Accounting for Share Capital (Part - 4) | Accountancy Class 12 - Commerce PDF Download

Page No 8.123:

Question 66:

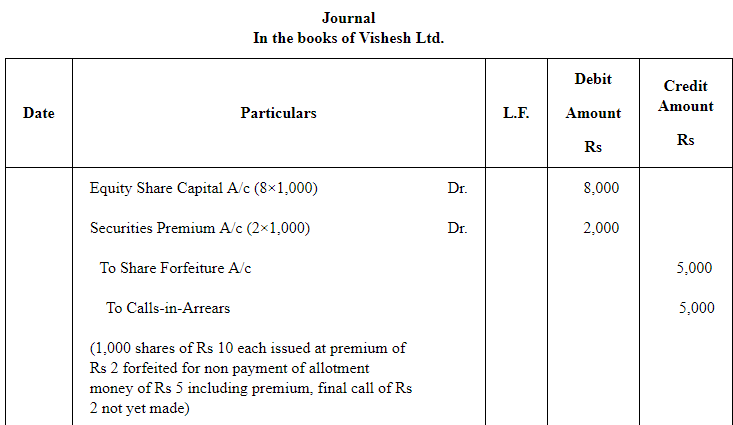

Pass necessary journal entries in the books of the company for the following transactions:

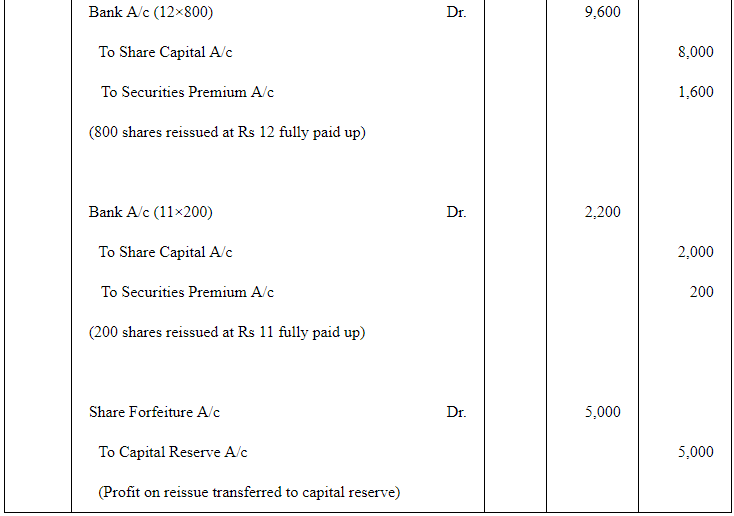

Vishesh Ltd. forfeited 1,000 Equity Shares of ₹10 each issued at a premium of ₹2 per share for non-payment of allotment money of ₹5 per share including premium. The final call of ₹2 per share was not yet called on these shares. Of the forfeited shares 800 shares were reissued at ₹12 per share as fully paid-up.

The remaining shares were reissued at ₹11 per share fully paid-up.

ANSWER:

Question 67:

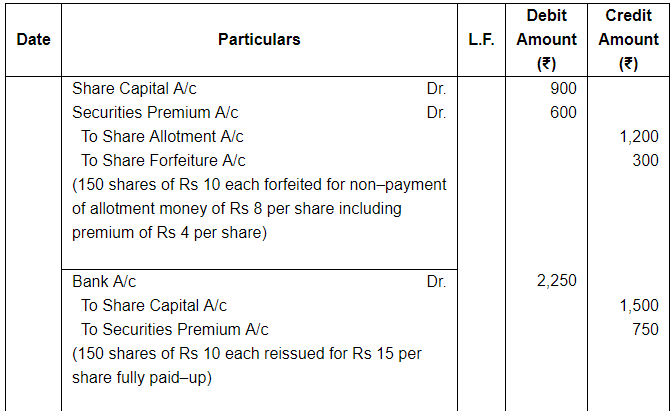

150 shares of ₹10 each issued at a premium of ₹4 per share payable with allotment were forfeited for non-payment of allotment money of ₹8 per share including premium. The first and final call of ₹4 per Pass Journal entries in the books of X Ltd. for the above.

ANSWER:

Question 68:

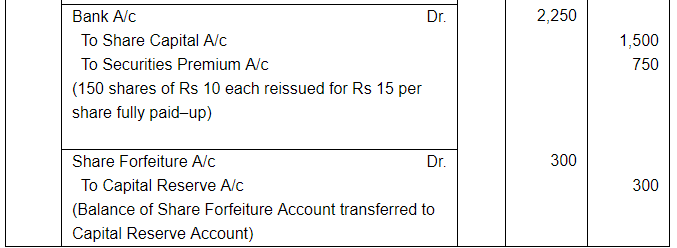

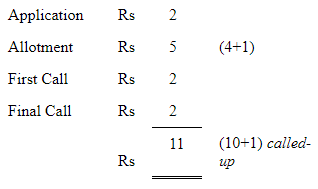

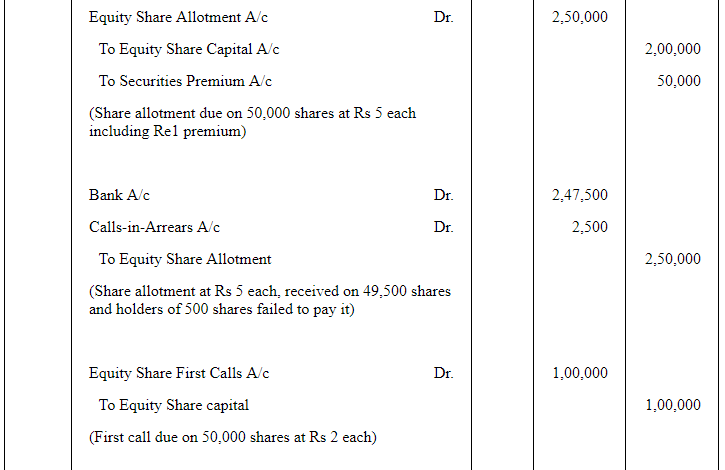

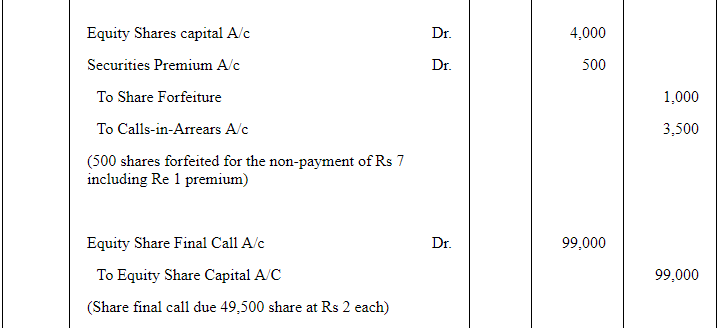

Commence Publications Ltd. issued 50,000 Equity Shares of ₹10 each at a premium of 10% payable as under:

On application ₹2,

On first call ₹2,

On allotment ₹5,

On final call ₹2.

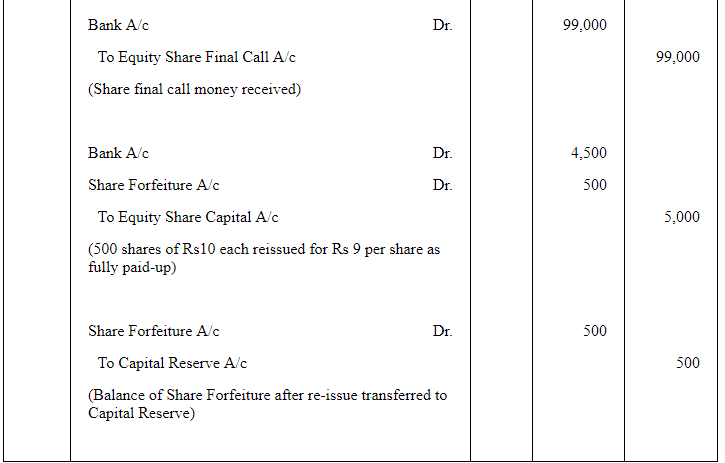

The calls were made by the company and all the money was duly received except the allotment and call money on 500 shares. These shares were, therefore, forfeited and later reissued @ ₹9 per share as fully paid-up.

Pass necessary journal entries to record the above transactions.

ANSWER:

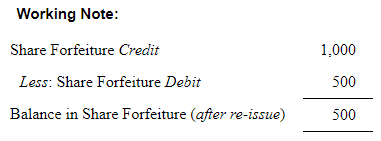

Issued and applied 50,000 equity shares at Rs 10 each at a premium Re 1

Capital Reserve = Balance in Share Forfeiture (after re-issue) = Rs 500

Question 69:

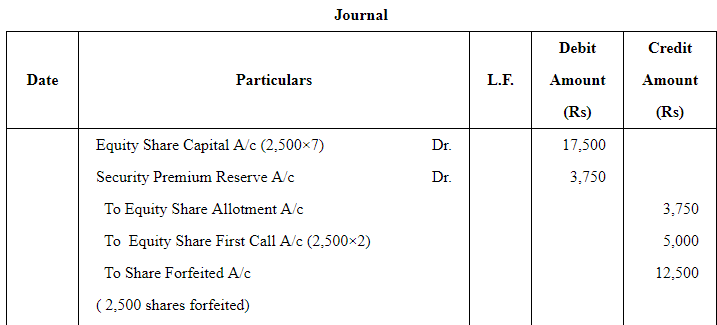

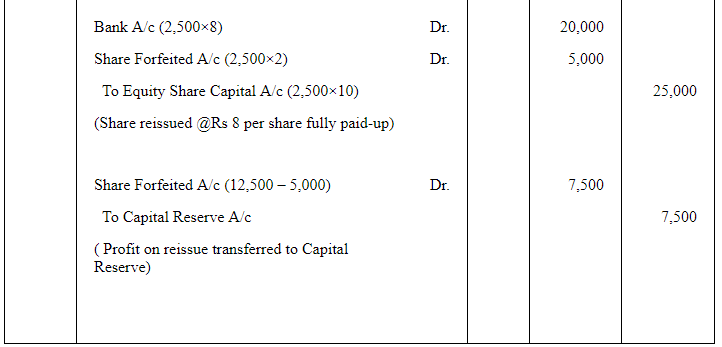

Gaurav applied for 5,000 shares of ₹10 each at a premium of 2.50 per share. But he was allotted only 2,500 shares on pro rata basis . After having paid ₹3 per share on application, he did not pay allotment money of ₹4.50 per share (including premium) and on his subsequent failure to pay the first call of ₹2 per share, his shares were forfeited. These shares were reissued at the rate of ₹8 per share credited as fully paid .

Pass journal entries to record the forfeiture and reissue of shares.

ANSWER:

Working Notes:

WN 1: Calculation of Amount unpaid on Allotment

Amount received on application (5,000×3) = 15,000

Less: Amount adjusted on application (2,500×3) = 7,500

Excess amount received on application = 7,500

Amount due on allotment (2,500×4.5) = 11,250

Amount unpaid on allotment = 3,750 (11,250 – 7,500)

Note:

Rs 7,500 received on application will be transferred to allotment, but first of all we have to transfer such amount to Capital A/c and rest would be transferred to Securities Premium A/c. Capital on allotment is Rs 5,000 (2,500×2) that is fully received and balance amount of advance Rs 2,500 will be transferred to Securities Premium A/c. So, amount of premium unpaid is Rs 3,750 (2,500×2.5 –2,500).

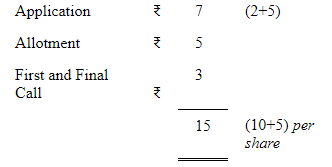

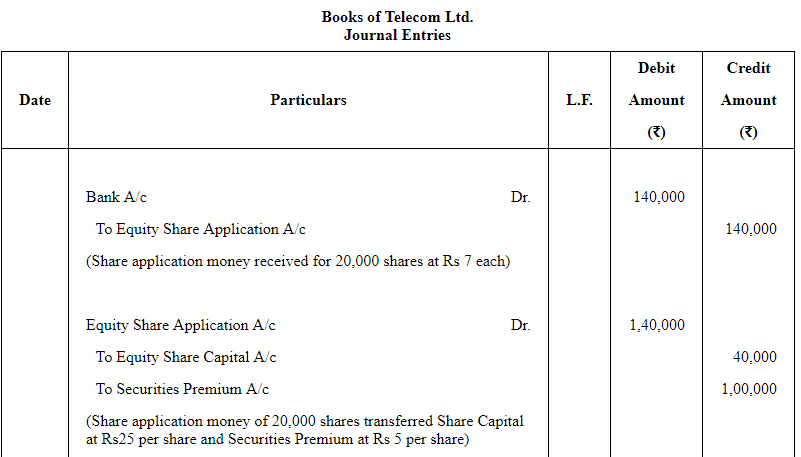

Question 70:

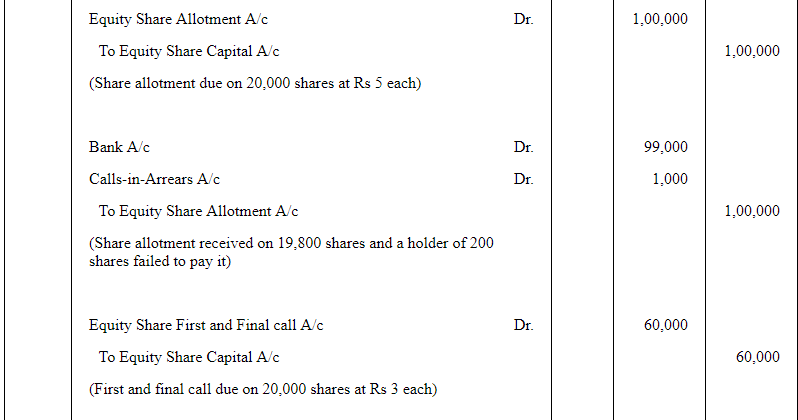

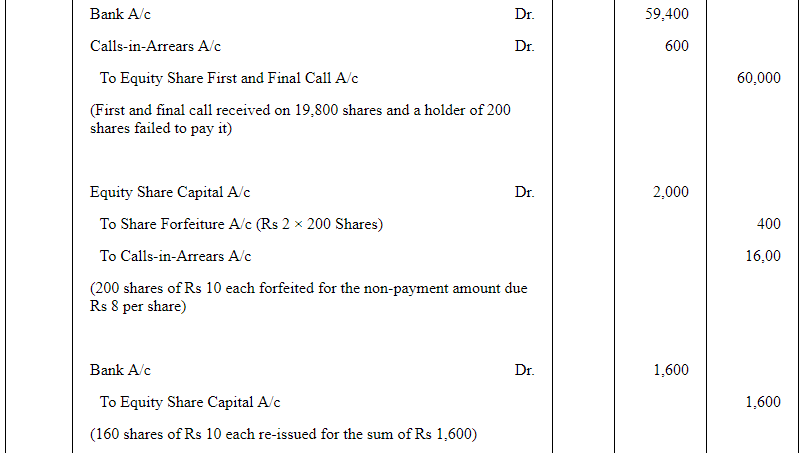

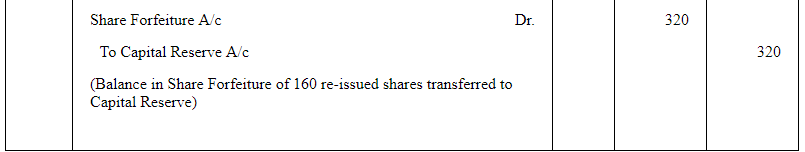

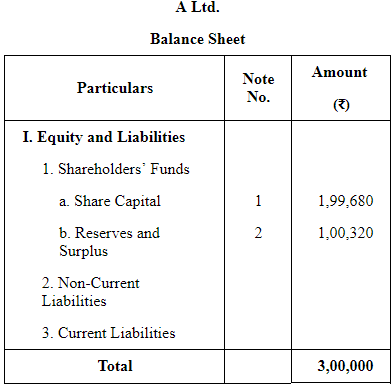

'Telecom Ltd.' issued 20,000 Equity Shares of ₹10 each at a premium of ₹5 per share, payable as: ₹7 (including premium) on application, ₹5 on allotment and the balance after three months of allotment. A shareholder to whom 200 shares were allotted failed to pay the allotment and call money and his shares were forfeited. 160 of the forfeited shares were reissued for ₹1,600.

Give necessary entries in company's Journal and the Balance Sheet.

ANSWER:

Issued and Applied 20,000 equity shares of ₹10 each at a premium of ₹5

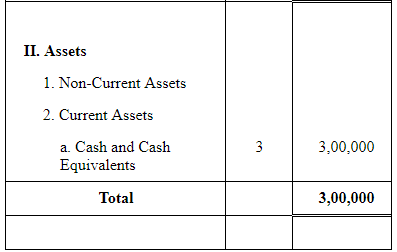

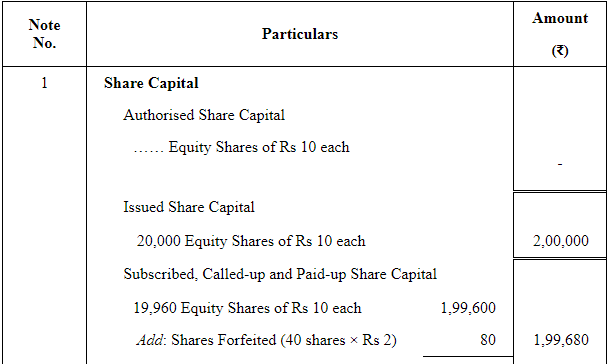

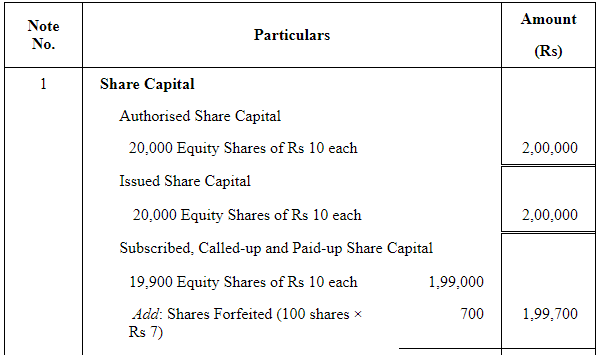

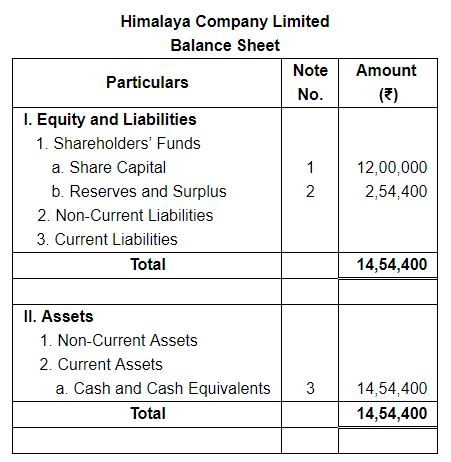

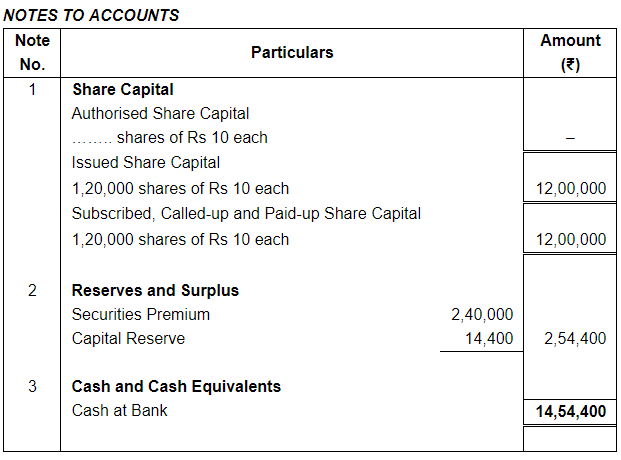

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

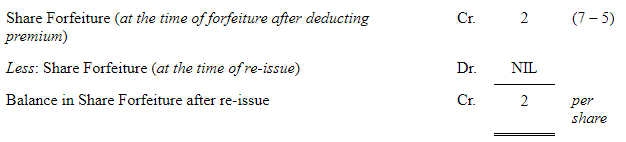

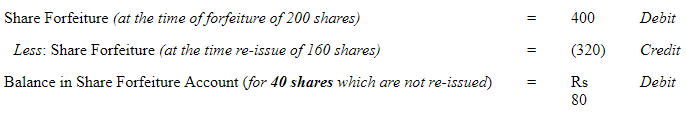

Working Notes: 1. Share Forfeiture of Re-issued Shares

Capital Reserve = Balance in Share Forfeiture after reissue (per share) × Number of Shares Re-issued = Rs 2 × 160 = Rs 320

2. Calculation of balance remaining in Share Forfeiture Account (to be shown in the Balance Sheet)

Question 71:

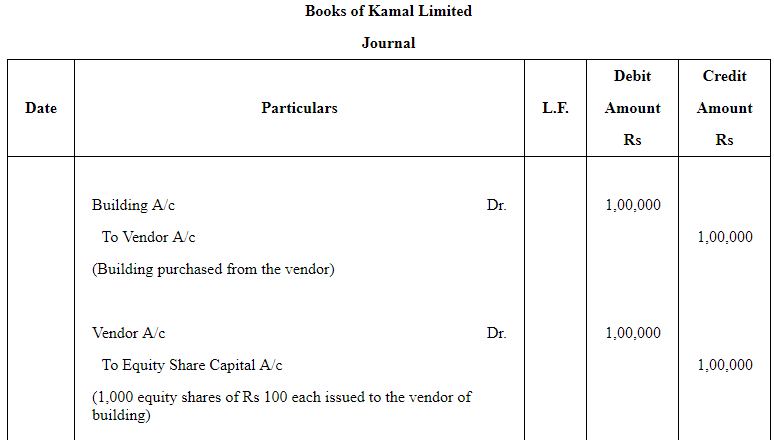

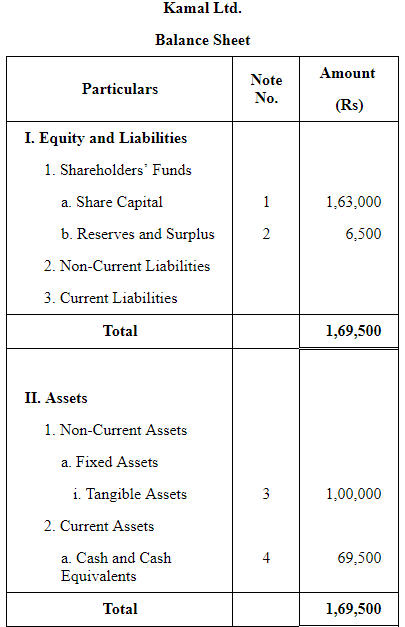

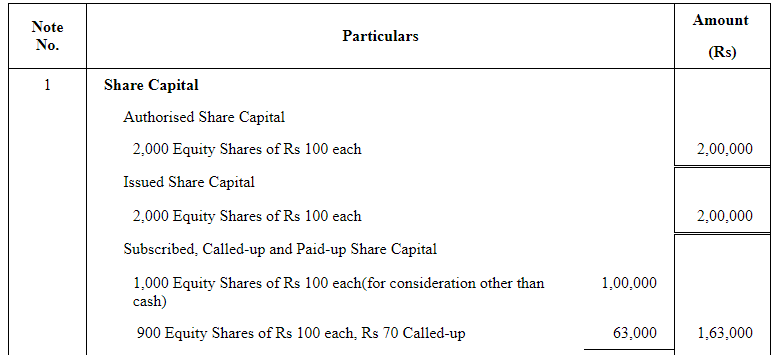

Kamal Ltd. was formed on 1st April, 2010 with an authorised capital of ₹2,00,000, divided into 2,000 Equity Shares of ₹100 each. 1,000 shares were issued as fully paid to the vendors of building for payment of the purchase consideration. The remaining 1,000 shares were offered or public subscription at a premium of ₹5 per share payable as:

On application ₹10 per share,

On allotment ₹25 per share(including premium),

On first call ₹40 per share,

On final call ₹30 per share.

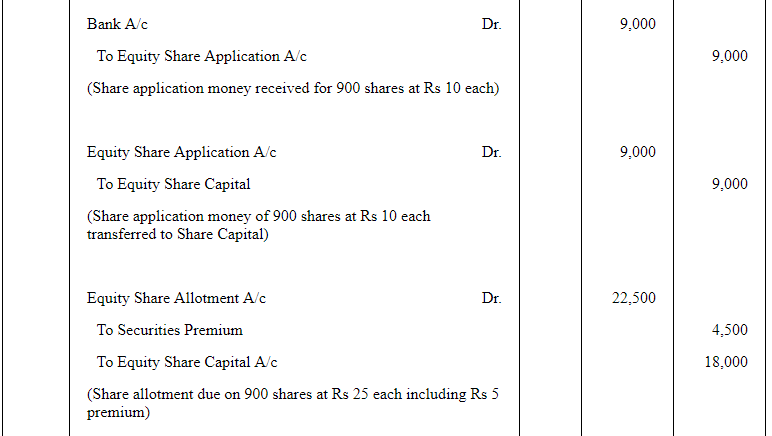

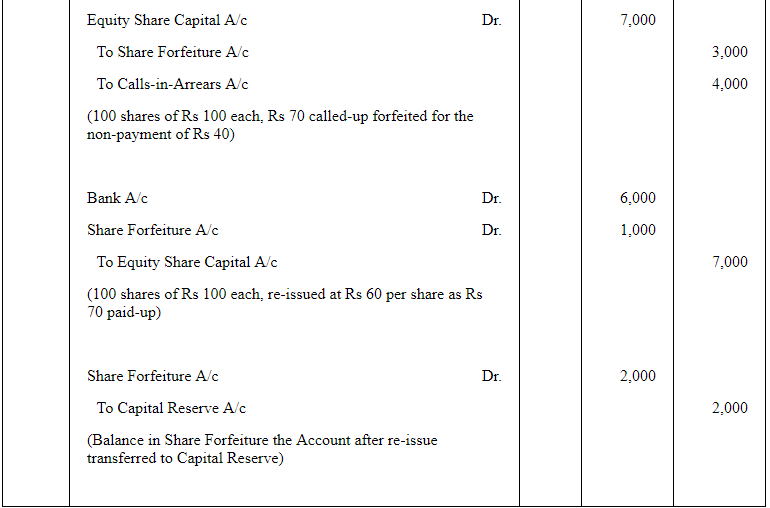

Applications were received for 900 shares which were duly allotted and the allotment money was received in full . At the time of the first call, a shareholder who held 100 shares failed to pay the first call money and his shares were forfeited. These shares were reissued @ ₹60 per share, ₹70 per share paid-up.

Final call has not been made.

You are required to

(i) give necessary journal entries to record the above transactions and

(ii) show how share capital would appear in the Balance Sheet of the company.

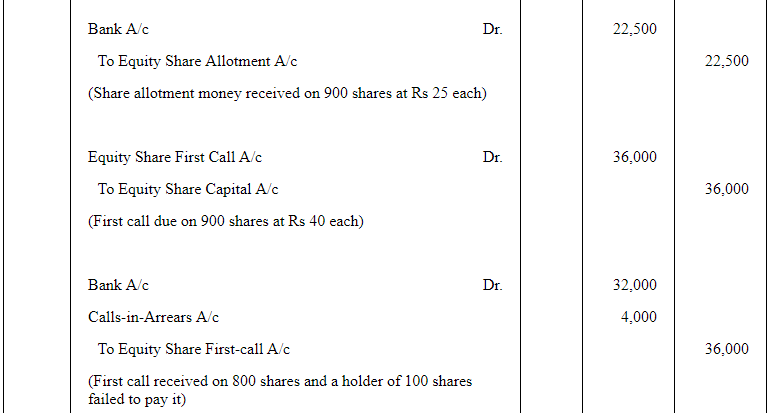

ANSWER:

Authorised Capital: 2,000 equity shares at Rs 100 each

Issued Capital:

1,000 equity shares at Rs 100 each to the vendor of the building

1,000 equity shares at Rs 100 each with a premium Rs 5 to the public

Applied by public: 900 equity shares

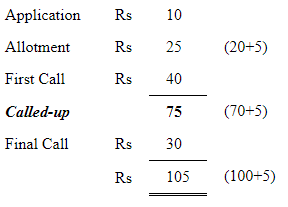

Payable by public as:

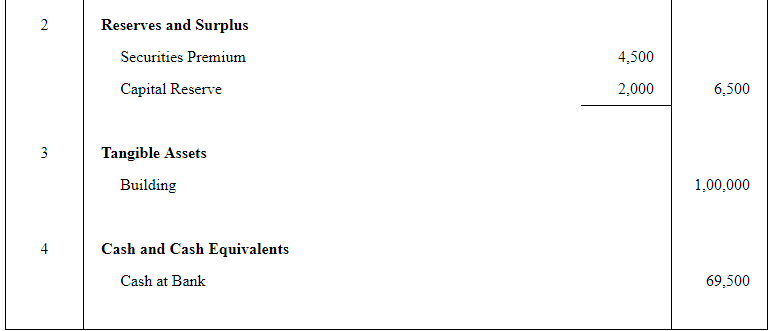

As per the Schedule III of Companies Act 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

Page No 8.124:

Question 72:

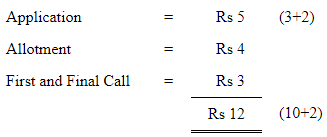

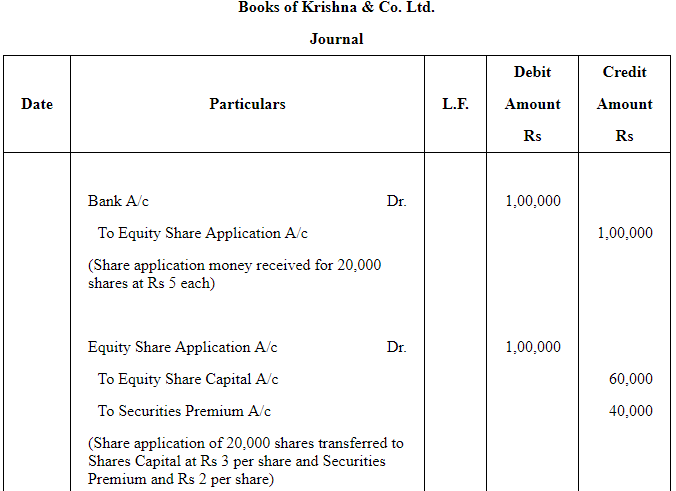

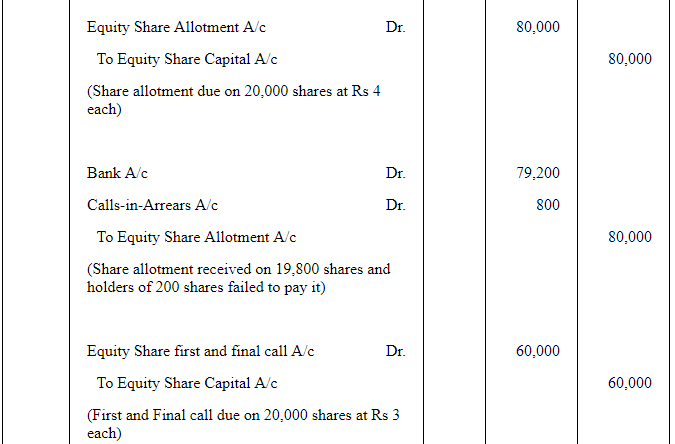

Krishna & Co. Ltd. with an authorised capital of ₹2,00,000 divided into 20,000 Equity Shares of ₹ 10 each, issued the entire amount of the shares payable as:

₹5 on application (including premium ₹2 per share),

₹4 on allotment, and

₹3 on call.

All share money is received in full with the exception of the allotment money on 200 shares and the call money on 500 shares (including the 200 shares on which the allotment money has not been paid).

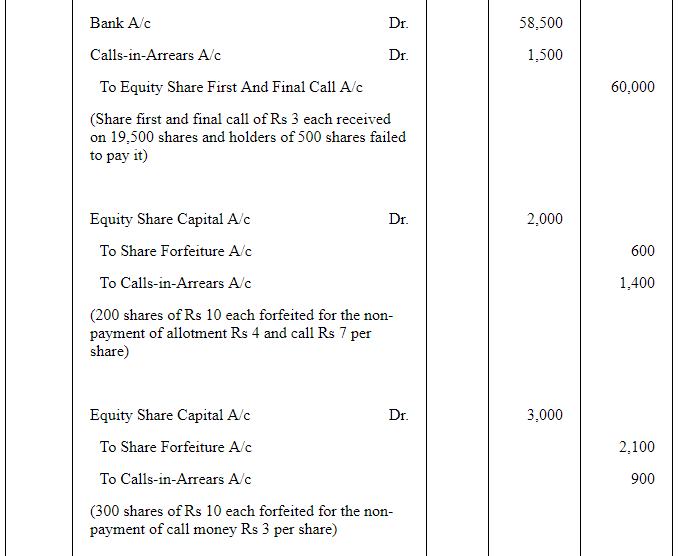

The above 500 shares are duly forfeited and 400 of these( including the 200 shares on which allotment money has not been paid) are reissued at ₹7 per share payable by the purchaser as fully paid-up. Pass journal entries (including cash transactions) and show the balances in the Balance Sheet giving effect to the above transactions.

ANSWER:

Authorised capital 20,000 shares of 10 each

Issued and applied 20,000 shares of Rs 10 each at a premium Rs 2

Payable as:

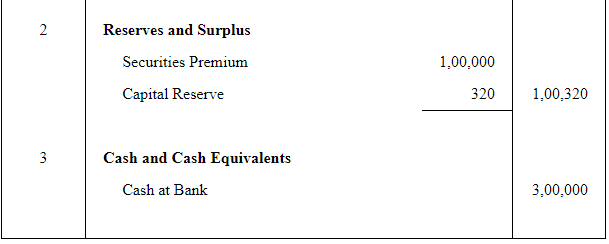

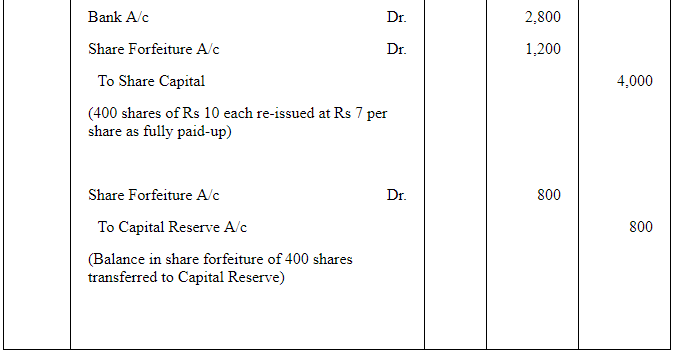

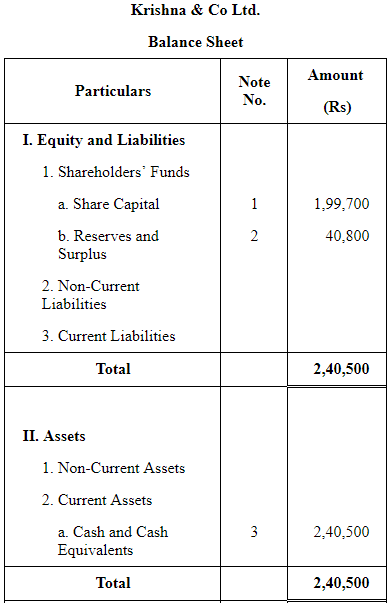

As per the Schedule III of Companies Act, 2013, the Company's Balance Sheet is presented as follows.

NOTES TO ACCOUNTS

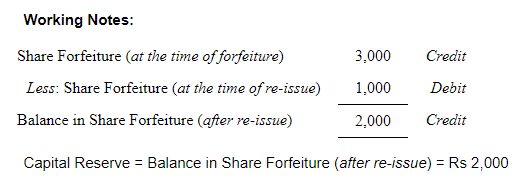

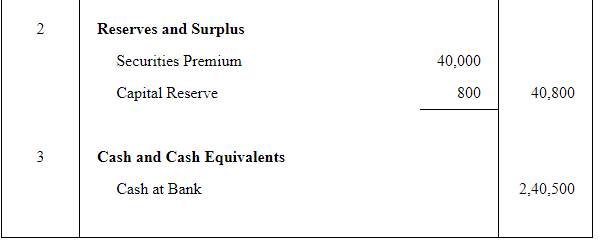

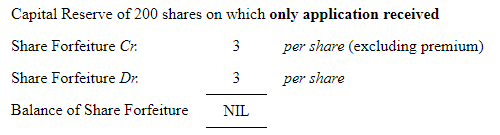

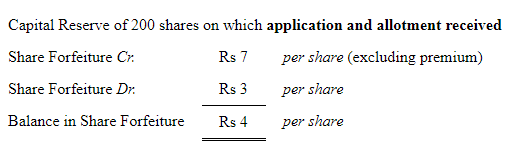

Working Notes:

1.

2.

Capital Reserve = 200 Shares × Balance of Share Forfeiture (per share)

= 200 × 4

= Rs 800

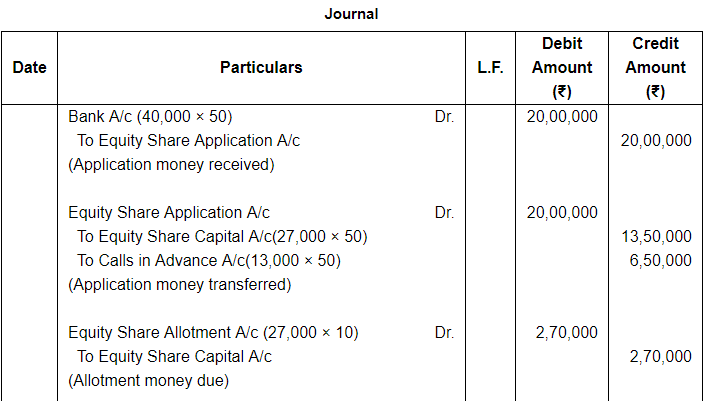

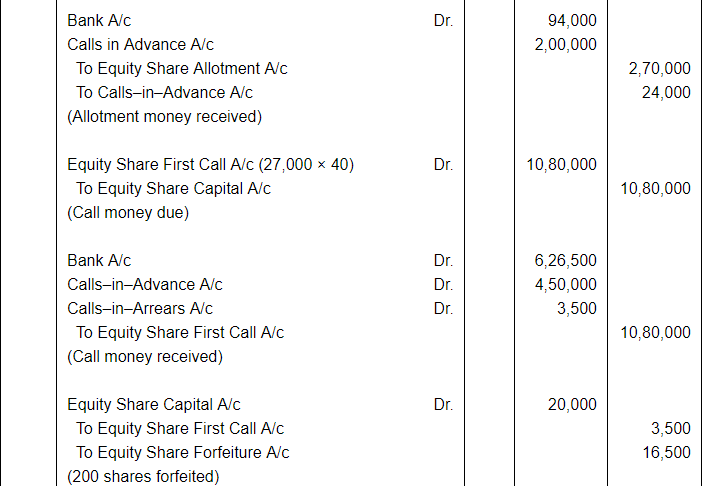

Question 73:

Midee Ltd. invited applications for issuing 27,000 shares of ₹ 100 each payable as follows:

₹ 50——per share on application;

₹ 10——per share on allotment; and

Balance——on First and Final call.

Applications were received for 40,000 shares. Full allotment was made to the applicants of 7,000 shares. The remaining applicants were allotted 20,000 shares on pro rata basis. Excess money received on applications was adjusted towards allotment and call.

Asha, holding 600 shares was belonged to the category of applicants to whom full allotment was made,paid the call money at the time of allotment . Ankur, who belonged to the category of applicants to whom shares were allotted on pro rata basis did not pay anything after application on his 200 shares . Ankur's shares were forfeited after the First and Final call. These shares were later reissued at ₹105 per share as fully paid-up.

Pass necessary journal entries in the books of Midee Ltd . for the above transactions, by opening Calls-in-Arrears and Calls-in-Advance Accounts wherever necessary.

ANSWER:

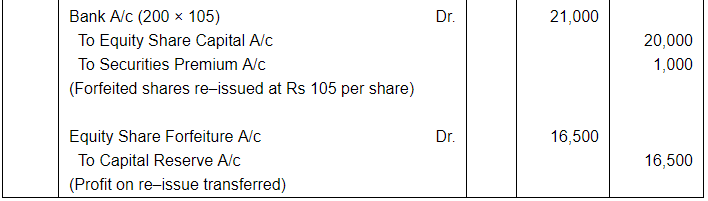

Question 74:

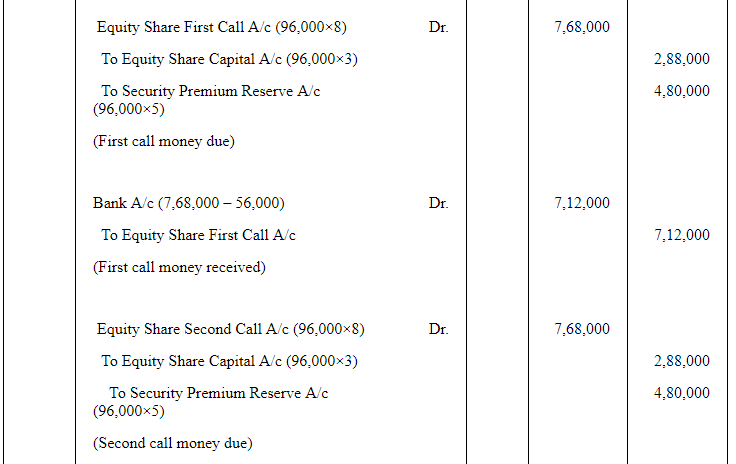

VXN Ltd. invited applications for issuing 50,000 equity shares of ₹10 each at a premium of ₹ 8 per share . The amount was payable as follows:

On Application —— ₹4 per share (Including ₹2 premium);

On Allotment —— ₹6 per share (Including ₹3 premium);

On First Call —— ₹5 per share (Including ₹1 premium); and

On Second and Final Call —— Balance Amount

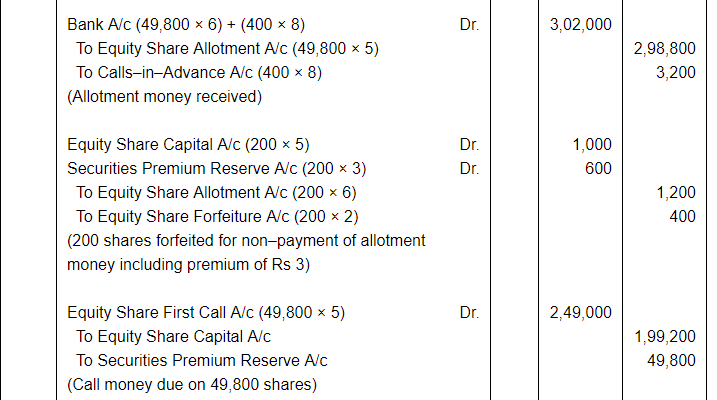

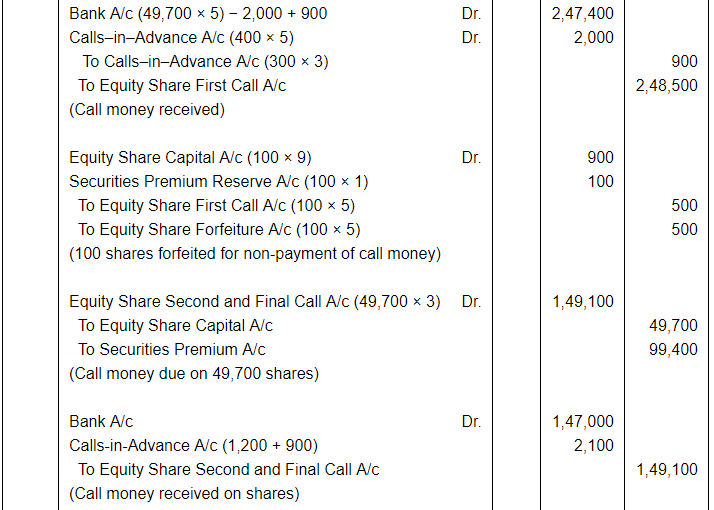

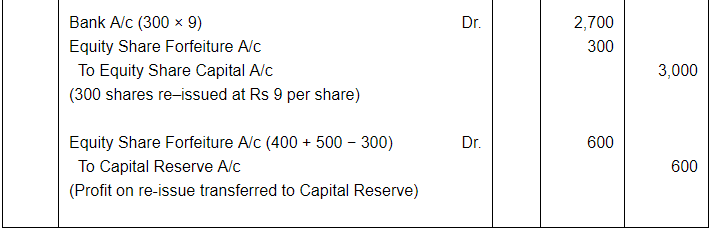

The issue was fully subscribed . Gopal, a shareholder holding 200 shares, did not pay the allotment money and Madhav, a holder of 400 shares, paid his entire share money along with the allotment money. Gopal's shares were immediately forfeited after allotment. Afterwards, the first call was made. Krishna, a holder of 100 shares, failed to pay the first call money and Girdhar, a holder of 300 shares, paid the second call money also along with the first call. Krishna's shares were forfeited immediately after the first call. Second and final call was made afterwards and was duly received. All the forfeited shares were reissued at ₹9 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of the company.

ANSWER:

Page No 8.125:

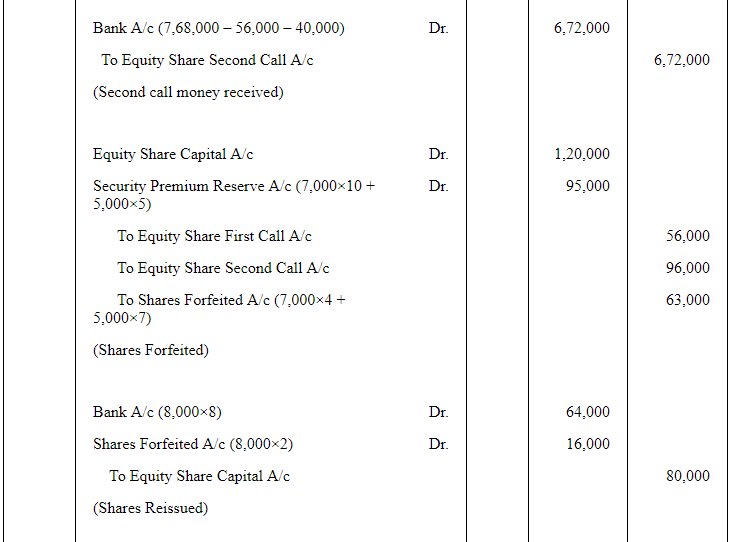

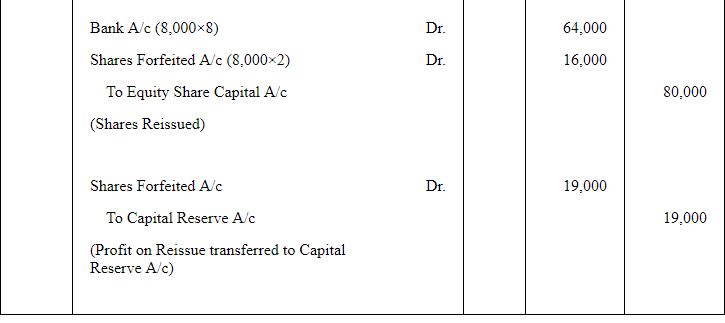

Question 75:

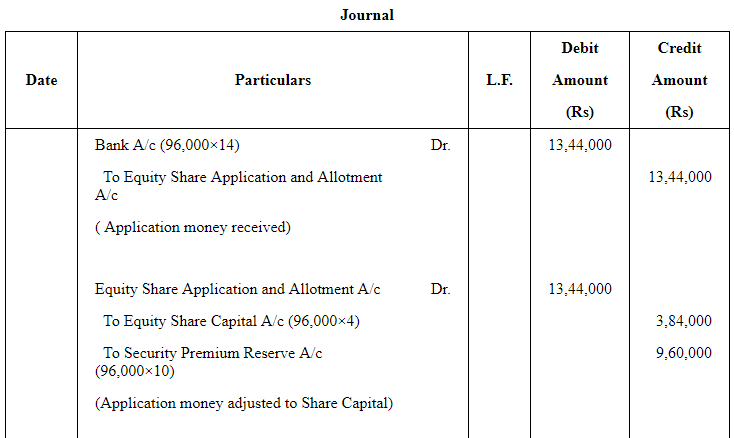

Sukanya Ltd. invited applications for issuing 1,00,000 equity shares of ₹ 10 each. The shares were issued at a premium of ₹ 20 per share. The amount was payable as follows:

On Application and Allotment —— ₹14 per share (including premium of ₹ 10),

On First Call —— ₹ 8 per share (including premium of ₹ 5),

On Final Call —— ₹ 8 per share (including premium of ₹ 5).

Applications for 96,000 shares were received. Rohit , a shareholder holding 7,000 shares, failed to pay both the calls and Namit , a holder of 5,000 shares , did not pay the final call.

Shares of Rohit and Namit were forfeited . Of the forfeited shares 8,000 shares including all the shares of Rohit were reissued to Reena at ₹ 8 per share fully paid-up.

Pass necessary journal entries for the above transactions in the books of Sukanya Ltd.

ANSWER:

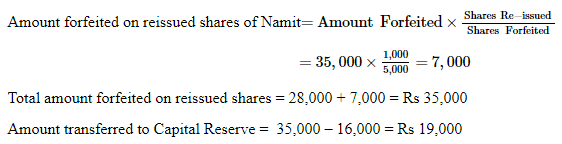

Working Notes:

WN1: Amount transferred to Capital Reserve

Amount forfeited on reissued shares of Rohit = Rs 28,000

Question 76:

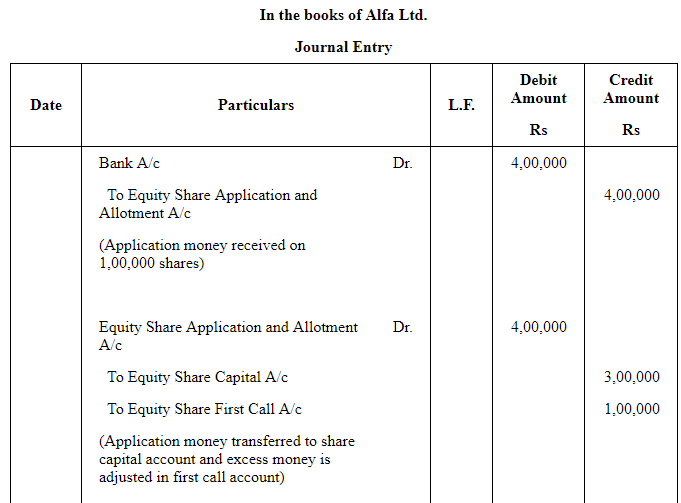

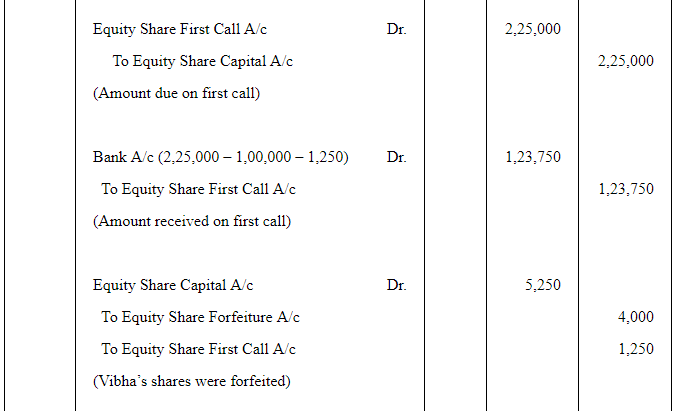

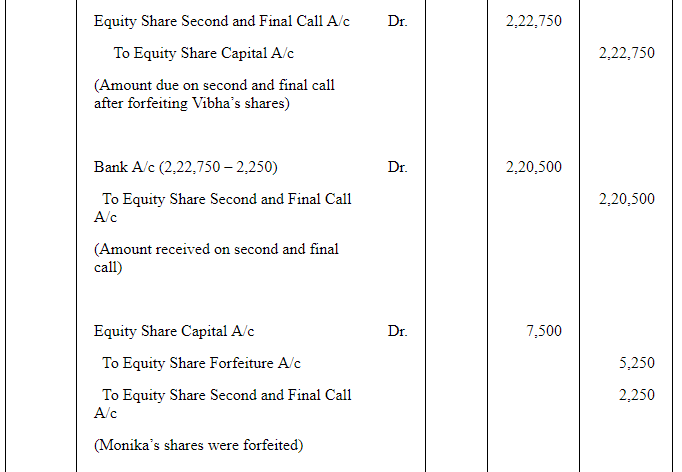

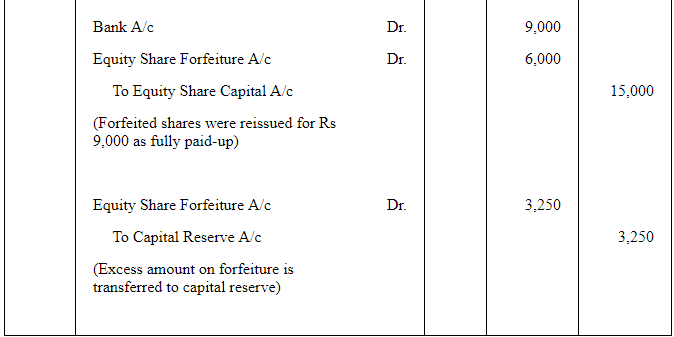

Alfa Ltd. invited applications for issuing 75,000 equity shares of ₹10 each. The amount was payable as follows:

On application and allotment —— ₹4 per share,

On first Call —— ₹3 per share,

On second and final Call —— balance.

Applications for 1,00,000 shares were received. Shares were allotted to all the applicants on pro rata basis and excess money received with applications was transferred towards sums due on first call. Vibha who was allotted 750 shares failed to pay the first call . Her shares were immediately forfeited . Afterwards the second call was made. The amount due on second call was also received except on 1,000 shares applied by Monika. Her shares were also forfeited. All the forefited shares were reissued to Mohit for ₹9,000 as fully paid-up.

Pass necessary journal entries in the Books of Alfa Ltd . for the above transactions.

ANSWER:

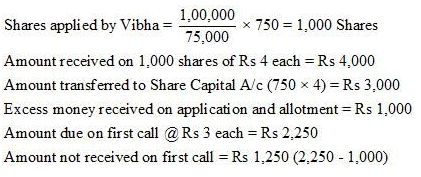

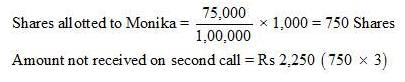

Working Notes:

WN1: Calculation of Amount not received on First Call

WN2: Calculation of Amount not received on Second Call

Question 77:

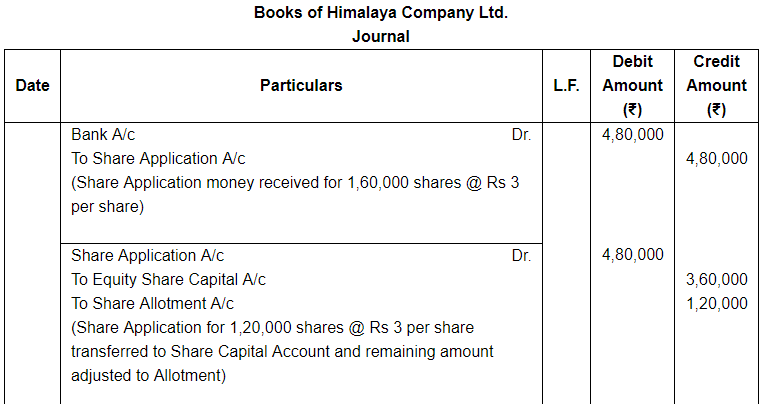

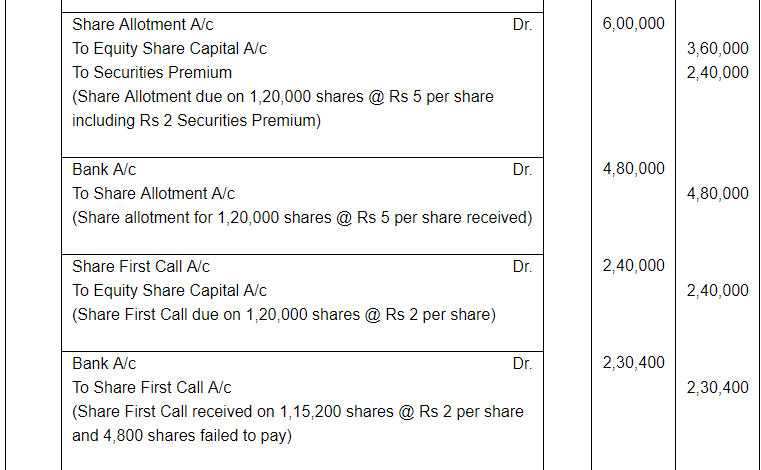

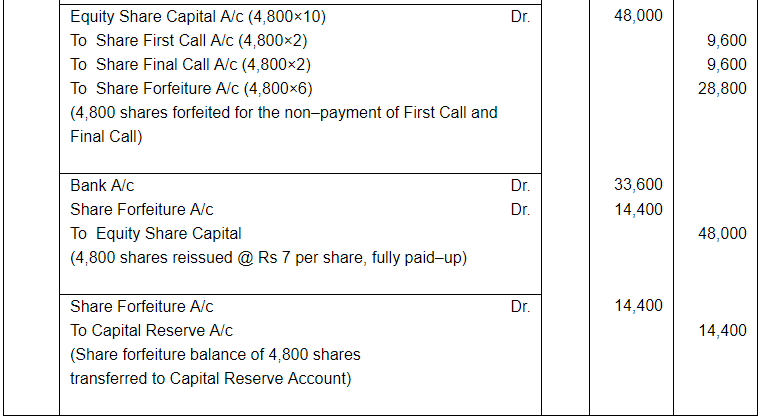

Himalaya Company Limited issued for public subscription 1,20,000 equity shares of ₹ 10 each at a premium for ₹ 2 per share payable as under

With Application —— ₹3 per share,

On allotment (including premium) —— ₹ 5 per share,

On First call —— ₹ 2 per share

On Second and Final call —— ₹ 2 per share.

Applications were received for 1,60,000 shares . Allotment was made on pro rata basis . Excess money on application were adjusted against the amount due on allotment.

Rohan to whom 4,800 shares were allotted failed to pay for the two calls. These shares were subsequently forfeited after the second call was made . All the shares forfeited were reissued to Teena as fully paid at ₹ 7 per share.

Record journal entries and show the transactions relating to share capital in the company's Balance Sheet.

ANSWER:

Question 78:

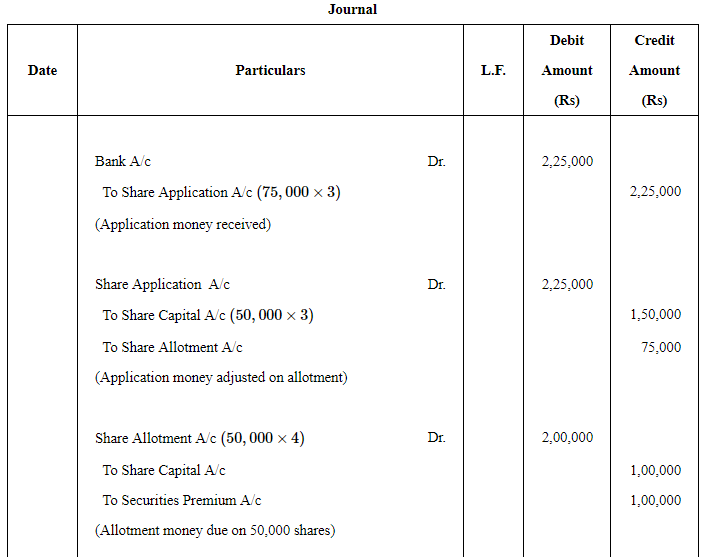

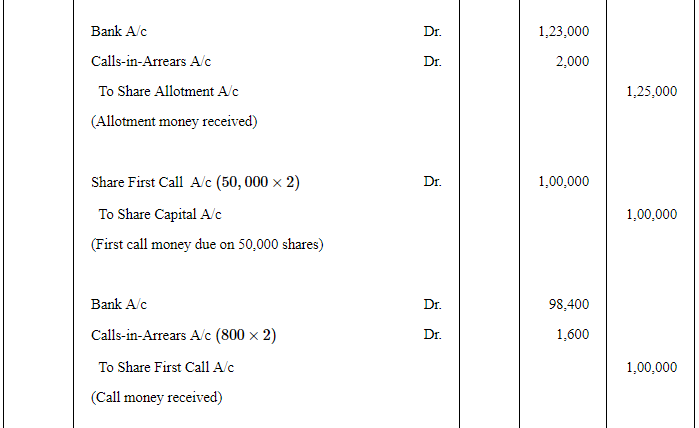

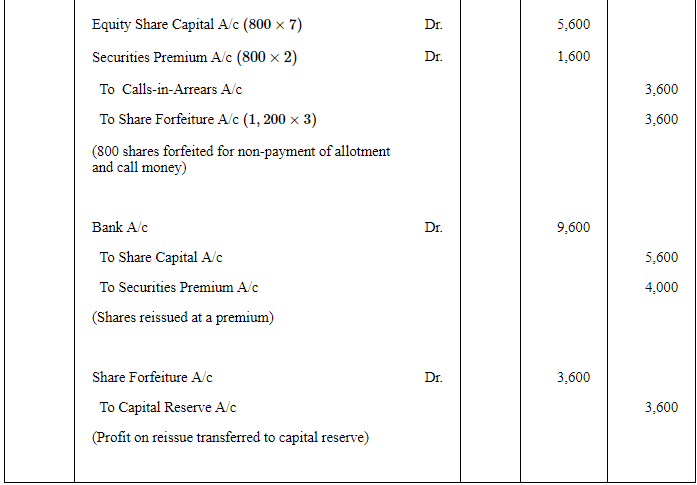

Amrit Ltd. issued 50,000 shares of ₹ 10 each at a premium of ₹2 per share payable as ₹3 on application, ₹4 on allotment (including premium) , ₹2 on first call and the remaining on second call.

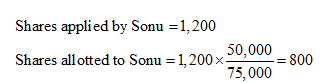

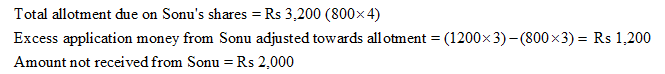

Applications were received for 75,000 shares and pro rata allotment was made to all the applicants.

All moneys due were received except allotment and first call from Sonu who applied for 1,200 shares. All his shares were forfeited. The forfeited shares were reissued for ₹9,600. Final call was not made . Pass necessary Journal entries.

ANSWER:

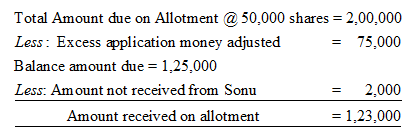

Working Notes:

WN1 Calculation of No. of Shares Allotted to Sonu

WN2 Calculation of Amount Received on Allotment

Page No 8.126:

Question 79:

Dogra Ltd. had an authorised capital of ₹1,00,00,000 divided into Equity Shares of ₹100 each. The company offered 84,000 shares to the public at premium.

The amount was payable as follow:

On Application —— ₹30 per share,

On Allotment —— ₹40 per share(including premium),

On First and Final call —— ₹50 per share.

Applications were received for 80,000 shares.

All sums were duly received except the following:

Lakhan, a holder of 200 shares did not pay allotment and call money.

Paras, a holder of 400 shares did not pay call money.

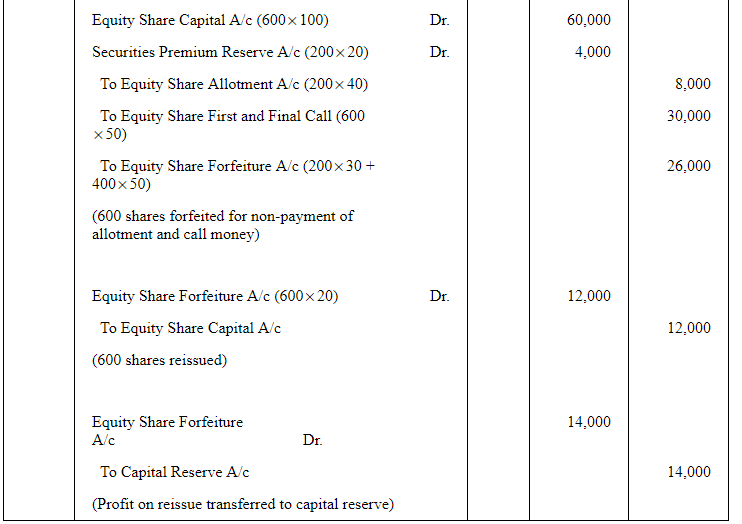

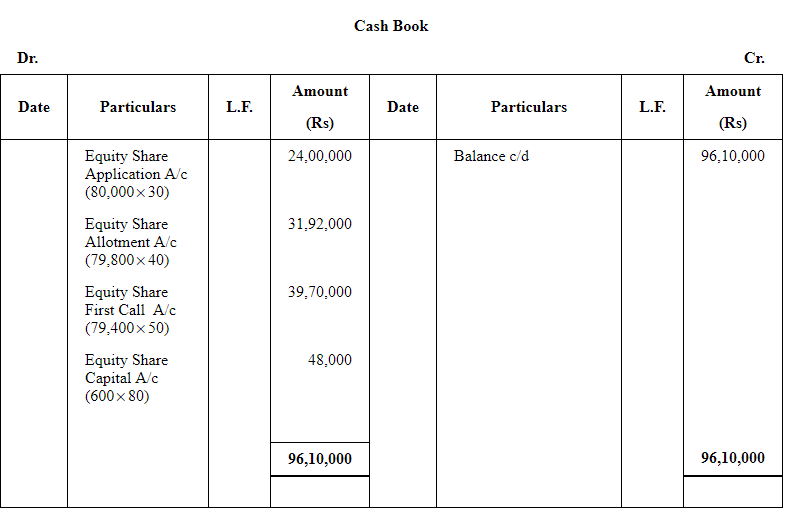

The company, forfeited the shares of Lakhan and Paras. Subsequently the forfeited shares were reissued for ₹ 80 per share as fully paid-up . Show the entries for the above transactions in the Cash Book and journal of the company

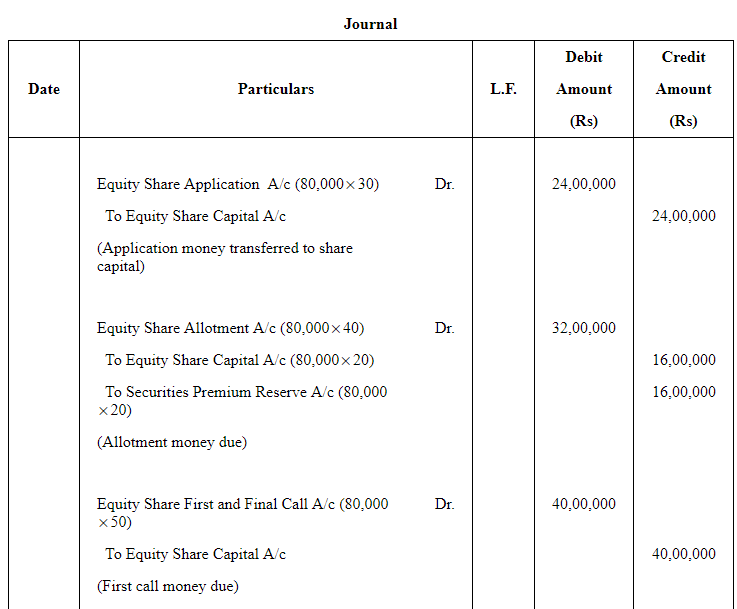

ANSWER:

|

42 videos|168 docs|43 tests

|

FAQs on Accounting for Share Capital (Part - 4) - Accountancy Class 12 - Commerce

| 1. What is share capital? |  |

| 2. What are the types of share capital? |  |

| 3. How is share capital calculated? |  |

| 4. Can a company change its share capital? |  |

| 5. What is authorized share capital? |  |