Sample Previous Year Questions: Simple Interest and Compound Interest | Quantitative for GMAT PDF Download

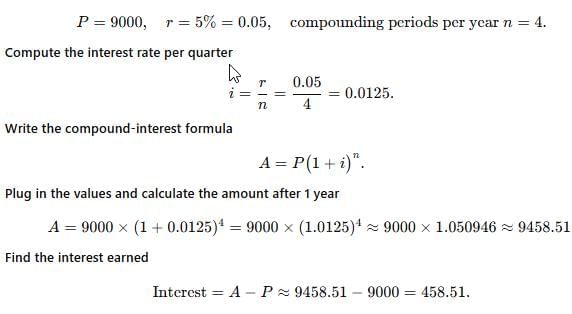

Q1. A principal of $9,000 is invested at an annual interest rate of 5%, compounded quarterly. What is the interest earned after 1 year?

Q1. A principal of $9,000 is invested at an annual interest rate of 5%, compounded quarterly. What is the interest earned after 1 year?

A) $450

B) $456

C) $461

D) $459

E) $471

Ans: D) $459

Explanation:

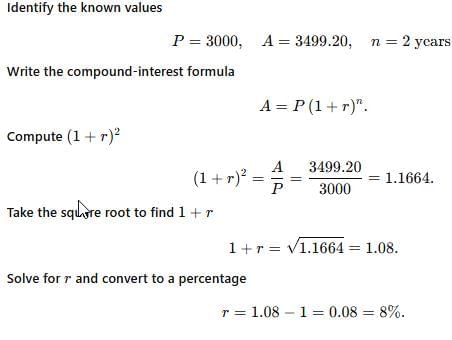

Q2. A principal of $3,000 grows to $3,499.20 after 2 years at an annual compound interest rate, compounded annually. What is the annual interest rate?

A) 6%

B) 7%

C) 8%

D) 9%

E) 10%

Ans: C) 8%

Explanation:

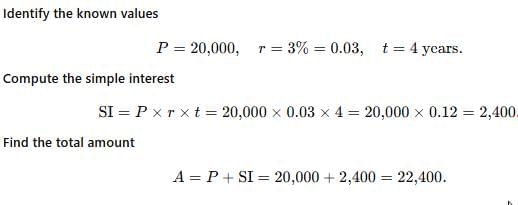

Q3. A sum of $20,000 is invested at a simple interest rate of 3% per year. What is the total amount (principal + interest) after 4 years?

A) $21,200

B) $22,000

C) $22,400

D) $22,800

E) $23,200

Ans: C) $22,400

Explanation:

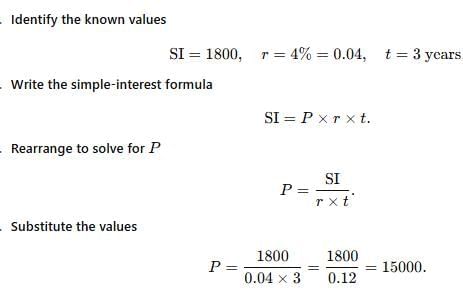

Q4. An investment earns $1,800 in simple interest over 3 years at an annual rate of 4%. What was the principal amount?

A) $13,000

B) $14,000

C) $15,000

D) $16,000

E) $17,000

Ans: C) $15,000

Explanation:

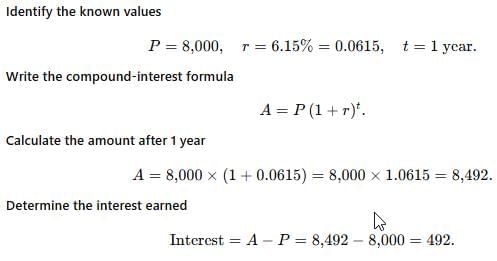

Q5. A principal of $8,000 is invested at an annual interest rate of 6.15%, compounded once per year. What is the interest earned after 1 year?

A) $480

B) $486

C) $489

D) $492

E) $495

Ans: D) $492

Explanation:

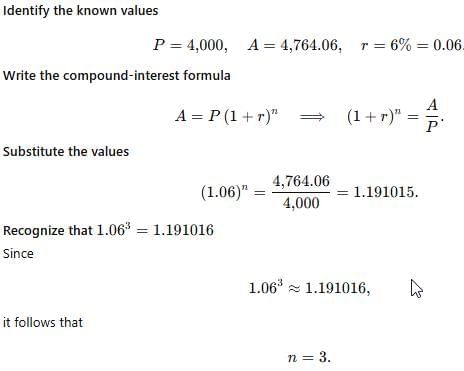

Q6. A $4,000 principal grows to $4,764.06 at 6% compound interest, compounded annually. How many years did it take?

A) 2

B) 3

C) 4

D) 5

E) 6

Ans: B) 3

Explanation:

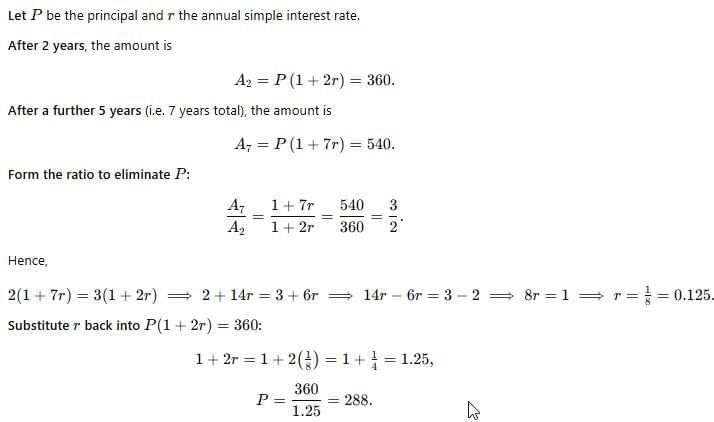

Q7. Jane invested a sum in a bank that paid simple interest. The amount grew to $360 after 2 years, and she received $540 after 5 more years. What was the principal amount?

A) $257

B) $246

C) $288

D) $320

E) $472

Ans: C) $288

Explanation:

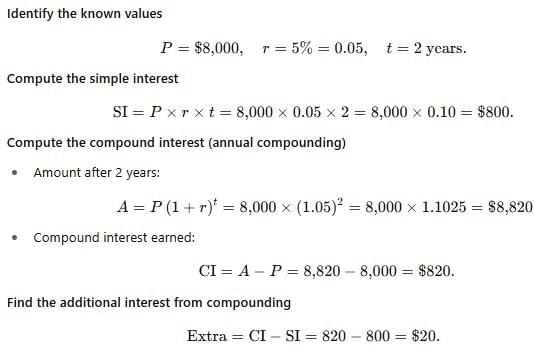

Q8. Mark invested $8,000 for 2 years at 5% interest. One account used simple interest, the other compound interest annually. How much more interest from the compound?

A) $20

B) $25

C) $30

D) $35

E) $40

Ans: A) $20

Explanation:

|

127 videos|154 docs|111 tests

|

FAQs on Sample Previous Year Questions: Simple Interest and Compound Interest - Quantitative for GMAT

| 1. What is the formula for calculating simple interest? |  |

| 2. How does compound interest differ from simple interest? |  |

| 3. What is the significance of the time period in interest calculations? |  |

| 4. Can you explain how to convert an annual interest rate to a monthly rate for compound interest calculations? |  |

| 5. How do you calculate the total amount accumulated after a certain period with compound interest? |  |