Small Modular Reactors (SMRs) – Future of Nuclear | Science & Technology for UPSC CSE PDF Download

SMRs represent a transformative approach to nuclear energy, offering smaller, safer, and more cost-effective reactors compared to traditional large-scale plants. Their modular design allows factory fabrication, rapid deployment, and scalability, making them ideal for remote areas, industrial applications, and clean energy transitions. Globally, SMRs are gaining traction as countries aim for net-zero emissions, with a market projected to reach USD 295.8 billion by 2040. India’s Department of Atomic Energy (DAE), Bhabha Atomic Research Centre (BARC), and Nuclear Power Corporation of India Limited (NPCIL) are prioritizing SMRs to complement thorium-based reactors (e.g., Advanced Heavy Water Reactor, AHWR) and reduce reliance on fossil fuels.

Basics of Small Modular Reactors

Definition and Design

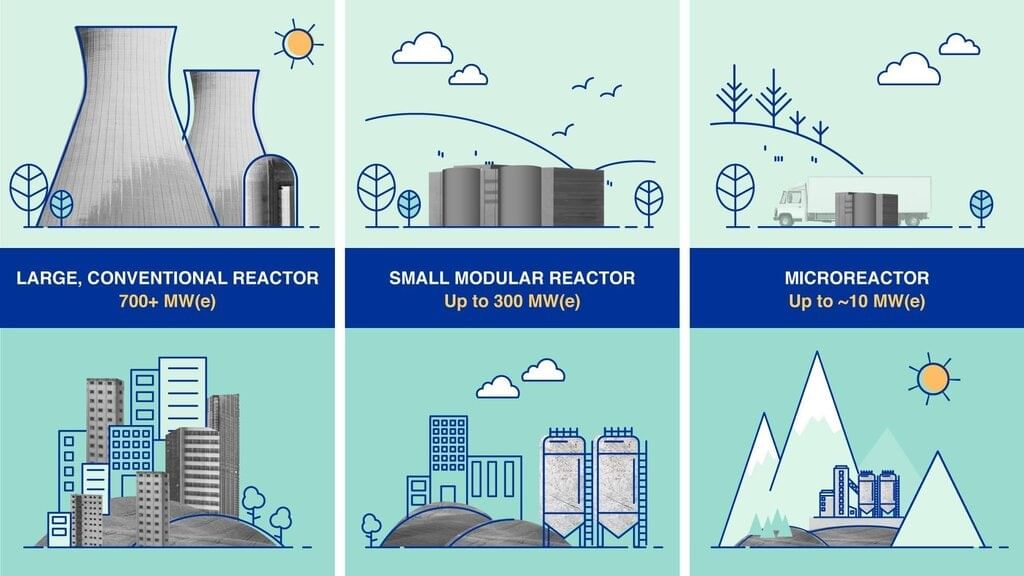

Capacity: Typically 10–300 MWe, compared to 1,000+ MWe for conventional reactors.

Types:

Light Water Reactors (LWRs): Use water as coolant/moderator; most common (e.g., NuScale’s VOYGR).

Fast Reactors: Use fast neutrons for higher efficiency; align with India’s Stage 2 FBRs.

High-Temperature Gas-Cooled Reactors (HTGRs): Use helium for high thermal efficiency, suitable for hydrogen production.

Molten Salt Reactors (MSRs): Use liquid fuel, ideal for thorium; India explores MSRs for Stage 3.

Modular Design: Factory-built, transportable modules reduce construction time (3–5 years vs. 7–10 for large reactors).

Key Features

Compact Size: Fits smaller sites; footprint ~10–20 acres vs. 100+ for large reactors.

Passive Safety: Inherent safety systems (e.g., gravity-driven cooling) reduce accident risks.

Scalability: Multiple units can be added as demand grows, unlike single large reactors.

Applications: Power generation, desalination, industrial heat, hydrogen production, and remote grids.

Advantages of SMRs

Safety: Passive systems (e.g., convection cooling) minimize meltdown risks, as seen in post-Fukushima designs. Lower core damage frequency than traditional reactors.

Cost-Effectiveness: Lower capital costs (~$1–3 billion vs. $6–10 billion for large reactors). Factory production reduces on-site expenses.

Flexibility: Suitable for remote areas, islands, or industrial hubs. Can integrate with renewables for hybrid grids.

Reduced Waste: Smaller fuel loads produce less high-level waste (HLW); thorium-based SMRs further reduce waste longevity.

Deployment Speed: Shorter construction timelines (3–5 years) enable faster energy delivery.

Decarbonization: Zero-emission power supports SDG 7 (Affordable and Clean Energy) and net-zero goals.

Challenges of SMRs

Technical: Scaling up from prototypes to commercial fleets requires extensive testing. Fuel supply and reprocessing for advanced SMRs (e.g., MSRs) remain complex.

Economic: High initial R&D costs; global uranium prices make large reactors more competitive currently. SMRs need economies of scale to reduce per-unit costs.

Regulatory: Licensing new designs is time-consuming; global harmonization of standards is lacking. India’s Atomic Energy Regulatory Board (AERB) needs updates for SMR-specific codes.

Public Perception: Post-Chernobyl/Fukushima fears fuel opposition, as seen in protests near India’s Jaitapur site.

Waste Management: While less than large reactors, SMR waste requires tailored disposal solutions, especially for thorium-based designs.

Global Competition: China’s operational thorium MSR (April 2025) and US SMR advancements (e.g., NuScale) challenge India’s pace.

Global Advancements in SMRs

Market Growth: Global SMR market valued at USD 5.8 billion (2024), projected to reach USD 295.8 billion by 2040, driven by clean energy demand.

Key Players:

United States: NuScale’s VOYGR (77 MWe) certified by NRC (2023); first plant planned for 2029. Companies like TerraPower and X-energy focus on fast reactors and HTGRs.

China: Operational 2 MW thorium MSR (April 2025); plans for 200 MW by 2030. Leads in thorium-based SMRs.

Russia: Floating SMRs (e.g., Akademik Lomonosov, 70 MWe) operational since 2020; targets Arctic regions.

United Kingdom, Canada, France: Developing SMRs for grid and industrial use; Canada’s ARC-100 and UK’s Rolls-Royce SMRs in advanced stages.

Trends (2025): Focus on hydrogen production, microgrids, and integration with renewables. IAEA’s SMR Platform (2024) promotes global collaboration, including India.

India’s Role in SMR Development

Strategic Context

India’s three-stage nuclear programme (PHWRs → FBRs → Thorium-based reactors) integrates SMRs to bridge Stages 2 and 3. With 1.07 million tonnes of thorium reserves, India aims to leverage SMRs for thorium fuel cycles, reducing uranium import dependence.

Key Projects and Initiatives

Bharat Small Reactors: Announced in 2025-26 Union Budget, India plans five SMRs by 2033, with ₹20,000 crore allocated. Designs include LWRs and thorium-based MSRs.

Prototype Fast Breeder Reactor (PFBR, Kalpakkam): 500 MWe, core loading completed March 2024, commissioning by 2026. Supports SMR fuel cycles via plutonium production.

Advanced Heavy Water Reactor (AHWR): 300 MWe thorium-fueled reactor under design at BARC; serves as a prototype for thorium-based SMRs.

Fast Reactor Fuel Cycle Facility (FRFCF): Commissioned 2024, reprocesses fuel for FBRs and future SMRs.

Private Sector: Indian Space Policy 2023 and proposed amendments to Atomic Energy Act (2025) enable private firms (e.g., Reliance, Tata) to partner with NPCIL for SMR development.

International Collaborations

India-France LoI (2025): Focuses on SMR and Advanced Modular Reactor (AMR) co-development, including safety and thorium integration.

India-US Cooperation: Post-2025 US Entity List removal (BARC, IGCAR), iCET initiative supports joint SMR manufacturing and safety protocols.

IAEA Engagement: India participates in IAEA’s SMR Platform, sharing thorium expertise and learning global safety standards.

Recent Developments (2024-2025)

Budget 2025-26: ₹20,000 crore for Nuclear Energy Mission, funding SMR R&D, safety upgrades, and regulatory reforms.

AERB Updates: Developing SMR-specific safety codes, aligning with IAEA’s GSR Part 2 (2024).

Public-Private Push: NPCIL invited proposals from private firms in 2025 for SMR fabrication, targeting 2030 deployment.

Thorium Focus: BARC’s 2025 trials for thorium-based MSR fuel cycles aim to reduce waste and enhance safety.

SMRs as the Future of Nuclear

Why SMRs?

Clean Energy Transition: SMRs provide zero-emission power, supporting India’s net-zero by 2070 and global SDG 7 goals.

Scalability: Modular design suits India’s diverse energy needs, from urban grids to remote Himalayan regions.

Thorium Integration: India’s thorium reserves make SMRs ideal for Stage 3, reducing waste and import reliance.

Economic Viability: Lower costs and faster deployment align with India’s $1.8 trillion space-nuclear economy target by 2035.

Global Potential

Decentralized Power: SMRs can power remote areas, islands, and industrial hubs, reducing grid strain.

Hydrogen Production: High-temperature SMRs (e.g., HTGRs) support green hydrogen, critical for decarbonizing industries.

Climate Resilience: Compact designs withstand extreme weather, addressing Fukushima-like risks.

India’s Vision

Energy Security: SMRs support 100 GW by 2047, reducing coal dependence (50% of India’s energy mix in 2025).

Global Leadership: India’s thorium-based SMRs could be exported to Global South, enhancing nuclear diplomacy.

Sustainability: Less waste and safer designs align with SDG 13 (Climate Action).

Challenges, Future Prospects, and Significance

Challenges

Technical: Scaling thorium-based SMRs requires advanced reprocessing; prototypes need rigorous testing.

Regulatory: AERB’s SMR licensing framework is under development; global harmonization lacking.

Cost: Initial R&D costs (~₹50,000 crore for five SMRs) strain budgets; economies of scale needed.

Public Opposition: Protests near Jaitapur and Kovvada reflect Chernobyl/Fukushima fears, delaying projects.

Global Competition: China’s thorium MSR (2025) and US/UK advancements outpace India’s deployment.

Future Prospects

Deployment Timeline: India’s five SMRs by 2033; thorium-based SMRs by 2035.

Private Sector Role: Amendments to Atomic Energy Act (2025) will boost private investment, accelerating SMR rollout.

International Ties: Collaborations with France, US, and IAEA will enhance safety, fuel tech, and global market access.

Export Potential: India could lead thorium-SMR exports to Asia and Africa by 2040.

Integration with Renewables: SMRs in hybrid grids with solar/wind, planned for 2030s.

Significance for India

Energy Security: SMRs support India’s 1.4 billion population and 100 GW nuclear target, reducing imports.

Environmental Impact: Zero-emission power and less waste align with net-zero and SDG goals.

Global Standing: Thorium-SMR expertise positions India as a nuclear innovator in NSG and IAEA forums.

Small Modular Reactors represent the future of nuclear energy due to their safety, scalability, and alignment with clean energy goals. India’s strategic focus on SMRs, integrated with its thorium-based programme, positions it to achieve energy security and global leadership. Recent developments, like the 2025-26 budget and international collaborations, signal robust progress. By addressing challenges like regulatory delays and public perception, India can leverage SMRs to meet its 2047 nuclear targets and contribute to a sustainable energy future.

|

90 videos|490 docs|209 tests

|

FAQs on Small Modular Reactors (SMRs) – Future of Nuclear - Science & Technology for UPSC CSE

| 1. What are Small Modular Reactors (SMRs) and how do they differ from traditional nuclear reactors? |  |

| 2. What are the advantages of using SMRs in energy production? |  |

| 3. What challenges do SMRs face in terms of development and deployment? |  |

| 4. How is India contributing to the global advancements in SMR technology? |  |

| 5. Why are SMRs considered the future of nuclear energy? |  |