NCERT Solution: Dissolution of Partnership Firm - 1 | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

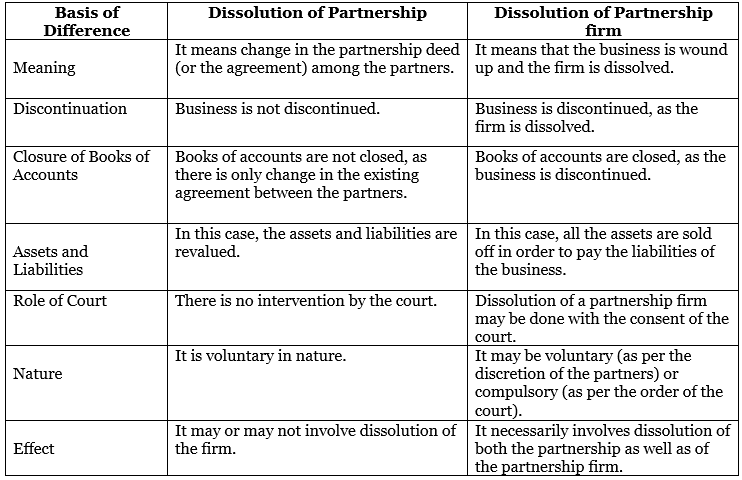

Q1: State the difference between dissolution of partnership and dissolution of partnership firm.Ans:

Q2: State the accounting treatment for:

i. Unrecorded assets

ii. Unrecorded liabilities

Ans:

(i) Accounting Treatment for Unrecorded Assets

Unrecorded asset is an asset, the value of which has been written off in the books of accounts but the asset is still in a usable position. The accounting treatment for unrecorded assets is:

(a) When the unrecorded asset is sold for cash

Cash A/c | Dr. |

To Realisation A/c |

|

(Unrecorded assets sold for cash) |

|

(b) When the unrecorded asset is taken over by any partner

Partner's Capital A/c | Dr. |

To Realisation A/c |

|

(Unrecorded asset taken over by the partner) |

|

(ii) Accounting Treatment for Unrecorded Liabilities

Unrecorded liabilities are those liabilities which are not recorded in the books of account. The accounting treatment for unrecorded liability is:

(a) When the unrecorded liability is paid off

Realisation A/c | Dr. |

To Cash A/c |

|

(Unrecorded liability paid in cash) |

|

(b) When the unrecorded liability is taken over by a partner

Realisation A/c | Dr. |

To Partner's Capital A/c |

|

(Unrecorded liability taken over by the partner) | |

Q3: On dissolution, how you deal with partner’s loan if it appears on the

(a) Assets side of the Balance Sheet

(b) Liabilities side of the Balance Sheet

Ans:

(a) If partner's loan appears on the assets side of the Balance Sheet then it implies that the partner has taken loan from the business and is liable to pay back to the business. In such case, the loan amount is transferred to his capital account. Thus the accounting entry will be:

Partner’s Capital A/c | Dr. |

To Partner's Loan A/c |

|

(Partner's loan transferred to Partner's Capital Account) |

|

(b) If partner's loan appears on the liabilities side of the Balance Sheet then it implies that the partner has forwarded loan to the firm and the firm is liable to pay back the amount to the partner. In such case, partner's loan is paid off after paying all the external liabilities. The partner's loan is not transferred to the Realisation Account, in fact, it is paid in cash. The following accounting entry is passed.-

Partner’s Loan A/c | Dr. |

To Cash/Bank A/c |

|

(Partner’s loan paid in cash) |

|

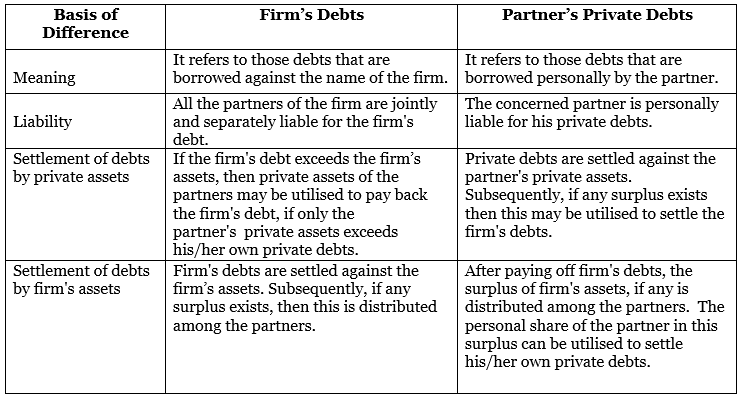

Q4: Distinguish between firm’s debts and partner’s private debts.

Ans:

Q5: State the order of settlement of accounts on dissolution.

Ans: The following are the rules of settlement of accounts on dissolution as per the Section 48 of Partnership Act 1932.

1. Application of Assets: Amount received by the realisation (sale) of the assets shall be used in the following order:

(a) First of all the external liabilities and expenses are to be paid.

(b) Then, all loans and advances forwarded by the partners should be paid.

(c) Then, the capital of each partner should be paid off. If there remains any surplus after the payment of (a), (b) and (c), then it should be distributed among the partners in their profit sharing ratio.

2. Treatment of Loss: In case of loss and any deficiency of capital this should be paid in the following order:

(a) First these should be adjusted against firm's profits.

(b) Then, against the total capital of the firm.

(c) Even if there exists any loss and deficiencies then it should be borne by all the partners individually in their profit sharing ratio.

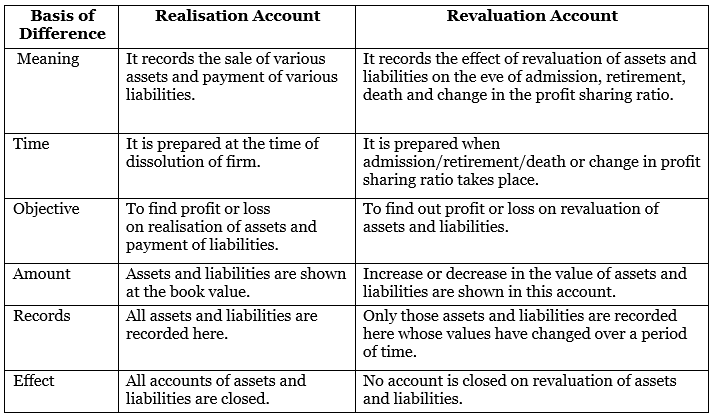

Q6: On what account realisation account differs from revaluation account.

Ans:

Long Answer Questions

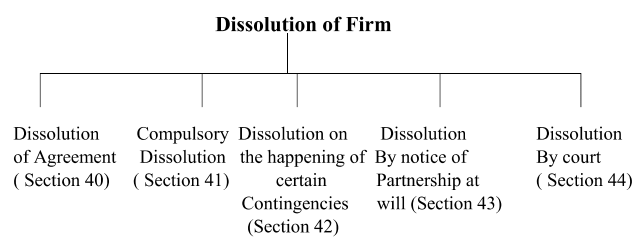

Q1: Explain the process of dissolution of a partnership firm?Ans: Dissolution of partnership firm implies discontinuation of the business of the partnership firm. According to the Section 39 of Partnership Act, dissolution of partnership between all the partners of a firm is called dissolution of partnership firm. Dissolution involves winding up of business, disposal of assets and paying off the liabilities and distribution of any surplus or borne of loss by the partners of the firm. As per the Partnership Act 1932, a partnership firm may be dissolved in the following manners:

(1) Dissolution by Agreement

(1) Dissolution by AgreementA firm may be dissolved with:

(a) the consent of all the partners, or

(b) the contract between the partners

(2) Compulsory Dissolution

A firm may be dissolved by:

(a) the adjudication of all the partners or of all partners but one as insolvent

(b) happening of an event or change in government policies that make the business unlawful.

(3) Dissolution on the happening of Certain Contingencies

Subject to the contract between the partners, a firm is dissolved

(a) if formed for a specific period then on the expiry of the period

(b) if formed for a specific purpose then on completion of the purpose

(c) on the death of partner/partners

d) on insolvency of a partner/partners

(4) Dissolution by Notice

If partnership is at will then the partnership firm is dissolved if any partner giving notice in writing to all the other partners expressing his/her intention to dissolve the firm.

(5) Dissolution by Court

The court may order to dissolve a partnership firm when:

(a) a partner becomes insane or lunatic.

(b) a partner becomes permanently incapable of performing the duties.

(c) a partner is guilty of misconduct and affects the business activities.

(d) a partner repeatedly breaks the terms of agreement .

(e) a partner transfers his interest to a third party without the consent of other partners.

(f) a business persistently incurs losses.

Besides these above mentioned circumstances, a partnership firm may be dissolved if the court at any stage finds dissolution of the firm to be justified and inevitable.

The following are the rules of settlement of accounts on dissolution as per the Section 48 of Partnership Act 1932.

1. Application of Assets: Amount received by the realisation (sale) of the assets shall be used in the following order:

(a) First of all the external liabilities and expenses are to be paid.

(b) Then, all loans and advances forwarded by the partners should be paid.

(c) Then, the capital of each partners should be paid off. If there remains any surplus after the payment of (a), (b) and (c), then it should be distributed among the partners in their profit sharing ratio.

2. Treatment of Loss: In case of loss and any deficiency of capital, then this should be paid in the following order:

(a) First these should be adjusted against firm's profits.

(b) Then, against the total capital of the firm.

(c) If still there exists any loss and deficiencies, then it should be borne by all the partners individually in their profit sharing ratio.

Q2: What is a Realisation Account?

Ans: On dissolution of a firm, all the books of account are closed, all assets are sold and all liabilities are paid off. In order to record the sale of assets and discharge of liabilities, a nominal account is opened named Realisation Account. The main purpose to open Realisation Account is to ascertain the profit or loss due to the realisation of assets and liabilities. Realisation profit (if credit side > debit side) or realisation loss (if debit side > credit side) are transferred to the Partner's Capital Account in their profit sharing ratio.

Concisely, following are the important objectives of preparing Realisation Account.

(1) To close all the books of account.

(2) To record transactions relating to the sale of assets and discharge of liabilities.

(3) To determine profit or loss due to the realisation of assets and liabilities.

Accounting treatment of items related to Realisation Account

(1) For transfer of assets

Realisation A/c | Dr. |

To Sundry Assets A/c (Individually) |

|

(All Assets transferred to realisation account, except |

|

(2) For transfer of liabilities

Sundry Liabilities A/c (Individually) | Dr. |

To Realisation A/c |

|

(All Liabilities transferred to Realisation account except Partner's Capitals, P and L credit balance, Loan from Partner) |

|

(3) For sale of assets

Bank A/c (Amount received) | Dr. |

To Realisation A/c |

|

(Assets sold for cash) |

|

(4) For payment of liabilities

Realisation A/c | Dr. |

To Bank A/c |

|

(Liabilities paid in cash) |

|

(5) For payment of realisation expenses

Realisation A/c | Dr. |

To Bank A/c |

|

(Expenses paid) |

|

(6) For transfer of profit on realisation

Realisation A/c | Dr. |

To Partner's Capital A/c |

|

(Profit on realisation transferred to partner 's capital account) |

|

(7) For transfer of loss on realisation

Partner's Capital A/c | Dr. |

To Realisation A/c |

|

(Loss transferred to partner's capital account) |

|

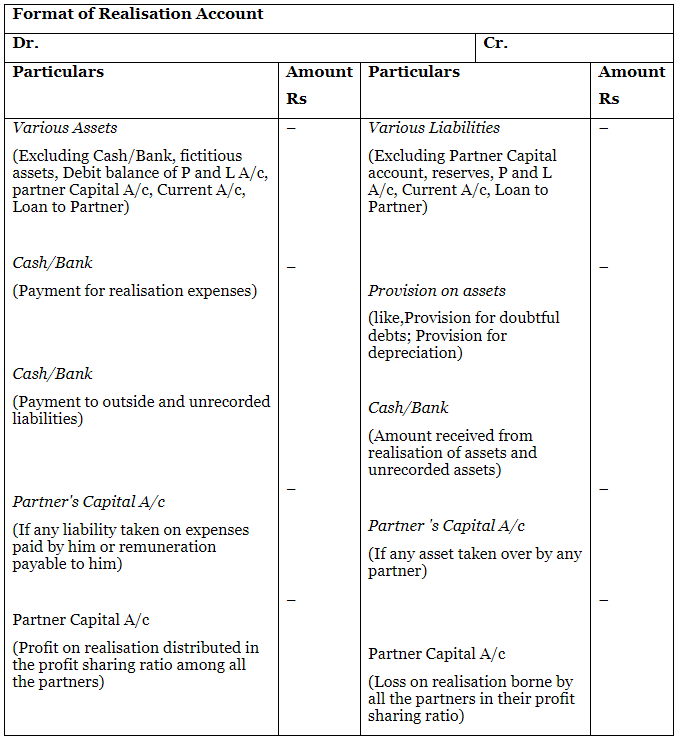

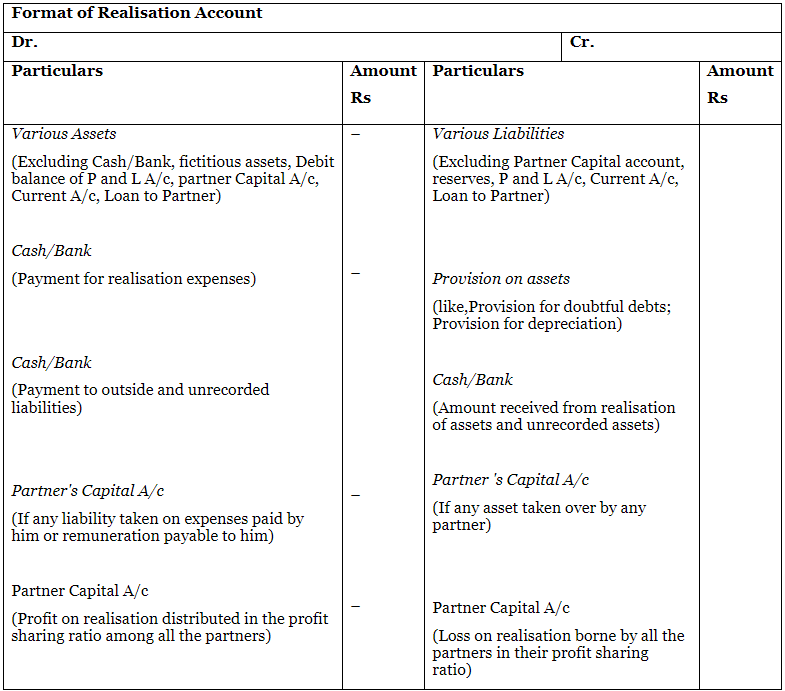

Q3: Reproduce the format of Realisation Account.

Ans:

Q4: How deficiency of creditors is paid off at the time of dissolution of firm.

Ans: At the time of dissolution of a firm, the amount received from the sale of the firm's assets are utilised to pay the creditors. If the sale receipts fall short, then partners' private assets are used for settling the dues of the firm's creditors. Even if some portion of the amount due to creditors is left unpaid, then there arises deficiency of creditors. There are generally two procedures to be followed to treat the deficiency of creditors.

1. Transferring deficiency to the Deficiency Account

2. Transferring deficiency to the Partner's Capital Account

In the former procedure, a separate account is prepared for the firm's creditors. Then in order to ascertain the firm's cash balance accruing from the sale of the firm's assets and partners' private assets, a Cash Account is prepared. After ascertaining the cash availability with the firm, the creditors and the external liabilities are paid proportionately (partially).

The remaining unpaid creditors or the deficiency is transferred to the Deficiency Account. In the latter procedure, creditors are paid by the cash available with the firm including the partner's individual contribution. The deficiency or unpaid creditors amount is transferred to the Partner's Capital Account. Thus the deficiency of the creditors is borne by all the partners in their profit-sharing ratio. If any partner becomes insolvent and is unable to bear the deficiency, then this will be regarded as a capital loss to the firm. If the partnership deed is silent about such capital loss in the facet of insolvency of a partner, then according to the Garner v/s Murray case, such capital loss need to be borne by the solvent partners in their capital ratio.

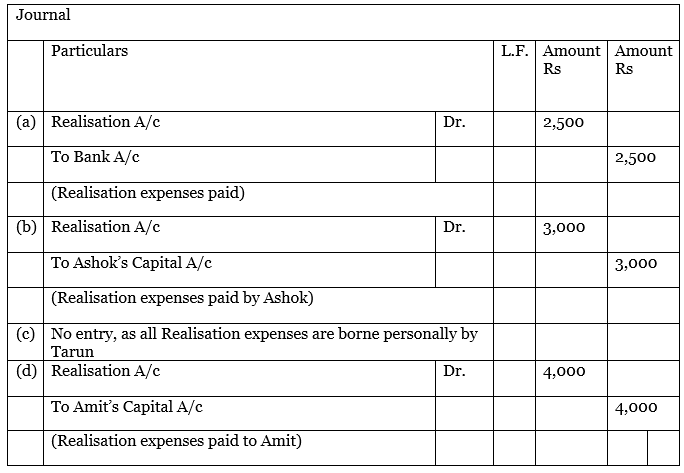

Numerical Questions

Q1: Journalise the following transactions regarding Realisation expenses:[a] Realisation expenses amounted to Rs 2,500.

[b] Realisation expenses amounting to Rs 3,000 were paid by Ashok, one of the partners.

[c] Realisation expenses Rs 2,300 borne by Tarun, personally.

[d] Amit, a partner was appointed to realise the assets, at a cost of Rs 4,000. The actual amount of Realisation amounted to Rs 3,000.

Ans:

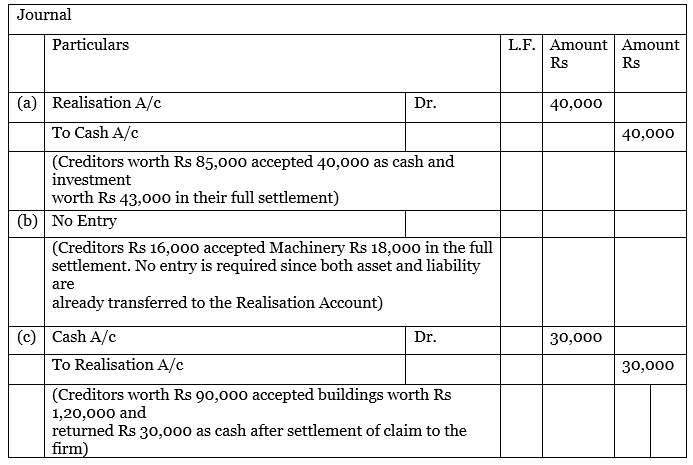

Q2: Record necessary journal entries in the following cases:

[a] Creditors worth Rs 85,000 accepted Rs 40,000 as cash and Investment worth Rs 43,000, in full settlement of their claim.

[b] Creditors were Rs 16,000. They accepted Machinery valued at Rs 18,000 in settlement of their claim.

[c] Creditors were Rs 90,000. They accepted Buildings valued Rs 1,20,000 and paid cash to the firm Rs 30,000.

Ans:

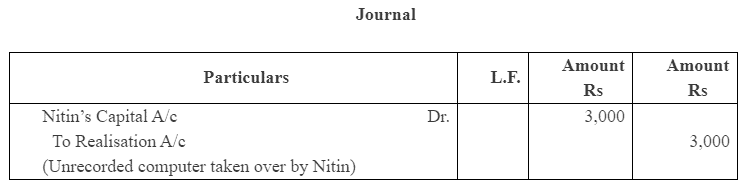

Q3: There was an old computer which was written off in the books of Accounts in the previous year. The same has been taken over by a partner Nitin for Rs 3,000. Journalise the transaction, supposing. That the firm has been dissolved.

Ans:

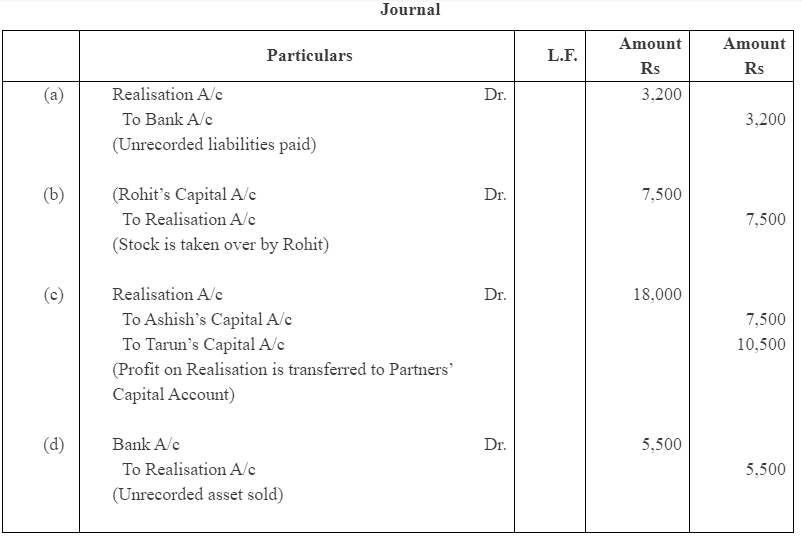

Q4: What journal entries will be recorded for the following transactions on the dissolution of a firm:

[a] Payment of unrecorded liabilities of Rs 3,200.

[b] Stock worth Rs 7,500 is taken by a partner Rohit.

[c] Profit on Realisation amounting to Rs 18,000 is to be distributed between the partners Ashish and Tarun in the ratio of 5:7.

[d] An unrecorded asset realised Rs 5,500.

Ans:

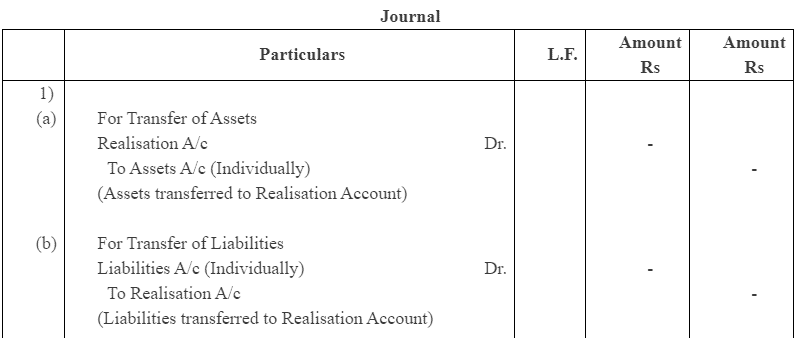

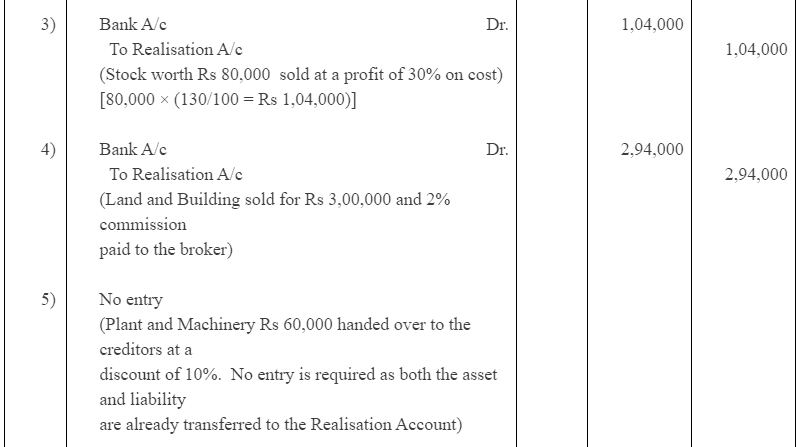

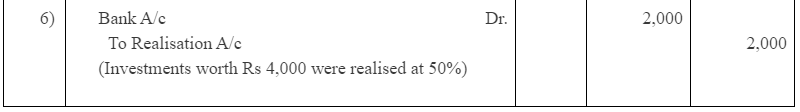

Q5: Give journal entries for the following transactions:

1. To record the Realisation of various assets and liabilities,

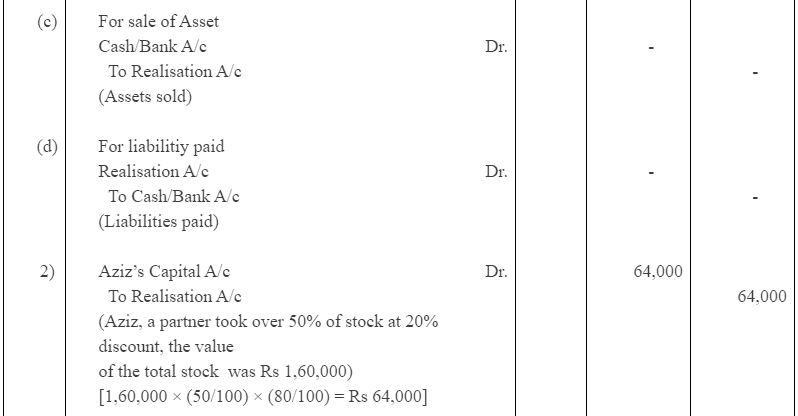

2. A Firm has a Stock of Rs 1,60,000. Aziz, a partner took over 50% of the Stock at a discount of 20%,

3. Remaining Stock was sold at a profit of 30% on cost,

4. Land and Building (book value Rs 1,60,000) sold for Rs 3,00,000 through a broker who charged 2%, commission on the deal,

5. Plant and Machinery (book value Rs 60,000) was handed over to a Creditor at an agreed valuation of 10% less than the book value,

6. Investment whose face value was Rs 4,000 was realised at 50%.

Ans:

Note: Click here for Part II.

|

51 videos|270 docs|51 tests

|

FAQs on NCERT Solution: Dissolution of Partnership Firm - 1 - Accountancy Class 12 - Commerce

| 1. What are the key steps involved in the dissolution of a partnership? |  |

| 2. How is profit or loss shared among partners during dissolution? |  |

| 3. What are the legal implications of dissolving a partnership? |  |

| 4. What happens to the assets of a partnership upon dissolution? |  |

| 5. Can a partner withdraw from a partnership without dissolving it? |  |