Capital and Money Markets: Money Market Instruments | Management Optional Notes for UPSC PDF Download

Introduction

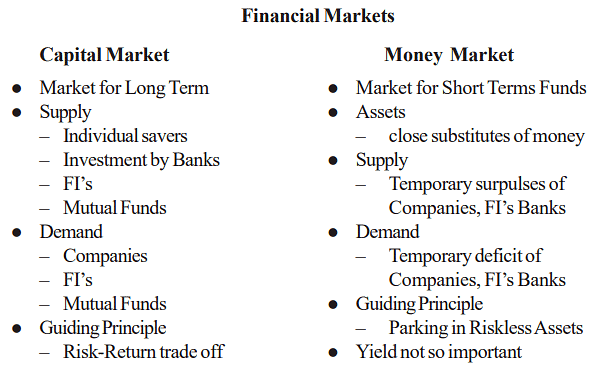

- The debt market is commonly divided into two segments: the money market, which deals with short-term debt with a maturity of one year or less, and the capital market, which focuses on long-term debt. This distinction arises from the fact that these two sectors operate under different market dynamics and cater to distinct needs of market participants. This unit delves into the characteristics, operations, and advancements within the Money Market.

- While banks and financial institutions meticulously plan their cash flows, they often encounter disparities between actual cash inflows and outflows on any given day. These shortfalls or excesses are typically of short-term nature. While this is a common occurrence across all enterprises, it is more manageable for commercial entities that rely on their banking relationships. However, banks and financial institutions facing temporary shortages cannot defer their obligations and must meet them promptly to avoid triggering a run on the banks.

- Conversely, institutions with temporary surpluses seek very safe or risk-free short-term investment opportunities. These investments are essentially the deployment of temporary funds in search of modest returns, serving as a means of parking funds until needed. Thus, investments in the money market do not adhere to the conventional risk-return trade-off rule but instead prioritize safety or risklessness. Money markets stand apart from capital markets in their function and characteristics.

Functions And Features of Money Markets

The money market is defined as a marketplace for money and close substitutes, implying assets easily convertible into cash without capital loss. It also serves as a hub for short-term funds, typically with maturities up to one year. The overarching functions of the money market can be summarized as follows:

- Balancing supply and demand for short-term funds.

- Acting as a conduit for central bank intervention to influence liquidity and interest rates.

- Facilitating access for providers and users of short-term funds to meet borrowing and investment needs at efficient market prices.

Thus, the money market serves as a critical component within the financial system, enabling the alignment of surplus funds from lenders with the short-term requirements of borrowers. Additionally, it provides a platform for central bank involvement to regulate liquidity and transmit monetary policy signals effectively.

Evolution of the Money Market in India Since the Mid-1980s

Recognizing the necessity for financial system reforms in India, the Reserve Bank of India (RBI) established a committee chaired by Shri Sukhamoy Chakravarty in 1985 to review the monetary system's functioning. This committee, while proposing comprehensive reforms, highlighted the unique nature of the money market, suggesting further examination through a dedicated study group. Consequently, the RBI formed a Working Group on the Money Market chaired by Shri N. Vaghul, which presented its findings in 1987. Based on these recommendations, the RBI initiated several measures in the 1980s aimed at broadening and deepening the money market, including:

- Establishment of the Discount and Finance House of India (DFHI) in 1988, a money market institution jointly owned by the RBI, public sector banks, and financial institutions. Subsequently, the RBI divested its stake, leading to the merger of DFHI with SBI Gilts to form SBI DFHI Ltd.

- Introduction of new money market instruments such as Commercial Paper, Certificates of Deposit, and Interbank Participation Certificates in 1988-89, expanding the market's instrument range.

- Gradual removal of interest rate ceilings on call money, starting from October 1988, to facilitate price discovery. This included freeing DFHI operations from interest rate ceilings in 1988, followed by the complete withdrawal of interest rate ceilings in May 1989 for all call/notice money market participants and interbank term money transactions. Currently, money market interest rates are predominantly determined by market forces.

- Furthermore, similar institutions to DFHI, known as Primary Dealers (PDs), were permitted, with approximately 16 PDs operating in India across both public and private sectors. These PDs serve as vital market makers in the money market, actively participating in Treasury Bills and Government Bonds auctions, as well as engaging in the buying, holding, and selling of Government Debt (Primary Securities).

Money Market Instruments

Money market instruments cater to the needs of institutions with temporary surpluses by offering low-risk investment options. These instruments are specifically designed for the money market and are outlined below.

Characteristics of Money Market Transactions:

- Short-term duration

- Utilization of instruments with minimal risk

- Negligible transaction costs

- Smooth transaction processes

- High trading volumes

- Market efficiency relies on:

- Cost-effective transactions

- Availability of information

- Participation of numerous entities

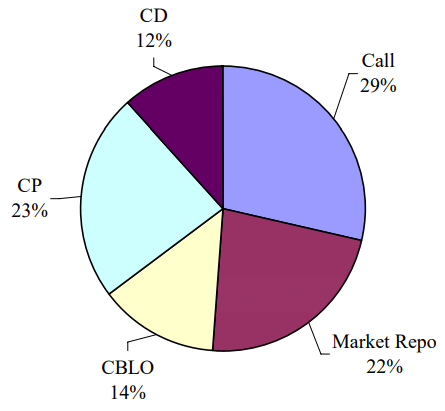

The following figure illustrates the distribution of different instruments within India's overall money market.

Call Money Market:

The call money market serves as the overnight inter-bank funds market in India, characterized by the following aspects:

- Overnight funds and deposits

- Participants include banks, primary dealers, and restricted financial institutions

- Driven by temporary surpluses or deficits of banks and primary dealers

- Subject to RBI restrictions but primarily regulated by market forces

- Exclusive to banks and primary dealers

- Clean lending in the form of deposits

- Interest rates are deregulated, determined by market forces, and exhibit volatility with significant fluctuations during the day

- Involves high-value transactions with no involvement of brokers

- Initially, the call/notice money market primarily functioned as an interbank market until 1990, with exceptions such as UTI and LIC operating as lenders since 1971. The RBI gradually liberalized its policies regarding entry into the call/notice money market to enhance liquidity. Bank behavior in this market varies, with some banks actively borrowing while others predominantly lend. The RBI plays a significant role in moderating liquidity and market volatility through repos, refinance operations, and changes in cash reserve ratio maintenance procedures.

Recently, a reference rate known as "MIBOR" (Mumbai Interbank Offer Rate) akin to LIBOR has emerged in the overnight call money market through the National Stock Exchange and Reuters.

Commercial Paper:

- Commercial paper (CP) is a money market instrument issued by highly rated corporations in the form of a promissory note, offering a discounted fixed maturity. Introduced in India in 1989, CP enables corporate borrowers to diversify short-term borrowing sources while providing investors with an additional instrument. The Reserve Bank stipulates terms and conditions for CP issuance, including eligibility criteria, issuance modes, maturity periods, denominations, and issuance procedures.

- CP interest rates are not subject to restrictions, and refinements have been made over time, such as easing restrictions on maturity and size, removing the minimum current ratio requirement, and restoring working capital finance. Corporates, primary dealers (PDs), and satellite dealers (SDs) are eligible to issue CP with a maturity ranging from 15 days to 1 year, with no lock-in period observed. CP issuance tends to be inversely related to money market rates.

Certificates of Deposit:

- Certificates of deposit (CDs) represent securitized and tradable term deposits mobilized by banks, making otherwise non-tradable bank deposits marketable. Introduced in India in 1989, CDs' terms and conditions, including eligibility, maturity periods, size, transferability, and reserve requirement applicability, are regulated by the Reserve Bank.

- CDs generally entail relatively high-cost liabilities, with banks resorting to this source when deposit growth is slow but credit demand is high.

Treasury Bills

- Treasury bills (T-bills) serve as short-term borrowing instruments for the government, playing a crucial role in its cash management. Key characteristics of T-bills include short-term debt with maturities of less than a year, issuance at a discount and redemption at face value, periodic auctions, minimal investment requirement, robust secondary market, eligibility for reverse repo transactions with the RBI, and suitability as a cash management tool.

- T-bills' risk-free nature makes their yields short-term benchmarks, influencing the pricing of various floating-rate products. Central banks prefer T-bills for market interventions to regulate liquidity and short-term interest rates, often combined with repos/reverse repos.

Repurchase Agreements (Repos)/Ready Forward Transactions:

- Repurchase agreements (repos) involve acquiring immediate funds by selling securities while simultaneously agreeing to repurchase them at a predetermined price on a future date. Repos serve as versatile money market instruments combining elements of securities purchase/sale operations and money market borrowing/lending operations.

- These transactions, often collateralized, feature a specified repo rate representing the money market borrowing/lending rate. In the Indian market, both interbank repos and RBI repos are operational, serving absorption/injection of liquidity purposes. Recent developments include the eligibility of all government securities for repo, extension of repo privileges to primary dealers, and allowance for non-bank participants to lend money through reverse repos.

- Additionally, repos are now permitted in PSU bonds and private corporate debt securities held in dematerialized form in recognized stock exchanges, with the removal of the minimum period requirement for interbank repo transactions. The RBI effectively utilizes repos to manage excess liquidity and signal interest rates, with the repo rate acting as a ceiling and the reverse repo rate as the floor within an interest rate corridor.

Collateralized Borrowing and Lending Obligations (CBLOs):

- CBLOs offer a platform provided by the Clearing Corporation of India Ltd (CCIL) for borrowing and lending funds against securities. This mechanism facilitates the participation of lenders and borrowers, including banks, primary dealers, financial institutions, mutual funds, non-banking finance companies, and corporates. CBLOs are short-term derivative debt instruments with maturities of up to 90 days, addressing limitations present in the Repos market where obligations can only be settled on the due date without the ability to pre-pay or call back.

- CBLO holders can sell or investors can buy them at any time during their tenure. Denominated in Rs 50 lakh units, CBLOs are traded through offers and bids specifying discount rates and maturity periods on an auction market screen. Orders are matched based on the best quotations, with negotiation opportunities. CCIL sets borrowing limits for participants based on securities valuation after applying a haircut. CBLOs have emerged as effective cash management instruments for banks and corporate firms.

Money Market Mutual Funds (MMMFs):

- Introduced in April 1991, MMMFs aim to provide investors with an additional short-term investment avenue and make money market instruments accessible to individuals. A Task Force was formed to examine the framework outlined in April 1991 and the Scheme's implications, leading to the announcement of a detailed MMMF scheme by the Reserve Bank in April 1992.

- MMMF portfolios primarily consist of short-term money market instruments, offering investors the opportunity to earn yields close to short-term money market rates with adequate liquidity. However, the growth of MMMFs has been slower than anticipated.

Factors Influencing Money Markets in India:

Numerous factors play a role in influencing and impacting money markets. Of these, the Reserve Bank of India (RBI) stands out as the most significant influencing factor. Given its role in conducting monetary policy, the RBI directly regulates the money market. The primary objective of the RBI's operations in the money market is to maintain liquidity and short-term interest rates at levels aligned with monetary policy goals, including ensuring price stability, facilitating adequate credit flow to productive sectors, and fostering orderly conditions in the foreign exchange market.

The Reserve Bank of India influences liquidity and interest rates through various mechanisms:

RBI Intervention and Signaling in the Money Market:

RBI Repo Operations:

- Involves the sale of Government of India (GOI) bonds from its own holdings with a commitment to repurchase them.

- Implications include borrowing from the market, absorbing liquidity, and setting a floor for interest rates.

RBI Reverse Repo Operations:

- Entail the purchase of GOI bonds into its own holdings with subsequent sale.

- Implications include lending to banks/primary dealers, injecting liquidity, and establishing a ceiling for interest rates.

Liquidity Adjustment Facility (LAF):

The Narasimham Committee proposed that RBI support the market through a Liquidity Adjustment Facility (LAF), where the RBI periodically resets its repo and reverse repo rates. This mechanism provides a reasonable corridor for market operations and works in conjunction with Open Market Operations (OMO).

- Operational on a daily basis.

- Encompasses both the Repo and Reverse Repo windows.

- Features pre-announced Reverse Repo and Repo Rates.

- Utilizes an "auction" model for the borrowing or injection of funds.

- Provides highly effective fine-tuning of money supply, liquidity, and interest rates.

- Open Market Operations (OMO) involve the sale or purchase of RBI securities on its own account, influencing money supply and liquidity over the longer term.

The primary focus of LAF is to maintain the continuous presence of the Reserve Bank in the money market through the operation of the repos window. While reverse repos absorb excess liquidity at a specified rate (floor) and repos inject liquidity into the system at a specified rate (ceiling), the floor and ceiling rates established by the repos window create an effective corridor for the operation of the call money market. Depending on the policy stance aimed at easing or tightening liquidity, adjustments to the floor and ceiling rates may be made periodically. While the Reserve Bank's repos window has generally been effective in managing liquidity at the floor rate, supplying liquidity at a capped rate requires careful consideration of various factors.

Money Market And Monetary Policy In India

- The relationship between the money market and monetary policy in India holds significant importance. A central bank aims to impact monetary conditions by managing liquidity through various instruments. In a regulated financial environment, liquidity management relies on direct instruments such as cash reserve requirements, refinance limits, administered interest rates, and credit restrictions.

- This direct control influences the cost, availability, and direction of fund flow. However, in a deregulated and liberalized market, where interest rates are primarily determined by market forces, managing liquidity becomes more nuanced. In such circumstances, monetary conditions are influenced through market-based instruments like open market operations and refinance/discount/repo windows. The central bank, while still maintaining authority over primary liquidity, operates as part of the market, albeit with significant influence.

- The effectiveness of market-based indirect instruments relies heavily on the presence of a dynamic, liquid, and efficient money market seamlessly integrated with other financial segments, particularly government securities and foreign exchange markets. This integrated and efficient market is crucial for transmitting monetary policy impulses through money market interventions to influence the general level of interest rates, thereby impacting monetary conditions.

Conclusion

This unit has provided an overview of the short-term funds market, particularly in the context of India. It began by distinguishing between capital and money markets, discussed the features and functions of the money market, and delved into the growth and evolution of India's money markets since the mid-1980s. Additionally, it explored various factors affecting money market operations, highlighting the significant influence of the Reserve Bank of India's policy. Finally, the unit briefly touched on monetary policy and its repercussions on the money market.

FAQs on Capital and Money Markets: Money Market Instruments - Management Optional Notes for UPSC

| 1. What are the key functions of money markets? |  |

| 2. What are the main features of money markets? |  |

| 3. How has the money market evolved in India since the mid-1980s? |  |

| 4. What are some examples of money market instruments? |  |

| 5. How does the money market influence monetary policy in India? |  |