All Exams >

Commerce >

4 Months Preparation for Commerce Class 12 Boards >

All Questions

All questions of Reconstitution of a Partnership Firm: Retirement/Death of a Partner for Commerce Exam

Geeta and Sita are partners in a firm sharing-profits in the ratio of 3 : 2. They decide to share future profits equally. For this purpose the goodwill of the firm has been valued at Rs. 50,000. Record necessary adjustment entry for the same.- a)Dr. Sita and Cr. Geeta by Rs. 4,500

- b)Dr. Geeta and Cr. Sita by Rs. 5,000

- c)Dr. Sita and Cr. Geeta by Rs. 4,000

- d)Dr. Sita and Cr. Geeta by Rs. 5,000

Correct answer is option 'D'. Can you explain this answer?

Geeta and Sita are partners in a firm sharing-profits in the ratio of 3 : 2. They decide to share future profits equally. For this purpose the goodwill of the firm has been valued at Rs. 50,000. Record necessary adjustment entry for the same.

a)

Dr. Sita and Cr. Geeta by Rs. 4,500

b)

Dr. Geeta and Cr. Sita by Rs. 5,000

c)

Dr. Sita and Cr. Geeta by Rs. 4,000

d)

Dr. Sita and Cr. Geeta by Rs. 5,000

|

|

Neha Sharma answered |

Adjutment of goodwill amount at the time of change in profit sharing ratio:

Old Ratio = 3:2 and New Ratio 1:1

Geeta’s Sacrifice = 3/5 – 1/2 = 1/10

Sita’s Gain = 2/5 – 1/2 = 1/10

Share in goodwill = 50,000 × 1/10 = 5,000

Old Ratio = 3:2 and New Ratio 1:1

Geeta’s Sacrifice = 3/5 – 1/2 = 1/10

Sita’s Gain = 2/5 – 1/2 = 1/10

Share in goodwill = 50,000 × 1/10 = 5,000

This a MCQ (Multiple Choice Question) based practice test of Chapter 4 - Retirement and Death of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinationsQ How can a partner get retirement from the partnership firm?- a)When all existing partners agreed

- b)With the effect of agreement

- c)When a new partner is admitted

- d)Both When all existing partners agreed and With the effect of agreement

Correct answer is option 'D'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 4 - Retirement and Death of a Partner of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q How can a partner get retirement from the partnership firm?

a)

When all existing partners agreed

b)

With the effect of agreement

c)

When a new partner is admitted

d)

Both When all existing partners agreed and With the effect of agreement

|

Aravind Saha answered |

A partner can get retirement in the following ways:

(1) With the consent of all the partners

(2) Due to ill health

(3) Agreement/contract is over

(4) By giving notice

(1) With the consent of all the partners

(2) Due to ill health

(3) Agreement/contract is over

(4) By giving notice

Any change in the relations of partners without affecting the existing of partnership firm is called ____- a)Retirement

- b)Reassessment

- c)Reconstitution

- d)Revaluation

Correct answer is option 'C'. Can you explain this answer?

Any change in the relations of partners without affecting the existing of partnership firm is called ____

a)

Retirement

b)

Reassessment

c)

Reconstitution

d)

Revaluation

|

|

Alok Mehta answered |

Meaning of Reconstitution of Partnership Firm

"Partnership is the relation between persons who have agreed to shore tbi profits of a business carried on by all or any of them acting for all." In short, partnership is the result of an agreement between persons for sharing the profits of a business. A change in the partnership agreement brings to an end of the existing agreement and a new agreement comes into force. This new agreement changes relationship among the members of the partnership firm. When there is change in the relations without affecting the existence of partnership firm, it is called Reconstitution of Partnership Firm'. As a result of reconstitution, the firm continues as a new or reconstituted firm.

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5 and 1/10. What will be the new ratio of X and Y after the retirement of Z.- a)5:4

- b)4:5

- c)3:2

- d)1:1

Correct answer is option 'A'. Can you explain this answer?

X, Y and Z are partners sharing profits in the ratio of 1/2, 2/5 and 1/10. What will be the new ratio of X and Y after the retirement of Z.

a)

5:4

b)

4:5

c)

3:2

d)

1:1

|

Sharmila Sharma answered |

After the retirement of Z, new ratio of X and Y will be 5:4.

Simplifying, 1/2, 2/5, 1/10 , L.C.M. is 10

Ratio will be 5:4:1

Hence , If z will retire then new ratio will be 5:4.

Outgoing partner is not entitled to take _______- a)His Capital account balance

- b)His share of Loss on Revaluation

- c)His share of profit for the period

- d)Complete goodwill of the firm

Correct answer is option 'D'. Can you explain this answer?

Outgoing partner is not entitled to take _______

a)

His Capital account balance

b)

His share of Loss on Revaluation

c)

His share of profit for the period

d)

Complete goodwill of the firm

|

Knowledge Hub answered |

Outgoing partner cannot take complete goodwill of the firm. Outgoing partner is entitled for the followings:

(i) His capital account balance

(ii) His share of profit reserves & gains etc.

(iii) Revaluation profit or loss

(iv) His share of goodwill

Note: outgoing partner is entitled for his share of goodwill only and not the complete goodwill of the firm.

(i) His capital account balance

(ii) His share of profit reserves & gains etc.

(iii) Revaluation profit or loss

(iv) His share of goodwill

Note: outgoing partner is entitled for his share of goodwill only and not the complete goodwill of the firm.

Goodwill given in adjustments (after the balance sheet) will be ____________- a)Used to adjusted the share of retiring partner

- b)Distributed among the gaining partners

- c)Distributed among sacrificing partners

- d)Distributed among all the partners

Correct answer is option 'A'. Can you explain this answer?

Goodwill given in adjustments (after the balance sheet) will be ____________

a)

Used to adjusted the share of retiring partner

b)

Distributed among the gaining partners

c)

Distributed among sacrificing partners

d)

Distributed among all the partners

|

Mohit Yadav answered |

Answer is Correct because remaining partner's have acquired the Sacrificing partner's share or goodwill.(So,gaining partner's pay such amount to sacrificing partner in his ratio in term of goodwill)

A , B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. C died on 31st March 2010. What will be the new ratio of A and B:- a)5 : 3

- b)3 : 2

- c)1 : 1

- d)1 : 3

Correct answer is option 'A'. Can you explain this answer?

A , B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. C died on 31st March 2010. What will be the new ratio of A and B:

a)

5 : 3

b)

3 : 2

c)

1 : 1

d)

1 : 3

|

Saikat Sharma answered |

Ratio of A and B will be 5:3 (after adjusting the old share and acquired share).

The circumstances when change in profit sharing ratio is needed:- a)At the time of admission/retirement/death

- b)To distribute the revaluation profit

- c)When existing partner’s decide

- d)Both When existing partner’s decide and At the time of admission/retirement/death

Correct answer is option 'D'. Can you explain this answer?

The circumstances when change in profit sharing ratio is needed:

a)

At the time of admission/retirement/death

b)

To distribute the revaluation profit

c)

When existing partner’s decide

d)

Both When existing partner’s decide and At the time of admission/retirement/death

|

|

Rohini Verma answered |

Change in profit sharing ratio is essential in the following circumstances:

1. When existing partners have decided to change their existing profit sharing ratio to new ratio.

2. When a new partner is admitted

3. When a partner gets retirement from the firm

4. At the time of death of a partner

1. When existing partners have decided to change their existing profit sharing ratio to new ratio.

2. When a new partner is admitted

3. When a partner gets retirement from the firm

4. At the time of death of a partner

This a MCQ (Multiple Choice Question) based practice test of Chapter 2 - Change in Profit sharing ratio of existing Partners of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q Which of the following is responsible for the Reconstitution of Partnership?- a)Retirement/death of a partner

- b)Change in existing profit sharing ratio

- c)Change in the value of Debtors

- d)Both Change in existing profit sharing ratio and Retirement/death of a partner

Correct answer is option 'D'. Can you explain this answer?

This a MCQ (Multiple Choice Question) based practice test of Chapter 2 - Change in Profit sharing ratio of existing Partners of Accountancy of Class XII (12) for the quick revision/preparation of School Board examinations

Q Which of the following is responsible for the Reconstitution of Partnership?

a)

Retirement/death of a partner

b)

Change in existing profit sharing ratio

c)

Change in the value of Debtors

d)

Both Change in existing profit sharing ratio and Retirement/death of a partner

|

Ameya Mukherjee answered |

Reconstitution of the firm can take place on the following occasions:

1.Change in the profit sharing ratio of the existing partners

2.Admission of a new partner

3.Retirement of an existing partner

4.Death of a partner

1.Change in the profit sharing ratio of the existing partners

2.Admission of a new partner

3.Retirement of an existing partner

4.Death of a partner

What is the meaning of change in the profit sharing ratio:- a)In which all partner including the new partner share future profit and loss

- b)Purchase of shares of profit by one partner form another partner

- c)In which all partner including the deceased partner executor partner share future profit and loss

- d)In which all partner including the retired partner share future profit and loss

Correct answer is 'B'. Can you explain this answer?

What is the meaning of change in the profit sharing ratio:

a)

In which all partner including the new partner share future profit and loss

b)

Purchase of shares of profit by one partner form another partner

c)

In which all partner including the deceased partner executor partner share future profit and loss

d)

In which all partner including the retired partner share future profit and loss

|

Anisha Chauhan answered |

Sometimes, the partners of a firm may agree to change their existing profit sharing ratio. As a result of this, some partners will gain in future profits while others will lose. In such a situation, the partner who gains by change in profit sharing ratio must compensate the partner who has made the sacrifice. In simple words, it is also known as purchase of shares of profit by one partner form another partner.

Can you explain the answer of this question below:What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:

- A:

Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

- B:

Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

- C:

Amount of compensation = Profit of the year x share of profit gained

- D:

Amount of compensation = Value’s of firm goodwill x share of profit gained

The answer is B.

What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:

Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

Amount of compensation = Profit of the year x share of profit gained

Amount of compensation = Value’s of firm goodwill x share of profit gained

|

Anuj Kumar answered |

This is bcoz compensation is given only to the partner who sacrificed his share for other partners,so he will get compensation for his sacrificing share

L, M and N are partners sharing ratio 3:2:1. M died and N the son of M is of the opinion that the rightful owner of his father’s share of profit and the profit of the firm be shared between L and N equally. L does not agree to settle the dispute because there is partnership deed which is showing old profit sharing ratio 3:2:1.- a)Distribute profit between L and N in the ratio of 3:2

- b)Distribute profit between L and N in the ratio of 1:11

- c)Distribute profit between L and N equally

- d)Distribute profit between L and N in the ratio of 3:1

Correct answer is option 'D'. Can you explain this answer?

L, M and N are partners sharing ratio 3:2:1. M died and N the son of M is of the opinion that the rightful owner of his father’s share of profit and the profit of the firm be shared between L and N equally. L does not agree to settle the dispute because there is partnership deed which is showing old profit sharing ratio 3:2:1.

a)

Distribute profit between L and N in the ratio of 3:2

b)

Distribute profit between L and N in the ratio of 1:11

c)

Distribute profit between L and N equally

d)

Distribute profit between L and N in the ratio of 3:1

|

Sparsh Sen answered |

The profit should be distributed among the Land N in Ratio 3:1. Profits cannot be shared equally because there is partnership deed and profit should be distributed accordingly.

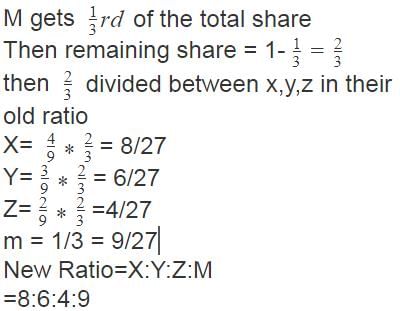

X, Y and Z are partners sharing profits in the ratio of 4:3:2. They admit a new partner M in the partnership firm for 1/3rd share in future profit. What will be the new ratio of all the partners?- a)8 : 6 : 2 : 1

- b)8 : 6 : 5 : 3

- c)8 : 6 : 4 : 9

- d)8 : 6 : 4 : 2

Correct answer is option 'C'. Can you explain this answer?

X, Y and Z are partners sharing profits in the ratio of 4:3:2. They admit a new partner M in the partnership firm for 1/3rd share in future profit. What will be the new ratio of all the partners?

a)

8 : 6 : 2 : 1

b)

8 : 6 : 5 : 3

c)

8 : 6 : 4 : 9

d)

8 : 6 : 4 : 2

|

|

Arun Yadav answered |

How sacrificing ratio is differ from gaining ratio on the basis of mode of calculation- a)It is calculated by taking difference between gaining and new ratio

- b)It is calculated by taking difference between new and old ratio

- c)It is calculated by taking difference between old and new ratio

- d)It is calculated by taking difference between old and gaining ratio

Correct answer is option 'B'. Can you explain this answer?

How sacrificing ratio is differ from gaining ratio on the basis of mode of calculation

a)

It is calculated by taking difference between gaining and new ratio

b)

It is calculated by taking difference between new and old ratio

c)

It is calculated by taking difference between old and new ratio

d)

It is calculated by taking difference between old and gaining ratio

|

Sankar Bose answered |

Difference between Sacrificing Ratio and Gaining Ratio

Sacrificing ratio and gaining ratio are two types of ratios that are used in partnership accounting. They are used to calculate the changes in the ownership structure of a partnership due to the admission, retirement or death of a partner.

Sacrificing Ratio

The sacrificing ratio is the ratio in which the old partners sacrifice their share of profits to the incoming partner. It represents the ratio in which the old partners agree to give up their share of profits to the new partner. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio.

Formula: Sacrificing Ratio = Old Ratio - New Ratio

Gaining Ratio

The gaining ratio is the ratio in which the incoming partner gains the share of profits from the old partners. It represents the ratio in which the new partner is entitled to share the profits of the partnership. The gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Formula: Gaining Ratio = New Ratio - Old Ratio

Mode of Calculation

The main difference between the sacrificing ratio and the gaining ratio is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Conclusion

In conclusion, the sacrificing ratio and the gaining ratio are two important ratios in partnership accounting. The sacrificing ratio represents the ratio in which the old partners sacrifice their share of profits to the incoming partner, while the gaining ratio represents the ratio in which the incoming partner gains the share of profits from the old partners. The main difference between the two ratios is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Sacrificing ratio and gaining ratio are two types of ratios that are used in partnership accounting. They are used to calculate the changes in the ownership structure of a partnership due to the admission, retirement or death of a partner.

Sacrificing Ratio

The sacrificing ratio is the ratio in which the old partners sacrifice their share of profits to the incoming partner. It represents the ratio in which the old partners agree to give up their share of profits to the new partner. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio.

Formula: Sacrificing Ratio = Old Ratio - New Ratio

Gaining Ratio

The gaining ratio is the ratio in which the incoming partner gains the share of profits from the old partners. It represents the ratio in which the new partner is entitled to share the profits of the partnership. The gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Formula: Gaining Ratio = New Ratio - Old Ratio

Mode of Calculation

The main difference between the sacrificing ratio and the gaining ratio is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

Conclusion

In conclusion, the sacrificing ratio and the gaining ratio are two important ratios in partnership accounting. The sacrificing ratio represents the ratio in which the old partners sacrifice their share of profits to the incoming partner, while the gaining ratio represents the ratio in which the incoming partner gains the share of profits from the old partners. The main difference between the two ratios is the mode of calculation. The sacrificing ratio is calculated by taking the difference between the old ratio and the new ratio, while the gaining ratio is calculated by taking the difference between the new ratio and the old ratio.

________ ratio in which the partners share all the accumulated profits, reserves, losses and fictitious assets in case of reconstitution of partnership firm- a)Old Ratio

- b)Sacrificing Ratio

- c)New Ratio

- d)Gaining Ratio

Correct answer is option 'A'. Can you explain this answer?

________ ratio in which the partners share all the accumulated profits, reserves, losses and fictitious assets in case of reconstitution of partnership firm

a)

Old Ratio

b)

Sacrificing Ratio

c)

New Ratio

d)

Gaining Ratio

|

|

Ishan Choudhury answered |

All accumulated profits, reserves, losses and fictitious assets will be distributed by the old partners in their old ratio at the time of reconstitution of partnership firm.

In case of change in profit sharing ratio among the existing partners who will compensate the existing partners:- a)Gaining partner shall compensate

- b)Sacrificing partner shall compensate

- c)Only one partner

- d)All Partner’s shall compensate

Correct answer is option 'A'. Can you explain this answer?

In case of change in profit sharing ratio among the existing partners who will compensate the existing partners:

a)

Gaining partner shall compensate

b)

Sacrificing partner shall compensate

c)

Only one partner

d)

All Partner’s shall compensate

|

|

Om Desai answered |

Whenever there is change in the existing profit sharing ratio, a gainer partner will compensate the sacrificing partner, for this purpose these steps should be followed by the partners:

1.Find out the Gainer due to change in existing profit sharing ratio

2.Find out the Sacrificing partner

3.Now, Debit the gainer partner and credit the sacrificing partner

1.Find out the Gainer due to change in existing profit sharing ratio

2.Find out the Sacrificing partner

3.Now, Debit the gainer partner and credit the sacrificing partner

What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:- a)Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

- b)Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

- c)Amount of compensation = Profit of the year x share of profit gained

- d)Amount of compensation = Value’s of firm goodwill x share of profit gained

Correct answer is option 'B'. Can you explain this answer?

What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:

a)

Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

b)

Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

c)

Amount of compensation = Profit of the year x share of profit gained

d)

Amount of compensation = Value’s of firm goodwill x share of profit gained

|

|

Jayant Mishra answered |

If the partners of a firm decide to change their Profit Sharing Ratio, the gaining partner must compensate the sacrificing partner. Following approach is suggested to deal with the Goodwill at the time of change in Profit sharing ratio:

Step 1: Write off the existing goodwill appearing in the books by passing the following journal entries:

All Partners' Capital/Current A/c Dr (In old ratio)

To Goodwill A/c

Step 2: Give credit of goodwill to the sacrificing partner and debit to the gaining partner.

(a) In case of fluctuating capitals

Gaining Partner's Capital A/c Dr

To Sacrificing Partner Capital A/c

(b) In case of fixed capitals

Gaining Partner's Current A/c Dr

To Sacrificing Partner Current A/c

The amount of compensation of goodwill is calculated as follow:

Amount of compensation payable By Gaining Partner to Sacrificing Partner = Total Goodwill of the firm x Share Gained

Amount of compensation payable By Sacrificing Partner to Gaining Partner = Total Goodwill of the firm x Share Sacrificed

Who is a sacrificing partner:- a)Whose share has increase as a result of change

- b)Whose share has does not get affected as a result of change

- c)Whose share has decrease as a result of change

- d)Whose share has increase as well as decrease as a result of change

Correct answer is 'C'. Can you explain this answer?

Who is a sacrificing partner:

a)

Whose share has increase as a result of change

b)

Whose share has does not get affected as a result of change

c)

Whose share has decrease as a result of change

d)

Whose share has increase as well as decrease as a result of change

|

Isha Chopra answered |

A sacrificing partner is one who has given or surrendered his share in favour of a new partner. That’s why a sacrificing partner is compensated by a new partner in the form of premium for goodwill.

What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:- a)Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

- b)Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

- c)Amount of compensation = Profit of the year x share of profit gained

- d)Amount of compensation = Value’s of firm goodwill x share of profit gained

Correct answer is 'B'. Can you explain this answer?

What should be the amount of compensation if the partners of the firm decide to change their profit share ratio:

a)

Amount of compensation = Value’s of firm goodwill x share of loss sacrificed

b)

Amount of compensation = Value’s of firm goodwill x share of profit sacrificed

c)

Amount of compensation = Profit of the year x share of profit gained

d)

Amount of compensation = Value’s of firm goodwill x share of profit gained

|

Navya Sengupta answered |

The amount of compensation will be equal to the proportionate amount of goodwill. The valuation of goodwill of a firm, its treatment and adjustment is required at the time of change in existing profit sharing ratio among the partners.

Goodwill of the firm is 30,000. Gain of A is 1/6 and Sacrifice of B is 1/6. How will be adjust goodwill?- a)Debit B and Credit A with Rs.5,000

- b)Debit A and Credit B with Rs.5,000

- c)Debit A and B with 15,000 each and Credit Goodwill with Rs.30,000

- d)Debit Goodwill with Rs.10,000 and Credit A and B with Rs.5,000 each

Correct answer is option 'B'. Can you explain this answer?

Goodwill of the firm is 30,000. Gain of A is 1/6 and Sacrifice of B is 1/6. How will be adjust goodwill?

a)

Debit B and Credit A with Rs.5,000

b)

Debit A and Credit B with Rs.5,000

c)

Debit A and B with 15,000 each and Credit Goodwill with Rs.30,000

d)

Debit Goodwill with Rs.10,000 and Credit A and B with Rs.5,000 each

|

|

Arun Yadav answered |

In this case adjustment will be made as follows:

1.Goodwill of the firm Rs.30,000 (given)

2.A’s Gain share in goodwill 30,000 × 1/6 = 5,000

3.B’s Sacrifice share of goodwill 30,000 × 1/6 = 5,000

Now, Debit the gainer and credit the sacrificing partner.

1.Goodwill of the firm Rs.30,000 (given)

2.A’s Gain share in goodwill 30,000 × 1/6 = 5,000

3.B’s Sacrifice share of goodwill 30,000 × 1/6 = 5,000

Now, Debit the gainer and credit the sacrificing partner.

A,B and C who are presently sharing profit and losses in the ratio of 5:3:2, decide to share future profits and losses in the ratio of 2:3:5 with effect from 1st April 2012.Balance sheet shown land building of 100000.What should be accounting g treatment if it decide it valued them at Rs.125000.By what amount revolution account should be credited in- a)Rs.12500

- b)Rs.1250

- c)Rs.2500

- d)Rs.25000

Correct answer is option 'D'. Can you explain this answer?

A,B and C who are presently sharing profit and losses in the ratio of 5:3:2, decide to share future profits and losses in the ratio of 2:3:5 with effect from 1st April 2012.Balance sheet shown land building of 100000.What should be accounting g treatment if it decide it valued them at Rs.125000.By what amount revolution account should be credited in

a)

Rs.12500

b)

Rs.1250

c)

Rs.2500

d)

Rs.25000

|

|

Ishika Roy answered |

D

A, B, and C are partners with capitals of Rs. 1,00,000, Rs. 75,000 and Rs. 50,000. On C’s retirement his share is acquired by A and B in the ration of 6:4. Gaining ratio will be:- a)3:2

- b)2:2

- c)2:3

- d)None

Correct answer is option 'A'. Can you explain this answer?

A, B, and C are partners with capitals of Rs. 1,00,000, Rs. 75,000 and Rs. 50,000. On C’s retirement his share is acquired by A and B in the ration of 6:4. Gaining ratio will be:

a)

3:2

b)

2:2

c)

2:3

d)

None

|

|

Nandini Iyer answered |

As nothing has been mentioned regarding the profit sharing ratio and partnership deed is also silent, so the profit sharing ratio is 1:1:1.

How sacrificing ratio is calculated- a)Sacrificing ratio = Old ratio + New ratio

- b)Sacrificing ratio = Old ratio – Gaining ratio

- c)Sacrificing ratio = New ratio – Old ratio

- d)Sacrificing ratio = Old share – New share

Correct answer is option 'D'. Can you explain this answer?

How sacrificing ratio is calculated

a)

Sacrificing ratio = Old ratio + New ratio

b)

Sacrificing ratio = Old ratio – Gaining ratio

c)

Sacrificing ratio = New ratio – Old ratio

d)

Sacrificing ratio = Old share – New share

|

Nidhi Yadav answered |

The sacrificing ratio is calculated by subtracting the new ratio from the old ratio. The formula is:

Sacrificing ratio = Old ratio - New ratio

Sacrificing ratio = Old ratio - New ratio

Treatment of General Reserve at the time of retirement is:- a)Credit side of Capital account of all the partners

- b)Debit the gainer partner

- c)Debit side of Capital account of all the partners

- d)Only in Balance SheetAt the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

Correct answer is option 'A'. Can you explain this answer?

Treatment of General Reserve at the time of retirement is:

a)

Credit side of Capital account of all the partners

b)

Debit the gainer partner

c)

Debit side of Capital account of all the partners

d)

Only in Balance SheetAt the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

|

Pallavi Chopra answered |

At the time of retirement of a partner, general reserve given in the balance sheet should be credited to all the partners (including outgoing partner) in their old profit sharing ratio.

A, B and C are sharing profits and losses in the ratio 10:6:4 with effect from 01/04/2013 they decide to share profit and losses equally. Which partner has to sacrifice- a)B

- b)A

- c)C

- d)All

Correct answer is option 'B'. Can you explain this answer?

A, B and C are sharing profits and losses in the ratio 10:6:4 with effect from 01/04/2013 they decide to share profit and losses equally. Which partner has to sacrifice

a)

B

b)

A

c)

C

d)

All

|

Knowledge Hub answered |

Calculation of sacrifice or gain:

1.Old Ratio 10:6:4

2.New Ratio 1:1:1

3.A’s Sacrifice (old – new share)

4.B is gainer (old – new share)

5.C is gainer (old – new share)

1.Old Ratio 10:6:4

2.New Ratio 1:1:1

3.A’s Sacrifice (old – new share)

4.B is gainer (old – new share)

5.C is gainer (old – new share)

P, Q and R are partners sharing profits equally. They decided that in future R will get 1/5 share in profits and remaining profit will be shared by P and Q equally. On the day of change, firm’s goodwill is valued at ` 60,000. Identify the gain or sacrifice of the partners.- a)P Debit Rs.4,000 and Q Credit Rs.4,000

- b)Q and R debit with 4,000 each and P Credit with 8,000

- c)P Debit with 8,000 Q and R credit with 4,000 each

- d)Q Debit Rs.4,000 and P Credit Rs.4,000

Correct answer is option 'B'. Can you explain this answer?

P, Q and R are partners sharing profits equally. They decided that in future R will get 1/5 share in profits and remaining profit will be shared by P and Q equally. On the day of change, firm’s goodwill is valued at ` 60,000. Identify the gain or sacrifice of the partners.

a)

P Debit Rs.4,000 and Q Credit Rs.4,000

b)

Q and R debit with 4,000 each and P Credit with 8,000

c)

P Debit with 8,000 Q and R credit with 4,000 each

d)

Q Debit Rs.4,000 and P Credit Rs.4,000

|

Gowri Chavan answered |

's capital was Rs. 75,000. Find the amount of capital that R brought into the firm.

Initially, all partners shared profits equally. Therefore, the share of each partner in the profits was 1/3.

Let the new profit share of R be x. Then, the profit shares of P and Q will be (1-x)/2 each.

Now, we can equate the initial profit share of R with the new profit share of R to get:

1/3 = x/5

Solving for x, we get:

x = 5/3 * 1/3 = 5/9

Therefore, the new profit shares of P, Q and R are 2/9, 2/9 and 5/9 respectively.

Let the amount of capital that R brought into the firm be y. Then, we can write:

R's capital share = 5/9 * Total capital = (5/9) * 75000 = 41666.67

Since all partners had equal capital shares initially, we can write:

P's capital share = Q's capital share = (1/3) * Total capital = (1/3) * 75000 = 25000

The total capital of the firm is the sum of individual capital shares of all partners. Therefore, we can write:

Total capital = P's capital share + Q's capital share + R's capital share

75000 = 25000 + 25000 + 41666.67

Solving for y, we get:

y = R's capital share = 41666.67 - 50000 = -8333.33

Since the amount of capital cannot be negative, we conclude that R did not bring any capital into the firm. Instead, R may have contributed some other valuable asset or service to the firm, which was considered equivalent to capital.

Initially, all partners shared profits equally. Therefore, the share of each partner in the profits was 1/3.

Let the new profit share of R be x. Then, the profit shares of P and Q will be (1-x)/2 each.

Now, we can equate the initial profit share of R with the new profit share of R to get:

1/3 = x/5

Solving for x, we get:

x = 5/3 * 1/3 = 5/9

Therefore, the new profit shares of P, Q and R are 2/9, 2/9 and 5/9 respectively.

Let the amount of capital that R brought into the firm be y. Then, we can write:

R's capital share = 5/9 * Total capital = (5/9) * 75000 = 41666.67

Since all partners had equal capital shares initially, we can write:

P's capital share = Q's capital share = (1/3) * Total capital = (1/3) * 75000 = 25000

The total capital of the firm is the sum of individual capital shares of all partners. Therefore, we can write:

Total capital = P's capital share + Q's capital share + R's capital share

75000 = 25000 + 25000 + 41666.67

Solving for y, we get:

y = R's capital share = 41666.67 - 50000 = -8333.33

Since the amount of capital cannot be negative, we conclude that R did not bring any capital into the firm. Instead, R may have contributed some other valuable asset or service to the firm, which was considered equivalent to capital.

Why there is need to calculate New profit share ratio- a)After retirement of a partner, there is no change in the continuing partners’ ratio.

- b)After retirement of a partner, there will be change in the continuing partners’ ratio.

- c)To settle the loan amount due to outgoing partner

- d)Both After retirement of a partner, there will be change in the continuing partners’ ratio. and After retirement of a partner, there is no change in the continuing partners’ ratio.

Correct answer is option 'B'. Can you explain this answer?

Why there is need to calculate New profit share ratio

a)

After retirement of a partner, there is no change in the continuing partners’ ratio.

b)

After retirement of a partner, there will be change in the continuing partners’ ratio.

c)

To settle the loan amount due to outgoing partner

d)

Both After retirement of a partner, there will be change in the continuing partners’ ratio. and After retirement of a partner, there is no change in the continuing partners’ ratio.

|

Uday Chakraborty answered |

When a partner is retired from the firm, there will be change in the ratio of remaining partners. It is necessary to find out the new ratio of existing partners.

New Profit sharing Ratio after retirement of a partner, can be calculated as:- a)New Ratio – Sacrificing Ratio

- b)Old Ratio + Acquired share

- c)Gain Ratio – Sacrificing Ratio

- d)New Ratio – Acquired share

Correct answer is option 'B'. Can you explain this answer?

New Profit sharing Ratio after retirement of a partner, can be calculated as:

a)

New Ratio – Sacrificing Ratio

b)

Old Ratio + Acquired share

c)

Gain Ratio – Sacrificing Ratio

d)

New Ratio – Acquired share

|

Aniket Basu answered |

= Old Ratio + Share of retiring partner/Remaining partners' share

b) New Ratio = Old Ratio - Share of retiring partner/Remaining partners' share

b) New Ratio = Old Ratio - Share of retiring partner/Remaining partners' share

What adjustments are required when existing partners decide to change their profit sharing ratio:- a)Goodwill

- b)Realisation Account

- c)Reserves and Accumulated profits

- d)Both Goodwill and Reserves and Accumulated profits

Correct answer is option 'D'. Can you explain this answer?

What adjustments are required when existing partners decide to change their profit sharing ratio:

a)

Goodwill

b)

Realisation Account

c)

Reserves and Accumulated profits

d)

Both Goodwill and Reserves and Accumulated profits

|

|

Ishan Choudhury answered |

Change in profit sharing ratio may also necessitate adjustments in the partner’s capital accounts with respect to undistributed profits and reserves, revaluation of assets and reassessment of liabilities, etc. The valuation of goodwill of a firm, its treatment, adjustment regarding undistributed profits and reserves and revaluation of assets and liabilities due to change in the profit sharing ratio of the partners.

A, B and C takes a Joint Life Policy, after five years B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement A and C decides to share profits equally. They had taken a Joint Life Policy of Rs. 2,50,000 with the surrender value Rs. 50,000. What will be the treatment in the partner’s capital account on receiving the JLP amount if joint life premium is fully charged to revenue as and when paid?- a)Rs. 50,000 credited to all the partners in old ratio.

- b)Rs. 2,50,000 credited to all the partners in old ratio

- c)Rs. 2,00,000 credited to all the partners in old ratio

- d)No treatment is required

Correct answer is option 'A'. Can you explain this answer?

A, B and C takes a Joint Life Policy, after five years B retires from the firm. Old profit sharing ratio is 2:2:1. After retirement A and C decides to share profits equally. They had taken a Joint Life Policy of Rs. 2,50,000 with the surrender value Rs. 50,000. What will be the treatment in the partner’s capital account on receiving the JLP amount if joint life premium is fully charged to revenue as and when paid?

a)

Rs. 50,000 credited to all the partners in old ratio.

b)

Rs. 2,50,000 credited to all the partners in old ratio

c)

Rs. 2,00,000 credited to all the partners in old ratio

d)

No treatment is required

|

Sagarika Pillai answered |

's capital account for the surrender value of the policy?

The surrender value of the policy will be credited to the capital account of A, B and C in their profit sharing ratio of 2:2:1. After B's retirement, the new profit sharing ratio will be 3:2 (equal sharing between A and C), so the surrender value will be credited to their capital accounts in the ratio of 3:2.

The entry in the capital accounts will be:

A's capital account: Dr. Rs. 75,000 (3/5 of surrender value)

C's capital account: Dr. Rs. 50,000 (2/5 of surrender value)

To Joint Life Policy account: Cr. Rs. 1,25,000 (total surrender value)

The surrender value of the policy will be credited to the capital account of A, B and C in their profit sharing ratio of 2:2:1. After B's retirement, the new profit sharing ratio will be 3:2 (equal sharing between A and C), so the surrender value will be credited to their capital accounts in the ratio of 3:2.

The entry in the capital accounts will be:

A's capital account: Dr. Rs. 75,000 (3/5 of surrender value)

C's capital account: Dr. Rs. 50,000 (2/5 of surrender value)

To Joint Life Policy account: Cr. Rs. 1,25,000 (total surrender value)

X, Y and Z are sharing profits in the ratio of 50%; 40% and 10% respectively. Now, they have decided to share future profits equally. Identify the gainer partner.- a)X is gainer

- b)Y is gainer

- c)Z is gainer

- d)Both X and Y are gainer

Correct answer is option 'C'. Can you explain this answer?

X, Y and Z are sharing profits in the ratio of 50%; 40% and 10% respectively. Now, they have decided to share future profits equally. Identify the gainer partner.

a)

X is gainer

b)

Y is gainer

c)

Z is gainer

d)

Both X and Y are gainer

|

Harshad Nair answered |

Calculation of gain or sacrifice:

Formula : Old Share – New Share

X = 5/10 – 1/3 = 1/6 Sacrifice

Y = 4/10 – 1/3 = 1/15 Sacrifice

Z = 1/10 - 1/3 = 7/30 Gain

Formula : Old Share – New Share

X = 5/10 – 1/3 = 1/6 Sacrifice

Y = 4/10 – 1/3 = 1/15 Sacrifice

Z = 1/10 - 1/3 = 7/30 Gain

Which of the following is calculated at the time of Retirement of a Partner?- a)Gaining Ratio

- b)Sacrifice of Retiring Partner

- c)Old Ratio

- d)Sacrifice of the employees

Correct answer is option 'A'. Can you explain this answer?

Which of the following is calculated at the time of Retirement of a Partner?

a)

Gaining Ratio

b)

Sacrifice of Retiring Partner

c)

Old Ratio

d)

Sacrifice of the employees

|

Pranav Saha answered |

At the time of retirement of death of a partner we need to calculate the gaining ratio of the existing partners. The main purpose of calculating gaining ratio is to adjust the share of goodwill at the time of retirement or death of a partner.

AK, BK and CK are sharing profits in the ratio of 2:1:1. They have decided to share future profits in the ratio of 3:2:1. Find out the gainer partner.- a)BK is the gainer partner

- b)CK is the gainer partner

- c)AK is the gainer partner

- d)Both AK is the gainer partner and CK is the gainer partner

Correct answer is option 'A'. Can you explain this answer?

AK, BK and CK are sharing profits in the ratio of 2:1:1. They have decided to share future profits in the ratio of 3:2:1. Find out the gainer partner.

a)

BK is the gainer partner

b)

CK is the gainer partner

c)

AK is the gainer partner

d)

Both AK is the gainer partner and CK is the gainer partner

|

Jay Chakraborty answered |

Calculation of gain or sacrifice:

Formula : Old Share – New Share

AK = 2/4 – 3/6 = No Sacrifice/ No Gain

BK = 1/4 – 2/6 = 1/12 Gain

CK = 1/4 - 1/6 = 1/12 Sacrifice

Formula : Old Share – New Share

AK = 2/4 – 3/6 = No Sacrifice/ No Gain

BK = 1/4 – 2/6 = 1/12 Gain

CK = 1/4 - 1/6 = 1/12 Sacrifice

Ram and Rohit shared profit and loss in the ratio of 3:2. With effect from 01/04/2012 they agreed to share profits equally. The goodwill of the firm was valued at 30000. Which partner account should be debited in this case for the adjustment- a)Ram Rs.3,000

- b)Rohit Rs.3,000

- c)Rohit Rs.30,000

- d)Both Rohit Rs.3,000 and Ram Rs.3,000 1,500 each

Correct answer is option 'B'. Can you explain this answer?

Ram and Rohit shared profit and loss in the ratio of 3:2. With effect from 01/04/2012 they agreed to share profits equally. The goodwill of the firm was valued at 30000. Which partner account should be debited in this case for the adjustment

a)

Ram Rs.3,000

b)

Rohit Rs.3,000

c)

Rohit Rs.30,000

d)

Both Rohit Rs.3,000 and Ram Rs.3,000 1,500 each

|

Jyoti Mukherjee answered |

Adjustment of goodwill amount at the time of change in profit sharing ratio:

Old Ratio = 3:2

New Ratio = 1:1

Ram’s Sacrifice = 3/5 – 1/2 = 1/15

Rohit’s Gain = 2/5 – 1/2 = 1/15

Rohit’s Gain of goodwill amount = 30,000 × 1/10 = 3,000

Old Ratio = 3:2

New Ratio = 1:1

Ram’s Sacrifice = 3/5 – 1/2 = 1/15

Rohit’s Gain = 2/5 – 1/2 = 1/15

Rohit’s Gain of goodwill amount = 30,000 × 1/10 = 3,000

Gaining ratio is the ratio in which continuing partners have ______ the share from the outgoing partner- a)Sacrificed

- b)Acquired

- c)Acquired and Sacrificed

- d)Both Acquired and Sacrificed

Correct answer is option 'B'. Can you explain this answer?

Gaining ratio is the ratio in which continuing partners have ______ the share from the outgoing partner

a)

Sacrificed

b)

Acquired

c)

Acquired and Sacrificed

d)

Both Acquired and Sacrificed

|

|

Aryan Khanna answered |

When a partner retires from the firm, his share will be acquired by the continuing partners. The ratio in which they acquire the share of retired partner, is known as gaining ratio.

X, Y and Z are partners sharing profits in the ratio of 4:3:2. The partners have decided to share future profits in the ratio of 3:1:1. Find out the gainer partner.- a)Z is gainer

- b)X is gainer

- c)Y is gainer

- d)Y and Z are gainer

Correct answer is option 'B'. Can you explain this answer?

X, Y and Z are partners sharing profits in the ratio of 4:3:2. The partners have decided to share future profits in the ratio of 3:1:1. Find out the gainer partner.

a)

Z is gainer

b)

X is gainer

c)

Y is gainer

d)

Y and Z are gainer

|

Janhavi Banerjee answered |

Calculation of gain or sacrifice:

Formula : Old Share – New Share

X = 4/9 – 3/5 = 7/45 Gain

Y = 3/9 – 1/5 = 6/45 Sacrifice

Z = 2/9 - 1/5 = 1/45 Sacrifice

Formula : Old Share – New Share

X = 4/9 – 3/5 = 7/45 Gain

Y = 3/9 – 1/5 = 6/45 Sacrifice

Z = 2/9 - 1/5 = 1/45 Sacrifice

Balances of M/s. Ram, Rahul and Rohit sharing profits and losses in proportion to their capitals, stood as Ram Rs. 3,00,000; Rahul Rs. 2,00,000 and Rohit Rs. 1,00,000. Ram desired to retire form the firm and the remaining partners decided to carry on, Joint life policy of the partners surrendered and cash obtained Rs. 60,000. What will be the treatment for JLP?- a)Rs. 60,000 credited to Revaluation Account

- b)Rs. 60,000 credited to Joint Life Policy Account

- c)Rs. 30,000 debited to Ram’s Capital Account

- d)Either ‘a’ or ‘b’

Correct answer is option 'B'. Can you explain this answer?

Balances of M/s. Ram, Rahul and Rohit sharing profits and losses in proportion to their capitals, stood as Ram Rs. 3,00,000; Rahul Rs. 2,00,000 and Rohit Rs. 1,00,000. Ram desired to retire form the firm and the remaining partners decided to carry on, Joint life policy of the partners surrendered and cash obtained Rs. 60,000. What will be the treatment for JLP?

a)

Rs. 60,000 credited to Revaluation Account

b)

Rs. 60,000 credited to Joint Life Policy Account

c)

Rs. 30,000 debited to Ram’s Capital Account

d)

Either ‘a’ or ‘b’

|

Aarya Sharma answered |

Answer: b) Rs. 60,000 credited to Joint Life Policy Account

Explanation:

When a partner retires or dies, the Joint Life Policy taken on the lives of the partners is surrendered and the cash received is credited to the Joint Life Policy Account. In this case, Ram is retiring and the remaining partners are continuing the business. Therefore, the Joint Life Policy will be surrendered and the cash received of Rs. 60,000 will be credited to the Joint Life Policy Account. This account will then be distributed among the remaining partners in their profit sharing ratio.

Explanation:

When a partner retires or dies, the Joint Life Policy taken on the lives of the partners is surrendered and the cash received is credited to the Joint Life Policy Account. In this case, Ram is retiring and the remaining partners are continuing the business. Therefore, the Joint Life Policy will be surrendered and the cash received of Rs. 60,000 will be credited to the Joint Life Policy Account. This account will then be distributed among the remaining partners in their profit sharing ratio.

L, M and N are partners sharing profit and losses in the ratio of 25:15:9 . M retires. It is decided that the profit sharing ratio between remaining partner will be the same as existing between M and N. Calculate Gaining ratio- a)45:80

- b)45:75

- c)40:75

- d)55:75

Correct answer is option 'B'. Can you explain this answer?

L, M and N are partners sharing profit and losses in the ratio of 25:15:9 . M retires. It is decided that the profit sharing ratio between remaining partner will be the same as existing between M and N. Calculate Gaining ratio

a)

45:80

b)

45:75

c)

40:75

d)

55:75

|

|

Aryan Khanna answered |

Old Share 25 : 15 : 9

L’s share = 25/29

Gain Ratio = 45: 75

L’s share = 25/29

Gain Ratio = 45: 75

X, Y, Z are partners sharing profits and losses equally. They took a joint life policy of Rs. 5,00,000 with a surrender value of Rs. 3,00,000. The firm treats the insurance premium as an expense. Y retired and X and Z decided to share profits and losses in 2:1. The amount of Joint life policy will be transferred as: - a)Credited to X, Y and Z’s Capital accounts with Rs. 1,00,000 each

- b)Credited to X, Y and Z’s capital accounts with Rs. 1,66,667 each

- c)Credited to X, and Z capital accounts with Rs. 2,50,000 each

- d)Credited to Y’s capital account with Rs. 3,00,000 each

Correct answer is option 'A'. Can you explain this answer?

X, Y, Z are partners sharing profits and losses equally. They took a joint life policy of Rs. 5,00,000 with a surrender value of Rs. 3,00,000. The firm treats the insurance premium as an expense. Y retired and X and Z decided to share profits and losses in 2:1. The amount of Joint life policy will be transferred as:

a)

Credited to X, Y and Z’s Capital accounts with Rs. 1,00,000 each

b)

Credited to X, Y and Z’s capital accounts with Rs. 1,66,667 each

c)

Credited to X, and Z capital accounts with Rs. 2,50,000 each

d)

Credited to Y’s capital account with Rs. 3,00,000 each

|

Ameya Menon answered |

's capital accounts in their profit sharing ratio

b)Credited to X and Z's capital accounts in their new profit sharing ratio

c)Credited to Y's capital account

d)Credited to the firm's current account

Answer: b) Credited to X and Z's capital accounts in their new profit sharing ratio

Explanation:

Since Y has retired, the partnership firm is now between X and Z only. They have also decided to share profits and losses in the ratio of 2:1. Therefore, the amount of joint life policy should be transferred to their capital accounts in the new profit sharing ratio. Hence, option b) is the correct answer. Option a) is incorrect because Y is no longer a partner in the firm. Option c) is also incorrect because Y has already received his share of the partnership assets upon retirement. Option d) is incorrect because the joint life policy is a partnership asset and not a current liability of the firm.

b)Credited to X and Z's capital accounts in their new profit sharing ratio

c)Credited to Y's capital account

d)Credited to the firm's current account

Answer: b) Credited to X and Z's capital accounts in their new profit sharing ratio

Explanation:

Since Y has retired, the partnership firm is now between X and Z only. They have also decided to share profits and losses in the ratio of 2:1. Therefore, the amount of joint life policy should be transferred to their capital accounts in the new profit sharing ratio. Hence, option b) is the correct answer. Option a) is incorrect because Y is no longer a partner in the firm. Option c) is also incorrect because Y has already received his share of the partnership assets upon retirement. Option d) is incorrect because the joint life policy is a partnership asset and not a current liability of the firm.

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B. - a)Rs. 20,000 and Rs. 10,000

- b)Rs. 8,000 and Rs. 4,000

- c)They will not contribute any thing

- d)Information is insufficient for any comment

Correct answer is option 'B'. Can you explain this answer?

A, B and C are partners sharing profits in the ratio 2:2:1. On retirement of B, goodwill was valued as Rs. 30,000. Find the contribution of A and C to compensate B.

a)

Rs. 20,000 and Rs. 10,000

b)

Rs. 8,000 and Rs. 4,000

c)

They will not contribute any thing

d)

Information is insufficient for any comment

|

Rajesh Jain answered |

Gaining partner compensate the retiring partner by paying goodwill in gaining ratio..

In this question gaining ratio is 4:6

and B's share of goodwill is 12000

so A will compensate 12000*4/6 I.e.8000

B will compensate 12000*2/6 I.e.4000

In this question gaining ratio is 4:6

and B's share of goodwill is 12000

so A will compensate 12000*4/6 I.e.8000

B will compensate 12000*2/6 I.e.4000

Goodwill given in the balance sheet is debited to the partners at the time of retirement in:- a)Gain Ratio

- b)Sacrificing Ratio

- c)New Ratio

- d)Old Ratio

Correct answer is option 'D'. Can you explain this answer?

Goodwill given in the balance sheet is debited to the partners at the time of retirement in:

a)

Gain Ratio

b)

Sacrificing Ratio

c)

New Ratio

d)

Old Ratio

|

|

Vikas Kapoor answered |

At the time of retirement, goodwill given in the balance sheet should be debited to the partners in their old profit sharing ratio (including the outgoing partner).

X, Y and Z are partners sharing profits in the ratio of 8/14; 4/14 and 2/14. Profit and Loss account shows a loss of Rs.2,800. Now partners have decided to share future profits in the ratio of 4:2:2. Who is the gainer and with what amount?- a)Z Rs.300

- b)X Rs.300

- c)Y Rs.300

- d)Z and X Rs.150 each

Correct answer is option 'A'. Can you explain this answer?

X, Y and Z are partners sharing profits in the ratio of 8/14; 4/14 and 2/14. Profit and Loss account shows a loss of Rs.2,800. Now partners have decided to share future profits in the ratio of 4:2:2. Who is the gainer and with what amount?

a)

Z Rs.300

b)

X Rs.300

c)

Y Rs.300

d)

Z and X Rs.150 each

|

Puja Kaur answered |

Adjustment of loss at the time of change in profit sharing ratio:

Old Ratio = 8:4:2 OR 4:2:1

New Ratio = 4:2:2 OR 2:1:1

Formula = Old – New ratio

X’s Sacrifice 2/28; Y’s Sacrifice 1/28 and Z’s Gain 3/28.

Old Ratio = 8:4:2 OR 4:2:1

New Ratio = 4:2:2 OR 2:1:1

Formula = Old – New ratio

X’s Sacrifice 2/28; Y’s Sacrifice 1/28 and Z’s Gain 3/28.

A, B and C are sharing profits and losses in the ratio 5:3:2 with effect from 01/04/2013 they decide to share profit and losses equally. Calculate B partner’s gain share- a)1/30th share

- b)1/20th share

- c)1/25th share

- d)1/10th share

Correct answer is option 'A'. Can you explain this answer?

A, B and C are sharing profits and losses in the ratio 5:3:2 with effect from 01/04/2013 they decide to share profit and losses equally. Calculate B partner’s gain share

a)

1/30th share

b)

1/20th share

c)

1/25th share

d)

1/10th share

|

Janhavi Banerjee answered |

Calculation of gain or sacrificing ratio:

Formula : Old Share – New Share

A = 5/10 – 1/3 = 5/30 Sacrifice

B = 3/10 – 1/3 = 1/30 Gain

C = 2/10 - 1/3 = 4/30 Gain

Formula : Old Share – New Share

A = 5/10 – 1/3 = 5/30 Sacrifice

B = 3/10 – 1/3 = 1/30 Gain

C = 2/10 - 1/3 = 4/30 Gain

What is gaining ratio:- a)In which profit sharing ratio of sacrificing partners decrease

- b)In which profit sharing ratio of gaining partners decrease

- c)In which profit sharing ratio of sacrificing partners increase

- d)In which profit sharing ratio of gaining partners increase

Correct answer is 'D'. Can you explain this answer?

What is gaining ratio:

a)

In which profit sharing ratio of sacrificing partners decrease

b)

In which profit sharing ratio of gaining partners decrease

c)

In which profit sharing ratio of sacrificing partners increase

d)

In which profit sharing ratio of gaining partners increase

|

|

Poonam Reddy answered |

Gaining Ratio is calculated at the time of retirement or death of partner. It is the excess of new ratio over old ratio of old partners except retired or deceased partner. Formula : Gaining Ratio = New Ratio - Old

When the New ratio is deducted with Old Ratio we get:- a)New Ratio

- b)Old Ratio

- c)Sacrifice only

- d)Gain Ratio

Correct answer is option 'D'. Can you explain this answer?

When the New ratio is deducted with Old Ratio we get:

a)

New Ratio

b)

Old Ratio

c)

Sacrifice only

d)

Gain Ratio

|

Raghav Shah answered |

Gaining ratio is calculated by deducting the old ratio from the new ratio. The following formula is used to calculate the gain ratio.

Gaining ratio = New ratio – old ratio

Gaining ratio = New ratio – old ratio

Why do existing partners change their profit sharing ratio:- a)Due active participation in management by a partner

- b)Due to change in capital contribution

- c)Due to Tax Policy of Government

- d)Both Due to change in capital contribution and Due active participation in management by a partner

Correct answer is option 'D'. Can you explain this answer?

Why do existing partners change their profit sharing ratio:

a)

Due active participation in management by a partner

b)

Due to change in capital contribution

c)

Due to Tax Policy of Government

d)

Both Due to change in capital contribution and Due active participation in management by a partner

|

Srishti Kaur answered |

Reasons for Change in Profit Sharing Ratio

There are various reasons why existing partners may change their profit sharing ratio. Some of the reasons are discussed below:

1. Due to Active Participation in Management by a Partner

When a partner is actively involved in the management of the business, it is likely that they will demand a larger share of the profits. This is because they are contributing more than just their capital to the business. They are also contributing their time, skills, and expertise, which are just as important as capital. Therefore, if a partner is actively involved in the management of the business, it may be necessary to adjust their profit sharing ratio accordingly.

2. Due to Change in Capital Contribution

Another reason why partners may change their profit sharing ratio is due to a change in capital contribution. If one partner contributes more capital than the other, it is only fair that they receive a larger share of the profits. Similarly, if one partner reduces their capital contribution, it may be necessary to adjust their profit sharing ratio accordingly.

3. Due to Tax Policy of Government

Sometimes, the government may introduce new tax policies that affect the profit sharing ratio of partners. For example, if the government introduces a new tax on profits, it may be necessary to adjust the profit sharing ratio to ensure that each partner is paying their fair share of the tax.

Conclusion

In conclusion, partners may change their profit sharing ratio for various reasons. However, the most common reasons are due to a change in capital contribution and active participation in management by a partner. It is important for partners to discuss and agree on the profit sharing ratio beforehand to avoid any misunderstandings or disputes in the future.

There are various reasons why existing partners may change their profit sharing ratio. Some of the reasons are discussed below:

1. Due to Active Participation in Management by a Partner

When a partner is actively involved in the management of the business, it is likely that they will demand a larger share of the profits. This is because they are contributing more than just their capital to the business. They are also contributing their time, skills, and expertise, which are just as important as capital. Therefore, if a partner is actively involved in the management of the business, it may be necessary to adjust their profit sharing ratio accordingly.

2. Due to Change in Capital Contribution

Another reason why partners may change their profit sharing ratio is due to a change in capital contribution. If one partner contributes more capital than the other, it is only fair that they receive a larger share of the profits. Similarly, if one partner reduces their capital contribution, it may be necessary to adjust their profit sharing ratio accordingly.

3. Due to Tax Policy of Government

Sometimes, the government may introduce new tax policies that affect the profit sharing ratio of partners. For example, if the government introduces a new tax on profits, it may be necessary to adjust the profit sharing ratio to ensure that each partner is paying their fair share of the tax.

Conclusion

In conclusion, partners may change their profit sharing ratio for various reasons. However, the most common reasons are due to a change in capital contribution and active participation in management by a partner. It is important for partners to discuss and agree on the profit sharing ratio beforehand to avoid any misunderstandings or disputes in the future.

Goodwill Given in the old Balance Sheet will be:- a)Written off by the old partners

- b)Written off by the Sacrificing partners

- c)Distributed by Gainer partners

- d)Credited to old Partners Capital accounts

Correct answer is option 'A'. Can you explain this answer?

Goodwill Given in the old Balance Sheet will be:

a)

Written off by the old partners

b)

Written off by the Sacrificing partners

c)

Distributed by Gainer partners

d)

Credited to old Partners Capital accounts

|

|

Vikas Kapoor answered |

Goodwill given in the old balance sheet will be written off by all the partners (including retiring partner) at the time of retirement of a partner. Goodwill will be written off in the old ratio of all the partners.

Vinod and Pandey are partners sharing profits in the ratio of 7:3 respectively. On 1.4.2015 they have decided to change their profit sharing ratio to 6:4. Calculate sacrifice/gain of Vinod.- a)Vinod’s Sacrifice 1/10

- b)Vinod’s Sacrifice 2/10

- c)Vinod’s Gain 2/10

- d)Vinod’s Gain 1/10

Correct answer is option 'A'. Can you explain this answer?

Vinod and Pandey are partners sharing profits in the ratio of 7:3 respectively. On 1.4.2015 they have decided to change their profit sharing ratio to 6:4. Calculate sacrifice/gain of Vinod.

a)

Vinod’s Sacrifice 1/10

b)

Vinod’s Sacrifice 2/10

c)

Vinod’s Gain 2/10

d)

Vinod’s Gain 1/10

|

Rambha Kumari answered |

Vinod p Old ratio = 7\10: 3\10 New ratio= 6\10: 4\10 sacrificing ratio= old ratio - new ratio Vinod sacrifice= 7/10- 6/10= 1/10

Chapter doubts & questions for Reconstitution of a Partnership Firm: Retirement/Death of a Partner - 4 Months Preparation for Commerce Class 12 Boards 2025 is part of Commerce exam preparation. The chapters have been prepared according to the Commerce exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for Commerce 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Reconstitution of a Partnership Firm: Retirement/Death of a Partner - 4 Months Preparation for Commerce Class 12 Boards in English & Hindi are available as part of Commerce exam.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

4 Months Preparation for Commerce Class 12 Boards

170 videos|830 docs|208 tests

|

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up within 7 days!

Access 1000+ FREE Docs, Videos and Tests

Takes less than 10 seconds to signup