All Exams >

UPSC >

Economic Survey & Government Reports >

All Questions

All questions of Volume I (2020 - 2021) for UPSC CSE Exam

Consider the following statements about the PM-eVIDYA: - It is an initiative for multi-mode access to digital/online education.

- Special needs of the visually impaired have been considered under this initiative.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'C'. Can you explain this answer?

Consider the following statements about the PM-eVIDYA:

- It is an initiative for multi-mode access to digital/online education.

- Special needs of the visually impaired have been considered under this initiative.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Anjali Rao answered |

- A program for multi-mode access to digital/online education will be launched under the PM eVIDYA program. Hence, statement 1 is correct.

- The programme consists of:

(i) DIKSHA for school education in states/UTs: e-content and QR coded Energized Textbooks for all grades (one nation, one digital platform)

(ii) One earmarked TV channel per class from 1 to 12 (one class, one channel)

(iii) Extensive use of Radio, Community radio and Podcasts.

(iv) Special e-content for visually and hearing impaired. Hence, statement 2 is correct.

(v) Top 100 universities will be permitted to automatically start online courses by 30th May, 2020.

Consider the following statements: - The FDI in the defense sector has been increased from 49 percent to 74 percent through automatic route.

- Mauritius has been the largest source of FDI in India in FY20.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

Consider the following statements:

- The FDI in the defense sector has been increased from 49 percent to 74 percent through automatic route.

- Mauritius has been the largest source of FDI in India in FY20.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Upasana Menon answered |

Statement 1: The FDI in the defense sector has been increased from 49 percent to 74 percent through automatic route.

This statement is correct. In May 2020, the Government of India made changes to the Foreign Direct Investment (FDI) policy in the defense sector. The FDI limit in the defense sector was increased from 49 percent to 74 percent through the automatic route. This means that foreign investors can now invest up to 74 percent in defense production in India without requiring prior government approval.

Statement 2: Mauritius has been the largest source of FDI in India in FY20.

This statement is incorrect. In FY20 (April 2019 to March 2020), Singapore was the largest source of Foreign Direct Investment (FDI) in India, surpassing Mauritius. Historically, Mauritius has been one of the largest sources of FDI in India due to its tax treaty with India, which allowed companies to route their investments through Mauritius to take advantage of tax benefits. However, in recent years, the Indian government has taken measures to curb round-tripping of funds and promote direct investments. As a result, Singapore has emerged as the top source of FDI in India.

In conclusion, only statement 1 is correct. The FDI limit in the defense sector has been increased from 49 percent to 74 percent through the automatic route. Statement 2 is incorrect as Mauritius was not the largest source of FDI in India in FY20, but Singapore held that position.

This statement is correct. In May 2020, the Government of India made changes to the Foreign Direct Investment (FDI) policy in the defense sector. The FDI limit in the defense sector was increased from 49 percent to 74 percent through the automatic route. This means that foreign investors can now invest up to 74 percent in defense production in India without requiring prior government approval.

Statement 2: Mauritius has been the largest source of FDI in India in FY20.

This statement is incorrect. In FY20 (April 2019 to March 2020), Singapore was the largest source of Foreign Direct Investment (FDI) in India, surpassing Mauritius. Historically, Mauritius has been one of the largest sources of FDI in India due to its tax treaty with India, which allowed companies to route their investments through Mauritius to take advantage of tax benefits. However, in recent years, the Indian government has taken measures to curb round-tripping of funds and promote direct investments. As a result, Singapore has emerged as the top source of FDI in India.

In conclusion, only statement 1 is correct. The FDI limit in the defense sector has been increased from 49 percent to 74 percent through the automatic route. Statement 2 is incorrect as Mauritius was not the largest source of FDI in India in FY20, but Singapore held that position.

The 15th Finance Commission has suggested shifting which of the following State subjects to the Concurrent List of the 7th Schedule?- a)Health

- b)Agriculture

- c)Public Order

- d)Betting and Gambling

Correct answer is option 'A'. Can you explain this answer?

The 15th Finance Commission has suggested shifting which of the following State subjects to the Concurrent List of the 7th Schedule?

a)

Health

b)

Agriculture

c)

Public Order

d)

Betting and Gambling

|

|

Meera Singh answered |

The high level group (HLG) formed for the health sector by the 15th Finance Commission has recommended to shift the subject of ‘health’ to the Concurrent List of the Indian Constitution from the State List. Hence, option (a) is correct.

Consider the following statements about the Consolidated Sinking Fund: - The Consolidated Sinking Fund is managed by the Reserve Bank of India.

- The purpose of this fund is to strengthen the crisis response of the Union Government.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

Consider the following statements about the Consolidated Sinking Fund:

- The Consolidated Sinking Fund is managed by the Reserve Bank of India.

- The purpose of this fund is to strengthen the crisis response of the Union Government.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Nikita Singh answered |

- A sinking fund is a kind of fund in which a fixed amount is deposited at a regular interval. So the sinking fund is like a recurring deposit. After some years this fund turns into a huge collection of funds that are further used to repay the previous debt taken by the government or a company.

- It is also called Debt Remittance Fund because the amount deposited in it is used to repay the debt in the future and the government or company does not have to suffer much in repaying the loan in the maturity year of the loan. This is also like a recurring deposit account in the bank.

- It is also called Debt Remittance Fund because the amount deposited in it is used to repay the debt in the future and the government or company does not have to suffer much in repaying the loan in the maturity year of the loan. This is also like a recurring deposit account in the bank.

With reference to the Pro-cyclical Fiscal Policy stance during an economic boom, consider the following statements: - An increase in government expenditure will increase growth.

- In this fiscal policy stance, the government also increases the tax rates.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

With reference to the Pro-cyclical Fiscal Policy stance during an economic boom, consider the following statements:

- An increase in government expenditure will increase growth.

- In this fiscal policy stance, the government also increases the tax rates.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Arun Khatri answered |

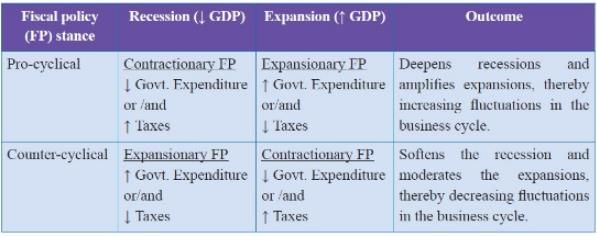

Cyclicality of the fiscal policy

- The cyclicality of the fiscal policy refers to a change in direction of government expenditure and taxes based on economic conditions.

- These pertain to decisions by policymakers based on the fluctuations in economic growth. There are two types of cyclical fiscal policies - counter-cyclical and procyclical.

Pro-cyclical Fiscal Policy Stance

- In a pro-cyclical fiscal policy, the government reinforces the business cycle by being expansionary during good times and contractionary during recessions.

- Pursuing a pro-cyclical fiscal policy is generally regarded as dangerous. It could raise macroeconomic volatility, depress investment in real and human capital, hamper growth and harm the poor.

- In Recession

(i) The government takes the route of Expansionary Fiscal Policy i.e. the government expenditure is decreased and taxes are increased. This decreases the consumption potential of the economy and deepens the recession. - In Economic Boom

(i) The government takes the route of contractionary Fiscal Policy i.e. the government expenditure is increased and taxes are decreased. Hence, statement 2 is NOT correct.

(ii) This increases the consumption potential of the economy and amplifies the economic boom. Hence, statement 1 is correct.

Consider the following statements: - The K-shaped recovery implies that there are inequalities in the recovery process.

- In V shape recovery jobs are permanently lost.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

Consider the following statements:

- The K-shaped recovery implies that there are inequalities in the recovery process.

- In V shape recovery jobs are permanently lost.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Arun Khatri answered |

- A K-shaped recovery occurs after a recession when certain parts of the economy resumes growth while others lag behind indefinitely

- In a K-shaped recovery different sections of an economy recover at starkly different rates.

- Rich households have seen their incomes largely protected, and savings rates increased during the lockdown, the scope of future consumption. But households at the bottom are likely to have witnessed permanent hits to jobs and incomes. Hence, statement 1 is correct.

- V-shaped recovery: It is the next-best scenario after Z-shaped recovery in which the economy quickly recoups lost ground and gets back to the normal growth trend-line.

(i) In this, incomes and jobs are not permanently lost, and the economic growth recovers sharply and returns to the path it was following before the disruption. Hence, statement 2 is NOT correct.

Which of the following statements defines the Ricardian Equivalence Proposition?- a)Taxation and borrowing are equivalent means of financing expenditure.

- b)Wealth that can be stored in the form of money for future use.

- c)A system in which the central bank allows the exchange rate to be determined by market forces.

- d)Exchange of commodities without the mediation of money.

Correct answer is option 'A'. Can you explain this answer?

Which of the following statements defines the Ricardian Equivalence Proposition?

a)

Taxation and borrowing are equivalent means of financing expenditure.

b)

Wealth that can be stored in the form of money for future use.

c)

A system in which the central bank allows the exchange rate to be determined by market forces.

d)

Exchange of commodities without the mediation of money.

|

|

Kavita Shah answered |

Ricardian equivalence

- The theory that consumers are forward looking and anticipate that government borrowing today will mean a tax increase in the future to repay the debt, and will adjust consumption accordingly so that it will have the same effect on the economy as a tax increase today. Hence, option (a) is correct.

Consider the following statements: - The Primary sector employs less than 50% of the workforce in India.

- The Gross Value Added by the primary sector in GDP is below 15%.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

Consider the following statements:

- The Primary sector employs less than 50% of the workforce in India.

- The Gross Value Added by the primary sector in GDP is below 15%.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Kavita Shah answered |

- The primary sector in India (agriculture and mining sectors) contributes around 16% of Gross Value Added (GVA) while it employs around 43% of the workforce. Hence, statement 1 is correct and statement 2 is NOT correct.

- India’s GDP is estimated to contract by 7.7% in the Financial Year (FY) 2020-21, composed of a sharp 15.7% decline in the first half and a modest 0.1% fall in the second half.

- Sector-wise, agriculture has remained the silver lining while contact-based services, manufacturing, construction were hit hardest, and have been recovering steadily.

- The external sector provided an effective cushion to growth with India recording a Current Account Surplus of 3.1% of GDP in the first half of FY 2020-21.

Which of the following statements defines the term ‘interest growth rate differential’ (IGRD)?- a)The difference between interest paid on government debt and the economy’s nominal growth rate.

- b)A loan in which the lender receives interest during the term of the loan and principal is repaid in a lump sum at maturity.

- c)The ratio of proposed Principal and Interest payment expenses is divided by the gross monthly household income.

- d)None of the Above

Correct answer is option 'A'. Can you explain this answer?

Which of the following statements defines the term ‘interest growth rate differential’ (IGRD)?

a)

The difference between interest paid on government debt and the economy’s nominal growth rate.

b)

A loan in which the lender receives interest during the term of the loan and principal is repaid in a lump sum at maturity.

c)

The ratio of proposed Principal and Interest payment expenses is divided by the gross monthly household income.

d)

None of the Above

|

|

Arun Khatri answered |

Interest-Growth Rate Differential (IGRD): The difference between the average interest rate that governments pay on their debt and the nominal growth rate of the economy is known as ‘Interest-Growth Differential’. Hence, option (a) is correct.

The World Governance Index is released by:- a)World Bank

- b)The World Economic Forum

- c)Global Governance Institute

- d)Organization for Economic Cooperation and Development

Correct answer is option 'A'. Can you explain this answer?

The World Governance Index is released by:

a)

World Bank

b)

The World Economic Forum

c)

Global Governance Institute

d)

Organization for Economic Cooperation and Development

|

|

Sanvi Kapoor answered |

The World Governance Index is released by the World Bank. The data published by the World Justice Project is used by the World Bank in its World Governance Indicators. Hence, option (a) is correct.

Which of the following organizations is not a co-publisher of the Global Innovation Index?1. World Intellectual Property Organization (WIPO)2. Office of the United States Trade Representative (USTR)3. World Trade Organization (WTO)4. INSEADSelect the correct answer using the code given below:

- a)1 and 4 only

- b)2 and 3 only

- c)1 and 2 only

- d)3 and 4 only

Correct answer is option 'B'. Can you explain this answer?

Which of the following organizations is not a co-publisher of the Global Innovation Index?

1. World Intellectual Property Organization (WIPO)

2. Office of the United States Trade Representative (USTR)

3. World Trade Organization (WTO)

4. INSEAD

Select the correct answer using the code given below:

a)

1 and 4 only

b)

2 and 3 only

c)

1 and 2 only

d)

3 and 4 only

|

|

Kavita Shah answered |

Global Innovation Index

- The GII is co-published by Cornell University, INSEAD, and the World Intellectual Property Organization (WIPO), a specialized agency of the United Nations. It seeks to assist economies in evaluating their innovation performance. Hence, option (b) is correct.

- GII has two sub-indices: the Innovation Input Sub-Index and the Innovation Output Sub-Index, and seven pillars, each consisting of three sub-pillars, further divided into a total of 80 indicators.

Which of the following statements define the term ‘Solow-Swan Model’?- a)Changes in the level of output in an economy is the result of changes in the population growth, capital and technology.

- b)The rate of economic growth depends on two things i.e. Level of Savings and Capital-Output Ratio.

- c)It describes how much output is produced for any given amounts of factor inputs productivity.

- d)It says that economic growth occurs by increasing either the capital stock or the size of the labour force, or both.

Correct answer is option 'A'. Can you explain this answer?

Which of the following statements define the term ‘Solow-Swan Model’?

a)

Changes in the level of output in an economy is the result of changes in the population growth, capital and technology.

b)

The rate of economic growth depends on two things i.e. Level of Savings and Capital-Output Ratio.

c)

It describes how much output is produced for any given amounts of factor inputs productivity.

d)

It says that economic growth occurs by increasing either the capital stock or the size of the labour force, or both.

|

|

Arun Khatri answered |

Solow-Swan Model

- Robert Solow and Trevor Swan first introduced the neoclassical growth theory in 1956.

(i) The theory states that economic growth is the result of three factors—labor, capital, and technology. Hence, option (a) is correct. - The Solow Model highlights that output per worker mainly depends on savings, population growth and technological progress.

- While an economy has limited resources in terms of capital and labor, the contribution from technology to growth is boundless.

Which of the following statements defines the term ‘Lorenz Curve’?- a)It shows that inflation and unemployment have a stable and inverse relationship.

- b)It shows that as the economy develops, market forces first increase and then decrease economic inequality.

- c)It is a relationship between tax rates and the amount of tax revenue collected by governments.

- d)It shows the cumulative share of income from different sections of the population.

Correct answer is option 'D'. Can you explain this answer?

Which of the following statements defines the term ‘Lorenz Curve’?

a)

It shows that inflation and unemployment have a stable and inverse relationship.

b)

It shows that as the economy develops, market forces first increase and then decrease economic inequality.

c)

It is a relationship between tax rates and the amount of tax revenue collected by governments.

d)

It shows the cumulative share of income from different sections of the population.

|

|

Arun Khatri answered |

- Lorenz Curve: A Lorenz curve is a graphical representation of income inequality or wealth inequality developed by American economist Max Lorenz in 1905. The graph plots percentiles of the population on the horizontal axis according to income or wealth. Hence, option (d) is correct.

- Phillips Curve: The Phillips curve is an economic concept developed by A. W. Phillips. He stated that inflation and unemployment have a stable and inverse relationship. The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment.

- Kuznets Curve: The Kuznets curve expresses a hypothesis advanced by economist Simon Kuznets in the 1950s and 1960s. According to this hypothesis, as an economy develops, market forces first increase and then decrease economic inequality.

- Laffer Curve: The Laffer Curve is a theory developed by supply-side economist Arthur Laffer to show the relationship between tax rates and the amount of tax revenue collected by governments.

With reference to the Sahaj Bijli Har Ghar Yojana (Saubhagya), consider the following statements: - As per the Saubhagya Portal, all the states of India have achieved universal electrification.

- The government launched Saubhagya Yojana for providing electricity connections to all willing un-electrified households in rural areas only.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'D'. Can you explain this answer?

With reference to the Sahaj Bijli Har Ghar Yojana (Saubhagya), consider the following statements:

- As per the Saubhagya Portal, all the states of India have achieved universal electrification.

- The government launched Saubhagya Yojana for providing electricity connections to all willing un-electrified households in rural areas only.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Arun Khatri answered |

Pradhan Mantri Sahaj Bijli Har Ghar Yojana (PM Saubhagya)

Objectives of the scheme

Objectives of the scheme

- The government had launched Saubhagya Yojana in October 2017 with the objective to achieve universal household electrification by providing electricity connections to all willing un-electrified households in rural areas and all willing poor households in urban areas in the country by March 2019. Hence, statement 2 is NOT correct.

Targets and Achievements

- All States have declared electrification of all households on the Saubhagya portal, except 18,734 households in Left Wing Extremists (LWE) affected areas of Chhattisgarh as of 31.03.2019. Hence, statement 1 is NOT correct.

- Electricity connections to 262.84 lakh households have been released from 11.10.2017 to 31.03.2019.

- Subsequently, seven States reported that 19.09 lakh un-electrified households identified before 31.03.2019, which were earlier un-willing but have expressed willingness to get electricity connection. States have been asked to electrify these households under Saubhagya.

Consider the following statements: - The Fiscal Responsibility and Budget Management Act set the target to limit the fiscal deficit upto 3% of the GDP by 2021.

- The NK Singh committee was formed to create a roadmap for fiscal consolidation for the Center and the States.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'C'. Can you explain this answer?

Consider the following statements:

- The Fiscal Responsibility and Budget Management Act set the target to limit the fiscal deficit upto 3% of the GDP by 2021.

- The NK Singh committee was formed to create a roadmap for fiscal consolidation for the Center and the States.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Anjali Rao answered |

- The government’s fiscal deficit has increased to Rs. 11.58 lakh crore or 145.5% of the Budget Estimate (BE) at the end of December 2020 (accounting for the first nine months of the year 2020-21) mainly on account of lower revenue realisation.

- A high fiscal deficit can also be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation.

- The Fiscal Responsibility and Budget Management Act, 2003 provides that the Centre should take appropriate measures to limit the fiscal deficit upto 3% of the GDP by 31st March, 2021. Hence, statement 1 is correct.

- The NK Singh committee (set up in 2016) recommended that the government should target a fiscal deficit of 3% of the GDP in years up to 31st March, 2020, cut it to 2.8% in 2020-21 and to 2.5% by 2023.

(i) The Finance Commission has constituted a committee under the chairmanship of NK Singh in order to create a roadmap for fiscal consolidation for the Center and the States. The Finance Commission submitted its first report to the Government of India in February 2020. Hence, statement 2 is correct.

As per the Economic Survey 2020-21, consider the following statements: - Poverty concentration in urban areas of India has increased after post-liberalization in 1991 as compared to the 1950's.

- In the post-liberalisation period urban growth and non-agricultural growth has emerged as a major factor in poverty reduction including rural poverty.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'C'. Can you explain this answer?

As per the Economic Survey 2020-21, consider the following statements:

- Poverty concentration in urban areas of India has increased after post-liberalization in 1991 as compared to the 1950's.

- In the post-liberalisation period urban growth and non-agricultural growth has emerged as a major factor in poverty reduction including rural poverty.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Amit Sharma answered |

Poverty Reduction and Development

- The World Bank (2000) has found that India could have achieved a sustained decline in poverty during the 1970s-1990s only when the GDP growth picked up from 3.5 per cent in the initial years.

- Evidence from 80 countries demonstrated that in medium to long run, growth in average incomes contributed to 66-90 percent of the variations in changes in poverty.

- Many researchers have found that growth reduced poverty, and the association has acquired more strength after the 1991 reforms. The pattern of growth has changed significantly after 1991. Poverty is concentrating more and more in urban areas, as now one-in-three poor people are living in urban areas, which was about one-in-eight in the early 1950s. Hence, statement 1 is correct.

- In the post-liberalisation period urban growth and non-agricultural growth has emerged as a major driver of national poverty reduction including rural poverty. Hence, statement 2 is correct.

With reference to the ‘Bare Necessities Index’, consider the following statements: - It is based on four dimensions namely, housing, water, food and sanitation.

- BNI also covers the electricity connection and type of electrical wiring in the home as an indicator under dimensions.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'B'. Can you explain this answer?

With reference to the ‘Bare Necessities Index’, consider the following statements:

- It is based on four dimensions namely, housing, water, food and sanitation.

- BNI also covers the electricity connection and type of electrical wiring in the home as an indicator under dimensions.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Arun Khatri answered |

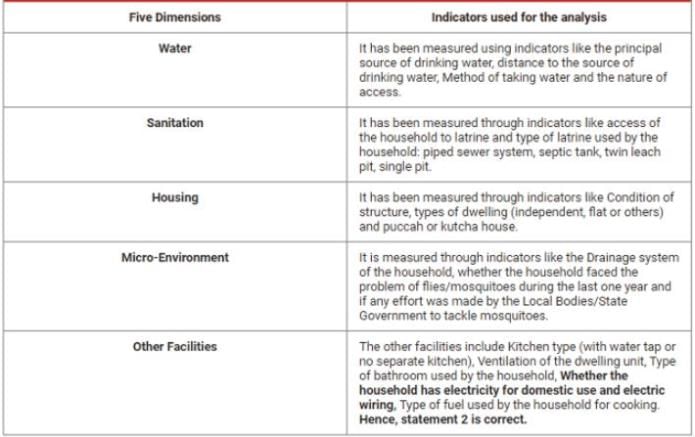

Bare Necessities Index

- Bare Necessities Index (BNI) has been constructed at the rural, urban and all India level for the year 2012 and 2018. (Except Telangana, as Telangana did not exist in 2012).

- The index is constructed using 26 indicators on five dimensions viz., water, sanitation, housing, micro-environment, and other facilities. Hence, statement 1 is NOT correct.

- A BNI based on large annual household survey data of the National Sample Office (NSO).

With reference to the Rule of Law Index in 2020, consider the following statements: - India has been ranked in 69th position.

- India’s performance has improved significantly in following due process in administrative proceedings between 2015 and 2020.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'C'. Can you explain this answer?

With reference to the Rule of Law Index in 2020, consider the following statements:

- India has been ranked in 69th position.

- India’s performance has improved significantly in following due process in administrative proceedings between 2015 and 2020.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Arun Khatri answered |

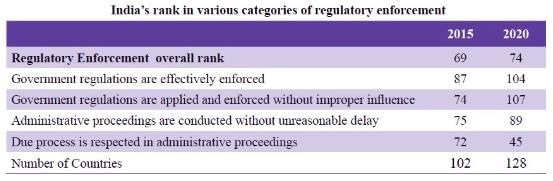

Rule of Law Index 2020

- The World Justice Project has released the Rule of Law Index and ranked India in the 69th position. Hence, statement 1 is correct.

- India’s performance along various indicators:

- India’s performance has improved significantly in following due process in administrative proceedings, with its rank improving from 72 in 2015 (out of 102 countries) to 45 in 2020 (out of 128 countries). Hence, statement 2 is correct.

- In contrast, it has deteriorated over time on certain other parameters.

The ‘e-Sanjeevani’, recently in the news refers to?- a)Portal for online purchase of medicines

- b)Encyclopedia of Ayurvedic medicines

- c)Telemedicine initiative

- d)None of the above

Correct answer is option 'C'. Can you explain this answer?

The ‘e-Sanjeevani’, recently in the news refers to?

a)

Portal for online purchase of medicines

b)

Encyclopedia of Ayurvedic medicines

c)

Telemedicine initiative

d)

None of the above

|

|

Kiran Mehta answered |

Answer

:

c

)

Tele

med

ic

ine

initiative

Ex

plan

ation

:

e

-

San

jee

v

ani

is

an

online

tele

med

ic

ine

initiative

launched

by

the

Ministry

of

Health

and

Family

Welfare

,

Government

of

India

,

to

provide

virtual

medical

consultation

to

patients

from

anywhere

in

India

.

It

enables

a

patient

to

connect

with

a

doctor

through

video

conf

eren

cing

for

medical

consultation

.

The

initiative

was

launched

in

2020

in

order

to

contain

the

spread

of

CO

VID

-

19

pand

emic

.

With reference to the GINI Coefficient, consider the following statements: - It can be used to measure the wealth distribution among a population.

- The score of 0 represents perfect inequality and the score of 1 represents perfect equality.

Which of the statements given above is/are correct?

- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

With reference to the GINI Coefficient, consider the following statements:

- It can be used to measure the wealth distribution among a population.

- The score of 0 represents perfect inequality and the score of 1 represents perfect equality.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

Ameya Ahuja answered |

Explanation:

GINI Coefficient:

- The GINI Coefficient is a measure of statistical dispersion intended to represent the income or wealth distribution among a population.

- It is often used to quantify the level of economic inequality within a society.

Statement Analysis:

1. It can be used to measure the wealth distribution among a population:

- This statement is correct. The GINI Coefficient is commonly used to assess wealth distribution by providing a numerical value between 0 and 1.

- A GINI Coefficient of 0 represents perfect equality, where everyone has the same wealth, while a score of 1 signifies perfect inequality, where one person has all the wealth.

2. The score of 0 represents perfect inequality and the score of 1 represents perfect equality:

- This statement is incorrect. In reality, the score of 0 represents perfect equality, where everyone has the same wealth, and the score of 1 represents perfect inequality, where one person has all the wealth.

Therefore, the correct answer is option 'A', which states that only statement 1 is correct.

GINI Coefficient:

- The GINI Coefficient is a measure of statistical dispersion intended to represent the income or wealth distribution among a population.

- It is often used to quantify the level of economic inequality within a society.

Statement Analysis:

1. It can be used to measure the wealth distribution among a population:

- This statement is correct. The GINI Coefficient is commonly used to assess wealth distribution by providing a numerical value between 0 and 1.

- A GINI Coefficient of 0 represents perfect equality, where everyone has the same wealth, while a score of 1 signifies perfect inequality, where one person has all the wealth.

2. The score of 0 represents perfect inequality and the score of 1 represents perfect equality:

- This statement is incorrect. In reality, the score of 0 represents perfect equality, where everyone has the same wealth, and the score of 1 represents perfect inequality, where one person has all the wealth.

Therefore, the correct answer is option 'A', which states that only statement 1 is correct.

Consider the following statements about the Defense Acquisition Procedure 2020: - It contains policies for modernisation of the Armed Forces including the Coast Guard.

- Offset clause has been introduced in the government-to-government purchases.

Which of the statements given above is/are correct?- a)1 only

- b)2 only

- c)Both 1 and 2

- d)Neither 1 nor 2

Correct answer is option 'A'. Can you explain this answer?

Consider the following statements about the Defense Acquisition Procedure 2020:

- It contains policies for modernisation of the Armed Forces including the Coast Guard.

- Offset clause has been introduced in the government-to-government purchases.

Which of the statements given above is/are correct?

a)

1 only

b)

2 only

c)

Both 1 and 2

d)

Neither 1 nor 2

|

|

Sonal Gupta answered |

Defense Acquisition Procedure 2020

Defense Acquisition Procedure 2020 is a set of guidelines and policies that aim to streamline the procurement process for defense equipment and modernization of the Armed Forces, including the Coast Guard.

Statement Analysis

Statement 1: It contains policies for modernisation of the Armed Forces including the Coast Guard.

- This statement is correct as the Defense Acquisition Procedure 2020 does indeed include policies for the modernization of the Armed Forces, which encompasses all branches of the military, including the Coast Guard.

Statement 2: Offset clause has been introduced in the government-to-government purchases.

- This statement is incorrect as the Defense Acquisition Procedure 2020 does not specifically mention the introduction of an offset clause in government-to-government purchases. However, offset clauses may be included in individual contracts based on specific requirements.

Conclusion

Therefore, the correct answer is option 'A' - 1 only, as the first statement is accurate in stating that the Defense Acquisition Procedure 2020 contains policies for the modernization of the Armed Forces, including the Coast Guard.

Defense Acquisition Procedure 2020 is a set of guidelines and policies that aim to streamline the procurement process for defense equipment and modernization of the Armed Forces, including the Coast Guard.

Statement Analysis

Statement 1: It contains policies for modernisation of the Armed Forces including the Coast Guard.

- This statement is correct as the Defense Acquisition Procedure 2020 does indeed include policies for the modernization of the Armed Forces, which encompasses all branches of the military, including the Coast Guard.

Statement 2: Offset clause has been introduced in the government-to-government purchases.

- This statement is incorrect as the Defense Acquisition Procedure 2020 does not specifically mention the introduction of an offset clause in government-to-government purchases. However, offset clauses may be included in individual contracts based on specific requirements.

Conclusion

Therefore, the correct answer is option 'A' - 1 only, as the first statement is accurate in stating that the Defense Acquisition Procedure 2020 contains policies for the modernization of the Armed Forces, including the Coast Guard.

Chapter doubts & questions for Volume I (2020 - 2021) - Economic Survey & Government Reports 2025 is part of UPSC CSE exam preparation. The chapters have been prepared according to the UPSC CSE exam syllabus. The Chapter doubts & questions, notes, tests & MCQs are made for UPSC CSE 2025 Exam. Find important definitions, questions, notes, meanings, examples, exercises, MCQs and online tests here.

Chapter doubts & questions of Volume I (2020 - 2021) - Economic Survey & Government Reports in English & Hindi are available as part of UPSC CSE exam.

Download more important topics, notes, lectures and mock test series for UPSC CSE Exam by signing up for free.

Contact Support

Our team is online on weekdays between 10 AM - 7 PM

Typical reply within 3 hours

|

Free Exam Preparation

at your Fingertips!

Access Free Study Material - Test Series, Structured Courses, Free Videos & Study Notes and Prepare for Your Exam With Ease

Join the 10M+ students on EduRev

Join the 10M+ students on EduRev

|

|

Create your account for free

OR

Forgot Password

OR

Signup to see your scores

go up

within 7 days!

within 7 days!

Takes less than 10 seconds to signup