Summary of Union Budget 2025-26 | General Test Preparation for CUET UG - CUET Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Objectives of the Budget 2025-26 |

|

| Economic Outlook and Fiscal Indicators |

|

| Key Provisions and Announcements |

|

| Tax Reforms & Personal Finance |

|

| Conclusion |

|

Introduction

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman in February 2025, sets the foundation for India's transformation into a developed nation (Viksit Bharat) by 2047. The budget focuses on inclusive growth, private sector investment, employment generation, and strengthening India's middle class.

Guiding Principles of the Budget

- Fuel for Growth: Structural reforms in taxation, industries, and social sectors.

- Inclusivity: Development focused on Garib (poor), Youth, Annadata (farmers), and Nari (women).

- Destination: Achieving Viksit Bharat by strengthening economic fundamentals and expanding opportunities.

Objectives of the Budget 2025-26

- Ensuring Inclusive Development with a focus on Garib, Youth, Annadata (farmers), and Nari (women).

- Strengthening India's Middle Class through tax reforms and income growth.

- Invigorating Private Sector Investments to drive employment and economic growth.

- Enhancing Spending Power by uplifting household sentiments and providing financial security.

- Accelerating Economic Growth through infrastructure expansion and industrial incentives.

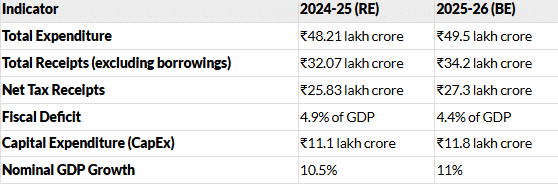

Economic Outlook and Fiscal Indicators

The government aims to reduce the fiscal deficit to 4.4% of GDP by focusing on efficient expenditure management and enhanced tax compliance.

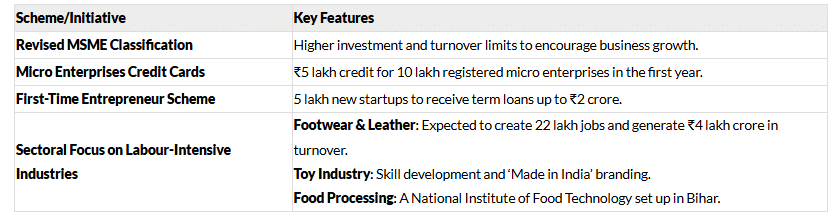

Key Provisions and Announcements

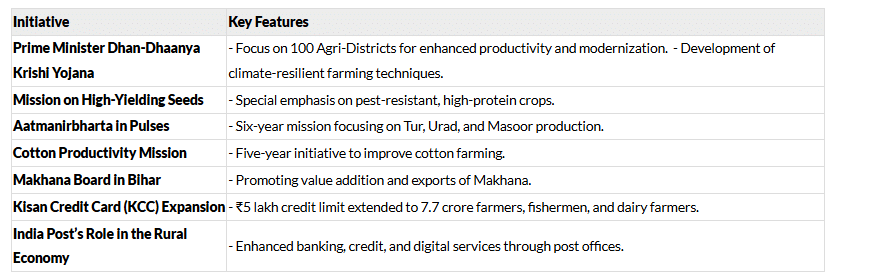

1. Spurring Agricultural Growth & Rural Prosperity

2. Inclusive Human Resource Development & Social Justice

3. Investing in People, Economy & Innovation

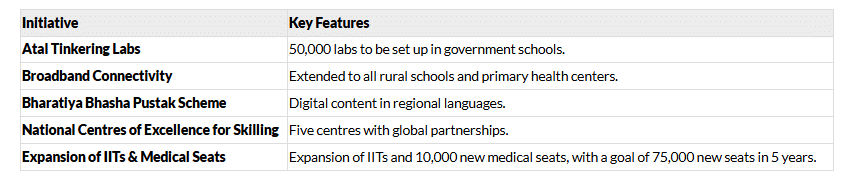

Education & Skilling

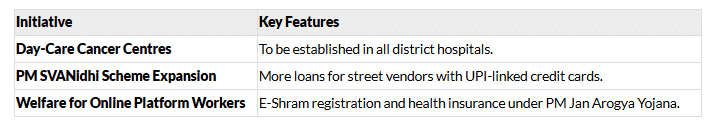

Health & Social Welfare

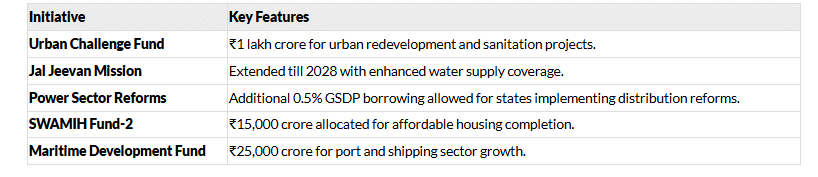

4. Infrastructure & Investment

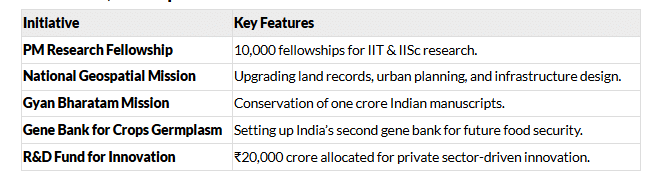

5. Research, Development & Innovation

6. Promoting Exports & Trade

I. BharatTradeNet (BTN) for International Trade

- A new digital public infrastructure proposed to create a unified platform for trade documentation and financing solutions.

- Aligns with international best practices to streamline export and import processes.

- Complements the Unified Logistics Interface Platform (ULIP), improving efficiency in logistics and supply chain management.

II. Export Promotion Mission

- Jointly driven by the Ministries of Commerce, MSME, and Finance.

- Provides sectoral and ministerial targets to facilitate:

- Easier access to export credit for small and medium enterprises.

- Cross-border factoring support to improve liquidity for exporters.

- Assistance for MSMEs to comply with global non-tariff regulations, reducing trade barriers in overseas markets.

III. Integration with Global Supply Chains

- Encourages domestic manufacturing in selected sectors to meet international demand.

- Facilitation groups with government officials and industry experts to streamline export processes for key industries.

- Support for electronic equipment manufacturing to take advantage of Industry 4.0 opportunities.

IV. Warehousing Facility for Air Cargo

- Establishment of new warehousing facilities for high-value and perishable exports, including:

- Horticulture produce (fruits, vegetables, floriculture).

- Pharmaceuticals and biotech products.

- High-value electronics and precision components.

- Improved cargo screening and customs clearance protocols to reduce processing time.

V. Global Capability Centres (GCCs)

- New policy framework for state governments to promote GCCs in Tier-2 cities.

- Focus areas include:

- Building necessary talent and infrastructure to support GCC expansion.

- Reforming local by-laws to attract foreign investment in IT-enabled services.

- Encouraging industry collaboration for long-term export growth.

VI. Trade Facilitation Measures

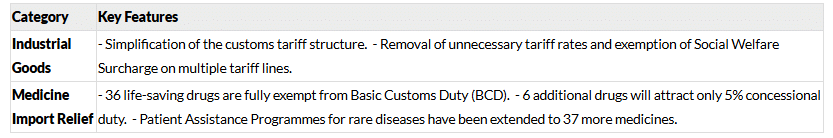

A. Rationalization of Customs Tariff

- Simplification of the tariff structure by reducing redundant tariff rates.

- Exemption of Social Welfare Surcharge on multiple tariff lines to lower export costs.

- Duty concessions on raw materials used in export-oriented industries.

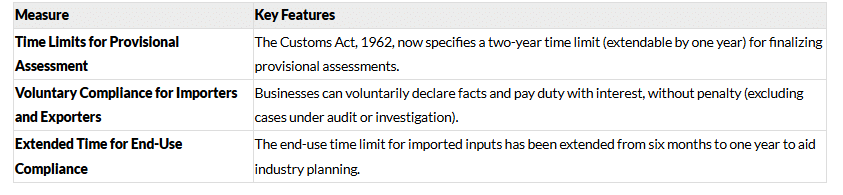

B. Compliance and Ease of Doing Business

- Time Limit for Provisional Assessment: Amendment to the Customs Act, 1962, setting a two-year limit (extendable by one year) for finalizing provisional assessments.

- Extended End-Use Compliance: Compliance time for imported goods used in manufacturing exports extended from six months to one year, reducing filing requirements.

VII. Sector-Specific Export Incentives

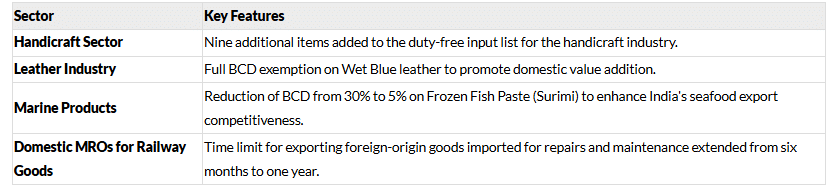

A. Handicraft and Leather Industry

- Nine additional handicraft items added to the list of duty-free inputs to boost exports.

- Leather sector benefits from full exemption of Basic Customs Duty (BCD) on Wet Blue leather, promoting domestic value addition and employment.

B. Marine and Agricultural Exports

- BCD on Frozen Fish Paste (Surimi) reduced from 30% to 5% to enhance India’s seafood export competitiveness.

- Special initiatives for horticulture and processed food exports, including better warehousing and cold-chain logistics.

C. Domestic MRO Services for Export Goods

- Time limit for exporting foreign-origin goods imported for repairs and maintenance (MRO sector) extended from six months to one year, facilitating smoother international trade.

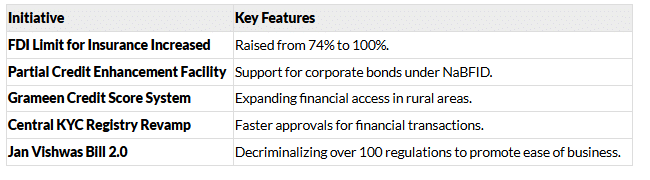

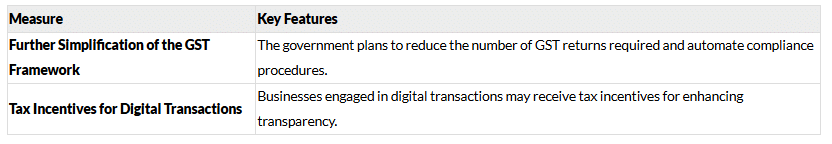

7. Financial Sector Reforms & Digital Transactions

Tax Reforms & Personal Finance

Direct Taxes

Direct taxes are levied directly on individuals and businesses based on their income or profits. Key updates in the Union Budget 2025-26 include:

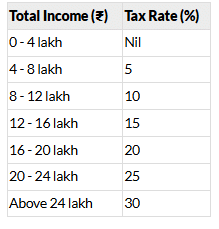

1. Personal Income Tax Reforms

- Increase in Tax Exemption Limit: The exemption limit under the new tax regime has been raised to ₹12 lakh.

- Standard Deduction: The standard deduction has been increased to ₹75,000.

- Revised Tax Slabs under the New Regime:

2. TDS and TCS Rationalization

- Increased TDS Thresholds:

- TDS on rent has been increased to ₹6 lakh.

- The senior citizen interest deduction limit has been raised to ₹1 lakh.

- Increase in TCS Collection Threshold:

- Under RBI’s Liberalized Remittance Scheme (LRS), the threshold for tax collection at source (TCS) on foreign remittances has been increased from ₹7 lakh to ₹10 lakh.

- Decriminalization: Delays in TCS payments up to the due date of filing statements will no longer attract criminal liability.

3. Measures to Improve Tax Compliance

- Voluntary Compliance Incentives:

- The time limit for filing updated income tax returns has been extended from two years to four years.

- Taxpayers can voluntarily disclose omitted income and pay tax with interest.

- Faceless Assessment and E-Verification:

- The faceless tax assessment system will be further streamlined to reduce unnecessary scrutiny and litigation.

4. Taxation of Start-ups and Businesses

- Extension of Tax Benefits for Startups:

- The incorporation period for eligible start-ups to avail tax benefits has been extended by five years, applicable to startups incorporated before April 1, 2030.

- Presumptive Taxation for Non-Residents:

- A new presumptive taxation regime will be introduced for non-residents providing services to electronics manufacturing companies.

- Tax Incentives for Infrastructure Investment:

- Sovereign Wealth Funds and Pension Funds investing in the infrastructure sector can now avail benefits for an extended period of five years.

5. Reforms for Ease of Doing Business

- Streamlining Transfer Pricing:

- A new scheme will allow businesses to determine arm's length pricing for international transactions over a three-year block period.

- Expansion of Safe Harbour Rules:

- To reduce tax litigation, safe harbour provisions will be broadened to provide more certainty in international taxation.

6. Other Direct Tax Provisions

- Tonnage Tax Scheme for Inland Vessels:

- Inland vessels registered under the Indian Vessels Act, 2021, will now be covered under the tonnage tax scheme.

- International Financial Services Centre (IFSC) Tax Benefits:

- Specific tax benefits have been introduced for ship-leasing units, insurance offices, and treasury centres of global companies established in IFSC.

Indirect Taxes

Indirect taxes are levied on goods and services rather than directly on income. The major changes in indirect taxation under the Union Budget 2025-26 are:

1. Rationalization of Customs Duties

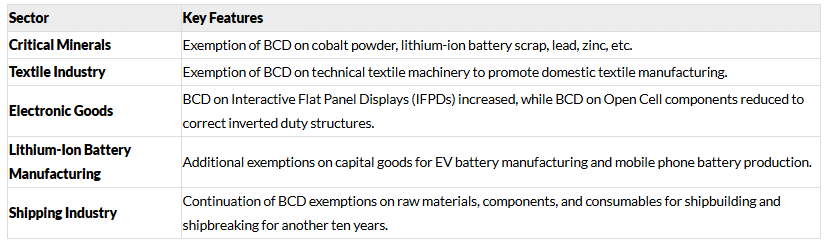

2. Export Promotion and Duty Exemptions

3. Trade Facilitation and Ease of Compliance

4. Encouragement for Domestic Manufacturing

5. GST and Other Indirect Tax Changes

Conclusion

The Union Budget 2025-26 is a blueprint for India's transformation into a developed economy by 2047. It focuses on rural prosperity, industrial growth, digital transformation, infrastructure expansion, and financial sector reforms. With tax reliefs for the middle class, strategic investments in infrastructure, support for MSMEs, and a push for self-reliance, the budget aims to sustain high economic growth, employment generation, and inclusive development.

This budget sets the stage for India's next phase of growth, aligning with the long-term vision of Viksit Bharat!

|

164 videos|628 docs|1136 tests

|