Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > Cash Books & The General Journal

Cash Books & The General Journal | Accounting for GCSE/IGCSE - Class 10 PDF Download

The Cash & Petty Cash Books

- Both the cash book and petty cash book serve as primary records.

- They document all transactions involving cash exchanges, with petty cash typically utilized for minor transactions.

- The bookkeeper sources information from various documents such as receipts, cheques and their counterfoils, paying-in slips, bank statements, and petty cash vouchers.

- Additionally, the cash book and petty cash book form integral components of the double-entry accounting system, distinguishing them from other primary records.

The General Journal

- The general journal, often called "the journal," serves as a record for all transactions not documented in other primary entry books.

- It includes various transactions like:

- Opening balances during the inception of a business.

- Introducing capital into the business.

- Taking drawings from the business.

- Purchasing non-current assets.

- Selling non-current assets.

- Correcting errors in previous entries.

- Transferring balances to the income statement.

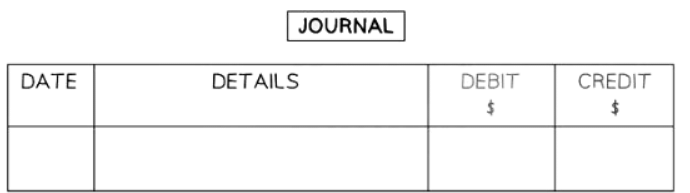

The layout of the general journal

How to Create a Journal Entry for a Transaction

- Step 1: Input the date of the transaction.

- Step 2: In the details column, record the names of the accounts to be debited. It's customary to list debit accounts before credit accounts.

- Step 3: Input the corresponding values in the debit column.

- Step 4: In the details column, record the names of the accounts to be credited. Typically, credit entries are indented.

- Step 5: Input the corresponding values in the credit column.

- Step 6: Ensure that the total debit amount equals the total credit amount.

- Step 7: Provide a narrative for the journal entry. This should offer a brief explanation of the transaction, particularly useful for non-regular transactions or error corrections.

The document Cash Books & The General Journal | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

22 videos|29 docs|13 tests

|

Related Searches