CAT Exam > CAT Questions > Answer the following questions based on the ...

Start Learning for Free

Answer the following questions based on the information given below:

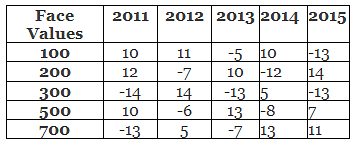

A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).

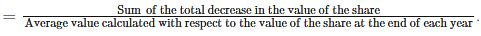

Volatility of a share

Sum of the total increase in the value of the share

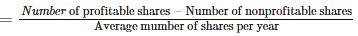

Stability factor of an year

In the above expression, a share is profitable or not only w.r.t. the previous year.

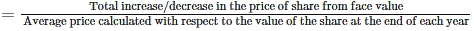

Fluctuation index of a share

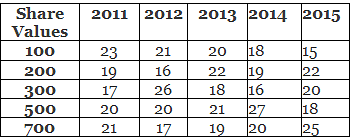

Table1: Percentage change in the value of the shares

Table2: Percentage distribution of number of shares of the firm in respective years.

Q. Which year has the highest stability factor?

- a)2011

- b)2012

- c)2013

- d)2015

Correct answer is option 'A'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Most Upvoted Answer

Answer the following questions based on the information given below:A...

Number of shares sold in 2012 corresponds to 5x while total shares sold in five years = 6x + 5x + 4x + 7x + 3x = 25x . Average shares sold per year = 2x/5 = 5x (which is the same as number of shares sold in 2012.

A share is profitable w.r.t. the previous year, if it shows a positive percentage change; and vice versa.

Identify the profitable and unprofitable shares for each year. 2011: Profitable = 100, 200, 500 and unprofitable = 300, 700 (Figures represent face value).

So Stability factor for 2011 = [(0.23 + 0.19 + 0.2) - (0.17 + 0.21)] × 6x/5x

Similarly, stability factor for 2012 = [(0.21 + 0.26 + 0.17) - (0.16 + 0.2)] × 5x/5x = 0.28

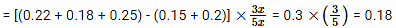

Stability factor for 2013 = [(0.22 + 0.21) - (0.2 + 0.18 + 0.19)] × 4x/5x i.e. < />

Similarly, stability factor for 2015

Hence, the highest stability factor is in 2011.

Hence, the correct option is (a).

Attention CAT Students!

To make sure you are not studying endlessly, EduRev has designed CAT study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in CAT.

|

Explore Courses for CAT exam

|

|

Similar CAT Doubts

Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer?

Question Description

Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? for CAT 2024 is part of CAT preparation. The Question and answers have been prepared according to the CAT exam syllabus. Information about Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? covers all topics & solutions for CAT 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer?.

Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? for CAT 2024 is part of CAT preparation. The Question and answers have been prepared according to the CAT exam syllabus. Information about Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? covers all topics & solutions for CAT 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer?.

Solutions for Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? in English & in Hindi are available as part of our courses for CAT.

Download more important topics, notes, lectures and mock test series for CAT Exam by signing up for free.

Here you can find the meaning of Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer?, a detailed solution for Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? has been provided alongside types of Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Answer the following questions based on the information given below:A firm floated shares with five different face values of 100, 200, 300, 500 and 700. The number of shares sold over the five years was in the ratio 6 : 5 : 4 : 7 : 3 respectively from 2011 to 2015 and the total numbers of shares sold in 2012 was 10500. The value of a share at the end of an year is calculated on the increased or decreased value of the share at the end of the previous year. Table 1 shows the percentage change in the value of a share with respect to the previous year. Table 2 shows percentage distribution of different types of shares in the respective years (Face value is the initial value of the share).Volatility of a shareSum of the total increase in the value of the shareStability factor of an yearIn the above expression, a share is profitable or not only w.r.t. the previous year.Fluctuation index of a shareTable1: Percentage change in the value of the sharesTable2: Percentage distribution of number of shares of the firm in respective years.Q. Which year has the highest stability factor? a)2011b)2012c)2013d)2015Correct answer is option 'A'. Can you explain this answer? tests, examples and also practice CAT tests.

|

Explore Courses for CAT exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.