Economic Development - 1 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

India to Import at Concessional Duty

Why in News?

India has recently permitted limited imports of various agricultural commodities, including corn, crude sunflower oil, refined rapeseed oil, and milk powder, under the Tariff-Rate Quota (TRQ). This initiative aims to manage the rising food inflation in the country.

Tariff-Rate Quota (TRQ)

- A trade policy tool that permits a specific quantity of a good to be imported at a lower tariff rate, with higher tariffs applying to quantities exceeding this limit.

- Aims to balance the protection of domestic industries with the necessity of fulfilling demand through imports. \

India's Position in Vegetable Oil and Milk Market

India’s Position in Vegetable Oils

- India is the largest importer of vegetable oils globally, meeting nearly two-thirds of its needs through imports.

- Palm oil, which constitutes 40% of India’s vegetable oil consumption, is primarily imported from Indonesia and Malaysia.

- In 2021, the Indian government launched the National Mission on Edible Oil-Oil Palm to enhance domestic palm oil production.

- Sunflower oil and soybean oil are imported from countries like Russia, Ukraine, Argentina, and Brazil.

- The top producers of edible oil include China, India, the United States, Indonesia, and Brazil.

Milk Production

- India is the largest producer of milk in the world, accounting for approximately 24.64% of global milk production in 2021-22, according to the Food and Agriculture Organisation (FAO).

- The National Dairy Development Board (NDDB) reported a 58% increase in milk production from 2014-15 to 2022-23, with total production reaching 230.58 million tonnes.

Corn Production

- India ranks fourth in the world in terms of corn cultivation area and is the seventh largest producer of corn globally, contributing around 2% to global corn output.

- Corn production estimates for 2023-24 suggest a yield of approximately 33.5 million metric tons.

Top Producers of Corn:United States, China, and Brazil

Concessional Duty

About:. concessional duty is a type of tariff imposed on imported goods, but at a lower rate than the standard duty.

Reasons for Imposition:

- Reduced Import Costs: By lowering the duty, the government aims to make importing certain goods cheaper, benefiting consumers by making those goods more affordable domestically.

- Control Prices: Concessional duties can help regulate domestic prices, especially for essential commodities.

- Encourage Specific Industries: Reduced duties on raw materials or equipment can incentivize domestic production in certain industries.

- Strengthen Trade Relations: Offering concessional duties can be a way to build stronger trade partnerships with other countries.

- Temporary Measure: Concessional duties are often implemented as temporary measures to address specific situations, like high domestic prices or shortages. Once the situation improves, the duty may be raised back to the standard rate.

Efforts to Boost Ethanol Production in India

Why in News?

The Indian government is actively enhancing ethanol production capabilities to meet rising fuel demands and environmental goals. This initiative is part of the BioE3 policy, which aims to foster biotechnology-centered manufacturing in India.

Key Takeaways

- The BioE3 policy promotes high-performance biomanufacturing to address challenges in agriculture, health, and environmental sustainability.

- India aims to achieve an annual ethanol requirement of approximately 13.5 billion liters by 2025-26, primarily for fuel blending.

- Establishment of enzyme-manufacturing facilities is crucial to support ethanol production and reduce reliance on imported enzymes.

Additional Details

- BioE3 Policy: This policy focuses on six strategic sectors, including high-value bio-based chemicals and climate-resilient agriculture, aiming to create a sustainable biomanufacturing ecosystem.

- Ethanol Blended Petrol (EBP) Programme: Launched in 2003, the EBP program promotes blending ethanol with petrol, with current blending rates increasing from 1.6% in 2013-14 to 11.8% in 2022-23.

- 2G Ethanol Plant: A pioneering 2G ethanol plant in Panipat, Haryana, utilizes rice straw as a feedstock, with a production capacity of 100,000 liters daily.

- Enzyme-Manufacturing Facilities: These facilities will produce enzymes essential for converting organic waste into ethanol, significantly lowering production costs.

In conclusion, India's efforts to boost ethanol production through the BioE3 policy and the establishment of enzyme-manufacturing facilities are vital for achieving fuel sustainability, enhancing economic growth, and addressing environmental challenges. By focusing on local production of enzymes and expanding biomanufacturing capabilities, India is set to make significant strides towards a greener future.

Cotton Cultivation in India

Why in News?

The data recently released by the Ministry of Textiles shows that cotton consumption by the textile industry from October 2023 to September 2024 is one of the highest seen in this decade.

Key Takeaways

- Cotton accounts for around 25% of the total global production.

- Approximately 67% of India's cotton is grown in rain-fed areas, while 33% is in irrigated regions.

- Cotton is often referred to as 'White-Gold' due to its economic significance.

Additional Details

- Growing Conditions:Cotton cultivation requires a hot, sunny climate with a long frost-free period. It thrives in warm and humid conditions and can be planted in various soil types, including:

- Well-drained deep alluvial soils in northern regions.

- Variable-depth black clayey soils in the central region.

- Mixed black and red soils in the southern zone.

- Hybrid and Bt Cotton: Hybrid cotton is produced by crossing two parent strains with different genetic traits. Bt cotton is a genetically modified variety that is pest-resistant.

- India’s Global Standing: As of November 2023, India is the largest producer of cotton, followed by China and the United States. The Central Zone (Gujarat, Maharashtra, Madhya Pradesh) is the largest producing area.

Challenges in the Cotton Sector

- Pest Attack: The pink bollworm (Pectinophora gossypiella) has significantly impacted cotton production, leading to lower yields and quality. Its monophagous nature contributes to resistance against Bt proteins.

- Yield Fluctuations: Cotton production can be unpredictable due to limited irrigation, declining soil fertility, and erratic weather patterns, such as unexpected droughts or heavy rainfall.

- Smallholder Dominance: Most cotton farming is conducted by small-scale farmers who often lack access to modern technologies, affecting overall productivity.

- Limited Market Access: Many cotton growers struggle to reach markets, forcing them to sell at lower prices to intermediaries.

Way Forward

- Integrated Pest Management: Advocating for IPM strategies that utilize natural controls and beneficial insects to manage pests effectively.

- Address the Yield Gap: India has a high cotton acreage but lower yields compared to other producers. Initiatives like the Large-Scale Demonstrations Project can promote best practices.

- Modernisation and Infrastructure Development: Utilizing schemes such as the Technology Upgradation Fund Scheme (TUFS) to modernize facilities and enhance efficiency.

- Improve MSP Calculation: Refining the Minimum Support Price (MSP) formula can ensure better returns for farmers.

- Strengthen Market Linkages: Developing robust procurement systems and price stabilization funds can help farmers achieve fairer prices.

- Branding and Traceability: Initiatives like 'Kasturi Cotton' can enhance the identity of Indian cotton and attract premium prices in the global market.

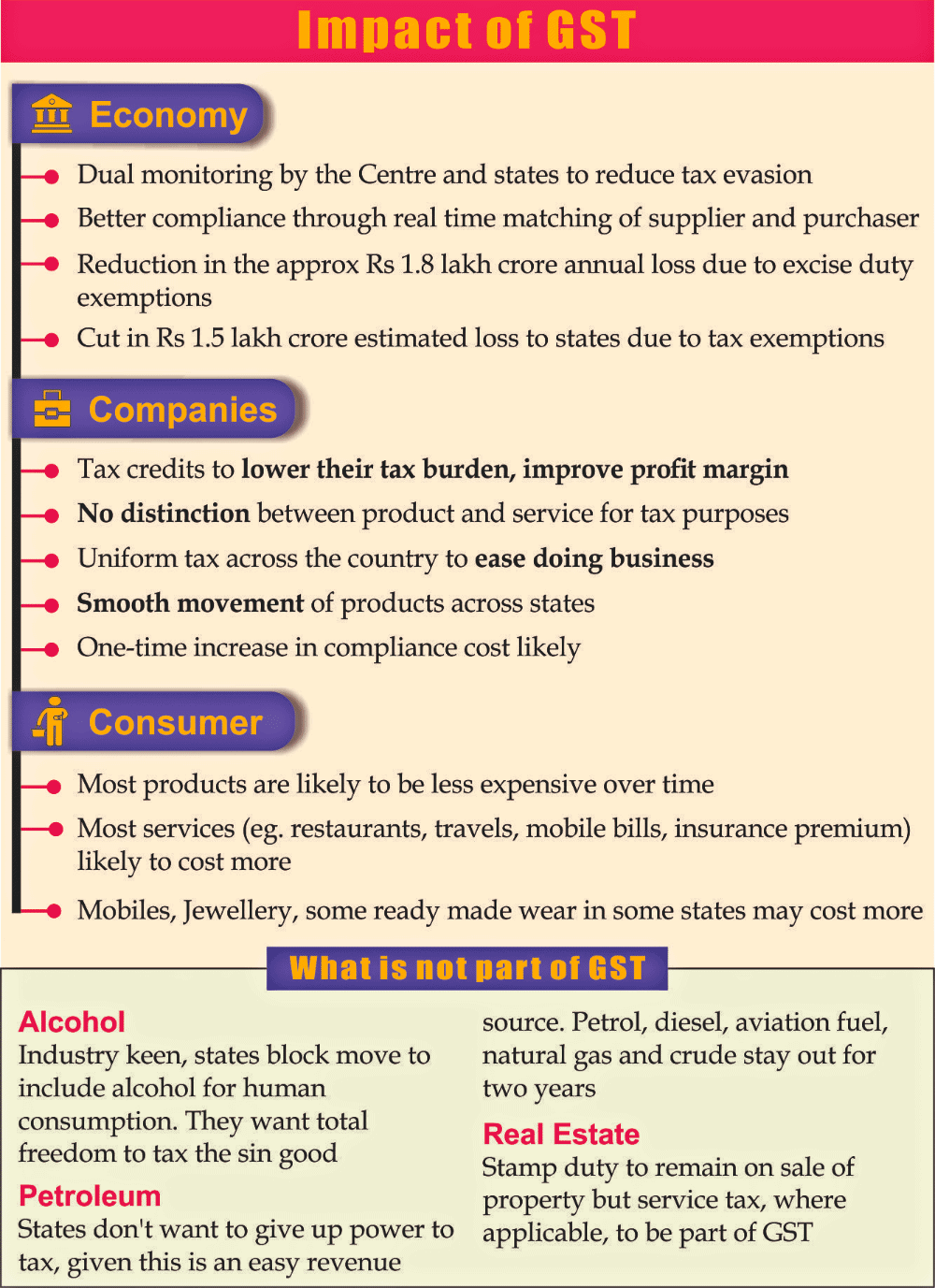

53rd GST Council Meeting

Why in News?

Recently, the 53rd meeting of the Goods and Services Tax (GST) Council has approved several measures to ease compliance for small businesses, exempting hostel accommodation, railway services, and more. It also agreed to reconvene in August 2024 to discuss restructuring the multiple tax rates under the seven-year GST framework.

Key Takeaways

- The GST Council introduced Aadhaar-based biometric authentication to prevent fraudulent input tax credit claims.

- Hostel accommodation services outside educational institutions are now exempt from GST for rents up to Rs 20,000 per person per month for stays up to 90 days.

- Exemption on railway platform tickets aims to reduce financial burdens on passengers.

- The GST rate on carton boxes has been reduced from 18% to 12% to lower costs for manufacturers and consumers.

- A uniform GST rate for all milk cans has been established, regardless of material.

- The Council recommended waiving interest and penalties for non-fraudulent cases under Section 73 of the GST Act.

- New monetary limits for filing appeals were set: Rs 20 lakh for the GST Appellate Tribunal, Rs 1 crore for High Court, and Rs 2 crore for the Supreme Court.

- The government introduced a scheme for special assistance to states for capital investment, contingent on implementing citizen-centric reforms.

- There is an intent to bring petrol and diesel under the GST regime, pending state consensus on tax rates.

Additional Details

- Aadhaar-based Biometric Authentication: This initiative aims to enhance tax compliance and reduce fraudulent claims made through fake invoices.

- Exemption for Hostel Accommodation: This measure makes hostel living more affordable for students and working individuals, as it alleviates the previous 12% GST on these services.

- GST Reduction on Cartons: The reduction in GST on carton boxes is intended to support the packaging industry by lowering costs.

- Waiver of Interest and Penalties: This encourages compliance among taxpayers who have made honest mistakes, fostering a more cooperative tax environment.

The GST Council plays a critical role in shaping India's tax landscape by recommending the implementation and modifications of GST policies. Its recent decisions reflect a commitment to facilitating business compliance and improving affordability for consumers.

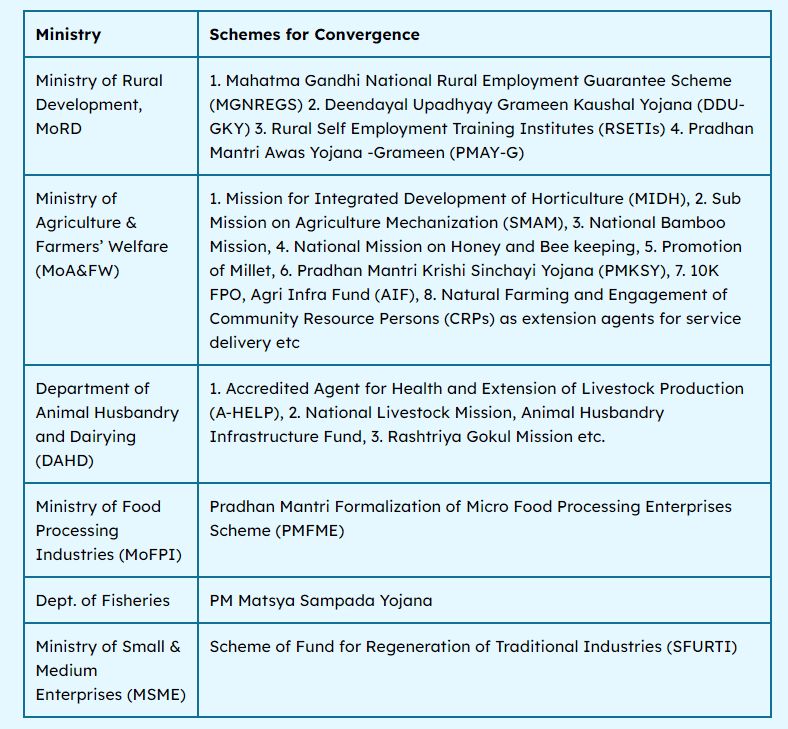

Lakhpati Didi

Why in News?

Recently, the Prime Minister of India attended the Lakhpati Didi Sammelan in Maharashtra, an important event aimed at empowering rural women through Self-Help Groups (SHGs).

Key Takeaways

- The Prime Minister awarded certificates to 11 lakh new Lakhpati Didis who achieved this milestone during the third term of the current government.

- A revolving fund of Rs 2,500 crore was launched, benefiting approximately 48 lakh members of 4.3 lakh SHGs.

- Bank loans amounting to Rs 5,000 crore were disbursed to support 25.8 lakh members of 2.35 lakh SHGs.

- The PM highlighted the crucial role of women in the rural economy, noting their contributions to India's growth as the third-largest global economy.

Additional Details

- Lakhpati Didi Initiative: This initiative recognizes members of SHGs who achieve an annual household income of Rs. 1,00,000 or more, sustained over at least four agricultural seasons or business cycles, with an average monthly income exceeding Rs. 10,000.

- The initiative was launched under the Deendayal Antyodaya Yojana - National Rural Livelihoods Mission (DAY-NRLM), promoting multiple livelihood activities for sustainable income.

- The initiative aims to empower women by enhancing their incomes and transforming their lives, enabling them to serve as role models in their communities.

- Lakhpati Didi Strategy: The strategy focuses on diversifying livelihood options, providing implementation support, and facilitating access to training and resources.

- Regular training programs are conducted for SHG members and community institutions to enhance skills related to livelihood activities.

- The initiative collaborates with various government schemes and private sector partners to optimize resources for capacity building.

Since the launch of the Lakhpati Didi Yojana in 2023, one crore women have achieved the status of Lakhpati Didis. The government has now increased the target from 2 crore to 3 crore, acknowledging the success of 83 lakh SHGs and 9 crore women in transforming the rural socio-economic landscape. Over Rs 6,000 crore has been disbursed to support numerous Women SHGs across India.

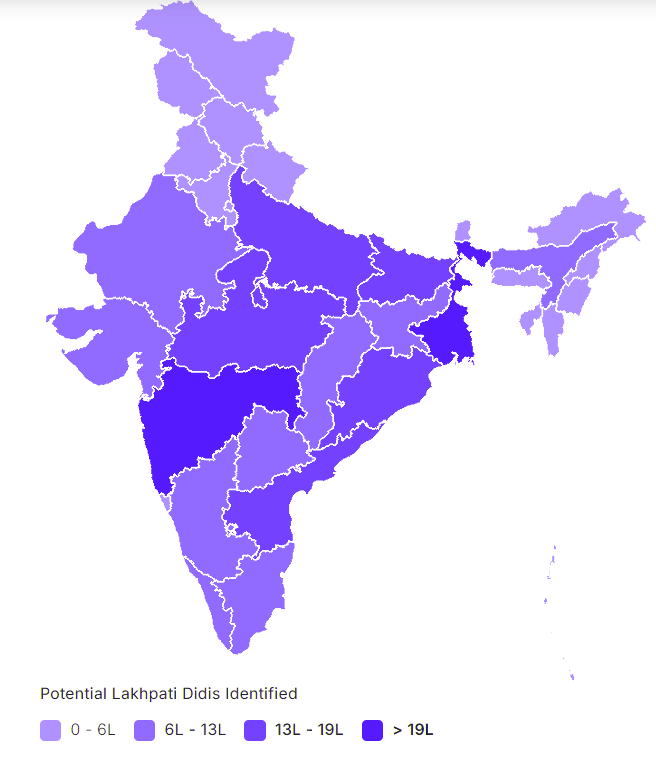

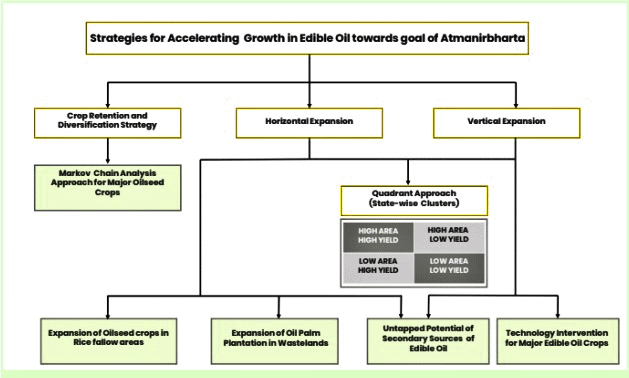

NITI Aayog’s Strategies for Growth in Edible Oils

Why in News?

Recently, a report titled “Pathways and Strategies for Accelerating Growth in Edible Oils towards Goal of Atmanirbharta” was released by NITI Aayog. The report analyses the current edible oil sector, outlines its future potential, and provides a detailed roadmap to address challenges, aiming to close the demand-supply gap and achieve self-sufficiency.

Key Takeaways

- The report focuses on the edible oil sector's production, consumption, and import trends.

- It identifies key strategies to boost domestic oilseed production and reduce import dependency.

Additional Details

- Oilseed Production and Area: Nine major oilseed crops (groundnut, rapeseed-mustard, soybean, sunflower, sesame, safflower, niger seed, castor, and linseed) cover 14.3% of the gross cropped area, contributing 12-13% to dietary energy and about 8% to agricultural exports.

- Rising Consumption: Per capita consumption has surged to 19.7 kg/year, with domestic production meeting only 40-45% of the demand.

- Growth Trends: The report projects that production of the nine major oilseeds will rise to 43 MT by 2030 and 55 MT by 2047, up from 37.96 MT in 2021-22.

- Strategic Interventions: NITI Aayog suggests a three-pillar strategy: crop retention and diversification, horizontal and vertical expansion to boost production.

To achieve self-sufficiency in India's edible oil sector, strategic interventions must focus on enhancing oilseed production through crop diversification, horizontal and vertical expansion, and improved processing. By optimising seed quality, modernising infrastructure, and utilising wastelands effectively, India can significantly reduce import dependency and meet future demand projections.

Challenges in the Edible Oil Sector

- Rainfed Production Dependence: 76% of oilseed cultivation is rainfed, making it vulnerable to erratic weather patterns.

- Increased Consumption: Low import duties and high imports negatively impact domestic oilseed farmers.

Recommendations of the NITI Aayog Report

- Enhance Oilseed Development: Focus on revitalising oilseeds in Bundelkhand and the Indo-Gangetic Plain.

- Promote Wasteland Utilisation: Expand oil palm cultivation on suitable wastelands.

- Cluster-Based Seed Village: Establish “One Block-One Seed Village” hubs for high-quality oilseed supply.

- Enhancing Marketing Infrastructure: Ensure procurement at MSP through cooperative federations.

Embracing these measures will be crucial for ensuring sustainable growth and resilience in the edible oil sector by 2030 and beyond.

Cryptocurrency and Blockchain Overview

Why in News?

Recently, former US President Donald Trump expressed support for Bitcoin during a crypto gathering. Amid ongoing discontent with government responses to inflation and economic crises, there is growing skepticism towards traditional financial systems. This movement is driven by a desire for financial autonomy and a belief in the transformative potential of blockchain technology. However, the long-term financial viability and sustainability of cryptocurrencies remain uncertain.

Key Takeaways

- The rise of cryptocurrency is linked to increasing distrust in conventional financial systems.

- Blockchain technology underpins cryptocurrencies, providing a decentralized and secure method for transactions.

- While cryptocurrencies offer innovative opportunities, they also present various challenges and risks.

Additional Details

- What is Cryptocurrency: It is a decentralized digital or virtual currency that utilizes cryptography for security. Examples include Bitcoin, Ethereum, Ripple, and Litecoin.

- Transactions are recorded on a public digital ledger called the blockchain, maintained by a decentralized network of computers globally, which verifies and adds new transactions.

- To participate in cryptocurrency transactions, users must obtain a digital wallet that securely stores their public and private keys needed for transactions.

- Mining: This process involves using computational power to solve complex mathematical problems, validating transactions on the blockchain and rewarding miners with cryptocurrencies.

Pros and Cons of Cryptocurrency

- Pros of Cryptocurrency:

- Security and Transparency: Blockchain technology enhances security and transparency, reducing fraud and operational costs for financial institutions.

- Innovation and Tokenization: Blockchain enables the tokenization of assets, facilitating new financial instruments and models.

- Reshaping Finance: Cryptocurrencies challenge traditional notions of trust and ownership, potentially transforming global financial systems.

- Financial Autonomy: Cryptocurrencies can offer financial independence, especially in areas with unstable economies.

- Cons of Cryptocurrency:

- Volatility: The speculative nature of cryptocurrencies leads to extreme price fluctuations, undermining their use as stable currencies.

- Regulatory Challenges: The uncertain regulatory environment poses risks related to fraud and illegal activities, complicating mainstream adoption.

- Limited Utility: The low acceptance rate by merchants and financial institutions restricts the practical use of cryptocurrencies.

- Transaction Costs: High fees and slower transaction times compared to conventional methods can hinder usability.

In conclusion, the rapid growth of cryptocurrency in India indicates significant progress towards digitalization, yet this expansion faces substantial challenges due to the lack of a comprehensive regulatory framework. This regulatory gap creates uncertainty for businesses and increases the risk of fraud, while also raising concerns about money laundering and other illegal activities. Therefore, establishing a robust regulatory structure is essential for addressing these challenges.

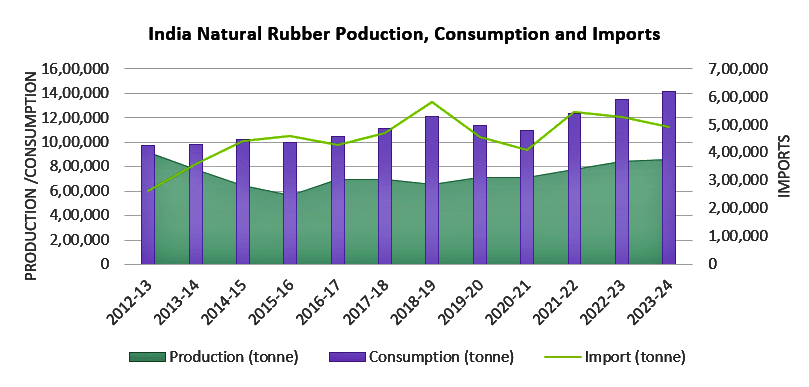

Natural Rubber Production Challenges in India

Why in News?

India is currently grappling with a significant shortage in natural rubber production, falling short of meeting domestic demand by approximately 550,000 tonnes.

Key Takeaways

- India is the third-largest producer and fourth-largest consumer of natural rubber globally.

- The National Rubber Policy 2019 aims to address the challenges faced by the rubber sector.

- Kerala leads rubber production in India, with Tripura following.

- Natural rubber is primarily harvested from rubber trees, while synthetic rubber is produced through industrial processes.

Additional Details

- Sources of Natural Rubber: It is mainly derived from the latex of rubber trees, which contains proteins and alkaloids.

- Production Conditions: Natural rubber thrives in tropical climates with temperatures between 20°C and 35°C, requiring over 200 cm of rainfall annually and well-drained loamy or laterite soils.

- Despite a slight increase in production, domestic consumption significantly outpaces supply, largely due to the high demand from the tyre industry, which consumes about 70% of natural rubber.

- India heavily relies on imports, with 528,677 tonnes imported from countries such as Indonesia and Thailand, exacerbated by a customs duty of 25% on imports.

- Political and environmental challenges in supplier nations, along with local climatic patterns, further disrupt supply stability.

The National Rubber Policy, introduced in 2019, encompasses both short-term and long-term strategies developed by a dedicated Task Force to tackle the sector's challenges. Its main elements include:

- Initiatives for new plantations and support for rubber growers.

- Enhancing processing and marketing capabilities.

- Addressing labor shortages and promoting trade.

- Integrated efforts involving different government levels and research initiatives focusing on climate change impacts.

The execution of the policy is managed by the Rubber Board under the Sustainable and Inclusive Development framework, which includes financial support for planting, distribution of high-quality planting materials, and extensive training programs aimed at improving cultivation methods and productivity. Furthermore, there is a push for public-private partnerships to enhance the development of rubber plantations and processing facilities.

|

44 videos|5283 docs|1115 tests

|

FAQs on Economic Development - 1 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What are the main reasons for India to import certain products at concessional duty? |  |

| 2. How is India boosting its ethanol production? |  |

| 3. What are the major challenges facing cotton cultivation in India? |  |

| 4. What were the key outcomes of the 53rd GST Council Meeting? |  |

| 5. What strategies has NITI Aayog proposed for the growth of edible oils in India? |  |