Issue of Debentures ( Part - 2) | Accountancy Class 12 - Commerce PDF Download

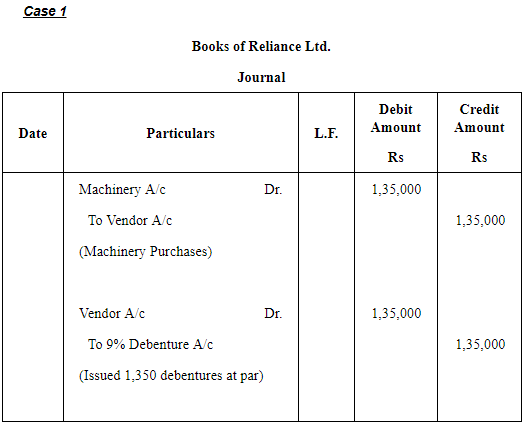

Page No 9.54:

Question 16:

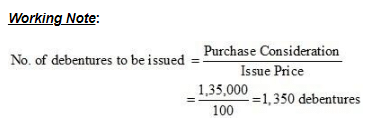

Reliance Ltd. purchased machinery costing ₹1,35,000. It was agreed that the purchase consideration be paid by issuing 9% Debentures of ₹100 each. Assume debentures have been issued

(i) at par and

(ii)at a discount of 10%.

Give necessary journal entries.

ANSWER:

Case 2

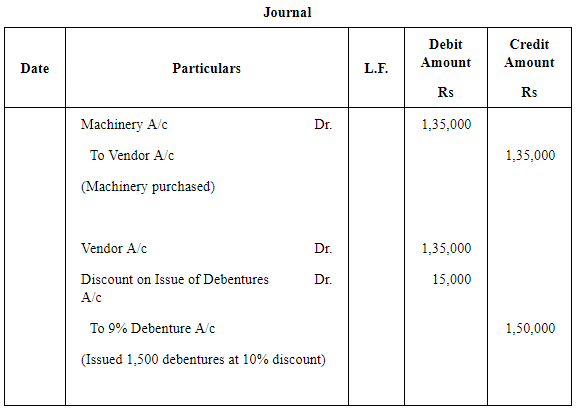

Question 17:

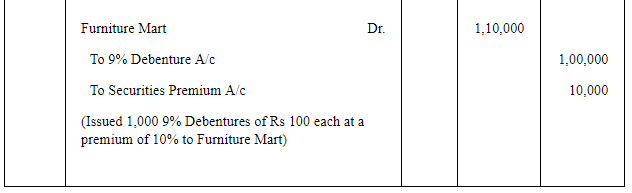

Deepak Ltd purchased furniture of ₹2,20,000 from M/s. Furniture Mart. 50% of the amount was paid to M/s. Furniture Mart by accepting a Bill of Exchanged and for the balance the company issued 9% Debenture of ₹100 each at a premium of 10% in favour of M/s. Furniture Mart.

Pass Journal entries in the books of Deepak Ltd.

ANSWER:

Question 18:

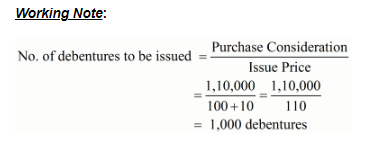

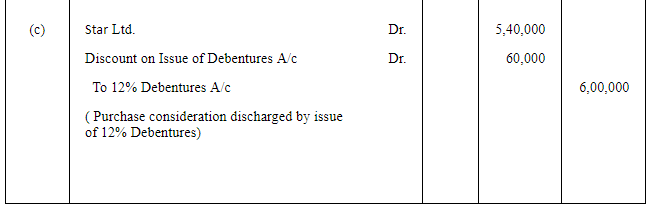

Bright Ltd. took over the assets of ₹6,60,000 and liabilities of ₹80,000 of Star Ltd. for an agreed purchase consideration of ₹6,00,000 payable 10% in cash and the balance by the issue of 12% Debentures of ₹100 each. Give necessary Journal entries in the books of Bright Ltd., assuming that:

Case (a): The debentures are issued at par.

Case (b): The debentures are issued at 20% premium.

Case (c): The debentures are issued at 10% discount.

ANSWER:

Question 19:

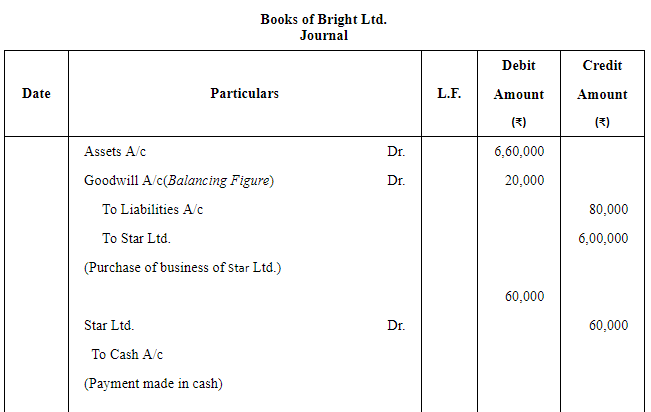

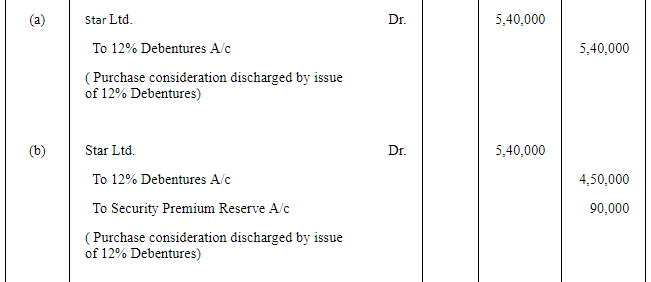

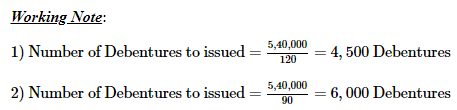

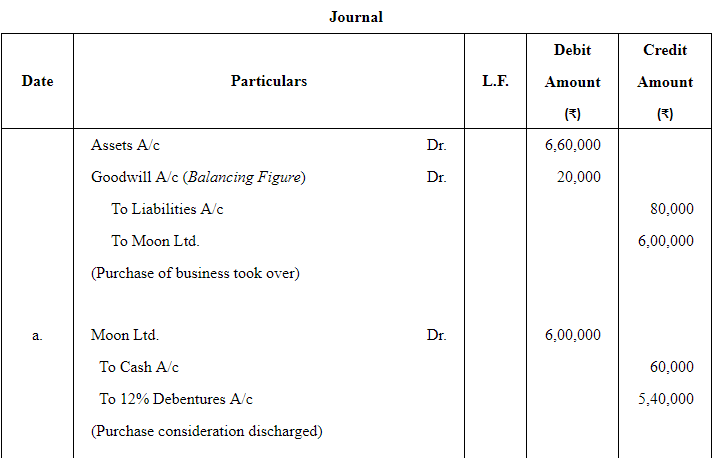

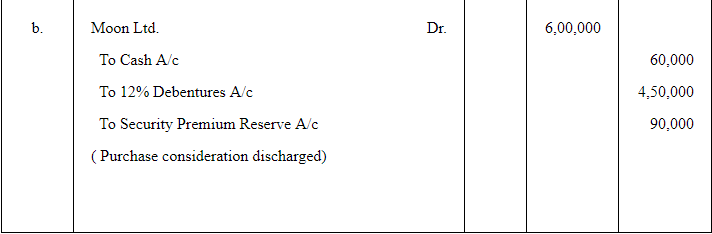

Star Ltd. took over the assets of ₹6,60,000 and liabilities of ₹80,000 of Moon Ltd. for ₹6,00,000. Give necessary Journal entries in the books of Star Ltd. assuming that:

Case (a): The purchase consideration was payable 10% in cash and the balance in 5,400; 12% Debentures of ₹100 each.

Case (b): The purchase consideration was payable 10% in cash and the balance in 4,500; 12% Debentures of ₹100 each issued at 20% premium.

ANSWER:

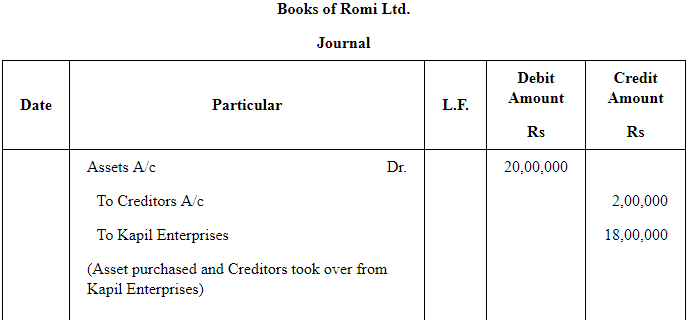

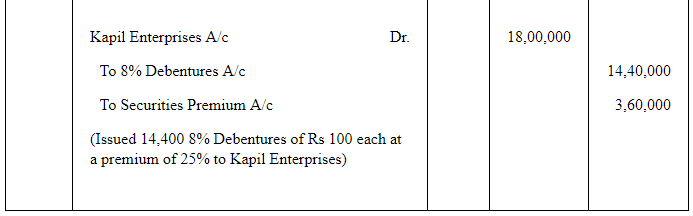

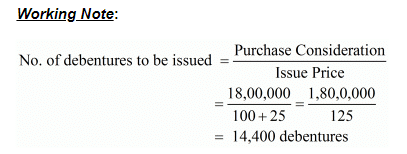

Question 20:

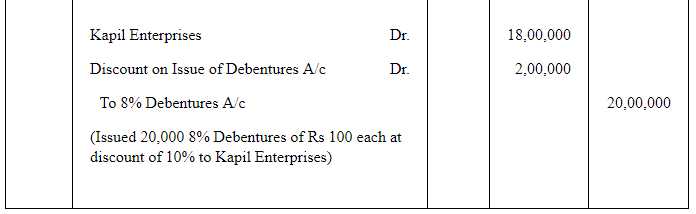

Romi Ltd. acquired assets of ₹20 lakhs and took over creditors of ₹2 lakhs from Kapil Enterprises.

Romi Ltd. issued 8% Debentures of ₹100 each at a discount of 25% as purchase consideration.

Record necessary journal entries in the books of Romi Ltd.

ANSWER:

Question 21:

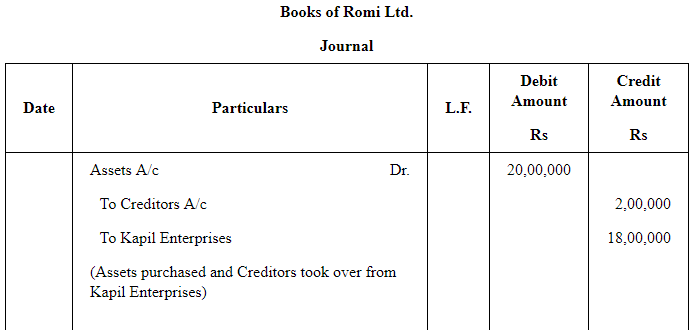

Romi Ltd. acquired assets of ₹20 lakhs and took over creditors of ₹2 lakhs from Kapil Enterprises.

Romi Ltd. issued 8% Debentures of ₹100 each at a discount of 10% as purchase consideration.

Record necessary journal entries in the books of Romi Ltd.

ANSWER:

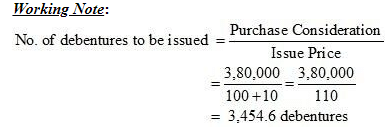

Question 22:

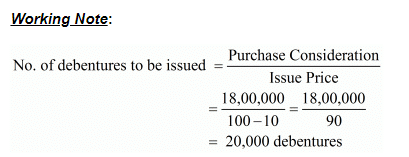

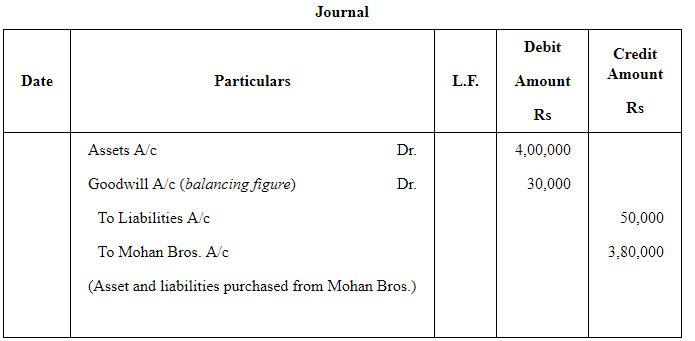

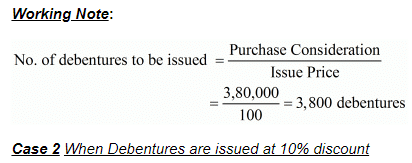

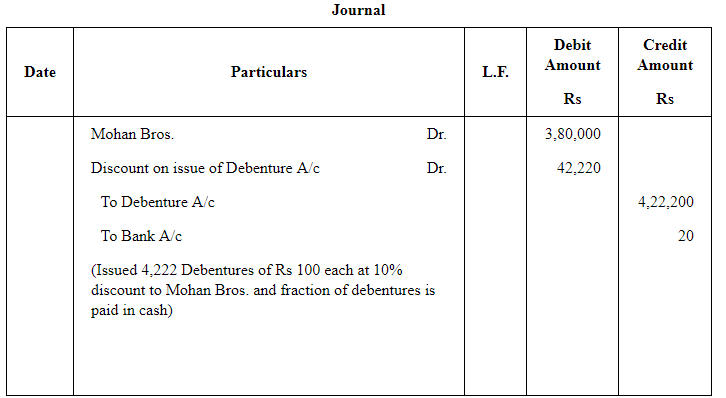

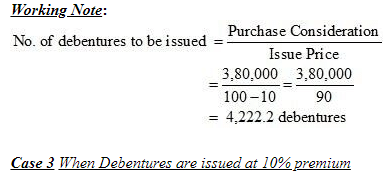

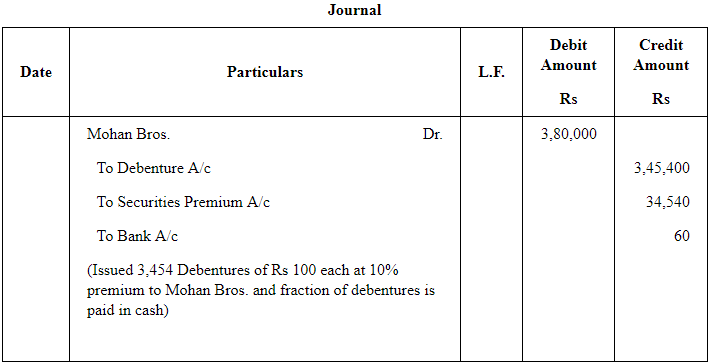

Exe Ltd. purchased the assets of the book value ₹4,00,000 and took over the liabilities of ₹50,000 from Mohan Bros.It was agreed that the purchase consideration ,settled at ₹3,80,000 be paid by issuing debentures of ₹100 each.

Pass journal entries if debenture are issued:

(a) at par

(b) at a discount of 10% and

(c) at a premium of 10%.

It was agreed that any fraction of debentures be paid in cash.

ANSWER:

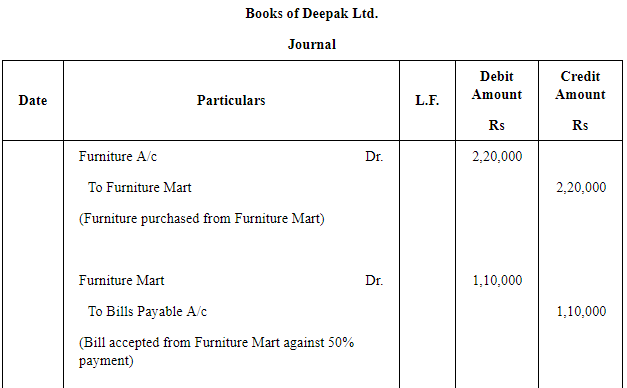

Case 1 When Debentures are issued at Par

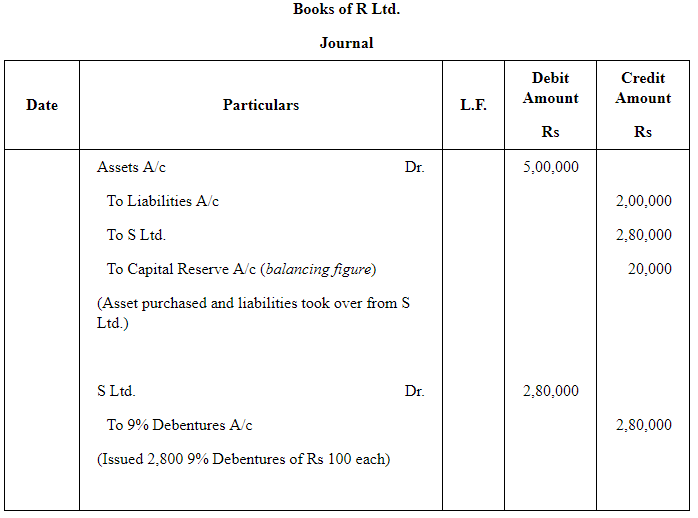

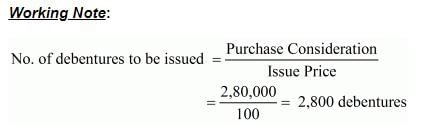

Question 23:

R Ltd. purchased the assets of S Ltd. for ₹5,00,000. It also agreed to take over the liabilities of S Ltd. amounted to ₹2,00,000 for a purchase consideration of ₹2,80,000 .

The payment of S Ltd. was made by issue of 9% Debentures of ₹100 each at par.

Pass necessary journal entries in the books of R Ltd.

ANSWER:

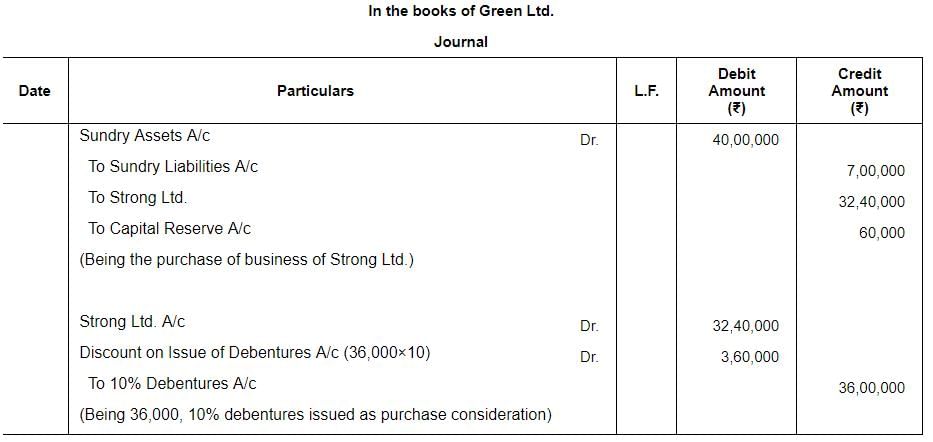

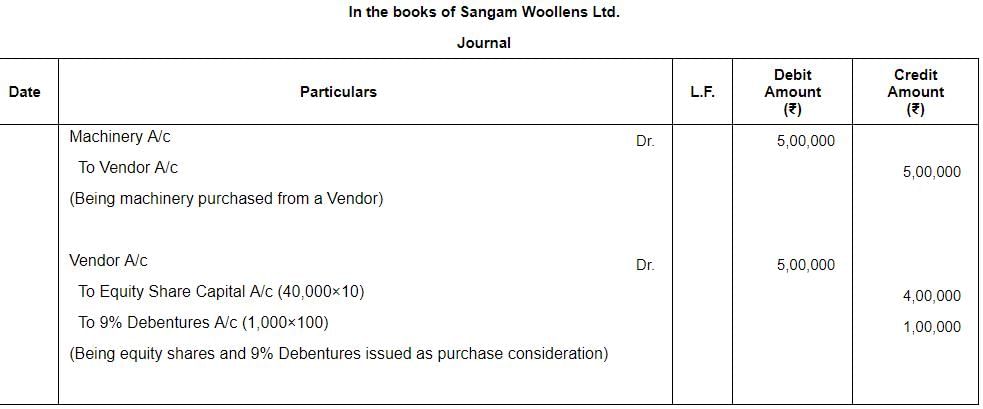

Question 24:

Green Ltd. purchased the assets of Strong Ltd. for ₹40,00,000 and took over liabilities of 7,00,000 at an agreed value of ₹32,40,000. Payment was made by issuing 10% Debentures of 100 each at a discount of 10%. Pass the necessary Journal entries in the books of Green Ltd.

ANSWER:

Working Notes:

Number of Debentures issued= (32,40,000/90) = 36,000 debentures

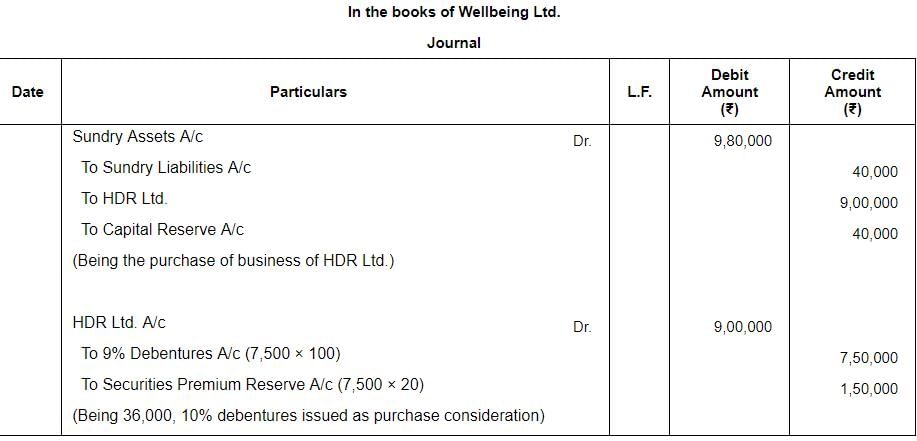

Question 25:

Wellbeing Ltd. took over assets of ₹9,80,000 and liabilities of ₹40,000 of HDR Ltd. at an agreed value of ₹9,00,000. Wellbeing Ltd. paid to HDR Ltd. by issue of 9% Debentures of ₹100 each at a premium of 20%. Pass necessary Journal entries to record the above transactions in the books of Wellbeing Ltd.

ANSWER:

Working Notes:

Number of Debentures issued = (9,00,000/120) = 7,500 debentures

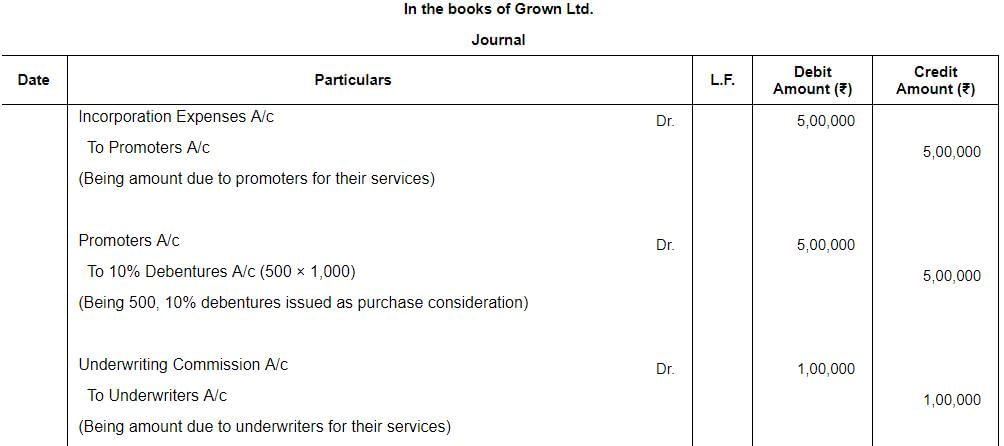

Question 26:

Grown Ltd. issued 500, 10% Debentures of ₹1,000 each credited as fully paid-up to the promoters for their services to incorporate the company. It also issued 100, 10% Debentures of ₹1,000 each credited as fully paid-up to the underwriters towards their commission. Pass the Journal entries.

ANSWER:

Page No 9.55:

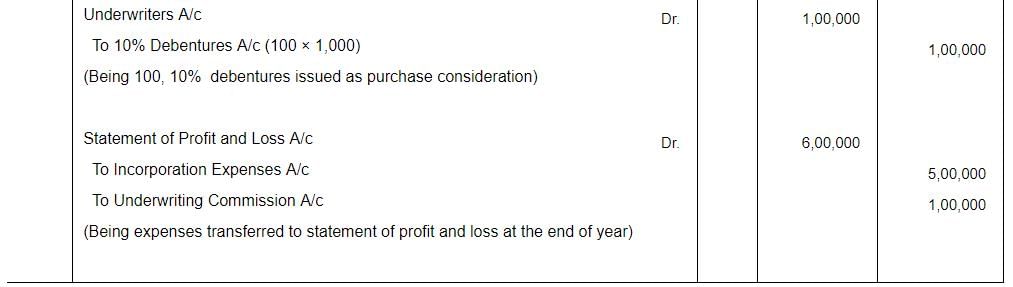

Question 27:

'Sangam Woollens Ltd.', Ludhiana, are the manufacturers and exporters of woollen garments. The company decided to distribute free of cost woollen garments to 10 villages of Lahaul and Spiti District of Himachal Pradesh. The company also decided to employ 50 young persons from these villages in its newly established factory. The company issued 40,000 Equity Shares of ₹10 each and 1,000, 9% Debentures of ₹100 each to the vendor for the purchase of machinery of ₹5,00,000. Pass necessary Journal entries.

ANSWER:

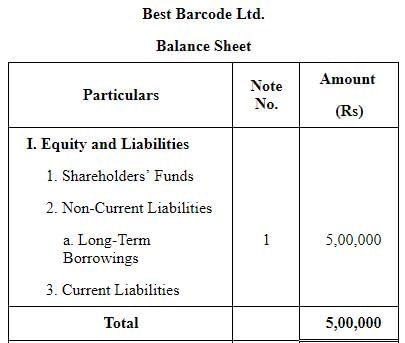

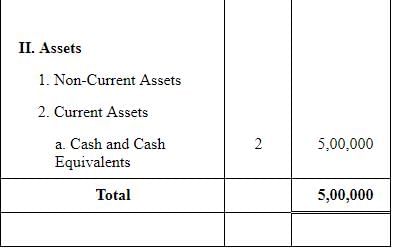

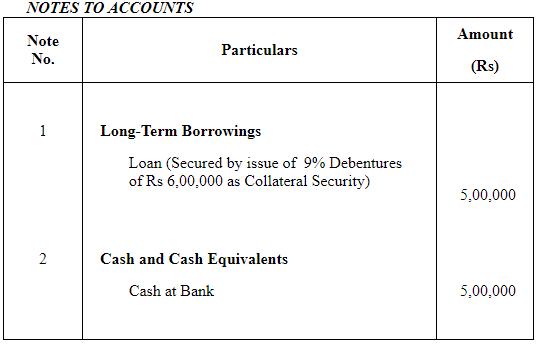

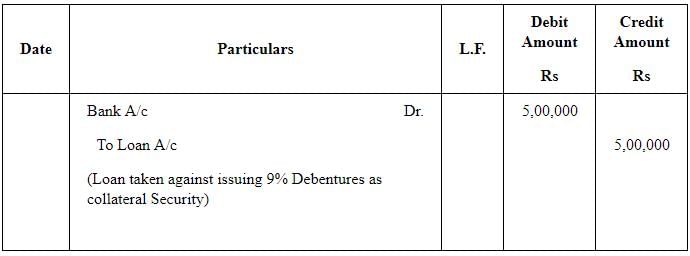

Question 28:

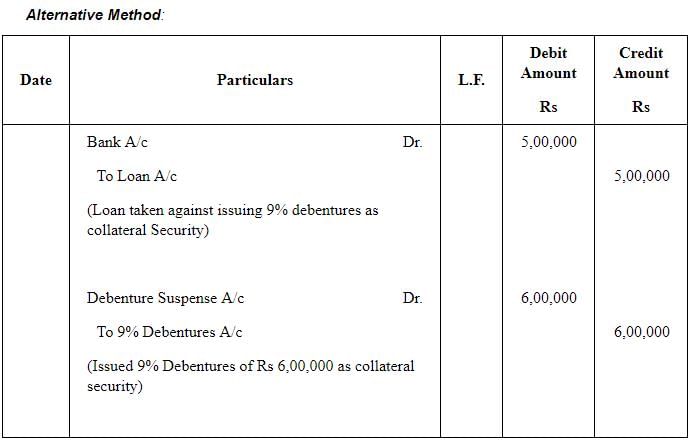

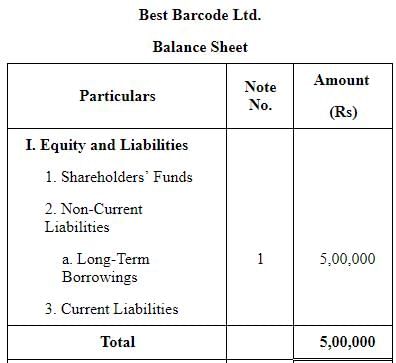

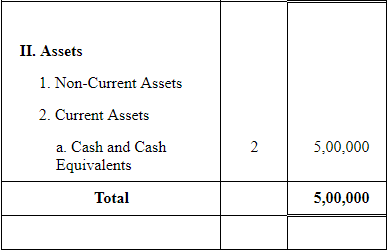

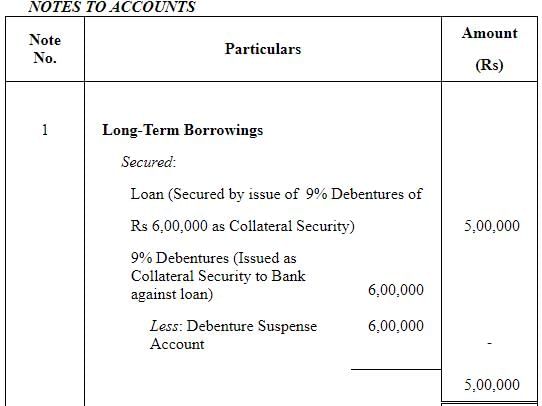

Best Barcode Ltd. took a loan of ₹5,00,000 from a bank giving ₹6,00,000; 9% Debentures as collateral security. Pass journal entries regarding issue of debentures, if any, and show this loan in the Balance Sheet of the company.

ANSWER:

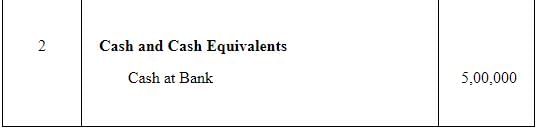

Posting in the Company's Balance Sheet

Question 29:

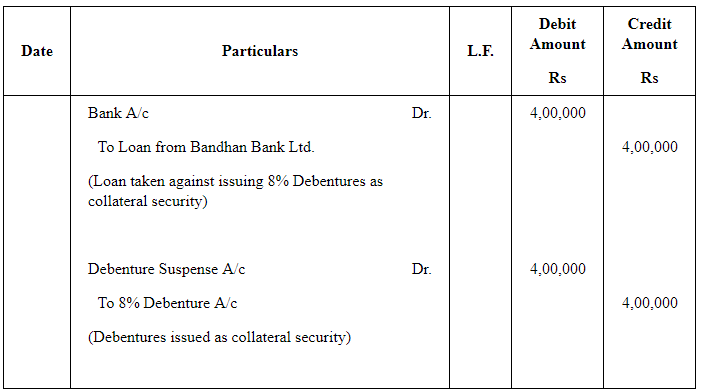

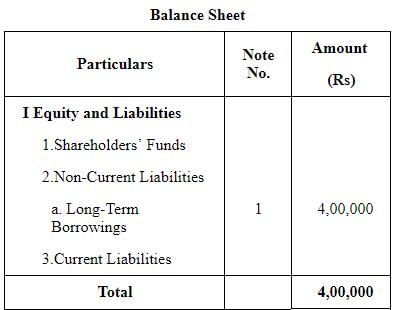

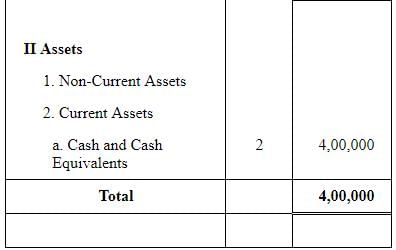

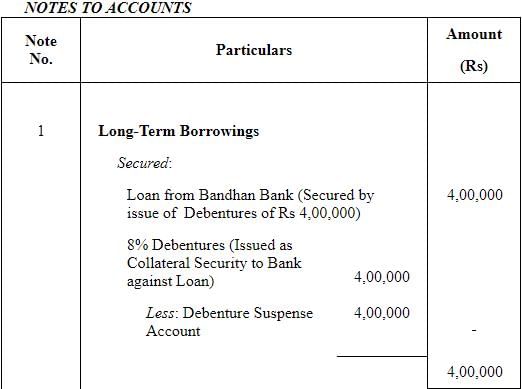

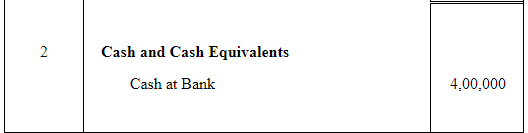

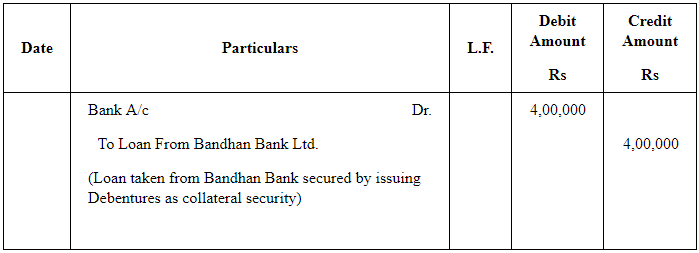

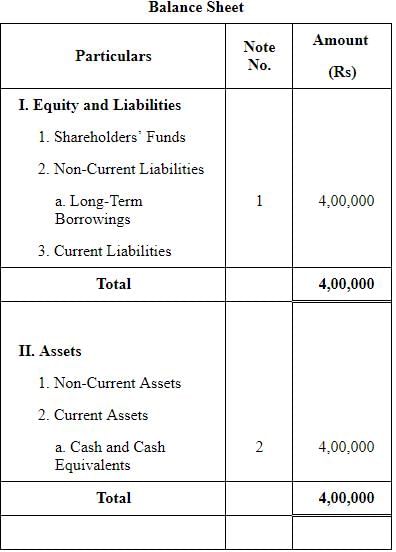

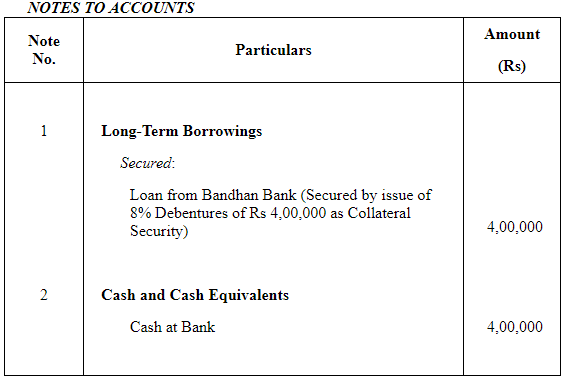

A company took a loan of ₹4,00,000 from Bandhan Bank Ltd. and issued 8% Debentures of ₹4,00,000 as a collateral security.

ANSWER:

When Debentures Issued as Collateral Security are shown separately

Posting in the Company's Balance Sheet (When Debentures Issued as Collateral Security are shown separately)

Alternative Method: When debentures Issued as Collateral Security are not shown separately

(When Debentures Issued as Collateral Security are not shown separately)

|

42 videos|199 docs|43 tests

|

FAQs on Issue of Debentures ( Part - 2) - Accountancy Class 12 - Commerce

| 1. What is the process of issuing debentures? |  |

| 2. What are the advantages of issuing debentures for a company? |  |

| 3. What are the risks associated with investing in debentures? |  |

| 4. Can debentures be converted into equity shares? |  |

| 5. What is the role of a debenture trustee? |  |