UPSC Exam > UPSC Questions > Consider the following statements: The weight...

Start Learning for Free

Consider the following statements:

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

How many of the above statements are correct?

- a)Only one

- b)Only two

- c)All three

- d)None

Correct answer is option 'B'. Can you explain this answer?

Verified Answer

Consider the following statements: The weightage of food in Consumer P...

Statements 1 and 2 are correct.

Context: Recently, India’s Wholesale Price Index (WPI)-based inflation surged to a 13-month high of 1.26%, up from 0.5%, driven primarily by increases in food and fuel prices.

The Wholesale Price Index (WPI) is an economic indicator that measures the average change in prices of goods at the wholesale level, i.e., before they reach the retail level.

It is used to track inflation and deflation trends in the economy by reflecting price changes in a basket of wholesale goods.

Context: Recently, India’s Wholesale Price Index (WPI)-based inflation surged to a 13-month high of 1.26%, up from 0.5%, driven primarily by increases in food and fuel prices.

The Wholesale Price Index (WPI) is an economic indicator that measures the average change in prices of goods at the wholesale level, i.e., before they reach the retail level.

It is used to track inflation and deflation trends in the economy by reflecting price changes in a basket of wholesale goods.

S3: The Reserve Bank of India (RBI) Governor, Raghuram Raja in 2014 announced that the central bank had adopted the new Consumer Price Index (CPI) (combined) as the key measure of inflation.

Most Upvoted Answer

Consider the following statements: The weightage of food in Consumer P...

Analysis of the Statements

To understand the correctness of the statements regarding the Consumer Price Index (CPI) and Wholesale Price Index (WPI), let's evaluate each one:

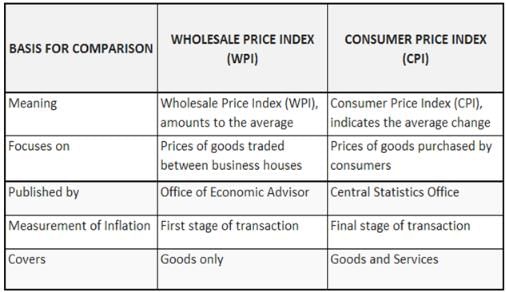

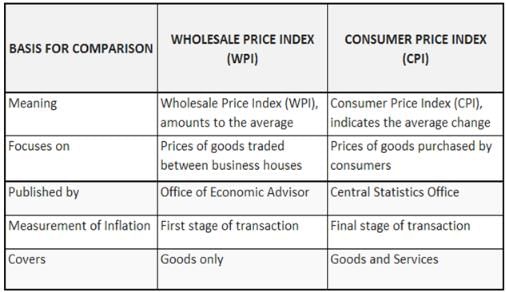

Statement 1: Weightage of food in CPI vs. WPI

- The weightage of food in the CPI is indeed higher than in the WPI.

- CPI reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, which includes a significant proportion of food items.

- WPI, on the other hand, focuses on the prices of wholesale goods and has a lower weight for food items.

- Conclusion: This statement is correct.

Statement 2: WPI and prices of services

- WPI primarily measures the price changes of goods at the wholesale level and does not include services.

- CPI, however, includes both goods and services, reflecting the overall cost of living for consumers.

- Conclusion: This statement is also correct.

Statement 3: RBI's adopted measure for inflation

- The Reserve Bank of India (RBI) traditionally relied on WPI for inflation measurement.

- However, in recent years, the RBI has shifted its focus to CPI as the key measure for assessing inflation and formulating monetary policy.

- Conclusion: This statement is incorrect.

Final Assessment

- Out of the three statements, two are correct (Statements 1 and 2), while one is incorrect (Statement 3).

Thus, the correct answer is option 'B': Only two statements are correct.

To understand the correctness of the statements regarding the Consumer Price Index (CPI) and Wholesale Price Index (WPI), let's evaluate each one:

Statement 1: Weightage of food in CPI vs. WPI

- The weightage of food in the CPI is indeed higher than in the WPI.

- CPI reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, which includes a significant proportion of food items.

- WPI, on the other hand, focuses on the prices of wholesale goods and has a lower weight for food items.

- Conclusion: This statement is correct.

Statement 2: WPI and prices of services

- WPI primarily measures the price changes of goods at the wholesale level and does not include services.

- CPI, however, includes both goods and services, reflecting the overall cost of living for consumers.

- Conclusion: This statement is also correct.

Statement 3: RBI's adopted measure for inflation

- The Reserve Bank of India (RBI) traditionally relied on WPI for inflation measurement.

- However, in recent years, the RBI has shifted its focus to CPI as the key measure for assessing inflation and formulating monetary policy.

- Conclusion: This statement is incorrect.

Final Assessment

- Out of the three statements, two are correct (Statements 1 and 2), while one is incorrect (Statement 3).

Thus, the correct answer is option 'B': Only two statements are correct.

|

Explore Courses for UPSC exam

|

|

Question Description

Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? for UPSC 2025 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer?.

Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? for UPSC 2025 is part of UPSC preparation. The Question and answers have been prepared according to the UPSC exam syllabus. Information about Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? covers all topics & solutions for UPSC 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer?.

Solutions for Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? in English & in Hindi are available as part of our courses for UPSC.

Download more important topics, notes, lectures and mock test series for UPSC Exam by signing up for free.

Here you can find the meaning of Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer?, a detailed solution for Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? has been provided alongside types of Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Consider the following statements: The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI). The WPI does not capture changes in the prices of services, which CPI does. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.How many of the above statements are correct?a)Only oneb)Only twoc)All threed)NoneCorrect answer is option 'B'. Can you explain this answer? tests, examples and also practice UPSC tests.

|

Explore Courses for UPSC exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.