30-Days Timetable for Accountancy Class 12 (CBSE) | Accountancy Class 12 - Commerce PDF Download

Accountancy in Class 12 might look number-heavy, but it’s one of the most scoring subjects if you build clarity and practice regularly. With this 30-day plan, you’ll get the structure you need to revise smartly, solve questions confidently, and write perfect answers for the board exam.

Even if you're feeling behind or confused about where to begin, this plan is your step-by-step guide to catching up and staying on track.

Before You Begin, Remember This

Understanding the “why” behind entries and formats will always help more than just memorising them. Focus on logic, not just rules.

Let Go of These Starting Today:

- Confusion about what to study: This plan has it all sorted.

- Avoiding difficult chapters: We’ll break them down for you.

- Worrying about time: 30 days of focused effort can change everything.

What This 30-Day Plan Will Help You Do

Complete revision of Accounting for Partnership Firms, Company Accounts, and Financial Statement Analysis

Strengthen your concepts with Chapter Notes, Flashcards, and Mindmaps

Practise all types of questions, including journal entries, ledger balances, and ratio analysis questions

Solve past year board questions (PYQs)

Improve speed and accuracy with Tests and Worksheets

Day-by-Day Plan

Below is a detailed day-wise schedule, breaking the monotony by varying activities—emphasizing reading for conceptual understanding, practice for application, and revision for retention.

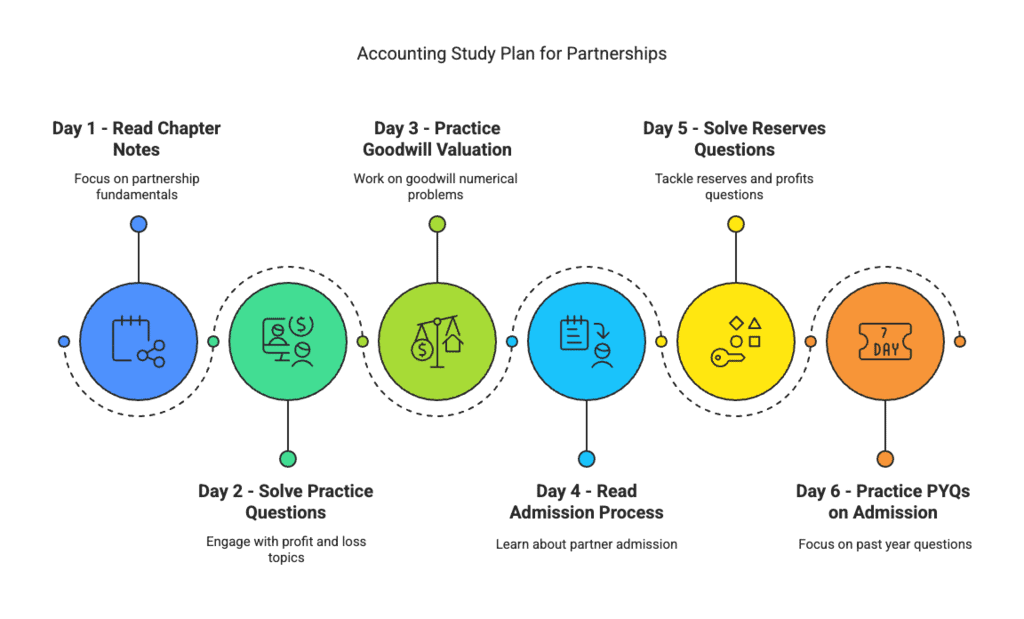

Day 1-3: Accounting for Partnerships: Basic Concepts

Day 1: Read chapter notes covering the essentials of partnerships. Watch video lectures to understand core ideas like partnership deeds and profit division.

Day 2: Solve practice questions to reinforce the chapter, focusing on important concepts like Profit and Loss Appropriation and goodwill valuation. Use flashcards to revise the chapter and emphasize terms like interest on capital and profit-sharing ratio.

Day 3: Practice numerical problems and PYQs to solidify understanding. Revise using mindmaps to review the chapter, paying attention to key areas like fixed vs. fluctuating capital and past adjustments. Review key points from chapter notes.

Day 4-6: Reconstitution of a Partnership Firm: Admission of a Partner

Day 4: Read chapter notes on partnership reconstitution. Watch PPTs to explore essential topics like admission effects and goodwill treatment.

Day 5: Solve practice questions to strengthen the chapter, focusing on critical concepts like revaluation of assets and treatment of reserves. Use flashcards to revise the chapter and highlight ideas like sacrificing ratio and AS-26 guidelines.

Day 6: Practice PYQs and additional problems to deepen knowledge. Revise using mindmaps to go over the chapter, concentrating on areas like goodwill accounting and accumulated profits. Review key points from chapter notes.

Day 7-9: Reconstitution of a Partnership Firm: Retirement/Death of a Partner

Day 7: Read chapter notes on retirement and death processes. Watch videos to grasp major topics like accounting for retiring partners and a deceased partner’s share.

Day 8: Solve practice questions to build chapter mastery, focusing on key ideas like revaluation adjustments and executor’s account. Use flashcards to revise the chapter and emphasize concepts like profit till death and reserve treatment.

Day 9: Practice numerical problems and PYQs to enhance skills. Revise using mindmaps to review the chapter, spotlighting areas like capital account preparation and settlement. Review key points from chapter notes.

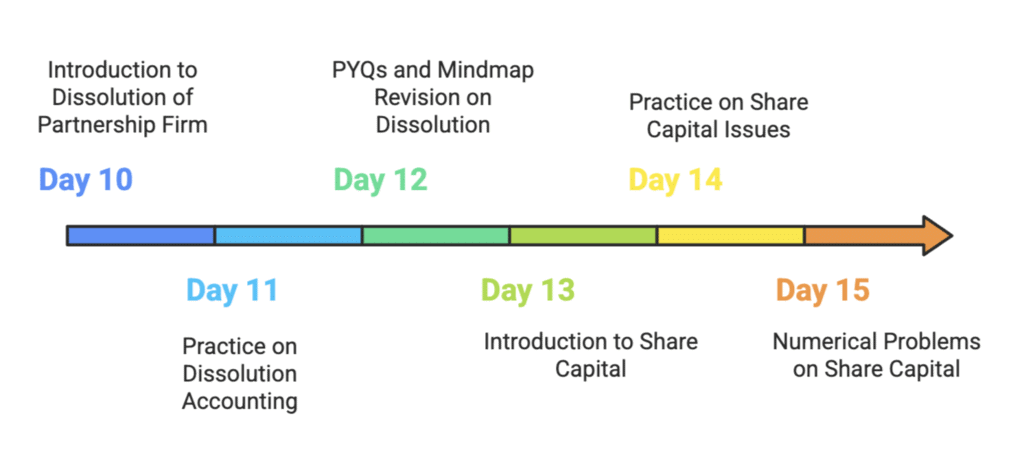

Day 10-12: Dissolution of a Partnership Firm

Day 10: Read chapter notes on partnership dissolution. Watch lectures to understand vital topics like types of dissolution and account settlement.

Day 11: Solve practice questions to reinforce the chapter, focusing on essential concepts like Realization Account and cash/bank handling. Use flashcards to revise the chapter and highlight terms like dissolution types and asset realization.

Day 12: Practice PYQs and problems to solidify learning. Revise using mindmaps to go over the chapter, concentrating on key areas like settlement procedures and capital accounts. Review key points from chapter notes.

Day 13-15: Accounting for Share Capital

Day 13: Read chapter notes on share capital basics. Watch videos to explore core topics like share issuance and company features.

Day 14: Solve practice questions to strengthen the chapter, focusing on important concepts like issue at par/premium and forfeiture of shares. Use flashcards to revise the chapter and emphasize ideas like ESOP and Schedule III disclosure.

Day 15: Practice numerical problems and PYQs to deepen understanding. Revise using mindmaps to review the chapter, paying attention to areas like share reissue and public subscription. Review key points from chapter notes.

Day 16-18: Issue and Redemption of Debentures

Day 16: Read chapter notes on debentures. Watch PPTs to understand major topics like debenture issuance and redemption methods.

Day 17: Solve practice questions to build chapter knowledge, focusing on critical concepts like issue at discount and redemption by lump sum. Use flashcards to revise the chapter and highlight terms like collateral security and interest on debentures.

Day 18: Practice PYQs and additional problems to reinforce skills. Revise using mindmaps to go over the chapter, spotlighting areas like writing off discount and redemption options. Review key points from chapter notes.

Day 19-21: Financial Statements of a Company

Day 19: Read chapter notes on financial statements. Watch lectures to grasp essential topics like Balance Sheet preparation and profit/loss statements.

Day 20: Solve practice questions to reinforce the chapter, focusing on key ideas like Schedule III format and statement objectives. Use flashcards to revise the chapter and emphasize concepts like major headings and statement uses.

Day 21: Practice problems and PYQs to solidify understanding. Revise using mindmaps to review the chapter, concentrating on areas like statement limitations and importance. Review key points from chapter notes.

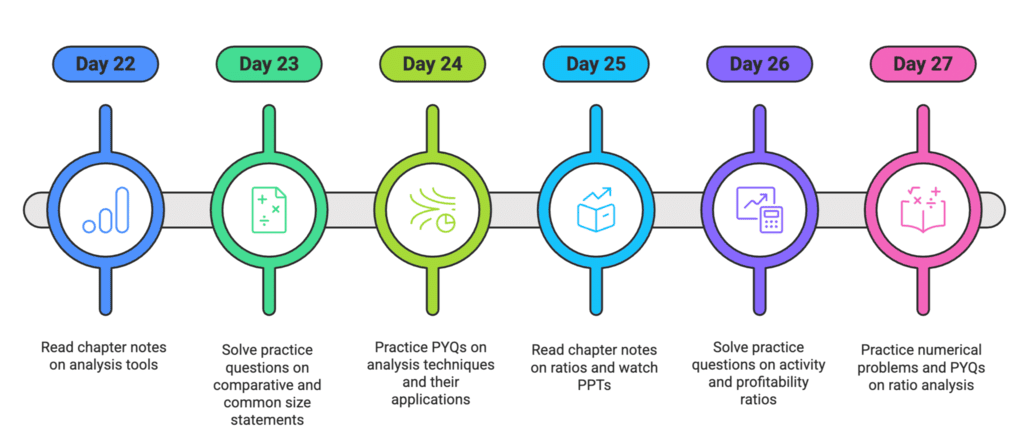

Day 22-24: Analysis of Financial Statements

Day 22: Read chapter notes on financial analysis tools. Watch videos to explore core topics like comparative statements and common size statements.

Day 23: Solve practice questions to strengthen the chapter, focusing on important concepts like statement preparation and analysis objectives. Use flashcards to revise the chapter and highlight ideas like analysis significance and limitations.

Day 24: Practice PYQs and problems to enhance skills. Revise using mindmaps to go over the chapter, paying attention to key areas like tools of analysis and their applications. Review key points from chapter notes.

Day 25-27: Accounting Ratios

Day 25: Read chapter notes on accounting ratios. Watch PPTs to understand vital topics like liquidity and solvency ratios.

Day 26: Solve practice questions to build chapter mastery, focusing on critical concepts like activity ratios and profitability ratios. Use flashcards to revise the chapter and emphasize formulas like Current Ratio and Gross Profit Ratio.

Day 27: Practice numerical problems and PYQs to deepen knowledge. Revise using mindmaps to review the chapter, spotlighting areas like ratio objectives and advantages. Review key points from chapter notes.

Day 28-30: Cash Flow Statements

Day 28: Read chapter notes on cash flow basics. Watch lectures to grasp major topics like activity classification and AS-3 Indirect Method.

Day 29: Solve practice questions to reinforce the chapter, focusing on key ideas like operating activities and financing adjustments. Use flashcards to revise the chapter and highlight terms like cash equivalents and depreciation adjustments.

Day 30: Practice PYQs and problems to solidify learning. Revise using mindmaps to go over the chapter, concentrating on areas like cash flow preparation and investment activities. Review key points from chapter notes.

|

42 videos|199 docs|43 tests

|

FAQs on 30-Days Timetable for Accountancy Class 12 (CBSE) - Accountancy Class 12 - Commerce

| 1. What are the key topics covered in the Class 12 Accountancy syllabus for CBSE? |  |

| 2. How can I effectively manage my 30-day study plan for Accountancy? |  |

| 3. What are some effective study techniques for mastering Accountancy concepts? |  |

| 4. How can I prepare for the Accountancy practical exam in Class 12? |  |

| 5. What are common mistakes to avoid while studying for the Class 12 Accountancy exam? |  |