NCERT Solution (Part - 5) - Accounting for Share Capital | Additional Study Material for Commerce PDF Download

Page No 69:

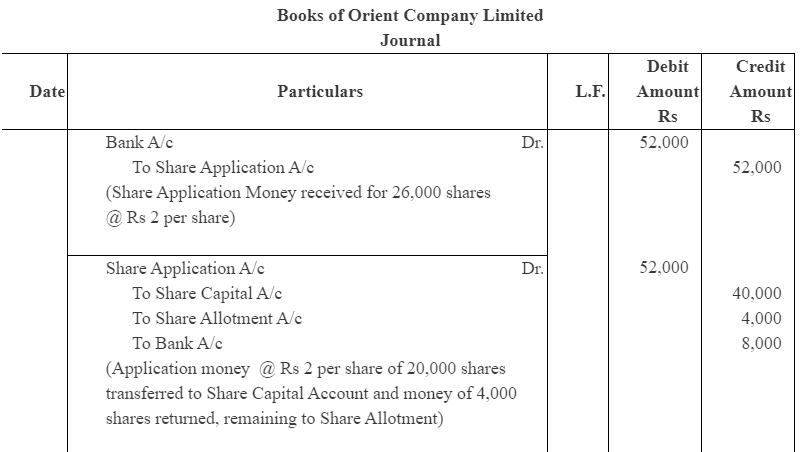

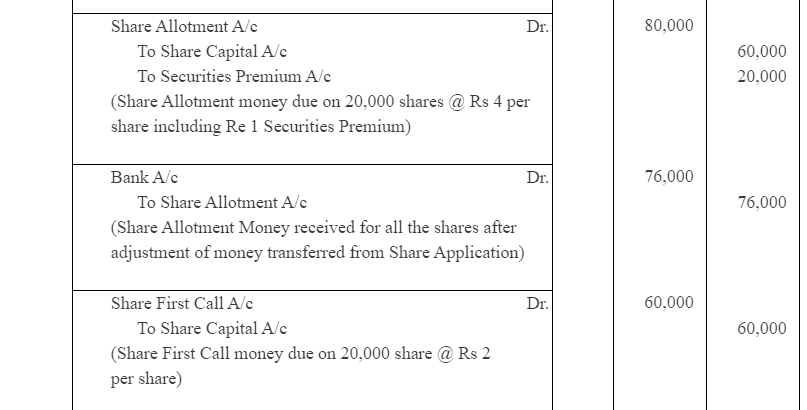

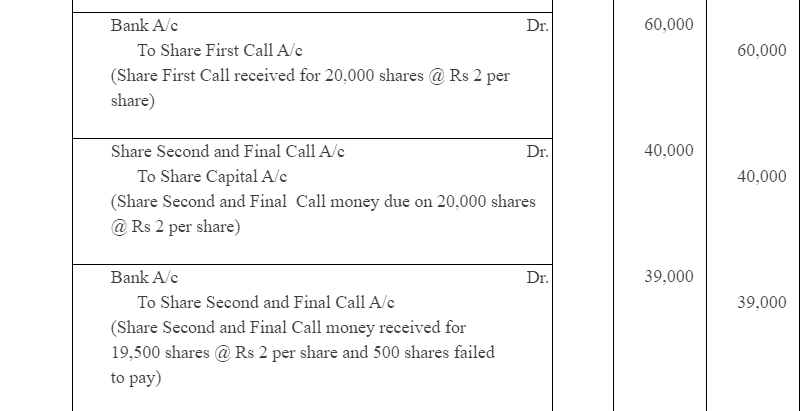

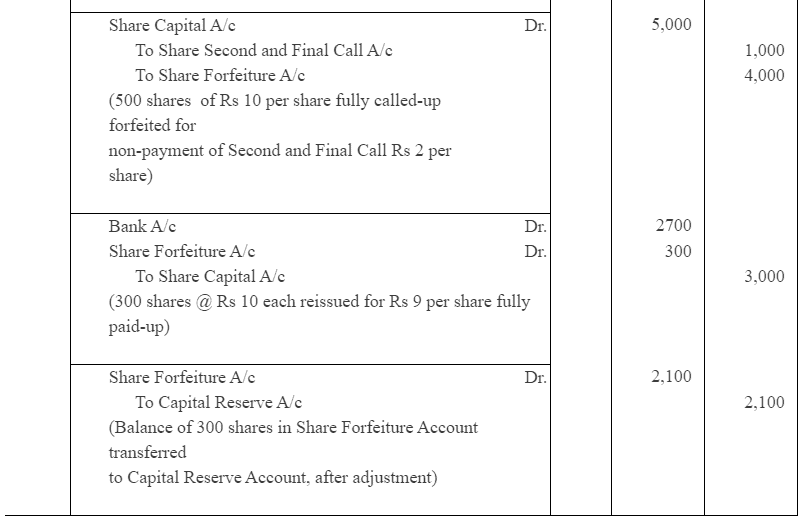

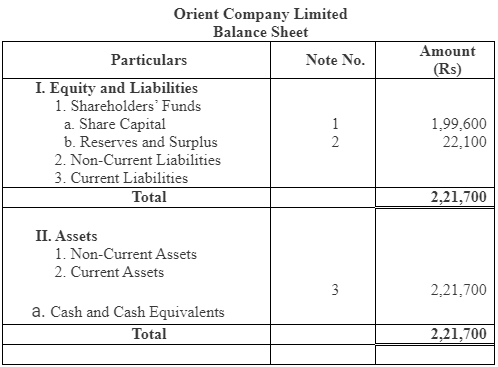

Question 18 : The Orient Company Limited offered for public subscription 20,000 equity shares of Rs 10 each at a premium of 10% payable at Rs 2 on application; Rs 4 on allotment including premium; Rs 3 on First Call and Rs 2 on Second and Final call. Applications for 26,000 shares were received. Applications for 4,000 shares were rejected. Pro-rata allotment was made to the remaining applicants. Both the calls were made and all the money were received except the final call on 500 shares which were forfeited. 300 of the forfeited shares were later on issued as fully paid at Rs 9 per share. Give journal entries and prepare the balance sheet.

Answer :

Working Notes:

Share Forfeiture Account credited | Rs 8 per share |

Less: Share Forfeiture Account debited | Rs 1 per share |

Amount transferred to Capital Reserve Account, after adjustment | Rs 7 per share |

Amount transferred to Capital Reserve Account, after adjustment for 300 shares = 300 Shares @ Rs 7 per share = Rs 2,100

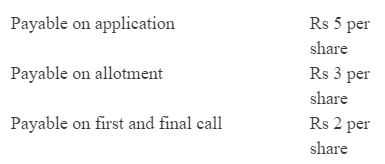

Question 19 : Alfa Limited invited applications for 4,00,000 of its equity shares of Rs 10 each on the following terms :

Applications for 5,00,000 shares were received. It was decided :

(a) to refuse allotment to the applicants for 20,000 shares;

(b) to allot in full to applicants for 80,000 shares;

(c) to allot the balance of the available shares' pro-rata among the other applicants; and

(d) to utilise excess application money in part as payment of allotment money.

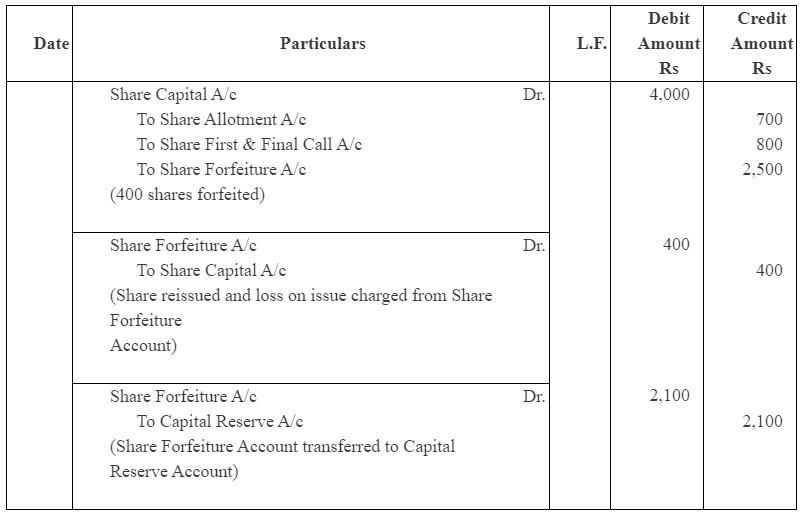

One applicant, whom shares had been allotted on pro-rata basis, did not pay the amount due on allotment and on the call, and his 400 shares were forfeited. The shares were reissued @ Rs 9 per share. Show the journal and prepare Cash book to record the above.

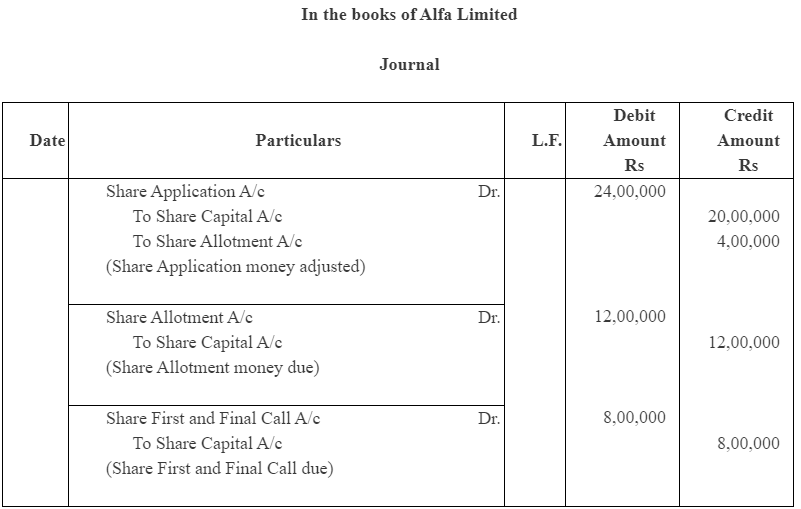

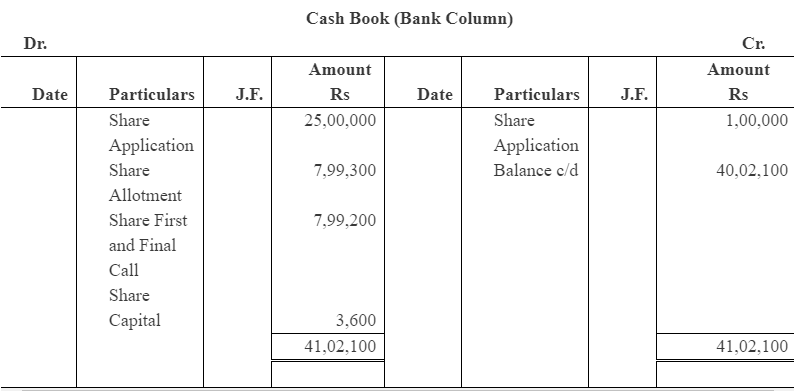

Answer :

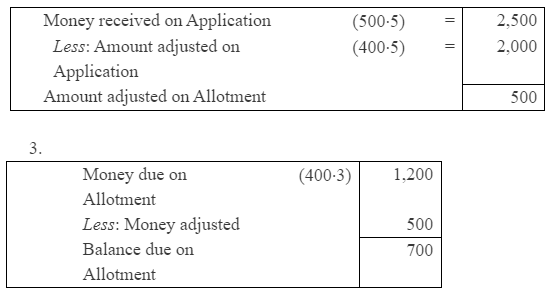

Working Note:

2. Call in arrears by applicant on allotment

Page No 70:

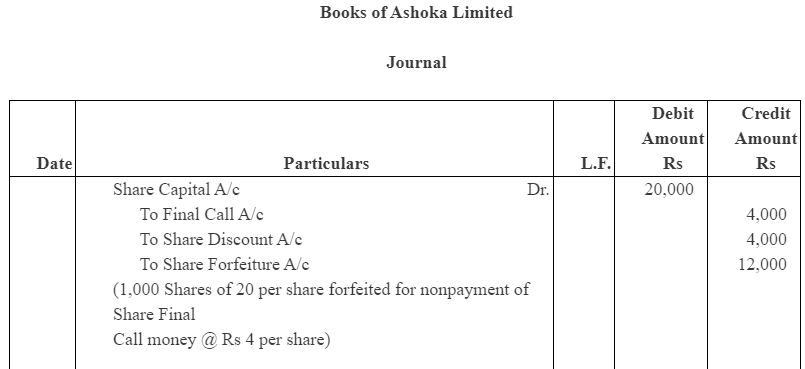

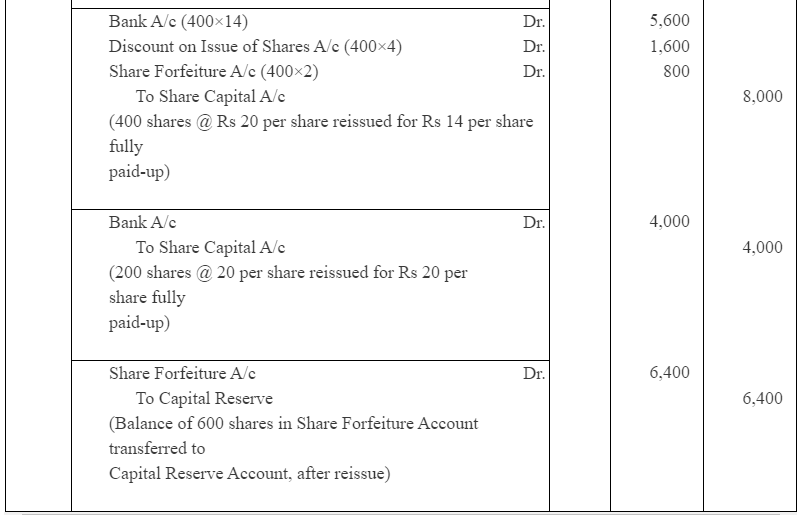

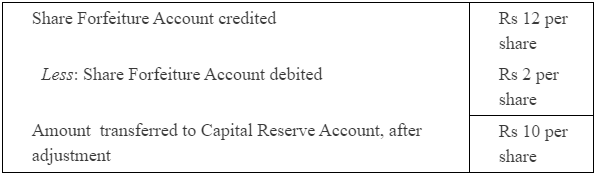

Question 20 : Ashoka Limited Company which had issued equity shares of Rs 20 each at a discount of Rs 4 per share, forfeited 1,000 shares for non-payment of final call of Rs 4 per share. 400 of the forfeited shares are reissued at Rs 14 per share out of the remaining shares of 200 shares reissued at Rs 20 per share. Give journal entries for the forfeiture and reissue of shares and show the amount transferred to capital reserve and the balance in Share Forfeiture Account.

Answer :

Balance in Share Forfeiture Account (12,000 – 800 – 6,400) = Rs 4,800

Working Notes:

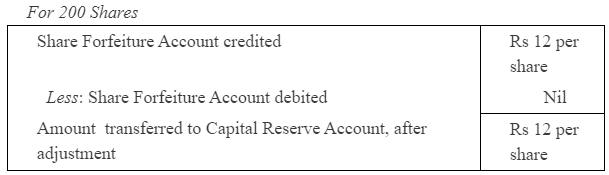

For 400 Shares

Amount of 400 shares transferred to Capital Reserve Account, after reissue = 400 Shares @ Rs 10 per share = Rs 4,000

Amount of 200 shares transferred to Capital Reserve Account, after reissue = 200 Shares @ Rs 12 per share = Rs 2,400

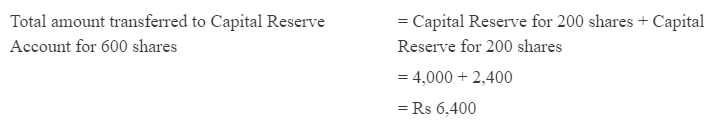

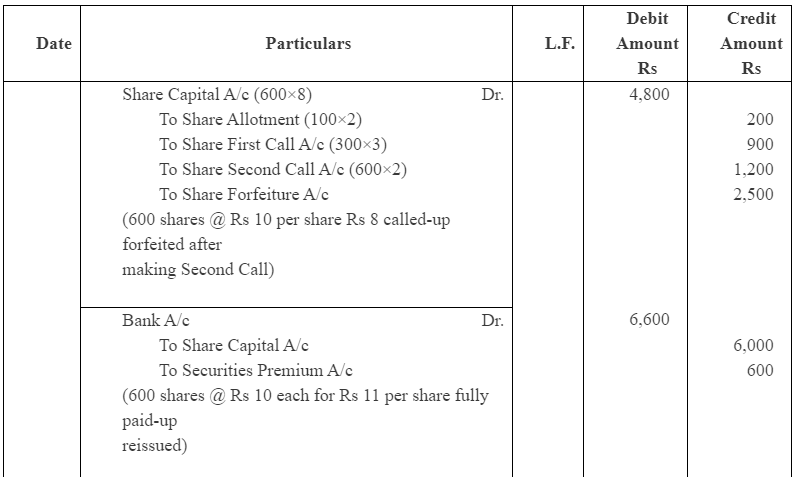

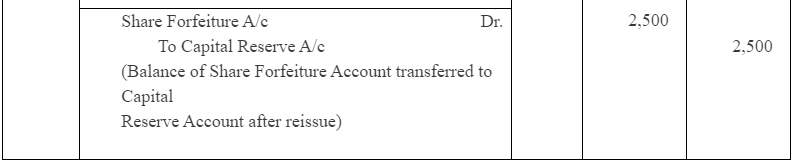

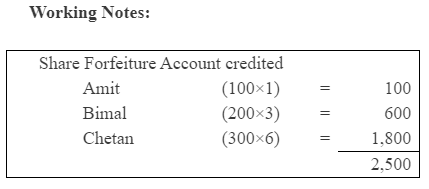

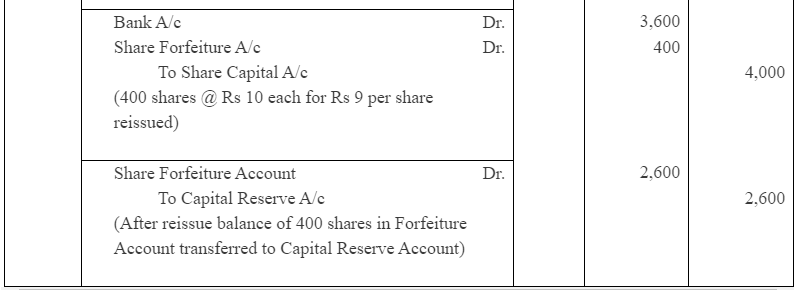

Question 21 : Amit holds 100 shares of Rs 10 each on which he has paid Re.1 per share as application money. Bimal holds 200 shares of Rs 10 each on which he has paid Re.1 and Rs 2 per share as application and allotment money, respectively. Chetan holds 300 shares of Rs 10 each and has paid Re.1 on application, Rs 2 on allotment and Rs 3 for the first call. They all fail to pay their arrears and the second call of Rs 2 per share and the directors, therefore, forfeited their shares. The shares are reissued subsequently for Rs 11 per share as fully paid. Journalise the transactions.

Answer :

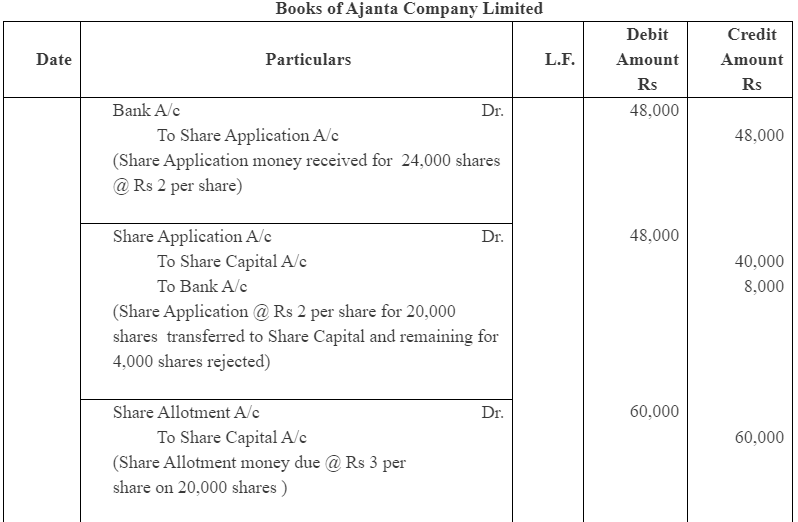

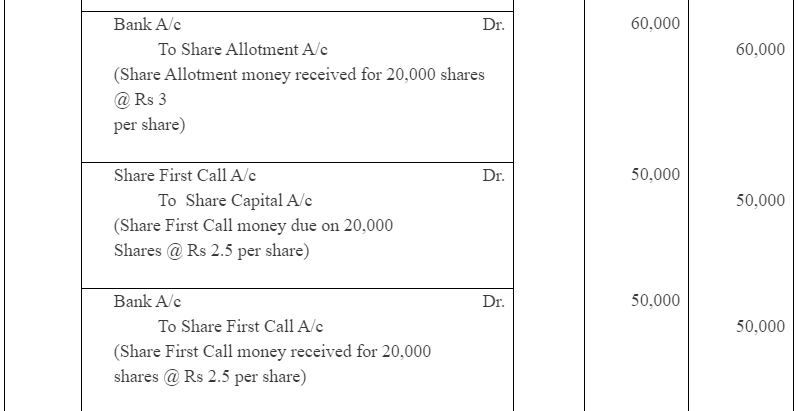

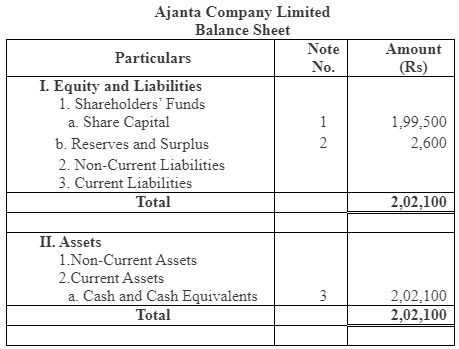

Question 22 : Ajanta Company Limited having a normal capital of Rs 3,00,000, divided into shares of Rs 10 each offered for public subscription of 20,000 shares payable at Rs 2 on application; Rs 3 on allotment and the balance in two calls of Rs 2.50 each. Applications were received by the company for 24,000 shares. Applications for 20,000 shares were accepted in full and the shares allotted. Applications for the remaining shares were rejected and the application money was refunded.

All moneys due were received with the exception of the final call on 600 shares which were forfeited after legal formalities were fulfilled. 400 shares of the forfeited shares were reissued at Rs 9 per share.

Record necessary journal entries and prepare the balance Sheet showing the amount transferred to capital reserve and the balance in Share forfeiture account.

Answer :

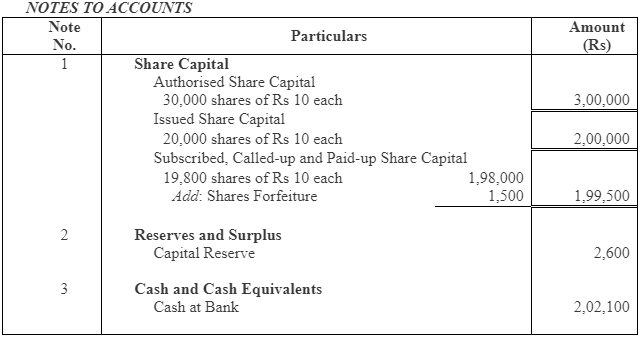

Amount of 400 shares transferred to Capital Reserve Account, after reissue = 400 Shares @ Rs 6.5 per share = Rs 2,600

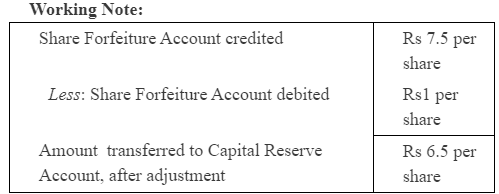

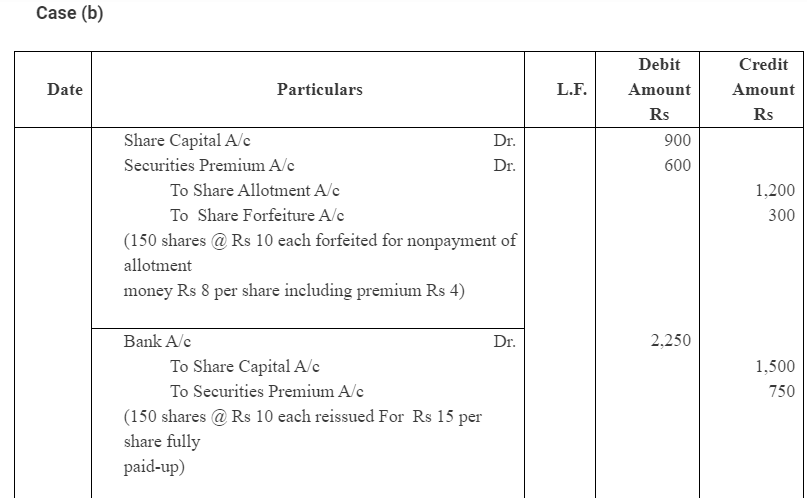

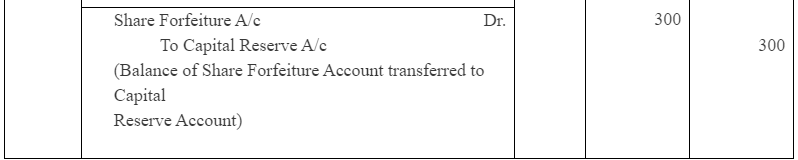

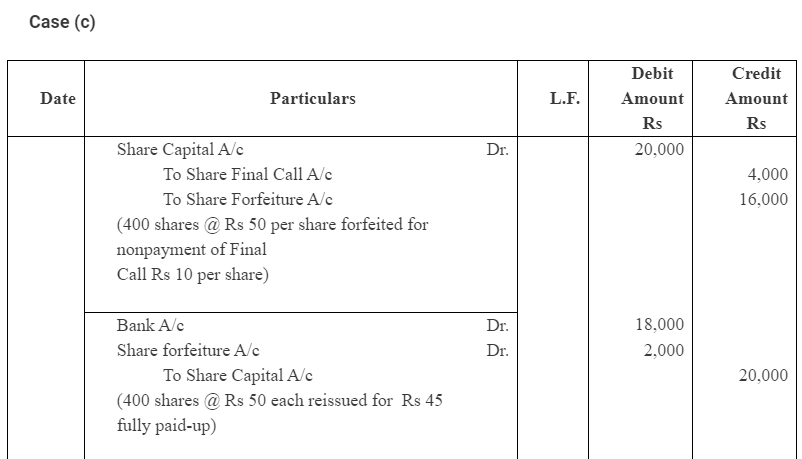

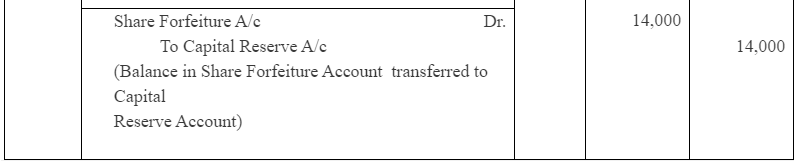

Question 23 : Journalise the following transaction in the books Bhushan Oil Ltd:

(a) 200 shares of Rs 100 each issued at a discount of Rs 10 were forfeited for the non payment of allotment money of Rs 50 per share. The first and final call of Rs 20 per share on these share were not made. The forfeited share were reissued at Rs 70 per share as fully paid-up.

(b) 150 shares of Rs 10 each issued at a premium of Rs 4 per share payable with allotment were forfeited for non-payment of allotment money of Rs 8 per share including premium. The first and final call of Rs 4 per share were not made. The forfeited share were reissued at Rs 15 per share fully paid-up.

(c) 400 share of Rs 50 each issued at par were forfeited for non-payment of final call of Rs 10 per share. These share were reissued at Rs 45 per share fully paid-up.

Answer :

Page No 71:

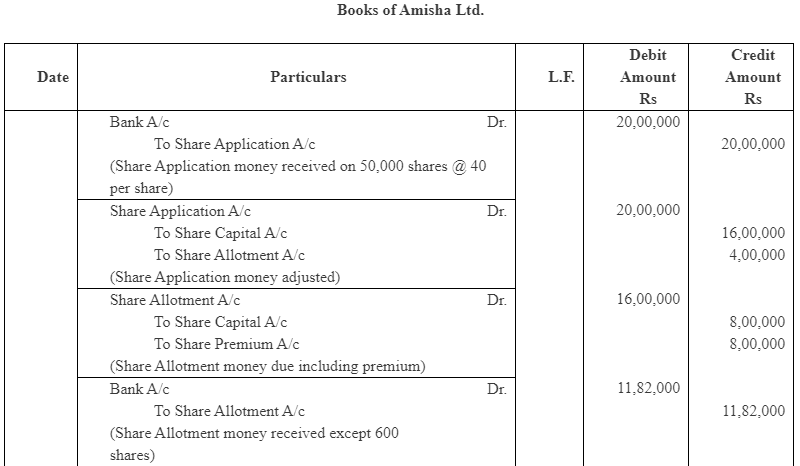

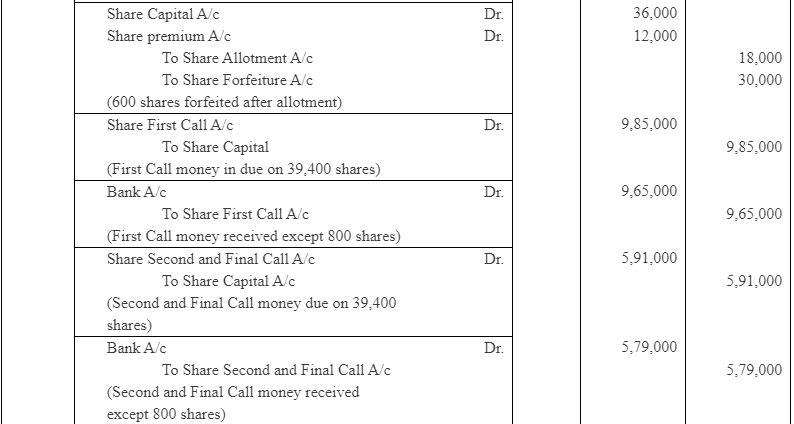

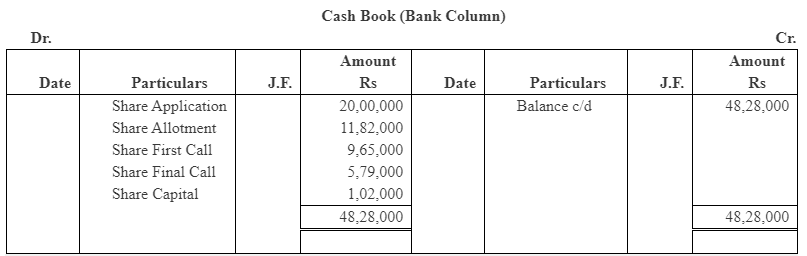

Question 1 : Amisha Ltd inviting application for 40,000 shares of Rs 100 each at a premium of Rs 20 per share payable; on application Rs 40 ; on allotment Rs 40 (Including premium): on first call Rs 25 and Second and final call Rs 15.

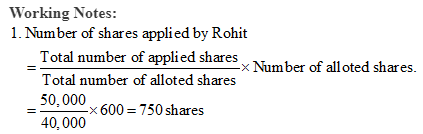

Application were received for 50,000 shares and allotment was made on pro-rata basis. Excess money on application was adjusted on sums due on allotment.

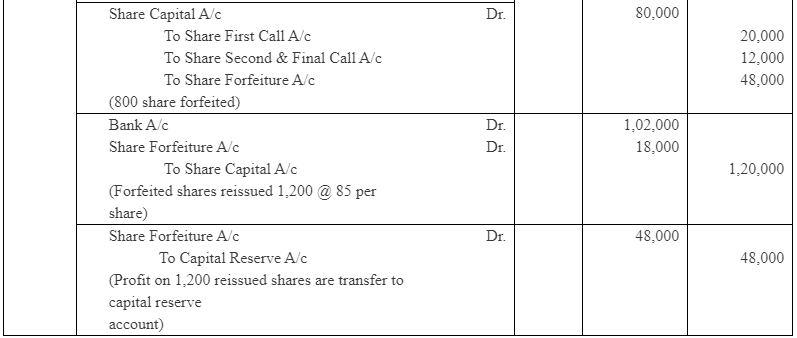

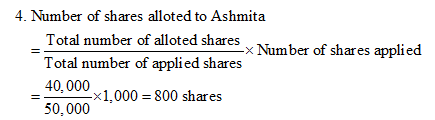

Rohit to whom 600 shares were allotted failed to pay the allotment money and his shares were forfeited after allotment. Ashmita, who applied for 1,000 shares failed to pay the Two calls and his shares were forfeited after the second call. Of the shares forfeited, 1,200 shares were sold to Kapil for Rs 85 per share as fully paid, the whole of Rohit's shares being included.

Record necessary journal entries.

Answer :

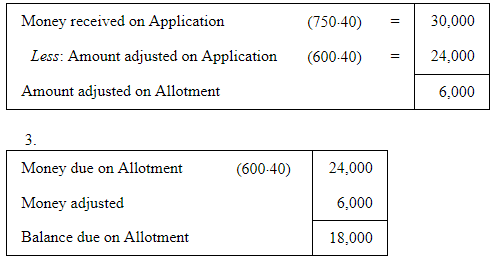

2. Call in arrears by Rohit on allotment

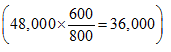

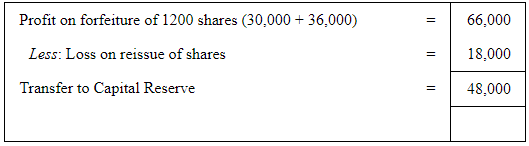

5. Profit on the forfeiture of 600 share of Rohit = Rs 30,000

6. Balance in Share Forfeiture Account (48,000 – 36,000) = Rs 12,000

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 5) - Accounting for Share Capital - Additional Study Material for Commerce

| 1. What is share capital in accounting? |  |

| 2. How is share capital recorded in accounting books? |  |

| 3. What is the difference between authorized share capital and issued share capital? |  |

| 4. How is share capital different from reserves and surplus? |  |

| 5. What are the types of share capital? |  |