NCERT Solutions (Part - 2) - Recording of Transactions-I | Accountancy Class 11 - Commerce PDF Download

Q3: Describe how accounts are used to record information about the effects of transactions?

Ans:

- To determine the amount of money we are owed by our debtors or the amount we owe to our creditors, it is necessary to prepare accounts.

- This is because every transaction is recorded in the order it occurs in the original book of entry, known as the journal.

- However, the journal does not offer a clear overview of our financial position at a glance.

- By preparing accounts, we can gain a better understanding of the business activities that occur between the time of recording transactions.

There are some steps to record transactions in accounts; it can be easily understood with the help of an example.

Sold goods to Mr A worth Rs 50,000 on 12th April and received payment Rs 40,000 on 25th April. The following journal entries will be recorded:

Step 1- Locate the account in the ledger, i.e., Mr A's Account.

Step 2- Enter the date of transaction in the date column of the debit side of Mr A's Account.

Step 3- In the 'Particulars' column of the debit side of Mr A's Account, the name of the corresponding account is to be written, i.e., 'Sales'.

Step 4- Enter the page number of the ledger in the Journal Folio (J.F.) column of Mr A's Account.

Step 5- Enter the amount in the 'Amount' column.

Step 6- The same steps are to be followed to post entries in the credit side of Mr A's Account.

Step 7- After entering all the transactions for a particular period, balance the account by totalling both sides and write the difference in the shorter side, as 'Balance c/d'.

Step 8- Total of account is to be written on either side.

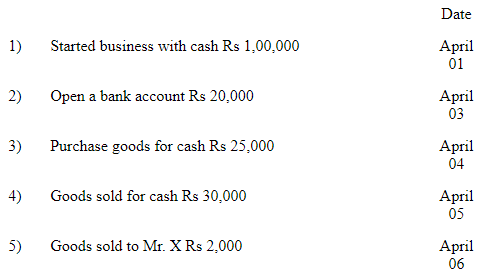

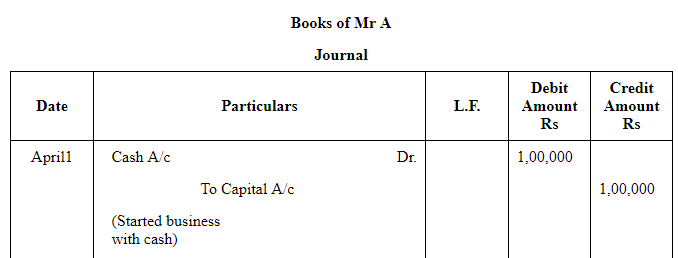

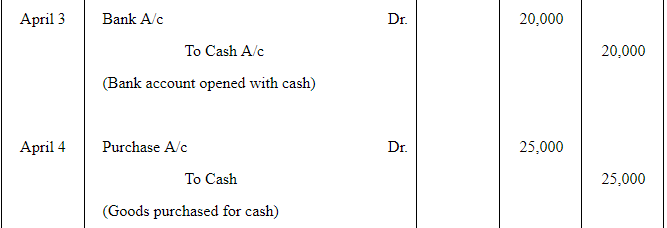

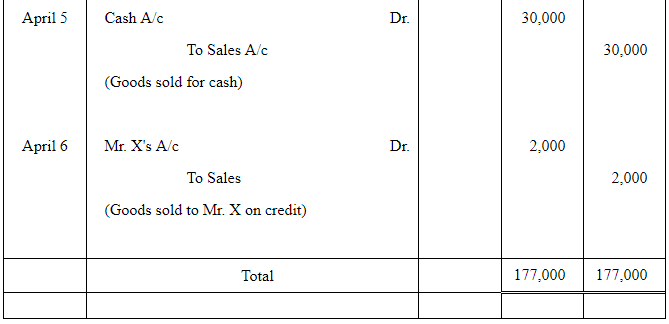

Q4: What is a journal? Give a specimen of journal showing at least five entries.

Ans:

- Journal is derived from the French word Jour, means daily records.

- In this book, transactions are recorded in order of their occurrence, i.e., in chronological order from the source document.

- It is also termed as the book of original entry, and each transaction is termed as journal entry.

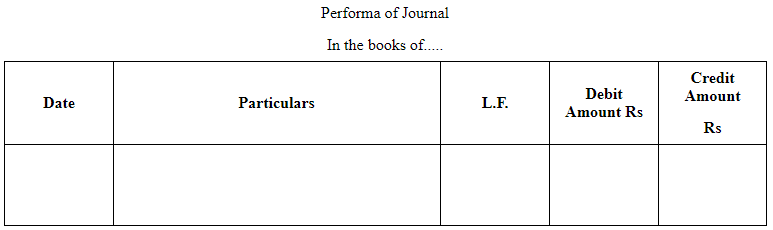

Date- Date of transaction is recorded in the order of their occurrence.

Particulars- Details of business transactions like, name of the parties involved and the

name of related accounts, are recorded.

L.F.- Page number of ledger account when entry is posted.

Debit Amount- Amount of debit account is written.

Credit Amount- Amount of credit account is written.

Recording of a Journal Entry

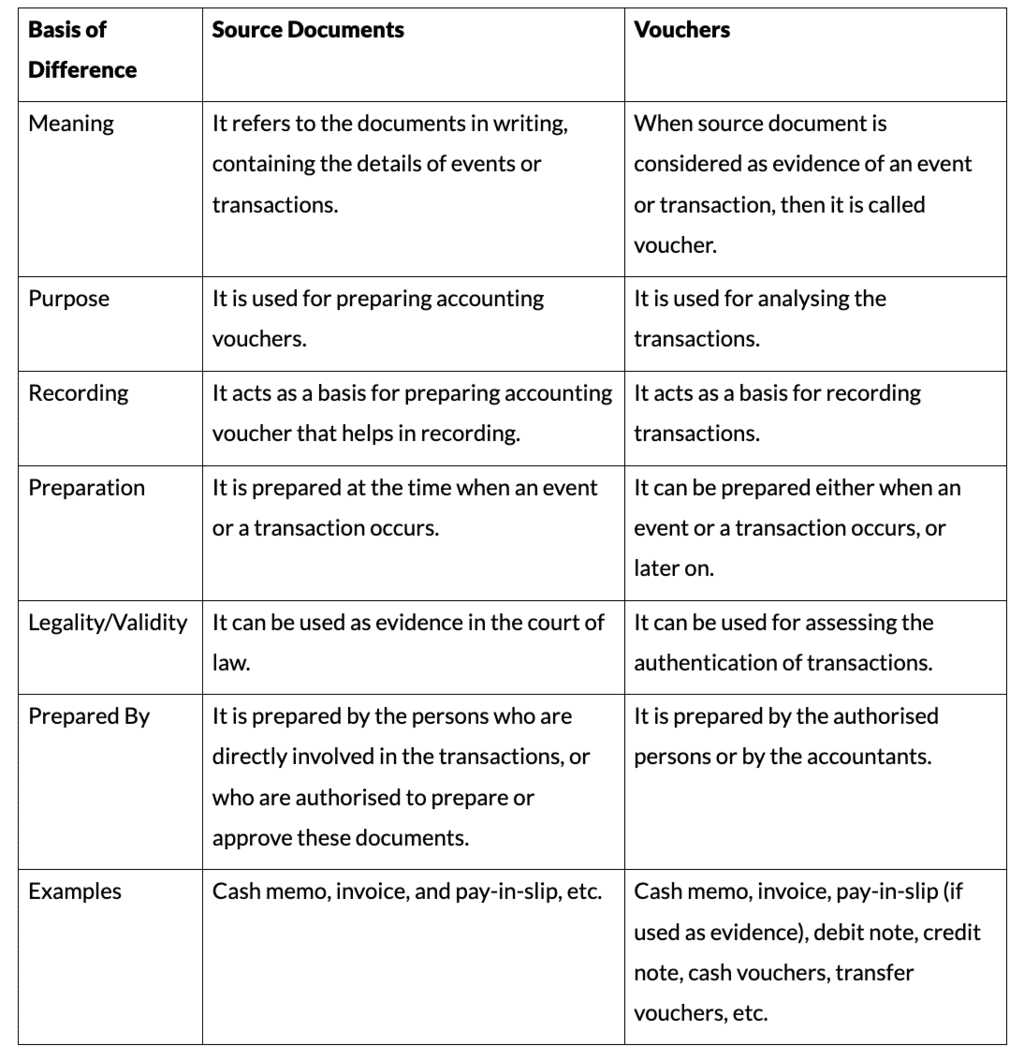

Q5: Differentiate between source documents and vouchers.

Ans:

Q6: Accounting equation remains intact under all circumstances. Justify the

statement with the help of an example.

Ans:

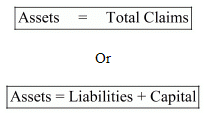

According to the dual-aspect concept, every transaction simultaneously has two effects of equal amount, i.e. debit and credit. However, in any case, the equality of total assets with the total claims of business (sum of capital and liabilities) is not disturbed. This equality is algebraically represented as:

or, Liabilities = Asset - Capital

or, Capital = Assets - Liabilities

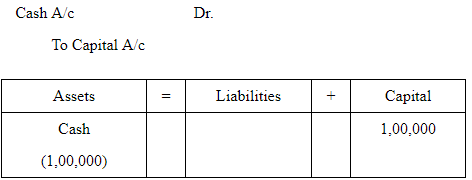

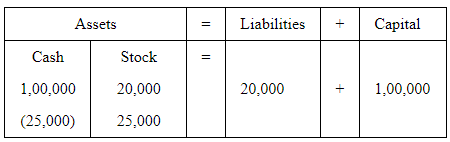

In any circumstance, the above equation cannot be changed. For example,

1. The business started with cash Rs 1,00,000

Assets decrease, as cash is invested into the business and capital increases. Thus the

equality between LHS and RHS remains intact.

2. Goods purchased on credit Rs 20, 000

Assets increase as well as liability increases, without disturbing the equality.

3. Goods purchased with cash 25000

As goods are purchased for cash, so cash balance reduces by Rs 25,000, but on the other hand, stock balance increases by Rs 25,000. Thus the total balance of LHS remains equal to the total claims.

Q7: Explain the double-entry mechanism with an illustrative example.

Ans:

The double entry system is based on the dual aspect concept. It means every transaction has two-sided effects, i.e., every debit has its credit. This system is explained by Luca Pacioli in his book Summade Arithmetica Geometria Proportioni et Proportionalita, 1494. He said if one is receiver, then the other should be the giver.

In double-entry system, accounts are classified as shown below.

1. Personal Accounts: It includes individual persons, firms, companies, and other institutions, such as Mr. A, M/s ABC & Co. etc.

Rule of double entry system for personal accounts:

- Debit the receiver.

- Credit the giver.

2. Impersonal Accounts: It relates to non living things. Impersonal accounts are further classified as real accounts and nominal accounts.

1. Real Account- It includes all types of assets.

i. Tangible assets that can be seen and touched; for example, machinery, building, etc.

ii. Intangible assets that cannot be seen and touched; for example, goodwill, patent, etc.

Rule of double entry system for real accounts:

- Debit what comes in.

- Credit what goes out.

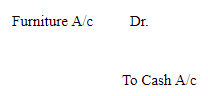

For example:

Furniture purchased for cash

2. Nominal Account: It includes all expenses, losses, incomes and gains. Rule of double entry system for nominal accounts:

- Debit all losses and expenses.

- Credit all gains and income.

Numerical questions

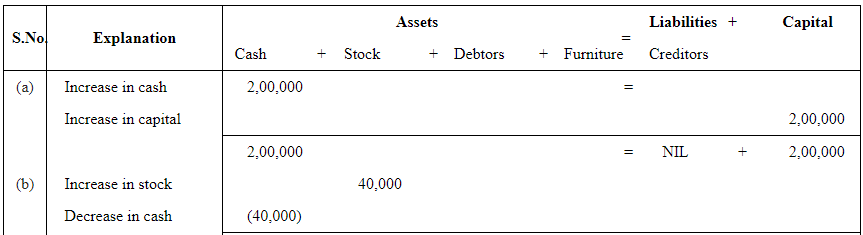

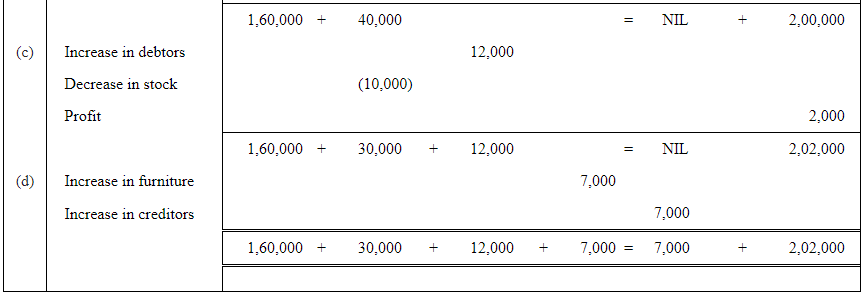

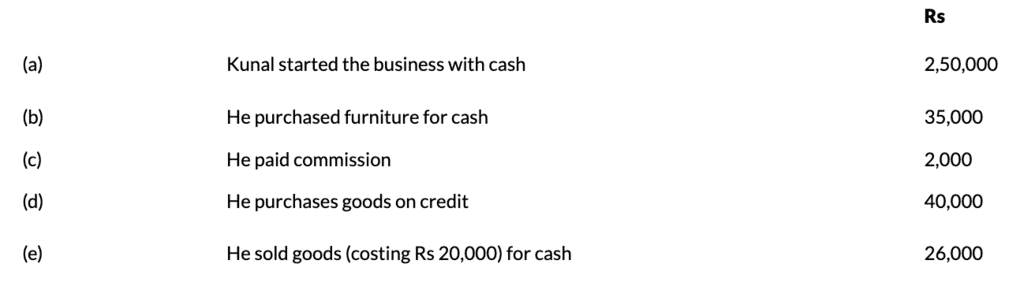

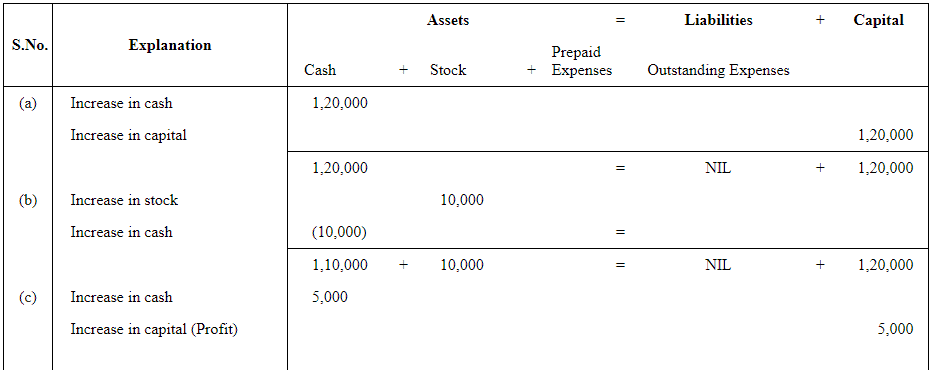

Q1: Prepare accounting equation on the basis of the following:

(a) Harsha started business with cash Rs 2,00,000

(b) Purchased goods from Naman for cash Rs 40,000

(c) Sold goods to Bhanu costing Rs 10,000/- Rs 12,000

(d) Bought furniture on credit Rs 7,000

Ans:

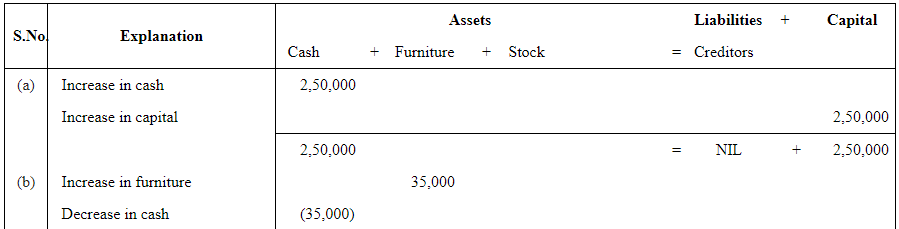

Q2: Prepare the accounting equation from the following:

Ans:

Page No 89:

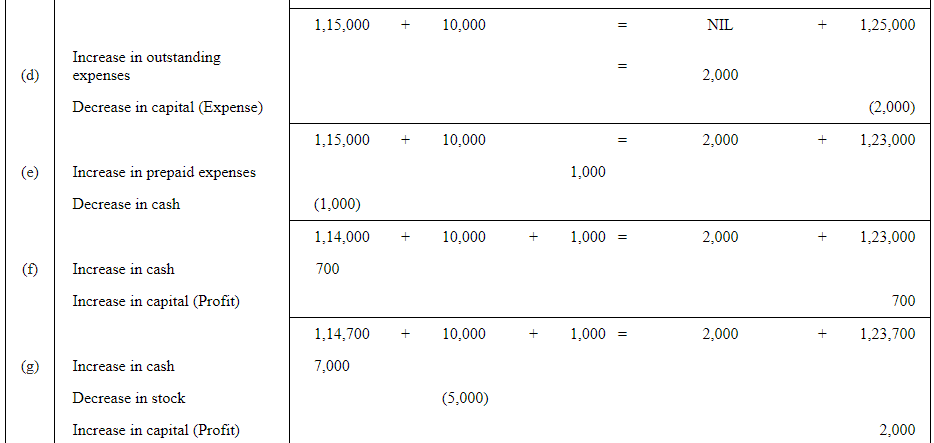

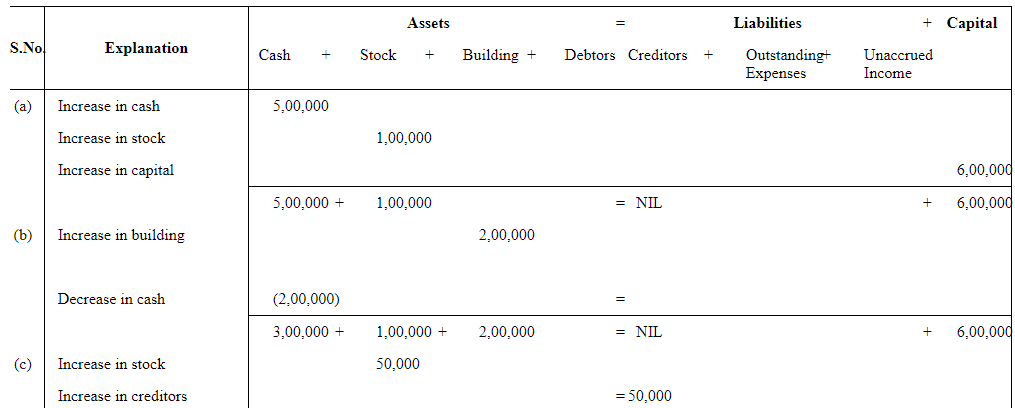

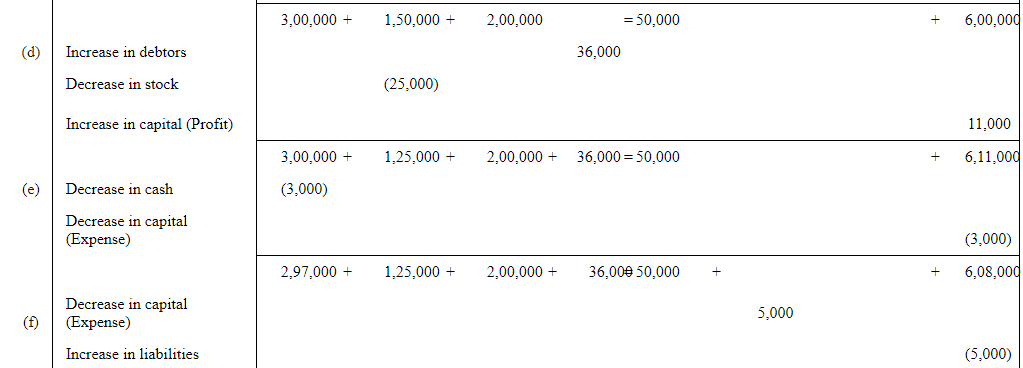

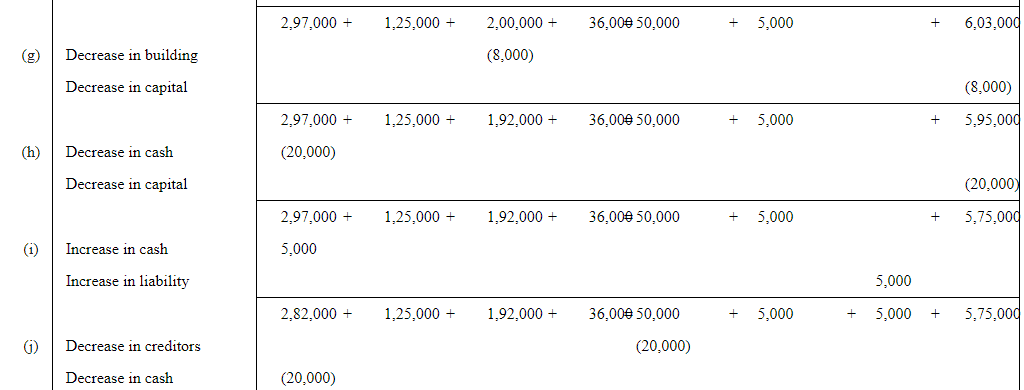

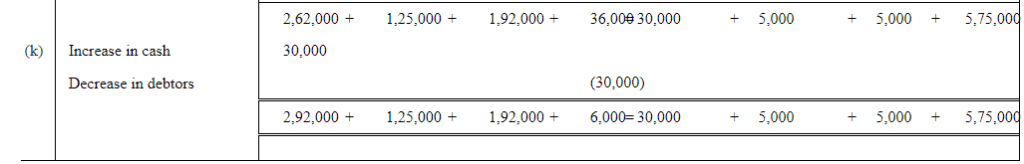

Q3: Mohit has the following transactions, prepare accounting equation:

Ans:

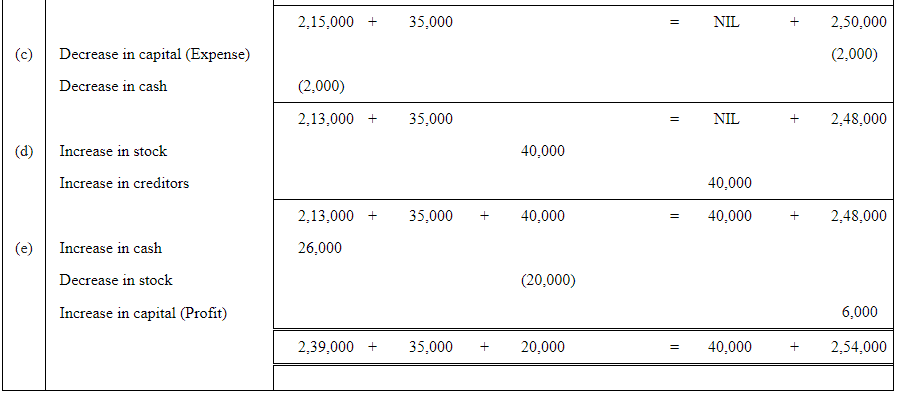

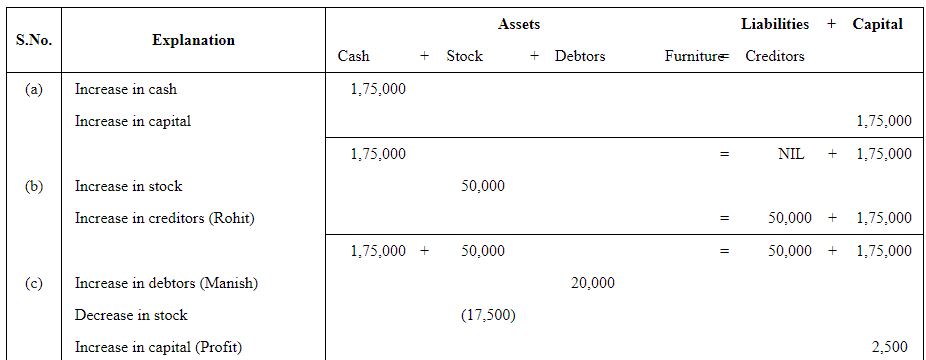

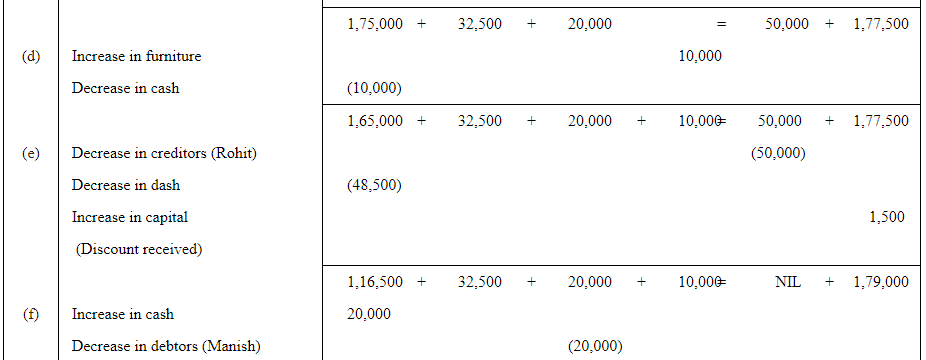

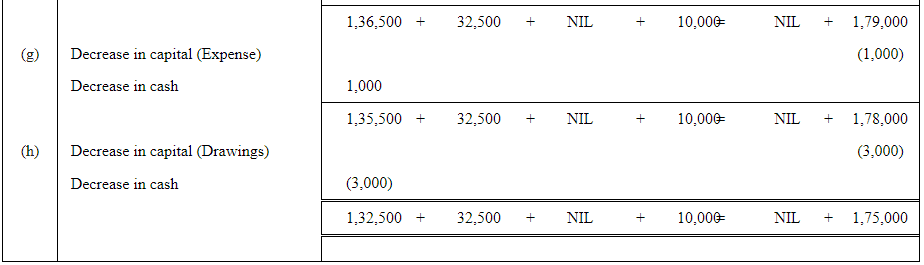

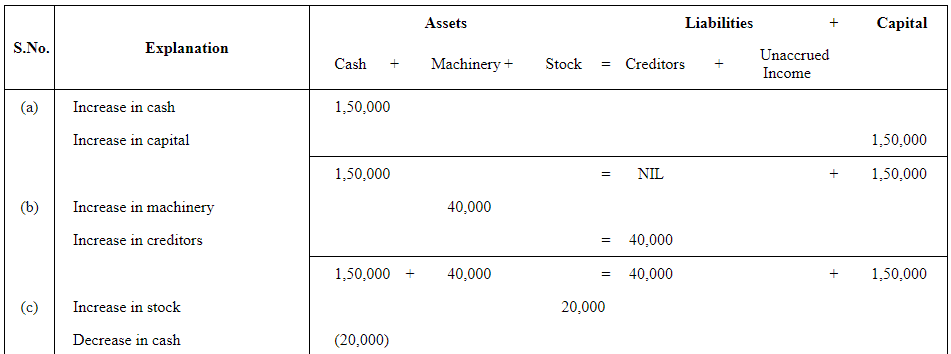

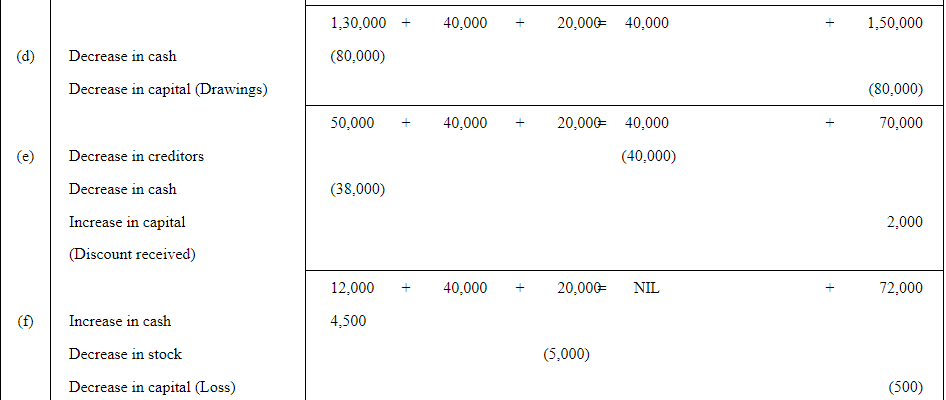

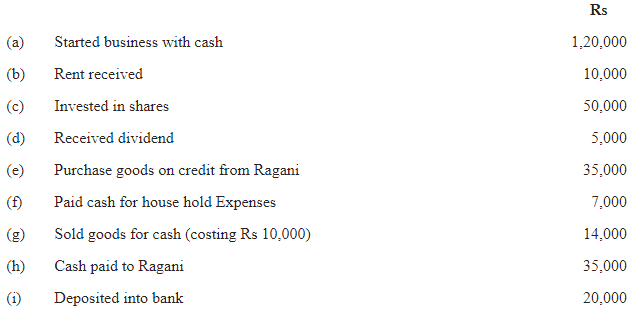

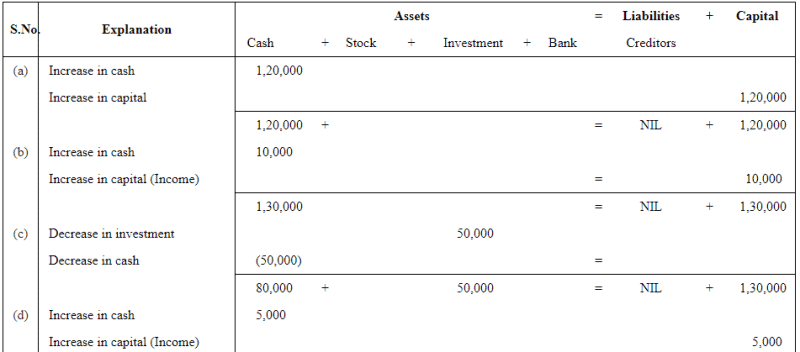

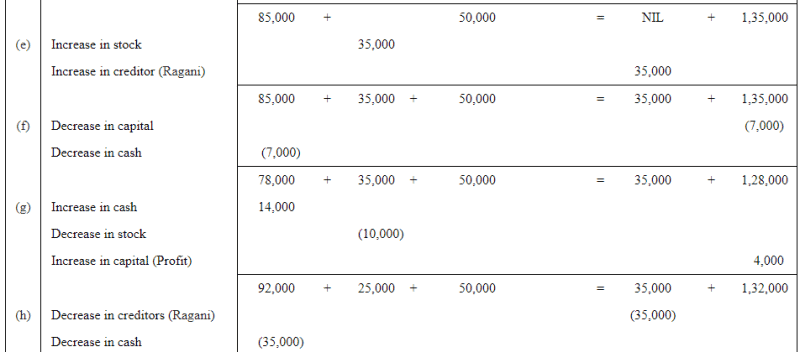

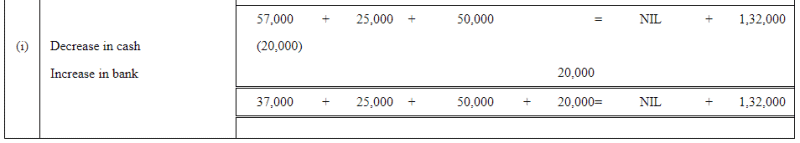

Q4: Rohit has the following transactions:

Prepare the Accounting Equation to show the effect of the above transactions on the assets, liabilities and capital.

Ans:

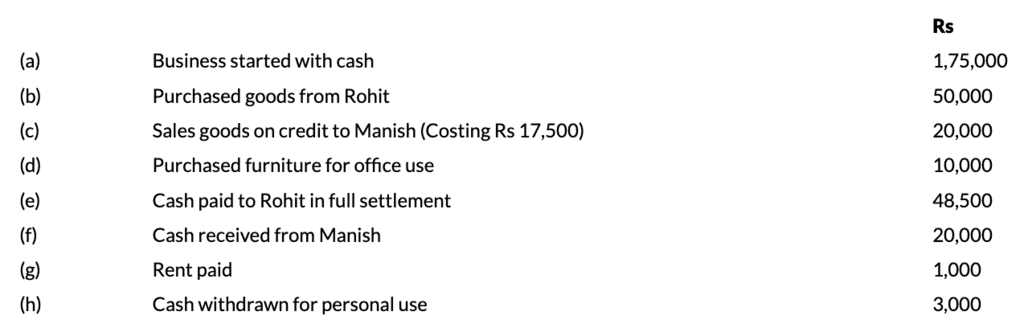

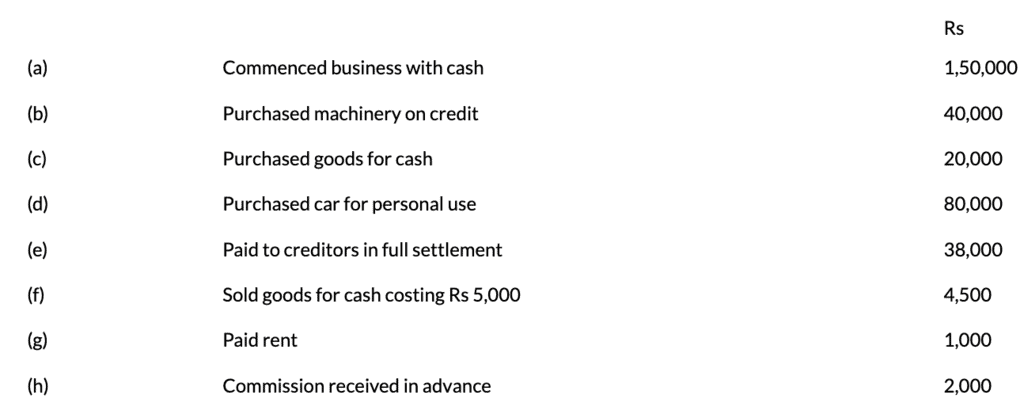

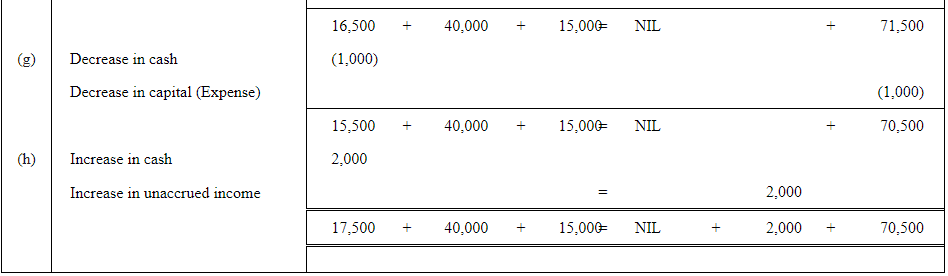

Q5: Use the accounting equation to show the effect of the following transactions of M/s Royal Traders:

Ans:

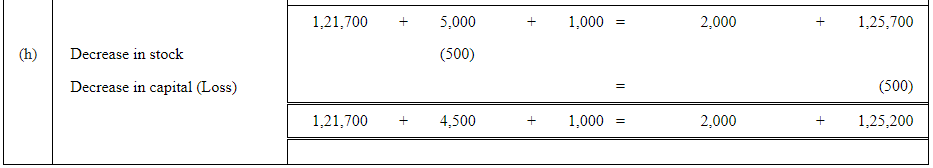

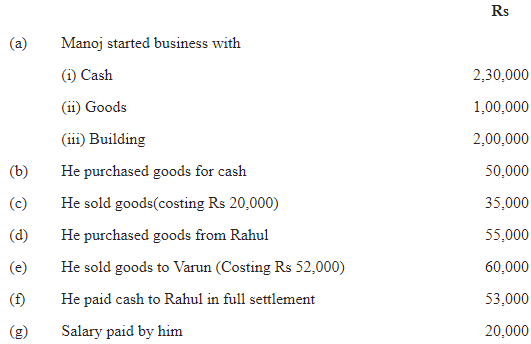

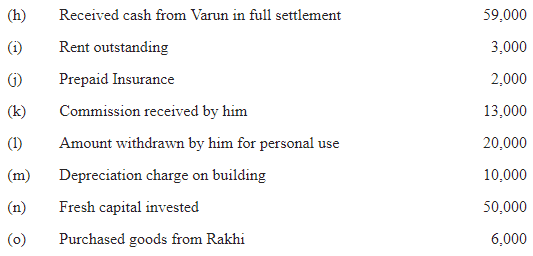

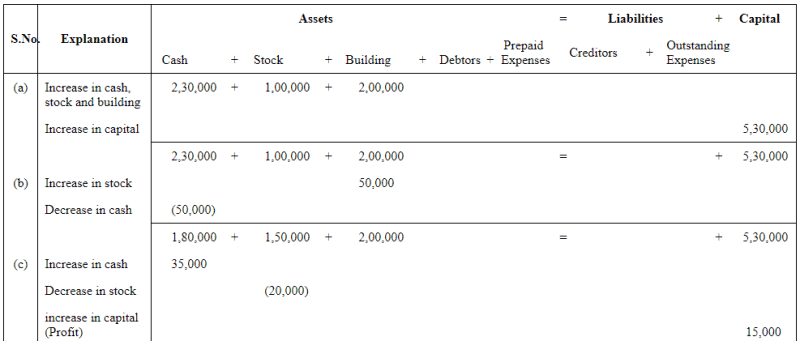

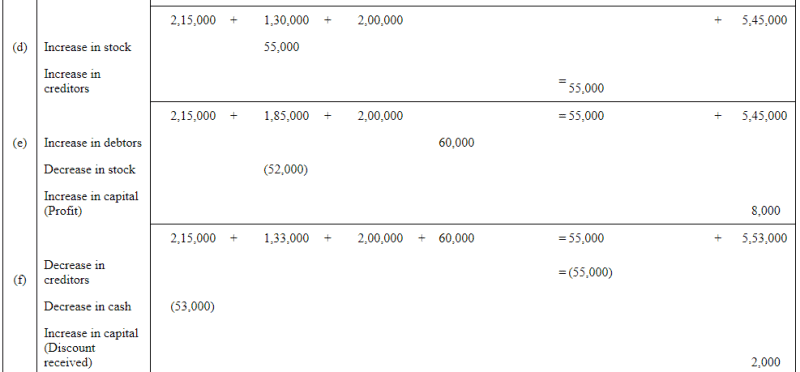

Q6: Show the accounting equation on the basis of the following transaction:

Ans:

Page No 90:

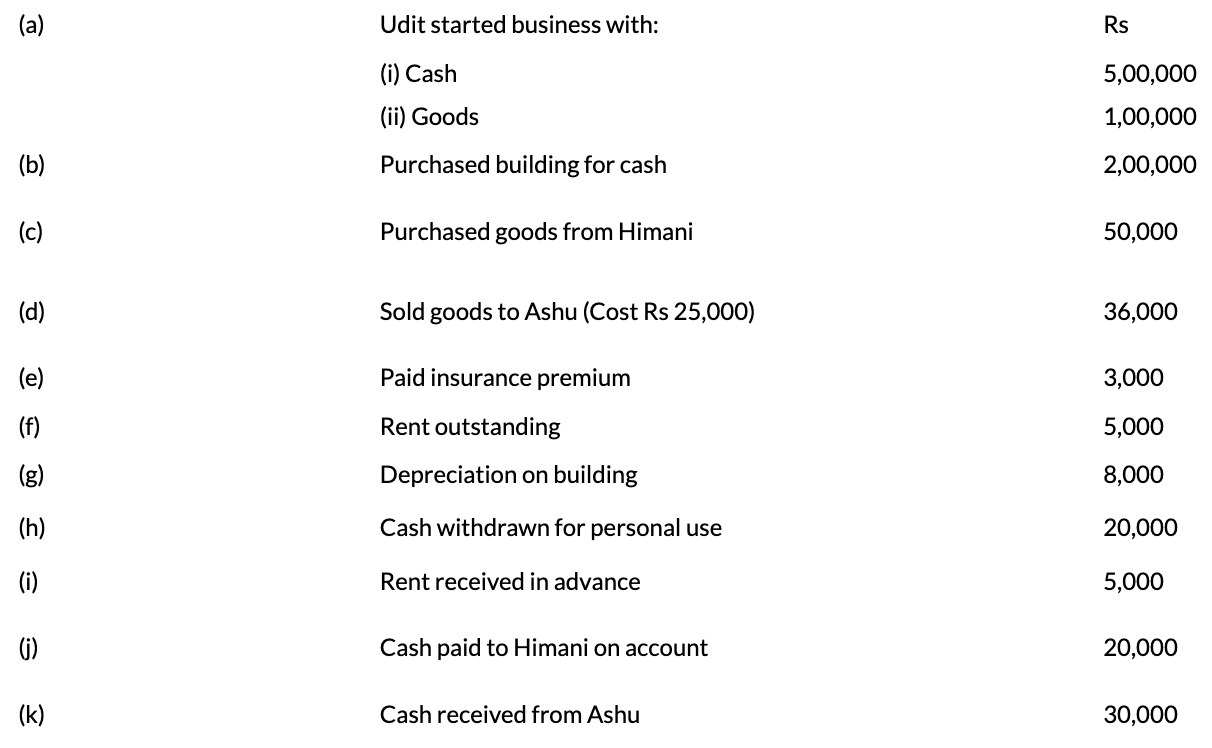

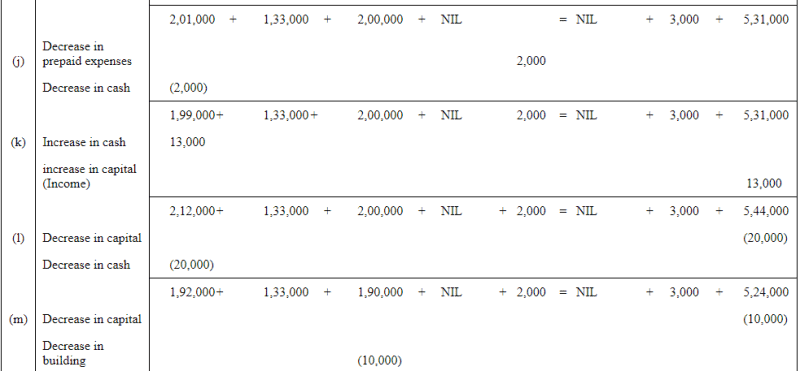

Question 7: Show the effect of the following transactions on Assets, Liabilities and Capital through accounting equation:

Ans:

Question 8: Show the effect of the following transaction on the accounting equation:

Ans:

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solutions (Part - 2) - Recording of Transactions-I - Accountancy Class 11 - Commerce

| 1. What is recording of transactions? |  |

| 2. What is the importance of recording transactions in a business? |  |

| 3. What are some of the commonly used methods for recording transactions? |  |

| 4. What is the role of a bookkeeper in recording transactions? |  |

| 5. What are some of the common mistakes that businesses make while recording transactions? |  |