Weekly Current Affairs (8th to 14th August 2025) | General Test Preparation for CUET UG - CUET Commerce PDF Download

RBI Launches SIP and Auto-Bidding for Treasury Bills

Why in News?

Why in News?

On August 8, 2025, the Reserve Bank of India (RBI) announced significant enhancements to its Retail Direct platform, introducing the Systematic Investment Plan (SIP) for Treasury Bills (T-Bills) alongside an auto-bidding facility. These innovations aim to streamline the investment process for retail investors in government securities, thereby broadening access to short-term debt instruments.

Key Takeaways

- The RBI has launched SIPs for Treasury Bills to facilitate systematic investing.

- An auto-bidding feature has been introduced to automate the bidding process for T-Bills.

- This initiative is designed to promote retail investment and enhance liquidity in the government securities market.

Additional Details

- Treasury Bills (T-Bills): T-Bills are government-issued short-term debt instruments with maturities of 14, 91, 182, or 364 days. They are sold at a discount and redeemed at face value, with the difference constituting the investor's earnings. T-Bills are considered a safe investment option due to government backing and typically offer higher returns compared to idle bank savings.

- RBI Retail Direct Platform: Launched in 2021, this platform allows retail investors to buy and sell Government Securities (G-Secs) directly, eliminating intermediaries. It offers services such as opening Gilt accounts and participating in auctions, thus democratizing access to government securities.

- SIP Feature: The SIP option enables investors to make regular, smaller investments in T-Bills, making it ideal for disciplined saving towards short- to medium-term financial goals.

- Auto-Bidding Facility: This feature automates the bidding process in primary auctions, allowing investors to set preferences for bid amounts and frequencies, thus reducing manual effort and ensuring timely participation.

- Benefits and Challenges: While T-Bills are a secure investment channel, liquidity may pose challenges as investors need to hold T-Bills until maturity or find buyers in the secondary market.

This initiative by the RBI is poised to enhance opportunities for retail investors, potentially reducing reliance on institutional buyers and fostering a more dynamic market for short-term government debt instruments.

ICMR Launches SHINE Initiative

Why in News?

Why in News?

The Indian Council of Medical Research (ICMR) recently launched the ICMR-SHINE Initiative, a nationwide outreach program aimed at school students in Classes 9 to 12. This initiative seeks to ignite scientific curiosity among youth and promote careers in the field of biomedical research. It aligns with the Prime Minister’s vision of "One Day as a Scientist" and pays tribute to Prof. V. Ramalingaswami, a prominent figure in Indian medical research.

Key Takeaways

- The ICMR-SHINE Initiative targets secondary and senior secondary students.

- It aims to inspire students to consider careers in biomedical research.

- The initiative includes hands-on activities and expert interactions to enhance learning.

Additional Details

- ICMR-SHINE: This acronym stands for Science & Health Innovation for the Nextgen Explorers. It represents a pioneering approach where all ICMR institutes conduct simultaneous interactive activities, engaging thousands of students across India in the realms of science, health, and biomedical research.

- The program emphasizes the practical aspects of science, showcasing how public health research can save lives and what scientists do on a daily basis.

- Students participate in group activities, including a survey game and an anthropometry game, which are designed to provide hands-on experiences.

- Visits to laboratories and exhibitions by the National Institute of Malaria Research (ICMR-NIMR) allow students to meet scientists and technical staff, providing insights into the real-world impact of biomedical research.

The ICMR-SHINE Initiative is a significant step towards fostering a scientific mindset among the youth of India, reflecting the nation's commitment to health research and innovation. By inspiring the next generation, ICMR is contributing to the future of biomedical research in India and honoring the legacy of Prof. V. Ramalingaswami.

Notary Portal Launched by Government of India

Why in News?

Why in News?

The Government of India has recently launched the Notary Portal to enhance and modernize the services provided under the Notaries Act of 1952 and the Notaries Rules of 1956. This digital platform aims to connect notaries appointed by the Central Government with relevant authorities, facilitating various functions online.

Key Takeaways

- The Notary Portal enables online submission of applications, verification of eligibility, and issuance of digital Certificates of Practice.

- As of July 2025, over 34,900 digitally signed Certificates of Practice have been issued, indicating a rapid adoption of the portal.

Additional Details

- Purpose and Features: The portal is designed to make notarial services faceless, paperless, transparent, and efficientby providing a single interface for all stakeholders. Key services include:

- Appointment applications

- Eligibility verifications

- Issuance and renewal of digital certificates

- Changes in practice areas

- Annual return submissions

- The Notaries Act, 1952: This Act regulates the functioning of notaries in India, ensuring standards and accountability. Notaries must be legal practitioners or meet specific qualifications set by the Central or State Governments.

- Functions and Responsibilities:Notaries perform essential legal acts, including:

- Administering oaths

- Attesting and authenticating documents

- Preparing and certifying various legal documents

- Appointment and Registration: Appointments are made by the Central or State Governments, with each maintaining a register that includes details such as the notary's name, qualifications, and registration date.

- Disciplinary Actions: The government has the authority to remove notaries from the register for professional misconduct, ensuring integrity within the notarial system.

- Reciprocal Recognition: The Act allows for the recognition of foreign notarial acts, promoting cross-border legal transactions upon approval from the Central Government.

The Notary Portal represents a significant step towards digitizing notarial services in India, aiming to streamline processes and enhance accessibility for all stakeholders involved.

UPI Data and Tax Compliance Challenges in Small Businesses

Why in News?

The rapid rise of Unified Payments Interface (UPI) usage in India has significantly transformed the landscape of digital payments. By 2025, UPI transactions reached ₹260 lakh crore annually, capturing 28% of all retail payments. However, this surge has introduced new challenges for tax authorities and small vendors, as evidenced by protests from small traders against the Karnataka Commercial Taxes Department's use of UPI data to identify tax evaders. This situation illustrates the complex balance between digitization, transparency, and the concerns of small businesses.

Key Takeaways

- UPI transactions have drastically increased, changing the dynamics of retail payments.

- Tax authorities are utilizing UPI data to uncover unregistered businesses and tax evasion.

- Small vendors are facing challenges due to misunderstandings about UPI payments and tax obligations.

- A need for increased awareness and education among small businesses regarding tax compliance is evident.

Additional Details

- UPI Growth: Initially launched as a peer-to-peer payment method, UPI has evolved to facilitate merchant payments. In FY25, 70% of UPI transactions were peer-to-peer while 30% were peer-to-merchant. The shift from NEFT payments—from 61% in FY18 to 48% in FY25—indicates a move towards more instant digital payment solutions.

- Tax Authorities Using UPI Data: Tax departments are analyzing UPI data to identify businesses evading taxes. For instance, Karnataka’s department scrutinized payments exceeding GST exemption limits from 2022 to 2025, issuing notices to numerous small vendors suspected of tax evasion.

- GST Exemptions and Small Vendor Concerns: Small businesses with a turnover under ₹40 lakh for goods and ₹20 lakh for services are exempt from GST. However, vendors selling taxable items alongside exempt goods may still owe taxes. The composition scheme offers simplified tax options for businesses with turnovers under ₹1.5 crore, but many vendors are unaware or hesitant about compliance.

- Challenges Faced by Small Vendors: Many small vendors mistakenly view UPI transactions as cash, leading to unexpected tax demands based on aggregated transactions. Some received notices demanding payments that far exceed their actual business scale, causing distress. Tax authorities need refined methods to differentiate exempt sales from taxable business income.

- Awareness and Sensitisation Measures: To mitigate these issues, authorities should implement awareness campaigns that clarify the connection between UPI data and tax compliance. Educating vendors on GST benefits, input tax credits, and the composition scheme can promote voluntary registration. A grace period of at least one year before issuing tax notices based on UPI data is recommended to enhance understanding and cooperation.

In conclusion, while the growth of UPI represents a significant advancement in digital transactions, it poses challenges for small businesses that must navigate the complexities of tax compliance. A balanced approach that emphasizes education and transparent communication is essential to ensure fair taxation and avoid pushing users back to cash transactions.

DSP Mutual Fund Launches Flexicap Quality Index Fund

Why in News?

On August 11, 2025, DSP Mutual Fund launched the DSP Nifty500 Flexicap Quality 30 Index Fund, marking a significant development in India's financial markets. This fund is notable for being the first low-cost flexicap strategy in the country, designed to help investors adapt to the evolving equity landscape through a systematic, rules-based approach.

Key Takeaways

- The New Fund Offer (NFO) period ran from August 8 to August 22, 2025.

- The fund replicates the Nifty500 Flexicap Quality 30 Index, which comprises 30 fundamentally strong companies.

- Investments are evenly distributed among large, mid, and small-cap companies.

- It employs a passive investment strategy to minimize costs and complexity.

Additional Details

- Quality Stock Selection Criteria: Stocks are selected based on financial robustness, focusing on parameters like high return on equity (ROE), low debt levels, and consistent earnings growth. This approach ensures investment in companies with strong fundamentals.

- Dynamic Flexicap Allocation Using Momentum: The fund adjusts its allocation between large-cap and small & mid-cap (SMID) stocks quarterly, based on a momentum signal derived from market trends.

- This dynamism allows for allocations to be adjusted to either 33% or 67% in each segment, effectively capturing market movements while maintaining a focus on quality.

The DSP Nifty500 Flexicap Quality 30 Index Fund represents a strategic innovation in mutual fund offerings, emphasizing a disciplined investment philosophy that targets high-quality businesses at reasonable valuations. With the quality factor currently being underpriced, this fund is positioned to provide potential long-term benefits while simplifying the investment process for participants.

India-U.S. Trade Tensions Over Russian Oil Imports

Why in News?

Why in News?

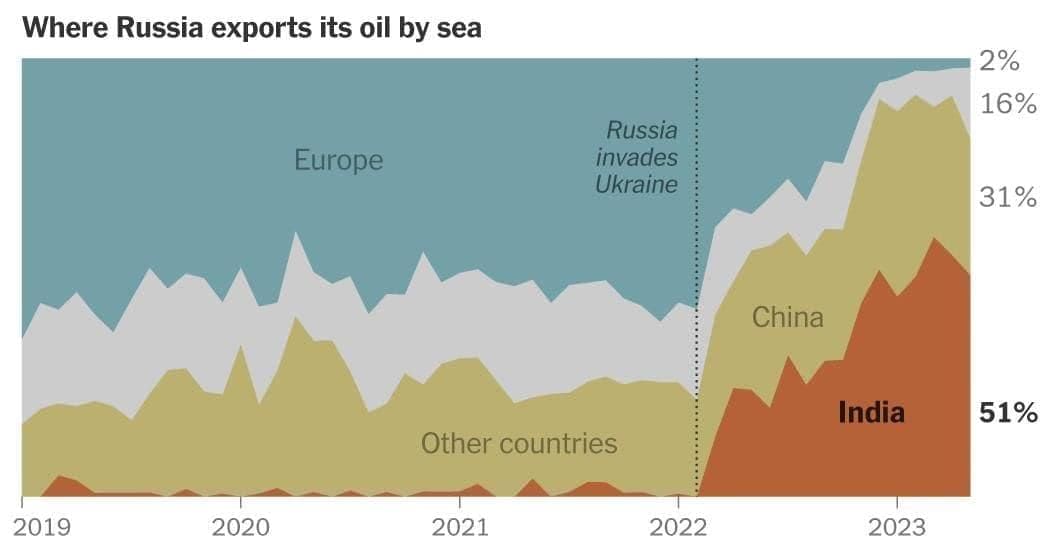

The recent trade dispute between India and the United States has intensified, primarily due to the U.S. imposing a 25% penalty tariff on Indian imports linked to Russia's oil. This action follows unsuccessful Free Trade Agreement (FTA) negotiations and previous reciprocal tariffs by the U.S., leading to significant economic and diplomatic challenges for India.

Key Takeaways

- The U.S. announced a 25% penalty tariff on Indian goods related to Russian oil imports effective from August 27.

- India criticized the U.S. for unfairly targeting its oil imports while continuing its own trade with Russia.

- India's dependence on Russian oil has increased significantly, with over 35% of its crude oil now sourced from Russia.

- The ongoing dispute may complicate India-U.S. relations, affecting broader geopolitical dynamics.

Additional Details

- U.S. Tariffs: The tariffs were implemented after the U.S. imposed a reciprocal 25% tariff on Indian goods starting August 7, following the collapse of FTA negotiations. These measures aim to reduce India’s Russian oil imports amidst ongoing Western sanctions.

- India’s Response: India has condemned the U.S. actions, asserting its commitment to protect national interests. Prime Minister Narendra Modi has indicated a willingness to bear personal costs to safeguard the interests of farmers and producers in the face of these trade tensions.

- Dependence on Russian Oil: Since the Ukraine conflict began in 2022, India has increasingly relied on discounted Russian crude oil, leading to substantial annual savings. This relationship complicates India's ability to decrease imports without economic repercussions.

- Impact on Relations: The trade tensions are straining decades of cooperation between India and the U.S. in defense, technology, and strategy, as India navigates its refusal to halt Russian oil imports.

- Broader Implications: The tariffs are disrupting Indian exports, particularly in textiles, as U.S. buyers seek alternatives. This situation tests India’s strategic autonomy amidst global power rivalries.

The ongoing trade dispute underscores the challenges in global trade influenced by geopolitical conflicts and sanctions. As diplomatic efforts continue, the outcome will significantly affect India’s economic landscape and its relations with major world powers.

Kakori Conspiracy

Why in News?

Why in News?

The Kakori Conspiracy is significant in India’s fight for independence, marking a bold act of resistance against British colonial rule. On 9 August 1925, members of the Hindustan Republican Association (HRA) executed a train robbery near Kakori in Uttar Pradesh to fund their revolutionary activities and protest against oppressive taxation.

Key Takeaways

- The Kakori train robbery was aimed at securing funds for the HRA’s fight against British rule.

- It involved notable revolutionaries including Ram Prasad Bismil and Ashfaqulla Khan.

- The operation was designed to avoid harming civilians, focusing solely on government funds.

Additional Details

- Hindustan Republican Association (HRA): Formed to liberate India through armed rebellion, the HRA later became known as the Hindustan Socialist Republican Association.

- The Kakori train robbery resulted in the theft of Rs. 8,000, which was intended to finance further revolutionary efforts.

- The subsequent trial garnered national attention, showcasing the revolutionary leaders' defiance against colonial injustice.

- Despite public outcry, the British executed four key revolutionaries in December 1927, intensifying nationalist sentiments across India.

The Kakori Conspiracy remains a pivotal event in Indian history, symbolizing the courage and sacrifices made by young Indians for the cause of independence. It continues to inspire and educate future generations about the struggle against colonial oppression.

Punjab Deploys Baaj Akh Anti-Drone System

Why in News?

Why in News?

Punjab has initiated a significant measure in the fight against drug and weapon smuggling along its border with Pakistan by launching the Baaj Akh Anti-Drone System (ADS). This makes Punjab the first state in India to utilize such advanced technology for border security, underlining its commitment to the ongoing War Against Drugs initiative.

Key Takeaways

- Punjab has a 553-kilometre border with Pakistan, notorious for narcotics and arms trafficking.

- The Baaj Akh system automatically detects drones and alerts authorities, enhancing security efforts.

- The initiative is part of a broader anti-drug campaign that includes educational programs in schools.

Additional Details

- Baaj Akh Anti-Drone System: The system, translating to "Hawk Eye," employs advanced detection technology for identifying drones and their control stations. It functions without the need for manual monitoring, providing a vital second layer of defense alongside the Border Security Force (BSF).

- The ADS units have been strategically placed in high-traffic border areas, with plans for expansion to enhance overall security.

- The project cost is approximately Rs 51.4 crore, reflecting a significant investment in Punjab's border security infrastructure.

- The anti-drug campaign includes a new syllabus on drug awareness for students in grades 9 to 12, benefiting around 800,000 pupils.

The deployment of the Baaj Akh Anti-Drone System represents a crucial advancement in Punjab's security measures, aiming to curb drug smuggling and enhance border safety through coordinated efforts among various security agencies, including the Punjab Police, BSF, Army, and Air Force.

Section 498-A IPC

Why in News?

Why in News?

The Supreme Court of India has recently upheld a suspension on arrests under Section 498-A of the Indian Penal Code, which deals with cruelty against married women by their husbands or relatives. This judgement, delivered in July 2025, introduces a two-month ‘cool-off’ period during which no arrests or coercive actions can be taken, igniting discussions on criminal justice and gender equality in India.

Key Takeaways

- Introduction of Section 498-A: Established in 1983 to combat cruelty against women in marriage.

- Judicial Endorsement: The Supreme Court supported a two-month suspension on arrests, raising concerns over the impact on justice for victims.

- Impact on Complainants: Delays may endanger women and discourage reporting of domestic violence.

- Misuse Debate: Questions arise about the potential for misuse versus the actual effectiveness of the law.

Additional Details

- Judicial Endorsement of Suspension: The Allahabad High Court initiated a two-month suspension on arrests, citing a ‘cool-off’ period. The Supreme Court endorsed this decision, but without thorough examination of the social realities involved.

- Impact on Complainants and Police Investigations: The suspension may embolden offenders and create barriers to timely justice, as women may already face significant social stigma when reporting abuse.

- Family Law and Alternate Dispute Resolution: While mediation is encouraged in family matters, it is not suitable for serious criminal allegations like domestic violence, which require strict enforcement of penal laws.

- Statistical and Social Context: In 2022, over 1.34 lakh cases were filed under Section 498-A. Surveys indicate that many incidents of domestic violence go unreported due to stigma and fear of social repercussions.

- Legal and Social Implications: Selective suspension of provisions can undermine uniformity in criminal law, making it harder for victims to access justice.

In summary, the Supreme Court's ruling on Section 498-A raises critical issues regarding the balance between protecting women from domestic violence and ensuring that the law is not misused. The effectiveness of this law hinges on proper enforcement and support for victims, while the suspension of arrests could lead to increased vulnerability for complainants.

Aviation Workforce Shortage

Why in News?

Why in News?

The aviation sector is currently grappling with a significant shortage of skilled personnel as of 2025. Two primary strategies have emerged during the 42nd ICAO Assembly to tackle this issue. The European Union (EU) is advocating for an expansion of the talent pool and enhancement of career attractiveness, whereas India is proposing a global Code of Conduct to manage the international recruitment of its trained aviation workforce. These differing perspectives reflect various priorities related to workforce mobility and operational stability.

Key Takeaways

- The aviation sector is facing a critical shortage of skilled personnel in 2025.

- Two main approaches from the EU and India highlight differing priorities on workforce management.

Additional Details

- India’s Position on Workforce Stability: India perceives the recruitment of its trained pilots, engineers, and cabin crew by foreign airlines as disruptive. It contends that uncoordinated poaching undermines fleet expansion plans and compels airlines to allocate resources for replacements. India advocates for an ICAO-led Code of Conduct that mandates standardized notice and consultation prior to recruitment. Current regulations require a six-month notice for pilots transferring between domestic airlines, which is deemed sufficient for recruiting and training replacements.

- European Union’s Approach to Talent Shortage: The EU views the talent shortage as a global issue impacting various sectors, including flight crew and air traffic management. Contributing factors include uncompetitive compensation, inadequate fatigue management, departures due to the pandemic, and a lack of diversity. The EU supports mobility in line with International Labour Organisation (ILO) Conventions No. 97 and No. 111 and ICAO’s Next Generation of Aviation Professionals initiative, focusing on making aviation careers more appealing and increasing training capacity.

In conclusion, while both India and the EU present valid concerns regarding aviation workforce management, the emphasis should be on creating attractive career paths and enhancing training opportunities rather than imposing restrictive measures that could hinder mobility and growth within the sector.

New Freshwater Crab Species Discovered In Western Ghats

Why in News?

Why in News?

Recent research conducted in the Western Ghats of Kerala has resulted in the identification of a new genus and two new species of freshwater crabs. This discovery highlights the rich biodiversity and significant endemic species of the region, emphasizing the need for conservation in the face of habitat threats.

Key Takeaways

- A new genus named Kasargodia and two species Kasargodia sheebae and Pilarta vaman have been discovered.

- The discoveries were made by scientists from the University of Kerala and the National University of Singapore.

- Both species are part of the family Gecarcinucidae and were found in isolated mountain streams.

Additional Details

- Discovery and Naming:

The species Kasargodia sheebae was discovered in Kasaragod district and is named after the district and the researcher’s wife, Sheeba Smrithy Raj. Pilarta vaman, found in Gavi, Pathanamthitta district, is named after the Hindu deity Vaman, reflecting its small size.

- Physical Characteristics:

Kasargodia sheebae has a brownish-orange carapace adorned with numerous black spots, while its limbs and claws are orange with black markings. Pilarta vaman has a more quadrate carapace and is significantly smaller.

- Habitat and Distribution:

The Western Ghats, a recognized biodiversity hotspot, hosts many endemic freshwater crab species. These crabs are primarily nocturnal and reside in deep burrows, making them difficult to locate. The region exhibits nearly 70% endemism among freshwater crabs, surpassing many other groups.

- Conservation Concerns:

Both crab species face threats from human activities, including tourism that disrupts their habitats. Habitat degradation and pollution pose additional risks to their survival, necessitating conservation efforts.

- Scientific Importance:

The discoveries enhance our understanding of freshwater crab taxonomy and biodiversity. Publication in scientific journals like the Journal of Crustacean Biology and Zootaxa validates these findings, underscoring the importance of continued exploration in biodiversity hotspots.

In summary, the discovery of new crab species in the Western Ghats underscores the region's rich biodiversity and highlights the urgent need for conservation measures to protect these unique species and their habitats.

New OCI Rules Tighten Overseas Citizenship Regulations

Why in News?

Why in News?

On August 14, 2025, the Ministry of Home Affairs (MHA) announced new reforms that introduce stricter regulations for Overseas Citizens of India (OCI). These changes aim to enhance the oversight of OCI registrations and cancellations, focusing on criminal convictions and other grounds that may lead to the cancellation of OCI status, regardless of whether the offences occurred in India or abroad.

Key Takeaways

- The OCI scheme, introduced in 2005, allows foreign nationals of Indian origin lifelong visa-free travel to India.

- New cancellation criteria include imprisonment of two years or more and serious charges recognized under Indian law.

Additional Details

- Overview of OCI Scheme: The OCI scheme grants visa-free access to individuals of Indian origin who were citizens of India on or after January 26, 1950, excluding those with Pakistani or Bangladeshi lineage. It offers multiple benefits but does not equate to full Indian citizenship.

- New Cancellation Criteria: OCI registration can be cancelled if the holder is sentenced to two years or more in prison, or if they are charged with offences punishable by seven years or more, regardless of where the offence took place.

- Additional Grounds for Cancellation: OCI status may also be revoked if it was obtained through fraud, if the individual displays disaffection towards the Constitution of India, or engages in unlawful trade during wartime. Cancellation can also occur if the individual commits a serious offence within five years of obtaining OCI status.

- Implications of the New Rules: These reforms aim to curb misuse of OCI privileges while ensuring adherence to national security and public order. The rules apply to all OCI cardholders globally.

- Legal Basis and Enforcement: The new regulations are enacted under clause (da) of section 7D of the Citizenship Act, 1955, and are enforced by the Ministry of Home Affairs, with support from the Ministry of External Affairs.

In summary, the introduction of stricter rules for OCI holders underscores the government's commitment to maintaining India's sovereignty and public interest while regulating the privileges associated with OCI status.

|

164 videos|798 docs|1153 tests

|

FAQs on Weekly Current Affairs (8th to 14th August 2025) - General Test Preparation for CUET UG - CUET Commerce

| 1. What is the significance of the RBI launching SIP and auto-bidding for Treasury Bills? |  |

| 2. What is the SHINE Initiative launched by the ICMR? |  |

| 3. What are the features of the Notary Portal launched by the Government of India? |  |

| 4. What challenges do small businesses face regarding UPI data and tax compliance? |  |

| 5. How does the aviation workforce shortage impact the industry? |  |