Vivek Singh Summary: Land Reforms | Indian Economy for UPSC CSE PDF Download

Land Rights Before Independence

Mughal Period (before 1765)

- During the Mughal era in India, land revenue was collected by zamindars, who acted as intermediaries between the cultivators and the Mughal Emperor.

- The zamindars collected economic rent from the peasants, kept a portion for themselves, and forwarded the remaining amount to the State.

- The land technically belonged to the State, not the zamindars, who only had the right to collect rent.

- The Nawabs of Bengal governed their territory under the Mughal Empire through feudal chiefs.

British East India Company (post-1757)

- The British East India Company began its rule in India after the battle of Plassey in 1757, defeating the Nawab of Bengal, Sirajudaulla.

- The Company's power was further consolidated after the battle of Buxar, leading Emperor Shah Alam II to grant the Company Diwani Rights in 1765, allowing them to collect revenue in Bengal, Bihar, and later Orissa.

Warren Hastings and the Five-Year Settlement (1772-1785)

- Warren Hastings, the first Governor General of Bengal, introduced the Five-Year Settlement, auctioning the right to collect land revenue to the highest bidder for a five-year term.

- This system faced challenges as inexperienced contractors often overbid, leading to instability in the Company’s revenue.

- The actual collection varied and seldom met expectations, creating uncertainty for both peasants and zamindars regarding future assessments and collectors.

Lord Cornwallis, Governor General of Bengal (1786 – 1793) and the Permanent Settlement of Revenue Administration:

The earlier system introduced by Hastings was found to be defective for both the peasants and the Company. To address this, Lord Cornwallis implemented the Permanent Settlement in Bengal, Bihar, and Odisha in 1793. This system aimed to provide stability to the revenue framework and continued in India until its independence. Cornwallis conducted a thorough survey of past records and, based on the data from the previous ten years, determined the potential revenue that could be collected from the land and fixed the amount for future years.

Features of Permanent Settlement:

- Land Ownership: Before Cornwallis, landlords were not considered the owners of the land. The Permanent Settlement recognized landlords as the landowners, shifting the responsibility of revenue collection from farmers to landlords.

- Zamindars' Role: Zamindars and revenue collectors were transformed into landlords. They became not only agents of the government for collecting land revenue but also the owners of the entire land within their zamindaris. Their ownership rights were made hereditary and transferable.

Ryotwari Settlement:

The Ryotwari settlement was introduced by Thomas Munro and Alexander Reed in the Bombay and Madras Presidencies in 1820. In these areas, there were no zamindars, and land revenue was settled directly with the peasants, known as Ryots, without any intermediaries.

- Land Revenue Demand: The land revenue demand was fixed by the state, often set at an exorbitantly high rate.

- Ownership Rights: The cultivator or ryot was recognized as the owner of the land. The government issued a "patta" to each peasant, confirming their ownership rights.

- Actual Cultivator vs. Owner: While the Ryotwari settlement theoretically conferred rights on actual landowners, in practice, the cultivator was often different from the owner.

- Periodic Revisions: The Ryotwari settlement was not permanent and was revised periodically, typically every 20 to 30 years.

- Government Rights: The government retained the right to enhance land revenue at its discretion.

Mahalwari System

- The Mahalwari system was an adapted version of the zamindari system and was implemented in regions such as the Ganga valley, the North-West provinces, parts of Central India, and Punjab. Under this system, revenue settlement was conducted at the village level, where the entire village, referred to as an estate or mahal, was responsible for paying revenue to the state collectively.

- A common feature across all these systems was the British distortion of land rights for peasants in India. The British conducted a thorough scientific survey of land and recorded the rights of landowners in their revenue records. However, they left unrecorded the entitlements of actual cultivators, sharecroppers, tenants, and lessees. During British rule, land owned by individuals could be seized and sold to collect revenue, and the purchaser would obtain a clear title to the land.

Land Reforms After Independence

Land Records Management

- "Land" falls under the jurisdiction of state governments in India, leading to variations in how land records are managed across different states and even within the same state.

- The management of land records in most states involves several departments, requiring citizens to approach multiple agencies for comprehensive land records. These agencies include:

- Revenue Department for textual records and mutations.

- Survey & Settlement (or Consolidation ) Department for maps.

- Registration Department for verifying encumbrances and registering transfers, mortgages, etc.

- Panchayats (in some states, for mutations) and municipal authorities for urban land records.

- This fragmented approach leads to time wastage, opportunities for rent-seeking, and harassment of citizens.

Definition and Importance of Land Reform

- Land reform commonly refers to the redistribution of land from the wealthy to the landless or land-poor individuals.

- More broadly, it encompasses the regulation of land ownership, operation, leasing, sales, and inheritance of land.

- In a country like India, where land is scarce and unevenly distributed, and a significant portion of the rural population lives below the poverty line, there are strong economic and political reasons for land reform.

Historical Context

- At the time of India’s independence, land ownership was concentrated in the hands of a few, leading to the exploitation of farmers and hindering the socio-economic development of the rural population.

- To address this issue, the equal distribution of land became a priority for the post-independence government.

- Land reforms were viewed as a crucial foundation for building a strong and prosperous nation, which is why they were given top priority on the policy agenda at the time of Independence.

Legislative Action

- In the years following independence, India enacted a significant amount of land reform legislation.

- The Constitution of 1949 delegated the responsibility for adopting and implementing land and tenancy reforms to state governments.

- This delegation resulted in considerable variation in how these reforms were implemented across different states and over time.

Major Land Reforms Post-Independence

1. Abolition of Intermediaries: Zamindars, Jaghirdars, etc.

- The primary goal of abolishing intermediaries like zamindars and jaghirdars was to establish a direct relationship between the cultivators and the government. By 1949, several provinces introduced zamindari abolition bills, inspired by the Uttar Pradesh Zamindari Abolition Committee's report.

- Initially, zamindars challenged the constitutionality of these laws in court, arguing violations of property rights and unfair compensation. In response, the government passed constitutional amendments (first, fourth, and seventeenth) to strengthen state legislatures, making court challenges regarding fundamental rights and compensation issues inadmissible.

- The abolition process, carried out within a democratic framework and without significant coercion or violence, progressed rapidly, with most provinces enacting zamindari abolition acts by 1956. This speed was partly due to the social isolation of zamindars during the national movement, where they were viewed as part of the imperialist camp. The zamindari abolition was largely successful, resulting in around two crore former tenants becoming landowners.

- However, a major challenge in implementing these acts was the lack of adequate land records. In some regions, weaknesses in the implementation allowed zamindars to retain lands claimed under 'personal cultivation.' The definition of 'personal cultivation' was vague, enabling not just those who physically tilled the land but also those who supervised it or provided capital to be considered cultivators. There were no limits on the size of land that could be declared under a zamindar's 'personal cultivation.'

2. Tenancy Reforms

- Background:Tenancy Cultivation in India was prevalent under the Zamindari and Ryotwari systems. There were three main categories of tenants:

- Occupancy Tenants: These tenants had permanent and inheritable rights to the land. They enjoyed security of tenure and could claim compensation from landlords for any improvements made to the land.

- Tenants at Will: This category of tenants did not have security of tenure. They were often subjected to exorbitant rents and could be evicted by the landlord at any time.

- Sub-Tenants: Sub-tenants were appointed by occupancy tenants to cultivate the land.

Tenancy Reforms in the 1950s and 60s

The tenancy reforms aimed to address issues of security, rent levels, and ownership rights for tenants.

- Security of Tenure: The goal was to guarantee security of tenure to tenants who had cultivated a piece of land continuously for a fixed number of years, typically around six years. However, this objective was met with only limited success.

- Rent Reduction: The reforms aimed to reduce rents paid by tenants to a fair level, generally considered to be between one-fourth to one-sixth of the gross produce value of the leased land. In practice, only the upper stratum of tenantry, which had secured occupancy rights and was often indistinguishable from landowners, could enforce legal rent rates.

- Right to Ownership: Tenants were to gain the right to ownership of the lands they cultivated, subject to certain restrictions. This objective was achieved only partially.

Impact of Tenancy Reforms

- Underground Tenancy: In many states, tenancy reforms pushed tenancy arrangements underground. Tenancy continued in a concealed form, with tenants being referred to as “farm servants,” despite having the same status as before.

- Sharecropping: In the early years of land reform, tenants were often converted to sharecroppers. Sharecroppers were not considered tenants and, therefore, were not protected under existing tenancy legislation in some states, such as Uttar Pradesh. Only cash rent payers were recognized as tenants, leaving sharecroppers vulnerable.

- Oral and Informal Tenancies: Most tenancies were oral and informal, meaning they were not recorded. This lack of documentation deprived tenants of the benefits of legislation designed to protect them.

3. Ceilings on Size of Landholdings and Its Distribution

- The land ceiling acts set limits on the amount of land an individual or family can own. The primary goal of these acts was to redistribute surplus land to the landless, aiming for a more equitable distribution of land.

- By the early 1960s, all state governments had enacted land ceiling acts. However, until 1970, not a single acre was declared surplus in most large states. The ceiling limits varied from state to state. To achieve uniformity, a new land ceiling policy was introduced in 1971. In 1972, national guidelines were issued, establishing ceiling limits of 10-18 acres for the best land, 18-27 acres for second-class land, and 27-54 acres for other land, with slightly higher limits in hilly and desert areas.

- The ceiling reform achieved only partial success. One major weakness was the numerous exemptions allowed, such as for tea, coffee, and rubber plantations, orchards, specialized farms operated by sugar factories, and efficiently managed farms with significant investments. Other factors contributing to the failure included exemptions for religious and charitable institutions, benami transfers, falsification of land deeds, judicial interventions, loopholes in ceiling laws, lack of land records, inefficient administration, and lack of political will. Additionally, the generally poor quality of surplus lands and the lack of financial and institutional support for bringing these lands under cultivation were significant issues in implementing the ceiling reform.

4. Consolidation of Land Holdings

- Consolidation of land holdings refers to the process of combining various small plots of land owned by a farmer, which are scattered across a village, into one compact block. This can be done through purchase or exchange of land with others.

- In India, the average size of land holdings is very small and is gradually decreasing, while the number of holdings is increasing. This is primarily due to inheritance laws that lead to the subdivision and fragmentation of farms with each passing generation.

The subdivision and fragmentation of land holdings create several problems, such as:

- Wastage of land

- Difficulties in land management

- Challenges in adopting new technology

- Disputes over land boundaries

- Low productivity

To address these issues, legislation for the compulsory consolidation of holdings was enacted in various regions of India, including Bombay in 1947, Punjab in 1948, and Uttar Pradesh in 1953.

- Similar provisions were made in other provinces, except for Kerala and Madras. By 1964-65, a total area of 55 million acres had been consolidated, benefiting primarily the upper strata of the peasantry and facilitating their shift to capitalist farming.

However, several obstacles hindered the swift implementation of the consolidation program, such as:

- Poor response from cultivators who preferred fragmented parcels for safety during natural calamities

- Complicated process of land consolidation

- Variation in land quality

- Lack of enforcing machinery

- Insufficient political will

Impact of Land Reforms

- Tenancy reforms led to over one crore tenants gaining ownership rights in states like Assam, West Bengal, Kerala, Tamil Nadu, and Gujarat.

- In West Bengal, more than 10 lakh individuals benefited from surplus land distribution due to ceiling laws.

- Landlords often lacked personal interest and investment in land improvement. However, when this land was transferred to actual cultivators, significant investments were made, leading to increased productivity.

- The distribution of land to real cultivators provided a strong incentive to improve land quality, transforming it into a valuable resource and enhancing agricultural productivity.

- These reforms also elevated the social status of landless individuals and tenants, contributing to social equity.

Land Acquisition Act 2013

(The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act 2013)

- In India, "land" is managed by the states, while "land acquisition" is a shared responsibility of both the central government and the states. This is because "land" is on the state list of the Constitution, and "land acquisition" is on the concurrent list. However, states must align their laws with central legislation. If there is a disagreement, the central law takes precedence.

- The Land Acquisition Act of 1894 was introduced by the British to acquire private land for projects like railway construction. After India gained independence, this Act continued to be used with some amendments until December 31, 2013.

However, it had several significant issues:

- Inadequate Protection: The 1894 Act was criticized for not adequately protecting the interests of landowners and those affected by land acquisition.

- Lack of Rehabilitation: The Act did not provide for the rehabilitation of individuals displaced from their land, even though their livelihoods were severely impacted by compulsory acquisition.

- Insufficient Compensation: Compensation under the 1894 Act was often much lower than the actual market value of the land, leading to unfair outcomes for landowners.

- Outdated Provisions: The Act failed to meet evolving needs and standards, causing societal resistance. This resistance led to the abandonment of several projects, such as the Tata Motors' small car project in Singur.

- Need for Reform: Being over 120 years old, the Act was deemed outdated and in need of replacement with a fair and rational law that aligned with constitutional provisions, particularly Article 300A.

- Eminent Domain and Article 300A: When India adopted its Constitution, the right to property was a fundamental right. However, in 1978, the 44th Constitutional Amendment removed this right as a fundamental one. Article 300A was introduced to ensure that no person could be deprived of their property except by law.

- This law gives the government the power of "eminent domain," allowing it to acquire private land for public purposes, such as roads, schools, and utilities, with fair compensation to the landowner. Today, the right to property is a constitutional or statutory right, not a fundamental one.

The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act 2013

The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act 2013, commonly known as the LA Act 2013, was enacted in September 2013 and came into effect on January 1, 2014. This legislation governs the acquisition of land solely for public purpose projects.

The following categories of projects fall under public purpose:

- Projects related to national security, such as those for the naval, military, air force, central paramilitary forces, or public sector undertakings (PSUs).

- Infrastructure projects including railways, highways, roads, ports, power plants, industrial corridors, mining, agro-processing, and warehousing.

- Government-aided or administered educational and research institutions, excluding private hospitals, private educational institutions, and private hotels.

- Projects for the benefit of project-affected families.

- Residential projects for the poor and landless.

Applicability

The LA Act 2013 is applicable in the following situations:

- When the Central or State government acquires land for its own use, holding, and control for public purposes, including Public Sector Undertakings (PSUs), without requiring consent.

- When the government acquires land for Public Private Partnership (PPP) projects for public purposes, provided that prior consent from at least 70% of the affected families (landowners) is obtained.

- When the government acquires land for private companies for public purposes, subject to obtaining prior consent from at least 80% of the affected families (landowners).

Key Features of the Land Acquisition Act, 2013

The Land Acquisition Act of 2013 has several important features aimed at ensuring fair compensation and addressing social impacts. Here are the key points:

(i) Compensation:

- Urban Land: Compensation is equal to the Market Value of the land and immovable property.

- Rural Land: Compensation is double the Market Value.

- Transitional Areas: If land lies between urban and rural areas, the multiplying factor will be between 1 and 2, depending on the distance from the urban area.

- Solatium: An additional compensation for emotional attachment equal to 100% of the compensation is also provided.

(ii) Prohibition on Multi-Cropped Land:

- The Act prohibits the acquisition of irrigated multi-cropped land except in exceptional circumstances.

- This restriction does not apply to linear projects such as roads, irrigation canals, railways, and power lines.

- In exceptional cases, the Act empowers State governments to set limits on the acquisition of multi-cropped land, agricultural land, and private purchases.

(iii) Social Impact Assessment (SIA):

- Before acquiring land, the government must consult the local Panchayat or Municipality and conduct an SIA study in consultation with them.

- The SIA report, which must be made public, should include:

- Assessment of public purpose served by the acquisition.

- Estimation of affected and displaced families.

- Extent of land, houses, settlements, and common properties likely to be affected.

- Justification for the minimum land required.

- Consideration of alternative locations for acquisition.

- Study of social impacts, costs, and overall benefits of the project.

(iv) Rehabilitation and Resettlement (R&R):

- Affected families will receive additional benefits alongside compensation, including:

- A job (if created) or a one-time payment of five lakhs per affected family, or a monthly payment of Rs 2000 (linked to CPI) for 20 years.

Benefits for Affected Families

- Resettlement Allowance: Each affected family will receive a one-time Resettlement Allowance of Rs. 50,000/-.

- Monthly Subsistence Allowance: Affected families will get a monthly subsistence allowance of Rs. 3,000 for one year.

- Housing Assistance: In case of displacement and loss of a house, the affected person will be provided with a constructed house.

Comment on the New Land Acquisition Act 2013

- The new Land Acquisition (LA) Act 2013 aims to streamline the land acquisition process, enhance transparency, and protect the rights of landowners by ensuring proper compensation and rehabilitation.

- Balancing Act: The Act seeks to balance industrial growth with the rights of landowners, emphasizing the protection of landowner rights.

- Consent Challenge: Obtaining consent from 70% to 80% of project-affected families is challenging, especially in areas with rising population density.

Model Agricultural Land Leasing Act 2016

- Background: After India gained independence, the focus was on abolishing the Zamindari system and redistributing land to farmers. The leaders of that time viewed tenancy and sub-tenancy as part of the feudal land system inherited from the British. As a result, the laws aimed at reforming tenancy sought to transfer ownership rights to tenants while discouraging or prohibiting the leasing and sub-leasing of land.

- Initial Reforms: Initially, these reforms were meant to benefit tenants by giving them ownership rights. However, powerful landowners managed to undermine these reforms, and by 1992, only 4% of cultivated land had ownership rights transferred to cultivators. Some states abolished tenancy altogether in an attempt to transfer ownership, which ended up harming tenants by removing their protections and forcing them to operate in secrecy.

- Tenancy Regulations: In some states, tenancy was allowed but with strict limits on land rent, set at a fraction of the produce. This led to oral contracts where tenants paid closer to 50% of the produce in rent. Large states like Telangana, Bihar, Karnataka, Madhya Pradesh, and Uttar Pradesh banned land leasing, with exceptions for specific categories like widows and defense personnel. Other states, such as Punjab, Haryana, and Gujarat, did not ban leasing but gave tenants the right to purchase leased land after a certain period.

- Current Situation: Today, the restrictive tenancy laws are no longer relevant and have negative impacts on tenants, landowners, and public policy implementation. Tenants lack security and are discouraged from making long-term investments, while landowners feel insecure about leasing their land. This has led to an increase in fallow land as landowners and their children seek non-farm employment. Only a few states like Andhra Pradesh, Tamil Nadu, Rajasthan, and West Bengal have more liberal tenancy laws, with West Bengal limiting tenancy to sharecroppers. However, many states with liberal laws do not recognize sharecroppers as tenants.

- In April 2016, an expert panel under the NITI Aayog drafted a model act on land leasing, which the Central Government forwarded to States for implementation. This act aims to protect the rights of landowners while providing tenant farmers with access to essential services like insurance, credit, and compensation for crop damage.

- The model law is designed to encourage landowners to lease their agricultural land to tenant farmers without the fear of losing ownership. This arrangement is expected to motivate tenants to invest in land improvement and provide landowners with security, facilitating efficient government policies. The law aims to make productive use of unused land and enable tenant farmers to invest in land and access credit and insurance. Currently, approximately 18% of land holdings and 13% of cultivable area are managed by tenant farmers.

Key Features of the Model Act 2016

- Leasing Agricultural Land: The Act allows individuals to lease agricultural land for cultivation, including agriculture and related activities.

- Access to Financial Services: Tenant farmers and sharecroppers can access bank credit, crop insurance, and disaster relief benefits.

- Consolidation of Farmland: The Act permits the consolidation of small, economically unviable plots of land to create larger operational holdings, reducing cultivation costs and increasing profitability.

- Flexibility in Lease Terms: The duration of the lease and the consideration amount will be mutually agreed upon by the landowner and the tenant.

- No Area Ceilings: There are no restrictions on the area of land that can be leased or consolidated, allowing market forces to determine the size of operational holdings.

- Leasing for Allied Activities: Land can be leased for allied activities, such as livestock or animal husbandry, for a maximum period of five years.

- Dispute Resolution: The Model Act proposes a quicker litigation process for disputes through criminal proceedings and special tribunals. Dispute settlement will occur at the levels of the Gram Sabha, Panchayat, and Tehsildar, outside the jurisdiction of courts.

- Addressing Current Restrictions: Current restrictions on land leasing have limited the occupational mobility of landowners and led to concealed tenancy agreements. The Act aims to create a formal land lease market, which is essential for the rural poor to escape the poverty trap.

Examples of Land Leasing Reforms:

- In China, land leasing laws have been revised to allow farmers to lease their land for up to 30 years, even to corporate entities. This change aims to attract long-term investments in high-value crops.

- Andhra Pradesh and Kerala have liberalized their restrictive land leasing laws while safeguarding the land rights of owners. Their innovative approaches provide valuable lessons for policymakers at the national level.

Moving Forward:

- One of the reasons landowners are hesitant to lease out their land for extended periods is the lack of tamper-proof land records maintained by revenue departments. To address this issue, the government could digitize and geo-tag land records, linking them with Aadhaar cards and the bank accounts of farmers.

- This would create a centralized, transparent, and easily accessible land records system, facilitating the leasing of agricultural land.

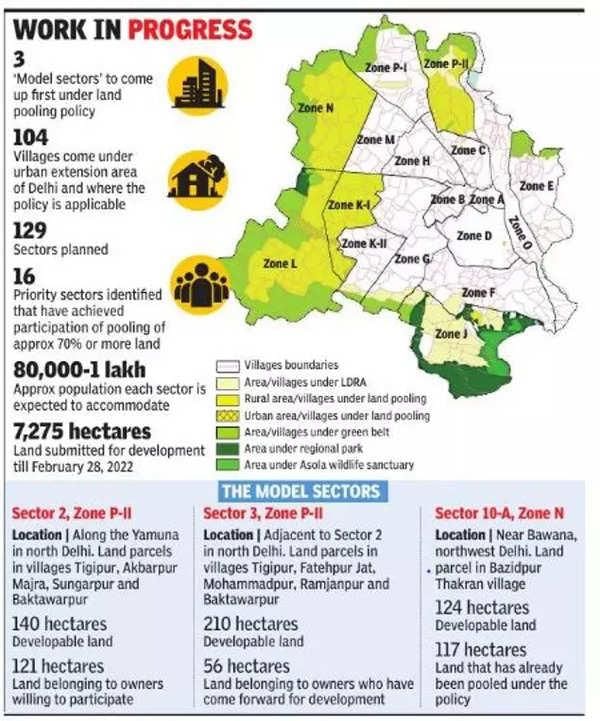

Land Pooling Policy

- The Land Pooling Policy involves the consolidation of small parcels of land owned by individuals, which are then entrusted to a Land Pooling Agency. This agency is responsible for developing essential infrastructure such as roads, drainage systems, and parks on the pooled land. Once the infrastructure development is complete, the agency redistributes the land back to the original owners after deducting a portion to cover the development costs.

- Typically, landowners receive 60-70% of their original land back after the infrastructure has been developed. They are willing to surrender 30-40% of their land because the improved infrastructure benefits them and increases the value of the land they receive back. This arrangement helps address the challenges posed by rising land compensation costs following the implementation of the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013.

- In Delhi, the Land Pooling Agency is the Delhi Development Authority (DDA), which is urbanizing villages and outskirts of the city as part of its smart city initiative. The DDA has launched an online portal for landowners to submit their land for pooling. Landowners contributing between 2-20 hectares will receive 48% of the developed land back, while those offering more than 20 hectares will receive 60% back. This policy has already been implemented in states like Gujarat and Maharashtra.

Digitization of Land Records

- The Government of India, through the Ministry of Finance, is encouraging states to digitize their land records. States such as Karnataka, Rajasthan, Madhya Pradesh, Uttar Pradesh, Kerala, Andhra Pradesh, Telangana, and Gujarat have already made progress in this area by digitizing their land records.

- Digitizing land records will facilitate the creation of online "Mortgage Charges" on land. This advancement will improve credit and loan delivery while reducing loan frauds. With digitized records, only genuine farmers who own land will be able to access agricultural loans.

- Creating a "Mortgage Charge" involves transferring interest in the ownership of a property or land to secure the repayment of a debt.

- With the digitization of land records, this process will now occur online. For instance, previously, if a farmer wanted a loan, they had to provide physical copies of their land records, which banks needed to authenticate.

- This process was prone to fraud and required extensive documentation. However, with digitized land records, the entire procedure will be faster and more secure, happening online without the need for physical paperwork.

Recent Developments

- Financial Incentives for Land Reforms: The central government has allocated Rs 10,000 crore in 2024-25 under the Scheme for Special Assistance to States for Capital Investment to promote land-related reforms in rural and urban areas. An additional Rs 5,000 crore is designated for creating a Farmers’ Registry.

- Unique Land Parcel Identification Number (ULPIN): In rural areas, ULPIN, also known as Bhu-Aadhaar, is being assigned to land parcels to prevent fraud and disputes, particularly in regions with outdated records. Cadastral maps are being digitized, and land subdivisions are surveyed to reflect current ownership.

- Urban Land Record Digitization: States are incentivized to digitize urban land records using Geographic Information System (GIS) mapping and develop IT-based systems for property record administration, updates, and tax management.

- SVAMITVA Scheme Progress: The Survey of Villages and Mapping with Improvised Technology in Village Areas (SVAMITVA) scheme, using drone surveys and GIS mapping, continues to secure property rights in rural India. It was highlighted at the World Bank Land Conference 2025 as a model for rural land governance, with legal ownership cards issued to villagers.

- Digital India Land Records Modernization Programme (DILRMP): As of 2025, 98.5% of rural land records have been digitized, improving accessibility and transparency. However, challenges like outdated maps and poor record quality persist.

- Andhra Pradesh Land Reforms: In March 2025, Andhra Pradesh introduced reforms to overhaul land administration, focusing on transparency, protecting property rights, and resolving disputes through legislative, policy, and administrative changes.

- Mission Basundhara (Assam): Launched as a major land reform initiative, it streamlines land records and ensures rightful ownership, with efforts to protect indigenous and tribal lands.

|

108 videos|425 docs|128 tests

|

FAQs on Vivek Singh Summary: Land Reforms - Indian Economy for UPSC CSE

| 1. What were the key land rights issues before India's independence? |  |

| 2. What major land reforms were implemented in India after independence? |  |

| 3. What is the significance of the Land Acquisition Act 2013? |  |

| 4. How does the Model Agricultural Land Leasing Act 2016 benefit farmers? |  |

| 5. What is the importance of digitization of land records in India? |  |