Issue of Debentures ( Part - 3) | Accountancy Class 12 - Commerce PDF Download

Question 30:

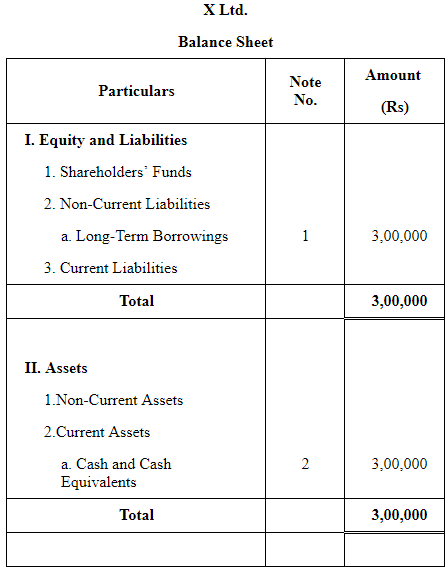

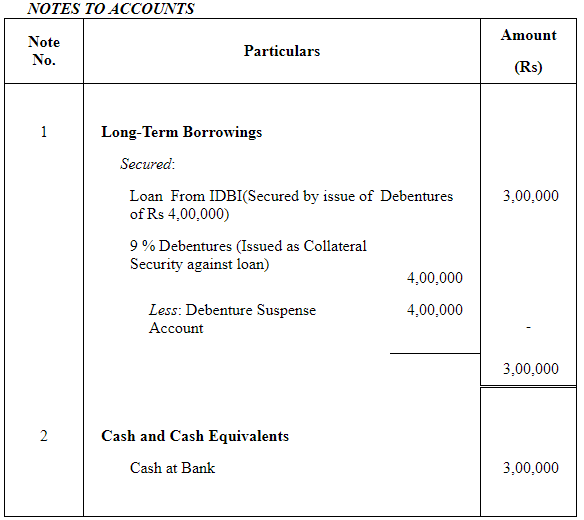

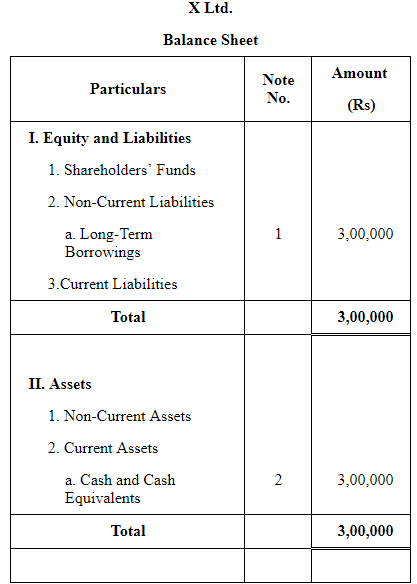

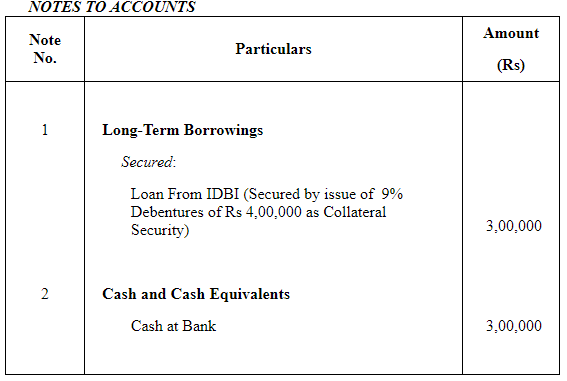

X Ltd. took a loan of ₹3,00,000 from IDBI Bank . The company issued 4,000; 9% Debentures of ₹100 each as a collateral security for the same. Show how these items will be presented in the Balance Sheet of the company.

ANSWER:

When Debentures Issued as Collateral Security is shown separately

Alternative Method: When Debentures Issued as Collateral Security are not shown separately

Question 31:

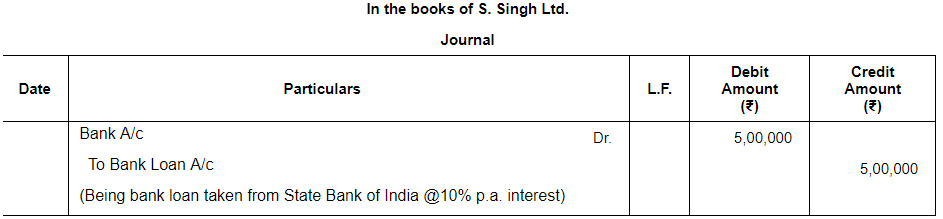

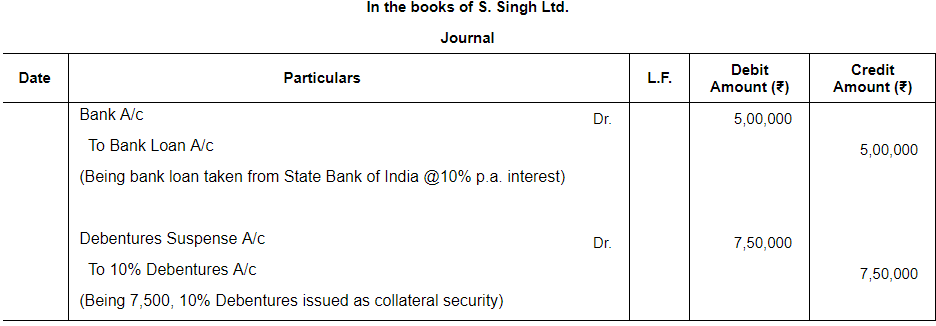

S. Singh Limited obtained a loan of ₹5,00,000 from State Bank of India @ 10% p.a. interest. The company issued ₹7,50,000, 10% Debentures of ₹100 each in favour of State Bank of India as Collateral Security. Pass necessary Journal entries for the above transactions:

(i) When company decided not to record the issue of 10% Debentures as Collateral Security.

(ii) When company decided to record the issue of 10% Debentures as Collateral Security.

ANSWER:

(i) When company decided not to record the issue of 10% debentures as Collateral Security

(ii) When company decided to record the issue of 10% debentures as Collateral Security

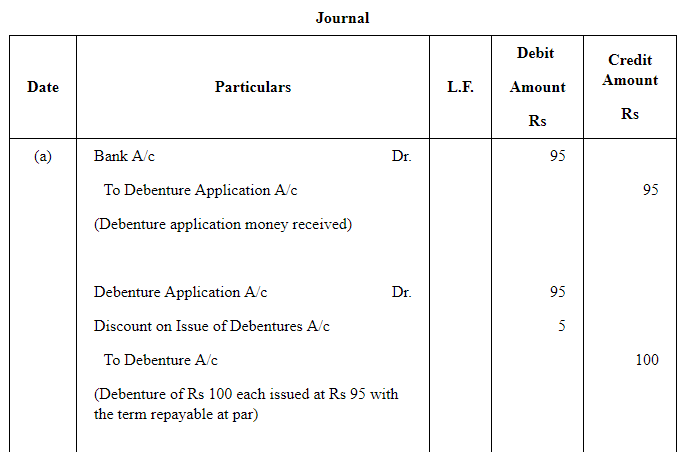

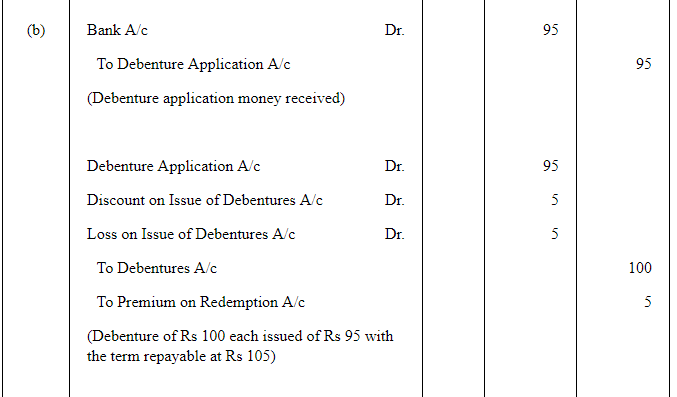

Question 32:

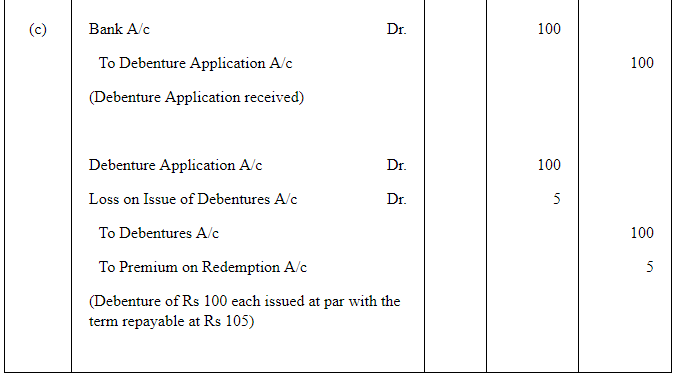

Journalise the following:

(a) A debenture issued at ₹95, repayable at ₹100.

(b) A debenture issued at ₹95, repayable at ₹105.

(c) A debenture issued at ₹95, repayable at ₹105.

The face value of debenture is ₹100 in each of the above cases.

ANSWER:

Question 33:

Pass journal entries in the following cases:

(a) A Co.Ltd. issued ₹40,000; 12% Debentures at a premium of 5% redeemable at par.

(b) A Co.Ltd. issued ₹40,000; 12% Debentures at a discount of 10% redeemable at par.

(c) A Co.Ltd. issued ₹40,000; 12% Debentures at par redeemable at 10% premium.

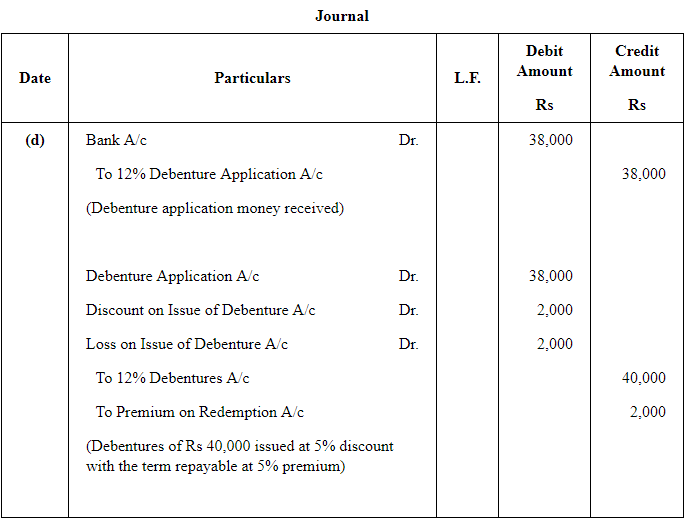

(d) A Co.Ltd. issued ₹40,000; 12% Debentures at a discount of 5% and redeemable at 5% premium.

(e) A Co.Ltd. issued ₹40,000; 12% Debentures at a premium of 10% redeemable at 110%.

ANSWER:

Question 34:

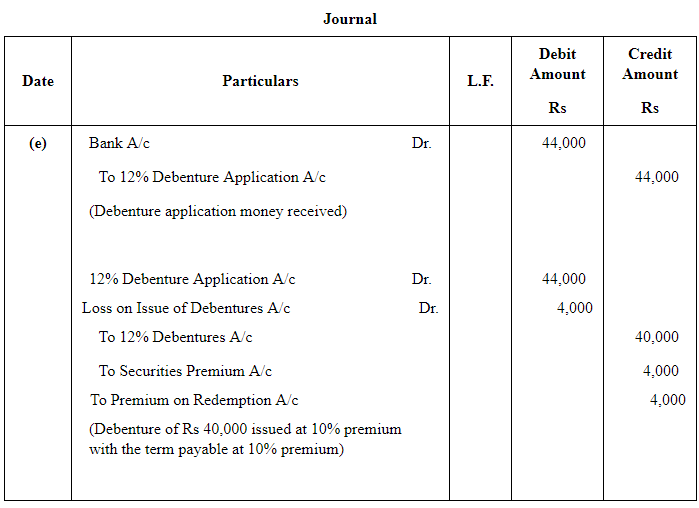

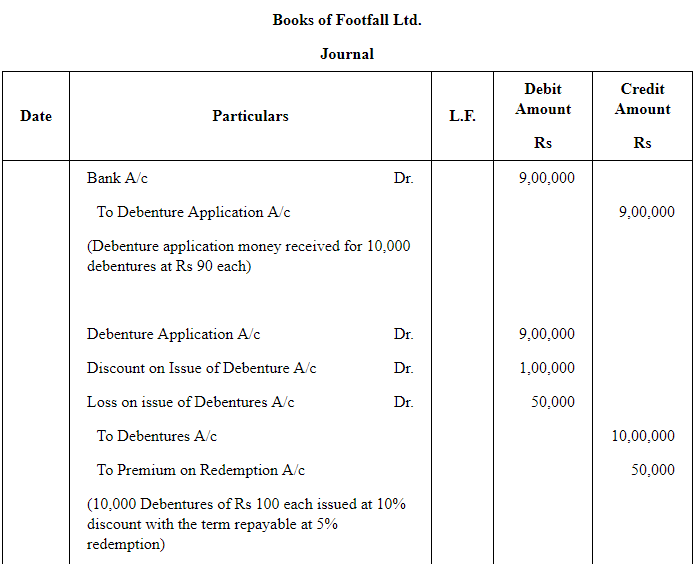

Footfall Ltd. issues 10,000 Debentures of ₹100 each at a discount of 10% redeemable at a premium of 5% after the expiry of three years.

Pass Journal entries for the issue of these debentures.

ANSWER:

Question 35:

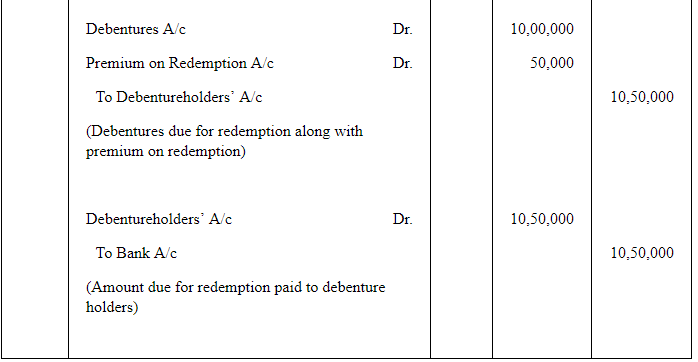

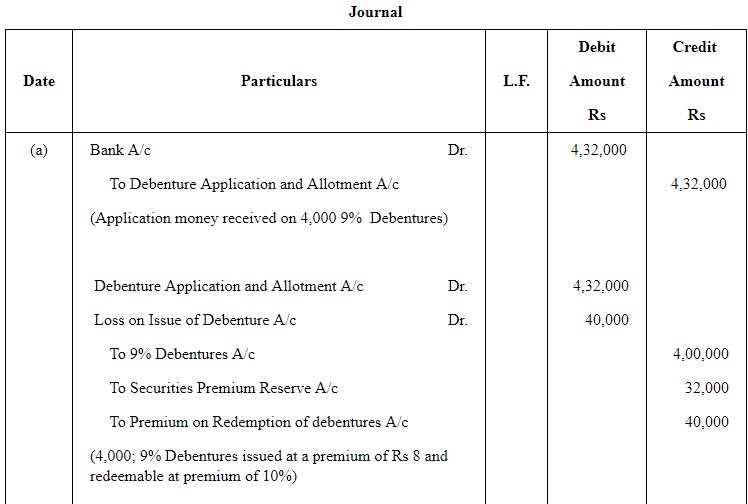

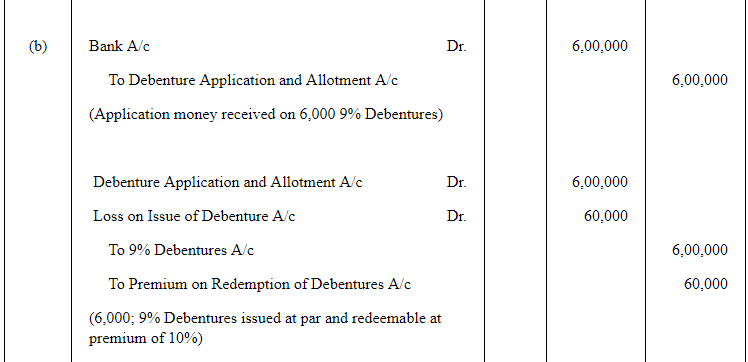

Pass necessary Journal entries relating to the issue of debentures for the following:

(a) Issued ₹4,00,000; 9% Debentures of ₹100 each at a premium of 8% redeemable at 10% premium.

(b) Issued ₹6,00,000; 9% Debentures of ₹100 each at par, repayable at a premium of 10%.

(c) Issued ₹10,00,000; 9% Debentures of ₹100 each at a premium of 5%, redeemable at par.

ANSWER:

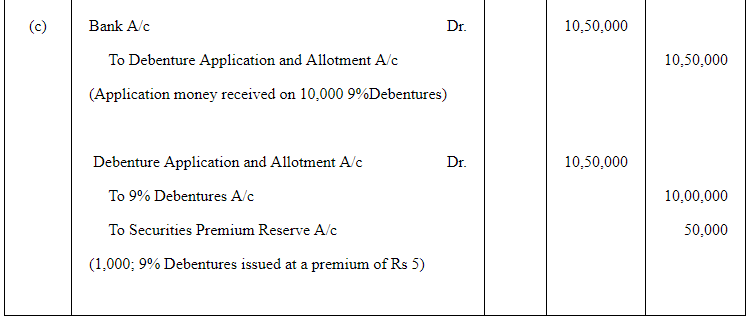

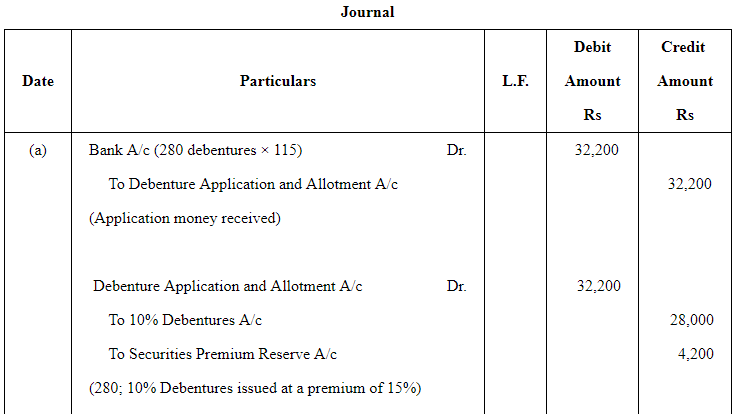

Question 36:

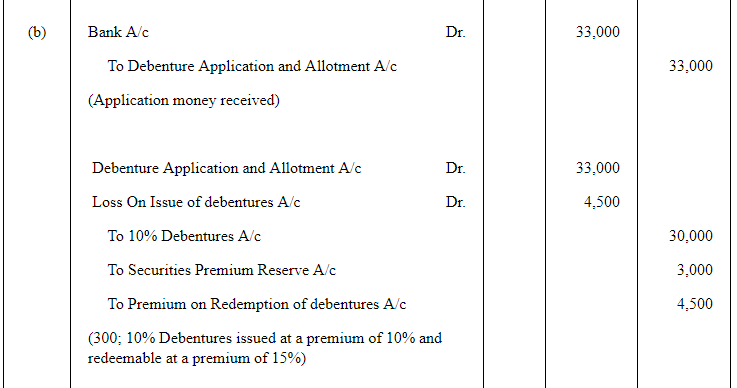

Pass necessary Journal entries relating to the issue of debentures for the following:

(a) Issued ₹28,000; 10% Debentures of ₹100 each at a premium of 15% redeemable at par.

(b) Issued ₹30,000; 10% Debentures of ₹100 each at a premium of 10% and redeemable at a premium of 15%.

(c) Issued ₹80,000; 10% Debentures of ₹100 each at par repayable at a premium of 10%.

ANSWER:

Page No 9.56:

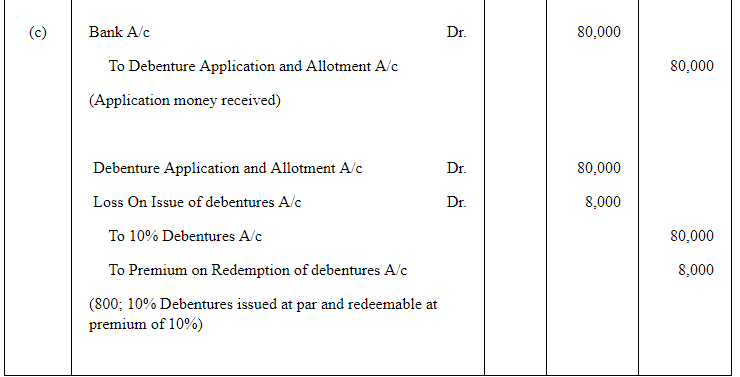

Question 37:

Journalise the following transaction at the time of issue of 12% Debentures: Nandan Ltd. issued ₹90,000, 12% Debentures of ₹100 each at a discount of 5% redeemable at 110%.

ANSWER:

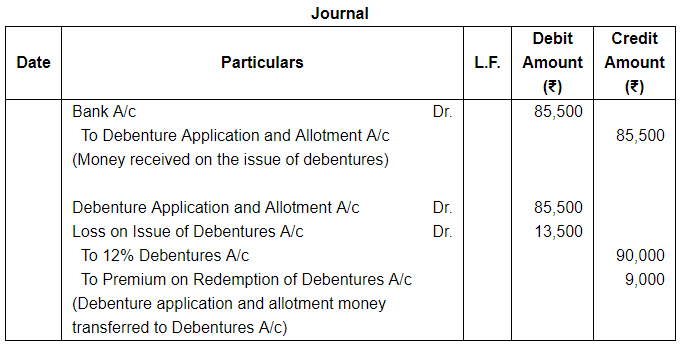

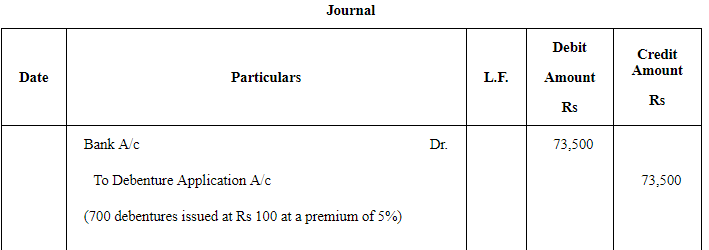

Question 38:

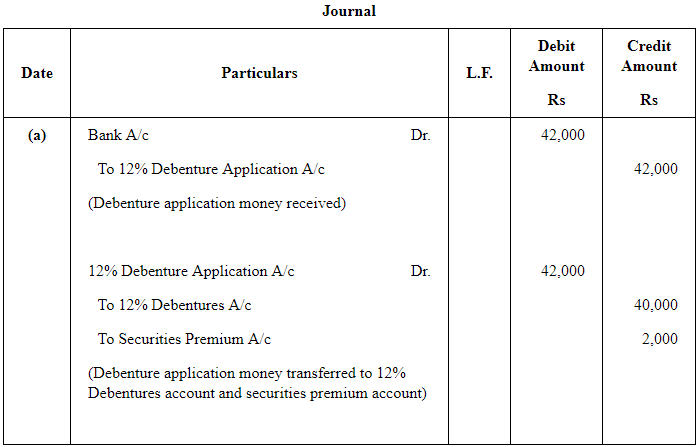

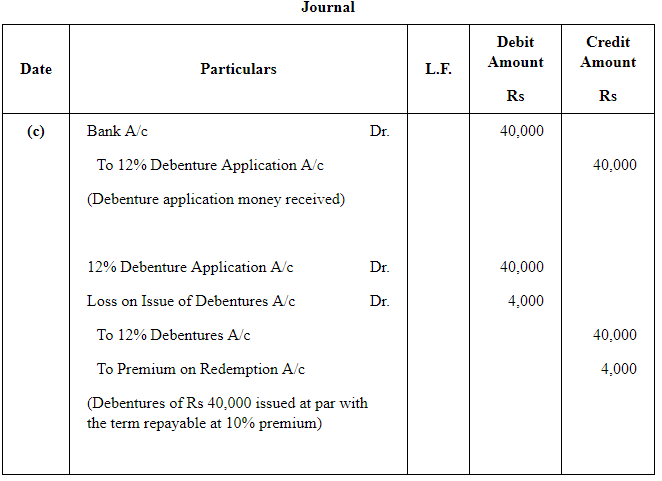

Pass necessary Journal entries for the issue of debentures in the following cases:

(a) ₹40,000; 12% Debentures of ₹100 each issued at a premium of 5% redeemable at par.

(b) ₹70,000; 12% Debentures of ₹100 each issued at a premium of 5% redeemable at ₹110.

ANSWER:

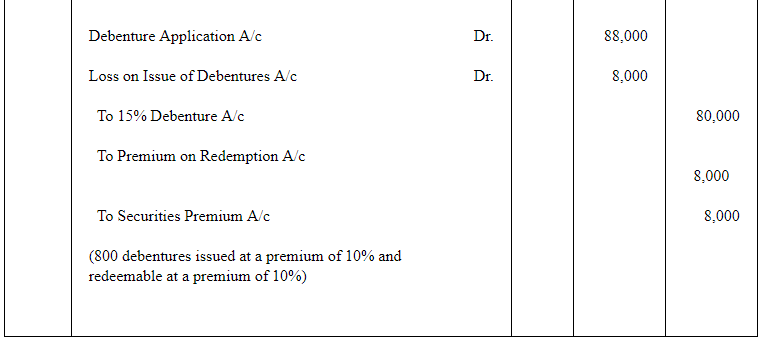

(b)

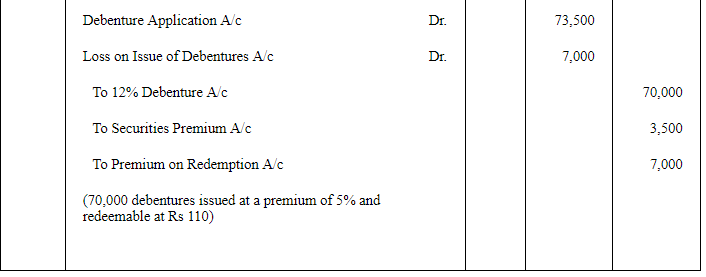

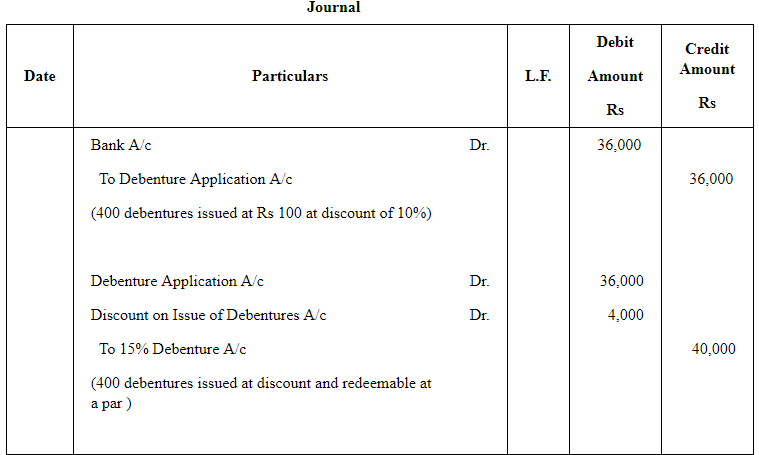

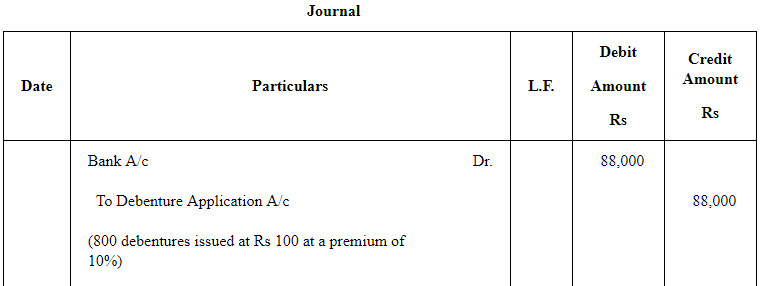

Question 39:

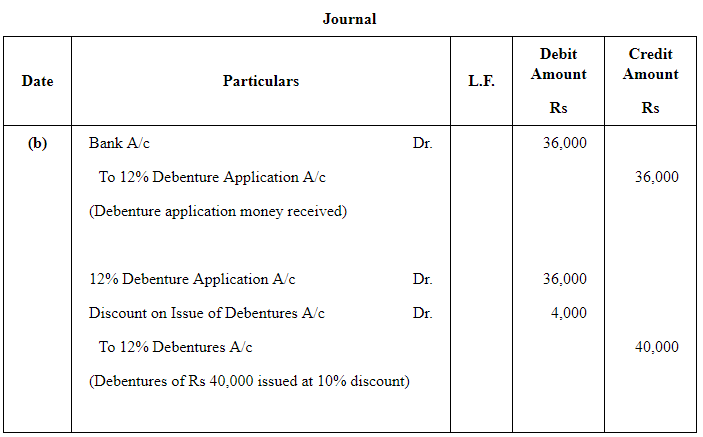

Pass necessary Journal entries for the issue of Debentures in the following cases:

(a) ₹40,000; 15% Debentures of ₹100 each issued at a discount of 10% redeemable at par.

(b) ₹80,000; 15% Debentures of ₹100 each issued at a premium of 10% redeemable at a premium of 10%.

ANSWER:

(a)

(b)

Question 40:

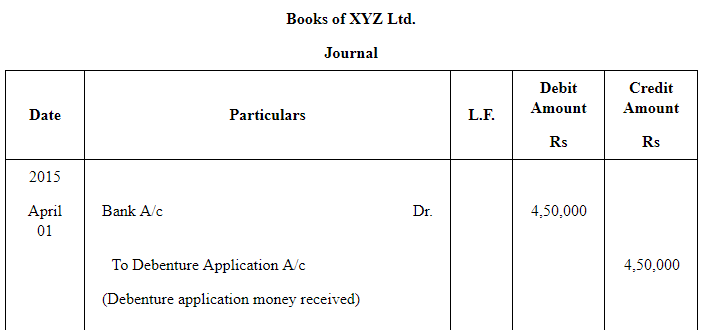

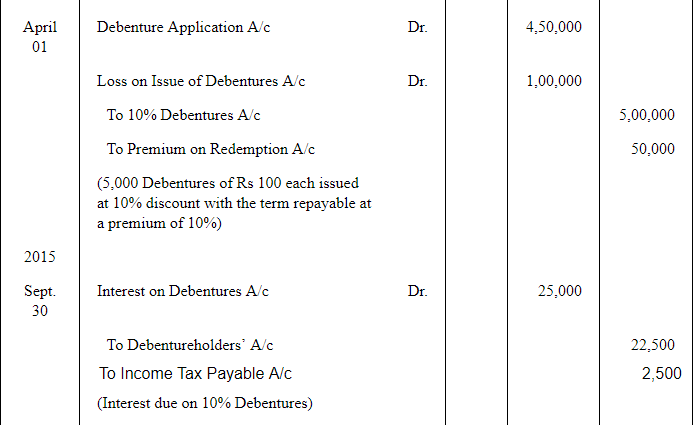

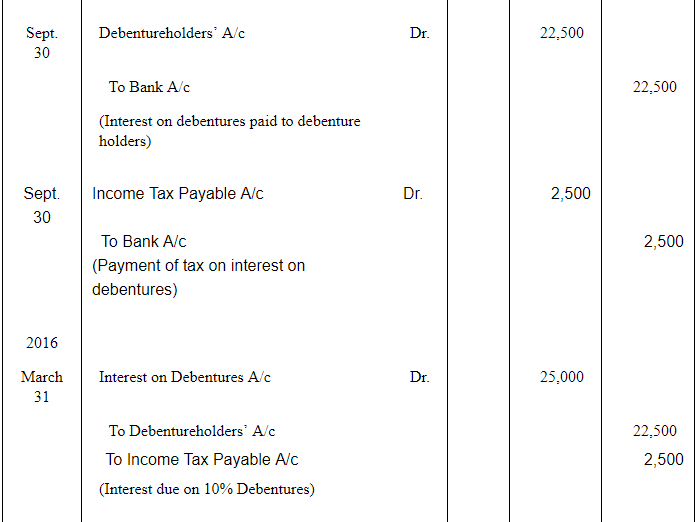

XYZ Ltd.issued 5,000 , 10% Debentures of ₹100 each on 1st April, 2015 at a discount of 10% redeemable at a premium of 10% after 4 years. Give journal entries for the year ended 31st March, 2016, assuming that the interest was payable half-yearly on 30th September and 31st March. Tax is to be deducted @ 10%.

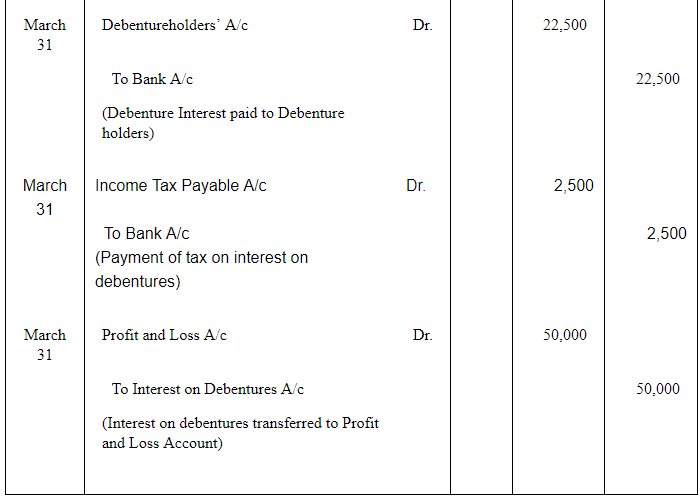

ANSWER:

Question 41:

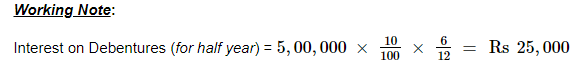

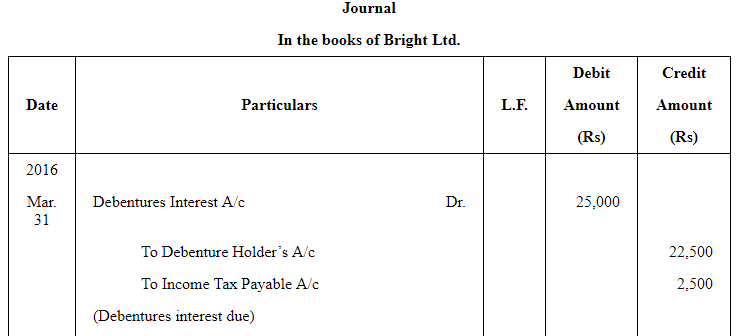

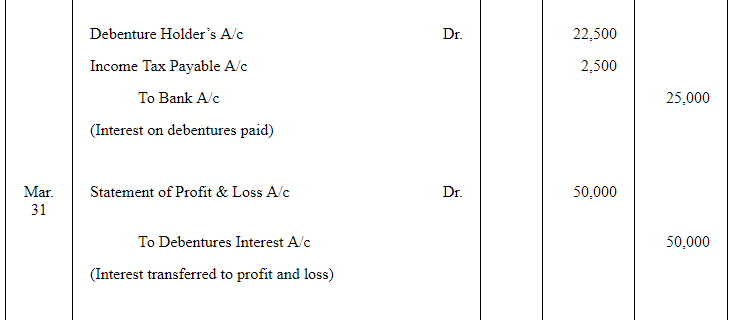

Bright Ltd. issued 5,000; 10% Debentures of ₹100 each on 1st April, 2015 . The issue was fully subscribed . According to the terms of issue, interest on the debentures is payable half-yearly on 30th September and 31st March and the tax deducted at source is 10%.

Pass necessary journal entries related to the debenture interest for the year ending 31st March , 2016 and transfer of interest on debentures of the year to the Statement of Profit and Loss .

ANSWER:

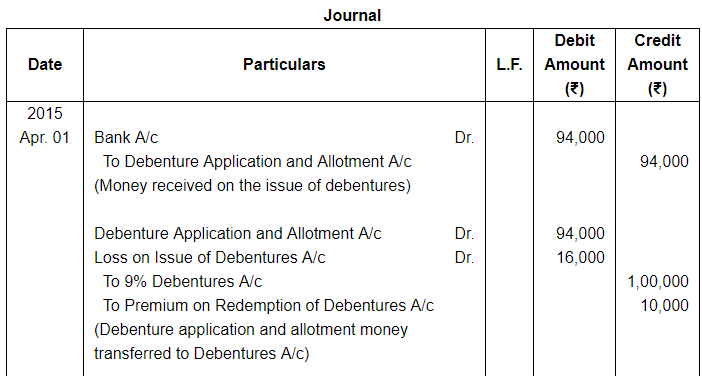

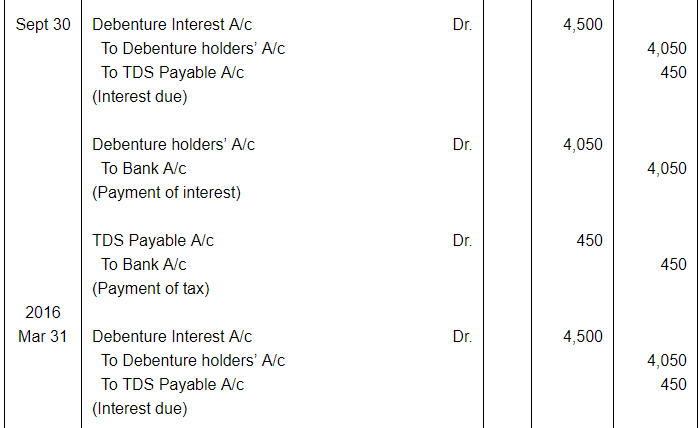

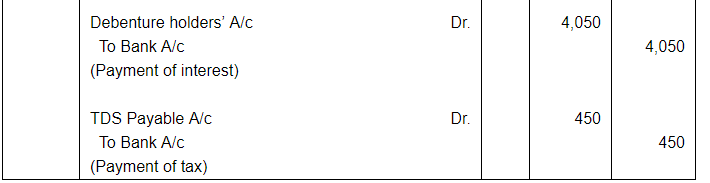

Question 42:

On 1st April, 2015, V.V.L.Ltd issued 1,000, 9% Debentures of ₹100 each at a discount of 6%, redeemable at a premium of 10% after three years. Pass necessary journal entries for the issue of debentures and debenture interest for the year ended 31st March, 2016, assuming that interest is payable on 30th September and 31st March and the rate of tax deducted at source is 10%. The company closes its books on 31st March every year.

ANSWER:

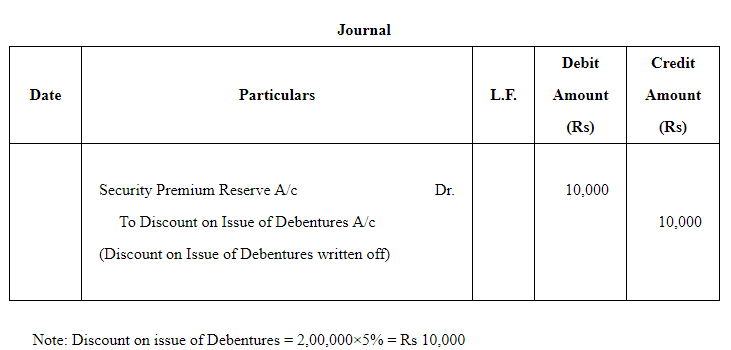

Question 43:

Kitply Ltd.issued ₹2,00,000, 10% Debentures at a discount of 5% .The terms of issue provide the repayment at the end of 4 years . Kitply Ltd.has a balance of ₹5,00,000 in Securities Premium Reserve . The company decided to write off discount on issue of debentures from Securities Premium Reserve in the first year.

Pass the journal entry.

ANSWER:

Question 44:

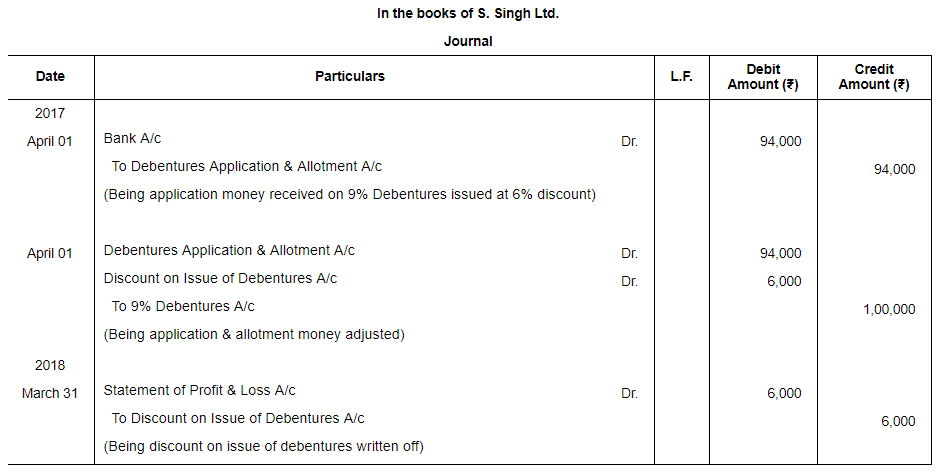

A limited company issued ₹1,00,000, 9% Debentures at a discount of 6% on 1st April, 2017. These debentures are to be redeemed equally, spread over 5 annual instalments.

Pass the Journal entries for issue of debentures and writing off the discount.

ANSWER:

Question 45:

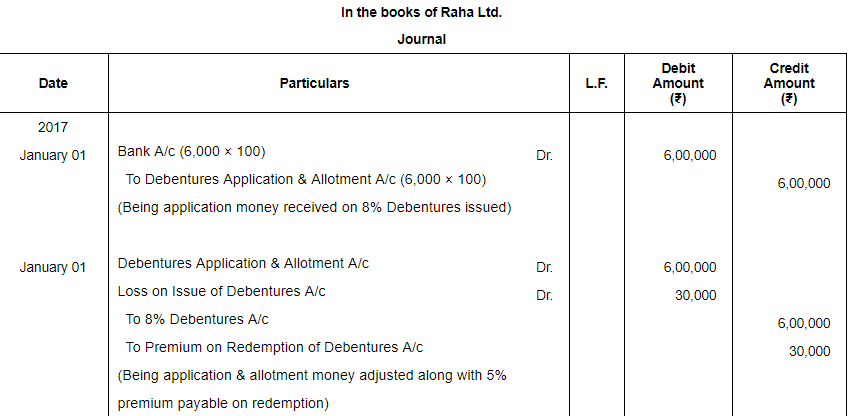

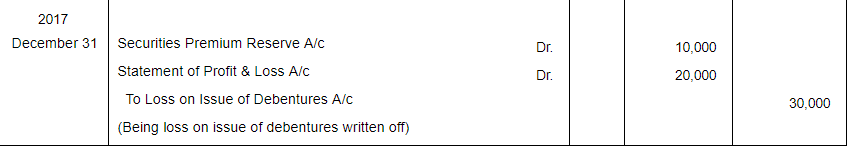

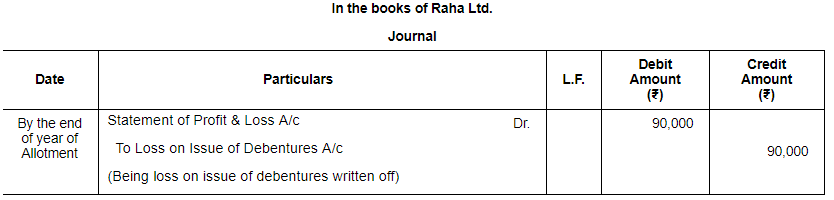

On 1st January, 2017, Raha Ltd. issued 6,000, 8% Debentures of nominal (face) value of ₹100 each redeemable at 5% premium in equal proportions at the end of 5, 10 and 15 years. It has a balance of ₹10,000 in Securities Premium Reserve.

Pass Journal entries. Also give Journal entries for writing off Loss on Issue of Debentures.

ANSWER:

Question 46:

Global Ltd. issued 10,000, 8% Debentures of ₹100 each redeemable in four equal instalments by draw of lots from the end of 3 years at a premium of ₹9.

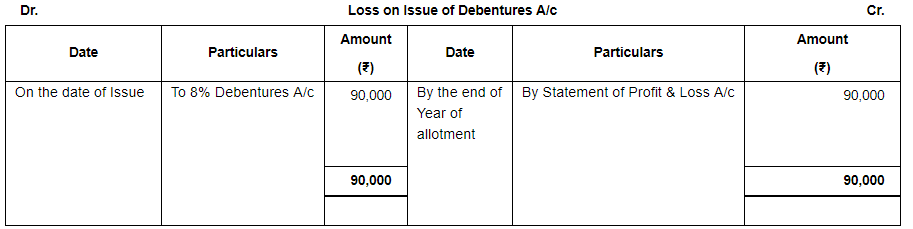

Pass the Journal entries for writing off the Loss on Issue of Debentures. Also prepare Loss on issue of Debentures Account.

ANSWER:

Page No 9.57:

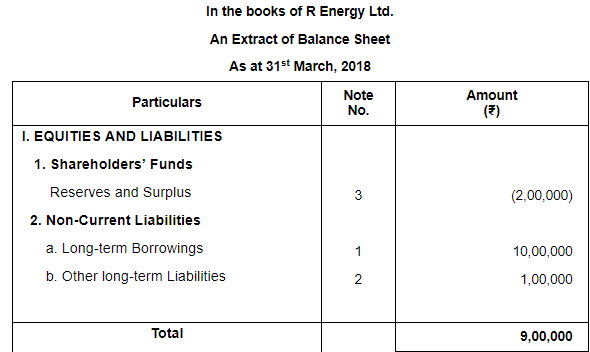

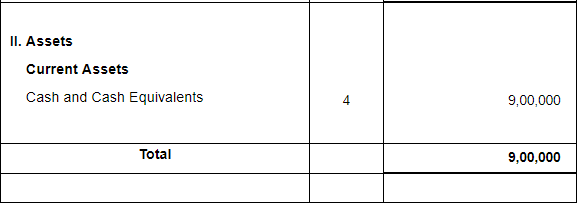

Question 47:

On 1st June, 2017, R Energy Ltd. issued 10,000, 7% Debentures of ₹100 each at a discount of 10% redeemable at a premium of 10% at the end of five years. All the debentures were subscribed and allotment was made.

Prepare the Balance Sheet (extract) as at 31st March, 2018.

ANSWER:

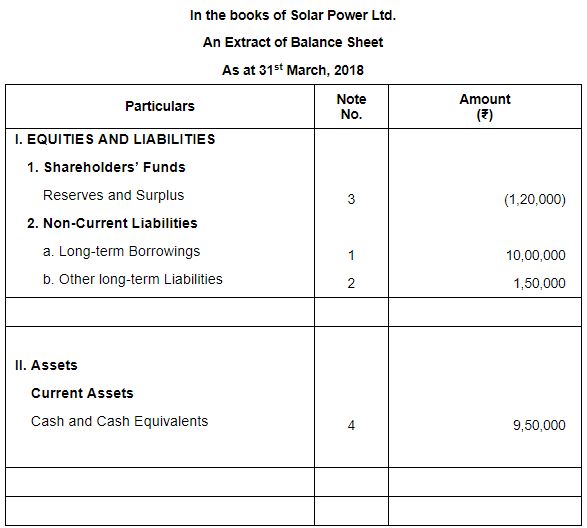

Question 48:

On 1st April, 2017, Solar Power Ltd. issued 10,000, 8% Debentures of ₹100 each at a discount of 5% redeemable at a premium of 15% at the end of five years. All the debentures were subscribed and allotment was made. The company had balance in Securities Premium Reserve of ₹80,000.

Prepare the Balance Sheet (extract) as at 31st March, 2018.

ANSWER:

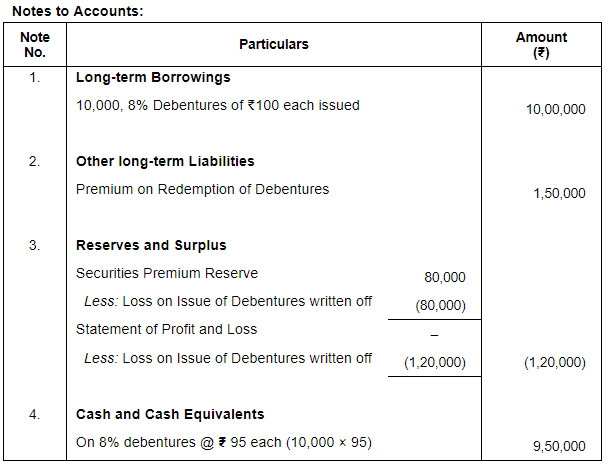

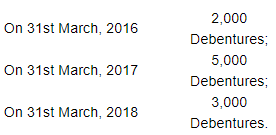

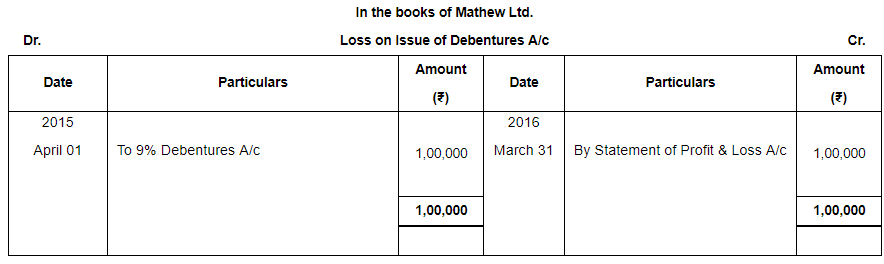

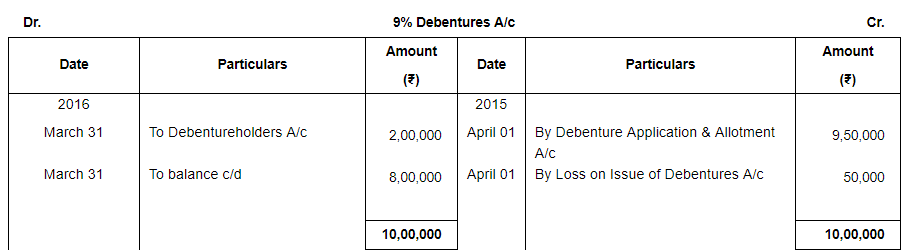

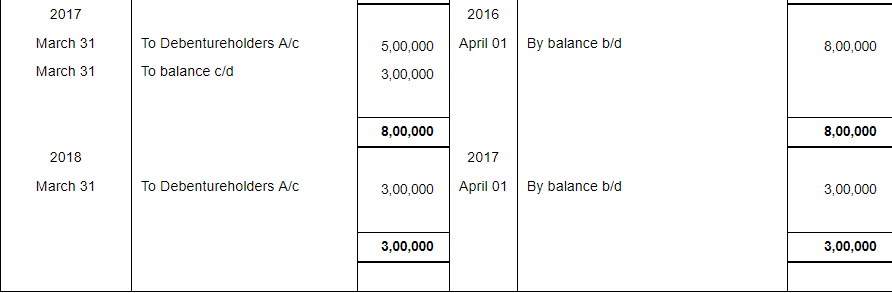

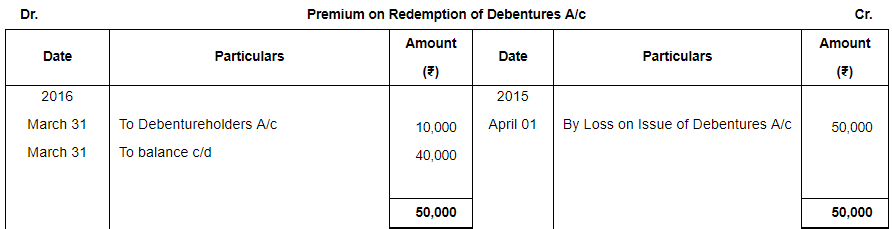

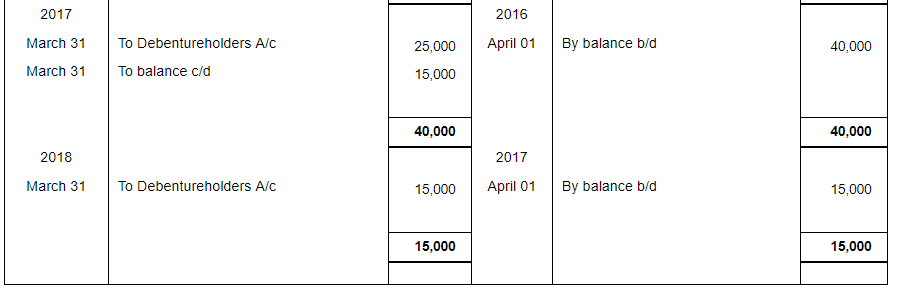

Question 49:

On 1st April, 2015. Mathew Ltd. issued 10,000, 9% Debentures of ₹100 each at a discount of 5%, redeemable at a premium of 5%. These debentures were redeemable as follows:

Prepare the Loss on Issue of Debentures Account, Debentures Account and Premium on Redemption of Debentures Account for three years.

ANSWER:

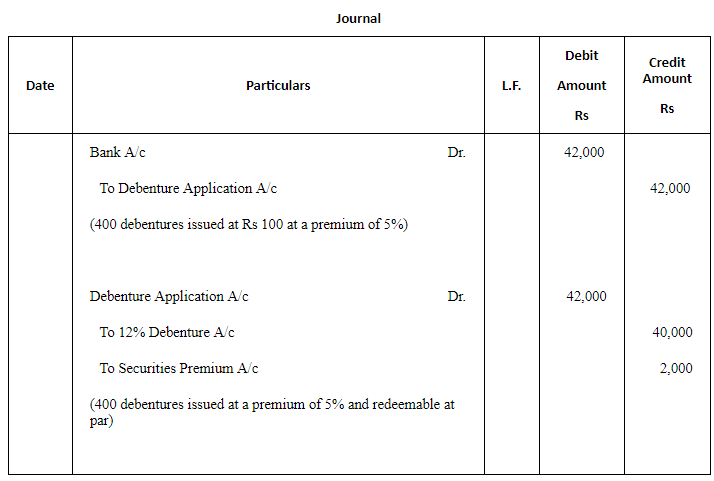

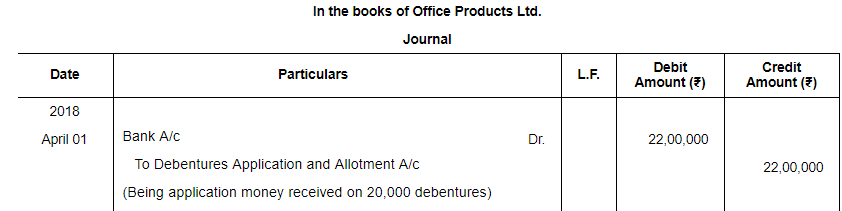

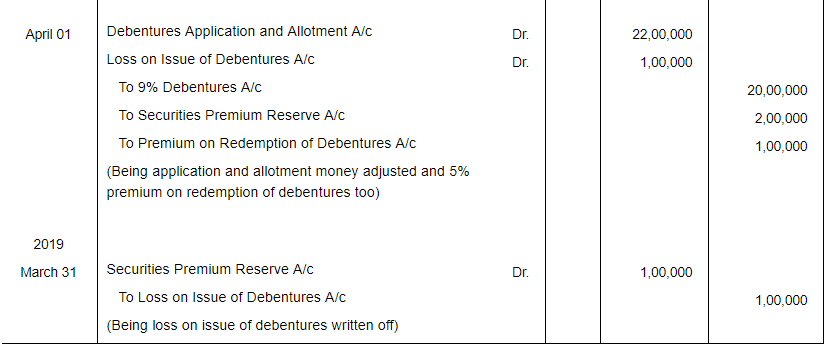

Question 50:

Office Products Ltd, issued on 1st April, 2018, 20,000, 9% Debentures of ₹100 each at a premium of 10% redeemable at a premium of 5% after 5 years. Issue price was payable along with application. Pass the necessary Journal entries.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Issue of Debentures ( Part - 3) - Accountancy Class 12 - Commerce

| 1. What is a debenture? |  |

| 2. How are debentures different from shares? |  |

| 3. What are the different types of debentures? |  |

| 4. How are debentures issued? |  |

| 5. What are the advantages of investing in debentures? |  |