All Exams >

CLAT >

4 Months Preparation Course for CLAT UG >

All Questions

All questions of Passage Based for Practice for CLAT Exam

An angle in a semi-circle is?- a)π

- b)π/4

- c)π/2

- d)2π

Correct answer is option 'C'. Can you explain this answer?

An angle in a semi-circle is?

a)

π

b)

π/4

c)

π/2

d)

2π

|

Prerna Sen answered |

F an angle is inscribed in a semicircle, it will be half the measure of a semicircle (180 degrees), therefore measuring 90 degrees. Angles in semicircle is one way of finding missing missing angles and lengths. Pythagorean's theorem can be used to find missing lengths (remember that the diameter is the hypotenuse).

2 / 3 is a rational number whereas √2 / √3 is- a)Also a rational number

- b)An irrational number

- c)Not a number

- d)A natural periodic number

Correct answer is option 'B'. Can you explain this answer?

2 / 3 is a rational number whereas √2 / √3 is

a)

Also a rational number

b)

An irrational number

c)

Not a number

d)

A natural periodic number

|

Attar Singh answered |

2/3 is a rational number.

Now, see

√2/√3 ( rationalise )

√2/√3×√3/√3

√6/3

which is a irrational number.

So, option B is correct answer.

Now, see

√2/√3 ( rationalise )

√2/√3×√3/√3

√6/3

which is a irrational number.

So, option B is correct answer.

Shopkeeper offers 10% discount on an article and still makes a profit of 20%. What is the CP of the article marked at 500?- a)440

- b)400

- c)425

- d)375

Correct answer is option 'D'. Can you explain this answer?

Shopkeeper offers 10% discount on an article and still makes a profit of 20%. What is the CP of the article marked at 500?

a)

440

b)

400

c)

425

d)

375

|

|

Ekansha khanna answered |

Let's assume the cost price (CP) of the article is x.

According to the question, the shopkeeper offers a 10% discount on the article, so the selling price (SP) becomes 90% of the CP.

Also, the shopkeeper still makes a profit of 20%, which means the SP is 120% of the CP.

**Calculating Selling Price (SP)**

SP = 120% of CP

SP = (120/100) * CP

SP = (6/5) * CP

**Calculating Discounted Selling Price (SP)**

SP = 90% of CP

SP = (90/100) * CP

SP = (9/10) * CP

Now, we can equate the two expressions for the selling price:

(6/5) * CP = (9/10) * CP

**Solving for CP**

(6/5) * CP = (9/10) * CP

6 * 10 = 9 * 5

60 = 45

This equation is not true, which means our assumption that the cost price is x is incorrect. Therefore, we need to find the correct value of CP.

We know that the article is marked at 500 rupees, and the shopkeeper offers a 10% discount. Therefore, the selling price after the discount is 90% of the marked price.

**Calculating Selling Price after Discount (SP)**

SP = 90% of marked price

SP = (90/100) * 500

SP = 450

We also know that the shopkeeper makes a profit of 20%, which means the selling price is 120% of the cost price.

**Calculating Cost Price (CP)**

CP = 120% of SP

CP = (120/100) * 450

CP = 540

Therefore, the cost price of the article is 540 rupees.

Now, let's check if the shopkeeper can offer a 10% discount and still make a profit of 20%.

**Calculating Selling Price after Discount (SP)**

SP = 90% of CP

SP = (90/100) * 540

SP = 486

**Calculating Profit**

Profit = SP - CP

Profit = 486 - 540

Profit = -54

We can see that the shopkeeper incurs a loss of 54 rupees, which contradicts the information given in the question. Hence, the given scenario is not possible.

Therefore, option D (375) cannot be the correct answer.

According to the question, the shopkeeper offers a 10% discount on the article, so the selling price (SP) becomes 90% of the CP.

Also, the shopkeeper still makes a profit of 20%, which means the SP is 120% of the CP.

**Calculating Selling Price (SP)**

SP = 120% of CP

SP = (120/100) * CP

SP = (6/5) * CP

**Calculating Discounted Selling Price (SP)**

SP = 90% of CP

SP = (90/100) * CP

SP = (9/10) * CP

Now, we can equate the two expressions for the selling price:

(6/5) * CP = (9/10) * CP

**Solving for CP**

(6/5) * CP = (9/10) * CP

6 * 10 = 9 * 5

60 = 45

This equation is not true, which means our assumption that the cost price is x is incorrect. Therefore, we need to find the correct value of CP.

We know that the article is marked at 500 rupees, and the shopkeeper offers a 10% discount. Therefore, the selling price after the discount is 90% of the marked price.

**Calculating Selling Price after Discount (SP)**

SP = 90% of marked price

SP = (90/100) * 500

SP = 450

We also know that the shopkeeper makes a profit of 20%, which means the selling price is 120% of the cost price.

**Calculating Cost Price (CP)**

CP = 120% of SP

CP = (120/100) * 450

CP = 540

Therefore, the cost price of the article is 540 rupees.

Now, let's check if the shopkeeper can offer a 10% discount and still make a profit of 20%.

**Calculating Selling Price after Discount (SP)**

SP = 90% of CP

SP = (90/100) * 540

SP = 486

**Calculating Profit**

Profit = SP - CP

Profit = 486 - 540

Profit = -54

We can see that the shopkeeper incurs a loss of 54 rupees, which contradicts the information given in the question. Hence, the given scenario is not possible.

Therefore, option D (375) cannot be the correct answer.

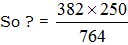

(764 x?) ÷250= 382- a)135

- b)125

- c)115

- d)145

Correct answer is option 'B'. Can you explain this answer?

(764 x?) ÷250= 382

a)

135

b)

125

c)

115

d)

145

|

Srestha Nair answered |

(764 x ?) ÷ 250 = 382

= 125

= 125

285 is summation of 3 numbers. Ratio between 2nd and 3rd numbers is 6:5. Ratio between 1st and 2nd numbers is 3:7. The 3rd number is?- a) 135

- b) 150

- c) 124

- d) 105

Correct answer is option 'D'. Can you explain this answer?

285 is summation of 3 numbers. Ratio between 2nd and 3rd numbers is 6:5. Ratio between 1st and 2nd numbers is 3:7. The 3rd number is?

a)

135

b)

150

c)

124

d)

105

|

|

Shubhangi kumar answered |

Given information:

- Sum of 3 numbers = 285

- Ratio between 2nd and 3rd numbers = 6:5

- Ratio between 1st and 2nd numbers = 3:7

Let's assume the 3 numbers to be x, y, and z.

Finding the 2nd and 3rd numbers:

- Ratio between 2nd and 3rd numbers = 6:5

- Let the common ratio between them be 'k'

- Therefore, 2nd number = 6k and 3rd number = 5k

Finding the 1st and 2nd numbers:

- Ratio between 1st and 2nd numbers = 3:7

- Let the common ratio between them be 'm'

- Therefore, 1st number = 3m and 2nd number = 7m

Using the above values in the given equation:

x + y + z = 285

3m + 7m + 5k + 6k = 285

10m + 11k = 285

Dividing both sides by 5:

2m + (11/5)k = 57

We need to find the value of the 3rd number, which is 5k.

Solving the equations:

From the equation 2m + (11/5)k = 57, we can assume some values for m and k, and then solve for the other variable. For example, we can assume m = 1 and k = 23/11.

Substituting these values in the above equation:

2(1) + (11/5)(23/11) = 57

2 + 23 = 57

25 ≠ 57

Therefore, we need to try other values of m and k until we get a valid solution.

After trying some values, we can find that m = 5 and k = 10.

Substituting these values in the above equation:

2(5) + (11/5)(10) = 57

10 + 22 = 57

32 ≠ 57

Therefore, this is not a valid solution.

Trying other values, we can find that m = 7 and k = 4.

Substituting these values in the above equation:

2(7) + (11/5)(4) = 57

14 + 8.8 = 57

22.8 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 9 and k = 1.

Substituting these values in the above equation:

2(9) + (11/5)(1) = 57

18 + 2.2 = 57

20.2 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 11 and k = -2.

Substituting these values in the above equation:

2(11) + (11/5)(-2) = 57

22 - 4.4 = 57

17.6 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 13 and k = -5.

Substituting these values in the above equation:

2(13)

- Sum of 3 numbers = 285

- Ratio between 2nd and 3rd numbers = 6:5

- Ratio between 1st and 2nd numbers = 3:7

Let's assume the 3 numbers to be x, y, and z.

Finding the 2nd and 3rd numbers:

- Ratio between 2nd and 3rd numbers = 6:5

- Let the common ratio between them be 'k'

- Therefore, 2nd number = 6k and 3rd number = 5k

Finding the 1st and 2nd numbers:

- Ratio between 1st and 2nd numbers = 3:7

- Let the common ratio between them be 'm'

- Therefore, 1st number = 3m and 2nd number = 7m

Using the above values in the given equation:

x + y + z = 285

3m + 7m + 5k + 6k = 285

10m + 11k = 285

Dividing both sides by 5:

2m + (11/5)k = 57

We need to find the value of the 3rd number, which is 5k.

Solving the equations:

From the equation 2m + (11/5)k = 57, we can assume some values for m and k, and then solve for the other variable. For example, we can assume m = 1 and k = 23/11.

Substituting these values in the above equation:

2(1) + (11/5)(23/11) = 57

2 + 23 = 57

25 ≠ 57

Therefore, we need to try other values of m and k until we get a valid solution.

After trying some values, we can find that m = 5 and k = 10.

Substituting these values in the above equation:

2(5) + (11/5)(10) = 57

10 + 22 = 57

32 ≠ 57

Therefore, this is not a valid solution.

Trying other values, we can find that m = 7 and k = 4.

Substituting these values in the above equation:

2(7) + (11/5)(4) = 57

14 + 8.8 = 57

22.8 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 9 and k = 1.

Substituting these values in the above equation:

2(9) + (11/5)(1) = 57

18 + 2.2 = 57

20.2 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 11 and k = -2.

Substituting these values in the above equation:

2(11) + (11/5)(-2) = 57

22 - 4.4 = 57

17.6 ≠ 57

Therefore, this is not a valid solution either.

Trying other values, we can find that m = 13 and k = -5.

Substituting these values in the above equation:

2(13)

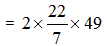

Tap A and B can separately fill the tank in 10 hours 15 hours respectively. If both taps are opened together, how much time will it take to fill the tank fully?

- a)6 hrs

- b)4 hrs

- c)5 hrs

- d)3 hrs

Correct answer is option 'A'. Can you explain this answer?

Tap A and B can separately fill the tank in 10 hours 15 hours respectively. If both taps are opened together, how much time will it take to fill the tank fully?

a)

6 hrs

b)

4 hrs

c)

5 hrs

d)

3 hrs

|

Lekshmi Singh answered |

GIVEN:

Time taken by tap A to fill the tank = 10 hours

Time taken by tap B to fill the tank = 15 hours

CONCEPT:

Here we need to add the time taken by A and B.

FORMULAE USED:

Time taken to fill the tank if A and B are opened simultaneously = 1 / (Time taken by tap A + Time taken by tap B)

CALCULATION:

Time taken by tap A to fill the tank = 10 hours

⇒ Quantity of tank filled by tap A = 1/10 units

Time taken by tap B to fill the tank = 15 hours

⇒ Quantity of tank filled by tap B = 1/15 units

Time taken by A and B together = 1/{(1/10) + (1/15)} = 1/(1/6)

∴ Time taken by A and B together = 6 hrs

15x ? - 8 x 2 – 9 = 0- a)2/3

- b)3/2

- c)5/3

- d)4/3

Correct answer is option 'C'. Can you explain this answer?

15x ? - 8 x 2 – 9 = 0

a)

2/3

b)

3/2

c)

5/3

d)

4/3

|

Raghav Mehta answered |

15 x ? – 8 x 2 – 9 = 0

The Writ Jurisdiction of Supreme Court can be invoked under Article 32 of the Constitution for the violation of fundamental rights guaranteed under Part - III of the Constitution. Any provision in any Constitution for Fundamental Rights is meaningless unless there are adequate safeguards to ensure enforcement of such provisions. Since the reality of such rights is tested only through the judiciary, the safeguards assume even more importance. In addition, enforcement also depends upon the degree of independence of the Judiciary and the availability of relevant instruments with the executive authority. Indian Constitution, like most of Western Constitutions, lays down certain provisions to ensure the enforcement of Fundamental Rights. However, Article 32 is referred to as the “Constitutional Remedy” for enforcement of Fundamental Rights. This provision itself has been included in the Fundamental Rights and hence it cannot be denied to any person. Dr. B. R. Ambedkar described Article 32 as the most important one, without which the Constitution would be reduced to nullity. It is also referred to as the heart and soul of the Constitution. By including Article 32 in the Fundamental Rights, the Supreme Court has been made the protector and guarantor of these Rights. An application made under Article 32 of the Constitution before the Supreme Court, cannot be refused on technical grounds. In addition to the prescribed five types of writs, the Supreme Court may pass any other appropriate order. Moreover, only the questions pertaining to the Fundamental Rights can be determined in proceedings against Article 32. Under Article 32, the Supreme Court may issue a Writ against any person or government within the territory of India. Where the infringement of a Fundamental Right has been established, the Supreme Court cannot refuse relief on the ground that the aggrieved person may have remedy before some other court or under the ordinary law.

The relief can also not be denied on the ground that the disputed facts have to be investigated or some evidence has to be collected. Even if an aggrieved person has not asked for a particular Writ, the Supreme Court, after considering the facts and circumstances, may grant the appropriate Writ and may even modify it to suit the exigencies of the case. Normally, only the aggrieved person is allowed to move the Court. But it has been held by the Supreme Court that in social or public interest matters, any one may move the Court. A Public Interest Litigation can be filed before the Supreme Court under Article 32 of the Constitution or before the High Court of a State under Article 226 of the Constitution under their respective Writ Jurisdictions.What is the correct meaning of the word ‘infringement’?- a)provision

- b)infarction

- c)observance

- d)violation

Correct answer is option 'D'. Can you explain this answer?

The Writ Jurisdiction of Supreme Court can be invoked under Article 32 of the Constitution for the violation of fundamental rights guaranteed under Part - III of the Constitution. Any provision in any Constitution for Fundamental Rights is meaningless unless there are adequate safeguards to ensure enforcement of such provisions. Since the reality of such rights is tested only through the judiciary, the safeguards assume even more importance. In addition, enforcement also depends upon the degree of independence of the Judiciary and the availability of relevant instruments with the executive authority. Indian Constitution, like most of Western Constitutions, lays down certain provisions to ensure the enforcement of Fundamental Rights. However, Article 32 is referred to as the “Constitutional Remedy” for enforcement of Fundamental Rights. This provision itself has been included in the Fundamental Rights and hence it cannot be denied to any person. Dr. B. R. Ambedkar described Article 32 as the most important one, without which the Constitution would be reduced to nullity. It is also referred to as the heart and soul of the Constitution. By including Article 32 in the Fundamental Rights, the Supreme Court has been made the protector and guarantor of these Rights. An application made under Article 32 of the Constitution before the Supreme Court, cannot be refused on technical grounds. In addition to the prescribed five types of writs, the Supreme Court may pass any other appropriate order. Moreover, only the questions pertaining to the Fundamental Rights can be determined in proceedings against Article 32. Under Article 32, the Supreme Court may issue a Writ against any person or government within the territory of India. Where the infringement of a Fundamental Right has been established, the Supreme Court cannot refuse relief on the ground that the aggrieved person may have remedy before some other court or under the ordinary law.

The relief can also not be denied on the ground that the disputed facts have to be investigated or some evidence has to be collected. Even if an aggrieved person has not asked for a particular Writ, the Supreme Court, after considering the facts and circumstances, may grant the appropriate Writ and may even modify it to suit the exigencies of the case. Normally, only the aggrieved person is allowed to move the Court. But it has been held by the Supreme Court that in social or public interest matters, any one may move the Court. A Public Interest Litigation can be filed before the Supreme Court under Article 32 of the Constitution or before the High Court of a State under Article 226 of the Constitution under their respective Writ Jurisdictions.

The relief can also not be denied on the ground that the disputed facts have to be investigated or some evidence has to be collected. Even if an aggrieved person has not asked for a particular Writ, the Supreme Court, after considering the facts and circumstances, may grant the appropriate Writ and may even modify it to suit the exigencies of the case. Normally, only the aggrieved person is allowed to move the Court. But it has been held by the Supreme Court that in social or public interest matters, any one may move the Court. A Public Interest Litigation can be filed before the Supreme Court under Article 32 of the Constitution or before the High Court of a State under Article 226 of the Constitution under their respective Writ Jurisdictions.

What is the correct meaning of the word ‘infringement’?

a)

provision

b)

infarction

c)

observance

d)

violation

|

|

Akansha kulkarni answered |

The correct meaning of the word 'infringement' is 'violation'.

Explanation:

- Definition: Infringement refers to the action of violating, disregarding, or failing to comply with a law, rule, or agreement.

- Usage: In the context of Fundamental Rights, 'infringement' signifies the violation or breach of the rights guaranteed under Part III of the Indian Constitution.

- Example: When the government restricts freedom of speech or discriminates against a certain group of individuals, it can be considered an infringement of their Fundamental Rights.

- Significance: Identifying and addressing infringements is crucial to uphold the sanctity of Fundamental Rights and ensure that individuals are protected from any unjust actions by the state or other entities.

- Legal Implications: In legal terms, proving infringement is essential to seek redressal or relief through mechanisms like filing a Writ Petition under Article 32 of the Constitution for the enforcement of Fundamental Rights.

Explanation:

- Definition: Infringement refers to the action of violating, disregarding, or failing to comply with a law, rule, or agreement.

- Usage: In the context of Fundamental Rights, 'infringement' signifies the violation or breach of the rights guaranteed under Part III of the Indian Constitution.

- Example: When the government restricts freedom of speech or discriminates against a certain group of individuals, it can be considered an infringement of their Fundamental Rights.

- Significance: Identifying and addressing infringements is crucial to uphold the sanctity of Fundamental Rights and ensure that individuals are protected from any unjust actions by the state or other entities.

- Legal Implications: In legal terms, proving infringement is essential to seek redressal or relief through mechanisms like filing a Writ Petition under Article 32 of the Constitution for the enforcement of Fundamental Rights.

There is a controversy raging over the entry of giants such as Tesco and Wal-Mart into India after the government last week permitted foreign direct investment (FDI) in multi-brand retail. Most economic analysts look at it in terms of capital coming into India to oust local shopkeepers or in terms of capital coming in to offer better prices to farmers or set up distribution chains and storage facilities to help consumers. These arguments seem a little old. There is a technological dimension to this that may reveal that it is India that is behind the competitive edge of big retail chains.

In 2009, Wal-Mart picked Bangalore-based Infosys Technologies and India-centric Cognizant among three information technology service vendors for a $600 million multi-year contract. Finance is now easily available for retail companies from banks and equity markets. What sets the real smart retail giants apart is their ability to leverage software and IT to keep their competitive edge. Supply chain software can help lower costs by managing inventories. Data analytics and customer relations software can help them identify the more lucrative customers or choose discount strategies. Partners, employees and vendors of retail giants are now connected by software. Indian talent figures in all this. Infosys was an early adapter of Wal-Mart’s move to go in for radio-frequency identification (RFID) tags that helps the retail chain track inventories at low cost. Last year, Wal-Mart also acquired Kosmix, a cutting-edge search engine, founded by Indian-born Venky Harinarayan and Anand Rajaraman (who earlier co-founded Junglee.com that Amazon acquired). Now Kosmix is a part of Wal- Mart Labs. Its technology filters and aggregates information by topic from Twitter messages and the larger Web in real time. This is a new way to interact with shoppers. Tesco now owes its edge to its Bangalore IT facility called the “Hindustan Service Centre”. The British retail chain says 6,000-employee-strong HSC’s strategic initiatives cover the “IT, business, financial, commercial and property aspects.” In Bangalore, Indian techies develop tools like mobile applications for Tesco.From the passage, it can be assumed that the author’s views on FDI in multi-brand retail are- a)in favour of the government taking more measures to protect the interests of local shopkeepers.

- b)in favour but based on the condition the FDI will not adversely affect local shopkeepers.

- c)that India has an important role in giving the retail giants a competitive edge.

- d)against the use of foreign investment in the retail sector.

Correct answer is option 'C'. Can you explain this answer?

There is a controversy raging over the entry of giants such as Tesco and Wal-Mart into India after the government last week permitted foreign direct investment (FDI) in multi-brand retail. Most economic analysts look at it in terms of capital coming into India to oust local shopkeepers or in terms of capital coming in to offer better prices to farmers or set up distribution chains and storage facilities to help consumers. These arguments seem a little old. There is a technological dimension to this that may reveal that it is India that is behind the competitive edge of big retail chains.

In 2009, Wal-Mart picked Bangalore-based Infosys Technologies and India-centric Cognizant among three information technology service vendors for a $600 million multi-year contract. Finance is now easily available for retail companies from banks and equity markets. What sets the real smart retail giants apart is their ability to leverage software and IT to keep their competitive edge. Supply chain software can help lower costs by managing inventories. Data analytics and customer relations software can help them identify the more lucrative customers or choose discount strategies. Partners, employees and vendors of retail giants are now connected by software. Indian talent figures in all this. Infosys was an early adapter of Wal-Mart’s move to go in for radio-frequency identification (RFID) tags that helps the retail chain track inventories at low cost. Last year, Wal-Mart also acquired Kosmix, a cutting-edge search engine, founded by Indian-born Venky Harinarayan and Anand Rajaraman (who earlier co-founded Junglee.com that Amazon acquired). Now Kosmix is a part of Wal- Mart Labs. Its technology filters and aggregates information by topic from Twitter messages and the larger Web in real time. This is a new way to interact with shoppers. Tesco now owes its edge to its Bangalore IT facility called the “Hindustan Service Centre”. The British retail chain says 6,000-employee-strong HSC’s strategic initiatives cover the “IT, business, financial, commercial and property aspects.” In Bangalore, Indian techies develop tools like mobile applications for Tesco.

In 2009, Wal-Mart picked Bangalore-based Infosys Technologies and India-centric Cognizant among three information technology service vendors for a $600 million multi-year contract. Finance is now easily available for retail companies from banks and equity markets. What sets the real smart retail giants apart is their ability to leverage software and IT to keep their competitive edge. Supply chain software can help lower costs by managing inventories. Data analytics and customer relations software can help them identify the more lucrative customers or choose discount strategies. Partners, employees and vendors of retail giants are now connected by software. Indian talent figures in all this. Infosys was an early adapter of Wal-Mart’s move to go in for radio-frequency identification (RFID) tags that helps the retail chain track inventories at low cost. Last year, Wal-Mart also acquired Kosmix, a cutting-edge search engine, founded by Indian-born Venky Harinarayan and Anand Rajaraman (who earlier co-founded Junglee.com that Amazon acquired). Now Kosmix is a part of Wal- Mart Labs. Its technology filters and aggregates information by topic from Twitter messages and the larger Web in real time. This is a new way to interact with shoppers. Tesco now owes its edge to its Bangalore IT facility called the “Hindustan Service Centre”. The British retail chain says 6,000-employee-strong HSC’s strategic initiatives cover the “IT, business, financial, commercial and property aspects.” In Bangalore, Indian techies develop tools like mobile applications for Tesco.

From the passage, it can be assumed that the author’s views on FDI in multi-brand retail are

a)

in favour of the government taking more measures to protect the interests of local shopkeepers.

b)

in favour but based on the condition the FDI will not adversely affect local shopkeepers.

c)

that India has an important role in giving the retail giants a competitive edge.

d)

against the use of foreign investment in the retail sector.

|

|

Eshaan Kapoor answered |

In the sentence “There is a technological...of big retail chains.” the author highlights that India has played an important role in giving the retail giants a competitive edge. Option (c) is the answer. Options (a) and (b) are incorrect because they place importance on the interests of the local shopkeepers whereas the author does not highlight this in the passage. Option (d) is incorrect because it goes against the information in the passage and the stand that the author takes in the first paragraph.

Images are the core of society today; they have become the means of massive communication and, therefore, the essence of daily life. Humans have become homus photographicus. Almost every person has a camera, whether it is in a cellphone, iPad, tablet, point and shoot or any other device. People have learned to express emotions, ideas and concepts through images regardless of its complexity. Photos may be digital images but not every image is a photograph. In general, the image is defined as a figure, the representation of something. That is, the copy of an object, a mental representation is subject to cognition and interpretation.

The material images, under their production scheme, are prone to depict the world on a canvas, the medium determines how people look, read, sing and tell stories. Additionally, the narratives are considered to be truthful because, in order to photograph an object, it has to exist; it has a referent, contrary to painting, where the artist may create chimeras based on imagination. Nonetheless, the veracity of a picture may be questioned since it could be staged or transformed into something else, even something that is not as it appears in reality. For example, a portrait may be an idealistic version of a person, an alter ego or simply not the subject as known in daily life. To illustrate further, the case of Hippolyte Bayard becomes interesting to mention. In 1840, Bayard photographed himself as a drowned man, and people who saw the picture believed it was real. At the time, these images were believed to be real because a mechanic device, a camera, had taken them. In this way, Bayard created an alternative reality, where he was found dead.What is the most important message conveyed by the passage?- a)The difference between a photograph and a painting

- b)A photograph is a mode of communication

- c)Importance of photographic images in today’s context and their fallacies

- d)How a photographic image captures the different facets of life

Correct answer is option 'C'. Can you explain this answer?

Images are the core of society today; they have become the means of massive communication and, therefore, the essence of daily life. Humans have become homus photographicus. Almost every person has a camera, whether it is in a cellphone, iPad, tablet, point and shoot or any other device. People have learned to express emotions, ideas and concepts through images regardless of its complexity. Photos may be digital images but not every image is a photograph. In general, the image is defined as a figure, the representation of something. That is, the copy of an object, a mental representation is subject to cognition and interpretation.

The material images, under their production scheme, are prone to depict the world on a canvas, the medium determines how people look, read, sing and tell stories. Additionally, the narratives are considered to be truthful because, in order to photograph an object, it has to exist; it has a referent, contrary to painting, where the artist may create chimeras based on imagination. Nonetheless, the veracity of a picture may be questioned since it could be staged or transformed into something else, even something that is not as it appears in reality. For example, a portrait may be an idealistic version of a person, an alter ego or simply not the subject as known in daily life. To illustrate further, the case of Hippolyte Bayard becomes interesting to mention. In 1840, Bayard photographed himself as a drowned man, and people who saw the picture believed it was real. At the time, these images were believed to be real because a mechanic device, a camera, had taken them. In this way, Bayard created an alternative reality, where he was found dead.

The material images, under their production scheme, are prone to depict the world on a canvas, the medium determines how people look, read, sing and tell stories. Additionally, the narratives are considered to be truthful because, in order to photograph an object, it has to exist; it has a referent, contrary to painting, where the artist may create chimeras based on imagination. Nonetheless, the veracity of a picture may be questioned since it could be staged or transformed into something else, even something that is not as it appears in reality. For example, a portrait may be an idealistic version of a person, an alter ego or simply not the subject as known in daily life. To illustrate further, the case of Hippolyte Bayard becomes interesting to mention. In 1840, Bayard photographed himself as a drowned man, and people who saw the picture believed it was real. At the time, these images were believed to be real because a mechanic device, a camera, had taken them. In this way, Bayard created an alternative reality, where he was found dead.

What is the most important message conveyed by the passage?

a)

The difference between a photograph and a painting

b)

A photograph is a mode of communication

c)

Importance of photographic images in today’s context and their fallacies

d)

How a photographic image captures the different facets of life

|

|

Anaya Patel answered |

The author begins the passage by citing the importance of photographs in today’s life. In the second paragraph, the author mentions that a photograph may not always represent reality. Hence, photographs are a fallacy of reality. So, option (c) is correct.

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.Consider the following statements:

1. Vodafone bought Hutchison’s stake in the year 2008.

2. The then Finance Minister Pranab Mukherjee did not alter the Income Tax Act.

According to the above passage, which of the statements is/are valid?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'D'. Can you explain this answer?

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

Consider the following statements:

1. Vodafone bought Hutchison’s stake in the year 2008.

2. The then Finance Minister Pranab Mukherjee did not alter the Income Tax Act.

According to the above passage, which of the statements is/are valid?

1. Vodafone bought Hutchison’s stake in the year 2008.

2. The then Finance Minister Pranab Mukherjee did not alter the Income Tax Act.

According to the above passage, which of the statements is/are valid?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Uday Yadav answered |

Explanation:

Incorrect statements:

1. Vodafone bought Hutchison’s stake in the year 2008.

- According to the passage, Vodafone purchased Hutchison's stake in the Indian telecom company in 2007, not 2008. Therefore, this statement is incorrect.

2. The then Finance Minister Pranab Mukherjee did not alter the Income Tax Act.

- The passage mentions that the then Finance Minister Pranab Mukherjee altered the Income Tax Act to tax cross-border acquisitions with retrospective effect. Therefore, this statement is incorrect.

Therefore, according to the passage, neither of the statements (1 or 2) is valid.

Incorrect statements:

1. Vodafone bought Hutchison’s stake in the year 2008.

- According to the passage, Vodafone purchased Hutchison's stake in the Indian telecom company in 2007, not 2008. Therefore, this statement is incorrect.

2. The then Finance Minister Pranab Mukherjee did not alter the Income Tax Act.

- The passage mentions that the then Finance Minister Pranab Mukherjee altered the Income Tax Act to tax cross-border acquisitions with retrospective effect. Therefore, this statement is incorrect.

Therefore, according to the passage, neither of the statements (1 or 2) is valid.

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.As per the information in the passage, the author is most likely to agree with which of the following?- a)The legal system in India needs a change and archaic laws that have no purpose should be relegated.

- b)At present, there is a lack of clarity on the issue of retrospective taxes.

- c)Tax revenues can be raised from other methods and not just through taxes in retrospect.

- d)The finance minister should place greater focus on a good budget and leave out retrospective taxation altogether.

Correct answer is option 'B'. Can you explain this answer?

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

As per the information in the passage, the author is most likely to agree with which of the following?

a)

The legal system in India needs a change and archaic laws that have no purpose should be relegated.

b)

At present, there is a lack of clarity on the issue of retrospective taxes.

c)

Tax revenues can be raised from other methods and not just through taxes in retrospect.

d)

The finance minister should place greater focus on a good budget and leave out retrospective taxation altogether.

|

|

Aryan Khanna answered |

Option (a) can be ruled out by a reference to the second paragraph in which it is stated that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. However, this does not point to the general archaic nature of Indian law. Option (b) is the answer and can be inferred from the last line of the fourth paragraph - “.taxes in retrospect are best avoided.” The passage also talks about “the fog over retrospective taxes” which tells us that there is a lack of clarity about the issue. Option (c) is incorrect as the line, “Specifically, they must.tax revenue” implies that taxes in retrospect should not be used to just raise tax revenue. This does not imply that taxes in retrospect is not the only way to raise tax revenue. Option (d) can be ruled out because it goes beyond the scope of the passage and the focus of the author’s argument.

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.Which one of these options best explains the reference the author makes to the practice of treaty shopping?- a)Foreign investors route their investments to India through illegal means to avoid paying taxes.

- b)It is easier to invest in India by setting up a company in a tax free country like Mauritius.

- c)In order to avoid tax, it is possible for investors to bring in their investments into India by using obsolete tax laws.

- d)In order to avoid paying tax in India, it is possible for investors to bring in their investments into India through companies set up for this purpose in a different country.

Correct answer is option 'D'. Can you explain this answer?

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.

Specifically, they must never be used to merely raise tax revenue. In the Vodafone case, the Shome committee is unequivocal: the company to claim tax from is Hutchison, which made the profit from the sale of its stake in the telecom company. Vodafone was not required by the extant law to withhold capital gains tax. Since Vodafone made no profit in the deal, the question of interest and penalties on back taxes does not arise.

Mr Chidambaram has indicated his desire to reverse the decision as soon as possible, even before the next budget when, normally, amendments to the Income Tax Act are undertaken. He reckons investors will return to the table once the fog over retrospective taxes is lifted.

Which one of these options best explains the reference the author makes to the practice of treaty shopping?

a)

Foreign investors route their investments to India through illegal means to avoid paying taxes.

b)

It is easier to invest in India by setting up a company in a tax free country like Mauritius.

c)

In order to avoid tax, it is possible for investors to bring in their investments into India by using obsolete tax laws.

d)

In order to avoid paying tax in India, it is possible for investors to bring in their investments into India through companies set up for this purpose in a different country.

|

|

Uday Yadav answered |

Explanation:

Overview:

Treaty shopping is a practice where investors route their investments through letter-box companies in tax havens like Mauritius to avoid paying taxes in India.

Explanation:

- Definition: Treaty shopping involves setting up companies in countries with favorable tax treaties to take advantage of tax benefits.

- Example: Investors can establish a company in Mauritius, which has a tax treaty with India, to channel their investments into India and avoid paying taxes.

- Purpose: The main goal of treaty shopping is to minimize tax liabilities and maximize profits for investors.

- Legal Aspect: While treaty shopping may not be illegal, it raises concerns about tax avoidance and the misuse of tax treaties.

- Impact: Treaty shopping can lead to revenue losses for the Indian government and distort the tax system by allowing investors to exploit loopholes in tax laws.

- Government Response: The Indian government has been taking measures to prevent treaty shopping and ensure that investments are taxed appropriately to protect the country's tax revenues.

Overview:

Treaty shopping is a practice where investors route their investments through letter-box companies in tax havens like Mauritius to avoid paying taxes in India.

Explanation:

- Definition: Treaty shopping involves setting up companies in countries with favorable tax treaties to take advantage of tax benefits.

- Example: Investors can establish a company in Mauritius, which has a tax treaty with India, to channel their investments into India and avoid paying taxes.

- Purpose: The main goal of treaty shopping is to minimize tax liabilities and maximize profits for investors.

- Legal Aspect: While treaty shopping may not be illegal, it raises concerns about tax avoidance and the misuse of tax treaties.

- Impact: Treaty shopping can lead to revenue losses for the Indian government and distort the tax system by allowing investors to exploit loopholes in tax laws.

- Government Response: The Indian government has been taking measures to prevent treaty shopping and ensure that investments are taxed appropriately to protect the country's tax revenues.

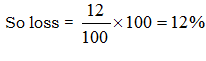

A fair price shopkeeper taken 10% profit on his goods. He lost 20% goods during theft. His loss percent is?- a)10

- b)11

- c)12

- d)8

Correct answer is option 'C'. Can you explain this answer?

A fair price shopkeeper taken 10% profit on his goods. He lost 20% goods during theft. His loss percent is?

a)

10

b)

11

c)

12

d)

8

|

Gitanjali Das answered |

Let cost price = 100

Loss during theft = 20

Saleable goods = 80

Profit taken = 10% of 80

= 8

S.P. = 88

Loss during theft = 20

Saleable goods = 80

Profit taken = 10% of 80

= 8

S.P. = 88

India’s delicately balanced current account wouldn’t be the only major casualty of costlier crude oil: Local travelers now have to pay more to fly within the country as expensive jet fuel propels airlines to raise domestic fares that had tracked global energy prices to plunge to record lows last year.

Higher consumer fares in January reflect the persistent rise in aviation-fuel prices, which increased 8% on-month in November at the New Delhi airport, the country’s busiest. After a brief lull in December, prices firmed in January and February, breaching the levels of 2015 when the cycle of declines began.

The trend has led carriers to pass additional fuel costs on to consumers, many of whom switched to airlines after the gap between air and upper-class train fares narrowed in 2016. A senior executive at Jet Airways, India’s second-biggest airline by market share, said that the airline has recently revived the practice of levying a fuel surcharge - a fare component linked to movements in jet fuel prices - on domestic flights.

“We used to charge between Rs 100 and Rs 300 depending on short- and long haul sectors. Now we charge as much as Rs 700,” he added. Jet-fuel is the biggest cost item for Indian carriers.

Prices of petroleum products began rising since the spring after the 2015-16 winter witnessed record lows for crude oil, with global prices breaching $30 a barrel on their way down to levels not seen since the 1980s. However, after a period of consolidation that analysts believed would have put many shale oil producers out of business, global crude oil prices began firming and have now stabilized around $55 a barrel, a level that some believe would be maintained over the medium term. Airlines had clubbed fuel surcharge with the base fare component in 2015 after an advisory from the Directorate General of Civil Aviation, the country’s aviation regulator. No-frills carrier SpiceJet has separated the two components over the last six months, although the fuel surcharge hasn’t been increased yet, said a spokesperson.

Travel company executives said overall fares have increased in January. According to data on Makemytrip, the country’s biggest online travel portal, average fares dropped in November and December but rose in January. Ticket prices for the Delhi-Mumbai sector rose to Rs 4,266 in January, compared with Rs 3,908 the same month last year, Rs 4,914 on the Mumbai- Bangalore sector compared with Rs 4,573 a year earlier, and Rs 4,473 on the Mumbai-Chennai route, compared with Rs 3,784 last January. Rival Cleartrip noticed divergent trends that showed those booking early stood to benefit. Last year, spot-booking fares too had fallen drastically.

“An analysis of the last three months of airfare data for the top 20 air travel sectors reveals that the increased cost to airlines, contributed by the fuel prices surge and the rupee’s depreciation, has resulted in a 15% increase in airfares for a booking window of 0-14 days,” said Samyukth Sridharan, president and chief operating officer of Cleartrip. “At the same time, we see that the airlines have been quite aggressive in offering deals to passengers who plan in advance, reflected in a 21% year on-year drop in fares on an average for travel bookings made over 14 days in advance.”

Last year, airlines had offered substantial discounts across sectors and made attractive offers for ticket-buyers who planned their travel in advance, resulting in lower yields. To be sure, the industry’s ability to charge more will depend on the direction in aviation fuel prices and seasonal changes in air-travel demand.

“February and March are lean months, and the airlines may not have room to increase so much. But there will be increases subsequently if jet fuel prices continue their climb,” said a senior executive of a budget carrier.What was the observation of Cleartrip on airline ticket prices?- a)Those who booked early had to pay a high price.

- b)There was a huge rush of passengers wanting to book their tickets early.

- c)The rush of passengers was seen in a handful of sectors.

- d)Those who booked early were benefitted.

Correct answer is option 'D'. Can you explain this answer?

India’s delicately balanced current account wouldn’t be the only major casualty of costlier crude oil: Local travelers now have to pay more to fly within the country as expensive jet fuel propels airlines to raise domestic fares that had tracked global energy prices to plunge to record lows last year.

Higher consumer fares in January reflect the persistent rise in aviation-fuel prices, which increased 8% on-month in November at the New Delhi airport, the country’s busiest. After a brief lull in December, prices firmed in January and February, breaching the levels of 2015 when the cycle of declines began.

The trend has led carriers to pass additional fuel costs on to consumers, many of whom switched to airlines after the gap between air and upper-class train fares narrowed in 2016. A senior executive at Jet Airways, India’s second-biggest airline by market share, said that the airline has recently revived the practice of levying a fuel surcharge - a fare component linked to movements in jet fuel prices - on domestic flights.

“We used to charge between Rs 100 and Rs 300 depending on short- and long haul sectors. Now we charge as much as Rs 700,” he added. Jet-fuel is the biggest cost item for Indian carriers.

Prices of petroleum products began rising since the spring after the 2015-16 winter witnessed record lows for crude oil, with global prices breaching $30 a barrel on their way down to levels not seen since the 1980s. However, after a period of consolidation that analysts believed would have put many shale oil producers out of business, global crude oil prices began firming and have now stabilized around $55 a barrel, a level that some believe would be maintained over the medium term. Airlines had clubbed fuel surcharge with the base fare component in 2015 after an advisory from the Directorate General of Civil Aviation, the country’s aviation regulator. No-frills carrier SpiceJet has separated the two components over the last six months, although the fuel surcharge hasn’t been increased yet, said a spokesperson.

Travel company executives said overall fares have increased in January. According to data on Makemytrip, the country’s biggest online travel portal, average fares dropped in November and December but rose in January. Ticket prices for the Delhi-Mumbai sector rose to Rs 4,266 in January, compared with Rs 3,908 the same month last year, Rs 4,914 on the Mumbai- Bangalore sector compared with Rs 4,573 a year earlier, and Rs 4,473 on the Mumbai-Chennai route, compared with Rs 3,784 last January. Rival Cleartrip noticed divergent trends that showed those booking early stood to benefit. Last year, spot-booking fares too had fallen drastically.

“An analysis of the last three months of airfare data for the top 20 air travel sectors reveals that the increased cost to airlines, contributed by the fuel prices surge and the rupee’s depreciation, has resulted in a 15% increase in airfares for a booking window of 0-14 days,” said Samyukth Sridharan, president and chief operating officer of Cleartrip. “At the same time, we see that the airlines have been quite aggressive in offering deals to passengers who plan in advance, reflected in a 21% year on-year drop in fares on an average for travel bookings made over 14 days in advance.”

Last year, airlines had offered substantial discounts across sectors and made attractive offers for ticket-buyers who planned their travel in advance, resulting in lower yields. To be sure, the industry’s ability to charge more will depend on the direction in aviation fuel prices and seasonal changes in air-travel demand.

“February and March are lean months, and the airlines may not have room to increase so much. But there will be increases subsequently if jet fuel prices continue their climb,” said a senior executive of a budget carrier.

Higher consumer fares in January reflect the persistent rise in aviation-fuel prices, which increased 8% on-month in November at the New Delhi airport, the country’s busiest. After a brief lull in December, prices firmed in January and February, breaching the levels of 2015 when the cycle of declines began.

The trend has led carriers to pass additional fuel costs on to consumers, many of whom switched to airlines after the gap between air and upper-class train fares narrowed in 2016. A senior executive at Jet Airways, India’s second-biggest airline by market share, said that the airline has recently revived the practice of levying a fuel surcharge - a fare component linked to movements in jet fuel prices - on domestic flights.

“We used to charge between Rs 100 and Rs 300 depending on short- and long haul sectors. Now we charge as much as Rs 700,” he added. Jet-fuel is the biggest cost item for Indian carriers.

Prices of petroleum products began rising since the spring after the 2015-16 winter witnessed record lows for crude oil, with global prices breaching $30 a barrel on their way down to levels not seen since the 1980s. However, after a period of consolidation that analysts believed would have put many shale oil producers out of business, global crude oil prices began firming and have now stabilized around $55 a barrel, a level that some believe would be maintained over the medium term. Airlines had clubbed fuel surcharge with the base fare component in 2015 after an advisory from the Directorate General of Civil Aviation, the country’s aviation regulator. No-frills carrier SpiceJet has separated the two components over the last six months, although the fuel surcharge hasn’t been increased yet, said a spokesperson.

Travel company executives said overall fares have increased in January. According to data on Makemytrip, the country’s biggest online travel portal, average fares dropped in November and December but rose in January. Ticket prices for the Delhi-Mumbai sector rose to Rs 4,266 in January, compared with Rs 3,908 the same month last year, Rs 4,914 on the Mumbai- Bangalore sector compared with Rs 4,573 a year earlier, and Rs 4,473 on the Mumbai-Chennai route, compared with Rs 3,784 last January. Rival Cleartrip noticed divergent trends that showed those booking early stood to benefit. Last year, spot-booking fares too had fallen drastically.

“An analysis of the last three months of airfare data for the top 20 air travel sectors reveals that the increased cost to airlines, contributed by the fuel prices surge and the rupee’s depreciation, has resulted in a 15% increase in airfares for a booking window of 0-14 days,” said Samyukth Sridharan, president and chief operating officer of Cleartrip. “At the same time, we see that the airlines have been quite aggressive in offering deals to passengers who plan in advance, reflected in a 21% year on-year drop in fares on an average for travel bookings made over 14 days in advance.”

Last year, airlines had offered substantial discounts across sectors and made attractive offers for ticket-buyers who planned their travel in advance, resulting in lower yields. To be sure, the industry’s ability to charge more will depend on the direction in aviation fuel prices and seasonal changes in air-travel demand.

“February and March are lean months, and the airlines may not have room to increase so much. But there will be increases subsequently if jet fuel prices continue their climb,” said a senior executive of a budget carrier.

What was the observation of Cleartrip on airline ticket prices?

a)

Those who booked early had to pay a high price.

b)

There was a huge rush of passengers wanting to book their tickets early.

c)

The rush of passengers was seen in a handful of sectors.

d)

Those who booked early were benefitted.

|

|

Tanvi nair answered |

Observation of Cleartrip on Airline Ticket Prices:

- Benefit of Booking Early: Cleartrip observed that passengers who booked their tickets in advance stood to benefit from lower fares.

- Drop in Fares for Advance Bookings: On average, there was a 21% year-on-year drop in fares for travel bookings made over 14 days in advance.

- Increased Cost to Airlines: The surge in fuel prices and the depreciation of the rupee contributed to a 15% increase in airfares for bookings made within 0-14 days.

- Aggressive Offers by Airlines: Airlines were aggressive in offering deals to passengers who planned their travel in advance, resulting in lower yields.

- Seasonal Changes in Demand: The industry's ability to charge more will depend on the direction of aviation fuel prices and seasonal changes in air-travel demand.

Overall, Cleartrip's observation highlights the advantage of booking airline tickets early to secure lower fares, as airlines have been offering attractive deals for passengers who plan their travel in advance. This trend is influenced by factors such as fuel prices, currency fluctuations, and seasonal variations in demand.

- Benefit of Booking Early: Cleartrip observed that passengers who booked their tickets in advance stood to benefit from lower fares.

- Drop in Fares for Advance Bookings: On average, there was a 21% year-on-year drop in fares for travel bookings made over 14 days in advance.

- Increased Cost to Airlines: The surge in fuel prices and the depreciation of the rupee contributed to a 15% increase in airfares for bookings made within 0-14 days.

- Aggressive Offers by Airlines: Airlines were aggressive in offering deals to passengers who planned their travel in advance, resulting in lower yields.

- Seasonal Changes in Demand: The industry's ability to charge more will depend on the direction of aviation fuel prices and seasonal changes in air-travel demand.

Overall, Cleartrip's observation highlights the advantage of booking airline tickets early to secure lower fares, as airlines have been offering attractive deals for passengers who plan their travel in advance. This trend is influenced by factors such as fuel prices, currency fluctuations, and seasonal variations in demand.

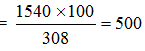

Find the greatest number which divides 285 and 1249, leaving remainder 9 and 7?- a)138

- b)139

- c)128

- d)None of the above

Correct answer is option 'A'. Can you explain this answer?

Find the greatest number which divides 285 and 1249, leaving remainder 9 and 7?

a)

138

b)

139

c)

128

d)

None of the above

|

Avantika Chakraborty answered |

Given numbers are 285 and 1249 and remainders are 9 and 7 respectively. Then new numbers after subtracting remainders are :

285 – 9 = 276

1249 – 7 = 1242.

The required number is HCF of 276 and 1242.

HCF by prime factorization method :

Prime factorization of 276 = 2x2x3x23 = 2^2 x 3^1 x 23^1

Prime factorization of 1242 = 2x3x3x3x23 = 2^1 x 3^3 x 23^1

HCF of 276 and 1242 = 2^1x 3^1x23^1

= 6 x 23 = 138

[HCF of two or more numbers = product of the smallest power of each common prime factor involved in the numbers.]

HCF of 276 and 1242 is 138.

Hence, the required greatest number which divides 285 and 1249 leaving remainders 9 and 7 respectively is 138.

The problem with backdating taxes is that the taxpayer will have to continuously guess how much of his current income will be taken away at a later date. This is the crux of the Parthasarathi Shome committee report on retrospective taxation of cross-border acquisition of Indian assets, like Vodafone’s $11.2 billion purchase of Hutchison’s stake in the country’s third largest telecom service provider in 2007.

The Supreme Court in January ruled against the taxman, who was claiming Rs. 11,200 crore in tax, penalty and interest. The court conceded that Indian law was incapable of plugging a widely used tax dodge by inbound foreign investment. The message for the government in the verdict was that the law needed to be changed to curb treaty shopping, the practice of routing investments through letter-box companies in havens like Mauritius to avoid paying taxes in India.

Presenting his last budget in March, the then finance minister Pranab Mukherjee, altered the Income Tax Act to tax such deals with retrospective effect. His argument was since the court felt the intent of the law was not clear, it had to be explicitly clarified for the entire past life of the Income Tax Act, which was enacted in 1962. This last bit - that deals done earlier could be taxed - raised a chorus of protest from the investing community, and the finance ministry under P Chidambaram sought an independent review of its stand. Mr Shome, a tax expert of international standing, has now told the government what it knew all this while: taxes in retrospect are best avoided.