Capital and Money Markets: Institutions | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Participants In Money Markets |

|

| Participants In Capital Markets |

|

| Conclusion |

|

Introduction

- The fundamental role of financial markets is to facilitate the exchange of funds between different parties. In the business realm, there is a diverse demand for funds across various purposes and timeframes. Funds may be needed for working capital, typically for shorter periods ranging from one month to one year, or for fixed assets with longer maturation periods of ten to twenty years.

- Consequently, there exists a multitude of financial markets, encompassing corporate bonds, equity shares, government and semi-government securities, mutual funds, as well as markets for foreign securities, public sector bonds, and equities, among others. These markets, where funds or securities are traded, vary in their purposes, maturities, and associated risks.

Based on these distinctions, financial markets can broadly be classified into two categories:

Money Market:

- The term "Money Market" may seem misleading, as it does not refer to the exchange of different currencies, which is known as the foreign exchange market. Instead, the money market deals with short-term loans or securities, typically maturing within a year. In essence, the money market encompasses the trading of short-term financial instruments such as short-term loans or deposits of banks, commercial papers, certificates of deposits, treasury bills, and notes. These instruments, also known as short-term financial assets, serve as near substitutes for money.

- They entail low risks of capital losses and default compared to the capital market. Due to their short maturity periods, changes in interest rates have minimal effects on their prices, resulting in low money market risk. Moreover, the default risk is low as major participants in this market include governments, central banks, commercial banks, and other significant institutions. As a result, money market instruments are highly liquid, allowing for quick turnovers at low transaction costs without significant losses.

- Another objective of the money market is to facilitate the rapid adjustment of actual liquidity positions to desired levels for individuals, institutions, and governments. It serves as a platform for balancing temporary cash surpluses with temporary cash deficits, ensuring that borrowers can quickly obtain short-term funds while lenders can convert their short-term financial assets into cash. The Central Bank of the country plays a crucial role in regulating and controlling the money supply and operations in the money market, making it a major participant in this market.

Capital Market:

- The capital market, as its name suggests, is a market that provides capital funds to individuals or firms in need. It deals with capital, which refers to the monetary value of ownership instruments and long-term claims to assets. In essence, the capital market involves the trading of financial instruments that provide long-term and medium-term funds. Various institutions and firms, commonly known as financial institutions, assist in this process. Capital markets comprise a complex system of institutions and mechanisms through which available long-term resources are pooled and transferred to interested entities such as businesses, governments, individuals, and other agencies. These funds are allocated based on the purpose and requirements of the borrowers.

- The capital market can be further categorized into various segments, including the primary and secondary markets, equity and debt markets, mortgage market, stock market, and securities market, among others. In the capital market, a significant portion of investment is made directly and internally financed by businesses through their earnings, which are then invested in long-term fixed assets such as plant and machinery, equipment, and premises. Additionally, individual investors, often referred to as household investors, also fulfill the long-term funds requirements of borrowing firms, either through direct investments in primary markets or indirectly through other financial institutions, a process known as indirect financing.

Participants In Money Markets

As previously mentioned, the money market serves as the mechanism for raising short-term funds, with the rates of funds varying based on sources, borrower creditworthiness, maturity periods, and other factors. Additionally, there exists a secondary market where old outstanding short-term claims or securities are traded at rates determined by supply and demand dynamics. The money market comprises specialized sub-markets that deal with specific types of short-term funds and instruments. Key participants in the money market include:

Central Bank:

- The Central Bank of any country acts as the apex monetary institution within the money market, overseeing and formulating policies related to monetary management. It serves as the government's financial agent, conducting major financial operations on its behalf.

- The Central Bank is a significant participant in the money market, engaging extensively in the purchase and sale of various securities, particularly those issued by the government. Its roles include:

- Issuing currency notes, a function exclusively under the purview of the Central Bank. For instance, in India, the Reserve Bank of India (RBI) has the sole authority to issue various currency notes except for one rupee notes and coins and subsidiary coins.

- Serving as the government's agent and advisor on financial matters such as loans, advances, and debt servicing. It also performs functions on behalf of government departments, boards, and public undertakings.

- Regulating banking operations in the country as the bankers' bank, overseeing interest rates on advances and deposits, and maintaining a privileged position whereby commercial banks are required to deposit a fixed percentage of their deposits with it.

- Maintaining adequate foreign exchange reserves to meet foreign trade requirements and stabilize the currency at the international level. This necessitates the Central Bank's participation in domestic and foreign financial markets.

Commercial Banks:

- Another significant participant in the country's money market is commercial banks, which conduct a major portion of money market operations. Commercial banks engage in borrowing and lending activities, accepting deposits from the public and providing loans and advances. Their functions include:

- Mobilizing public savings, typically in small holdings, and pooling them for investment purposes in the business sector.

- Meeting the short-term financial needs of business firms through cash credit, discounting bills, overdraft facilities, and other short-term debt instruments.

- Providing a range of services, including payment facilitation, collection of dues, and advisory services on investment portfolios, often referred to as Portfolio Management Service.

- Overall, central banks and commercial banks play significant roles in the money market, serving various functions and contributing to its efficient operation.

Indigenous Financial Agencies:

- Indigenous financial agencies play a crucial role in the money market, particularly within the unorganized sector. These agencies include money lenders, also known as Village Sahukars, and indigenous bankers. Money lenders primarily offer financial assistance to rural farmers, artisans, and others, while indigenous bankers accept deposits and engage in hundi transactions or money lending. Distinguishing between money lenders and indigenous bankers can be challenging, as the former typically lend their own funds, while the latter act as financial intermediaries by accepting deposits or availing themselves of bank credit.

- These agencies' primary function is to provide short-term loans to both urban and rural borrowers, often financing land trade and the movement of agricultural commodities such as cotton, oilseeds, and sugar. They primarily utilize hundi and bill discounting as financing techniques, occasionally providing loans against immovable properties like houses and land. Interest rates charged by these agencies are generally high compared to banks.

- Money lenders' lending policies are flexible and informal, relying on personal contacts with clients, leading to varying policies and rates from place to place. Loans are typically provided based on personal security, resulting in differing loan sizes and interest rates for individual clients. Indigenous financial agencies offer short-term financial assistance to rural and semi-urban borrowers, tailoring rates based on personal capability and risk.

Discount Houses

- Discount houses are integral components of the money market, primarily focused on discounting trade bills to enhance market liquidity. Typically found in developed money markets like London, discount houses facilitate liquidity by discounting trade bills, selling them to commercial banks to raise funds for further service to traders. They also provide guarantees to banks for bill payments on maturity, assuming responsibility in case of default.

- In addition to discounting trade bills, discount houses deal in short-term government securities, investing in Treasury Bills, commercial bills, and other government securities. Their earnings primarily come from commission on discounting trade bills and interest on investments. Although discount houses are crucial organs of developed money markets, they are not prevalent in India, as similar services are usually provided by commercial banks and other financial institutions.

Acceptance Houses:

- Acceptance houses are significant participants in the money market, contributing to liquidity by borrowing short-term loans from banks and lending them to traders. They accept bills of exchange drawn on them by sellers or buyers of goods, which can then be discounted at discount houses. Acceptance houses perform various functions beyond bill acceptance, including domestic and foreign banking services, short-term loans to traders, and advising on trade-related issues.

- Some acceptance houses also engage in medium and long-term financing for major projects. Overall, acceptance houses enhance liquidity in the secondary market by accepting bills for discounting, thereby bolstering traders' creditworthiness. While these houses are rare and mainly found in developed money markets like London, their presence is limited in India's nascent market.

Participants In Capital Markets

This section outlines the various financial institutions and agencies actively involved in or facilitating capital market activities, classified into banking institutions and non-banking financial institutions.

Banking Institutions:

- Banking institutions encompass a range of entities that accept long-term deposits from the public and provide lending services to borrowers. These institutions include commercial banks, cooperative banks, land development banks, foreign banks, and regional rural banks. Commercial banks, in addition to catering to short-term funding needs, now actively participate in capital market activities by accepting long-term deposits and providing long-term financing to businesses of all sizes, including small, medium, and large enterprises.

- They offer various types of long-term finance for purposes such as construction, vehicle purchases, and housing. Cooperative banks primarily focus on providing short and medium-term financial assistance to agriculturists, artisans, and others, often through cooperative societies. Land development banks cater to the long-term and medium-term funding needs of agriculturists, facilitating purchases of agricultural machinery and implements and other agricultural activities. Regional rural banks provide credit and other facilities to small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs in rural areas.

Non-Banking Financial Institutions:

- Non-banking financial institutions play a significant role in capital market activities, actively participating in capital transformation from savers to investors.

- These institutions collect funds through deposits from individuals and others and lend them to various sectors, including trade, industries, and government. They also engage in buying and selling instruments and creating new instruments to meet the diverse needs of savers.

Investment Banks:

- Investment banks act as financial intermediaries responsible for mobilizing savings and channeling them into business enterprises. Their functions include long-term financing of business undertakings, marketing of shares and debentures, acting as security middlemen, advising on issue marketing, and providing insurance instead of outright purchase of security.

- Investment banks play a significant role in providing necessary capital for the long-term needs of businesses, earning them the nickname "entrepreneurs of entrepreneurs." Some of these functions are assumed by merchant banks in India.

Merchant Banks:

- Merchant banking originated in the early nineteenth century in the UK, initially serving as a means to finance international trade through bills of exchange drawn on prominent merchant houses. In recent times, it has garnered significant attention from financial and consultancy firms alike. Merchant banks function as financial institutions offering specialized services such as bill acceptance, management of corporate issues, portfolio management, project counseling and financing, and corporate restructuring.

- Basically merchant banking activity is an institutional arrangement providing financial advisory and intermediary services to the corporate sector. One merchant banker may specialise in one activity only, simultaneously he may take up other supportive or complimentary activity.

In fact, there is a wide range of financial activities which come under the purview of merchant banking, a few among these are narrated below:

- Corporate Advisory: A key role of merchant bankers is to provide advice to corporate entities on various aspects such as identifying growth areas, assessing product lines and future trends, and revitalizing struggling companies by evaluating their technology and processes.

- Project Consultancy: Another essential function of merchant banking involves offering project consultancy services, which encompass preparing economic, technical, financial, and feasibility reports. Additionally, it involves evaluating project viability and outlining procedural steps for implementation, including identifying potential investment opportunities and financing patterns.

- Capital Restructuring: Capital restructuring aims to assist corporate management in optimizing their capital structure to maximize the utilization of financial resources. This may involve adjusting the debt-equity ratio, utilizing reserves and surpluses, capitalizing reserves, managing asset structure, and enhancing debt servicing capabilities to improve the overall fund generation capacity of the corporate entity.

- Issue Management: The primary objective of issue management is to facilitate the mobilization of capital market resources for clients by issuing securities such as equity shares, preference shares, and debentures. This includes obtaining consent from government agencies, preparing prospectuses, selecting brokers, underwriters, bankers, registrars, and coordinating with advertising agencies.

- Portfolio Advisory: Merchant bankers offer expert advice on portfolio management, assisting clients in determining which securities to buy or sell and optimizing their portfolio within the risk, return, and tax parameters of investors.

- Credit Syndication: Merchant bankers arrange credit procurement and project finance for client units by liaising with domestic and international banks and financial institutions to secure rupee and foreign currency loans. They may also arrange bridge finance and additional funds for cost escalations.

- Corporate Restructuring: Merchant banks facilitate external restructuring to enhance the overall performance of corporate entities. This may involve activities such as mergers, acquisitions, amalgamations, takeovers, alliances, and reconstructions. Merchant bankers assist in negotiations, legal documentation, official approvals, and tax matters related to proposed mergers.

- Working Capital Financing: Merchant bankers assist in securing working capital finance for clients, advising on potential sources for financing and helping enhance cash credit facilities when needed.

- Bill Discounting: Merchant banks, particularly in developed countries like the USA and the UK, arrange bill discounting facilities for clients by liaising with acceptance houses and discount houses. The reputation and credibility of merchant bankers play a crucial role in facilitating such arrangements. In India, various public financial institutions, commercial banks, foreign banks, and private non-banking finance companies are increasingly involved in providing merchant banking services.

Investment Companies

- Investment companies are institutions that gather funds from individuals, typically household savers, through specific financial instruments such as units, shares, or debentures. These pooled funds are then invested in suitable securities based on the objectives of the investment scheme. The primary goal of such investment companies is to maximize benefits through the utilization of large pooled resources while minimizing risks through expertise and diversification.

- Investment management has evolved into a complex and risky task, requiring extensive information and knowledge. Small investors with limited resources and information may find it challenging to navigate this landscape. Hence, the establishment of investment trusts or companies can be beneficial in providing professional management and diversification.

- Major types of investment companies include investment trusts, mutual funds, common trust funds of commercial banks, management investment companies, and unit trusts. Mutual funds have witnessed significant growth in the Indian investment market. These investment companies can be categorized into two main types: Management Investment Companies and Unit Trusts.

- Management Investment Companies: Also known as Discretionary trusts or mutual funds, these companies grant their management broad discretionary powers in selecting securities for their investment portfolios. These companies can be further classified as closed-ended and open-ended. Closed-ended companies have fixed capitalization and do not allow shareholders to redeem their investment before a specified period. In contrast, open-ended companies continuously offer new shares and allow investors to buy and sell shares at prices close to their net asset value.

- Unit Trusts: These investment companies are typically established under specific acts. Funds are raised from numerous investors through the sale of units, and the holders of these units are referred to as unit holders. Unit holders have a real interest in the securities held by the trust, and each unit holder receives a certificate representing their holdings in the trust's assets. Unit trusts are commonly structured as open-end investment companies.

In summary, investment companies play a crucial role in capital markets by mobilizing funds from a diverse range of investors and channeling them into productive investments through financial markets.

Insurance Companies

- Insurance companies have emerged as significant participants in capital markets due to the substantial funds available to them for investment purposes. These companies can be categorized into various types, such as life insurance companies, general insurance companies, and marine insurance companies, which cover risks related to fire, accidents, natural calamities, and various assets.

- Life insurance companies, in particular, are dominant due to their size and the protection they offer to policyholders. They perform two primary functions: protecting policyholders against losses due to premature death and investing funds in various financial instruments. The main source of funds for these companies is the premiums received from policyholders, making them responsible custodians of policyholder savings.

- Life insurance companies typically invest a significant portion of their funds in government and semi-government securities, as well as fixed-income securities of public sector and corporate entities. For instance, in India, the Life Insurance Corporation of India is required to invest a minimum of 50 percent of its total investible funds in marketable securities guaranteed by the Central or State Government.

- In addition to life insurance companies, general insurance companies also have substantial investible funds that they deploy in various sectors. For example, the General Insurance Corporation of India actively participates in the capital market.

In conclusion, insurance companies have become integral participants in capital markets worldwide, leveraging their significant funds to support investments across diverse sectors.

Development Banks

- Development banks, which emerged after the Second World War, are now active participants in capital markets worldwide. Their primary goal is to accelerate industrialization by providing essential elements of development such as finance, knowledge, and entrepreneurship skills. Therefore, a development bank serves as a hybrid institution combining the objectives of a finance corporation and a development corporation.

- These banks, also known as financial institutions, primarily focus on offering long-term financial assistance to industrial units across various sectors. This assistance comes in various forms, including term loans, subscription to shares and debentures, underwriting capital issues, and providing guarantees for term loans and deferred payments by importers.

- In India, major development banks include the Industrial Finance Corporation of India (IFCI), State Financial Corporations (SFCs), State Industrial Development Corporations (SIDCs), Industrial Reconstruction Bank of India (IRBI), IDBI, and ICICI. IDBI and ICICI, initially established as developmental banks, transformed into universal banks to adapt to the challenges in the liberalized environment.

Pension Funds

- Pension funds and retirement plans have become significant investors in capital markets in recent times. These funds constitute substantial investible assets that require careful selection of investment avenues based on the specific requirements of each fund or plan. Private pension plans or corporate pension funds have become major contributors to the capital market, particularly in developed countries, during the latter half of the twentieth century.

- In a pension plan, pension holders receive a fixed amount in a particular currency each month, often calculated based on the number of years worked in the organization. Contributions to pension plans are typically made by employers, leading them to seek investment outlets that offer high returns while minimizing risks. Assets in pension funds tend to grow over the long term as contributions from employed individuals exceed payments to retirees.

Finance Companies

- Private sector finance companies are another significant participant in the capital market. These companies raise funds from the public through shares, debentures, fixed deposits, short-term loans from banks, and inter-corporate deposits. They often raise funds at relatively high-interest rates, resulting in a distinct liability and capital structure compared to other public financial institutions. These companies typically have a higher proportion of equity capital and a significant portion of unsecured outstanding liabilities.

- Finance companies primarily focus on financing consumer durable goods, automobiles, furniture, etc., usually on an installment basis. Additionally, they provide short-term business credit to firms and professionals, competing with commercial banks and other financial institutions offering similar services. Despite charging higher interest rates compared to banks, consumers prefer finance companies due to their easy accessibility and fewer formalities.

In summary, finance companies play a crucial role in fulfilling the financial needs of specific segments of society and act as a link between money markets and capital markets. However, recent performance trends in India have been less than satisfactory for these companies.

Conclusion

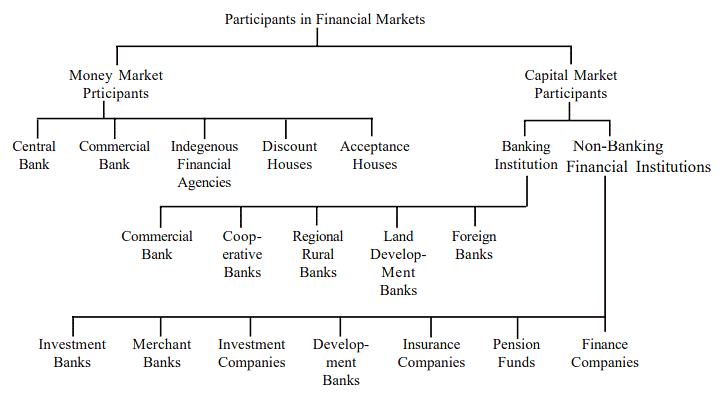

Financial markets enable the trading of financial assets, also known as financial instruments or securities. These assets represent the use of funds for a specific period rather than consumption. Various entities participate in financial market operations, facilitating the transfer of funds from surplus units to deficit units. Financial markets are categorized into money markets and capital markets. This unit discusses participants in each segment separately. In the money market segment, major participants include the Central Bank, Commercial Banks, indigenous Financial Agencies, Discount Houses, and Acceptance Houses. In the Capital Market, key players are Banking Institutions and non-banking Institutions. Figure provides an overview of the participants in Financial Markets.

FAQs on Capital and Money Markets: Institutions - Management Optional Notes for UPSC

| 1. What are money markets? |  |

| 2. Who are the participants in money markets? |  |

| 3. What are capital markets? |  |

| 4. Who are the participants in capital markets? |  |

| 5. How do money markets and capital markets differ? |  |