Test: The Tertiary Sector In The Indian Economy - 1 - UPSC MCQ

20 Questions MCQ Test - Test: The Tertiary Sector In The Indian Economy - 1

In the context of any country which one of the following would be considered as part of its social capital?

[2019]

Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly?

[2019]

The Service Area Approach was implemented under the preview of

[2019]

Which one of the following statements correctly describes the meaning of legal tender money?

[2018]

With reference to the governance of public sector banking in India, consider the following statements

1. Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

2. To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected

Which of the statements given above is/are correct?

[2018]

‘Global Financial Stability Report’ is prepared by the

[2016]

Which of the following is/are included in the capital budget of the Government of India?

1. Expenditure on acquisition of assets like roads, buildings, machinery, etc.

2. Loans received from foreign governments

3. Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below.

[2016]

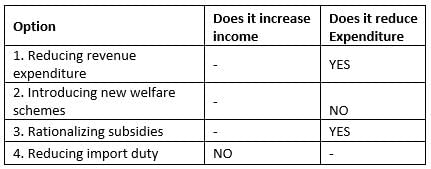

There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit?

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Reducing import duty

Select the correct answer using the code given below.

[2016]

The term ‘Base Erosion and Profit Shifting’ is sometimes seen in the news in the context of

[2016]

With reference to ‘Bitcoins’, sometimes seen in the news, which of the following statements is/are correct?

1. Bitcoins are tracked by the Central Banks of the countries.

2. Anyone with a Bitcoin address can send and receive Bitcoins from anyone else with a Bitcoin address.

3. Online payments can be sent without either side knowing the identity of the other.

Select the correct answer using the code given below.

[2016]

The term ‘Core Banking Solutions’ is sometimes seen in the news. Which of the following statements best describes/ describe this term?

1. It is a networking of a bank’s branches which enables customers to operate their accounts from any branch of the bank on its network regardless of where they open their accounts.

2. It is an effort to increase RBI’s control over commercial banks through computerization.

3. It is a detailed procedure by which a bank with huge non-performing assets is taken over by another bank.

Select the correct answer using the code given below.

[2016]

The establishment of ‘Payment Banks’ is being allowed in India to promote financial inclusion. Which of the following statements is/are correct in this context?

1. Mobile telephone companies and supermarket chains that are owned and controlled by residents are eligible to be promoters of Payment Banks.

2. Payment Banks can issue both credit cards and debit cards.

3. Payment Banks cannot undertake lending activities.

Select the correct answer using the code given below.

[2016]

What is/are the purpose/purposes of the ‘Marginal Cost of Funds based Lending Rate (MCLR)’ announced by RBI?

1. These guidelines help improve the transparency in the methodology followed by banks for determining the interest rates on advances.

2. These guidelines help ensure availability of bank credit at interest rates which are fair to the borrowers as well as the banks.

Select the correct answer using the code given below.

[2016]

When the Reserve Bank of India reduces the Statutory Liquidity Ratio by 50 basis points, which of the following is likely to happen?

[2015]

With reference to Indian economy, consider the following

1. Bank rate

2. Open market operations

3. Public debt

4. Public revenue

Which of the above is/are component/ components of Monetary Policy?

[2015]

'Basel III Accord' or simply 'Basel III', often seen in the news, seeks to

[2015]

In the context of Indian economy, which of the following is/are the purpose/purposes of ‘Statutory Reserve Requirements’?

1. To enable the Central Bank to control the amount of advances the banks can create

2. To make the people’s deposits with banks safe and liquid

3. To prevent the commercial banks from making excessive profits

4. To force the banks to have sufficient vault cash to meet their day-to-day requirements

Select the correct answer using the code given below.

[2014]

What is/are the facility/facilities the beneficiaries can get from the services of Business Correspondent (Bank Saathi) in branchless areas?

1. It enables the beneficiaries to draw their subsidies and social security benefits in their villages.

2. It enables the beneficiaries in the rural areas to make deposits and withdrawals.

Select the correct answer using the code given below.

[2014]

Consider the following liquid assets:

1. Demand deposits with the banks

2. Time deposits with the banks

3. Saving deposits with the banks

4. Currency

The correct sequence of these assets in the decreasing order of liquidity is

[2013]

Consider the following statements:

1. Inflation benefits the debtors.

2. Inflation benefits the bondholders.

Which of the statements given above is/are correct?

[2013]