers the interest rate. What does this explanation assume about the price level ?

Ans: Liquidity preference is a Keynesian theory. It shows demand for money with the given interest rate. Keynes said that there are two motives to hold money. One for transaction purpose and other for speculation of future interest.

At low interest rate there is a chance of increasing interest rate and thus falling bond prices. At low interest rate if capital loss outweighs interest rate earned investor will prefer to hold money. It is called as speculative demand for money.

Thus Money Demand (Md) = F(Y,r)

In Equilibrium MS = Md = F(Y,r)

Rise In Money Supply:

With rise in money supply, MS > MD. To achieve equilibrium demand of the money should increase. Increase can be either through increase in transaction demand of money or speculative demand. But income and price level are constant so transaction demand will not change. Thus speculative demand of money should increase. Speculative demand can be increased if interest rate falls. Hence, with rise in money supply interest rate falls to increase speculative demand of money to match increase in money supply.

With rise in money supply, MS > MD. To achieve equilibrium demand of the money should increase. Increase can be either through increase in transaction demand of money or speculative demand. But income and price level are constant so transaction demand will not change. Thus speculative demand of money should increase. Speculative demand can be increased if interest rate falls. Hence, with rise in money supply interest rate falls to increase speculative demand of money to match increase in money supply.

Assumption About Price Level:

Here price level is assumed constant. Otherwise, transaction demand of money may have also changed. This might have kept interest rate unchanged.

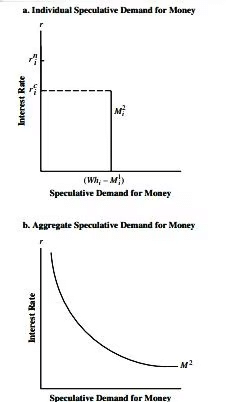

Q3(c): Explain how the weaknesses of Keynesian speculative demand for money have been identified in Regressive Expectations model.

Ans: Keynesian throry of money demand divides money demand in two parts. Keynes said that there are two motives to hold money. One for transaction purpose and other for speculation of future interest.

At low interest rate there is a chance of increasing interest rate and thus falling bond prices. At low interest rate if capital loss outweighs interest rate earned investor will prefer to hold money. It is called as speculative demand for money.

According to Keynes the demand for money refers to the desire to hold money as an alternative to purchasing an income-earning asset like a bond. However it was not able to answer the question : if bonds earn interest and money does not why should a person hold money?

Regressive Expectation Model:

According to the regressive expectations model a bond holder has an expected return on the bond from two sources, the bond’s yield and a potential capital gain.

Bond yield is inversely proportional to the bond prices. Thus, above critical interest rate (rc) speculative demand for money is low so bond is preferred source of holding wealth. Below rc speculative demand for money is high so money is preferred source of holding wealth.

Bond yield is inversely proportional to the bond prices. Thus, above critical interest rate (rc) speculative demand for money is low so bond is preferred source of holding wealth. Below rc speculative demand for money is high so money is preferred source of holding wealth.

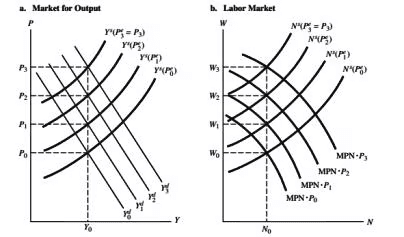

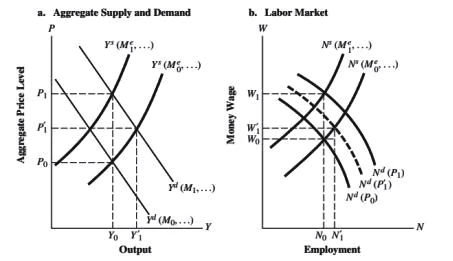

Q4(a): Derive short-run aggregate supply curve following Lucas, when expectations are not realised, assuming that labour market clears. What will be its shape when expectations are fulfilled ?

Ans: New classical policy is based on rational expectations about price level.

Assumptions:

- Flexibility of prices.

- Flexible wage rates.

- Perfect labor and goods market.

- According to the hypothesis of rational expectations, expectations are formed on the basis of all available relevant information concerning the variable being predicted

Expectations Are Realized:

Expectations Are Realized:

Lets consider that there is expectation about increasing money supply and thus prices. Lets say money supply increased and push prices up from P0 to P1′. Increase in price level will sift labor demand outward. But as money supply change is anticipated economic agent react to it adjust accordingly. It results into shift of labor supply and hence output to leftward. With systematic rise in money supply will result into same output and employment at increased price level. Thus long run aggregate supply curve will be vertical line. (In first diagram show vertical LAS)

Expectations Are Not Realized:

Lets say there is expectations of prices being constant. Unanticipated money supply increases prices from P0 to P1′. In that case value of marginal output increases but wages do not increases much due to wrong expectations. And thus in short run employment increases to N1′ and thus output to Y1′. Thus Aggregate supply curve would be upward sloping.

Q4(b): Describe high powered theory of money supply in brief. State the assumptions made in its construction.

Ans:High powered money refers to that currency that has been issued by the Government and Reserve Bank of India. H theory of money explains the change in money supply of economy due to change in high powered money.

Assumptions:

- High powered money is exogenously decided by the central banks or government.

- Banks offer only demand deposits. (No time deposits)

- Earning of banks is only through loans to commercial borrowers

- Currency-deposit ratio is exogenous and constant

- Reserve-deposit ratio of banks is exogenous and determined by the RBI. It is a constant term.

- Infinite demand for the bank loans at the going lending rate of banks, so that banks can remain ‘fully loaned up’ all the time. Thus, banks are generally not deterred from moving into earning assets out of undesired excess reserves.

- There is high monetary transmission in the economy.

Model: Money multiplier is ratio of commercial bank money to the high powered money.

H = C + R

m = M/H

Where H is high powered money, C is currency kept by public, R is reserved kept with RBI, m is money multiplier and M is money generated by commercial bank.

Now commercial bank money can be divided in currency held by public and demand deposit (D).

M = C + D

Now C = k*D

Where k is currency deposit ratio

R = r*D

Where r is cash reserve ratio

Hence H = (k+r)*D

and M = (k+1)*D

Hence money multiplier (m) = (1+k)/(r+k)

Thus money supply M = H*[(1+k)/(r+k)]

|

66 videos|170 docs|73 tests

|

FAQs on UPSC Mains Answer PYQ 2021: Economics Optional Paper 1 (Part - 1) - Economics Optional Notes for UPSC

| 1. What is the significance of the Economics Optional Paper in the UPSC Mains examination? |  |

| 2. How is the Economics Optional Paper structured in the UPSC Mains examination? |  |

| 3. What are the recommended books and resources for preparing for the Economics Optional Paper? |  |

| 4. What are some common mistakes to avoid while attempting the Economics Optional Paper? |  |

| 5. How important is current affairs in the preparation for the Economics Optional Paper? |  |