Carbon Capture & Utilisation Technologies | Science & Technology for UPSC CSE PDF Download

CCU technologies address the urgent need to reduce CO2 emissions, a major driver of global warming, while creating economic opportunities through utilization. Unlike Carbon Capture and Storage (CCS), which sequesters CO2 underground, CCU converts CO2 into products, enhancing circular economy principles. In India, CCU supports the National Green Hydrogen Mission and renewable energy integration, targeting 50% non-fossil fuel capacity by 2030. Recent developments, such as pilot projects in Gujarat and Tamil Nadu and international partnerships (e.g., India-US iCET initiative), underscore India’s commitment. CCU’s role in decarbonizing industries and supporting Aatmanirbhar Bharat makes it vital for UPSC, linking science, policy, and global climate leadership.

Carbon Capture Technologies

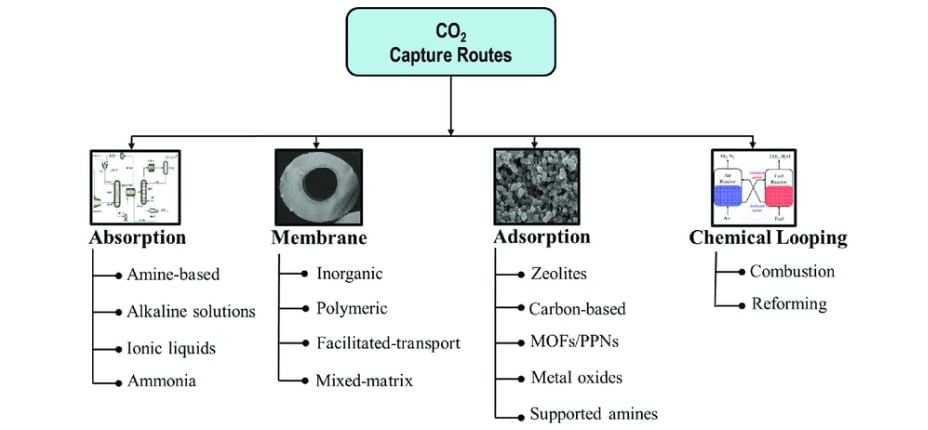

Capture Methods:

Post-Combustion: Captures CO2 from flue gases after fuel combustion (e.g., coal plants). Uses solvents like amines; most mature.

Pre-Combustion: Gasifies fuel to produce syngas, capturing CO2 before combustion. Common in integrated gasification combined cycle (IGCC) plants.

Oxy-Fuel Combustion: Burns fuel in pure oxygen, producing a CO2-rich exhaust for easy capture.

Direct Air Capture (DAC): Extracts CO2 from ambient air using chemical sorbents; energy-intensive but versatile.

Specifications: Capture efficiency ~85–95%; energy penalty ~10–30% of plant output; costs ~₹4,000–8,000/tonne CO2.

Key Technologies

Chemical Absorption: Amine-based solvents (e.g., monoethanolamine) absorb CO2; widely used in power and cement plants.

Physical Adsorption: Uses solid materials (e.g., zeolites, metal-organic frameworks) to trap CO2; suitable for DAC.

Membrane Separation: Filters CO2 using selective membranes; emerging for industrial applications.

Cryogenic Separation: Cools gases to separate CO2; energy-intensive, used in specific processes.

Carbon Utilisation Technologies

Converts captured CO2 into products via chemical, biological, or physical processes.

Requires energy (often renewable) or catalysts to transform CO2 into stable compounds.

Applications

Fuels: Synthetic fuels like methanol, ethanol, or synthetic natural gas (e.g., CO2 + H2 via green hydrogen).

Chemicals: Producing urea, polycarbonates, or formic acid for fertilizers and plastics.

Building Materials: CO2 mineralization into concrete or aggregates (e.g., CarbonCure technology).

Other Uses: Enhanced oil recovery (EOR), food-grade CO2 for beverages, or algae cultivation for biofuels.

Advantages

Emission Reduction: Offsets ~1.5–2 tonnes CO2 per tonne utilized (depending on process).

Economic Value: Creates products worth ₹10,000–50,000/tonne (e.g., methanol, concrete).

Circular Economy: Converts waste CO2 into usable commodities, reducing landfill needs.

Scalability: Applicable to industries (cement, steel) and DAC for atmospheric CO2.

Challenges

Energy Intensity: Utilization processes (e.g., methanol synthesis) require ~10–15 MWh/tonne CO2.

Cost: ₹5,000–10,000/tonne for capture and conversion; needs scale to compete with fossil-based products.

Market Demand: Limited demand for CO2-based products (e.g., methanol <1% of global fuel market).

Technology Maturity: Many processes (e.g., DAC, electrochemical conversion) are at pilot stage.

India’s Initiatives and Role

Policy Framework

National Action Plan on Climate Change (NAPCC): CCU supports missions like National Mission for Enhanced Energy Efficiency.

National Green Hydrogen Mission (NGHM, 2023): Integrates CCU for green methanol/ammonia production using renewable-powered hydrogen.

National Carbon Capture Utilisation and Storage (CCUS) Policy: Draft released in 2024, targeting 50 MMT CO2 capture by 2030.

Budget 2025-26: ₹2,500 crore for CCU pilots, including DAC and industrial applications.

Key Projects

Tata Steel, Jamshedpur: Pilot CCU plant (2024) captures 5 tonnes/day CO2, converting to methanol.

Dalmia Cement, Tamil Nadu: Uses CO2 mineralization for low-carbon cement; 10,000 tonnes CO2 utilized annually (2025).

ONGC, Gujarat: Enhanced oil recovery using CO2 from nearby refineries; captures 0.1 MMT/year.

BARC R&D: Develops DAC technology and CO2-to-methanol conversion; pilot in Mumbai (2025).

NTPC Vindhyachal: Post-combustion capture pilot captures 20 tonnes/day CO2 (2024).

Progress (as of 2025)

Capacity: ~0.2 MMT CO2 captured annually; 0.05 MMT utilized in pilots.

Achievements:

Tata Steel’s methanol pilot reduces emissions by 10,000 tonnes/year.

Dalmia Cement’s CCU cuts cement emissions by 5% per plant.

NGHM integrates CCU for 0.1 MMT green methanol production (2025).

Private Sector: Reliance, Adani, and NTPC invest ₹5,000 crore in CCU; startups like Carbon Clean Solutions scale capture tech.

International Collaborations

India-US iCET (2025): Supports CCU R&D for methanol and DAC; tech transfer from US firms.

India-Norway MoU (2024): Focuses on CO2 mineralization for cement; pilot in Gujarat.

Global CCS Institute: India joined in 2024, accessing expertise for CCUS scale-up.

ISA Integration: Links solar-powered electrolysis for green hydrogen with CCU for fuels.

Global Context and Trends

Market and Leaders

Market Growth: Global CCU market at USD 2.8 billion (2024), projected to reach USD 4.9 billion by 2030.

Key Players:

US: Leads DAC (Climeworks, Carbon Engineering); 1 MMT CO2 captured annually.

EU: Norway’s Sleipner CCS project integrates utilization; Germany pioneers CO2-to-chemicals.

China: 2 MMT CO2 captured (2025); focuses on EOR and methanol.

Canada: CarbonCure’s CO2 concrete tech adopted globally.

Trends (2025): DAC scale-up, CO2-to-fuels via green hydrogen, and policy incentives (e.g., EU’s carbon pricing).

Global Potential

Emission Reduction: CCU could abate 10% of global emissions (3.5 GtCO2) by 2050.

Applications: Fuels (50% of CCU market), chemicals (30%), construction (15%).

Challenges: High costs, limited CO2 demand, and energy-intensive processes.

India’s Role and Challenges

India’s Role

Industrial Decarbonization: CCU targets cement (15% of India’s emissions), steel (10%), and power (30%).

Green Hydrogen Synergy: NGHM’s 0.5 MMT green hydrogen (2025) supports CO2-to-methanol/ammonia.

Global Leadership: India’s low-cost CCU pilots (e.g., Tata Steel) attract FDI; potential to export tech to Global South.

Policy Support: CCUS policy and 2025-26 budget drive scale-up; tax incentives for CO2-based products proposed.

Challenges

High Costs: ₹5,000–10,000/tonne for capture and utilization; needs subsidies to compete.

Energy Demand: CCU requires ~10 MWh/tonne CO2, straining renewable capacity.

Infrastructure: Limited CO2 pipelines and storage facilities; only 100 km pipeline network in 2025.

Market Development: CO2-based products face low demand; methanol competes with cheaper fossil fuels.

Technology Maturity: DAC and electrochemical conversion at pilot stage; scaling delayed to 2030s.

Recent Developments

Budget 2025-26: ₹2,500 crore for CCU pilots, including ₹500 crore for DAC and ₹1,000 crore for industrial capture.

Pilot Projects: Tata Steel’s methanol plant scaled to 10 tonnes/day (2025); ONGC’s EOR expanded to 0.2 MMT/year.

International Ties: India-US iCET funds DAC R&D; India-Norway collaboration for cement CCU.

Policy: Draft CCUS policy (2024) sets 50 MMT capture target by 2030; tax breaks proposed for CO2 products.

Private Sector: Adani’s green ammonia project (2025) integrates CCU, targeting 0.1 MMT CO2 utilization.

Future Prospects and Significance

Future Prospects

Scale-Up: 50 MMT CO2 capture by 2030; 10 MMT utilized for fuels and chemicals.

Cost Reduction: CCU costs to drop to ₹2,000–3,000/tonne by 2035 with scale and renewable integration.

Infrastructure: 1,000 km CO2 pipeline network planned by 2030; Gujarat hub to lead utilization.

Global Market: India to export CO2-based methanol/ammonia to EU, Japan by 2035.

Technology: DAC and electrochemical conversion to reach commercial scale by 2030s, led by BARC.

Significance for India

Climate Goals: CCU could cut 100 MMT CO2 annually by 2030, supporting net-zero by 2070 and SDG 13.

Energy Security: Reduces fossil fuel dependence (₹12 lakh crore imports in 2024), supporting 1.4 billion population.

Economic Impact: Creates 1 lakh jobs; contributes to $1 trillion clean energy economy by 2035.

Global Leadership: Strengthens India’s role in UNFCCC, G20, and ISA through CCU innovation.

Carbon Capture and Utilisation (CCU) technologies are pivotal for India’s climate strategy, decarbonizing industries and creating economic value from CO2. With pilot projects like Tata Steel’s methanol plant and Dalmia Cement’s CO2 concrete, India is scaling CCU under the NGHM and CCUS policy. The 2025-26 budget and international collaborations (e.g., India-US, India-Norway) drive progress. Addressing challenges like high costs, energy demand, and infrastructure will ensure scalability.

|

90 videos|490 docs|209 tests

|

FAQs on Carbon Capture & Utilisation Technologies - Science & Technology for UPSC CSE

| 1. What are the primary technologies involved in carbon capture and utilization? |  |

| 2. What initiatives has India undertaken to enhance carbon capture and utilization? |  |

| 3. How does India's role in carbon capture and utilization compare to global trends? |  |

| 4. What are the key challenges India faces in implementing carbon capture and utilization technologies? |  |

| 5. What are the future prospects and significance of carbon capture and utilization in India? |  |