Page No 10.29:

Question 1:

Star Ltd. is a manufacturer of chemical fertilisers. Its annual turnover is ₹ 50 crores. The company had issued 5,000, 12% Debentures of ₹ 500 each at par. Calculate the amount of Debentures Redemption Reserve which needs to be created to meet the requirements of law.

ANSWER:

Amount required to be transferred to DRR=25% of Face value of Debentures =25% of Rs 25,00,000=Rs 6,25,000

Amount required to be transferred to DRR=25% of Face value of Debentures =25% of Rs 25,00,000=Rs 6,25,000

Question 2:

Young India Ltd. had issued following debentures:

(a) 1,00,000, 10% fully convertible debentures of ₹ 100 each on 1st April, 2016 redeemable by conversion after 5 years.

(b) 20,000, 10% Debentures of ₹ 100 each redeemable after 4 years , 25% Debentures in Cash and 75% by conversion.

State the amount of DRR required to be created as per the Companies Act,2013.

ANSWER:

(a) There is no need for creation of DRR because these debentures are fully convertible.

(b) DRR would be created for non-convertible part of debentures.

Amount Required to be transferred to DRR=25% of Face value of Debentures(Non-convertible) =25% of Rs 5,00,000(20,00,000×25%)=₹ 1,25,000

Amount Required to be transferred to DRR=25% of Face value of Debentures(Non-convertible) =25% of Rs 5,00,000(20,00,000×25%)=₹ 1,25,000

Question 3:

Dow Ltd. issued ₹ 2,00,000; 8% Debentures of ₹ 10 each at a premium of 8% on 30th June, 2016 redeemable on 31st March, 2018. How much amount should be transferred to Debentures Redemption Reserve before redemption of debentures?

ANSWER:

Section 71 (4) of the Companies Act, 2013 requires that an amount equal to at least 25% of the value of debentures is to be transferred to the Debenture Redemption Reserve Account. Accordingly, Rs 50,000 is required to be transferred to DRR (i.e. 25% of 2,00,000) before the actual date of redemption of debentures.

Question 4:

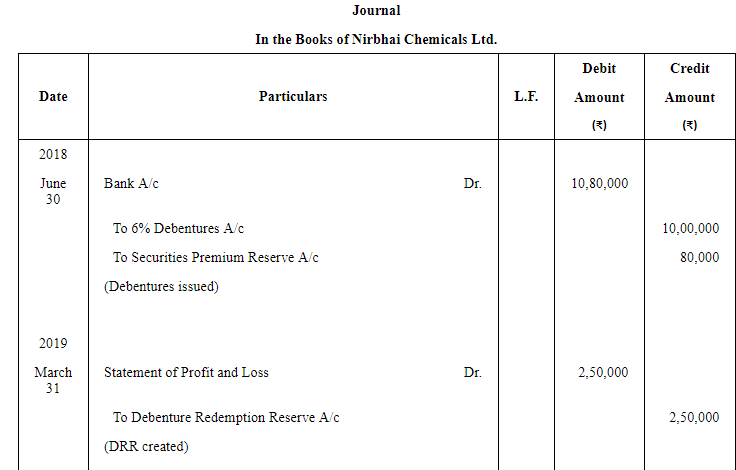

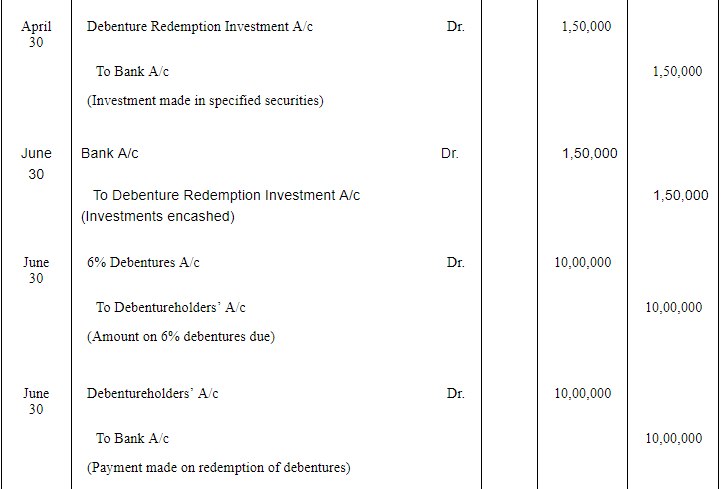

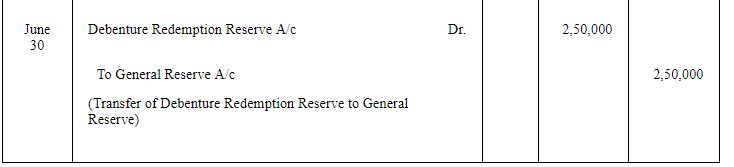

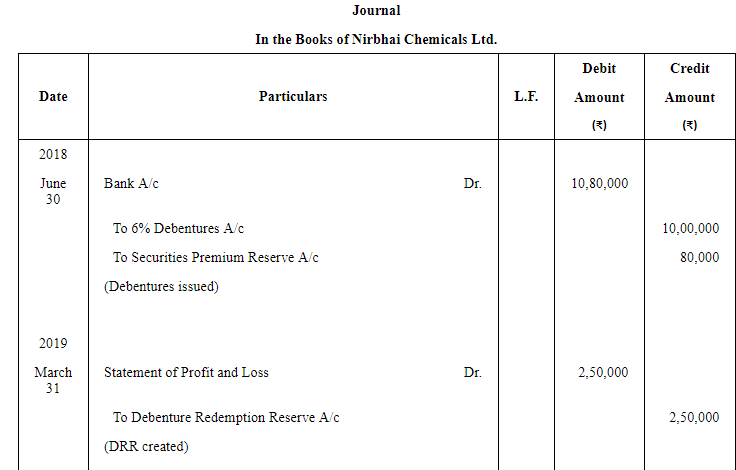

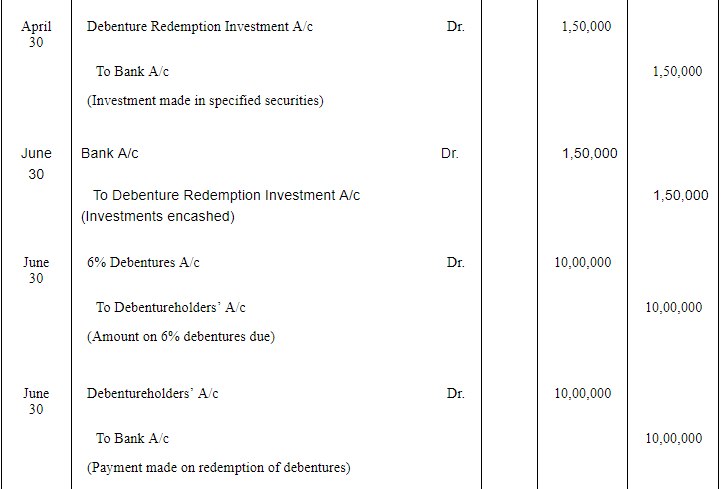

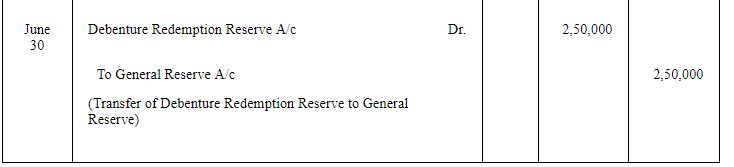

Nirbhai Chemicals Ltd. issued ₹ 10,00,000; 6% Debentures of ₹ 50 each at a premium of 8% on 30th June, 2018 redeemable on 30th June, 2019. The issue was fully subscribed. Pass Journal entries for issue and redemption of debentures. How much amount should be transferred to Debentures Redemption Reserve before redemption of debentures? Also, state how much amount should be invested in specified securities?

ANSWER:

Section 71 (4) of the Companies Act, 2013 requires that an amount equal to at least 25% of the value of debentures is to be transferred to the Debenture Redemption Reserve Account. So, Rs 2, 50,000 is required to be transferred to DRR (i.e. 25% of 10,00,000). Further, Rule 18 (7) requires every company that is required to create DRR to invest an amount at least equal to 15% of the value of debentures in specified securities. So, Rs 1,50,000 is to be invested in specified securities (i.e. 15% of 10,00,000).

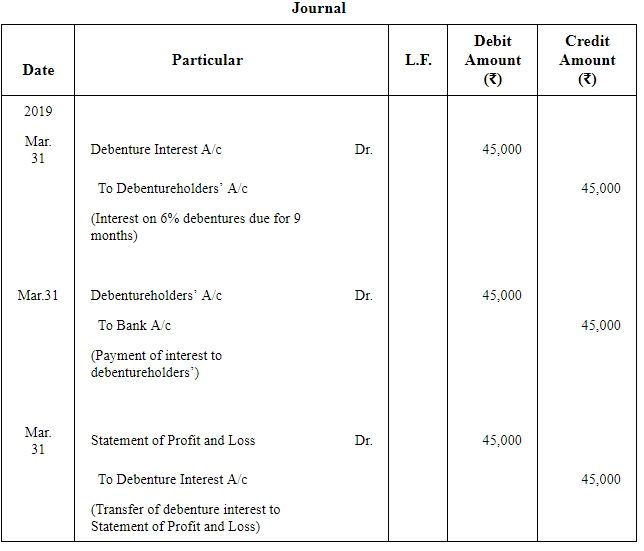

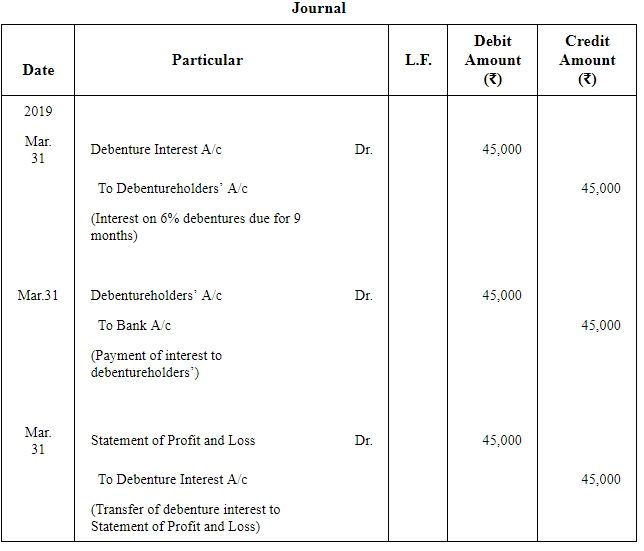

Note: Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures as given below.

Question 5:

Export-Import Bank of India (EXIM Bank) issued 20,000, 10% Debentures of ₹ 100 each through public issue and 10,000, 10% Debentures of ₹ 100 each through private placement . State the amount of investment to be made by EXIM Bank before redemption of debentures.

ANSWER:

The Companies Act, 2013 exempts Banking Companies to invest in specified securities.

Question 6:

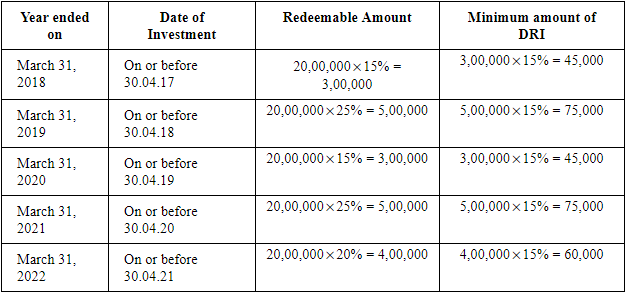

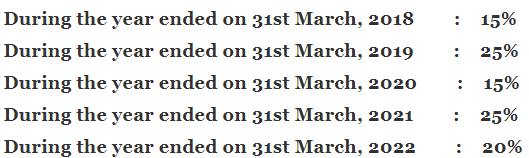

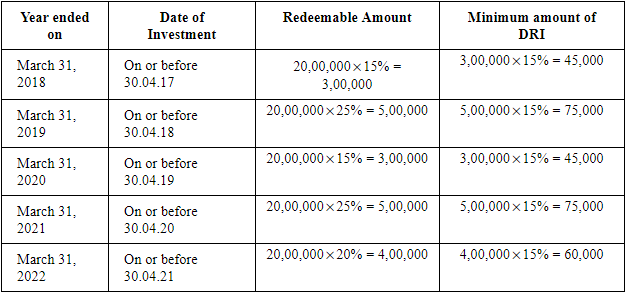

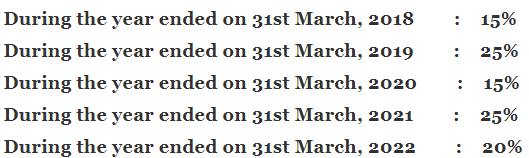

SRCC Ltd. has issued on 1st April, 2017, 20,000, 12% Debentures of ₹ 100 each redeemable by draw of lots as under:

How much minimum investment should be made by SRCC Ltd. as per Companies Act, 2013 before redemption of debentures? When should it be made?

ANSWER:

Amount to be invested in specified securities: