Humanities/Arts Exam > Humanities/Arts Questions > Case studyA and B were partners in a partners...

Start Learning for Free

Case study

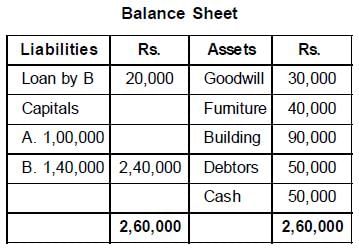

A and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:

It was agreed that following transactions will take place:

A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.

B. All the debtors proved good except a person C who did not pay Rs. 10,000.

B. All the debtors proved good except a person C who did not pay Rs. 10,000.

Q. The treatment of Goodwill appearing in the balance sheet will be:

- a)Transferred to Debit of Realisation A/C

- b)Written off among partners in old ratio

- c)Transferred to credit of Realisation A/C

- d)Raised and written off

Correct answer is option 'A'. Can you explain this answer?

Most Upvoted Answer

Case studyA and B were partners in a partnership firm. Due to the ill ...

On dissolution Goodwill will be transferred to Realisation A/c.

|

Explore Courses for Humanities/Arts exam

|

|

Similar Humanities/Arts Doubts

Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer?

Question Description

Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? for Humanities/Arts 2025 is part of Humanities/Arts preparation. The Question and answers have been prepared according to the Humanities/Arts exam syllabus. Information about Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? covers all topics & solutions for Humanities/Arts 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer?.

Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? for Humanities/Arts 2025 is part of Humanities/Arts preparation. The Question and answers have been prepared according to the Humanities/Arts exam syllabus. Information about Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? covers all topics & solutions for Humanities/Arts 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer?.

Solutions for Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? in English & in Hindi are available as part of our courses for Humanities/Arts.

Download more important topics, notes, lectures and mock test series for Humanities/Arts Exam by signing up for free.

Here you can find the meaning of Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer?, a detailed solution for Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? has been provided alongside types of Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Case studyA and B were partners in a partnership firm. Due to the ill health of B they decided to dissolve the firm. The position of Assets and Liabilities on the date of dissolution was:It was agreed that following transactions will take place:A. A wanted to start the business in sole proprietorship So he took Building and Furniture at 10% less than book value.B. All the debtors proved good except a person C who did not pay Rs. 10,000.Q.The treatment of Goodwill appearing in the balance sheet will be:a)Transferred to Debit of Realisation A/Cb)Written off among partners in old ratioc)Transferred to credit of Realisation A/Cd)Raised and written offCorrect answer is option 'A'. Can you explain this answer? tests, examples and also practice Humanities/Arts tests.

|

Explore Courses for Humanities/Arts exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.