All Exams >

CA Foundation >

Accounting for CA Foundation >

All Questions

All questions of Unit 2: Accounting Concepts, Principles And Conventions for CA Foundation Exam

Can you explain the answer of this question below:Money owed from an Outsider is a : - A:Asset

- B:Liability

- C:Expense

- D:Capital

The answer is a.

Money owed from an Outsider is a :

A:

Asset

B:

Liability

C:

Expense

D:

Capital

|

|

Alok Mehta answered |

When we have to receive something from any other person it becomes an asset for the receiving person. Liability will be one when something is due to be paid to an outsider. Expense is the outflow of economic resources to earn the specified revenue. Capital is the sum provided by the owner for investment purposes in a business.

Capital brought in by the proprietor is an example of

- a)Increase in asset and increase in liability.

- b)Increase in liability and decrease in asset

- c)Increase in asset and decrease in liability.

- d)Increase in one asset and decrease in another asset.

Correct answer is option 'A'. Can you explain this answer?

Capital brought in by the proprietor is an example of

a)

Increase in asset and increase in liability.

b)

Increase in liability and decrease in asset

c)

Increase in asset and decrease in liability.

d)

Increase in one asset and decrease in another asset.

|

Rutuja Dasgupta answered |

Increase in Asset and Increase in Liability

When a proprietor brings in capital, it is considered as an investment in the business. This investment increases the assets of the business while also creating a liability to the proprietor. The following points explain why capital brought in by the proprietor is an example of an increase in asset and an increase in liability:

Increase in Asset:

- The capital brought in by the proprietor is a cash injection into the business. This cash is considered an asset of the business as it can be used to purchase other assets such as equipment, inventory or property.

- The cash injection also increases the overall value of the business, which is reflected in the balance sheet as an increase in assets.

Increase in Liability:

- The capital brought in by the proprietor creates a liability to the business as well. The business now owes the proprietor the amount of capital invested.

- This liability is recorded in the balance sheet as an increase in liabilities.

Overall, the capital brought in by the proprietor is an example of an increase in asset and an increase in liability since it increases the value of the business while also creating a debt to the proprietor.

When a proprietor brings in capital, it is considered as an investment in the business. This investment increases the assets of the business while also creating a liability to the proprietor. The following points explain why capital brought in by the proprietor is an example of an increase in asset and an increase in liability:

Increase in Asset:

- The capital brought in by the proprietor is a cash injection into the business. This cash is considered an asset of the business as it can be used to purchase other assets such as equipment, inventory or property.

- The cash injection also increases the overall value of the business, which is reflected in the balance sheet as an increase in assets.

Increase in Liability:

- The capital brought in by the proprietor creates a liability to the business as well. The business now owes the proprietor the amount of capital invested.

- This liability is recorded in the balance sheet as an increase in liabilities.

Overall, the capital brought in by the proprietor is an example of an increase in asset and an increase in liability since it increases the value of the business while also creating a debt to the proprietor.

Which of the following does not follow Dual Aspect?- a)Increase in one asset, decrease in other.

- b)Increase in both asset and liability

- c)Decrease in one asset, decrease in other

- d)Increase in one asset & capital

Correct answer is option 'C'. Can you explain this answer?

Which of the following does not follow Dual Aspect?

a)

Increase in one asset, decrease in other.

b)

Increase in both asset and liability

c)

Decrease in one asset, decrease in other

d)

Increase in one asset & capital

|

|

Nandini Iyer answered |

The dual aspect concept states that every business transaction requires recordation in two different accounts. This concept is the basis of double entry accounting, which is required by all accounting frameworks in order to produce reliable financial statements. The concept is derived from the accounting equation, which states that:

Assets = Liabilities + Equity

Purchase of machinery for cash- a)Decreases total assets.

- b)Increases total assets.

- c)Retains total assets unchanged.

- d)Decreases total liabilities.

Correct answer is 'C'. Can you explain this answer?

Purchase of machinery for cash

a)

Decreases total assets.

b)

Increases total assets.

c)

Retains total assets unchanged.

d)

Decreases total liabilities.

|

Freedom Institute answered |

Purchase of Machinery. This transaction will give affect in two accounts i.e. Machinery Account and cash Account.

Hence there will be no affect in total assets as Machinery will increase and cash will decrease.

Yes, there will be a change in fixed assets and current assets. But total assets will remain unchanged.

Hence there will be no affect in total assets as Machinery will increase and cash will decrease.

Yes, there will be a change in fixed assets and current assets. But total assets will remain unchanged.

The ‘going concern concept’ is the underlying basis for- a)Stating fixed assets at their realizable values.

- b)Disclosing the market value of securities.

- c)Disclosing the sales and other operating information in the income statement.

- d)None of the above.

Correct answer is option 'A'. Can you explain this answer?

The ‘going concern concept’ is the underlying basis for

a)

Stating fixed assets at their realizable values.

b)

Disclosing the market value of securities.

c)

Disclosing the sales and other operating information in the income statement.

d)

None of the above.

|

Srsps answered |

The going concern concept is a fundamental principle of accounting. It assumes that during and beyond the next fiscal period a company will complete its current plans, use its existing assets and continue to meet its financial obligations

What is the effect on the Net Assets if cash is received from debtors of Rs. 50,000?- a)Increase

- b)Decrease

- c)No change

- d)None of these

Correct answer is option 'C'. Can you explain this answer?

What is the effect on the Net Assets if cash is received from debtors of Rs. 50,000?

a)

Increase

b)

Decrease

c)

No change

d)

None of these

|

|

Arun Khanna answered |

Description: Entry from receiving cash from debtors is:

Cash A/C Dr. 50,000

To Debtors A/C 50,000

Since, both the above items are current asset elements, there will be no change in current asset position due to this transaction.

According to which concept the owner of an enterprise pays the “interest on drawings”?- a)Accrual concept

- b)Conservative concept

- c)Entity concept

- d)Dual Aspect concept

Correct answer is option 'C'. Can you explain this answer?

According to which concept the owner of an enterprise pays the “interest on drawings”?

a)

Accrual concept

b)

Conservative concept

c)

Entity concept

d)

Dual Aspect concept

|

|

Rajat Patel answered |

Entity concept

Description: The owner of the enterprise pays the interest on drawings according to the Entity concept. According to this concept, business enterprise is a separate identity a part from its owner. The proprietor is treated as a creditor of the company. Therefore, when he withdraws money for his personal use from the business, it is treated as loan from the business to the proprietor, that is why he pays interest on drawings.

An asset was purchased for Rs. 6,60,000. Cash was paid Rs. 1,20,000 and for the balance a bill was drawn for 60 days. What will be the effect on fixed assets?- a)Rs. 1,20,000

- b)Rs. 5,40,000

- c)Rs. 6,60,000

- d)Nil

Correct answer is option 'C'. Can you explain this answer?

An asset was purchased for Rs. 6,60,000. Cash was paid Rs. 1,20,000 and for the balance a bill was drawn for 60 days. What will be the effect on fixed assets?

a)

Rs. 1,20,000

b)

Rs. 5,40,000

c)

Rs. 6,60,000

d)

Nil

|

Freedom Institute answered |

The effect on fixed assets when an asset is purchased for Rs. 6,60,000, with Rs. 1,20,000 paid in cash and the balance covered by a bill drawn for 60 days, would be: C: Rs. 6,60,000

Fixed assets should be recorded at the total purchase price, regardless of the payment method used. In this case, the entire cost of the asset, Rs. 6,60,000, should be recorded as an increase in fixed assets. The fact that part of the payment was deferred by drawing a bill does not affect the recorded value of the fixed asset.

Fixed assets should be recorded at the total purchase price, regardless of the payment method used. In this case, the entire cost of the asset, Rs. 6,60,000, should be recorded as an increase in fixed assets. The fact that part of the payment was deferred by drawing a bill does not affect the recorded value of the fixed asset.

The owner of a company included his personal medical expenses in the company’s income statement. Indicate the principle that is violated. - a)Cost principle

- b)Conservatism

- c)Disclosure

- d)Entity Concept

Correct answer is option 'D'. Can you explain this answer?

The owner of a company included his personal medical expenses in the company’s income statement. Indicate the principle that is violated.

a)

Cost principle

b)

Conservatism

c)

Disclosure

d)

Entity Concept

|

Srsps answered |

The entity concept, also known as the business entity principle, dictates that the business and its owner are separate entities for accounting purposes. This means that the personal financial affairs of the owner should not be mixed with the business's financial affairs. Including personal medical expenses in the company’s income statement violates this principle because it confuses the owner's personal transactions with those of the business.

Capital as on 1-4-05: Rs. 90,000

Capital introduced: Rs. 25,000

Drawings made: Rs. 35,000

Capital as on 31-3-06: Rs. 1,25,000

What is the amount of profit added to the Capital? - a)Rs. 50,000

- b)Rs. 60,000

- c)Rs. 75,000

- d)Rs. 45,000

Correct answer is option 'D'. Can you explain this answer?

Capital as on 1-4-05: Rs. 90,000

Capital introduced: Rs. 25,000

Drawings made: Rs. 35,000

Capital as on 31-3-06: Rs. 1,25,000

What is the amount of profit added to the Capital?

Capital introduced: Rs. 25,000

Drawings made: Rs. 35,000

Capital as on 31-3-06: Rs. 1,25,000

What is the amount of profit added to the Capital?

a)

Rs. 50,000

b)

Rs. 60,000

c)

Rs. 75,000

d)

Rs. 45,000

|

|

Kavita Joshi answered |

Net Profit= Closing Capital+ Drawings- Capital Introduced- Opening Capital

= 1,25,000+ 35,000- 25,000- 90,000

= Rs. 45,000

________refer to the general agreement on the usage and practices in social or economic life: - a)Accounting Assumptions

- b)Accounting convention

- c)Accounting Policies

- d)Accounting Principles

Correct answer is option 'B'. Can you explain this answer?

________refer to the general agreement on the usage and practices in social or economic life:

a)

Accounting Assumptions

b)

Accounting convention

c)

Accounting Policies

d)

Accounting Principles

|

Freedom Institute answered |

The term that refers to the general agreement on the usage and practices in social or economic life in the context of accounting is: B: Accounting convention

Accounting conventions are accepted standards, norms, or practices that guide the preparation of financial statements. They are not formal laws but are guidelines that have gained acceptance over time due to their general use and applicability in accounting and financial reporting.

Accounting conventions are accepted standards, norms, or practices that guide the preparation of financial statements. They are not formal laws but are guidelines that have gained acceptance over time due to their general use and applicability in accounting and financial reporting.

Cash of Rs. 2,000 is withdrawn for personal expenses. This will be debited to which account: - a)Drawings A/c

- b)Creditors A/c

- c)Capital A/c

- d)Cash A/c

Correct answer is option 'A'. Can you explain this answer?

Cash of Rs. 2,000 is withdrawn for personal expenses. This will be debited to which account:

a)

Drawings A/c

b)

Creditors A/c

c)

Capital A/c

d)

Cash A/c

|

Raghav Ghoshal answered |

The correct answer is option 'A', Drawings A/c.

Explanation:

- Drawings A/c is an account that represents the withdrawals made by the owner for personal expenses.

- When cash is withdrawn from the business for personal use, it is recorded as a debit to the Drawings A/c.

- This indicates that the owner has taken out funds from the business for personal purposes.

- The Drawings A/c is a contra account to the Capital A/c, which represents the owner's investment in the business.

- By debiting the Drawings A/c, the owner's equity in the business is reduced.

To understand this better, let's look at the different options and why they are not the correct answer:

a) Drawings A/c:

- This is the correct answer because cash withdrawn for personal expenses is debited to the Drawings A/c.

b) Creditors A/c:

- Creditors A/c represents the amounts owed by the business to its suppliers or creditors.

- Cash withdrawals for personal expenses do not involve any payment to creditors, so this option is not correct.

c) Capital A/c:

- The Capital A/c represents the owner's investment in the business.

- Cash withdrawals for personal expenses do not affect the owner's capital investment, so this option is not correct.

d) Cash A/c:

- The Cash A/c represents the cash balance of the business.

- When cash is withdrawn for personal expenses, it is recorded as a debit to the Drawings A/c, not the Cash A/c.

- This is because the Cash A/c represents the business's cash transactions, while the Drawings A/c represents the owner's personal withdrawals.

- Therefore, this option is not correct.

In conclusion, when cash of Rs. 2,000 is withdrawn for personal expenses, it is debited to the Drawings A/c.

Explanation:

- Drawings A/c is an account that represents the withdrawals made by the owner for personal expenses.

- When cash is withdrawn from the business for personal use, it is recorded as a debit to the Drawings A/c.

- This indicates that the owner has taken out funds from the business for personal purposes.

- The Drawings A/c is a contra account to the Capital A/c, which represents the owner's investment in the business.

- By debiting the Drawings A/c, the owner's equity in the business is reduced.

To understand this better, let's look at the different options and why they are not the correct answer:

a) Drawings A/c:

- This is the correct answer because cash withdrawn for personal expenses is debited to the Drawings A/c.

b) Creditors A/c:

- Creditors A/c represents the amounts owed by the business to its suppliers or creditors.

- Cash withdrawals for personal expenses do not involve any payment to creditors, so this option is not correct.

c) Capital A/c:

- The Capital A/c represents the owner's investment in the business.

- Cash withdrawals for personal expenses do not affect the owner's capital investment, so this option is not correct.

d) Cash A/c:

- The Cash A/c represents the cash balance of the business.

- When cash is withdrawn for personal expenses, it is recorded as a debit to the Drawings A/c, not the Cash A/c.

- This is because the Cash A/c represents the business's cash transactions, while the Drawings A/c represents the owner's personal withdrawals.

- Therefore, this option is not correct.

In conclusion, when cash of Rs. 2,000 is withdrawn for personal expenses, it is debited to the Drawings A/c.

Two primary qualitative characteristics of financial statements are:- a)Understandability and Materiality

- b)Relevance and Reliability

- c)Materiality and Reliability

- d)Relevance and Understandability

Correct answer is option 'B'. Can you explain this answer?

Two primary qualitative characteristics of financial statements are:

a)

Understandability and Materiality

b)

Relevance and Reliability

c)

Materiality and Reliability

d)

Relevance and Understandability

|

|

Priya Patel answered |

The following are all qualitative characteristics of financial statements:

Understandability -The information must be readily understandable to users of the financial statements. ...

Relevance.

Reliability.

Comparability.

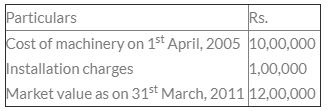

Consider the following data pertaining to Alpha Ltd.: While finalizing the annual accounts, if the company values the machinery at Rs. 12,00,000. Which of the following concepts is violated by the Alpha Ltd.?

While finalizing the annual accounts, if the company values the machinery at Rs. 12,00,000. Which of the following concepts is violated by the Alpha Ltd.?- a)Cost

- b)Matching.

- c)Realisation.

- d)Periodicity.

Correct answer is option 'A'. Can you explain this answer?

Consider the following data pertaining to Alpha Ltd.:

While finalizing the annual accounts, if the company values the machinery at Rs. 12,00,000. Which of the following concepts is violated by the Alpha Ltd.?

a)

Cost

b)

Matching.

c)

Realisation.

d)

Periodicity.

|

|

Denali Bora answered |

Here cost concept is violating because there is a principle while preparing annual accounts the market value or cost price whichever is less that should be considered and here Alfha ltd.consider market value which is more than cost value

Fixed assets and Current assets are categorized as per concept of: - a)Separate entity

- b)Going concern

- c)Consistency

- d)Time period

Correct answer is option 'B'. Can you explain this answer?

Fixed assets and Current assets are categorized as per concept of:

a)

Separate entity

b)

Going concern

c)

Consistency

d)

Time period

|

|

Jayant Mishra answered |

The concept of going concern treats the life of the business as indefinite i.e. the business life will consist of many accounting periods. Those assets benefit of which is received in one accounting year itself are current assets and those whose benefit extends to more than one accounting period are called fixed assets. Existence of more than one accounting period is supported by going concern concept only.

Ram purchased a car for Rs. 10,000 paid Rs. 3,000 as cash and balance amount will be paid in three equal installments. Due to this:- a)Total assets increase by Rs. 10,000

- b)Total liabilities increase by Rs. 3,000

- c)Assets will increase by Rs. 7,000 with corresponding increase in liability by Rs. 7,000

- d)Both (b) and (c)

Correct answer is option 'C'. Can you explain this answer?

Ram purchased a car for Rs. 10,000 paid Rs. 3,000 as cash and balance amount will be paid in three equal installments. Due to this:

a)

Total assets increase by Rs. 10,000

b)

Total liabilities increase by Rs. 3,000

c)

Assets will increase by Rs. 7,000 with corresponding increase in liability by Rs. 7,000

d)

Both (b) and (c)

|

Dipika Kaur answered |

Explanation:

When Ram purchased a car for Rs. 10,000 and paid Rs. 3,000 as cash, the balance amount of Rs. 7,000 will be paid in three equal installments. Let's understand how this transaction affects the accounting equation.

Assets = Liabilities + Owner's Equity

In this case, the car is an asset, and cash is also an asset. The total assets of the business increase by Rs. 10,000, as the business now owns a car worth Rs. 10,000.

a) Total assets increase by Rs. 10,000

Now, let's look at how the liabilities and owner's equity are affected.

Liabilities are the debts or obligations of the business. When Ram purchases a car for Rs. 10,000, he owes the remaining balance of Rs. 7,000 to the seller. This liability will be paid in three equal installments.

b) Total liabilities increase by Rs. 3,000

However, since the balance amount of Rs. 7,000 is to be paid in three equal installments, it means that there will be an increase in liabilities of Rs. 7,000. The liability will increase by Rs. 7,000 because the business is liable to pay the remaining balance in installments.

c) Assets will increase by Rs. 7,000 with corresponding increase in liability by Rs. 7,000

Therefore, the correct answer is option 'C', as assets will increase by Rs. 7,000 with a corresponding increase in liability by Rs. 7,000.

When Ram purchased a car for Rs. 10,000 and paid Rs. 3,000 as cash, the balance amount of Rs. 7,000 will be paid in three equal installments. Let's understand how this transaction affects the accounting equation.

Assets = Liabilities + Owner's Equity

In this case, the car is an asset, and cash is also an asset. The total assets of the business increase by Rs. 10,000, as the business now owns a car worth Rs. 10,000.

a) Total assets increase by Rs. 10,000

Now, let's look at how the liabilities and owner's equity are affected.

Liabilities are the debts or obligations of the business. When Ram purchases a car for Rs. 10,000, he owes the remaining balance of Rs. 7,000 to the seller. This liability will be paid in three equal installments.

b) Total liabilities increase by Rs. 3,000

However, since the balance amount of Rs. 7,000 is to be paid in three equal installments, it means that there will be an increase in liabilities of Rs. 7,000. The liability will increase by Rs. 7,000 because the business is liable to pay the remaining balance in installments.

c) Assets will increase by Rs. 7,000 with corresponding increase in liability by Rs. 7,000

Therefore, the correct answer is option 'C', as assets will increase by Rs. 7,000 with a corresponding increase in liability by Rs. 7,000.

ACE Traders purchased goods for Rs. 30,00,000 and sold 70% of such goods during the accounting year ended 31stMarch, 2012. The market value of the remaining goods was Rs. 6, 00,000. ACE Traders valued the closing stock at Rs. 6, 00,000 and not at Rs. 9, 00,000 due to concept of ______- a)Money measurement

- b)Periodicity

- c)Cost

- d)Conservatism

Correct answer is option 'D'. Can you explain this answer?

ACE Traders purchased goods for Rs. 30,00,000 and sold 70% of such goods during the accounting year ended 31stMarch, 2012. The market value of the remaining goods was Rs. 6, 00,000. ACE Traders valued the closing stock at Rs. 6, 00,000 and not at Rs. 9, 00,000 due to concept of ______

a)

Money measurement

b)

Periodicity

c)

Cost

d)

Conservatism

|

Sai Kulkarni answered |

The correct option is D.

Conservatism Principle is a concept in accounting under GAAP which recognises and records expenses and liabilities-certain or uncertain in nature, as soon as possible but recognises revenues and assets when they are assured of being received. It gives clear guidance in recording cases of uncertainty and estimates. Since the value of the goods is decreased the company writes down this decrease.

Outstanding expenses is included in Profit & Loss A/c at the year end according to which concept _________- a)Matching

- b)Full disclosure

- c)Accrual

- d)Going Concern

Correct answer is option 'C'. Can you explain this answer?

Outstanding expenses is included in Profit & Loss A/c at the year end according to which concept _________

a)

Matching

b)

Full disclosure

c)

Accrual

d)

Going Concern

|

|

Arun Khanna answered |

(c) Accrual

Description: Under accrual concept, The effects of transactions and other events are recognized on mercantile basis i.e. when they occur (and not when cash is received or paid) and they are recorded in accounting records and reported in financial statements of the period to which they relate.

The comparison of the financial statement of one accounting period with that of another accounting period is possible only when _______ concept is followed. - a)Cost

- b)Consistency

- c)Going concern

- d)Materiality

Correct answer is option 'B'. Can you explain this answer?

The comparison of the financial statement of one accounting period with that of another accounting period is possible only when _______ concept is followed.

a)

Cost

b)

Consistency

c)

Going concern

d)

Materiality

|

Anu Kaur answered |

Consistency Concept in Comparing Financial Statements

The consistency concept is a fundamental accounting principle that requires businesses to use the same accounting methods and procedures from period to period. This concept ensures that financial statements are comparable across different accounting periods, allowing users to make meaningful comparisons and draw accurate conclusions about a company's financial performance.

Explanation:

When the consistency concept is followed, financial statements can be compared meaningfully. The consistency concept requires that a company uses the same accounting policies and procedures in each accounting period. This means that the same methods of recording transactions, valuing assets and liabilities, and presenting financial information must be used consistently over time.

If a company changes its accounting policies or procedures from one period to the next, the financial statements become incomparable. Any differences in the financial statements may not be due to changes in the company's performance, but rather due to differences in accounting methods. As a result, users of financial statements cannot accurately compare the company's performance over time.

For example, if a company changes its method of depreciating its assets from the straight-line method to the declining balance method, the financial statements for the current period will not be comparable to those of the previous period. The change in depreciation method will affect the amount of depreciation expense recorded, which could have a significant impact on the company's reported profits.

Conclusion:

In conclusion, the consistency concept is crucial for ensuring that financial statements are comparable across different accounting periods. This allows users to make informed decisions based on the financial statements and draw accurate conclusions about a company's financial performance. Therefore, comparing financial statements of one accounting period with that of another accounting period is possible only when the consistency concept is followed.

The consistency concept is a fundamental accounting principle that requires businesses to use the same accounting methods and procedures from period to period. This concept ensures that financial statements are comparable across different accounting periods, allowing users to make meaningful comparisons and draw accurate conclusions about a company's financial performance.

Explanation:

When the consistency concept is followed, financial statements can be compared meaningfully. The consistency concept requires that a company uses the same accounting policies and procedures in each accounting period. This means that the same methods of recording transactions, valuing assets and liabilities, and presenting financial information must be used consistently over time.

If a company changes its accounting policies or procedures from one period to the next, the financial statements become incomparable. Any differences in the financial statements may not be due to changes in the company's performance, but rather due to differences in accounting methods. As a result, users of financial statements cannot accurately compare the company's performance over time.

For example, if a company changes its method of depreciating its assets from the straight-line method to the declining balance method, the financial statements for the current period will not be comparable to those of the previous period. The change in depreciation method will affect the amount of depreciation expense recorded, which could have a significant impact on the company's reported profits.

Conclusion:

In conclusion, the consistency concept is crucial for ensuring that financial statements are comparable across different accounting periods. This allows users to make informed decisions based on the financial statements and draw accurate conclusions about a company's financial performance. Therefore, comparing financial statements of one accounting period with that of another accounting period is possible only when the consistency concept is followed.

All the following items are classified as fundamental accounting assumption except- a)Consistency.

- b)Business entity.

- c)Going concern.

- d)Accrual

Correct answer is option 'B'. Can you explain this answer?

All the following items are classified as fundamental accounting assumption except

a)

Consistency.

b)

Business entity.

c)

Going concern.

d)

Accrual

|

Freedom Institute answered |

The item that is not classified as a fundamental accounting assumption is: B: Business entity.

The fundamental accounting assumptions typically include consistency, going concern, and accrual. The business entity concept, while a fundamental principle in accounting, classifies a business as separate from its owners, but it is not considered one of the "fundamental assumptions" that guide the preparation of financial statements under that specific designation.

The fundamental accounting assumptions typically include consistency, going concern, and accrual. The business entity concept, while a fundamental principle in accounting, classifies a business as separate from its owners, but it is not considered one of the "fundamental assumptions" that guide the preparation of financial statements under that specific designation.

Direct labor and salary outlays direct material purchases, which are classified as- a)price disbursements

- b)cash disbursements

- c)budget disbursements

- d)goods disbursements

Correct answer is option 'B'. Can you explain this answer?

Direct labor and salary outlays direct material purchases, which are classified as

a)

price disbursements

b)

cash disbursements

c)

budget disbursements

d)

goods disbursements

|

|

Alok Mehta answered |

Disbursement is the act of paying out or disbursing money. Examples of disbursements include money paid out to run a business, cash expenditures, dividend payments, the amounts that a lawyer might have to pay out on a person's behalf in connection with a transaction, etc.

A businessman purchased goods for Rs.25,00,000 and sold 80% of such goods during the accounting year ended 31st March, 2005. The market value of the remaining goods was Rs.4,00,000. He valued the closing stock at cost. He violated the concept of- a)Money measurement.

- b)Conservatism.

- c)Cost.

- d)Periodicity.

Correct answer is option 'B'. Can you explain this answer?

A businessman purchased goods for Rs.25,00,000 and sold 80% of such goods during the accounting year ended 31st March, 2005. The market value of the remaining goods was Rs.4,00,000. He valued the closing stock at cost. He violated the concept of

a)

Money measurement.

b)

Conservatism.

c)

Cost.

d)

Periodicity.

|

|

Arun Khanna answered |

The conservatism principle is the general concept of recognizing expenses and liabilities as soon as possible when there is uncertainty about the outcome, but to only recognize revenues and assets when they are assured of being received.

Provision for discount is made due to concept of:- a)Conservatism

- b)Matching

- c)Both (a) and (b)

- d)Materiality

Correct answer is option 'C'. Can you explain this answer?

Provision for discount is made due to concept of:

a)

Conservatism

b)

Matching

c)

Both (a) and (b)

d)

Materiality

|

|

Alok Mehta answered |

The likely amount of the discount to be allowed is debited to the Profit and Loss Account and credited to the Provision for Conservatism Discount Account. The balance in the latter account is deducted from book debts (Debtors) in the Balance Sheet and is carried forward to the next year.

A trader started retail business. During the year he sold goods worth Rs. 60,000 and for Rs.1,20,000 out of which only Rs. 1,00,000 was collected during the year. He had a closing stock of Rs. 10,000. His other business expenses for the period were Rs.20,000 out of which Rs.5,000 was outstanding at year end His total profit for the year 2008-09 as per the terms of accrual concept was

- a)Rs. 30,000

- b)Rs. 45,000

- c)Rs. 40,000

- d)Rs. 20,000

Correct answer is option 'B'. Can you explain this answer?

A trader started retail business. During the year he sold goods worth Rs. 60,000 and for Rs.1,20,000 out of which only Rs. 1,00,000 was collected during the year. He had a closing stock of Rs. 10,000. His other business expenses for the period were Rs.20,000 out of which Rs.5,000 was outstanding at year end His total profit for the year 2008-09 as per the terms of accrual concept was

a)

Rs. 30,000

b)

Rs. 45,000

c)

Rs. 40,000

d)

Rs. 20,000

|

|

Priya Patel answered |

The total profit for the year 2008-09 as per the accrual concept would be Rs. 45,000. This can be calculated by: Sales (Rs. 1,20,000) - Cost of goods sold (Rs. 60,000 (purchased goods) + Rs. 10,000 (closing stock)) - Expenses (Rs. 20,000 - Rs. 5,000 (outstanding expenses)) = Rs. 45,000. It is important to note that the Rs. 20,000 in expenses and Rs. 5,000 in outstanding expenses are considered in the calculation, as per the accrual concept expenses are recognized in the period in which they are incurred, rather than when they are paid.

The obligations of an enterprise other than owner’s fund are known as: - a)Assets

- b)Liabilities

- c)Capital

- d)None of these

Correct answer is option 'B'. Can you explain this answer?

The obligations of an enterprise other than owner’s fund are known as:

a)

Assets

b)

Liabilities

c)

Capital

d)

None of these

|

Freedom Institute answered |

The obligations of an enterprise other than the owner’s fund are known as: B: Liabilities

Liabilities are the financial obligations of a business, excluding the owner's equity, and include things like loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

Liabilities are the financial obligations of a business, excluding the owner's equity, and include things like loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued expenses.

The adjustments to be made for prepaid expenses is:- a)Add prepaid expenses to respective expenses and show it as an asset

- b)Deduct prepaid expenses form respective expanses and show it as an asset

- c)Add prepaid expenses to respective expenses and show it as a liability

- d)Deduct prepaid expenses form respective and show it as a liability

Correct answer is option 'B'. Can you explain this answer?

The adjustments to be made for prepaid expenses is:

a)

Add prepaid expenses to respective expenses and show it as an asset

b)

Deduct prepaid expenses form respective expanses and show it as an asset

c)

Add prepaid expenses to respective expenses and show it as a liability

d)

Deduct prepaid expenses form respective and show it as a liability

|

Mahesh Chakraborty answered |

Adjustments for Prepaid Expenses

Prepaid expenses refer to expenses that have been paid in advance but the benefits of which are yet to be realized. Thus, at the end of an accounting period, adjustments need to be made to account for these expenses.

The adjustments to be made for prepaid expenses are as follows:

Deduct Prepaid Expenses from Respective Expenses

The adjustment for prepaid expenses involves deducting the prepaid amount from the respective expenses and showing it as an asset. This adjustment is necessary because the amount of the prepaid expense has already been paid, and it is not an expense that needs to be recognized in the current period.

For example, if a company has paid $12,000 for rent for the next 12 months in advance, this amount will be recorded as a prepaid rent expense. At the end of each month, the company will deduct $1,000 (the amount of rent for that month) from the prepaid rent expense and show it as an asset.

This adjustment is made to ensure that the expenses are accurately reflected in the financial statements, and it also helps in determining the true profitability of the business.

Conclusion

In conclusion, the adjustment for prepaid expenses involves deducting the prepaid amount from the respective expenses and showing it as an asset. This adjustment helps in accurately reflecting the expenses in the financial statements and determining the true profitability of the business.

Prepaid expenses refer to expenses that have been paid in advance but the benefits of which are yet to be realized. Thus, at the end of an accounting period, adjustments need to be made to account for these expenses.

The adjustments to be made for prepaid expenses are as follows:

Deduct Prepaid Expenses from Respective Expenses

The adjustment for prepaid expenses involves deducting the prepaid amount from the respective expenses and showing it as an asset. This adjustment is necessary because the amount of the prepaid expense has already been paid, and it is not an expense that needs to be recognized in the current period.

For example, if a company has paid $12,000 for rent for the next 12 months in advance, this amount will be recorded as a prepaid rent expense. At the end of each month, the company will deduct $1,000 (the amount of rent for that month) from the prepaid rent expense and show it as an asset.

This adjustment is made to ensure that the expenses are accurately reflected in the financial statements, and it also helps in determining the true profitability of the business.

Conclusion

In conclusion, the adjustment for prepaid expenses involves deducting the prepaid amount from the respective expenses and showing it as an asset. This adjustment helps in accurately reflecting the expenses in the financial statements and determining the true profitability of the business.

The underlying accounting principle necessitating amortization of Intangible Assets is/are :- a)Cost Concept

- b)Realization concept

- c)Matching Concept

- d)Both ‘b’ and ‘c’

Correct answer is option 'C'. Can you explain this answer?

The underlying accounting principle necessitating amortization of Intangible Assets is/are :

a)

Cost Concept

b)

Realization concept

c)

Matching Concept

d)

Both ‘b’ and ‘c’

|

|

Jayant Mishra answered |

Amortization of intangible assets means charging a reasonable portion of the asset on a product basis to the revenue of that year. This is done as per the Matching Concept. Matching Concept states that all expenses matched with the revenue of that period should only be taken into consideration. Amortization is treated as an expense of that particular year. In the financial statements of the organization if any revenue is recognized then expenses related to earn that revenue should also be recognized.

Cost concept basically recognizes- a)Fair Market Value

- b)Historical Cost

- c)Realisable Value

- d)Replacement Cost

Correct answer is option 'B'. Can you explain this answer?

Cost concept basically recognizes

a)

Fair Market Value

b)

Historical Cost

c)

Realisable Value

d)

Replacement Cost

|

|

Nandini Iyer answered |

The cost concept basically recognises historical cost or the acquisition cost of the asset. The value of an asset is to be determined on the basis of historical cost.

Which financial statement represents the accounting equations

ASSETS = LIABILITIES + OWNER’S EQUITY

- a)Income Statement

- b)Cash Flow Statement

- c)Balance Sheet

- d)Funds Flow Statement

Correct answer is option 'C'. Can you explain this answer?

Which financial statement represents the accounting equations

ASSETS = LIABILITIES + OWNER’S EQUITY

a)

Income Statement

b)

Cash Flow Statement

c)

Balance Sheet

d)

Funds Flow Statement

|

Srsps answered |

The financial statement that represents the accounting equation (Assets = Liabilities + Owner’s Equity) is: C: Balance Sheet

The balance sheet is designed to show a company's financial position at a specific point in time and directly reflects the accounting equation by listing all assets, liabilities, and the owner’s equity.

The balance sheet is designed to show a company's financial position at a specific point in time and directly reflects the accounting equation by listing all assets, liabilities, and the owner’s equity.

The accounts that records expenses, gains and losses are

- a)Personal accounts

- b)Real accounts

- c)Nominal accounts

- d)None of the above

Correct answer is option 'C'. Can you explain this answer?

The accounts that records expenses, gains and losses are

a)

Personal accounts

b)

Real accounts

c)

Nominal accounts

d)

None of the above

|

Srsps answered |

A nominal account is a general ledger or temporary account formed and maintained by a business. It includes all necessary records of the business's expenses, losses, gains and revenues for a particular financial year.

Fundamental Accounting Assumptions are: - a)Going Concern, conservatism, Accrual

- b)Going concern, Matching, Consistency

- c)Going concern, Consistency, Accrual

- d)Going Concern, Entity, periodicity

Correct answer is option 'C'. Can you explain this answer?

Fundamental Accounting Assumptions are:

a)

Going Concern, conservatism, Accrual

b)

Going concern, Matching, Consistency

c)

Going concern, Consistency, Accrual

d)

Going Concern, Entity, periodicity

|

|

Alok Mehta answered |

If the fundamental accounting assumptions, viz. Going Concern, Consistency and Accrual are followed in financial statements, specific disclosure is not required. If a fundamental accounting assumption is not followed, the fact should be disclosed.

Human resources can’t be shown in Balance Sheet because of __________ concept.- a)Realization

- b)Conservatism

- c)Going concern

- d)Money Measurement

Correct answer is option 'D'. Can you explain this answer?

Human resources can’t be shown in Balance Sheet because of __________ concept.

a)

Realization

b)

Conservatism

c)

Going concern

d)

Money Measurement

|

Deepika Desai answered |

Be defined as the people who make up the workforce of an organization, including employees, contractors, and volunteers. Human resources management involves the recruitment, training, and development of employees, as well as managing employee relations, benefits, and compensation. The goal of human resources is to optimize the performance and productivity of employees, while also ensuring that the organization is compliant with legal and ethical standards. Human resources plays a critical role in the success of any organization, as it is responsible for attracting and retaining talented employees, creating a positive work culture, and promoting employee engagement and satisfaction.

Decrease in the amount of creditors results in- a)Increase in cash.

- b)Decrease in cash.

- c)Increase in assets.

- d)No change in assets.

Correct answer is option 'B'. Can you explain this answer?

Decrease in the amount of creditors results in

a)

Increase in cash.

b)

Decrease in cash.

c)

Increase in assets.

d)

No change in assets.

|

Rajveer Jain answered |

Explanation:

When there is a decrease in the amount of creditors, it means that the company has paid off some of its debts to the creditors. This will result in a decrease in the amount of cash because the company has used its cash to pay off the debts. The following points explain this in more detail:

• Creditors are liabilities: Creditors are the people or organizations to whom the company owes money. They are considered as liabilities in the balance sheet.

• Decrease in creditors means decrease in liabilities: When the company pays off some of its debts to the creditors, the amount of liabilities decreases.

• Decrease in liabilities means decrease in cash: When the amount of liabilities decreases, it means that the company has used its cash to pay off the debts. Hence, there will be a decrease in the amount of cash.

• No change in assets: The decrease in cash will be offset by the decrease in liabilities, so there will be no change in the total assets of the company.

Therefore, the correct answer is option B, which states that a decrease in the amount of creditors results in a decrease in cash.

When there is a decrease in the amount of creditors, it means that the company has paid off some of its debts to the creditors. This will result in a decrease in the amount of cash because the company has used its cash to pay off the debts. The following points explain this in more detail:

• Creditors are liabilities: Creditors are the people or organizations to whom the company owes money. They are considered as liabilities in the balance sheet.

• Decrease in creditors means decrease in liabilities: When the company pays off some of its debts to the creditors, the amount of liabilities decreases.

• Decrease in liabilities means decrease in cash: When the amount of liabilities decreases, it means that the company has used its cash to pay off the debts. Hence, there will be a decrease in the amount of cash.

• No change in assets: The decrease in cash will be offset by the decrease in liabilities, so there will be no change in the total assets of the company.

Therefore, the correct answer is option B, which states that a decrease in the amount of creditors results in a decrease in cash.

Window dressing of Accounts means: - a)Presenting accounts in beautiful manner

- b)Showing more losses to avoid Income Tax

- c)Showing more profits to attract Investment

- d)All of the above

Correct answer is option 'C'. Can you explain this answer?

Window dressing of Accounts means:

a)

Presenting accounts in beautiful manner

b)

Showing more losses to avoid Income Tax

c)

Showing more profits to attract Investment

d)

All of the above

|

Sanjana Khanna answered |

Explanation:

Window dressing of accounts is a practice of manipulating or presenting financial statements in an attractive manner to make them appear better than they actually are. This is often done to impress stakeholders, such as investors, creditors, and regulatory bodies.

The most common reason for window dressing is to show higher profits or better financial ratios, which can attract more investments or loans. Some companies may also use window dressing to avoid income tax or to hide losses from stakeholders.

There are various ways in which companies can indulge in window dressing of accounts. Some common methods include:

1. Overstating revenues: Companies may recognize revenues earlier than they should or may include non-recurring revenues to show higher profits.

2. Understating expenses: Companies may delay recognition of expenses or may understate expenses to show higher profits.

3. Manipulating reserves: Companies may manipulate their reserves to show better financial ratios or to hide losses.

4. Misclassifying items: Companies may misclassify items in their financial statements to present a better picture of their financial performance.

Conclusion:

In conclusion, window dressing of accounts is a practice that can be misleading and can harm the interests of stakeholders. Investors and creditors should be aware of the potential for window dressing and should carefully review financial statements before making any investment or lending decisions. Regulators should also monitor companies for any potential window dressing and take appropriate actions when necessary.

Window dressing of accounts is a practice of manipulating or presenting financial statements in an attractive manner to make them appear better than they actually are. This is often done to impress stakeholders, such as investors, creditors, and regulatory bodies.

The most common reason for window dressing is to show higher profits or better financial ratios, which can attract more investments or loans. Some companies may also use window dressing to avoid income tax or to hide losses from stakeholders.

There are various ways in which companies can indulge in window dressing of accounts. Some common methods include:

1. Overstating revenues: Companies may recognize revenues earlier than they should or may include non-recurring revenues to show higher profits.

2. Understating expenses: Companies may delay recognition of expenses or may understate expenses to show higher profits.

3. Manipulating reserves: Companies may manipulate their reserves to show better financial ratios or to hide losses.

4. Misclassifying items: Companies may misclassify items in their financial statements to present a better picture of their financial performance.

Conclusion:

In conclusion, window dressing of accounts is a practice that can be misleading and can harm the interests of stakeholders. Investors and creditors should be aware of the potential for window dressing and should carefully review financial statements before making any investment or lending decisions. Regulators should also monitor companies for any potential window dressing and take appropriate actions when necessary.

If nothing is written in the financial statements about the three fundamental assumptions, then it could be pressured that:- a)They have not been followed.

- b)They have been followed.

- c)They have been followed to some extent.

- d)None of the above.

Correct answer is option 'B'. Can you explain this answer?

If nothing is written in the financial statements about the three fundamental assumptions, then it could be pressured that:

a)

They have not been followed.

b)

They have been followed.

c)

They have been followed to some extent.

d)

None of the above.

|

Puja Singh answered |

The three fundamental assumptions in accounting are the going concern assumption, the monetary unit assumption, and the time period assumption. These assumptions provide the foundation for preparing financial statements and interpreting financial information.

If nothing is written in the financial statements about these assumptions, it indicates that they have been followed. This is because if any of these assumptions were not followed, it would be required to disclose the departure from the assumption in the financial statements. Therefore, the correct answer is option 'B' - They have been followed.

Let's understand each assumption and why it is important in financial reporting:

**1. Going Concern Assumption:**

This assumption states that an entity will continue to operate in the foreseeable future, and there is no intention to liquidate or significantly curtail its operations. It assumes that the entity will continue its activities long enough to realize its assets and discharge its liabilities in the ordinary course of business. This assumption is important because it allows the financial statements to be prepared on the basis that the entity will continue to operate, and assets and liabilities are reported at their carrying amounts rather than their liquidation or fire-sale values.

**2. Monetary Unit Assumption:**

This assumption states that the financial statements are prepared in a currency that is stable and widely accepted as a medium of exchange. It assumes that the value of money remains constant over time, ignoring the effects of inflation or deflation. This assumption allows for the aggregation and comparison of financial information over different periods and entities. Without this assumption, it would be difficult to make meaningful comparisons and analyze financial data.

**3. Time Period Assumption:**

This assumption states that the life of an entity can be divided into artificial time periods, such as months, quarters, or years, to provide timely and relevant financial information. It assumes that financial statements are prepared at regular intervals to meet the needs of users. This assumption allows for the measurement and reporting of financial performance and financial position over specific time periods, facilitating decision-making and analysis.

In conclusion, if nothing is written in the financial statements about the three fundamental assumptions, it indicates that they have been followed. The absence of any disclosure regarding departure from these assumptions suggests that the financial statements have been prepared on the basis of these assumptions, as required by accounting standards and principles. Therefore, option 'B' - They have been followed, is the correct answer.

If nothing is written in the financial statements about these assumptions, it indicates that they have been followed. This is because if any of these assumptions were not followed, it would be required to disclose the departure from the assumption in the financial statements. Therefore, the correct answer is option 'B' - They have been followed.

Let's understand each assumption and why it is important in financial reporting:

**1. Going Concern Assumption:**

This assumption states that an entity will continue to operate in the foreseeable future, and there is no intention to liquidate or significantly curtail its operations. It assumes that the entity will continue its activities long enough to realize its assets and discharge its liabilities in the ordinary course of business. This assumption is important because it allows the financial statements to be prepared on the basis that the entity will continue to operate, and assets and liabilities are reported at their carrying amounts rather than their liquidation or fire-sale values.

**2. Monetary Unit Assumption:**

This assumption states that the financial statements are prepared in a currency that is stable and widely accepted as a medium of exchange. It assumes that the value of money remains constant over time, ignoring the effects of inflation or deflation. This assumption allows for the aggregation and comparison of financial information over different periods and entities. Without this assumption, it would be difficult to make meaningful comparisons and analyze financial data.

**3. Time Period Assumption:**

This assumption states that the life of an entity can be divided into artificial time periods, such as months, quarters, or years, to provide timely and relevant financial information. It assumes that financial statements are prepared at regular intervals to meet the needs of users. This assumption allows for the measurement and reporting of financial performance and financial position over specific time periods, facilitating decision-making and analysis.

In conclusion, if nothing is written in the financial statements about the three fundamental assumptions, it indicates that they have been followed. The absence of any disclosure regarding departure from these assumptions suggests that the financial statements have been prepared on the basis of these assumptions, as required by accounting standards and principles. Therefore, option 'B' - They have been followed, is the correct answer.

Ram starts business with Rs. 90,000 and then buys goods from Shyam on credit for Rs. 23,000. The accounting equation based on Assets = Capital + Liabilities will be: - a)1,13,000=90,000+23,000

- b)1,13,000 = 1,13,000+0

- c)90,000=67,000+23,000

- d)67,000=90,000-23,000

Correct answer is option 'A'. Can you explain this answer?

Ram starts business with Rs. 90,000 and then buys goods from Shyam on credit for Rs. 23,000. The accounting equation based on Assets = Capital + Liabilities will be:

a)

1,13,000=90,000+23,000

b)

1,13,000 = 1,13,000+0

c)

90,000=67,000+23,000

d)

67,000=90,000-23,000

|

|

Alok Mehta answered |

Description: Accounting Equation as per the dual aspect concept is:

Assets= Capital + Liabilities

When Ram starts business:

A= C + L

Cash= Capital+ Liability

90,000= 90,000+ Nil

When gods are bought on Credit:

A= C+ L

Cash+ Goods= Capital+ Creditors

90,000+ 23,000= 90,000+ 23,000

1,13,000= 90,000+ 23,000

The concept of conservatism when applied to the balance sheet results in- a)Understatement of assets.

- b)Overstatement of assets.

- c)Overstatement of capital.

- d)Understatement of capital.

Correct answer is option 'A'. Can you explain this answer?

The concept of conservatism when applied to the balance sheet results in

a)

Understatement of assets.

b)

Overstatement of assets.

c)

Overstatement of capital.

d)

Understatement of capital.

|

|

Arun Khanna answered |

When applied to the balance sheet, the conservative approach results in understatement of assets and capital and overstatement of liabilities and provisions. The principle of conservatism, however should be applied cautiously. If the principle is stretched without reservations it results in the creation of secret reserves which is in direct conflict with the doctrine of full disclosure. Since the main aim of published accounts is to convey and not to conceal the information, the policy of secrecy is being abandoned in favour of the modern and more logical policy of disclosure.

Mohan purchased goods for Rs. 15,00,000 and sold 4/5th of the goods amounting Rs. 18,00,000 and met expenses amounting Rs. 2,50,000 during the year, 2011. He counted net profit as Rs. 3,50,000. Which of the accounting concept was followed by him?- a)Entity.

- b)Periodicity.

- c)Matching.

- d)Conservatism.

Correct answer is 'C'. Can you explain this answer?

Mohan purchased goods for Rs. 15,00,000 and sold 4/5th of the goods amounting Rs. 18,00,000 and met expenses amounting Rs. 2,50,000 during the year, 2011. He counted net profit as Rs. 3,50,000. Which of the accounting concept was followed by him?

a)

Entity.

b)

Periodicity.

c)

Matching.

d)

Conservatism.

|

Maheshwar Goyal answered |

The accounting concept followed by Mohan is Matching.

Explanation:

Matching concept is an accounting principle that requires businesses to match expenses incurred in a given accounting period with the revenue earned in the same period. This principle ensures that the financial statements reflect the actual profit or loss earned during the period.

In this case, Mohan purchased goods for Rs. 15,00,000 and sold 4/5th of the goods amounting Rs. 18,00,000. He also incurred expenses amounting Rs. 2,50,000 during the year. To calculate the net profit, Mohan subtracted the expenses from the revenue earned.

However, according to the matching concept, Mohan should have deducted the cost of goods sold (COGS) from the revenue earned to arrive at the gross profit. Then, he should have deducted the expenses incurred during the period from the gross profit to calculate the net profit.

Therefore, by deducting only the expenses incurred during the period from the revenue earned, Mohan violated the matching concept of accounting.

Explanation:

Matching concept is an accounting principle that requires businesses to match expenses incurred in a given accounting period with the revenue earned in the same period. This principle ensures that the financial statements reflect the actual profit or loss earned during the period.

In this case, Mohan purchased goods for Rs. 15,00,000 and sold 4/5th of the goods amounting Rs. 18,00,000. He also incurred expenses amounting Rs. 2,50,000 during the year. To calculate the net profit, Mohan subtracted the expenses from the revenue earned.

However, according to the matching concept, Mohan should have deducted the cost of goods sold (COGS) from the revenue earned to arrive at the gross profit. Then, he should have deducted the expenses incurred during the period from the gross profit to calculate the net profit.

Therefore, by deducting only the expenses incurred during the period from the revenue earned, Mohan violated the matching concept of accounting.

According to accrual concept of accounting, financial or business transaction is recorded:- a)when cash is received or paid

- b)when transaction occurs

- c)when profit is computed

- d)when balance sheet is prepared

Correct answer is option 'B'. Can you explain this answer?

According to accrual concept of accounting, financial or business transaction is recorded:

a)

when cash is received or paid

b)

when transaction occurs

c)

when profit is computed

d)

when balance sheet is prepared

|

Divya Dasgupta answered |

Accrual Concept of Accounting

Definition: Accrual concept of accounting is a principle that states that financial transactions should be recorded when they occur, regardless of when the cash is received or paid.

Explanation: The accrual concept of accounting is based on the matching principle, which states that expenses should be recognized when they are incurred and revenue should be recognized when it is earned.

Example: Let's say a company provides services to a customer in December but does not receive payment until January. According to the accrual concept of accounting, the company should record the revenue in December when the service was provided, even though the cash was not received until January.

Advantages:

- Provides a more accurate picture of a company's financial health by matching revenues and expenses in the same accounting period.

- Helps in better decision making by providing timely and accurate information.

- Improves comparability between companies.

Disadvantages:

- Can be complex and difficult to implement.

- Requires a good understanding of accounting principles and procedures.

- Can be time-consuming and expensive to maintain.

Conclusion: The accrual concept of accounting is an important principle that helps in providing a more accurate and realistic view of a company's financial health. It is based on the matching principle and requires transactions to be recorded when they occur, regardless of when the cash is received or paid. This principle has both advantages and disadvantages and requires a good understanding of accounting principles and procedures.

Definition: Accrual concept of accounting is a principle that states that financial transactions should be recorded when they occur, regardless of when the cash is received or paid.

Explanation: The accrual concept of accounting is based on the matching principle, which states that expenses should be recognized when they are incurred and revenue should be recognized when it is earned.

Example: Let's say a company provides services to a customer in December but does not receive payment until January. According to the accrual concept of accounting, the company should record the revenue in December when the service was provided, even though the cash was not received until January.

Advantages:

- Provides a more accurate picture of a company's financial health by matching revenues and expenses in the same accounting period.

- Helps in better decision making by providing timely and accurate information.

- Improves comparability between companies.

Disadvantages:

- Can be complex and difficult to implement.

- Requires a good understanding of accounting principles and procedures.

- Can be time-consuming and expensive to maintain.

Conclusion: The accrual concept of accounting is an important principle that helps in providing a more accurate and realistic view of a company's financial health. It is based on the matching principle and requires transactions to be recorded when they occur, regardless of when the cash is received or paid. This principle has both advantages and disadvantages and requires a good understanding of accounting principles and procedures.

Which of these is not fundamental accounting assumption?- a)Going concern

- b)Consistency

- c)Conservatism

- d)Accrual

Correct answer is option 'C'. Can you explain this answer?

Which of these is not fundamental accounting assumption?

a)

Going concern

b)

Consistency

c)

Conservatism

d)

Accrual

|

Aman Chaudhary answered |

The correct answer is option 'C) Conservatism'.

Explanation:

The fundamental accounting assumptions are the basic principles that guide the preparation and presentation of financial statements. These assumptions form the foundation of accounting and are generally accepted accounting principles (GAAP) that are followed by businesses worldwide. The three fundamental accounting assumptions are:

1) Going Concern Assumption: This assumption states that a business will continue to operate indefinitely, unless there is evidence to the contrary. It assumes that the business will not be liquidated in the near future and will be able to fulfill its obligations and continue its operations.

2) Consistency Assumption: This assumption requires that the same accounting methods and principles are consistently applied from one accounting period to another. It ensures comparability and allows users of financial statements to make meaningful comparisons over time.

3) Accrual Assumption: This assumption states that financial transactions are recorded when they occur, regardless of when the cash is received or paid. It recognizes revenues when they are earned and expenses when they are incurred, rather than when the cash is received or paid.

Conservatism, although an important concept in accounting, is not considered a fundamental accounting assumption. It is a principle that suggests that when there are uncertainties or doubts in accounting measurements, the accountant should choose the option that is least likely to overstate assets or income. In other words, it encourages the accountant to be cautious and conservative in recording financial transactions.

While conservatism is an important principle, it is not considered a fundamental accounting assumption because it is not universally applicable. Different accounting frameworks and jurisdictions may have different interpretations and applications of conservatism. Therefore, it does not have the same level of consensus and acceptance as the three fundamental accounting assumptions mentioned above.

In conclusion, the correct answer is option 'C) Conservatism' because it is not one of the fundamental accounting assumptions.

Explanation:

The fundamental accounting assumptions are the basic principles that guide the preparation and presentation of financial statements. These assumptions form the foundation of accounting and are generally accepted accounting principles (GAAP) that are followed by businesses worldwide. The three fundamental accounting assumptions are:

1) Going Concern Assumption: This assumption states that a business will continue to operate indefinitely, unless there is evidence to the contrary. It assumes that the business will not be liquidated in the near future and will be able to fulfill its obligations and continue its operations.

2) Consistency Assumption: This assumption requires that the same accounting methods and principles are consistently applied from one accounting period to another. It ensures comparability and allows users of financial statements to make meaningful comparisons over time.

3) Accrual Assumption: This assumption states that financial transactions are recorded when they occur, regardless of when the cash is received or paid. It recognizes revenues when they are earned and expenses when they are incurred, rather than when the cash is received or paid.

Conservatism, although an important concept in accounting, is not considered a fundamental accounting assumption. It is a principle that suggests that when there are uncertainties or doubts in accounting measurements, the accountant should choose the option that is least likely to overstate assets or income. In other words, it encourages the accountant to be cautious and conservative in recording financial transactions.

While conservatism is an important principle, it is not considered a fundamental accounting assumption because it is not universally applicable. Different accounting frameworks and jurisdictions may have different interpretations and applications of conservatism. Therefore, it does not have the same level of consensus and acceptance as the three fundamental accounting assumptions mentioned above.

In conclusion, the correct answer is option 'C) Conservatism' because it is not one of the fundamental accounting assumptions.

Which of these is not fundamental accounting assumption?- a)Going concern

- b)Consistency

- c)Conservatism

- d)Accrual

Correct answer is option 'C'. Can you explain this answer?

Which of these is not fundamental accounting assumption?

a)

Going concern

b)

Consistency

c)

Conservatism

d)

Accrual

|

|

Arjun Singhania answered |

As per As- 1 issued by ICAI, the three fundamental accounting assumptions are:

I) Going Concern

II) Consistency

III) Accrual

These require a mention in the financial statements if they are not followed. Therefore, conservatism is not a fundamental accounting assumption.

During life- time of an entity accountants prepare financial statements at arbitrary points of time as per:- a)Prudence

- b)Consistency

- c)Periodicity

- d)Matching

Correct answer is option 'C'. Can you explain this answer?

During life- time of an entity accountants prepare financial statements at arbitrary points of time as per:

a)

Prudence

b)

Consistency

c)

Periodicity

d)

Matching

|

|

Jayant Mishra answered |

According to the Periodicity Concept, The accounts should be prepared after every period and not at the end of the life of the entity. This period can be any arbitrary point of time but usually this period is one calendar year. This concept makes the accounting system workable and the term accrual meaningful.

Kanika Enterprises follows the written down value method of depreciating machinery year after year due to - a)Comparability

- b)Convenience.

- c)Consistency.

- d)All of the above.

Correct answer is option 'C'. Can you explain this answer?

Kanika Enterprises follows the written down value method of depreciating machinery year after year due to

a)

Comparability

b)

Convenience.

c)

Consistency.

d)

All of the above.

|

Aarya Sharma answered |

Explanation:

The correct answer is option 'C', which states that Kanika Enterprises follows the written down value method of depreciating machinery year after year due to consistency.

Consistency is an important principle of accounting, which requires that a company should follow the same accounting policies and methods year after year. By doing so, the financial statements of the company become more comparable and reliable.

The written down value method of depreciation is a common method used for depreciating fixed assets. Under this method, the depreciation is charged on the initial cost of the asset at a fixed rate every year. As the asset gets older, the value of the asset decreases, and hence the depreciation charge also decreases.

There are several advantages of using the written down value method of depreciation, such as:

1. Simplicity: It is a simple method of depreciation and easy to calculate.

2. Consistency: As mentioned earlier, consistency is an important principle of accounting, and this method ensures that the same method is used year after year.

3. Reflects actual usage: This method reflects the actual usage of the asset, as the depreciation charged is higher in the initial years when the asset is used more and lower in the later years when the usage is less.

4. Better matching: This method matches the cost of the asset with the revenues generated from its use, resulting in a more accurate picture of the company's financial performance.

Therefore, Kanika Enterprises follows the written down value method of depreciating machinery year after year due to consistency, which ensures that the financial statements of the company are comparable and reliable.

The correct answer is option 'C', which states that Kanika Enterprises follows the written down value method of depreciating machinery year after year due to consistency.

Consistency is an important principle of accounting, which requires that a company should follow the same accounting policies and methods year after year. By doing so, the financial statements of the company become more comparable and reliable.

The written down value method of depreciation is a common method used for depreciating fixed assets. Under this method, the depreciation is charged on the initial cost of the asset at a fixed rate every year. As the asset gets older, the value of the asset decreases, and hence the depreciation charge also decreases.

There are several advantages of using the written down value method of depreciation, such as:

1. Simplicity: It is a simple method of depreciation and easy to calculate.

2. Consistency: As mentioned earlier, consistency is an important principle of accounting, and this method ensures that the same method is used year after year.

3. Reflects actual usage: This method reflects the actual usage of the asset, as the depreciation charged is higher in the initial years when the asset is used more and lower in the later years when the usage is less.

4. Better matching: This method matches the cost of the asset with the revenues generated from its use, resulting in a more accurate picture of the company's financial performance.

Therefore, Kanika Enterprises follows the written down value method of depreciating machinery year after year due to consistency, which ensures that the financial statements of the company are comparable and reliable.

What is the objective of conservatism ?- a)Take all incomes and losses

- b)Anticipate losses but not profits

- c)Take all losses

- d)None of the above

Correct answer is option 'B'. Can you explain this answer?

What is the objective of conservatism ?

a)

Take all incomes and losses

b)

Anticipate losses but not profits

c)

Take all losses

d)

None of the above

|

Srsps answered |

The objective of conservatism in accounting is: B: Anticipate losses but not profits

Conservatism is an accounting principle where there is a preference for caution in the face of uncertainty. This guideline suggests that an accountant should choose solutions that result in lower profits and asset values but do not underestimate liabilities or expenses. Essentially, it means recognizing all probable losses when they are known, but not to anticipate profits. This helps ensure that financial statements do not overstate the financial health of a business.