Accounting for Share Capital (Part - 1) | Accountancy Class 12 - Commerce PDF Download

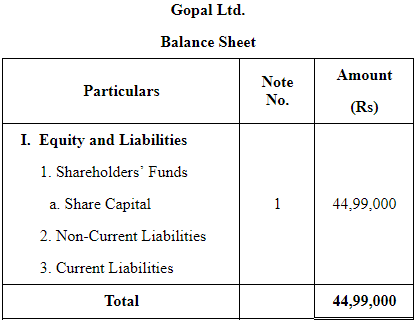

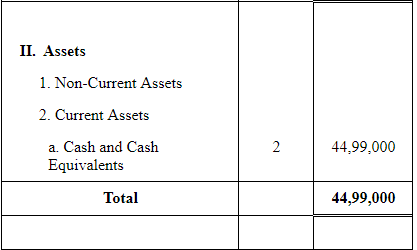

Page No 8.113:

Question 1:

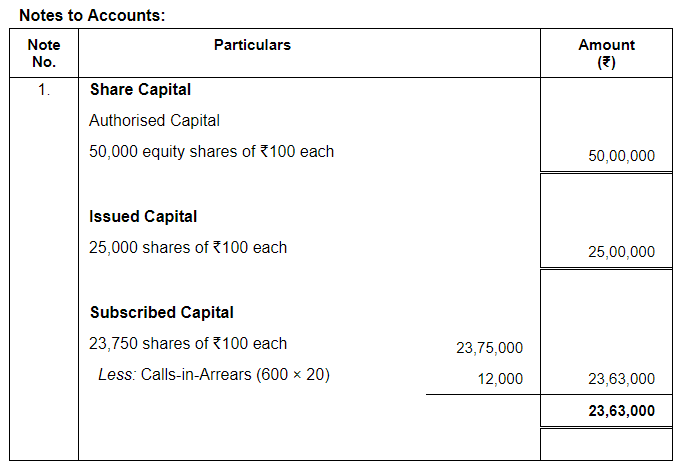

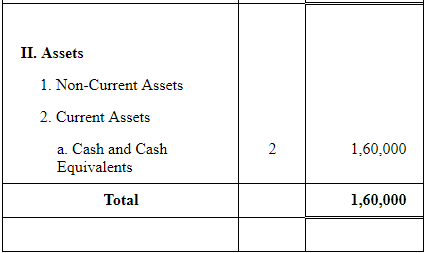

Gopal Ltd. was registered with an authorised capital of ₹50,00,000 divided into Equity Shares of ₹100 each. The company offered for public subscription all the shares. Public applied for 45,000 shares and allotment was made to all the applicants. All the calls were made and were duly received except the final call of ₹20 per share on 500 shares.

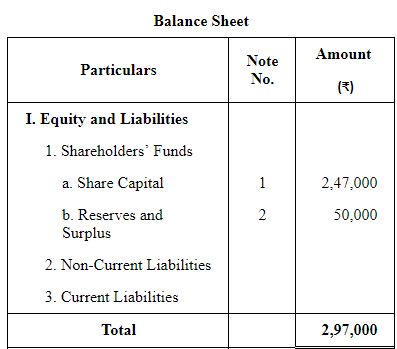

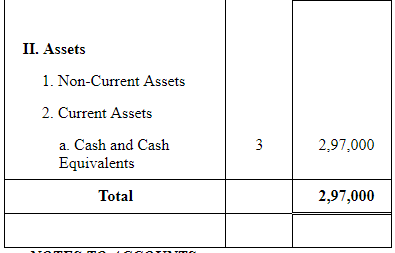

Prepare the Balance Sheet of the company showing the different types of share capital.

ANSWER:

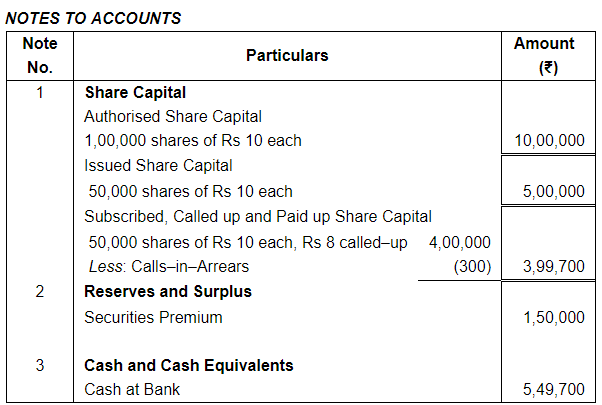

NOTES TO ACCOUNTS

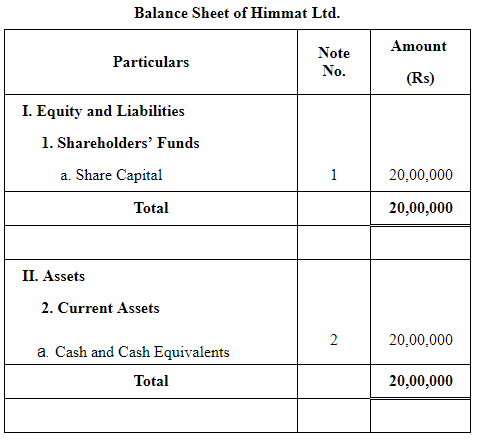

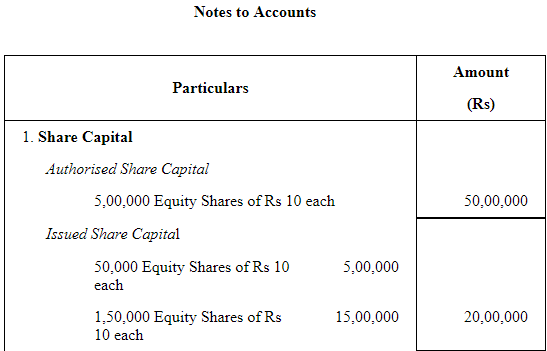

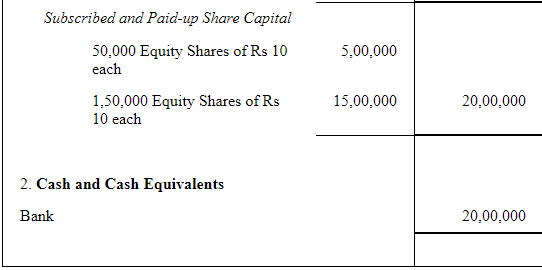

Page No 8.114:

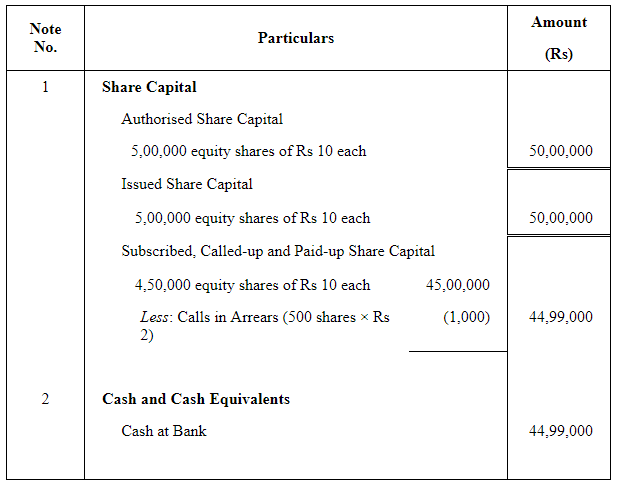

Question 2:

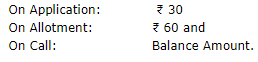

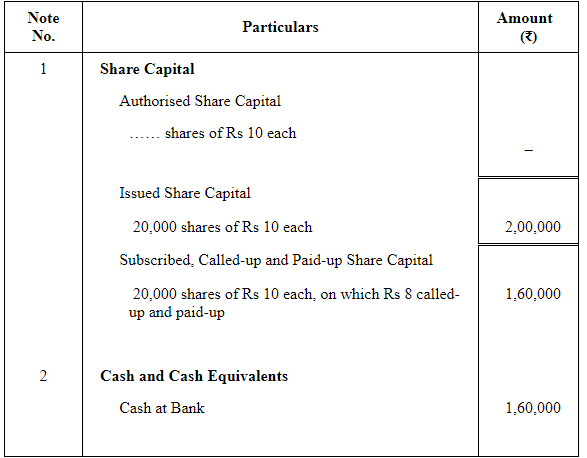

Himmat Ltd has authorised share capital of ₹ 50,00,000 divided into 5,00,000 Equity Shares of ₹ 10 each. It has existing issued and paid up capital of ₹ 5,00,000. It further issued to public 1,50,000 Equity Shares at par for subscription payable as under:

The issue was fully subscribed and allotment was made to all the applicants . Call was made during the year and was duly received.

Show share capital of the company in the Balance Sheet of the Company.

ANSWER:

Question 3:

Lennova Ltd. has authorised share capital of ₹1,00,00,000 divided into 1,00,000 Equity Shares of ₹100 each. It has existing issued and paid up capital of ₹25,00,000. It further issued to public 25,000 Equity Shares at a premium of 20% for subscription payable as under:

The issue was fully subscribed and allotment was made to all the applicants . The company did not make the call during the year.

Show share capital of the company in the Balance Sheet of the Company.

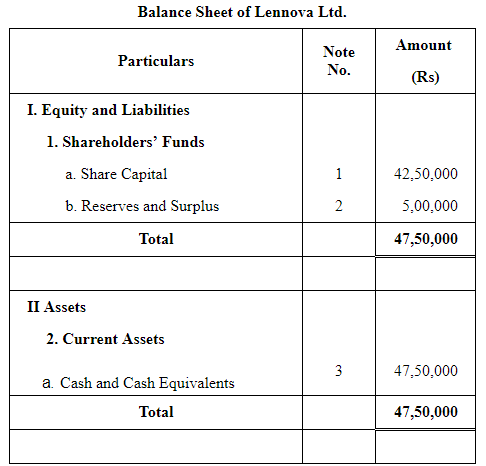

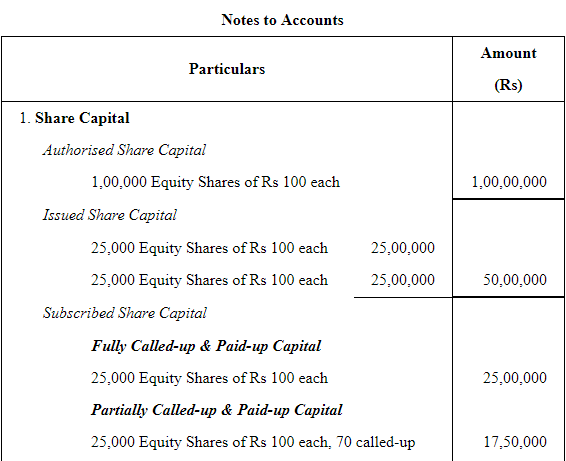

ANSWER:

Question 4:

Star Ltd. is registered with capital of ₹50,00,000 divided into 50,000 equity shares of ₹100 each, The Company issued 25,000 equity shares for subscription. Subscription was received for 23,750 shares and all the due amount was duly received, except the first and final call of ₹20 per share on 600 shares. Show the 'Share Capital' in the Balance Sheet of the company.

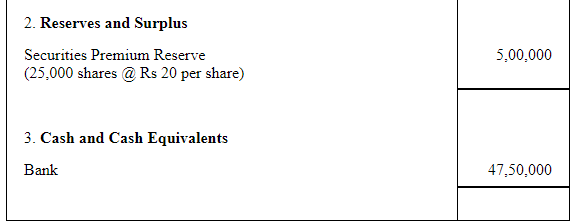

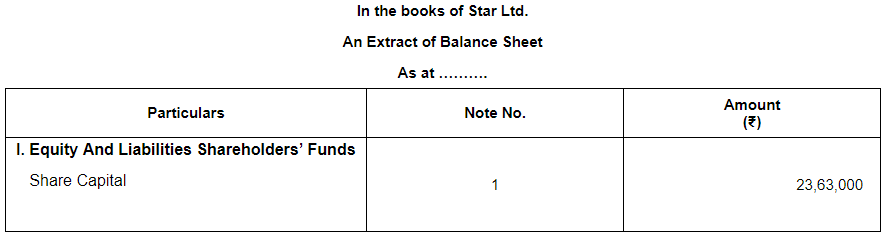

ANSWER:

Question 5:

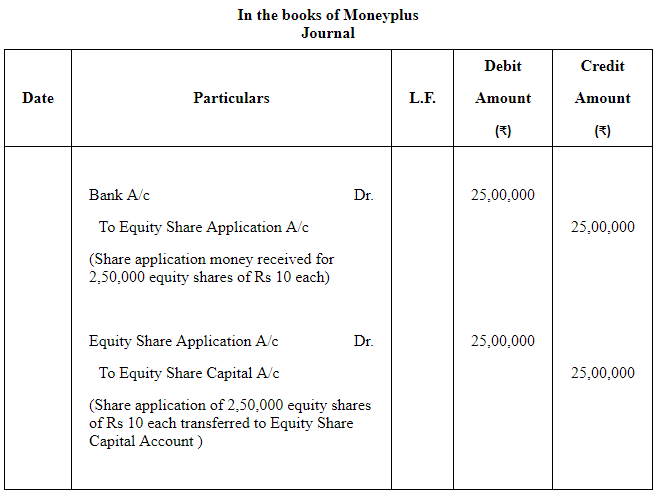

Moneyplus company issued 2,50,000 Equity Shares of ₹10 each to public. All amounts have been received in lump sum. Pass necessary Journal entries in the books of the company.

ANSWER:

Authorised Capital 2,50,000 equity shares of Rs 10 each

Issued and Subscribed Capital 2,50,000 shares

Question 6:

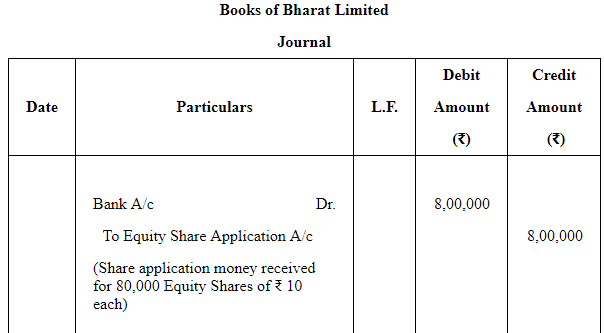

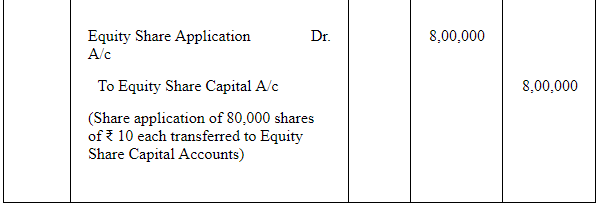

The authorised capital of ₹16,00,000 of Bharat Ltd. is divide into 1,60,000 Equity Shares of ₹10 each. Out of these shares, 80,000 Equity Shares were issued at par to public for subscription. The full nominal value is payable on application. All the shares were subscribed by the public and total amount was paid for. Pass necessary journal entries in the books of the company.

ANSWER:

Authorised Capital 1,60,000 equity shares of ₹10 each

Issued and Subscribed Capital 80,000 equity shares

Question 7:

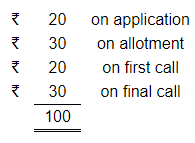

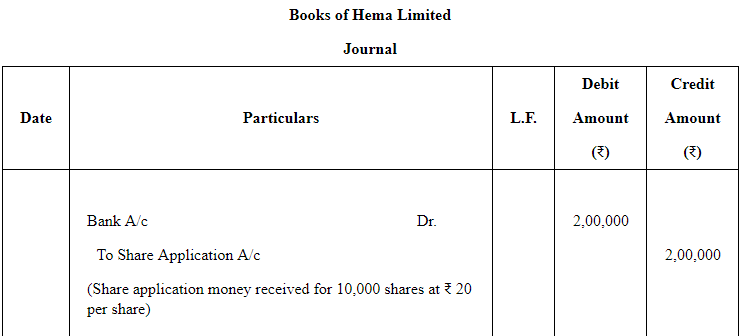

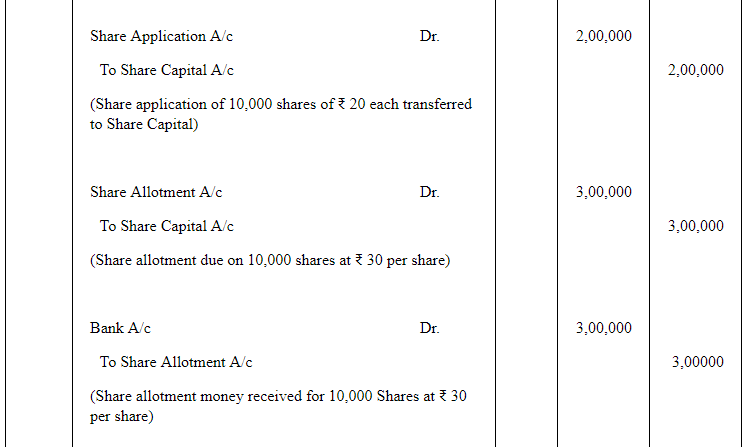

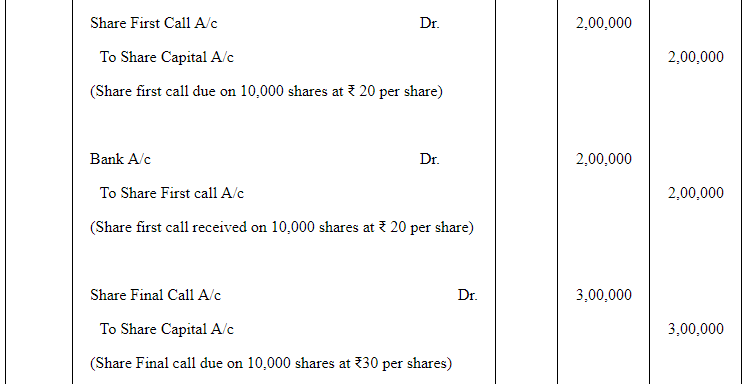

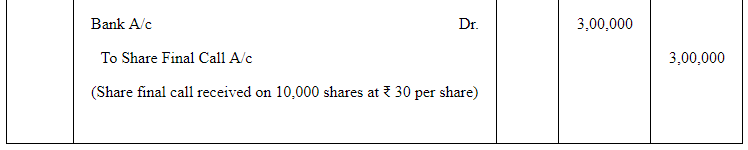

Hema Ltd. invited applications for 10,000 shares of ₹100 each payable as follows:

₹ 20 on application, ₹30 on allotment, ₹20 on first call and the balance on final call.

All the shares were applied and allotted. All the money was duly received.

You are required to Journalise these transactions.

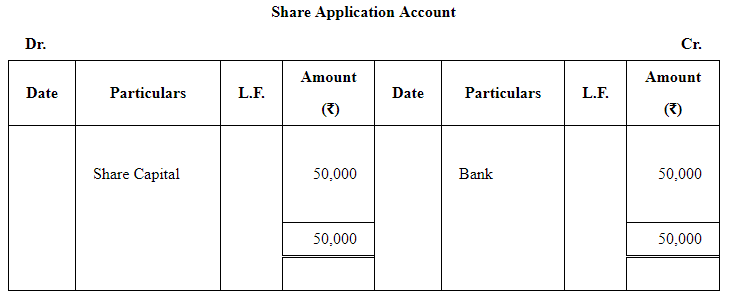

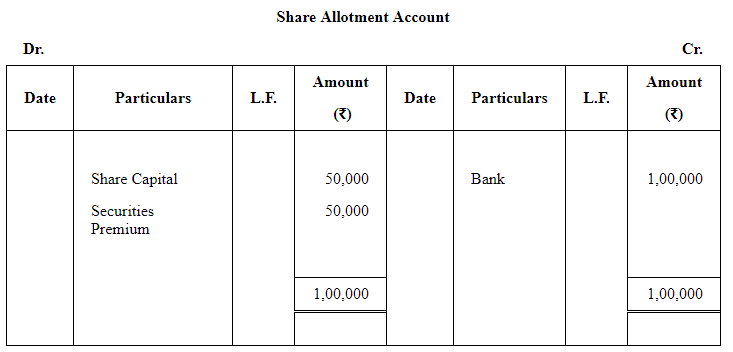

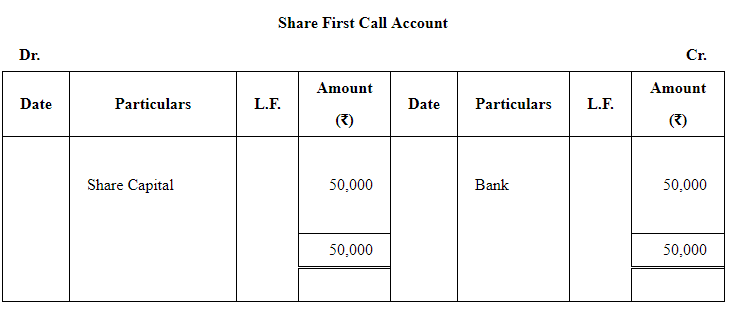

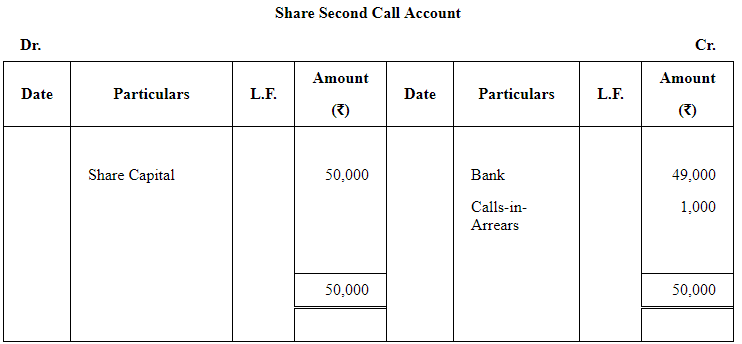

ANSWER:

Issued and Subscribed Capital 10,000 shares of ₹100 each

Payable as:

Question 8:

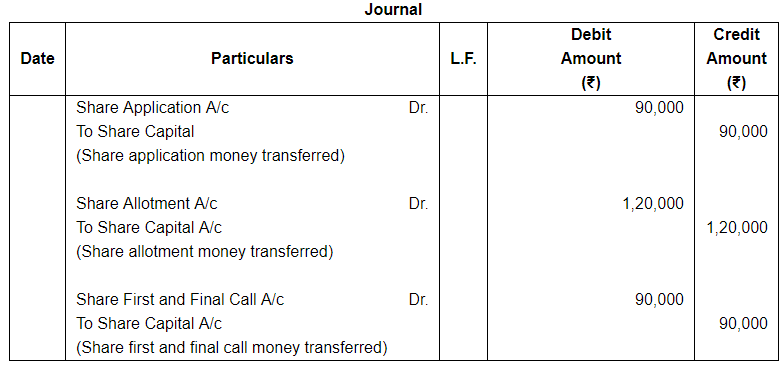

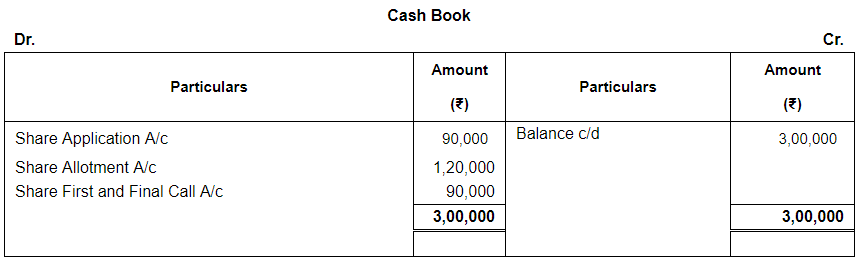

Marigold Ltd. was registered with the authorized capital of ₹3,00,000 divided into 3,000 shares of ₹100 each, which were offered to the public. Amount payable as ₹30 per share on application, ₹40 per share on allotment and ₹30 per share on first and final call . These shares were fully subscribed and all money was dully received. Prepare journal and Cash Book.

ANSWER:

Question 9:

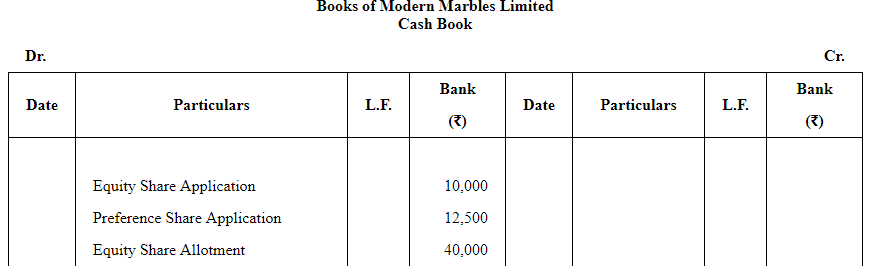

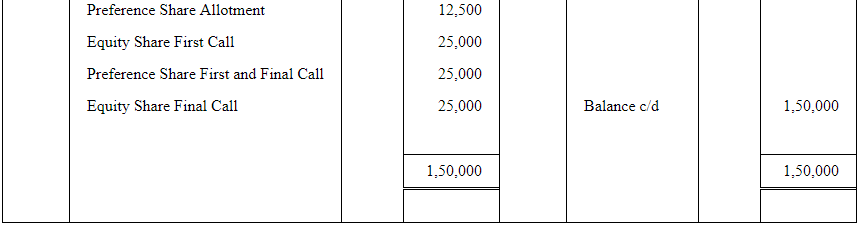

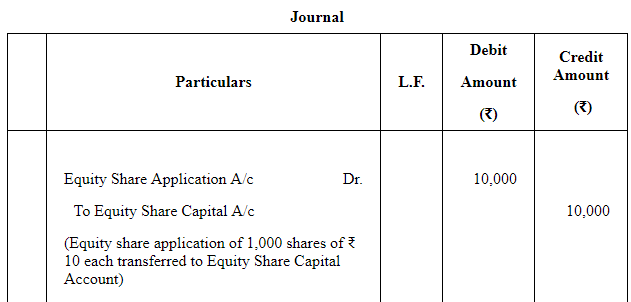

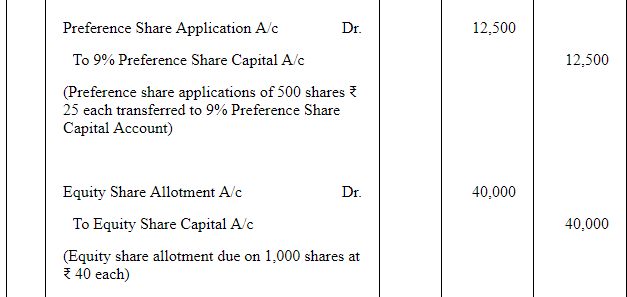

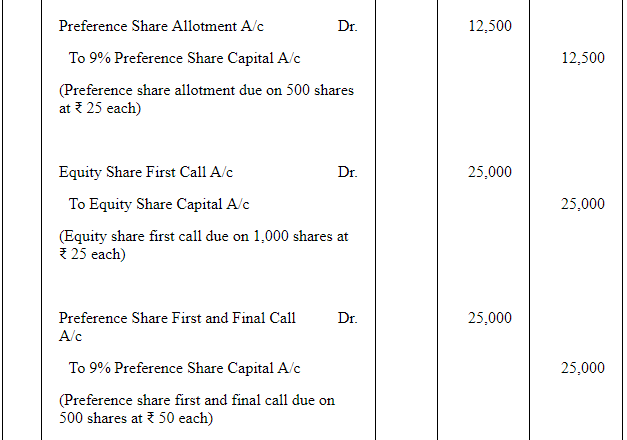

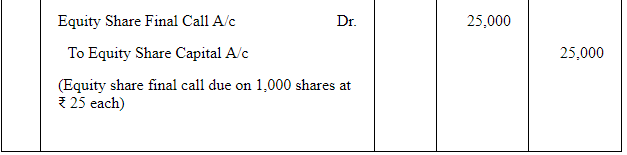

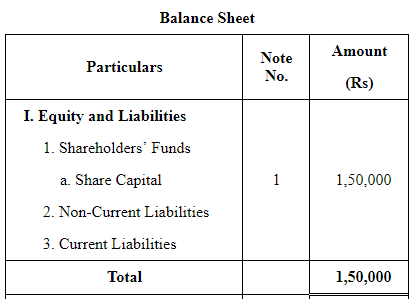

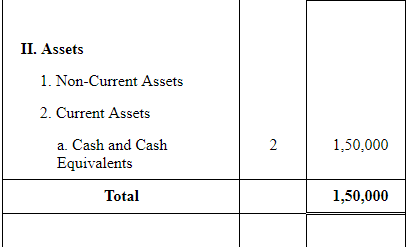

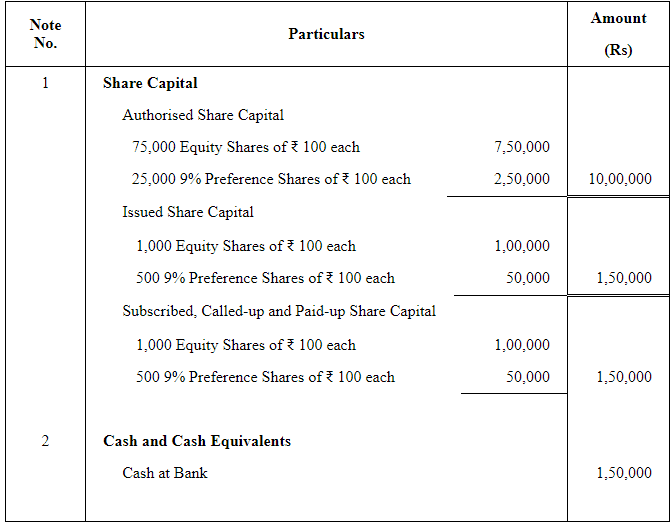

Modern Marbles Ltd. was registered with an authorised capital of ₹10,00,000 divided into 7,500 Equity Shares of ₹ 100 each and, 2,500 Preference Shares of ₹100 each. 1,000 Equity Shares and 500; 9% Preference Shares were offered to public on the following terms – Equity Shares payable ₹10 on application, ₹40 on allotment and the balance in two calls of ₹25 each. Preference Shares are payable ₹25 on application, ₹25 on allotment and ₹50 on first and final call. All the shares were applied for and allotted . Amount due was duly received. Prepare Cash Book and pass necessary Journal entries to record the above issue of shares and show how the Share Capital will appear in the Balance Sheet.

ANSWER:

Authorised Capital:

Equity Shares 7,500 of ₹100 each.

9% Preference Shares 2,500 of ₹100 each.

Issued Capital:

Equity Shares 1,000 of ₹100 each.

Payable as

₹10 on Application

₹40 on Allotment

₹25 on First Call

₹25 on Final Call

Preference Shares 500 of ₹100 each.

Payable as

₹25 on application

₹25 on allotment

₹50 on first and final call

NOTES TO ACCOUNTS

Page No 8.115:

Question 10:

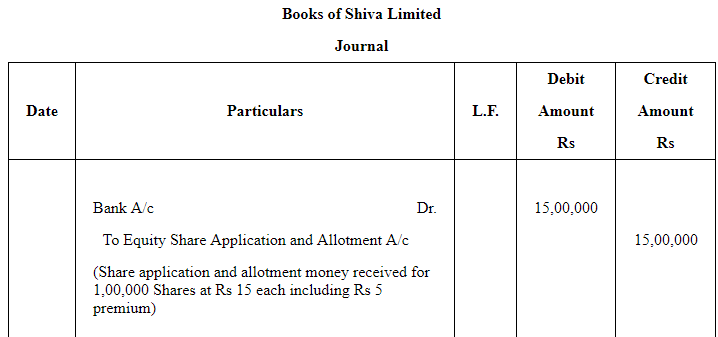

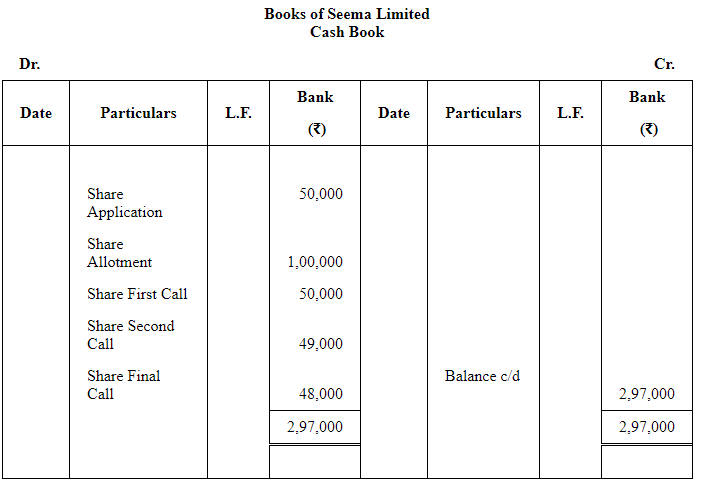

Shiva Ltd. issued 1,00,000 Equity Shares of ₹10 each at a premium of ₹5 per share. The whole amount was payable on application. The issue was fully subscribed. Pass necessary Journal entries.

ANSWER:

Issued 1,00,000 equity shares of Rs 10 each at a premium of Rs 5

Applied 1,00,000 shares

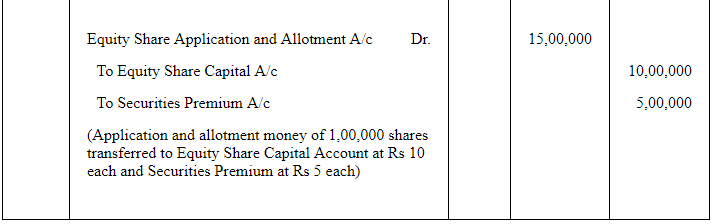

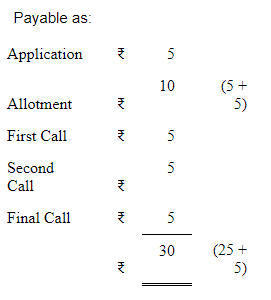

Question 11:

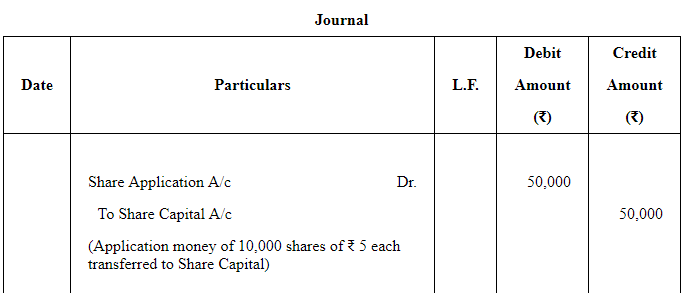

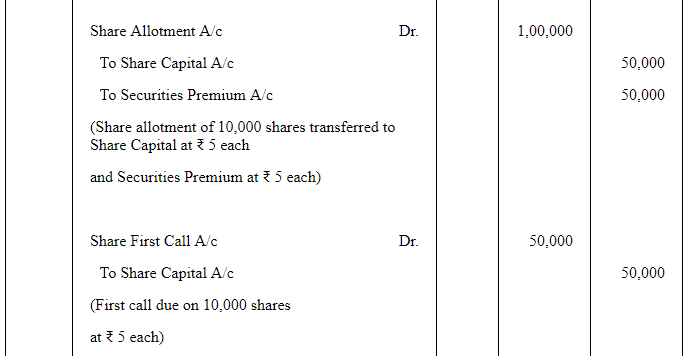

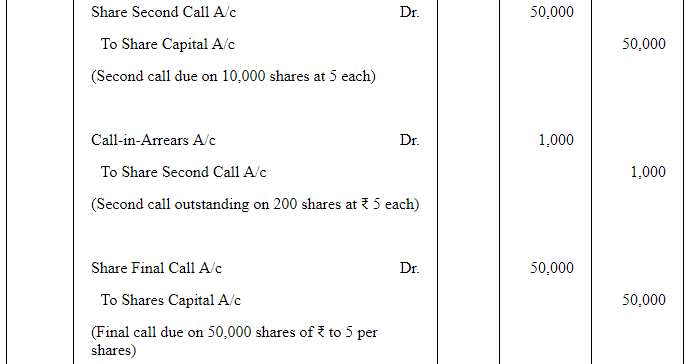

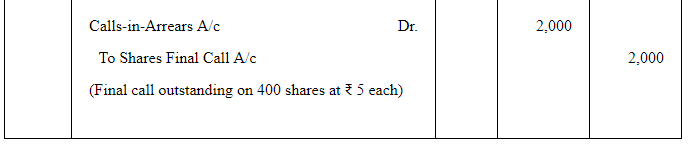

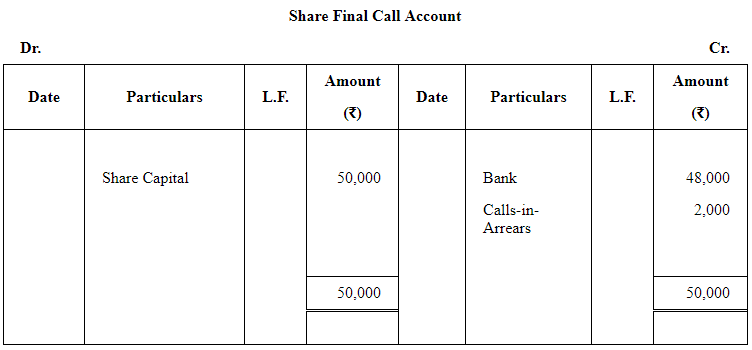

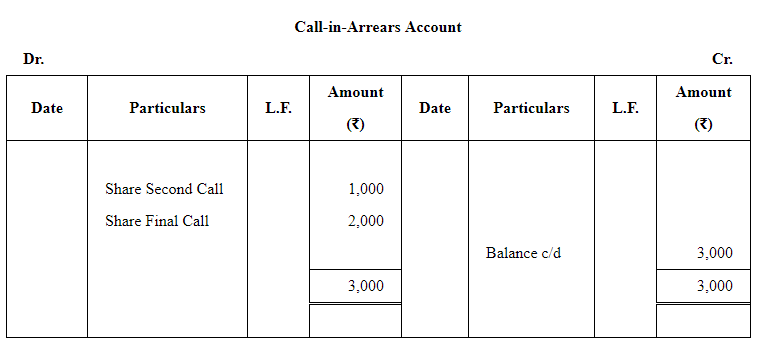

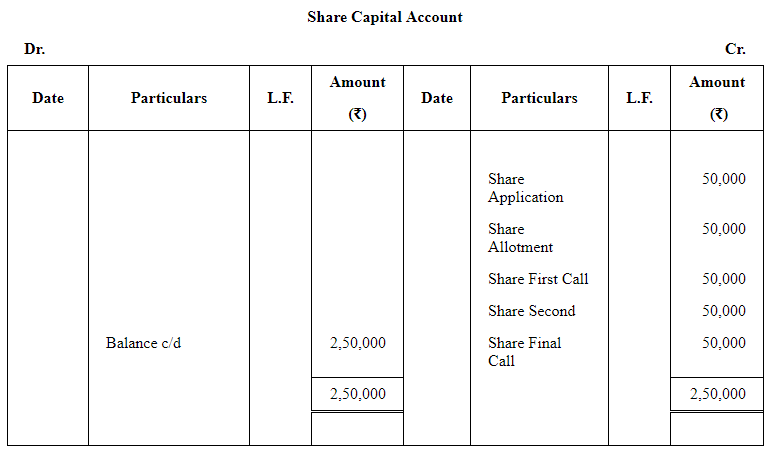

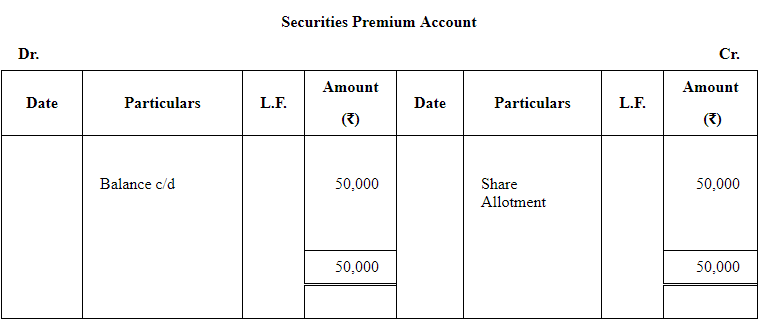

Seema Ltd. offered for subscription 10,000 shares of ₹25 each, payable ₹5 per share on application, ₹10 per share on allotment (including ₹5 per share as premium), ₹5 per share as first call on the shares and the balance in two equal amounts at intervals of three months. All the shares were applied for and allotted. All the money was received except the second call and final call on 200 and 400 shares respectively. Pass the entries in the company's Journal, Cash Book and the ledger. Also show the company's Balance Sheet on completion of the above transactions.

ANSWER:

Issued 10,000 shares of ₹25 each at premium of ₹5

Applied 10,000 shares

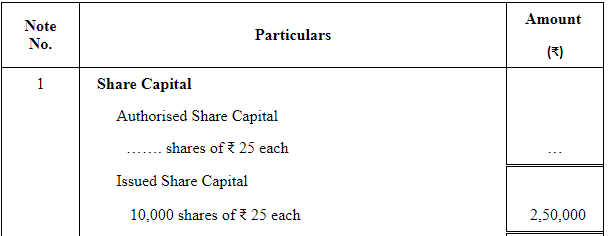

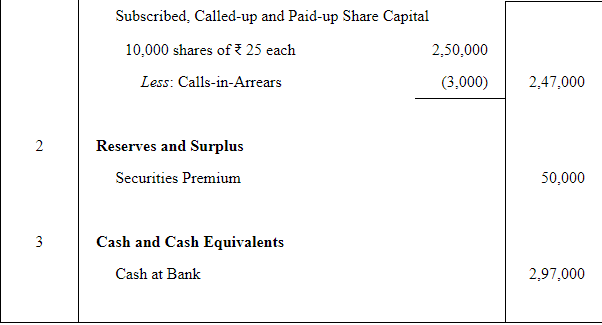

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

Page No 8.115:

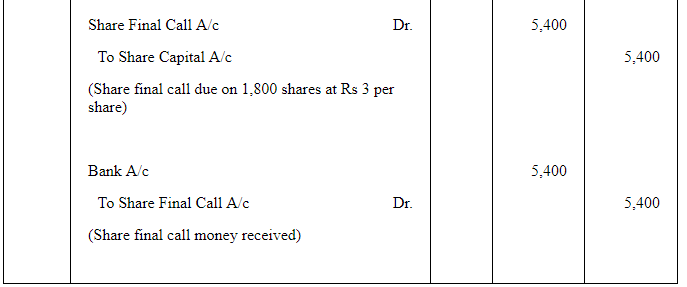

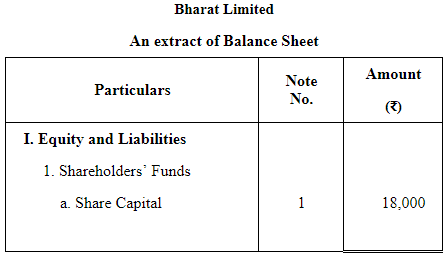

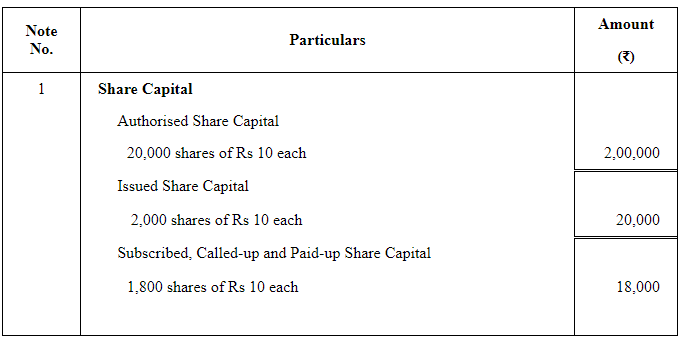

Question 12:

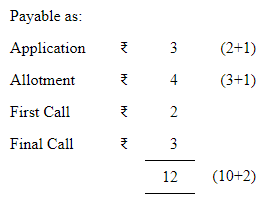

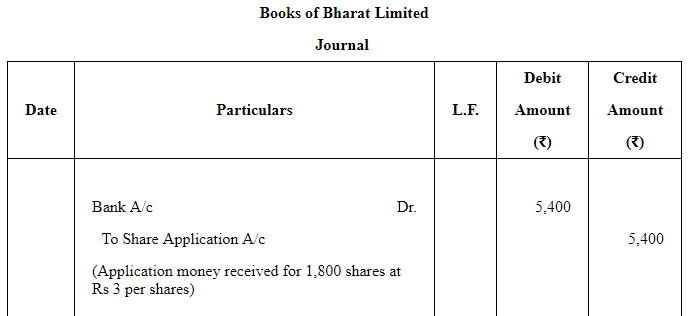

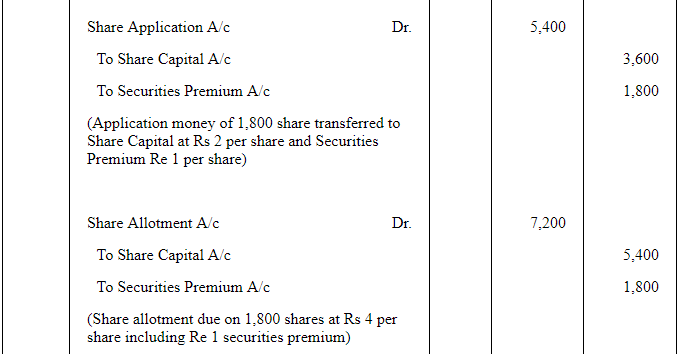

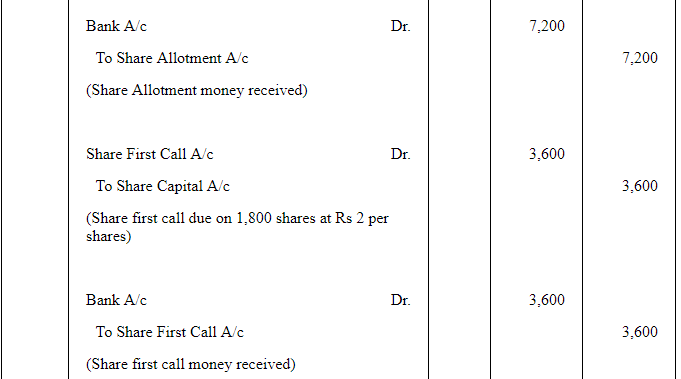

Bharat Ltd. was incorporated with a capital of ₹2,00,000 divided into shares of ₹10 each. 2,000 shares were offered for subscription and out of these, 1,800 shares were applied for and allotted. ₹3 per share (including ₹1 premium) was payable on application, ₹4 per share (including ₹1 premium) on allotment, ₹2 per share on first call and ₹3 per share on final call. All the money was received. Give necessary Journal entries and show share capital in the Balance Sheet.

ANSWER:

Authorised Capital 20,000 shares of ₹10 each

Issued Capital 2,000 shares

Applied 1,800 shares

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

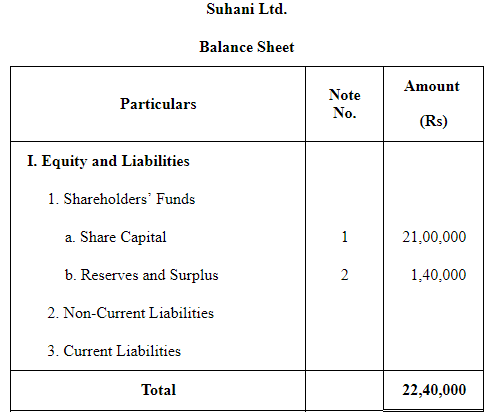

Question 13:

Authorized capital of Suhani Ltd . is ₹45,00,000 divided into 30,000 shares of ₹150 each. Out of these company issued 15,000 shares of ₹150 each at a premium of ₹10 per share. the amount was payable as follows:

₹50 per share on application , ₹40 per share on allotment (including premium), ₹30 per share on firs t call and balance on final call . Public applied for 14,000 shares. All the money was duly received .

Prepare an extract of Balance Sheet of Suhani Ltd. as per Schedule III , Part I of the companies Act, 2013 disclosing the above information . Also prepare 'Notes to Accounts' for the same.

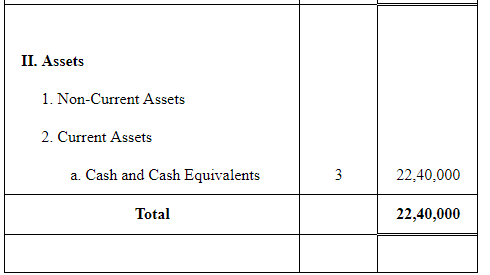

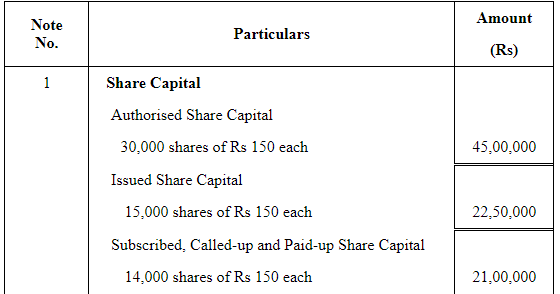

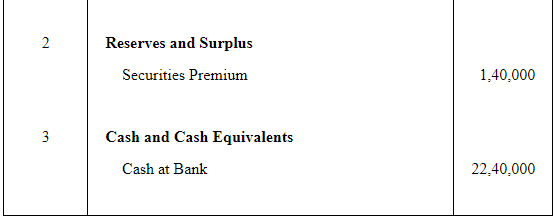

ANSWER:

NOTES TO ACCOUNTS

Question 14:

A company invited applications for 75,000 equity shares of ₹100 each. The application money received @ ₹30 per share was ₹27,00,000. Name the kind of subscription. List the three alternatives for allotting these shares.

ANSWER:

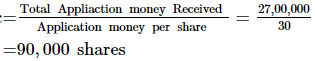

Total Money Received on Application = ₹27,00,000

Application money per share = ₹30

Number of shares applied by the public

Number of shares applied by the public

Number of shares applied by the public

Numberofsharesappliedbythepublic

Share Applications invited by the company = 75,000

Since, Number of Shares applied for by the company exceeds the number of shares offered by the company by 15,000 shares (i.e. 90,000 – 75,000). Therefore, it is a case of oversubscription of shares.

The alternatives available with the company are as follows:

1. By rejecting the excess applications and allotting only 75,000 shares.

2. By making allotment to the 90,000 shares applicants on a proportionate or pro-rata basis.

3. By making allotment to some on pro-rata basis and rejecting some applicants. For e.g.: 85,000 share applicants are given 75,000 shares on pro-rata basis and the remaining 5,000 shares have been rejected.

Question 15:

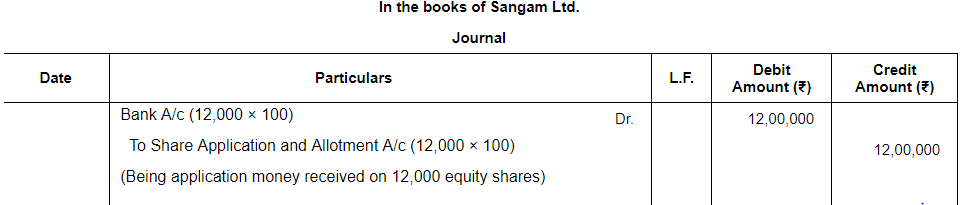

Sangam Ltd. invited applications for 10,000 Equity Shares of ₹100 each issued at par. The amount was payable on application. The issue was oversubscribed by 2,000 shares and allotment was made on pro rata basis. Pass necessary Journal entries.

ANSWER:

Note: Since the entire amount is receivable on application so the excess money on 2,000 shares has been refunded and allotment is made on a pro-rata basis to 12,000 shareholders.

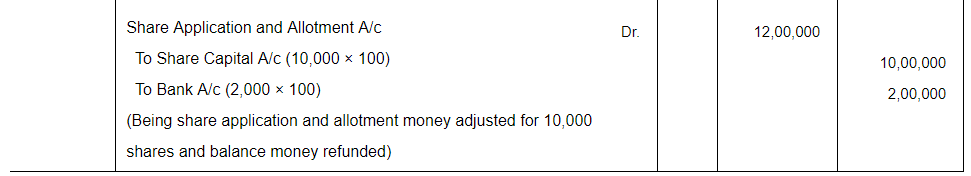

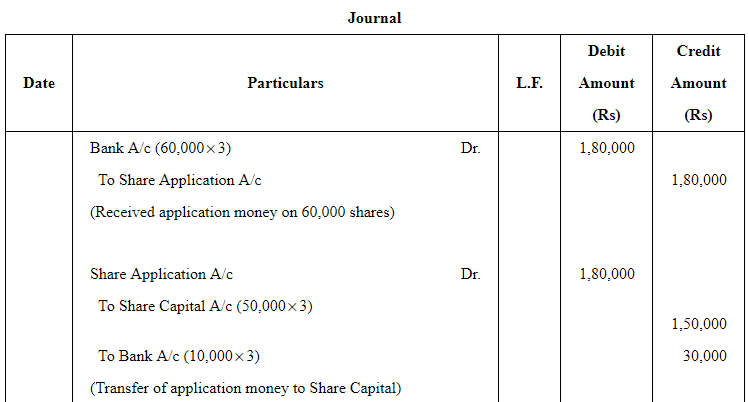

Question 16:

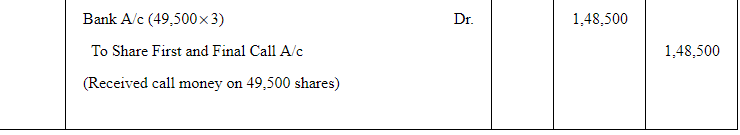

Citizen Watches Ltd. invited applications for 50,000 shares of ₹10 each payable ₹3 on application, ₹4 on allotment and balance on first and final call. Applications were received for 60,000 shares. Applications were accepted for 50,000 shares and remaining applications were rejected. All calls were made and received except First and Final call on 500 shares.

Pass the journal entries in the books of Citizen Watches Ltd.

ANSWER:

Question 17:

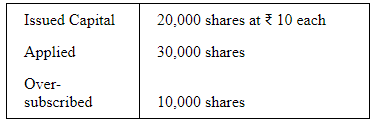

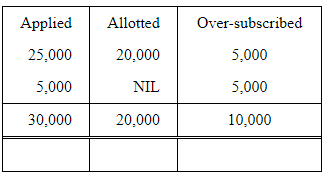

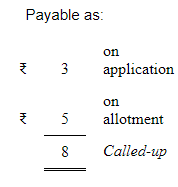

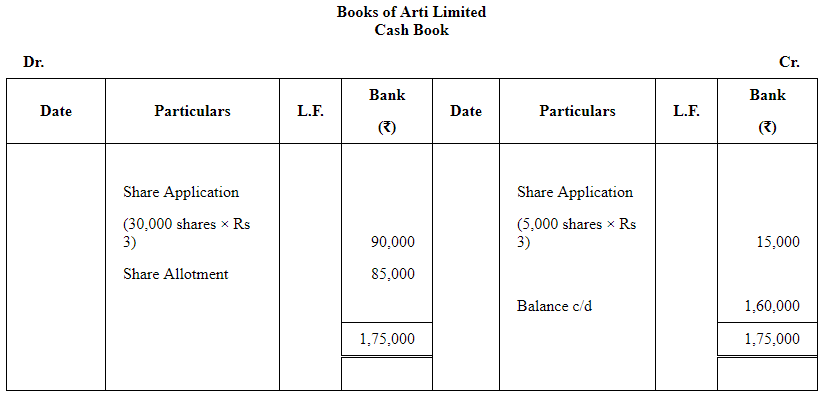

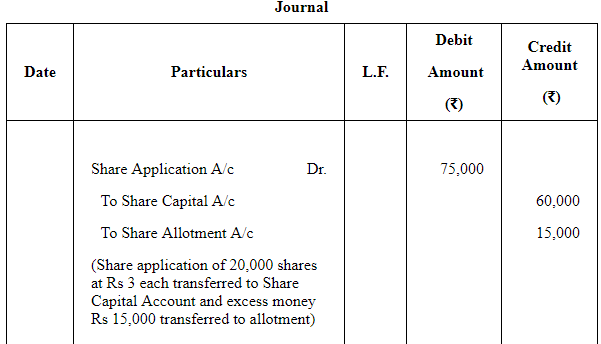

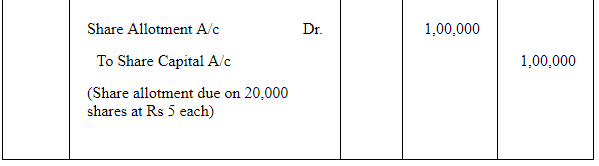

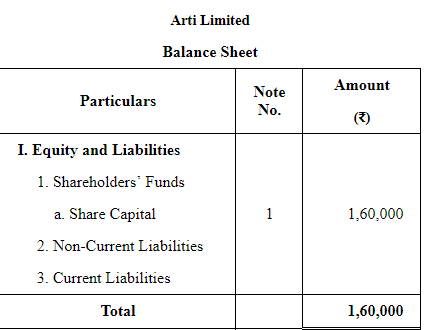

Arti Ltd. offered for subscription 20,000 shares of ₹10 each payable ₹3 on application, ₹5 on allotment and balance on first and final call. Applications were received for 30,000 shares. Letters of regret were issued to applicants for 5,000 shares and their application money was refunded. Application money for other 5,000 shares was applied towards the payment for allotment money. The balance of allotment money was also received in due time. Company didn't make first and final call.

You are to prepare the Journal, Cash Book, Ledger Accounts and show 'Share Capital' in the Balance Sheet of the company.

ANSWER:

NOTES TO ACCOUNTS

Question 18:

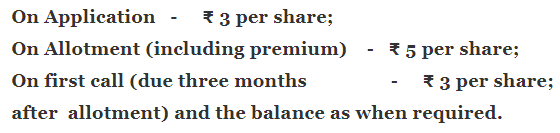

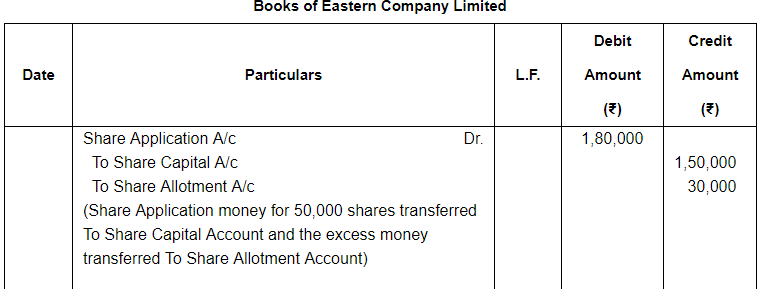

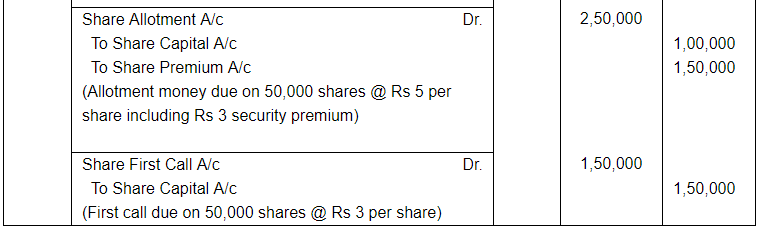

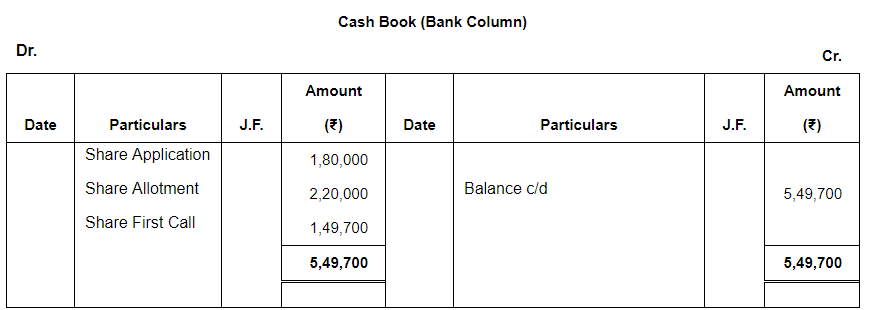

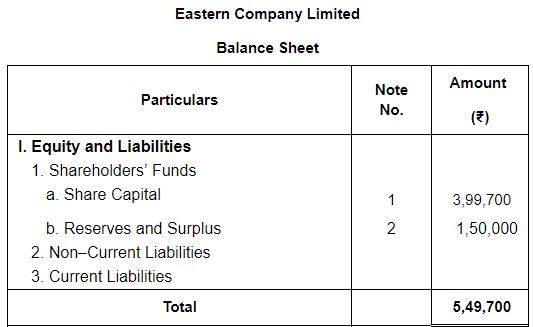

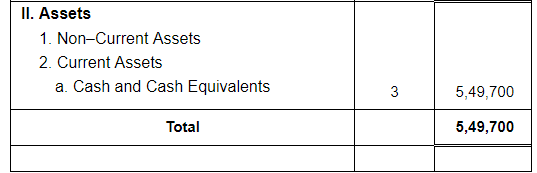

Eastern Company Limited , having an authorised capital of ₹10,00,000 divided into shares of ₹ 10 each , issued 50,000 shares at a premium of ₹ 3 per share payable as follows:

Applications were received for 60,000 shares and the directors allotted the shares as follows:

(i) Applicants for 40,000 shares received in full.

(ii) Applicants for 15,000 shares received an allotment of 8,000 shares.

(iii) Applicants for 5,000 shares received 2,000 shares on allotment , excess money being returned.

All amounts due on allotment were received.

The first call was made and the money was received except on 100 shares.

Give journal and cash book entries to record these transactions of the company. Also prepare the Balance Sheet of the company.

ANSWER:

Page No 8.116:

Question 19:

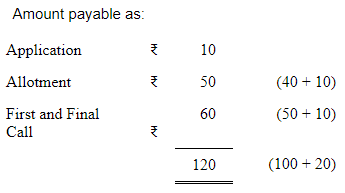

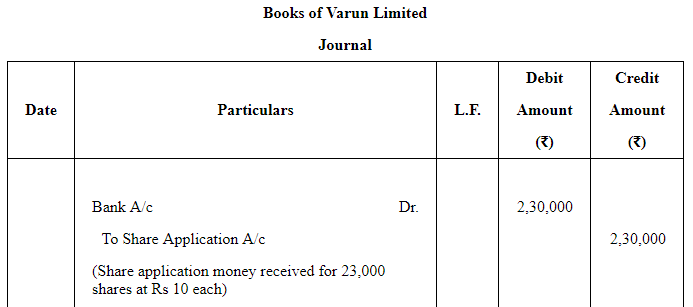

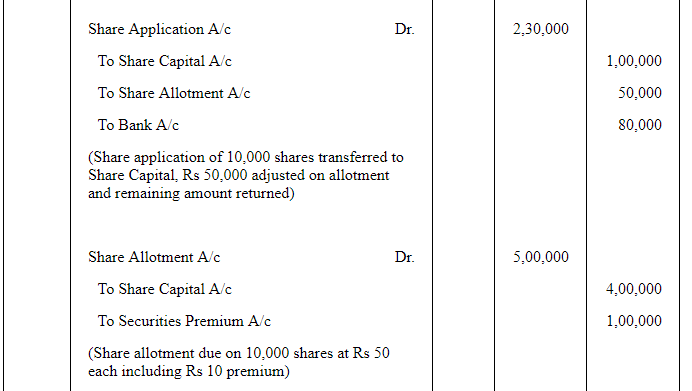

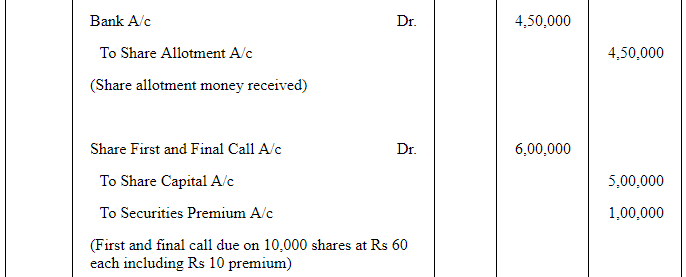

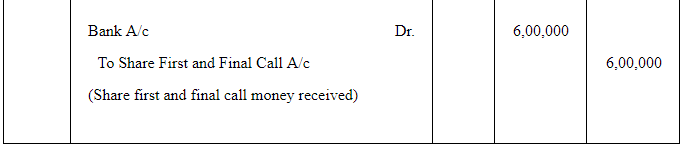

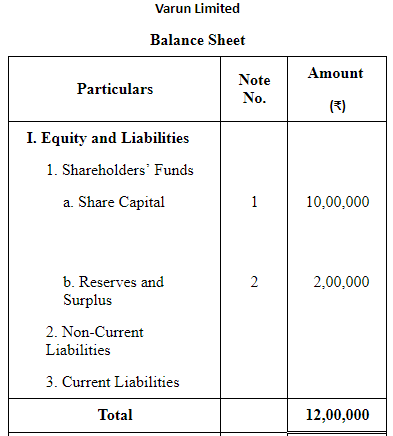

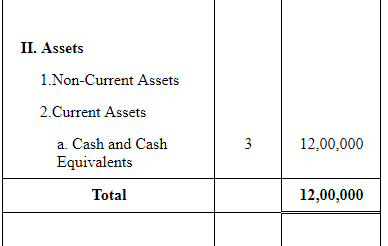

Varun Ltd. issued ₹10,00,000 shares of ₹100 each at a premium of ₹20 for subscription payable as:

₹10 per share on application,

₹40 per share and ₹10 premium on allotment, and

₹50 per share and ₹10 premium on final payment.

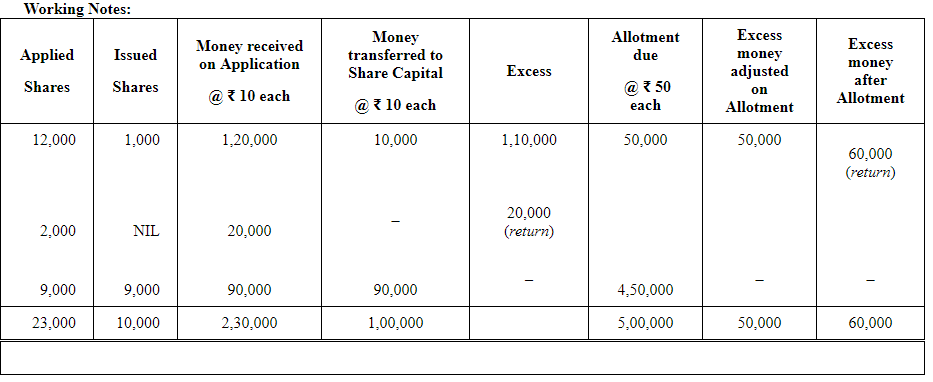

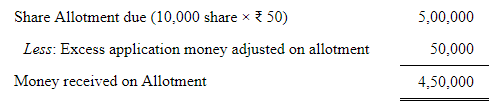

Over-payments on application were to be applied towards amount due on allotment and over-payments on application exceeding amount due on allotment was to be returned. Issue was oversubscribed to the extent of 13,000 shares. Applicants for 12,000 shares were allotted only 1,000 shares and applicants for 2,000 shares were sent letters of regret. All the money due on allotment and final call was duly received.

Pass necessary entries in the company's books to record the above transactions. Also, prepare company's Balance Sheet on completion of the above transactions.

ANSWER:

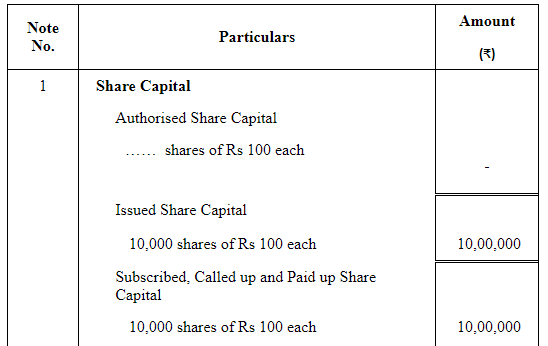

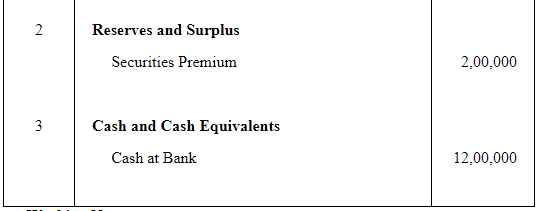

Posting in the Company's Balance Sheet

NOTES TO ACCOUNTS

|

42 videos|199 docs|43 tests

|

FAQs on Accounting for Share Capital (Part - 1) - Accountancy Class 12 - Commerce

| 1. What is share capital in accounting? |  |

| 2. How is share capital calculated? |  |

| 3. What are the types of share capital? |  |

| 4. Can share capital be increased or decreased? |  |

| 5. How does share capital affect a company's financial position? |  |